18 Pond Technologies Inc. – Target Markets

by Amna Alam

It was a 2008 article in the Washington post that first fueled Steve Martin’s inspiration behind Pond Technologies Inc. in Markham, Ontario. The article indicated that algae was a promising alternative to fossil fuel derived biofuels, and that it could pave the way for greener and more renewable energy [1]. A mere twelve hours later, Martin started growing algae in a coffee cup, taking the first stock from the film growing on his swimming pool. Humble beginnings propelled Martin into the biofuels industry, through numerous programs funded by the government and private investors. Aptly named Pond Biofuels at the time, it wasn’t until 2016 that the company reached a crossroads – one that would prompt them to adopt a new name: Pond Technologies Inc.

A few years after starting the original company, it became clear to Martin that algal biofuels were not as close to being adopted on a large scale as he had hoped. While the government and large energy companies were interested in investing in research into the creation of renewable transportation fuel, the high capital costs associated with the resources required for producing biofuels left little room for profit. Mainly, Martin found that while they had proprietary technology that would allow for efficient and rapid algal growth, this new industry that they were trying to tackle was not ready to leave fossil fuels entirely behind. Therefore, Martin wanted to expand the scope of the company and shift it from simply producing biofuels to creating other algal technologies, as demonstrated by the change in company name. The question that then remained was: Which algal products industry would be best to aim towards, such that it could provide sources of revenue but also remain in line with the original vision of the company for cleaner products from algae?

Industry (Algae Products)

Algae has been known to have applications across several industries. Globally, the algae products market was projected to reach approximately $3 billion USD by 2022 with a compound annual growth rate of 6.7% from 2017-2022 [2]. The largest share of the market was claimed by biofuels, but overall, nutraceuticals were growing at the fastest rate. These were followed by other applications such as cosmetics and bioplastics.

Key Trends

Growing demand for renewable and sustainable energy: By 2024, the largest sector of the algal products industries was projected to be biofuels, primarily in response to the awareness of the harmful effects caused by burning fossil fuels [3]. The Canadian government launched the Clean Air Agenda in 2007, looking towards fostering innovations that reduced greenhouse gas emissions and reduction of fossil fuel use in favor of renewable energy sources [4]. Included alongside solar, wind and hydropower were energy products derived form plant biomass.

The Asian Pacific Partnership (APP), had also implemented climate programs to foster innovations that would mitigate or possibly reverse the harmful effects of fossil fuel use. Altogether, the APP was made up of countries such as the United States, Korea, Japan, and more, which produced 62% of the world’s cement, 65% of the world’s smoke, and 60 % of the world’s steel [5] In 2009, Pond Technologies received funding by the APP to create a pre-commercial pilot algal photobioreactor that would be powered by carbon dioxide emissions released by the St. Mary’s Cement facility in Ontario [6].

Growing demand for natural products: Data from a 2015 Statistics Canada survey indicated that 45.6% of Canadians had used a form of nutritional supplement in the past year [7]. The most common types of these supplements included vitamins, omega-3 fatty acids, fibers and antioxidants. A 2011 survey projected that the largest increase in the natural health products industry was to be whey protein, omega-3 fatty acids, glucosamines, probiotics and sterol esters [8]. The major trend in the market was the shift in buyer power from baby boomers to millennials, who were more likely to expect nutritional information on the foods they were consuming, as well as becoming generally more health conscious [9]. With this, the nutraceuticals and functional foods industry saw an increase in the global market, and is projected to be almost $600 billion by 2025 [10].

Company History and Algal Technology

Pond Technologies Inc. was founded in 2008, when it was initially named Pond Biofuels. It was created by Steve Martin, who served as Senior Scientist at EXFO Photonics Solutions, a company that specialized in developing optics systems. His background made him an expert at helping to identify the ideal light conditions required for growth of algae strains under study [11]. Together with a gradually growing staff of project managers, sustainability experts and engineers, Pond Biofuels was able to receive numerous funds from the Canadian government and private investors [6]. They created a proprietary photobioreactor that caused algae to grow at a rapid rate due to novel light technology, as well as other relevant patents that offered the company strong IP protection [11]. With the large biomass of algae, they could extract fuels such as biodiesel (from the fats), and bioethanol (from the carbohydrates) [12]. Exhibit #1 shows the company’s patented photobioreactor.

The breakthrough for the company came when it received funding from the APP (Asia-Pacific Partnership) to create a pre-commercial pilot algal photobioreactor that was powered by carbon dioxide emissions released by the smokestack at St. Mary’s Cement facility in Ontario [6]. Smokestack emissions from the plant fed directly into the photobioreactor, where carbon dioxide supply was used for the growth of algae strains that were known to produce high saturated fat content. Initially aimed at creating biofuels on a large scale, it was this project that indicated to Martin and his colleagues that algae’s applications can be applied to different industries. And so, in 2014, Pond Technologies Inc. emerged, ready to target new sales channels.

The Technology

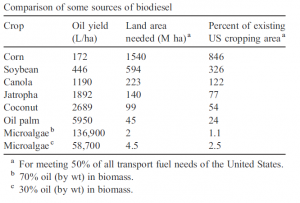

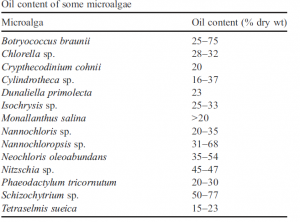

Algae consisted of a group of single-celled aquatic microorganisms that relied on light energy, water, and carbon dioxide in order to growth through photosynthesis [12]. These organisms were found to produce oils and carbohydrates in larger quantities in comparison to other land plants, making them a promising source for biofuels (See Exhibit #2 for yield data) [12. 13]. Once refined, the oils or carbohydrates could be converted into sustainable forms of diesel and ethanol, which were shown to produce fewer harmful emissions of carbon dioxide and nitric oxides in the atmosphere compared to their fossil fuel derived counterparts [12]. The oil, protein, and carbohydrate content per overall biomass varied across species, and depending on the desired end-product, an algal species that produces the largest quantity of the unrefined molecule could be chosen. For example, for the production of biodiesel, which is created from unsaturated fats, scientists would cultivate Neochloris oleoabundans and Schizochytrium sp., two species known to produce large quantities of unsaturated fats per overall biomass [12]. See Exhibit #3 for oil content of various algal species.

Closed vessel systems called photobioreactors were used to facilitate the rapid growth of algae, by providing control over factors such as light, temperature, water supply, and carbon dioxide content [12]. Bioreactors also decreased the overall risk of contamination that was associated with open cultivation systems, such as outdoor ponds [12]. This strict control made large-scale production of algae economically feasible. Pond Technologies had a patented algae platform that could grow algae at a fast rate by taking advantage of its response to light [14]. As an expert in optics, Martin and fellow engineers constructed an artificial LED system that exposed algae to strobing light [14]. The constant flickering of the lights indicated to algal cells that days are shorter, leading to an increase in the organism’s biomass and oil production, the latter of which could be dried, filtered and refined for use as transportation fuel [14].

The ability of algae to sequester carbon dioxide from the air and use it as a nutrient for its own growth has significant implications in the clean energy industry. It could not only mitigate the greenhouse gas emissions that were released by industrial facilities with smokestack, it could also use this to create oils which can be used as a cleaner oil that itself emits fewer green house gasses. The remaining biomass also had relevant uses: aside from fats, algae also produce protein and antioxidants that held importance in the nutraceutical and health supplement market [12]. One large disadvantage that algal biomass production faced was the high capital and operational expenditure that was associated with algal cultivation in photobioreactors [12].

The Opportunities

Up until 2013, Pond Biofuels had focused on cultivating carefully chosen algal species and extracting unsaturated fats (only single bonds in their chemical structure) for biodiesel production and carbohydrates for bioethanol production [15]. However, the company soon realized that the amount of nutrient resources required to get algal biofuels on the commercial level was far higher than they could supply with their own funds. With Martin’s background in optics, they were able to create patented technology that would increase the rate at which algae grew; however, they had no immediate solutions for the amount of carbon dioxide that was needed. Initially, they had been able to chemically alter dissolved glucose to release ethanol and carbon dioxide, the latter being used as a nutrient for algal growth (see Exhibit #4 for the chemical reaction) [16]. This resource was needed in great quantity and led to a high running cost for overall cultivation of the algae, which increased further when considering the manufacturing and operational costs of the photobioreactor itself. Martin decided that the company needed to tap into revenue streams that would allow it to mitigate some of the capital cost associated with the algae cultivation, and they had to look no further than algae’s other benefits outside of biofuel production.

Martin intended on delving deeper into the algal products market, specifically that of natural algal health products and pollution control in the energy industry. The biology of the species they had structured their technology on prevented them from initially being able to approach both industries. The first was an issue they were already familiar with based on their experience at the St. Mary’s cement facility: in order to grow algae on a commercial scale, large amounts of carbon dioxide were required [17]. Secondly, depending on the type of species of algae they chose, different valuable products could be derived [12]. The market they would choose to attempt to establish themselves in depended on these two factors.

The main decision that the company had to make was to decide whether they should go towards the fast-growing nutraceuticals industry, or to remain in the energy industry and capitalize carbon sequestering? Both of these came with their own benefits and limitation, making it a difficult decision for Pond Technologies Inc.

Potential Sales Channels and Strategies

- Nutraceuticals Industry

As the company had not delved into the nutraceuticals market in their research initiatives, the outreach from nutraceutical companies was not as large as that in the energy industry. The angle taken at the start of the company, when it was still called Pond Biofuels, was to produce renewable energy. However, Martin knew that the value of algal biomass was too great not to consider entering the nutraceutical market. Specifically, in their novel photobioreactor’s ability to produce algae on a rapid scale in comparison to outdoor systems, the company could provide the raw materials required for the production of supplements for nutraceutical manufacturers [11].

To start, algae species that produced high quantities of the desired molecules for supplement production were preferred. Chlorella and Spirulina species-derived nutraceuticals were already on the market in Canada, and Pond Technologies had the potential to follow suit [19]. These algal species produced unsaturated fatty acids, which are preferred forms of omega-3 on the market. Most importantly, an antioxidant called Astaxanthin which is derived from algal species such as Haematococcus sp., saw a surge in public interest and was readily incorporated in carotenoid supplements [19].

Pond Technologies Inc.’s strategy for this market was to produce the desired molecules in their in-house facility in Markham, and to sell the products to manufacturers [11]. In doing so, they were responsible for supplying their own resources, including large quantities of carbon dioxide. It would become the company’s responsibility to use carbon dioxide derived from dissolved glucose. Therefore, capital expenditure associated with algae’s production was not likely to be mitigated.

Additionally, the algal strains that Pond Technologies had used up to this point were aimed towards biofuels production. The company had conducted extensive research on algal species that produced unsaturated fatty acids, as well as large quantities of carbohydrates [20]. However, the nutraceuticals industry placed more importance on protein, fiber, and unsaturated fatty acids that made up omega-3 [8]. Overall, the demand for the molecules that particular algal species could produce were high, but came with limitations associated with large resource costs, and the company having to work with new algal species.

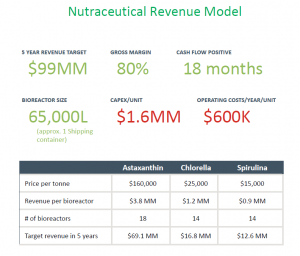

With these limitations taken into account, Pond Technologies Inc.’s calculations suggest that despite an estimated capital expenditure of $1.6 million per bioreactor and an additional $600,000 of operating costs per year, the cashflow would be positive in 18 months, if targeting customers that required biomass from Chlorella and Spirulina species, as well as raw Astaxanthin [8]. With the nutraceutical market projected to be worth over 500 million in the coming years, this was not an opportunity that Pond Technologies wanted to dismiss [10]. These market estimations are presented in Exhibit #5.

Company: Neptune Wellness Solutions [11, 21]

A Quebec based company specializing in manufacturing customized formulations of natural health products using healthy extracts from marine species and terrestrial seeds. The unsaturated fatty acids used in omega-3 oils (different from saturated fatty acids used in biofuel production) was a product of algae that served as an important ingredient in the gel-capsule formulations for this company. The red-pigmented antioxidant, Astaxanthin, was also valuable in preserving the quality of capsules by protecting them from light and heat, as well as providing health benefits of fighting off harmful effects on the body due to ultraviolet rays and converting harmful UVB rays into vitamin D. Production of these valuable compounds in Pond’s facility had the potential to create revenue by selling to this company, which itself sold raw materials to other manufacturers.

- Pollution Abatement in the Energy Industry

As growing concerns for greenhouse gas emissions take place around the world, Pond Technologies discovered a niche market that would not only take advantage of their breakthroughs in algal research, but also feed back into the company for the production of value products that the company could sell for profit.

Steve Martin was aware that algae could sequester carbon dioxide from the environment and use it as a nutrient for its own growth. In fact, in 2014, the company had done just that by installing their photobioreactor adjacent to St. Mary’s Cement [6]. However, after the successful implementation of Pond’s photobioreactor at the facility, Martin understood that carbon capture could serve as a sales channel on its own. By licensing their technology and selling their proprietary equipment to industrial facilities across North America, they could not only create a revenue stream, they could also cut back on cost of resources such as carbon dioxide, as well as use the produced algae into bioethanol, biodiesel, and other valuable products. In this way, the company would not lose sight of its original pursuit for renewable energy.

This sales channel did not work on a small scale, such as providing energy for a single house or furnace, as the net energy consumed would be far greater than the net energy produced. However, on a larger scale, and by targeting industrial emitters that produced over 25,000 tons of carbon dioxide per year, Pond Technologies had a way of settling into the niche market. There were over 10,000 large industrial emitters across North America, providing a large potential customer base [22].

The main reason value products could not overlap with the nutraceuticals market (omega-3 unsaturated fatty acids and protein) were because the algal strains that Pond had been working with in the industrial settings produced molecules more suitable for production of biodiesel and bioethanol. These included saturated fatty and carbohydrates. Without the limitation of using “clean” carbon dioxide, Pond Technologies had the potential to not only sequester air pollution, but also to continue creating an alternative energy source. On the other hand, this entailed that Pond was restricted by producing only forms of biofuels, which Martin had already discovered was not currently as established as the nutraceuticals industry. In targeting this industry, Martin found that even though fossil fuels were not ready to be discarded for other alternative biofuels, he could mitigate their harm and continue to collaborate with the government and private investors to create innovations that would make algal biofuels economically feasible [22].

Company: Markham District Energy [23]

By late 2016, the city of Markham had also shown an interest in collaborating with Pond Technologies. The proof-of-concept project at St. Mary’s Cement had shown enough promise that Markham District Energy was eager to work with the company on potential energy systems. MDE was involved in providing heating and electricity to city-wide infrastructure, and wanted to use the company’s photobioreactors to sequester carbon dioxide emissions form industrial facilities and produce algal biomass that could be burnt as a heating source.

The CEO of MDE, Bruce Ander, was a former chair of the International District Energy Association, and also wanted to further Pond’s network globally by introducing the company’s breakthrough technology to other members of the group, which spanned across 26 countries.

This was a significant advantage as it promised an increase in the company’s profit potential.

Company: Stelco Canada [24]

This Ontario based steel company provided products for transportation and infrastructure construction across North America, and was looking for a way to continue to reduce their carbon footprint without significantly decreasing their production value. Sujit Sanyal, Chief Operating Officer at Stelco Canada knew that Pond Technologies Inc. had become a leader in the carbon abatement sector. He said that a partnership with Pond Technologies Inc. could “demonstrate the potential for the steel industry to utilize science and innovation to make significant reductions in greenhouse gas emissions…. Our intention is to divert thousands of tonnes carbon from our operations while making Stelco more competitive and environmentally sustainable” [24]. This view was seconded by Steve Martin, who foresaw partnerships with heavyweight emitters like Stelco Canada leading to “transforming their GHGs into significant revenue streams” for Pond Technologies [24]. Stelco Canada hoped to start a project with Pond Technologies Inc. in creating the first ever commercially sized carbon-abatement system.

Future Challenges and Questions

Martin knew that regardless of which industry his company chose to focus on in the coming future, algae products would contribute not only to the financial wellbeing of the company, but also add value to the environment by fostering the production of green products. In 2008, when he had first read the article in the Washington Post, the goal had been to create green energy to replace fossil fuels. As the company grew, he found that perhaps conquering it was still further down in the pipeline, but that algal products could mitigate several of the harms that came with using fossil fuels, or even create green products in an entirely different sector. Despite finding himself in a place he hadn’t anticipated with his company, he felt that expanding the applications of algae, and fostering research into its many benefits was certainly the best way to go.

Having always been the idea man, he thought about how he could take algae further. Was there was a way to introduce genetic modification into the equation? Could he find a way to alter an algal cell’s genome such that it could not only increase the production of molecules required for the nutraceuticals industry, but enhance the production of those required for the energy industry? Would that prove to be the ultimate solution in establishing Pond Technologies Inc. in both markets, or would the public opinion on large scale production of transgenic organisms prove to be a setback?

References

- Hartman, E. (2008). A Promising Oil Alternative: Algae Energy. Washington Post. Accessed on March 1, 2018, from: http://www.washingtonpost.com/wp-dyn/content/article/2008/01/03/AR2008010303907.html.

- Research and Markets. (2018). Global Algae Products Market is Expected to Reach USB 3.3 Billion by 2022, Growing at a CAGR of 6.7%. Newswire. Accessed on March 22, 2018 from: https://www.prnewswire.com/news-releases/global-algae-products-market-2017-2022-market-is-expected-to-reach-usd-33-billion-by-2022-growing-at-a-cagr-of-67-300590146.html

- Transparency Market Research. (2016). Global Algae Market is Projected to be Worth $1.1 bn by 2024, at a CAGR of 7.39%. Newswire. Accessed on March 13, from https://www.prnewswire.com/news-releases/global-algae-products-market-2017-2022-market-is-expected-to-reach-usd-33-billion-by-2022-growing-at-a-cagr-of-67-300590146.html

- Reducing Canada’s greenhouse gas emissions. (2017). Environment and Climate Change Canada. Accessed on March 12, 2018, from: http://www.ec.gc.ca/dd-sd/default.asp?lang=En&n=AD1B22FD-1

- Pond Biofuels Inc., CO2 Remediation and Renewable Fuel Production Demonstration Plant for GHG Emitting Industries Receives Support From the Asia Pacific Partnership. (2009). Market Wired. Accessed on March 12, 2018, from: http://www.marketwired.com/press-release/pond-biofuels-inc-co2-remediation-renewable-fuel-production-demonstration-plant-ghg-1092064.htm

- Success Story Pond Biofuels Inc. (2012). Ontario Centres of Excellence. Accessed on March 12, 2018, from: http://www.oce-ontario.org/meet-our-companies/success-story/2012/01/09/pond-biofuels-inc-

- Statistics Canada. (2017). Canadian Community Health Survey – Nutrition: Nutrient intakes from food and nutritional supplements. Government of Canada. Accessed on March 4, 2018 from: http://www.statcan.gc.ca/daily-quotidien/170620/dq170620b-eng.htm

- Statistics Canada. (2016). Opportunities and Challenges Facing the Canadian Functional Foods and Natural Health Products Sector. Government of Canada. Accessed on March 6, 2018, from: http://www.agr.gc.ca/eng/industry-markets-and-trade/market-information-by-sector/functional-foods-and-natural-health-products/trends-and-market-opportunities-for-the-functional-foods-and-natural-health-products-sector/opportunities-and-challenges-facing-the-canadian-functional-foods-and-natural-health-products-sector/?id=1410206902299

- Agriculture and Agri-Foods Canada. (2015). Emerging Food Innovation: Trends and Opportunities. Government of Canada. Accessed March 4, 2018, from: http://www.agr.gc.ca/eng/industry-markets-and-trade/market-information-by-sector/processed-food-and-beverages/trends-and-market-opportunities-for-the-food-processing-sector/emerging-food-innovation-trends-and-opportunities/?id=1449236177345

- Newswire. (2017). The global nutraceuticals market is projected to reach USD 578.23 billion by 2025. Accessed on March 12, 2018 from https://www.prnewswire.com/news-releases/the-global-nutraceuticals-market-is-projected-to-reach-usd-57823-billion-by-2025-300585819.html

- Pond Technologies. (2018). Company Overview. Pond Technologies Incorporated. Accessed on March 2, 2018, from http://pondtechnologiesinc.com/wp-content/uploads/2018/02/PondTechnologiesInc-CorporatePresentationJan2018.pdf

- Chisti, Y. (2007). Biodiesel from microalgae. Biotechnology Advances,25(3), 294-306

- Grandview Research. (2017). Algal Biofuel market is expected to be USV 10 billion industry by 2025. Grand View Research. Accessed March 29, 2018, from https://www.grandviewresearch.com/blog/algae-biofuel-market-size-share

- Pond Technologies Youtube. (2103). Pond features in CBC’s The National. Youtube. Accessed on March 24, 2018, from: https://www.youtube.com/watch?v=pJyoUUP_IZ0

- Pond Biofuels. News. Pond Biofuels. Accessed on march 20, 2018, from: http://pondbiofuels.com/Company/News/News.html

- The Essential Chemical Industry. (2014). Biofuels. The Essential Chemical Industry – online. Accessed on March 14, 2018, from: http://www.essentialchemicalindustry.org/materials-and-applications/biofuels.html

- MaRS Entrepreneurship Programs. (2010). Meet the Entrepreneurs – Pond Biofuels. Youtube. Accessed on March 1, from https://www.youtube.com/watch?v=0QgdsjlUjPM

- Algae World News. (2017). Microalgae: Superfood or Supplement Scam? Algae World News. Accessed on March 30, 2018, from: http://news.algaeworld.org/2017/12/microalgae-superfood-or-supplement-scam/

- Pond Technologies Inc. (2015). Pond Technologies: Nutraceuticals. Pond Technologies Inc. Accessed on February 12, 2018, from: http://pondtechnologiesinc.com/technology/nutraceuticals/

- Pond Biofuels. (2011). Algae Production. Pond Technologies Inc. Accessed on March 3, 2018) from: http://pondbiofuels.com/Technology/AlgaeProduction/AlgaeProduction.html

- Neptune Wellness Solutions. (2017). Nutritional Solutions from Neptune. Neptune Wellness Solutions. Accessed on March 15, 2018, from: http://neptunecorp.com/nutritional-solutions-neptune/

- Midas Letter Youtube. (2018). Pond Technologies Holdings Inc Grows Algae that Eat-up Pollution. Accessed on April 4, 2018, from: https://www.youtube.com/watch?v=KWv6jhKAiJg

- Newswire. (2018). Pond Technologies Announces the commencement of Phase 1 of a $16.8 million project at Markham District Energy. Newswire. Accessed on March 1, 2018, from: https://www.newswire.ca/news-releases/pond-technologies-announces-the-commencement-of-phase-1-of-a-168-million-project-at-markham-district-energy-signs-global-marketing-agreement-for-the-district-energy-sector-675421433.html

- Newswire. (2017). Pond Technologies: First Commercial Carbon Abatement Algae Plant to be built at Stelco. Newswire. Accessed on March 1, 2018, from https://www.newswire.ca/news-releases/pond-technologies-first-commercial-carbon-abatement-algae-plant-to-be-built-at-stelco-662863433.html

- St. Mary’s Cement. (2017). Toward a greener, cleaner future. Accessed on April 6, 2018, from: http://www.stmaryscement.com/Pages/Media%20Centre/News/Toward-a-greener,-cleaner-future-.aspx

Exhibits

Exhibit #1: Pond Technologies Inc.’s 25,000L Photobioreactor

Source: Votorantim Cementos News [25].

Exhibit #2: Oil and Ethanol Yield Comparison Between Microalgae and Land Crops

a) Comparison of some source of biodiesel:

b) Ethanol production capacities by various feedstock, (L/Ha)

| Feedstock | Ethanol Yield |

| Switch grass | 10,760 |

| Sugar beet | 5,010–6,680 |

| Corn | 3,460–4,020 |

| Sweet sorghum | 3,050–4,070 |

| Cassava | 1,050–1,400 |

| Wheat | 2,590 |

| Corn stover | 1,050–1,400 |

| Algae | 46,760–140,290 |

Sources: a) Chisti, 2007 [12]; b) Grandview Research [13].

Exhibit #3: Oil Content of Some Microalgae

Source: Chisti, 2007 [12].

Exhibit #4: Chemical reaction for the conversion of glucose into ethanol and carbon dioxide

![]()

Source: Essential Chemical Industry website [16].

Exhibit #5: Pond Technologies Inc.’s Nutraceutical Revenue Model

Source: Pond Technologies Inc – Corporate Presentation [11].