43 Big Pharma and Biotech: A match made in heaven?

A look at mergers and acquisitions as strategies for sustainable growth in the pharma industry. |

|

Authored by Nadine Abraham

April 09th 2019

In the hot seat – Bristol-Myers Squibb |

“Okay, Giovanni, I’m going to look you in the eyes, and I’m going to ask you a question”.

Giovanni Caforio, the CEO of Bristol-Myers Squibb remains stoic and poised amidst the interrogation he’s received so far from Jim Cramer host of the show “MAD MONEY” (CNBC Markets). Bristol-Myers Squibb had recently been the centre of attention following a controversial merger signed with the biotech giant, Celgene.

“Were you approached by another company, and rather than become a part of that company, you decided to stay independent and bought Celgene for a ton of money so that any potential acquirer would no longer pursue you?”

When asked this question Giovanni simply smiles and replies, “Jim this is not a defensive deal…[sic] we are creating an even stronger Bristol-Myers Squibb – well positioned for long term growth”. (CNBC Mad Money, 2019)

Is this true? Do such mergers and acquisitions generate innovation necessary for long term growth? Or is this deal a disaster in the making?

This case study will examine the drivers behind such mergers and acquisitions as well examine the benefits and pitfalls to pharmaceutical companies. Finally, a commentary will be provided on whether this is a viable strategy for sustainable growth.

Company Profile – Bristol-Myers Squibb |

1989 marked a key date in Bristol-Myers Squibb history. It signified the inception of the company through the merger of two American pharmaceutical companies, Bristol-Myers and E.R. Squibb & Sons. (Bristol-Myers Squibb, 2019)

Dr Edward Squibb, a military surgeon was certainly ahead of the times. He recognized an immediate need for high quality medicines and began manufacturing them out of a humble brownstone building in Brooklyn, New York. Dr Squibb’s ethos was also shared by Hamilton College graduates William Bristol and John Myers who in 1887 purchased the down-and-out Clinton Pharmaceuticals Company. (Bristol-Myers Squibb, 2019)

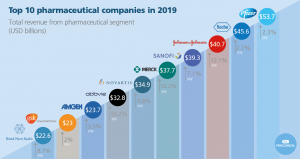

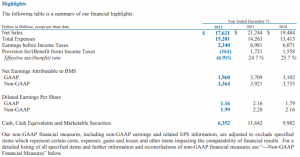

Fast-forward many decades later, the company has transformed from humble beginnings to a global bio-pharmaceutical company. Today, Bristol-Myers Squibb is ranked among the top ten pharmaceutical companies in the world following growth in 2018. (Exhibit A) In fact, the company’s year-end revenue was valued at $22.6 billion dollars, driven by strong sales of the immuno-therapy drug Opdivo and Eliquis, an anticoagulant.

Bristol-Myers Squibb or BMS for short, focuses its R & D efforts on four key disease areas. This includes oncology, cardiovascular, immuno-science, and fibrosis. This narrow focus is in stark contrast to the company’s early beginnings when it was churning out blockbuster drugs such as Plavix (anti-coagulant) and Abilify (anti-depressant) among others. (Bristol-Myers Squibb, 2019)

A key factor in BMS’s success is the strategic approaches undertaken by the company. In 2007, the company made the decision to fully transition to a bio-pharmaceutical company focusing on the aforementioned niche markets. (2007 BMS Annual Report) Prior to this, the company’s business model was a vertical fully integrated pharmaceutical company model.

The Traditional Pharmaceutical Business Model or the “Big is Better!” Strategy |

Why would a successful pharmaceutical company like Bristol Myers Squibb consider altering their business model? For most businesses, this is a risky gamble but often times, a necessary course of action.

Early on, pharmaceutical companies adopted the conventional strategy of creating blockbuster drugs. These were single products or a minority of products that generated large revenue streams of over $1 billion annually. (Exhibit B)

To develop a blockbuster drug however, it would take at least a decade and a price tag of $1 billion dollars to successfully bring the drug to market. (Franco & Kaitin, 2002)

The high costs associated with developing these products stem largely from the company’s operational model. Big Pharma companies are heavily invested with drug discovery, synthesis, clinical research and development, regulatory work and scale-up. Additionally, sales and marketing also play a large role in delivering the product to the public.

This type of model is termed as a fully integrated pharma company model or “FIPCO”.

Although initially heralded as the gold standard of business models, a shift in market trends demanded a need for change. These trends include but are not limited to patent expiry, research and development productivity, and regulation standards.

A SWOT analysis of the FIPCO model |

I. Strengths of the FIPCO business model

Or, in the words of Jerry Maguire, “Show me the money!”.

A key strength of this business model are the good cash-flow streams which are ‘recession resistant’ and provide constant dividends keeping shareholders satisfied. (Lowe, 2014) (Berman, 2018)

There are several reasons for these positive cash-flow streams. Firstly, a direct consequence of exclusive patent rights means that big pharma companies can strong arm consumers to pay hefty prices for their blockbuster drugs.

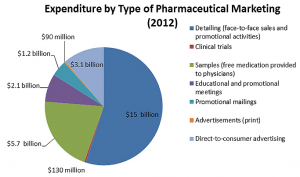

Secondly, an aggressive sales team coupled with marketing strategies reinforce the product’s brand. Interestingly, the target audience for these marketing campaigns is most often health care professionals, rather than consumers themselves. As seen on the right, around $3 billion was spent marketing to consumers and $24 billion spent towards physicians. (PEW Prescription Project, 2013)

Finally, big pharma companies have a strong global presence compared with smaller biotechnology firms. In accordance with the FIPCO model, pharma companies possess large manufacturing plants, laboratories and corporate offices distributed across the globe. Having this global presence also allows big pharma to build on their expertise concerning international regulations for clinical trials and product manufacture to name a few. (Gilbert et al., 2003) Big pharma companies retain a competitive edge over other small companies due to the scale of these commercialization operations.

II. Weaknesses of the FIPCO business model

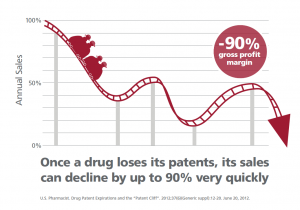

As highlighted above, big pharma’s cash flow depends on revenue generated from one or two blockbuster drugs. This becomes a troubling issue when the patent for the blockbuster drug expires. What results then is a ‘patent cliff’ or a significant drop in revenue when the product goes off patent. (Song & Han, 2016)

To offset this loss of revenue, big pharma companies begin investing R & D efforts to generate a drug pipeline. This approach fails however, as big pharma companies cannot discover blockbuster drugs fast enough.

To make matters worse for investors, the return on investment (ROI) is a meager 5% and this return is only achieved over a significant period of time. (Bingham, 2006) Analysts estimate at least a forty-year cycle of investment and return as profits generated from blockbuster drug sales are re-directed towards R & D efforts for other pipeline drugs. Admittedly there is a great deal of risk to the potential investor due to high failure rates which are second nature to big pharma companies. (Bingham, 2006)

Secondly, technological developments with the advent of the genomics era have ushered in a need for personalized medicines rather than a one-size-fits-all approach. Lastly, regulatory bodies within the healthcare industry and social pressures from patients and insurance agencies alike also serve to drive competition between the expensive brand-name drugs and cheaper generic drugs.

III. Threats to this business model

The entry of generic companies on the playing field significantly impact revenue for big pharma companies. In fact, the largest wave of blockbuster patent expirations in 2010 led to significant revenue losses for big pharma companies. A look a Bristol-Myers Squibb 2012 annual report illustrates how the loss of exclusivity over Plavix resulted in a loss of $3.6 billion dollars. (Exhibit E)

Additionally, while big pharma companies such as BMS do have pipeline drugs in the making, stringent regulatory barriers limit the approval process for these drugs. Hence, although R & D spending has increased, the drug approval rate has decreased significantly.

IV. Opportunities for developing new business models

The famous American motivational speaker, Zig Ziglar has been quoted as saying “Try to look at your weakness and convert it into your strength. That’s a success”.

This same fundamental concept can be applied to big pharma business models as well.

Patent loss has led several big pharma companies to develop innovative strategies for achieving new revenue streams. These can either be product centered or business model centered, the latter of which is many times neglected.

The key question here then is what are these sources of innovation and how can big pharma companies use innovation to improve R & D productivity?

Learning by example – Innovation exists in biotechnology business models |

Henry Chesbrough of Harvard Business School in 2003 proposed innovation as being key to the success of businesses. This trend in terms of innovative technologies forms the very hallmark of biotechnology companies. In fact, the source of this innovation stems from the close relationships between biotech and academia through which many technologies are born. (De Rubertis et al., 2009)

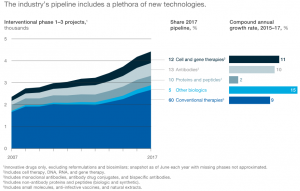

The advent of emerging technologies has triggered a shift in terms of the type of blockbuster drugs now being produced. Currently, 12% of the global clinic pipeline are cell-based and gene therapies. Biologics which comprise 5% of the global clinic pipeline are another exciting therapeutic, distinct in terms of their manufacturing processes. (McKinsey & Company, 2017) (Exhibit F)

In this case, recombinant DNA technology is used to manufacture these large molecules. This strongly contrasts with the big pharmaceutical companies that focus on conventional small molecule drug therapies produced via chemical synthesis.

“The economic environment for small biotech companies has been difficult for the past three to four years and doesn’t appear to be improving significantly.”Another key advantage here is that there are no ‘generic’ forms for biologics. However, in 2009, the US Congress passed a ‘bio-similar’ law which is the generic equivalent for biologics. Despite this, there is no clear regulatory FDA framework for approving these bio-similars making it difficult for competing companies to replicate biologics.

With such innovative products and technologies, a steady stream of revenue is required to fund the intensive research and development involved. In fact, for many developed countries such as the US and Canada, this has been difficult owing to periods of recession. In 2008, biotech companies were only able to raise 16.5 billion dollars – a decline of 45% compared with 2007. (PricewaterhouseCoopers, 2010)

Edward Lanphier, founder of Sangamo BioSciences whose company is developing a platform technology to treat HIV/AIDS has stated, “The economic environment for small biotech companies has been difficult for the past three to four years and doesn’t appear to be improving significantly”. (Drug Development Technology, 2012)

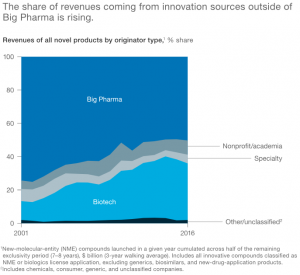

For this reason, many biotech firms look to form strategic alliances with big pharma companies for growth. (Exhibit G) There are various types of strategic alliances that can be adopted including partnerships, mergers, acquisitions and so forth.

2019 heralded one of the largest mergers in the big pharma industry – that of the biotech giant Celgene and Bristol-Myers Squibb.

Bristol-Myers Squibb and Celgene sign a merger |

On January 3rd, 2019, BMS and Celgene entered into a mega-merger having an equity value of $74 billion dollars. The terms of this agreement provide Celgene shareholders with one Bristol Myers Squibb’s share and $50 cash for each Celgene share. The shareholders would also receive one tradeable contingent value right for each share of Celgene. This would only apply however if the Celgene’s pipeline drugs ozanimod, liso-cel (JCAR017), and bb2121 receive FDA approval by December 21st, 2020 for the first two and March 31st 2021 for bb2121. (Campbell, 2019)

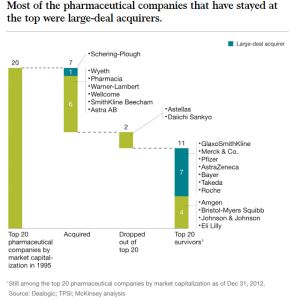

There are several key drivers for strategic alliances such as these. The 2017 Tax Cuts and Jobs Act in the US allowed for a reduction of the corporate tax rate from 35% to 21% making mergers and acquisitions attractive in the US. Not surprisingly, 2018 proved to be the year for mergers and acquisitions. Historically, analysts state that such mergers and acquisitions are what have shaped the pharmaceutical landscape. (Exhibit H)

Secondly, the higher costs of bringing a new drug to market are another driver behind such deals. In 2017, the average cost (adjusted for risks) was $2.6 billion dollars compared with $1.2 billion dollars in 2010. The reason behind this is the high cost of failure associated with phase 3 clinical trials – success rates are usually between 10 and 12%. Thirdly, regulatory standards for complex diseases such as cancer are very stringent. In 2017, only 18% of drugs in big pharma pipelines succeeded in coming on the market. Another positive for mega-mergers such as these are the shareholder value created and profits generated for the acquiring company.

So, Big Pharma does indeed have the necessary cash to burn. Therefore, companies such as BMS can afford to pick and choose who they wish to form a strategic alliance with.

Why then would Bristol-Myers Squibb choose to merge with Celgene?

Celgene – A biotech powerhouse |

Celgene is a large American biotechnology company which specializes in innovative therapies for cancer as well as immune-inflammatory diseases. The company took root in 1986 when founders David Stirling and Sol Barer teamed up at the Celanese Corporation. Celgene began as a spinoff company and eventually transitioned to an independent biotechnology company. (Celgene, 2019)

The company enjoyed its first taste of success in 2003 following the launch of ‘Thalomid’ which was initially used to treat a side effect of leprosy. In 2006, Celgene obtained US regulatory approval to use Thalomid as a treatment for multiple myeloma as well. (Celgene, 2019)

The company continued to grow and expand its product line through the acquisition of minor biotech companies thereby cementing its position as a top producer of innovative cancer-based therapeutics. The company’s relatively recent acquisition of Juno Therapeutics has allowed them to focus on CART based therapies. This would enable them to become a leader in immune-based therapies. (Celgene, 2019)

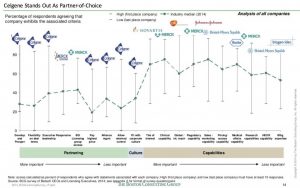

With so many smaller biotech companies under its belt, Celgene gained quite the reputation for being a savvy deal-maker. What is attractive about the company is its corporate culture. The biotech giant does not dictate terms in these agreements rather accommodates its partners needs as well. This is observed through the variety of deals struck ranging from strategic equity investments to structured acquisitions. In lieu of this, the company is very attractive to young biotech companies with an entrepreneurial mind-set. (The Boston Consulting Group, 2014) (Exhibit I)

Celgene’s luck ran out however in 2014 when it purchased the rights to an experimental drug GED-301 which was supposed to be a blockbuster drug to treat Crohn’s disease. In 2017, Celgene announced the drug had failed phase three trials. Immediately following this, Celgene’s stocks plummeted. (Campbell, 2017) To add to this tale of woe, Celgene would soon be facing a patent cliff of its own following the loss of exclusivity to its blockbuster drug Revlimid. The company was also running into significant debt as observed through its debt to equity ratio. This decline was attributed to the company’s recent acquisition of Receptos.

Celgene emerged as an attractive prospect for BMS owing to its oncology pipeline drugs. Celgene’s product portfolio proved to be complementary to BMS’s key research areas as well. Hence for BMS, the deal would mean an expansion of pipeline drugs (specifically oncology) to offset stiff competition from Merck’s product Keytruda.

A merger such as this appears to be a match made in heaven. However there are a few who are opposed to this marriage – namely BMS shareholders.

Trouble in Paradise – BMS Shareholders are not happy |

Bristol-Myers Squibb shareholders have openly voiced their dissatisfaction for the deal at hand. Firstly, the merger would mean that Bristol Myer Squibb assumes Celgene’s $32 billion dollar debt. This is a sizeable increase from BMS’s outstanding obligations of $7.3 billion dollars. (LaVito & Lovelace Jr. 2019)

BMS’s largest shareholders Wellington, Dodge and Cox, and Starboard Value have stated that BMS would be accepting far too much of a risk; furthermore, BMS shareholders seem to be getting the short end of the stick as the merger undervalues BMS stock price. Secondly, shareholders have argued that Celgene has a poor track record of delivering on its promises.

On a positive note, although there is a significant of debt absorbed by the acquiring partner, this is not always a bad thing. In fact, such mergers may lead to cost optimization strategies and improve R & D productivity.

Are mergers the right approach for big pharma and biotech? |

In conclusion, the remaining question that still needs to be addressed is, can mergers indeed generate innovation?

Mergers can be mutually beneficial. For Big Pharma, mergers may provide the big break these companies require to diversify their drug product pipeline. Secondly, the biotech industry cannot solely rely on investors to keep their firms afloat, eventually, they will be driven into such mergers and acquisitions to keep investors satisfied. (Warner, 2004) It is important however to note that mergers can occur between large biotech firms but is not as common as pharmaceutical mergers.

A butterfly effect resulting from these mergers is the job loss impacting scientists involved in R & D projects. Between 2002 to 2012, around 300,000 jobs were impacted by merger and acquisitions in the pharmaceutical industry. (Biospace, 2016) For employees that do survive the merger, there is the additional hassle of adapting to a new corporate environment. Big pharma is more conservative, whereas biotech may be considered more ‘hip’ and ‘individualistic’ and lacking the bureaucracy present in big pharma. (Biospace, 2016)

In the long run, however, critics argue that mergers and acquisitions may not be a sustainable means for big pharma to generate growth. Another consequence of mergers besides job loss is that certain R & D projects may be dropped by the acquiring company as part of cost-cutting strategies. Lastly, mergers and acquisitions may remove competitors from the market landscape which removes health competition and reduces innovation. (Lo, 2015)

The future of this deal is uncertain |

April 12th, 2019 is set to be the date that Bristol-Myers Squibb shareholders cast their vote on whether or not to go through with this deal. Should the deal not go through, there would be significant penalties incurred by Bristol-Myers Squibb including $2.2 billion dollars in termination fees and additional $40 million dollars to compensate Celgene’s expenses for this deal. On the one hand, should BMS win this merger, they could still lose out $15 billion dollars if the drug pipeline does not get approved.

Could this marriage be on the rocks? Only time will tell.

References

- Reuters. (2019, January 04). Celgene, Bristol-Myers set $2.2 billion termination fee for their mega-deal. Retrieved from https://www.businessinsider.com/r-celgene-bristol-myers-set-22-billion-termination-fee-for-their-mega-deal-2019-1/(n.d.). Retrieved from https://www.ddw-online.com/business/p97056-whither-pharmathe-demise-of-pharma-s-blockbuster-business-model.html

- Berman, K. (2018, January 18). Big Pharma, Big Dividends. Retrieved from https://www.forbes.com/sites/kenberman/2018/01/18/big-pharma-big-dividends/

- BioSpace. (2016, September 26). Biotech vs. Big Pharma: Which is the Better Place to Work? Retrieved from https://www.biospace.com/article/biotech-vs-big-pharma-which-is-the-better-place-to-work-/

- Bristol-Myers CEO: Celgene merger will yield 6 products in 24 months. (2019, March 07). Retrieved from https://www.cnbc.com/video/2019/03/06/bristol-myers-ceo-celgene-merger-will-generate-more-innovation.html

- Campbell, T. (2017, October 20). How Big of a Deal Is Celgene’s Flop? Retrieved from https://www.fool.com/investing/2017/10/20/how-big-of-a-deal-is-celgenes-flop.aspx

- Campbell, T. (2019, March 15). Is Celgene and Bristol-Myers a Match Made in Heaven or Doomed to Fail? Retrieved from https://www.fool.com/investing/2019/03/15/is-celgene-and-bristol-myers-a-match-made-in-heave.aspx

- Celgene Emerges as Biotech’s Shrewdest, Nimblest Dealmaker. (2015, June 23). Retrieved from https://xconomy.com/national/2013/08/05/celgene-emerges-as-biotechs-savviest-nimblest-dealmaker/

- Daniel. (2012, April 18). Small players, big drugs – pharmaceutical SMEs take the innovative edge. Retrieved from https://www.drugdevelopment-technology.com/features/featuredrug-pharmaceutical-sme-big-pharma-innovation/

- How do Drugs and Biologics Differ? (n.d.). Retrieved from https://www.bio.org/articles/how-do-drugs-and-biologics-differ

- Implications of Consolidation in the Pharma and Biotech Sector. (n.d.). Retrieved from https://www.sustainalytics.com/esg-blog/pharma-biotech-consolidation-2018/

- LaVito, A., & Jr., B. L. (2019, January 03). Bristol-Myers Squibb’s $74 billion acquisition of Celgene would combine two troubled companies. Retrieved from https://www.cnbc.com/2019/01/03/bristol-myers-squibb-shares-fall-on-74-billion-celgene-acquisition.html

- Lo, C. (2015, January 06). Pharma mergers: Big business, bad science? Retrieved from https://www.pharmaceutical-technology.com/features/featurepharma-mergers-big-business-bad-science-4467897/

- Lowe, D. (2014, March 10). Startups vs. Big Pharma. Retrieved from https://blogs.sciencemag.org/pipeline/archives/2014/03/10/startups_vs_big_pharma?r3f_986=https://www.google.com/

- NOVMEBER 2003 BUSINESS Rebuilding Big Pharma … – bain.com. (n.d.). Retrieved from https://www.bain.com/contentassets/040b2c20d74b4a42b262d0b0a3067a9b/rebuilding_big_pharma.pdf

- R&D in the ‘age of agile’. (n.d.). Retrieved from https://www.mckinsey.com/industries/pharmaceuticals-and-medical-products/our-insights/r-and-d-in-the-age-of-agile

- Six secrets to success|[mdash]|how to build a sustainable biotech business. (n.d.). Retrieved from https://www.nature.com/bioent/2009/090501/full/bioe.2009.5.html

- Speights, K. (2017, April 14). Celgene Stock History: The Biotech’s Path to Gigantic Gains. Retrieved from https://www.fool.com/investing/2017/04/14/celgene-stock-history-the-biotechs-path-to-giganti.aspx

- The Urge to Merge. (n.d.). Retrieved from https://www.the-scientist.com/biobusiness/the-urge-to-merge-49599

- Understanding how US tax reform will affect divestitures … (n.d.). Retrieved from https://www.fintechlog.com/2018/04/21/understanding-how-us-tax-reform-will-affect-divestitures/

- What’s behind the pharmaceutical sector’s M&A push. (n.d.). Retrieved from https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/whats-behind-the-pharmaceutical-sectors-m-and-a-push

- Who are the top 10 pharmaceutical companies in the world? (2019) | ProClinical Recruitment blogs. (n.d.). Retrieved from https://www.proclinical.com/blogs/2019-3/the-top-10-pharmaceutical-companies-in-the-world-2019

- Anderson, R. (2014, November 06). Pharmaceutical industry gets high on fat profits. Retrieved from https://www.bbc.com/news/business-28212223

- Gautam, A., & Pan, X. (2016). The changing model of big pharma: Impact of key trends. Drug Discovery Today,21(3), 379-384. doi:10.1016/j.drudis.2015.10.002

- Bristol-Myers CEO: Celgene merger will yield 6 products in 24 months. (2019, March 07). Retrieved from https://www.cnbc.com/video/2019/03/06/bristol-myers-ceo-celgene-merger-will-generate-more-innovation.html

- History Timeline. (n.d.). Retrieved from https://www.bms.com/about-us/our-company/history-timeline.html