6 Porter’s Five Forces

Amna A., Maham H., Viola H., Rashmi K.

An Open Educational Resource

Porter’s Five Forces is a framework used to analyze the balance of power within a particular industry and therefore, its overall profitability. These outline 5 forces that drive competition and threaten the company’s ability to make profits.

Created by Michael E. Porter of Harvard Business School in the 1970s, Porter’s Five Forces sets out to answer questions such as: What’s going on out there in your industry? What deserves your attention? Of the many things that are happening, which ones matter for competition? It is able to determine how different parts of an industry interact in order to allow for profitability without changing the level of quality of the product or services provided by industry. It is also able to determine how changes within an industry can affect a given sector. Porter’s 5 forces are therefore used to predict industry trends and changes in competition, and this information can help a company to make strategic decisions about the industry to gain/maintain status within it.

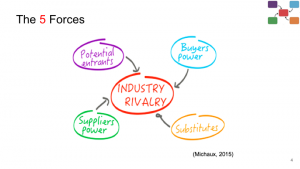

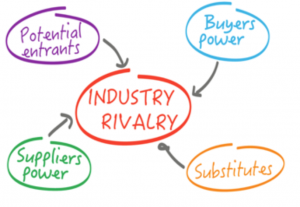

The Five Forces consist of Industry Rivalry, threats of potential entrants, threats of substitutes, strength of buyer power and strength of supplier power. As you can see in Figure 1, four of the forces feed into Industry rivalry.

Buyer’s Power

Buyers have the ability to influence the decision-making process of a company. Buyers with a lot of power can force prices down or demand that the company put more value into a service or product. Buyers are able to gain all the value for themselves, consequently decreasing profitability for the industry. If a company has many smaller buyers, the company is able to lose one such customer without any detrimental effects on the business. However, if the company has few larger buyers, this is not the case. Buyers have power if the following occur:

- A large volume of product is purchased by fewer buyers.

- Buyers are able to switch companies without incurring costs to themselves. This is due to the undifferentiated and standard nature of the products or services.

- Buyers have complete information on how the industry is working, including demand, actual market prices, and even supplier costs. This information can place buyers in a better negotiating position.

Supplier’s Power

Similar to buyers, suppliers can also influence industry decision making. Suppliers are able to dictate terms of business such as price, quality, delivery times, etc. A company should not be dependent on one large supplier but have many smaller suppliers in order to decrease supplier power. Suppliers retain their power due to the following:

- Suppliers are concentrated or have a monopoly on supplies.

- There are no real substitutes available to compete against.

Potential Entrants

These are individuals looking to enter the industry and create start-ups to compete with the existing companies and gain market share. Barriers to entry are the most critical variables which determine the position of an existing company in the industry. If the factors to start the business-like capital expenditure, technical know-how, regulations, cost advantages, customer’s brand loyalty etc. are high, the barriers for new entrants will be higher. The absence of these will allow for easier access for new entrants.

Substitutes

These are alternatives to the existing products or services available that customers can easily switch to. These substitutes have the most power when providing products/services with the same function but at higher quality and lower cost. This concept can restrict industry profitability due to the improvement of price-performance tradeoff, therefore producing higher profits for others.

Industry Rivalry

Firms with the same industry have the tendency to compete in an attempt to dominate the market. Rivalry is dependent on the number of firms within the same market and the extent to which they collude with each other. Rivalry occurs because there is opportunity or pressure for improvement. Firms compete using a variety of strategies, including price competition, advertising battles, product introductions, customer services changes and extended warranties. Rivalry is able to keep prices down, improve quality and therefore benefits industry customers.

Porter’s Five Forces: Netflix

Netflix is a US-based internet streaming media provider founded by Reed Hastings and Marc Randolph in 1997. It originally started with providing DVD-by-mail service in North America and now provides digital streaming with services available worldwide. Although Netflix is the most popular online subscription service for streaming entertainment in the world, there are some issues which threaten the long-term viability of their business model. Below is an assessment of Netflix using Porter’s Five Forces model to determine how market forces may affect the company’s business.

Power of Buyers

The bargaining power of buyers is high because:

- Customer loyalty is weak. Since customers have zero switching cost, they can cancel the subscription anytime and switch to a new or alternate service provider.

- Customers are highly price-sensitive. They tend to switch to a new or alternate service whenever the cost is increased. For instance, in 2011, Netflix divided their DVD-by-mail service and streaming service into two separate services, which was earlier priced $10 per month for both together. They increased the cost to $7.99 per month for each and in less than 3 months’ time, they lost around 800,000 customers. In 2014, they increased the cost from $7.99 to $8.99 per month and gave 2 years exemption from price increase to the existing subscribers to mitigate this risk.

- Customer subscription fees are the major stream of revenue since commercials are not included.

- There is a considerable threat posed by piracy sites which provide free streaming services and customers may compromise quality for this benefit.

- Mitigation of these concerns can considerably reduce the bargaining power of buyers. Offering original content (for example, original TV series like House of Cards, Orange is the New Black, and Arrested Development) which is available only through Netflix is one of the ways by which they are mitigating this risk.

Power of Suppliers

The bargaining power of suppliers is high because:

- Suppliers are contracted with Netflix through Licensing Agreements. Once the agreement expires, a supplier may switch to a new/alternate service provider and this will have a significant impact on the business as it reduces the volume of content available for Netflix customers. For instance, in 2013, after the contract with Netflix expired, Viacom contracted with Amazon and Netflix lost access to air their programs.

- Suppliers are also offering their own digital streaming services. Hulu, a joint venture of 21st Century Fox, NBCUniversal, and The Walt Disney Company, offers high volumes of own content, as well as shows from various other networks. A part of their subscription service supports commercials and hence mitigates the consumer price-sensitivity risk by creating an additional revenue stream that makes them less reliant on subscription volume to remain profitable.

- Suppliers own a majority of the content and Netflix is highly dependent on them for large volumes of content with high quality, which is a threat to the long-term viability of their business model.

- Mitigation of these concerns can considerably reduce the bargaining power of suppliers. As a mitigation strategy, Netflix pursued backward integration by making original content, thereby reducing their dependency on suppliers.

Potential Entrants

The threat of new entrants is moderate because:

- Netflix works on a high economy of scale with high product variety, maintaining low cost and increasing profit. New entrants with low investment capital are less likely to enter this market, but bigger companies like Google and Apple with strong financial and technical capabilities can be a huge threat to Netflix.

- Competition in online streaming is likely to intensify in the future since the movie and television industry is a well-recognized growth sector.

- Traditional service providers are entering the market. For instance, Crave TV owned by Bell, one of Canada’s leading telecommunication companies, has entered the Canadian market. They provide online streaming service at a much lower cost than Netflix but the service is available only for Bell customers, while Netflix is available for anyone with access to the internet. Likewise, HBO and CBS are new entrants in the US market with a competitive advantage of owning large volumes of content and brand name.

Substitutes

The threat of substitutes is moderate because:

- Certain customer segments still tend to rely on substitutes like Satellite and Cable TV, DVDs and Rentals, and Movie Theatres for entertainment. Customers will continue to rely on television to watch live shows which get broadcasted on specific channels and on theatres to watch newly released movies.

- While there is an increasing trend in the popularity and demand for digital streaming services, rapid technological advancements may result in new and innovative substitutes that could pose a threat in the future.

Industry Rivals

Competitive rivalry is moderate because:

- Although the competitive environment is high with industry rivals like Amazon, Hulu, YouTube, HBO, and several other networks, a collaborative environment is emerging among the competitors. For instance, products like Amazon Fire TV Stick and Google Chromecast give consumers access to Netflix and other 3rd party services.

- Consumers are subscribing to two or more services at a time and hence multiple organizations will get the market share.

Mayhem!

Mayhem is a role-playing activity that will allow students to take part in the framework of Porter’s Five Forces for a given company (See Case Summary below). The objectives of the activity are:

- To analyze Porter’s Five Forces for a given company by taking on a role in the industry, and to understand the supply chain’s effect on industry profitability.

- To assess how an industry changes in response to environmental shifts, and how this affects a given company aiming to grow within the industry.

Rules

- The students will be divided into five teams of 2-4 people, each representing an industry player outlined in Porter’s Five Forces. The presenters will take on the role of the Focal Firm, and the professor will take on the role of “Mayhem”. Descriptions of teams are outlined below, as well as relevant information regarding their position in the industry.

- Each group will be provided with important industry information pertaining to the other teams, for reference throughout the activity.

- The neutral round of the game will consist of the group members assessing their power or threat standing before any environmental shift or “mayhem” has occurred. This will be used to portray the current “attractiveness” of the industry. Answers will be recorded in in the Industry Outlook Table (see Table 2).

- For example, the Wannabes will decide whether the threat of new entrants against the focal firm is ↑ (high) or ↓ (low) prior to any environmental shift; the Customers group will decide whether their bargaining power is ↑ (high) or ↓ (low).

- Industry outlook will be scored by counting the number of ↓ (low) threat/power standings. A total score of 1/5 or 2/5 on the Industry Outlook chart indicates an industry that will not favour the growth of the focal firm. A score of 3/5 indicates a neutral industry, with a “wait and see” approach to be applied by the focal firm. A score of 4/5 or 5/5 indicates an industry that is favourable for growth or entry by the focal firm. See Table 2.

- For the second round of the game, the Mayhem player will randomly pick and present an environmental shift (see below) that may fluctuate the threat/power standings of the five teams. Groups will discuss how their threat/power standing has been shifted, and revise the “Industry Outlook” table. The class will then decide whether the industry is favourable or unfavourable towards the growth of the focal firm.

- Note: If a group is unaffected by the environmental shift, they will retain the threat/power standing from the neutral round.

- Several rounds of Mayhem will be played, depending on the time available.

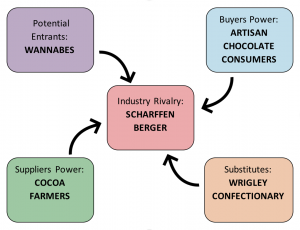

Case Summary: Olive and Sinclair Chocolate Company

Olive and Sinclair Chocolate Company is one of the 60 chocolatiers serving the gourmet chocolate niche market. The gourmet chocolate niche market is occupied by artisanal chocolatiers that aim to produce chocolate using fair trade cocoa instead of using cocoa cartels. The main goal of artisanal chocolatiers is to make handmade chocolate with new and unique flavours instead of mass production. As a result, artisanal chocolatiers charge top dollar for their chocolate, averaging at $6.00/2.75 lb. Olive and Sinclair charge $7.00/2.75 lb. As a company, they produce more than 60, 000 pounds of chocolate per year and are planning to expand internationally.

The gourmet chocolate niche is only 10 years old in the US, and it continues to flourish with the addition of new and unique flavours. Therefore, the competition in the industry is high, many opportunities are available for new entrants and the customers have high expectations towards fine tastes. Olive and Sinclair have built their brand around old-fashioned, Southern approach to chocolate making, which adds to their competitiveness.

Environmental Shifts

- There was a crop blight (disease) which impacted the cocoa market globally by causing a decrease in cocoa supply by 40%.

- Nestlé, one of U.S.A’s major chocolate confectionaries, went bankrupt and folded.

- A recently published study showed a link between autism and chocolate and has been gaining media attention. The study claimed that chocolate causes autism in children that also take allergy medication.

- OPTIONAL ROUND: Hershey’s, one of U.S. A’s largest chocolate confectionaries, went bankrupt and folded. Hershey’s had previously acquired Scharffen Berger, one of Olive and Sinclair’s main competitors.

Note: More details about the case and the activity can be found in the Wilson (2015) paper, as listed in the References.

Table 1: Key Artisan Chocolate Industry Partners for Olive and Sinclair Case Study

| Major Players in Case Study | Description |

| Olive and Sinclair Chocolatiers (Focal Firm) | – Based in Nashville.

– Specialty: Adding brown-cane sugar to chocolate gives it unique taste; products include Buttermilk White Chocolate, Bourbon Nib Brittle, Salt and Pepper Chocolate, and Mexican Style Cinnamon Chili Chocolate. – Branding: old-fashioned, southern, and local. O&S started with help form Nashville based companies, and partnerships are local. – Has had some success with expansion internationally. Products can be found at Whole Foods and coffee houses in Singapore, Japan, and U.K. |

| Artisan Chocolate Consumers (Customers) | – High-end artisan chocolate consumers

– Enjoy artisan chocolate because it is not mass-produced, and more care is taken by companies to create partnerships with cocoa-farmers. – These consumers are willing to pay a lot for artisan chocolate because of the attractiveness of a non-mass produced, farmer-friendly products. The great effort put in by artisanal chocolatiers to create the finest final product is a top selling point for customers. – Pay $7 for 2.75-ounce chocolate at Olive and Sinclair – Pay $3.75 per 3-ounce bar at Scharffen Berger (a major competitor based in San Francisco). – Pay $6 for 2.8-ounce bar at Chuao Chocolatier (a major competitor based in San Diego). |

| Cocoa Farmers (Suppliers) | – Farmers that supply cocoa for artisanal chocolatier companies or mass-produced companies with Fair Trade products (for example, 3% of Nestlé’s overall cocoa purchase comes from free trade).

– Most cocoa farming occurs in West Africa, South America, and Asia. – Artisanal chocolatiers often visit cocoa farmers in their home countries to find the finest supplies. |

| Scharffen Berger (Competitor) | – A San Francisco based artisanal chocolatier company.

– Carefully sourced cocoa beans produce high-quality cacao. – Add in flavours: pistachios, raspberries, coconuts. – Price is $3.75 per 3-ounce chocolate bars. – Known as the world’s best chocolatiers – Recently acquired by Hershey’s, but operating under the same name. Overall market: niche industry of artisanal chocolatiers is 10 years old in the U.S., with 60 non-mass production competitors. The market is fragmented, with lots of small business competition and openings for new entrants to start up in the industry. |

| Wrigley Confectionary (Substitute) | – Candy company that mass-produces corn syrup and cane candy with little or no chocolate ingredients in their products.

– Products include Starburst, Skittles, gummies, and various chewing gum brands. |

| Wannabes (New Entrants) | – External players considering start-up in the industry.

– They keep an eye on supply, demand, and industry outlook to determine if the opportunity exists to enter smoothly into the industry and gain profit. Overall market: niche industry of artisanal chocolatiers is 10 years old in the U.S., with 60 non-mass production competitors. The market is fragmented, with lots of small business competition and openings for new entrants to start up in the industry. |

Table 2: Industry Outlook Table for “Mayhem” Activity*

| ENVIRONMENTAL SHIFTS | Threat/Power Standings (↓↑) | ||||

| Artisan Chocolate Consumers (Customer) | Cocoa Farmers (Supplier) | Scharffen Berger (Competitor) | Wrigley (Substitute) | Wannabes (Potential Entrants) | |

| NO Shift | |||||

|

|||||

| Shift: Crop blight causes worldwide cocoa supply to drop by 40% | |||||

|

|||||

| Shift: Nestlé, one of the United States of America’s major chocolate confectionary, went bankrupt and folded. 3% of their total cocoa purchase was fair trade. | |||||

|

|||||

| Shift: Highly publicized study released, claiming that chocolate causes autism in children who are taking allergy medication. | |||||

|

|||||

| Shift (OPTIONAL): Hershey’s, one of the United States America’s largest chocolate confectionary, went bankrupt and folded. Hershey recently acquired Scharffen Berger. | |||||

|

|||||

*Note: Answers will be filled out in class.

References

- Law, J. (Ed.). (2009). Porter’s Five Forces. A Dictionary of Business and Management. Oxford University Press. Retrieved from http://www.oxfordreference.com/view/10.1093/acref/9780199234899.001.0001/acref-9780199234899-e-7237

- Michaux, S. (2015). Porter’s Five Forces: Understand competitive forces and stay ahead of the competition. 50Minutes.com – Management & Marketing.

- Owen, A. S. (2003). Accounting for Business Studies. Amsterdam: Routledge.

- Magretta, J. (2012). Understanding Michael Porter: The Essential Guide to Competition and Strategy. Boston, MA: Harvard Business Review Press.

- Porter, M. E. (2008). Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York, NY: Free Press.

- Richard Bowen, Robert Daigle, Tara Dion, Sarah Valentine (2014) Netflix Case Study | Retrieved from http://robertdaigle.com/wp-content/uploads/2014/01/BowenDaigleDionValentine_NetflixCaseStudy.pdf

- Shannon Szabo-Pickering (2016) A Porter’s Five Forces Analysis of Netflix | Retrieved from https://www.slideshare.net/ShannonPickering1/netflix-five-forces-analysis

- Netflix Logo | Retrieved from http://www.stickpng.com/img/icons-logos-emojis/tech-companies/netflix-logo

- Wilson, R. C. (2015). Mayhem: A Hands-on Case Playing Activity for Teaching Porter’s Five Forces to Undergraduate Business Students. Small Business Institute Journal; Greenville, 11(2), 48–59.

Appendix