28 Rebuilding the pipeline: Celgene and Juno Therapeutics

April 8, 2018

Adrienne Wan

Introduction

Mark Alles, CEO of Celgene, sat at his desk on a cold January morning looking out the window of his office contemplating what Celgene’s next steps would be. The press release had just been published about his appointment as Chairman of the Board of Directors of the company as Bob Hugin was set to step down after two years in the role and 19 years with the company.1 Alles had been with the New Jersey-based company since 2004 working in different senior positions such as Global Head of Hematology & Oncology, Executive Vice President, and most recently, President and Chief Operating Officer.1 It was now his turn to take up the mantle and lead the company into a new era of biopharmaceuticals.

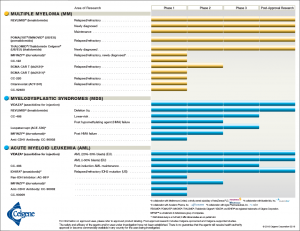

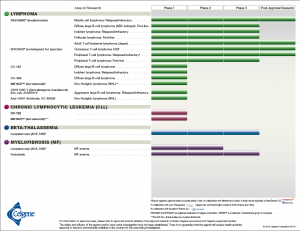

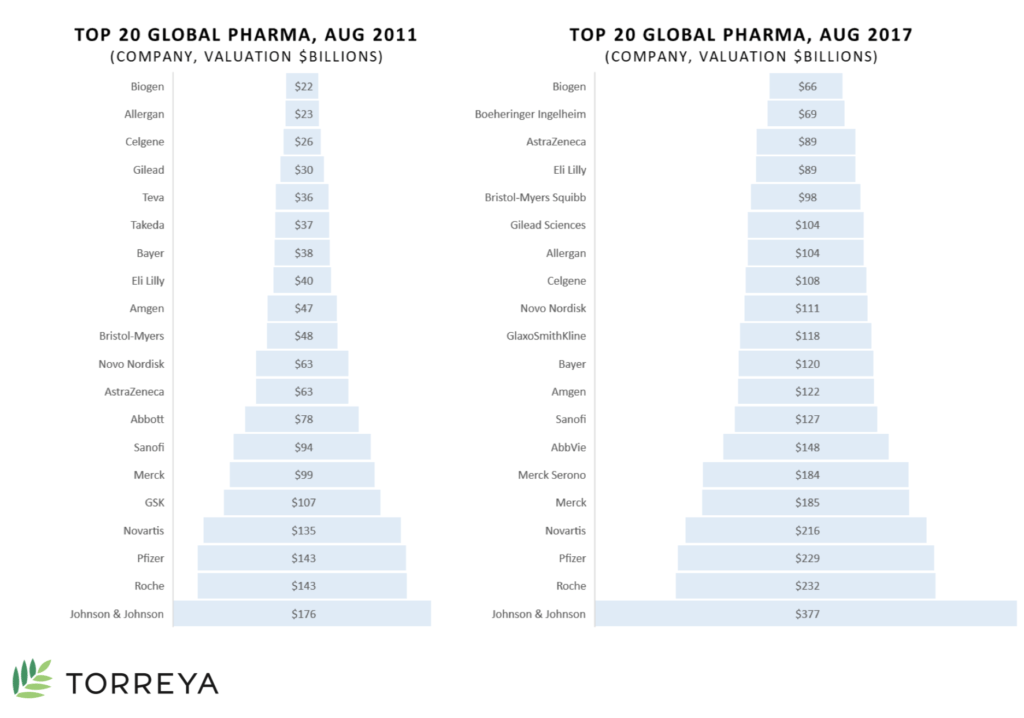

In keeping with Celgene’s vision of building an influential global biopharmaceutical establishment, with a focus on creating and bringing novel cancer, immune, and inflammatory treatments to people, Alles would have to ensure long-term success through smart acquisitions of leading novel therapeutics. Celgene’s portfolio consisted of drugs and biological treatments for blood and solid tumor cancers as well as immune and inflammatory diseases (see Exhibit 1).2 They also had more than 45 other drugs in the development pipeline at various phases of clinical trials (see Exhibit 2).3

The biopharmaceuticals industry and cancer therapies market

A 2016 report stated that biopharmaceuticals made up approximately one fifth of the entire pharmaceuticals market and produced around $228 billion in revenue globally. Growth is expected to continue as increasingly valuable investments are made, more patents are filed, and products constantly enter clinical trials each year.4, 5 By 2023, the global biopharmaceuticals market is projected to be valued at $341 billion with a compound annual growth rate of 8.5% for the next five years.6

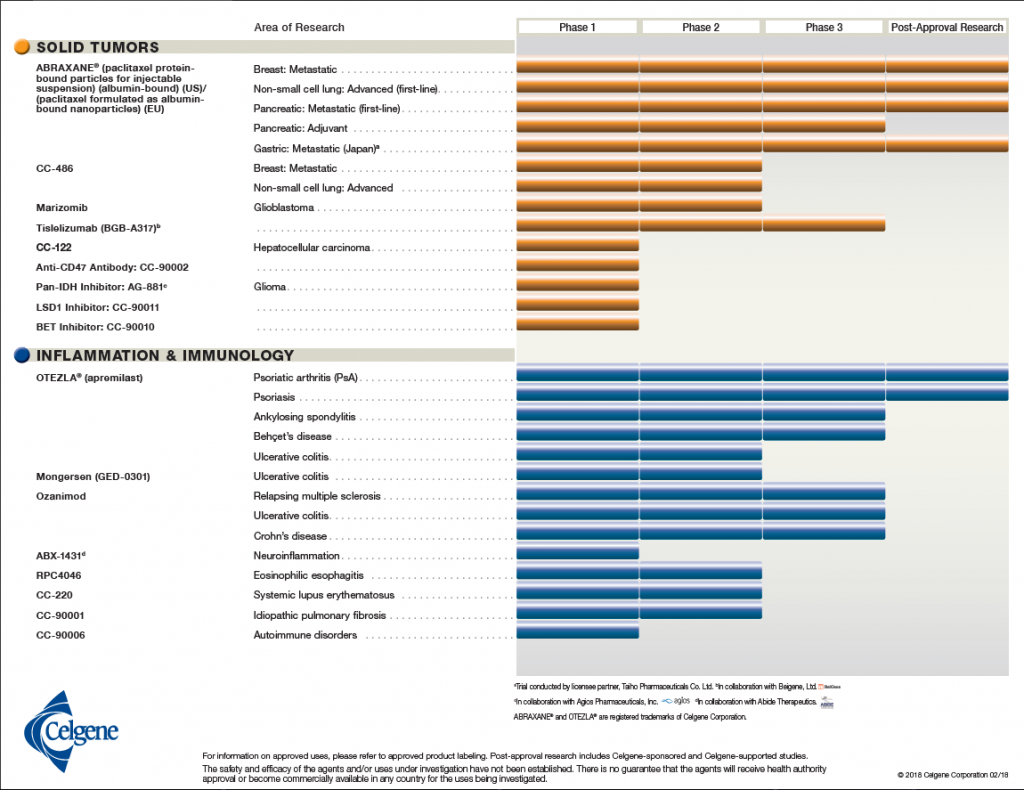

Some of the major challenges in this developing area are the complexity and expense of production costs as well as the increasingly strict regulations for therapy approval. Despite that, upcoming patent expirations for existing bio- and pharmaceuticals have created an environment for competitors to create biosimilars or generic version as well as emerging companies to break out into the market with their own novel products.7 Johnson & Johnson, Roche, and Pfizer are the top three pharmaceutical companies from 2017 (see Exhibit 3).8

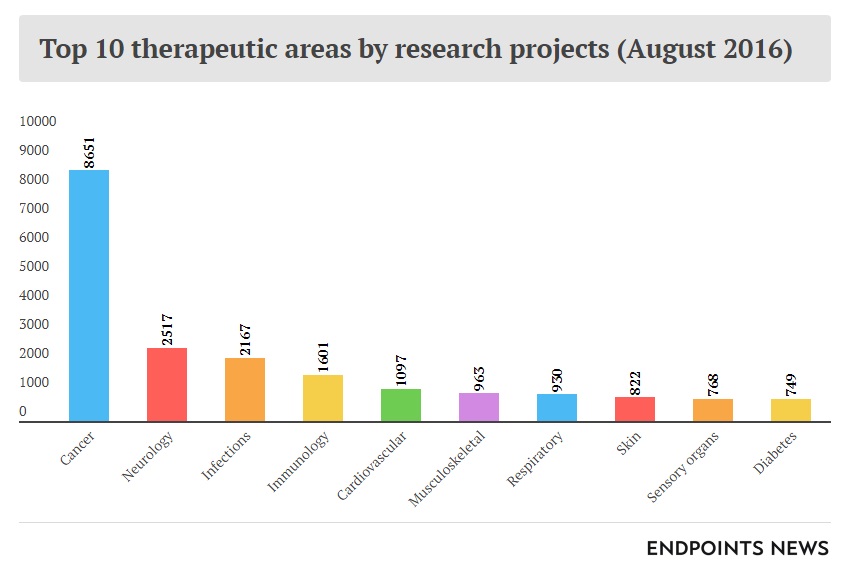

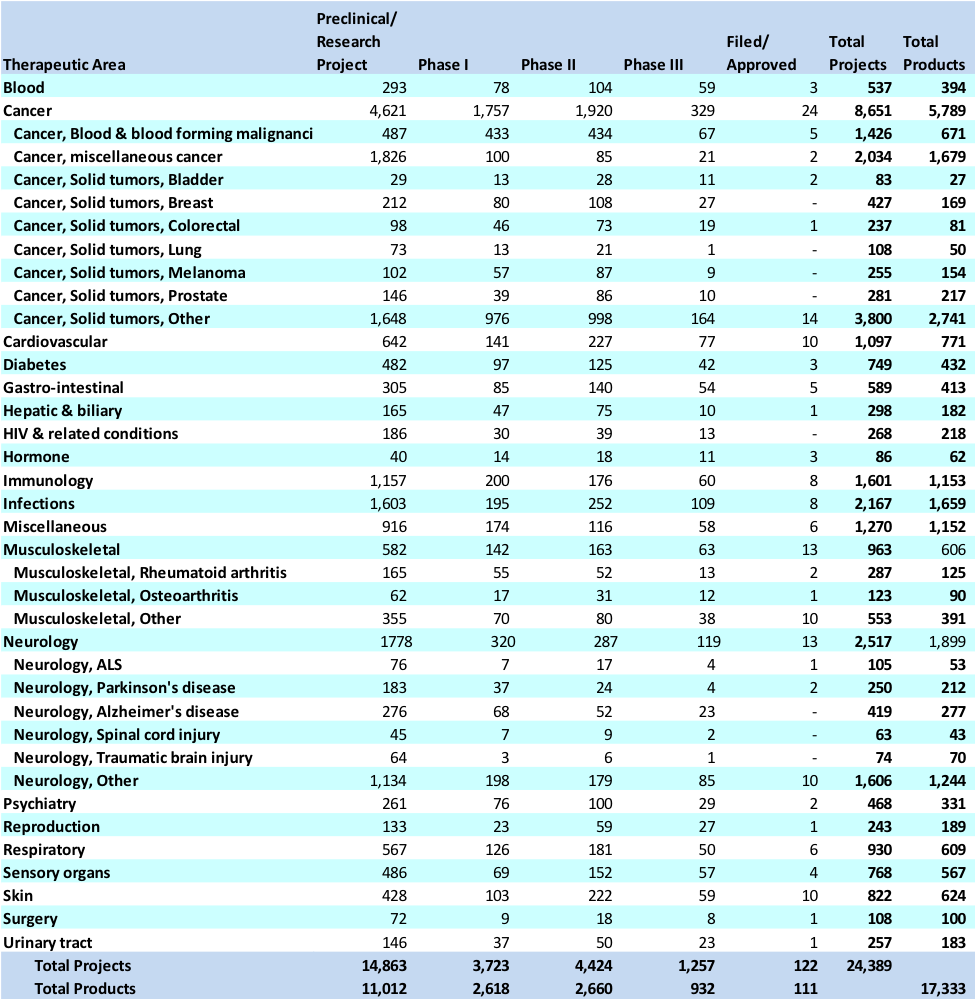

A 2015 report from the American Association for Cancer Research identified more than 830 cancer therapeutics in development, in clinical trials, or awaiting US Food and Drug Administration (FDA) review. 106 of them were for treatment of leukemia, while 92 were for various lymphomas. Personalized medicine is a growing field of research for its ability to be tailored to a patient’s specific condition while avoiding potentially adverse effects commonly seen with generalized therapeutics. According to this report, 73% of cancer therapeutics currently in development fell under the personalized medicine category.9 Cancer therapeutics were overwhelmingly the leading area of research in 2016 with nearly 9,000 projects from a total of more than 20,000 (see Exhibits 4 and 5).10

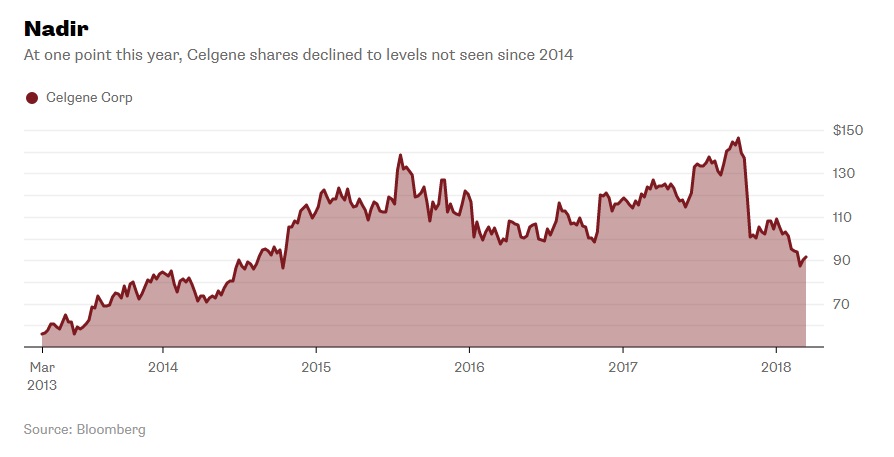

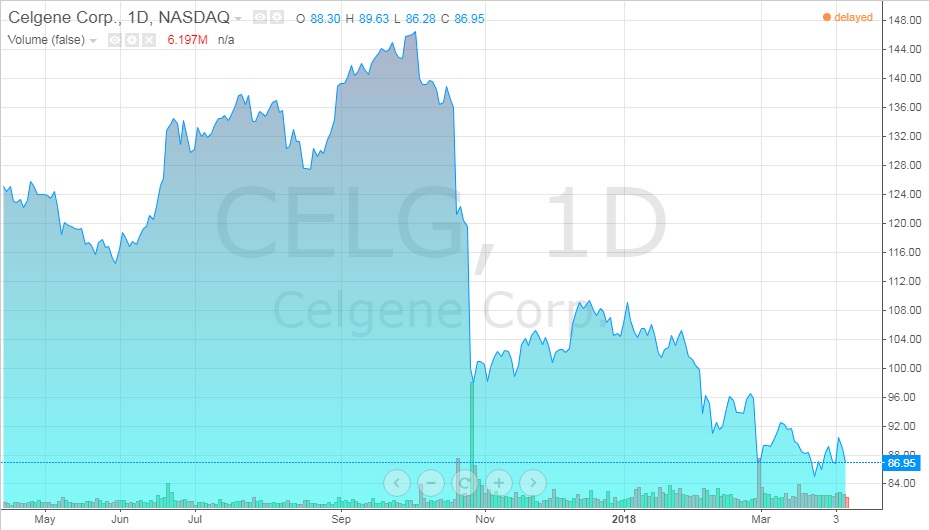

Celgene

Celgene has seen a lot of growth over the years both in number of employees and revenue (see Exhibits 6 and 7).11 Despite their stock value rising over 150% in the past five years, a 32% drop had suddenly occurred in recent months (see Exhibit 8). Not only were there problems with drugs in the development pipeline, but they had to stop clinical trials of one after rejection from the FDA. Investors were growing concerned over the company’s future.12

One of the major issues looming over the Celgene was that Revlimid, their most profitable drug for treating multiple myelomas which generated $8.2 billion in 2017 alone, would be going generic in 2022.13 In order to continue to be both sustainable and profitable, Celgene would have to diversify their portfolio and look to the drug development pipeline for a new therapeutic very soon.

A prospective Crohn’s disease drug, Mongersen or GED-0301, had failed in phase 3 clinical trials causing Celgene to contemplate continuing development on it after having already spent $2.6 billion in 2014.14

In 2015, Celgene had acquired Receptos, a leader in the treatment of immune and inflammatory diseases, for $7.2 billion in order to obtain Ozanimod, its latest multiple sclerosis drug still in development. John Newman, an analyst with Canaccord Genuity, said to investors that,

“Despite the likely termination of the GED-0301 program, we still believe that Ozanimod will be a meaningful contributor to long-term revenues due to differentiation on cardiac safety versus Gilenya® [fingolimod].”14

The FDA had rejected its initial application due to insufficient data of the drug’s application which has delayed its release.15 In explanation of the refusal-to-file letter, Celgene stated:

“[The FDA] determined that the nonclinical and clinical pharmacology sections in the [New Drug Application] were insufficient to permit a complete review.”16

As a result, the projected peak sales were estimated to fall from $5 billion to $3.5 billion.16

Cancer treatments

For years, global cancer rates have been rising due to increased life expectancy, lifestyle choices (smoking, exercise, diet, etc.), and environmental factors. It is one of the top leading causes of death in developed countries and is increasing in prevalence in less developed ones. It is expected that the global cancer therapeutics market will grow at a compound annual growth rate of 7.4% in the next four years resulting in an increase from $121 billion in 2017 to $173 billion in 2022.17 The cost of cancer therapeutics has increased from $91 billion to $113 billion in 2016 alone.18

Conventional cancer treatments available

Surgery: Depending on the type of cancer, doctors may be able to remove solid tumors from the patient. This is not possible for metastatic cancers that have spread or cancers of the blood like leukemia. Surgery can also be used to prevent (remove tissue that could become cancerous before it develops), diagnose (biopsy or tissue sampling), stage (determine the spread), and treat cancers (cure, debulk, etc.). The main risks are the same as those with any form of surgery: bleeding, clots, damage to surrounding tissue, infection, etc.19

Radiation therapy: High doses of high energy radiation are used to induce breaks in a cell’s DNA leading to cancer cell destruction and tumor reduction. While it is usually a localized treatment, healthy cells in the nearby surrounding tissue can also be harmed by radiation. At the same time, cancer cells that have spread from the site are unaffected by the treatment.20

Chemotherapy: Doctors may use drugs to kill rapidly dividing cells (cancerous ones) systemically throughout the body. Chemotherapy can be used to cure or control cancers as well as ease symptoms of the disease. The specific drug(s) used will depend on the type of cancer, what stage it is at, the patient’s age and health status, and if there is a history of previous cancer treatment in the past. While the main goal is to kill growing cancerous cells, chemo also affects healthy non-cancerous ones that are also rapidly dividing such as those located in the bone marrow, hair follicles, digestive tract, and reproductive organs.21

Other treatments:

- Virotherapy: using a viral vector to specifically target cancer cells of tumours to destroy them;

- Immunotherapy: stimulation of the immune system to promote its ability to fight transformed cells;

- Hormone therapy: treatment for cancers that use the body’s hormones to proliferate like breast and prostate cancers;

- Stem cell transplant: a follow up procedure after radiation or chemotherapy has been used to destroy the patient’s immune system – stem cells are transplanted to the individual to rebuild the immune system;

- Among others.22

Chimeric Antigen Receptor – T-cell Therapy (CAR-T)

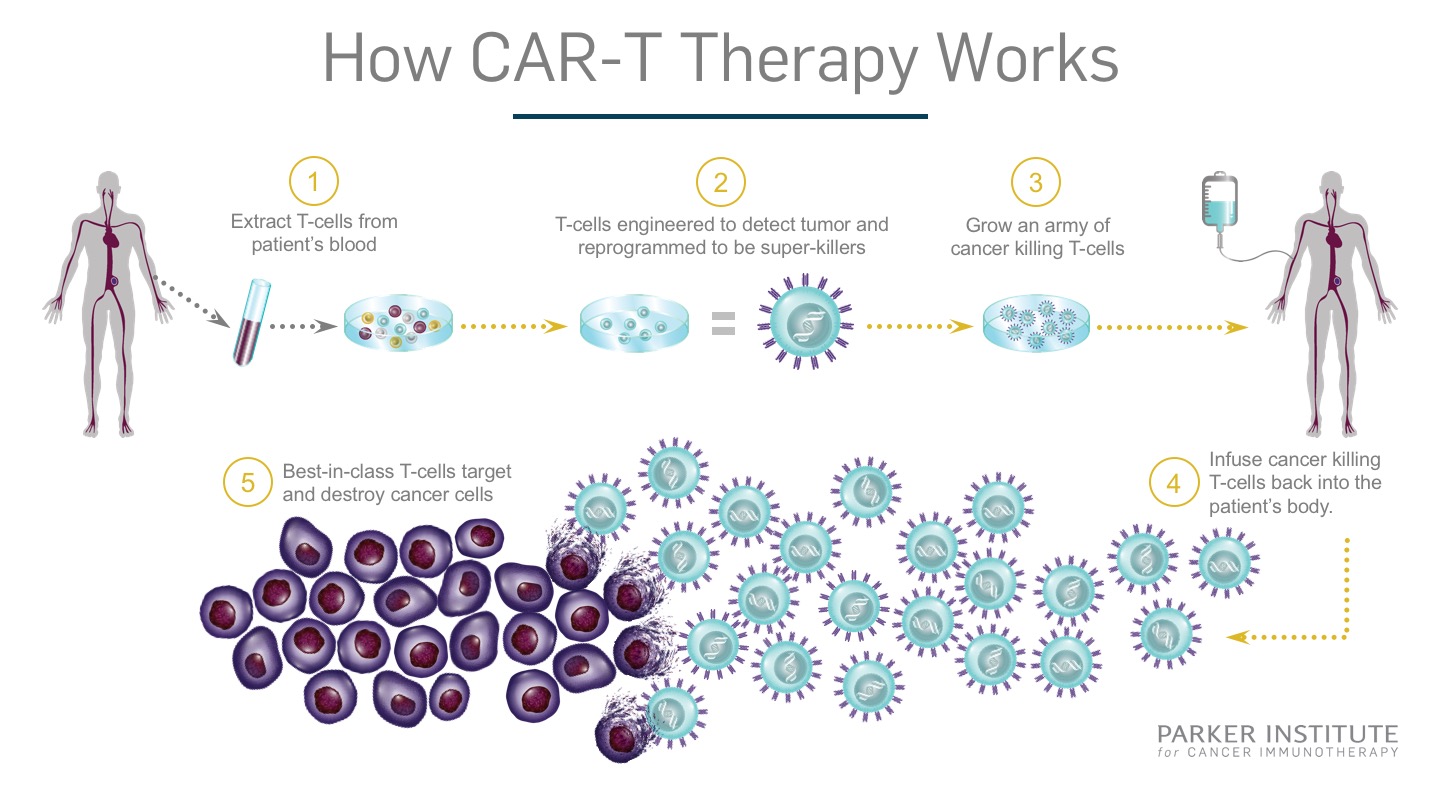

Chimeric Antigen Recepter – T-cell (CAR-T) therapy was a new area of research for treating patients with different types of blood cancers (see Exhibit 9). The first step in the process is to remove a portion of the patient’s blood. The T-lymphocytes, a type of white blood cell vital for fighting infections and cancerous cells, are isolated and sent to a manufacturing facility or lab. There, the cells are genetically engineered to produce the chimeric antigen receptor on its surface. These novel receptors are exceptionally good at identifying cancer cells in the body allowing the T-lymphocyte to attack and destroy them. After the lab work is completed, the modified cells are returned to the patient for the therapeutic effects to take hold. The entire process is expected to take only a few weeks.23 Their use has been focused on blood cancers for now but work has been started to test its efficacy on solid tumours.24

New developments in biopharmaceuticals for treating blood cancers have a promising outlook.

“[W]e are working to target cancer in a transformative way. On the one hand, you always want to improve current therapies. But you also want to leapfrog them when possible by investing in different technologies that may change the state of the disease more radically. We see the possibility of such a leapfrog moment with investigational [immunotherapies called] CAR-T cell therapies.”23

When looking at CAR-T therapeutics and Celgene’s in particular, Wim Souverijns, Celgene’s Corporate Vice President of Global Marketing in Hematology and Oncology, continued,

“… [they] are already having a tremendous impact on acute lymphoblastic leukemia, providing the chance for durable responses in kids with the disease. The same promise exists for lymphoma…. In multiple myeloma, where the nature of the disease is different, CAR-T cells may not be a cure but will probably help us control the disease better. The first data shown at the American Society of Clinical Oncology Annual Meeting earlier this year were impactful and strong. Now we’re looking at longer-term follow-ups to confirm that our high expectations are warranted.”23

One of the implications to consider with CAR-T therapy was that because it is a patient-specific procedure, it was also very expensive. In terms of the general therapy processes, the cell modification procedure could be complex, there were safety concerns once the cells had been returned to the patient, and because it was a new technology, the longevity of the therapy was uncertain. On top of that, while it was not intended for solid tumors at this stage, it was believed to be one of the best strategies that oncologists have for fighting blood cancers.25

One question that investors and analysts wanted to know the answer to was, is there much demand for this therapeutic currently and what are the projected numbers in the future? It was believed that demand was high at about 7-10,000 people requiring treatment for blood cancers each year. There were only 22 sites in America certified to administer the treatment though this will increase as demand and development do.25

Competition

While it was an emerging area of research in cancer immunotherapeutics, there were a few companies developing CAR-T treatments, some of which were already approved and available on the market.

Novartis’ Kymriah (tisagenlecleucel) was the first CAR-T to be FDA-approved.26 In a trial of 63 patients, 52 were in remission three months after treatment while 40 patients remained in remission one year later.27

Kite Pharma was another major contender who gained approval for their product Yescarta (axicabtagene ciloleucel) used to treat adults with large B-cell lymphoma and aggressive non-Hodgkin lymphoma. Recognizing the great potential it had, Gilead Sciences, Inc., a major North American biopharmaceutical company, bought out Kite Pharma for $12 billion in October of 2017.25

Juno: JCAR015 and JCAR017

Founded in 2013, Juno Therapeutics was a small biopharmaceutical company working on hematological therapeutics. Seeing an opportunity to broaden their areas of research and gain stake in the novel treatment, Celgene invested $1 billion into development of Juno’s CAR-T therapies in 2015 and the two announced a decade-long collaboration. Within two years, Celgene bought out 9.7% of the smaller company for $500 million.28

Juno had a very promising CAR-T therapy called JCAR015 that had been developed to treat acute lymphoblastic leukemia (ALL). ALL is a cancer of the white blood cells where they do not mature properly resulting in an abundance of underdeveloped dysfunctional cells in both circulating blood and bone marrow. It is most often diagnosed in patients under 20 years old.29

During the JCAR015 phase 2 clinical trials, three patient deaths had occurred due to cerebral edema, the buildup of excess fluid in the brain and spinal tissues causing swelling. The study was halted and Juno blamed the deaths on the pre-treatment that was common among many companies’ protocols, rather than the therapy. Changes were made to the procedure to remove the suspected pre-treatment and upon hearing that, the FDA allowed the study to continue. Stock prices rose once more. Two more deaths occurred, again, due to cerebral edema which forced Juno to terminate all clinical trials.26

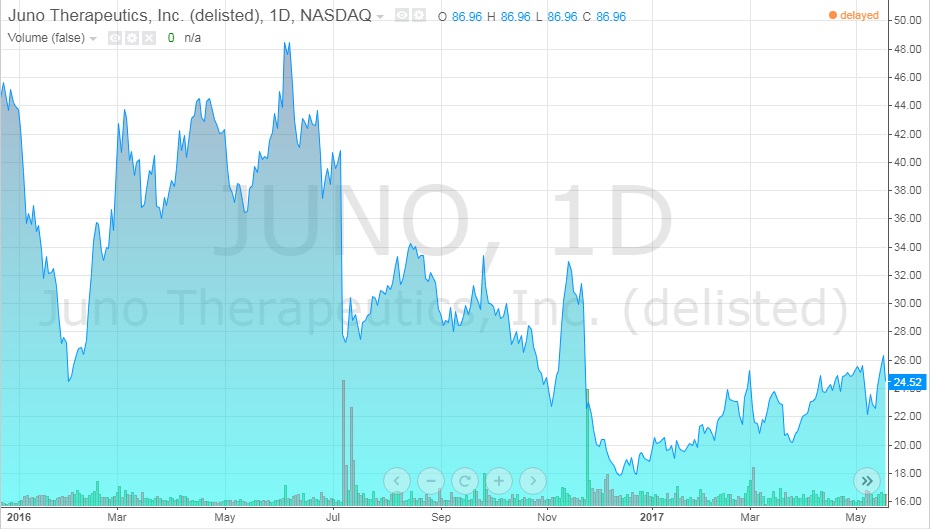

The first three deaths lead to the legal firm, Block & Leviton, suing Juno for failing to inform investors of all the details of the trials, like the deaths, knowing that it was important information. It was also alleged that the company was heavily selling stocks in the weeks before any announcements were made about the results of the experimental trials. The company denied these claims. In this time, Juno stocks fell from $50/share in the summer of 2016 to $23/share at early 2017 (see Exhibit 10).26

The five deaths that occurred during the clinical trials for JCAR015 were a major setback for Juno and forced the company to halt all testing. Investors were losing confidence in the company which caused stock prices to drop dramatically. In terms of drug development, Juno would have to reach further back into the pipeline for something that was not as far along requiring more time and money to regain their footing.28

Since then, Juno had been working on a new product, JCAR017, for treatment of large B-cell lymphoma and non-Hodgkin lymphoma.30 JCAR017 was thought to have greater safety and efficacy since it used defined CD4 and CD8 cell populations. By doing so, researchers had greater control over cell growth which was thought to be the major issue with JCAR015. These modified cells targeted a specific surface protein found in B-cell malignancies, a different type of cancer for another subset of white blood cells.28 So far, results have been positive with an overall response rate of 74%, or 14 out of 19 patients, at the three-month mark.30 It is expected that JCAR017 will gain FDA approval in 2019 with projected peak sales of about $3 billion.31

Despite the improvements and optimistic outlook, not everyone was confident in JCAR017’s potential. Brad Loncar, an investor analyst of novel cancer immunotherapies specifically, said,

“I think they are making a mistake by relying on JCAR-017. [It is] unclear if Juno will in fact be best in class or even if it will matter. The way this deal succeeds is if Celgene/Juno becomes a leader in CAR-T version 2.0, 3.0, etc. many years down the line.”30

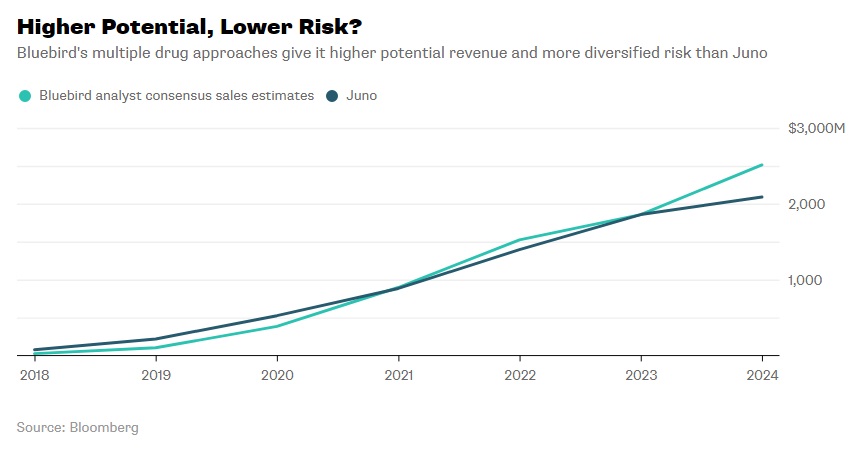

Celgene’s options

In 2013, before the Celgene-Juno partnership, the former had begun a partnership with Bluebird Bio, another small biopharmaceutical company developing a CAR-T therapeutic, bb2121, for targeting altered B-cells. 2016 clinical results showed that 56% of patients were in complete remission nine months post-treatment from a single dose. A few side effects were noted, but nothing fatal. Currently, the company has a second generation drug in the works.32 Some have wondered, would working with Juno be a conflict to Celgene’s first loyalties to Bluebird Bio? It turns out the two cell therapies had different molecular targets and did not occupy the same areas of the cancer therapeutics market so the overlap was not a serious concern. Between the two, analysts have projected Bluebird Bio’s potential revenue over the next five years to be close, but marginally greater than Juno’s (see Exhibit 11).33

Analysts have stated that Celgene’s attempt to enter the CAR-T market was a smart strategy since a large part of its research was heavily focused on hematology and cancer therapeutics. The development of new collaborative products or existing therapies that work synergistically could boost sales for all the players involved. Not only that, but being one of the bigger biopharmaceutical companies in North America, Celgene had the marketing capabilities and sales force to commercially succeed.34

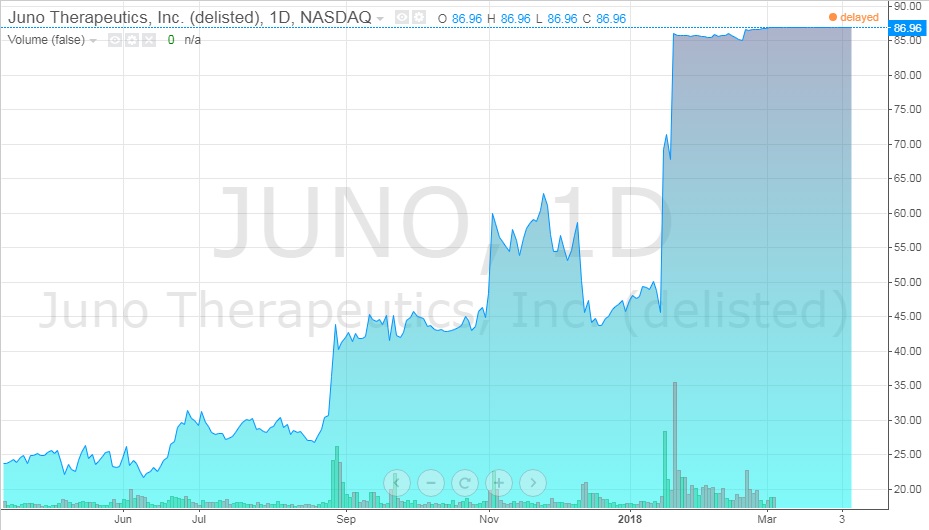

What would the acquisition of the remaining part of Juno mean for Celgene? Celgene would have complete control over JCAR017 as well as the other eight clinical and preclinical projects. Furthermore, the company would also gain 100% of revenue generated from these projects. Recent talks of a merger between the two had sent stock prices up (see Exhibits 12 and 13).31

Alles had the weight of carrying on the company on his shoulders and the decisions he had to make would no doubt define Celgene’s success over the next decade. With the looming decision of how to ensure Celgene’s future success and if Juno Therapeutics would be a piece of that puzzle, Alles turned away from the window and knew what to do.

Exhibits

Exhibit 1 Current Celgene products and their indications

| Name | Indication |

| Abraxane | Metastatic breast cancer, metastatic non-small cell lung cancer, metastatic adenocarcinoma |

| Idhifa | Adults with relapsed or refractory acute myeloid leukemia (AML) |

| Istodax | Cutaneous T-cell lymphoma, peripheral T-cell lymphoma |

| Otezla | Adult patients with active psoriatic arthritis, moderate to severe plaque psoriasis |

| Pomalyst | Multiple myeloma |

| Revlimid | Multiple myeloma, transfusion-dependent anemia, mantle cell lymphoma |

| Thalomid | Multiple myeloma, erythema nodosum leprosum |

| Vidaza | Myelodysplastic syndrome |

Source: Celgene Corporation. (n.d.). Therapies. Retrieved March 3, 2018, from http://www.celgene.com/therapies/

Exhibit 2 Celgene’s current products in the pipeline by area of research and clinical phase

Source: Celgene Corporation. (2018, February 18). Product Pipeline. Retrieved March 29, 2018, from http://media.celgene.com/content/uploads/product-pipeline.pdf

Source: Celgene Corporation. (2018, February 18). Product Pipeline. Retrieved March 29, 2018, from http://media.celgene.com/content/uploads/product-pipeline.pdf

Exhibit 3 Top 20 global pharmaceutical companies, August 2011 and 2017

Source: Carroll, J. (2017, July 18). King cancer: The top 10 therapeutic areas in biopharma R&D. Retrieved April 6, 2018, from https://endpts.com/king-cancer-the-top-10-therapeutic-areas-in-biopharma-rd/

Source: Carroll, J. (2017, July 18). King cancer: The top 10 therapeutic areas in biopharma R&D. Retrieved April 6, 2018, from https://endpts.com/king-cancer-the-top-10-therapeutic-areas-in-biopharma-rd/

Exhibit 4 Top ten therapeutic areas by number of research projects, August 2016

Source: Carroll, J. (2017, July 18). King cancer: The top 10 therapeutic areas in biopharma R&D. Retrieved April 6, 2018, from https://endpts.com/king-cancer-the-top-10-therapeutic-areas-in-biopharma-rd/

Source: Carroll, J. (2017, July 18). King cancer: The top 10 therapeutic areas in biopharma R&D. Retrieved April 6, 2018, from https://endpts.com/king-cancer-the-top-10-therapeutic-areas-in-biopharma-rd/

Exhibit 5 Distribution of products and projects by therapeutic area of research and phase

Source: Carroll, J. (2017, July 18). King cancer: The top 10 therapeutic areas in biopharma R&D. Retrieved April 6, 2018, from https://endpts.com/king-cancer-the-top-10-therapeutic-areas-in-biopharma-rd/

Source: Carroll, J. (2017, July 18). King cancer: The top 10 therapeutic areas in biopharma R&D. Retrieved April 6, 2018, from https://endpts.com/king-cancer-the-top-10-therapeutic-areas-in-biopharma-rd/

Exhibit 6 Summary balance sheet for years 2008-2017

| Year End (Dec) | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Total assets ($B) | 4.45 | 5.39 | 10.18 | 10.01 | 11.73 | 13.38 | 17.34 | 26.96 | 28.09 | 30.14 |

| Total liabilities ($B) | 0.95 | 0.99 | 4.18 | 4.49 | 6.04 | 7.79 | 10.82 | 21.05 | 21.49 | 23.22 |

| Total equity ($B) | 3.49 | 4.39 | 5.98 | 5.51 | 5.69 | 5.59 | 6.52 | 5.92 | 6.60 | 6.92 |

| Number of employees | 2441 | 2813 | 4182 | 4460 | 4700 | 5100 | 6012 | 7140 | 7132 | 7467 |

Source: Celgene Corporation. (n.d.). Financial information. Retrieved March 15, 2018, from http://ir.celgene.com/financials.cfm

Exhibit 7 Summary income statement for years 2008-2017

| Year end (Dec) | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Revenue ($B) | 2.25 | 2.73 | 3.58 | 4.84 | 5.43 | 6.48 | 7.64 | 8.9 | 10.92 | 12.82 |

| Total net income ($B) | -1.53 | 0.78 | 0.88 | 1.32 | 1.46 | 1.45 | 2.00 | 1.60 | 2.00 | 2.94 |

Source: Celgene Corporation. (n.d.). Financial information. Retrieved March 15, 2018, from http://ir.celgene.com/financials.cfm

Exhibit 8 Celgene stock value from March 2013-March 2018

Source: Nisen, M. (2018, March 14). People Are Talking About a Celgene LBO; That Should Worry It. Retrieved March 19, 2018, from https://www.bloomberg.com/gadfly/articles/2018-03-14/celgene-lbo-talk-should-worry-it

Source: Nisen, M. (2018, March 14). People Are Talking About a Celgene LBO; That Should Worry It. Retrieved March 19, 2018, from https://www.bloomberg.com/gadfly/articles/2018-03-14/celgene-lbo-talk-should-worry-it

Exhibit 9 How Chimeric Antigen Receptor – T-cell (CAR-T) therapy works

Source: Parker Institute. (2017, August 17). CAR T Therapy How It Works Final. Retrieved March 31, 2018, from https://www.parkerici.org/2017/08/30/leukemia-cancer-free-how-car-t-immunotherapy-saved-emily-whitehead/car-t_therapy-how-it-works_final/

Source: Parker Institute. (2017, August 17). CAR T Therapy How It Works Final. Retrieved March 31, 2018, from https://www.parkerici.org/2017/08/30/leukemia-cancer-free-how-car-t-immunotherapy-saved-emily-whitehead/car-t_therapy-how-it-works_final/

Exhibit 10 Juno stock value from January 2016-May 2017

Source: ADVFN. (n.d.). JUNO THERAPEUTICS, INC. (JUNO). Retrieved April 7, 2018, from https://www.advfn.com/stock-market/NASDAQ/JUNO/chart/trading-view

Source: ADVFN. (n.d.). JUNO THERAPEUTICS, INC. (JUNO). Retrieved April 7, 2018, from https://www.advfn.com/stock-market/NASDAQ/JUNO/chart/trading-view

Exhibit 11 Bluebird Bio and Juno projected revenue from 2018-2024

Source: Nisen, M. (2018, January 21). Bluebird Bio Shouldn’t Be Blue. Retrieved March 8, 2018, from https://www.bloomberg.com/gadfly/articles/2018-01-22/celgene-juno-deal-bluebird-bio-shouldn-t-be-blue

Source: Nisen, M. (2018, January 21). Bluebird Bio Shouldn’t Be Blue. Retrieved March 8, 2018, from https://www.bloomberg.com/gadfly/articles/2018-01-22/celgene-juno-deal-bluebird-bio-shouldn-t-be-blue

Exhibit 12 Celgene stock value from April 2017-April 2018

Source: ADVFN. (n.d.). Celgene (CELG). Retrieved April 7, 2018, from https://www.advfn.com/stock-market/NASDAQ/CELG/chart/trading-view

Source: ADVFN. (n.d.). Celgene (CELG). Retrieved April 7, 2018, from https://www.advfn.com/stock-market/NASDAQ/CELG/chart/trading-view

Exhibit 13 Juno stock value from April 2017-April 2018

Source: ADVFN. (n.d.). JUNO THERAPEUTICS, INC. (JUNO). Retrieved April 7, 2018, from https://www.advfn.com/stock-market/NASDAQ/JUNO/chart/trading-view

Source: ADVFN. (n.d.). JUNO THERAPEUTICS, INC. (JUNO). Retrieved April 7, 2018, from https://www.advfn.com/stock-market/NASDAQ/JUNO/chart/trading-view

Appendix

On March 6, 2018, Celgene announced it had completed the acquisition of Juno Therapeutics in a $9 billion deal contingent on the latter reaching specific regulatory and commercialization milestones.40

“The acquisition of Juno builds on our shared vision to discover and develop transformative medicines for patients with incurable blood cancers. Juno’s advanced cellular immunotherapy portfolio and research capabilities strengthen Celgene’s global leadership in hematology and adds new drivers for growth beyond 2020.” – Mark Alles, Celgene CEO, on the partnership.

“The people at Juno channel their passion for science and patients towards a common goal of finding cures by creating cell therapies that help people live longer, better lives. Continuing this work will take scientific prowess, manufacturing excellence and global reach. This union will provide all three.” – Hans Bishop, Juno CEO, on the partnership.41

The two acquisitions Celgene made in early 2018, Impact Biomedicines for $7 billion and Juno for $9 billion, had begun to instill confidence in investors. They could see that the company was no longer completely relying on Revlimid’s success and that it was serious about rebuilding the drug development pipeline. Despite the issues Celgene and Juno faced in the months leading up to the merger, analysts expect the company’s share value to rise 28% with improved earnings over the next two years.12

Endnotes

1 Celgene Corporation. (2018, January 29). Celgene Announces Retirement of Executive Chairman Bob Hugin and Appointment of CEO Mark Alles as Chairman of the Board of Directors. Retrieved March 15, 2018, from http://ir.celgene.com/releasedetail.cfm?releaseid=1055582

2 Celgene Corporation. (n.d.). Celgene. Retrieved March 5, 2018, from https://www.celgene.com/

3 Celgene Corporation. (2018, February 18). Product Pipeline. Retrieved March 29, 2018, from http://media.celgene.com/content/uploads/product-pipeline.pdf

4 Moorkens, E., Meuwissen, N., Huys, I., Declerck, P., Vulto, A., & Simoens, S. (2017, June 8). The Market of Biopharmaceutical Medicines: A Snapshot of a Diverse Industrial Landscape. Frontiers in Pharmacology. Retrieved April 6, 2018, from https://www.frontiersin.org/articles/10.3389/fphar.2017.00314/full

5 Otto, R., Santagostino, A., & Schrader, U. (2014, December). Rapid growth in biopharma: Challenges and opportunities. Retrieved April 6, 2018, from https://www.mckinsey.com/industries/pharmaceuticals-and-medical-products/our-insights/rapid-growth-in-biopharma

6 Mordor Intelligence. (2018, March). Global Biopharmaceuticals Market – Segmented by Type of Products and Applications – Growth, Trends and Forecasts (2018 – 2023). Retrieved April 6, 2018, from https://www.mordorintelligence.com/industry-reports/global-biopharmaceuticals-market-industry

7 Global Industry Analysts, Inc. (2015, June 3). MCP-7003: Biopharmaceuticals – A global strategic business report. Retrieved April 6, 2018, from http://www.strategyr.com/pressMCP-7003.asp

8 Carroll, J. (2017, October 25). What’s driving the rapid growth of the top 20 biopharma companies in the world?. Retrieved April 6, 2018, from https://endpts.com/top-20-pharma-companies-worldwide-by-valuation/

9 American Association for Cancer Research. (2015). Medicines in development for cancer. Retrieved April 6, 2018, from http://phrma-docs.phrma.org/sites/default/files/pdf/oncology-report-2015.pdf

10 Carroll, J. (2017, July 18). King cancer: The top 10 therapeutic areas in biopharma R&D. Retrieved April 6, 2018, from https://endpts.com/king-cancer-the-top-10-therapeutic-areas-in-biopharma-rd/

11 Celgene Corporation. (n.d.). Financial information. Retrieved March 15, 2018, from http://ir.celgene.com/financials.cfm

12 Kramer, M. (2018, March 14). Why Celgene’s Beaten Down Stock Can Rise 28%. Retrieved April 1, 2018, from https://www.investopedia.com/news/celgene-shares-may-rebound-28/

13 Lee, A. (2018, January 22). Immunotherapy Stocks Power Higher on Celgene-Juno Deal. Retrieved April 1, 2018, from https://www.thestreet.com/story/14457388/1/immunotherapy-stocks-move-higher-on-celgene-juno-deal.html

14 Philippidis, A. (2017, October 20). Celgene Weighs Fate of Crohn’s Candidate GED-0301 after Phase III Failures. Retrieved April 1, 2018, from https://www.genengnews.com/gen-news-highlights/celgene-weighs-fate-of-crohns-candidate-ged-0301-after-phase-iii-failures/81255077?q=celgene

15 Kenwell, B. (2018, February 28). Was Celgene’s Acquisition of Receptos a Huge Mistake?. Retrieved April 4, 2018, from https://www.thestreet.com/story/14504944/1/was-celgene-acquisition-of-receptos-a-huge-mistake.html

16 Lee, A. (2018, February 28). Celgene Shares Tank on Multiple Sclerosis Drug Application Setback. Retrieved April 3, 2018, from https://www.thestreet.com/story/14504430/1/celgene-shares-tank-multiple-sclerosis-drug-setback.html

17 ReportBuyer. (2017, November 14). The global cancer therapeutics market should reach $172.6 billion by 2022 from $121 billion in 2017 at a compound annual growth rate (CAGR) of 7.4%, from 2017 to 2022. Retrieved April 6, 2018, from https://www.prnewswire.com/news-releases/the-global-cancer-therapeutics-market-should-reach-1726-billion-by-2022-from-121-billion-in-2017-at-a-compound-annual-growth-rate-cagr-of-74-from-2017-to-2022-

18 Mordor Intelligence. (2018, March). Global Cancer Therapy Market – Segmented by Therapy Type, Cancer Type, End User – Growth, Trends and Forecast (2018 – 2023). Retrieved March 29, 2018, from https://www.mordorintelligence.com/industry-reports/global-cancer-therapies-market-industry

19 American Cancer Society. (n.d.). Cancer Surgery. Retrieved April 7, 2018, from https://www.cancer.org/treatment/treatments-and-side-effects/treatment-types/surgery.html

20 American Cancer Society. (n.d.). Radiation Therapy. Retrieved April 7, 2018, from https://www.cancer.org/treatment/treatments-and-side-effects/treatment-types/radiation.html

21 American Cancer Society. (n.d.). Chemotherapy. Retrieved April 7, 2018, from https://www.cancer.org/treatment/treatments-and-side-effects/treatment-types/chemotherapy.html

22 National Cancer Institute. (2017, April 6). Types of Cancer Treatment. Retrieved April 7, 2018, from https://www.cancer.gov/about-cancer/treatment/types

23 Celgene Corporation. (2017, December 5). Moving Beyond Chemotherapy in Blood Cancer Treatment. Retrieved March 7, 2018, from https://www.celgene.com/newsroom/cellular-immunotherapies/moving-beyond-chemotherapy-blood-cancer/

24 Research oncology. (n.d.). Chimeric Antigen Receptor T Cells (CAR T). Retrieved March 15, 2018, from https://researchoncology.com/pathways/immuno-oncology/chimeric-antigen-receptor-technology/

25 FierceBiotech. (2018, March 6). FierceBiotech’s rotten tomatoes and ripening fruit 2017. Retrieved March 15, 2018, from https://www.fiercebiotech.com/special-report/fiercebiotech-s-rotten-tomatoes-and-ripening-fruit-2017

26 Adams, B. (2017, February 17). 1. Juno Therapeutics. Retrieved March 15, 2018, from https://www.fiercebiotech.com/special-report/1-juno-therapeutics

27 Ramsey, L. (2018, January 22). Celgene is buying the cancer-drug maker Juno Therapeutics for $9 billion. Retrieved March 8, 2018, from http://www.businessinsider.com/celgene-acquires-juno-therapeutics-2018-1

28 Adams, B. (2018, January 17). Juno stock jumps as reports suggest Celgene wants a buyout. Retrieved March 15, 2018, from https://www.fiercebiotech.com/biotech/juno-jumps-afterhours-as-reports-suggest-celgene-wants-a-buyout

29 Leukemia & Lymphoma Society of Canada. (n.d.). About Blood Cancers. Retrieved March 15, 2018, from http://www.llscanada.org/disease-information/facts-and-statistics

30 Philippidis, A. (2018, January 22). Celgene to Acquire Juno for $9B, Expanding CAR-T, TCR Presence. Retrieved March 19, 2018, from https://www.genengnews.com/gen-news-highlights/celgene-to-acquire-juno-for-9b-expanding-car-t-tcr-presence/81255403?q=celgene

31 Taylor, P. (2018, January 22). Celgene confirms $9B Juno buyout, sees $3B sales for JCAR017. Retrieved March 8, 2018, from https://www.fiercebiotech.com/biotech/celgene-confirms-9bn-juno-buyout-sees-3bn-sales-for-jcar017

32 Taylor, P. (2017, December 10). Bluebird and Celgene’s CAR-T hits the mark in myeloma. Retrieved March 8, 2018, from https://www.fiercebiotech.com/biotech/bluebird-and-celgene-s-car-t-hits-mark-myeloma

33 Nisen, M. (2018, January 21). Bluebird Bio Shouldn’t Be Blue. Retrieved March 8, 2018, from https://www.bloomberg.com/gadfly/articles/2018-01-22/celgene-juno-deal-bluebird-bio-shouldn-t-be-blue

34 Lee, A. (2018, January 21). Celgene Could Be Bulking Up Very Fast. Retrieved March 3, 2018, from https://www.thestreet.com/story/14455526/1/celgene-could-be-bulking-up-very-fast.html

35 Celgene Corporation. (n.d.). Therapies. Retrieved March 3, 2018, from http://www.celgene.com/therapies/

36 Nisen, M. (2018, March 14). People Are Talking About a Celgene LBO; That Should Worry It. Retrieved March 19, 2018, from https://www.bloomberg.com/gadfly/articles/2018-03-14/celgene-lbo-talk-should-worry-it

37 Parker Institute. (2017, August 17). CAR T Therapy How It Works Final. Retrieved March 31, 2018, from https://www.parkerici.org/2017/08/30/leukemia-cancer-free-how-car-t-immunotherapy-saved-emily-whitehead/car-t_therapy-how-it-works_final/

38 ADVFN. (n.d.). JUNO THERAPEUTICS, INC. (JUNO). Retrieved April 7, 2018, from https://www.advfn.com/stock-market/NASDAQ/JUNO/chart/trading-view

39 ADVFN. (n.d.). Celgene (CELG). Retrieved April 7, 2018, from https://www.advfn.com/stock-market/NASDAQ/CELG/chart/trading-view

40 Celgene Corporation. (2018, March 6). Celgene Completes Acquisition of Juno Therapeutics, Inc., Advancing Global Leadership in Cellular Immunotherapy. Retrieved March 17, 2018, from http://ir.celgene.com/releasedetail.cfm?releaseid=1059796

41 Baccardax, M. (2018, January 21). Celgene Makes $9 Billion Cancer Treatment Play for Juno Therapeutics. Retrieved March 17, 2018, from https://www.thestreet.com/story/14456890/1/celgene-makes-9-billion-cancer-treatment-play-for-juno-therapeutics.html