34 The French Pharmaceutical Giant: A case study of Sanofi

The French Pharmaceutical Giant: A case study of Sanofi

By: Naheen Imtiaz

April 8, 2018

On Thursday, February 19th2015, Sanofi finally announced that the search for their CEO came to an end which started on the Fall of 2014 and took a four month period after which it declared that Dr. Oliver Brandicourt would be taking over as their current CEO replacing Chris Viehbacher. The former CEO was fired after having series of disputes with the board members, especially with the chairman of Sanofi, Serge Weinberg, who questioned his way of work ethics and the alleged disputes were due to the problems with communications and management style.

Mr. Viehbacher’s exit from Sanofi was disappointing to many of the investors of the company with whom Viehbacher used to go along well. The investors acknowledged that he was indeed successful into making Sanofi more like an innovative and dynamic company when it was lacking these, bringing back the company’s drug development process to its previous glory, and was acting more like a traditional company to survive than to gearing up with their rivals. However, his departure occurred at a time when the company was facing a crucial moment in the diabetes business and was at stake at profit in the US.

History of Sanofi before Dr. Oliver Brandicourt took charge

Sanofi, formerly known as Sanofi Aventis, is a French multinational pharmaceutical company and is one of the fifth largest in generating revenues from prescription sales of drugs. It has a high class R&D organization and the company holds a superb reputation for its drug discovery and development status providing therapeutic solutions over a range of diseases to improve the quality of life. The company covers vaccines as well and its division Sanofi Pasteur is undoubtedly the world’s largest manufacturer of vaccines. Sanofi is known as Sanofi Aventis Canada Inc. which is situated in Laval, Quebec and its Canadian division Sanofi Pasteur is located in Toronto, Ontario. Still having a world class R&D operation, there were no new drugs in the pipeline for Sanofi and that is when Chris Viehbacher was appointed as the CEO of Sanofi from December 2008. The company was going through a rough patch- with a lot of its patented drugs were soon going to lose the patent and will have to face patent expiry of the key drugs which was going to put at stake more than one-third of their revenue when Mr. Viehbacher took in charge. Pharmaceutical experts felt that Sanofi was lacking behind in the race to keep up with the changes in the pharmaceutical and biotech industry where other leaders were performing far better than Sanofi and that it was being run more like a traditional French company based in Paris than a competitive health leader.

Viehbacher was focused to transform the image of Sanofi to once its glorious R&D and make it a dynamic healthcare leader. The company focused on making new strategies with its R&D, management, emerging markets as well as focusing on non-prescription drug sectors. It declared a sales of 7,438 million euros for Q2 2009 as compared to 6,689 million euros in 2008 when Viehbacher was in action. Its stock value also went high and this was surprising as just the year before, i.e. in 2008, Sanofi’s stock had been considered the worst among its peers/rivals. Sanofi was the third largest pharmaceutical company of the world in the year 2009. However in 2013 when most of Sanofi’s key drugs had to face patent expiry, its revenue fell.

Biotech Boom- A strategic plan

In order to revitalize Sanofi’s R&D sector, Chris Viehbacher decided to depend on Regeneron to conduct and help Sanofi in R&D and compared to the French multinational giant, Regeneron was a much smaller biotech company based in USA. This did not go too well with the board members who questioned how Viehbacher was planning to help drive the growth of Sanofi who did not opt for mega mergers but still was making a multi-billion dollar collaboration with a smaller biotech company in comparison to Sanofi. In 2014 Sanofi paid about $1 billion to Regeneron to conduct research on their behalf as back in 2013 Sanofi lost most of its patented drugs and was about to enter generic sales. Chris’s goal was to use Sanofi’s skills and Regeneron’s expertise to help bring the change into Sanofi’s R&D which it was desperately trying to make better and brought out emerging products into the market.

The many faced problems

Despite all his efforts, he was finally showed the door on late 2014. In the same year the state filed suit against Sanofi when native Hawaiians were dying at an increased rate due to reasons of cardiovascular death for marketing the drug Plavix (Clopidogrel) as an anti-blood clotting agent for patients who suffered stroke or heart attack whereas the company knew that this drug would not work for the majority of the population in Hawaii. This lawsuit could make Sanofi come under a difficult phase as the drug company should have tested and trialed a drug in all different kinds of population.

Sanofi again came under limelight for the wrong reasons. It had to pay a fine of 40.6 million euros for making disparagement strategies about other company’s product and spreading false news about it in order to slow down the drug development process of competing generic drugs. French Competition Authority (FCA) found out about Sanofi’s disparagement practices and the company had to pay whopping amount of fine whereas they could have focused more on how making their products more dynamic. Recently Sanofi partnered with Viela Bio which is a spin off company of global drug giant AstraZeneca to help aid in Sanofi’s research program. Analysts saw a lot of potential in Viela Bio to become a leading biotech company as it was successful to raise a lot of money for its funding, $250 million, from investors and questioned Sanofi’s future that it was again partnering with a company, like it partnered with Regeneron, which could become their competitor in the future.

Innovation in the healthcare environment

Sanofi was focused on bringing quality medicines and effective treatment for the whole world and Canada was a core part of it. It wanted to meet the healthcare needs of Canadians and wanted to go for intellectual property protection regime as the Canadian innovative pharmaceuticals had no effective right of appeal when they face challenges with IP. Hugh O’Neill, president and CEO of Sanofi Canada said that the challenges with loss of patent exclusivity was needed to be met in order to deliver value to the Canadian healthcare system. He emphasized that Sanofi would be focusing more for a sustainable long term growth rather than following the traditional pharmaceutical business model. They wanted to have an effective discussion coupled with effective measures taken by the government as insufficient government policies with patent exclusivity was causing generalization of branded drugs even though they were still under patent protection. This situation was threatening Sanofi’s R&D investments, capital expenditures and job creation opportunities. Sanofi wanted to focus on this issue so that they can grow the Canadian market to a more sustainable one and does not fall behind with respect to their other international divisions.

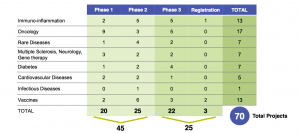

Lantus, Sanofi’s novel recombinant human insulin analog approved for use in high blood sugar control in patients with Type 1 and Type 2 diabetes, was one of its highest selling drug with sales above $7 billion in 2015. In 2009, Sanofi for the first time launched an eco-friendly insulin pen in Canada to provide safe and more efficient use of insulin instead of taking insulin shots with a needle. Diabetes is one of the chronic disease affecting more than two million people in Canada and it is estimated that one-third of the population do not know that they are vulnerable to this condition. According to Canadian, diabetes condition, Canadian healthcare system spend an estimated $13.2 billion each year to treat diabetes and its complications and by the year 2020, the cost would be mounting up to whopping $19.2 billion per year. Sanofi brought an added advantage to themselves as well for Canadians with the launch of this medicine pen as one of the first country in the world to do so to achieve sustainable control of the blood sugar level.

Some of the highlights of the new Canadian strategy included:

- Wider understanding about the needs of the patient, physicians, policy makers

- Creating a sustainable model to deliver greater savings of the country spend on healthcare by investing in product positioning

- Providing services and support to the patient by making a network or connection with them

- Collaborating with the marketers to target the right patient for the patient

- Securing the best possible results for Canada’s healthcare system and the patients.

- Spreading awareness about diseases and the significance of disease prevention.

Sanofi Pasteur

Sanofi’s constant struggle in the pharmaceutical market led to being questioned about its future and growth. The French drug maker had to sell its bone marrow transplant drug (Sargramostim) plant in January 2018 for $60 million as it seemed that they were having a hard time figuring out their constant challenges with R&D and as a result they could not target this drug market anymore, thereby selling it. So the company was inclined to focus on its largest division, the vaccines sector, Sanofi Pasteur.

Scandals of Dengue Vaccine

WHO reported that that it would review the safety data of Sanofi’s dengue vaccine after the French pharmaceutical giant announced that their vaccine could actually worsen the condition of dengue in some cases. This came as a shock and surprised the drug market as news evolved that by using the vaccine severe infections could arise which was actually supposed to be treated as a dengue vaccine whereas it was reported to worsen the disease. The Philippines Government would be taking legal actions against Sanofi and suspended massive immunization program which was taking place in Philippines. An estimated 830,000 school children were reported to be vaccinated by this drug and Philippines was asking the company to fund the treatment of the children who developed severe form of dengue after vaccination. This alarmed the pharmaceutical industry as Sanofi announced that infection rate could rise to about 90% more in patients who had been vaccinated, and being liable on Sanofi came under scrutiny as protests went on in Philippines and experts questioned if it was really liable to be depended on Sanofi and its treatment anymore.

Sanofi brought this vaccine to the market as a very promising and effective vaccine for dengue, a disease which affects millions of people by mosquito bite especially in the developing world, but the scenario became delicate when Sanofi found out that dengue can backfire after using their vaccine. The Philippines government paid $69 million to Sanofi for this vaccines and was planning to take legal actions against Sanofi. Atleast 20 children have died, allegedly after using the vaccine since Sanofi’s declaration and the victim’s parents have accused the dengue vaccine as the cause of death of their children. Sanofi was expecting a net loss of 100 million euros from this vaccine as a result of diminished. This dengue vaccine was sold in over 11 countries with massive immunization taking place in Philippines and Brazil. Philippines government started investigations about it. Sanofi spent about 20 years to bring this vaccine to the market as world’s first ever dengue vaccine which costed them 1.5 billion euros ($1.78 billion). Two other dengue vaccines were in line in the last stage of clinical trials and this situation could threaten Sanofi’s future sales of these dengue vaccines. Despite this scandal, Sanofi’s vaccines by Sanofi Pasteur made more than 5 billion euros in net sales year.

The challenges

As Chris Viehbacher exit from being the CEO of Sanofi, Oliver Brandicourt took up his place. Oliver being the new CEO of Sanofi was welcomed by many analysts. He took charge of Sanofi at a critical situation when it was busy to launch its products into the market which investors were looking forward to it to revitalize growth of Sanofi after long periods of no innovation and lack of R&D dynamicity. The chairman of Sanofi, Serge Weinberg, welcomed him to Sanofi and felt he was the right choice among all as he had a record 28 years pharmaceutical industry experience among which working with Pfizer, Bayer were notable before joining Sanofi. Though Mr. Brandicourt had all the commercial and scientific experiences and had an international professional background, he had to face a number of challenges.

From building a good relationship with the board members and investors to defending Sanofi’s place in the market specially the diabetes market was among the most important of them all. Former CEO Chris Viehbacher had a good rapport with the investors and this was the point that everybody was looking forward to as Oliver Brandicourt needs to stay along not only the board members but also with the investors who wanted to see that how he can make a difference regarding Sanofi’s difficult phase in making an increased growth. Lantus, the anti-diabetic drug, brought in more than a fifth of Sanofi’s revenue in 2014 and it was considered the world’s best-selling insulin. But there were to dangers to this business. One was that Lantus was about to lose its patent exclusiveness and the rivals have been targeting this product for a long time, making cheaper drugs than Lantus and producing its biosimilar version and the other was that since it was one of the widely used drugs, insurers were trying to make a much tougher way to make price negotiations. Lantus was under a lot of pressure in the US for this second reason. All these factors made Sanofi predict that their drug sales might not be profitable than the previous year. Oliver Brandicourt also needed to make sure that he kept the drug pipeline like an on-going process for Sanofi to bring in new and improved products into the market. He had a lot of cups to be filled and needed to ensure that he maintained his previous successes like that at Pfizer in bringing cholesterol lowering medicines to the market. His past experiences should prove to be advantageous for Sanofi as it was preparing to tackle up with the current scenarios of the pharmaceutical and biotech business.

The Promises and the Future

Sanofi was awaiting approval for Toujeo Insulin from US FDA to launch a better version of the world’s best-selling diabetic drug, Lantus, into the market. Clinical trials showed promising results of this new drug and Sanofi remarked it can dominate the diabetes market once again with this drug. They also developed Praluent with Regeneron Biotech, a new injectable cholesterol lowering drug and Sanofi stated that it would prove to be a key drug for their business targeting the statins markets as this drug was supposed to be better tolerated in patients with statin intolerance and making them a leader in this sector as well. Praluent showed results of overall fewer deaths cutting down 15% deaths associated with patients who received only statin treatment and were not responsive to this therapy. As a marketing strategy, Sanofi also planned to sell this drug at a cheaper rate for high risk patients with increased cholesterol. They offered lower the price upto 69% in exchange that insurers and pharmacies broaden their medicine coverage to more number of patients. Experts thought this strategy could be used to establish Sanofi as a leader of the future pharmaceutical industry and Sanofi was had clinical data reports to support their claim. Sanofi also had two new dengue vaccines which were present in their pipeline in the late stages of drug development.

However, Sanofi’s fourth-quarter sales of 2017 fell 10.8% at constant exchange rates to $1.64 billion though the total sales increased 4,1% and to 8.7 billion euros. The sales of diabetes and heart disease sector went down 20% in the fourth quarter of 2017 as diabetes sales were facing competition due to patent loss and generic business of their product from the competitors, especially in the US. Still Sanofi was trying to be a leader in an emerging field. It made two outstanding deals and took over on two big companies to be an outstanding achiever in rare blood disorder treatments. In 2018, the French pharmaceutical giant took part in one of its biggest deal since 2011 acquiring the US biotech company Bioverativ for $11.6 billion. Sanofi agreed to buy in cash all of the outstanding shares of Bioverativ for $105 per share.

Analysts felt this deal should have been too expensive for Sanofi to bear as its shares fell 3.4%, making the stock the worst performer on France’s index. However Sanofi felt that this would make their successful return to deal making after years of major takeover failures. Sanofi was also successful in cracking a deal to buy Belgium’s Ablynx who develop drugs for rare blood diseases for 3.9 billion euros ($4.8 billion) and beat their rival Novo Nordisk who wanted to acquire Ablynx first. Novo Nordisk said it was not ready such a big amount to crack the deal with Ablynx whereas they generate more revenues than Sanofi does. Sanofi last bought the US biotech company Genzyme in 2011 for about $20 billion and in 2016 it lost to Pfizer to on buying the California based cancer specialist Medivation. Last year it also lost to Johnson & Johnson another biggest rival of Sanofi to take over Actelion, the Swiss Biotech Company. Oliver Brandicourt felt that with acquiring these companies, Sanofi could become an emerging leader in the market of rare disorders associated with blood. They had managed to face the challenges in the US market with their diabetes drug facing generic competition and with the dengue vaccine making the infection even worse and analysts and experts have questioned about their growth in their R&D sector, bringing new drugs in their pipeline. Investors also questioned Sanofi’s costly acquiring of two major acquisition deals in their crucial moment.

Oliver Brandicourt stated that Sanofi would be ready to launch upto 18 new drugs by 2020. Sanofi said that annual sales of rare blood disease treatment drug market was around $10 billion. 181,000 people had been affected worldwide by this rare blood disorder. So, Sanofi targeted to execute their strategic goals with the launch of hemophilia drugs in the market which is projected to be grown more than 7% per year upto the year 2022.

References:

- Andrew Ward. 2015. Five Big challenges facing Sanofi’s new chief Oliver Brandicourt. Retrieved from- ft.com: https://www.ft.com/content/8cb2611a-b900-11e4-b8e6-00144feab7de

- Andrew Ward. 2015. Sanofi’s ousted CEO Viehbacher received 3M euros pay-off. Retrieved from- ft.com: https://www.ft.com/content/910d7646-a276-11e4-9630-00144feab7de

- 2009. Sanofi-Aventis Canada transforms to support Sustainable Business Model. Retrieved from- newswire.ca: https://www.newswire.ca/news-releases/sanofi-aventis-canada-transforms-to-support-sustainable-business-model-539796831.html

- 2010. Transforming Sanofi-Aventis. Retrieved from- icmrindia.org: http://www.icmrindia.org/casestudies/catalogue/Business%20Strategy/BSTR358.htm

- Carolyn Abraham. 2018. DNA on drugs: How genetic tests could make prescriptions more precise. Retrieved from- theglobeandmail.com: https://www.theglobeandmail.com/canada/article-dna-on-drugs-how-genetic-tests-could-make-prescriptions-more-precise/

- Camille Keres, Jean-Nicolas Maillard. 2018. How spreading fake news about your competitors’ products will get you in antitrust trouble. Retrieved from Steptoe.com: https://www.steptoe.com/en/news-publications/how-spreading-fake-news-about-your-competitors-products-will-get-you-in-antitrust-trouble.html

- Tina Reed. 2018. MedImmune announces $250 million spinout, plan to create 100 new jobs. Retrieved from bizjournals.com: https://www.bizjournals.com/washington/news/2018/02/28/medimmune-announces-250-million-spinout-plan-to.html

- 2010. Sanofi-Aventis Canada transforms to support Sustainable Business Model. Retrieved from- newswire.ca: https://www.newswire.ca/news-releases/sanofi-aventis-canada-transforms-to-support-sustainable-business-model-539796831.html

- 2009. New Lantus® ClikSTAR™ eco-friendly insulin pen now available in Canada. Retrieved from- newswire.ca- https://www.newswire.ca/news-releases/new-lantusr-clikstartm-eco-friendly-insulin-pen-now-available-in-canada-538680281.html

- 2009. Sanofi-Aventis Canada appoints Hugh O’Neill as President and CEO. Retrieved from- newswire.ca: https://www.newswire.ca/news-releases/sanofi-aventis-canada-appoints-hugh-oneill-as-president-and-ceo-538584411.html

- Eric Palmer. 2018. PTx will hire 40 for U.S Leukine plant it acquired from Sanofi. Retrieved from- fiercepharma.com: https://www.fiercepharma.com/manufacturing/ptx-will-hire-40-for-u-s-leukine-plant-it-acquired-from-sanofi

- Bill Berkrot. 2017. Trouble mounts for Sanofi dengue vaccine over safety concerns. Retrieved from- reuters.com: https://www.reuters.com/article/us-sanofi-dengue/trouble-mounts-for-sanofi-dengue-vaccine-over-safety-concerns-idUSKBN1DY26Y

- John Reed, Harriet Agnew. 2017. Philippines threatens Sanofi with legal action over dengue vaccine. Retrieved from- ft.com: https://www.ft.com/content/d27132a6-db37-11e7-a039-c64b1c09b482

- Denise Grady, Katy Thomas. 2017. Retrieved from nytimes.com: https://www.nytimes.com/2017/12/17/health/sanofi-dengue-vaccine-philippines.html

- Ned Pagliarulo. 2018. Regeneron-Sanofi cholesterol drug cuts heart risk in major study. Retrieved from- biopharmadive.com: https://www.biopharmadive.com/news/regeneron-sanofi-praluent-cut-cardiovascular-heart-risk-odyssey-study/518854/

- Joseph Walker. 2018. Regeneron, Sanofi to cut cholesterol drug price. Retrieved from- marketwatch.com: https://www.marketwatch.com/story/regeneron-sanofi-to-cut-cholesterol-drug-price-2018-03-10

- Eric Sagonowsky. 2018. Sanofi, Regeneron’s Praluent pulls off PCSK9 coup with 29% cut to death risks in most vulnerable patients. Retrieved from- fiercepharma.com: https://www.fiercepharma.com/pharma/sanofi-regeneron-praluent-odyssey-outcomes

- 2018. Sanofi 4th– quarter profit misses expectations but sales in line. Retrieved from- thepharmaletter.com: https://www.thepharmaletter.com/article/sanofi-4th-qtr-profit-misses-expectations-but-sales-in-line

- Matthias Blamont. 2018. Sanofi’s return to profit growth this year slower than hoped. Retrieved from reuters.com: https://www.reuters.com/article/us-sanofi-results/sanofis-return-to-profit-growth-this-year-slower-than-hoped-idUSKBN1FR0MW

- Matthia Blamont. 2018. UPDATE 1- Sanofi pins on 2018 for growth after recent takeover deals. Retrieved from- cnbc.com: https://www.cnbc.com/2018/02/07/reuters-america-update-1-sanofi-pins-hopes-on-2018-for-growth-after-recent-takeover-deals.html

- Sudip Kar-Gupta. 2018. Sanofi digs deep to buy U.S. hemophilia group Bioverativ for $ 11.6-billion. Retrieved from- theglobeandmail.com: https://www.theglobeandmail.com/report-on-business/international-business/european-business/sanofi-digs-deep-to-buy-us-hemophilia-group-bioverativ-for-116-billion/article37679776/

- Harriet Agnew, Arash Massoudi, Sarah Neville. 2018. Sanofi beats Novo Nordisk with 3.9 billion euros Ablynx deal. Retrieved from- ft.com: https://www.ft.com/content/38264d00-04f7-11e8-9650-9c0ad2d7c5b5

Exhibits

Exhibit 1: Diabetes statistics in Canada

Source: Diabetes.ca [ http://www.diabetes.ca/how-you-can-help/advocate/why-federal-leadership-is-essential/diabetes-statistics-in-canada]

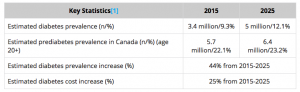

Exhibit 2: List of some of the top pharmaceutical companies with revenues greater than $10 billion

Green boxes= profit; Green arrow= position upwards

Red Boxes= loss; Red arrow= position fell

Source:En.wikipedia.org[ https://en.wikipedia.org/wiki/List_of_largest_pharmaceutical_companies_by_revenue]

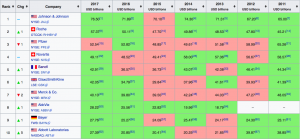

Exhibit 3: List of the Largest selling drugs with revenues over $5 billion in 2015

Source: En.wikipedia.org [ https://en.wikipedia.org/wiki/List_of_largest_selling_pharmaceutical_products]

Exhibit 4: List of Largest independent biotechnology and pharmaceutical companies based on market capitalization

Source: En.wikipedia.org [ https://en.wikipedia.org/wiki/List_of_largest_biotechnology_and_pharmaceutical_companies]

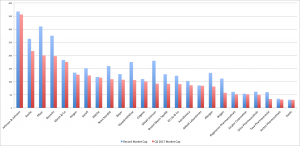

Exhibit 5: Graphical representation of top 25 biotechnology companies based on market capitalization for Q2 2017

Source: En.wikipedia.org [ https://en.wikipedia.org/wiki/List_of_largest_biotechnology_and_pharmaceutical_companies#/media/File:Top-25_Biotechs_Mkt_Cap_(Q22016).png]

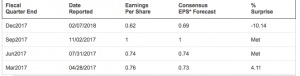

Exhibit 6: Quarterly earnings surprise history of Sanofi

Source: Nasdaq.com [ https://www.nasdaq.com/earnings/report/sny]

Exhibit 7: 2017 Results of Sanofi (Source: Sanofi.com: https://www.sanofi.com/media/Project/One-Sanofi-Web/sanofi-com/en/investors/img/2017_results_EN_web.pdf)

Company Sales and Business EPS

2017 Sales- 35,055 million euros

2017 Business EPS- 5.54 euros

Exhibit 8: Sales of Global Business unit of Sanofi (Source: Sanofi.com: https://www.sanofi.com/media/Project/One-Sanofi-Web/sanofi-com/en/investors/img/2017_results_EN_web.pdf)

- General Medicines & Emerging Markets- 14,048 million euros

- Sanofi Genyme (Specialty Care) – 5, 674 million euros

- Diabetes and Cardiovascular- 5, 400 million euros

- Sanofi Pasteur (Vaccines)- 5, 101 million euros

- Consumer HealthCare- 4, 832 million euros

Exhibit 9: Sales by Geography (Source: Sanofi.com: https://www.sanofi.com/media/Project/One-Sanofi-Web/sanofi-com/en/investors/img/2017_results_EN_web.pdf)

- US: 11,855 million euros

- Latin America: 2, 837 million euros

- Europe: 9, 525 million euros

- Eurasia: 1, 242 million euros

- Africa and Middle East: 2, 326 million euros

- Asia & South Asia: 3, 732 million euros

- Rest of the world: 3, 417 million euros

Exhibit 10: R&D Pipeline summary (Source: Sanofi.com: https://www.sanofi.com/media/Project/One-Sanofi-Web/sanofi-com/common/docs/investors/Sanofi_IR_Pipeline&CTSlides_Q42017Final.pdf)