12.9 Performance Management and Compensation

Matching Compensation with Core Values

As you review the compensation package your company offers, one thing that stands out is that it no longer matches the core values of your organization. When your organization merged five years ago with a similar firm that specializes in online shoe retailing, your company had to hire hundreds of people to keep up with growth. As a result—and what happens with many companies—the compensation plans are not revised and revisited as often as they should be. The core values your company adopted from the merging company focused on customer service, freedom to work where employees felt they could be most productive, and continuing education of employees, whether or not the education was related to the organization. The compensation package, providing the basic salary, health benefits, and retirement plan, seems a bit old-fashioned for the type of company yours has become.

After reviewing your company’s strategic plan and your human resource management (HRM) strategic plan, you begin to develop a compensation strategy that includes salary, health benefits, and retirement plan. You decide a good place to start would be with a better understanding of what is important to your employees. For example, you are considering implementing a team bonus program for high customer service ratings and coverage for alternative forms of medicine, such as acupuncture and massage. Instead of guessing what employees would like to see in their compensation packages, you decide to develop a compensation survey to assess what benefits are most important to your employees. As you begin this task, you know it will be a lot of work, but it’s important to the continued recruitment, retention, and motivation of your current employees.

So, what is compensation, and how is it determined?

Developing A Compensation Package

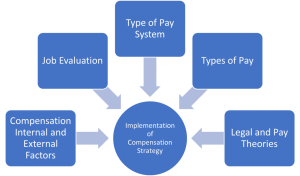

There are a few basic aspects of compensation packages we should discuss before moving into the specific aspects of compensation. These foundations can assist in the development of a compensation strategy that meets the goals of your organization and is in line with your strategic plan.

Before beginning to work on your compensation packages, some analysis should be done to determine your organization’s philosophy in regard to compensation. Before developing your compensation philosophies, there are some basic questions to address:

- From the employee’s perspective, what is a fair wage?

- Are wages too high to achieve financial health in your organization?

- Do managers and employees know and buy into your compensation philosophy?

- Does the pay scale reflect the importance of various job titles within the organization?

- Is your compensation competitive enough to attract and retain employees?

- Are you abiding by the laws with your compensation package?

- Is your compensation philosophy keeping in line with labour market changes, industry changes, and organizational changes?

Once these basic questions are addressed, we can see where we might have “holes” in our compensation package and begin to develop new philosophies in line with our strategic plan, which benefits the organization. Some possible compensation policies might include the following:

- Are salaries higher or lower depending on the location of the business? When looking at what to pay in a given country or area of a province different facets come into play…these could include cost of living in the area and fewer qualified people in a given area.

- Are salaries lower or higher than the average in your region or area? If the salary is lower, what other benefits will the employee receive to make up for this difference? For example, wages might not be as high, but offering flextime or free day care might offset the lower salary.

- Should there be a specific pay scale for each position in the organization, or should salaries be negotiated on an individual basis? If there is no set pay scale, how can you ensure individual salary offers are fair and nondiscriminatory?

- What balance of salary and other rewards, such as bonuses, should be part of your compensation package? For example, some organizations prefer to offer a lower salary, but through bonuses and profit-sharing, the employee has the potential to earn more.

- When giving raises, will the employee’s tenure be a factor, or will pay increases be merit-based only, or a combination of both?

Let’s discuss some pay policies that are used in determining compensation in more detail.

Compensation Policy

Some organizations choose a market compensation policy, market plus, or market minus philosophy. A market compensation policy is to pay the going rate for a particular job, within a particular market based on research and salary studies. The organization that uses a market plus philosophy will determine the going rate and add a percentage to that rate, such as 5 percent. So if a particular job category median pays $57,000, the organization with a market plus of 5 percent philosophy will pay $59,850. A market minus philosophy pays a particular percentage less than the market; so in our example, if a company pays 5 percent less, the same job would pay $54,150.

Market Plus Philosophy

An example of an organization with a market plus philosophy is Cisco Systems, listed as one of the top-paying companies on Fortune’s annual list. For example, they pay $131,716 for software engineers, while at Yahoo! software engineers are paid an average of $101,669, using a market philosophy. The pay at Cisco reflects its compensation philosophy and objectives:

Cisco operates in the extremely competitive and rapidly changing high-technology industry. The Board’s Compensation Committee believes that the compensation programs for the executive officers should be designed to attract, motivate, and retain talented executives responsible for the success of Cisco and should be determined within a framework based on the achievement of designated financial targets, individual contribution, customer satisfaction, and financial performance relative to that of Cisco’s competitors. Within this overall philosophy, the Compensation Committee’s objectives are to do the following:

- Offer a total compensation program that is flexible and takes into consideration the compensation practices of a group of specifically identified peer companies and other selected companies with which Cisco competes for executive talent.

- Provide annual variable cash incentive awards that take into account Cisco’s overall financial performance in terms of designated corporate objectives, as well as individual contributions and a measure of customer satisfaction.

- Align the financial interests of executive officers with those of shareholders by providing appropriate long-term, equity-based incentives.

Market Minus Philosophy

Organizations that compensate staff based on a market minus philosophy pay lower than the average market rate. This can be particularly positive when it comes to the wages of upper management. Employees often resent the significant disparity in wages between themselves and the executive team.

There are many reasons why an organization would choose one philosophy over another. A market minus philosophy may tie into the company’s core values, as in Whole Foods, or it may be because the types of jobs require an unskilled workforce that may be easier and less expensive to replace. A company may use a market plus philosophy because the industry’s cutting-edge nature requires the best and the brightest.

Other internal pay factors might include the employer’s ability to pay, the type of industry, and the value of the employee and the particular job to the organization. In addition, the presence of a union can lead to mandated pay scales.

External pay factors can include the current economic state. Unemployment rates are a factor in this assessment. As a result of surplus workers, compensation may be reduced within organizations because of the oversupply of workers. Inflation and the cost of living in a given area can also determine compensation in a given market. Finally, government legislation such as the Employment Standards Act determines the minimum amount that can be paid to certain workers in Ontario.

Once an organization has looked at the internal and external forces affecting pay, it can begin to develop a pay system within the organization.

Goals of a Compensation Package

Most of us, no matter how much we like our jobs, would not do them without a compensation package. When we think of compensation, often we think of only our paycheck, but compensation in terms of HRM is much broader.

This is the concept of Total Compensation Package. A compensation package can include pay, health-care benefits, and other benefits such as retirement plans, which will all be discussed in this chapter.

A compensation package should be positive enough to attract the best people for the job. An organization that does not pay as well as others within the same industry will likely not be able to attract the best candidates, resulting in poorer overall company performance.

Once the best employees and talent come to work for your organization, you want the compensation to be competitive enough to motivate people to stay with your organization. Although we know that compensation packages are not the only thing that motivates people, compensation is a key component.

Compensation can be used to improve morale, motivation, and satisfaction among employees. If employees are not satisfied, this can result not only in higher turnover but also in poor quality of work for those employees who do stay. A proper compensation plan can also increase loyalty in the organization.

Pay systems can also be used to reward individual or team performance and encourage employees to work at their own peak performance.

With an appropriate pay system, companies find that customer service is better because employees are happier. In addition, having fairly compensated, motivated employees not only adds to the bottom line of the organization but also facilitates organizational growth and expansion. Motivated employees can also save the company money indirectly, by not taking sick days when the employee is not really sick, and companies with good pay packages find fewer disability claims as well. Websites such as Glassdoor or Indeed give you easy access to salary information of companies.

So far, our focus on HRM has been a strategic focus, and the same should be true for the development of compensation packages. Before the package is developed for employees, it’s key to understand the role compensation plays in the bottom line of the organization. The next few sections will detail the aspects of creating the right compensation packages for your organization, including legal considerations.

Types of Pay Systems

Once you have determined your compensation strategy based on internal and external factors, you will need to evaluate jobs, develop a pay system, and consider pay theories when making decisions.

Job Evaluation Systems

As mentioned when we discussed internal and external factors, the value of the job is a major factor when determining pay. There are several ways to determine the value of a job through job evaluation. Job evaluation is defined as the process of determining the relative worth of jobs to determine pay structure. Job evaluation can help us determine if pay is equitable and fair among our employees. There are several ways to perform a job evaluation.

Job Ranking System

One of the simplest methods, used by smaller companies or within individual departments, is a job ranking system – to assist in attributing a pay grade to each job.

In this type of evaluation, job titles are listed and ranked in order of importance to the organization. A paired comparisoncan also occur, in which individual jobs are compared with every other job, based on a ranking system, and an overall score is given for each job, determining the highest-valued job to the lowest-valued job. For example, in the table below“Example of a Paired Comparison for a Job Evaluation”, four jobs are compared based on a ranking of 0, 1, or 2. Zero indicates the job is less important than the one being compared, 1 means the job is about the same, and 2 means the job is more important. When the scores are added up, it is a quick way to see which jobs are of more importance to the organization. Of course, any person creating these rankings should be familiar with the duties of all the jobs. While this method may provide reasonably good results because of its simplicity, it doesn’t compare differences between jobs, which may have received the same rank of importance.

| Job | Receptionist | Project Manager | Account Manager | Sales Director | Total |

| Receptionist | X | 0 | 0 | 0 | 0 = 4th |

| Project Administrative Assistant | 1 | X | 0 | 0 | 1 = 3rd |

| Account Manager | 2 | 1 | X | 0 | 3 = 2nd |

| Sales Director | 2 | 2 | 2 | X | 6 = 1st |

| Based on the paired ranking system, the sales director should have a higher salary than the project administrative assistant, because the ranking for that job is higher. Likewise, a receptionist should be paid less than the project administrative assistant because this job ranks lower. | |||||

|---|---|---|---|---|---|

Job Classification System

In a job classification system, every job is classified and grouped based on the knowledge and skills required for the job, years of experience, and amount of authority for that job. Tied to each job are the basic function, characteristics, and typical work of that job classification, along with pay range data.

Point Factor System

Another type of job evaluation system is the point-factor system, which determines the value of a job by calculating the total points assigned to it. The points given to a specific job are called compensable factors. These can range from leadership ability to specific responsibilities and skills required for the job. Once the compensable factors are determined, each is given a weight compared to the importance of this skill or ability to the organization. When this system is applied to every job in the organization, expected compensable factors for each job are listed, along with corresponding points to determine which jobs have the most relative importance. Some organizations use a point-factor system. Examples of some compensable factors include the following:

- Knowledge

- Autonomy

- Supervision

- Psychological demands

- Interpersonal skills

- Internal and external contacts

Each of the compensable factors has a narrative that explains how points should be distributed for each factor. The points are then multiplied by the weight to give a final score on that compensable factor. After a score is developed for each, the employee is placed on the appropriate pay level for his or her score.

Another option for job evaluation is called the Hay profile method. This proprietary job evaluation method focuses on three factors called know-how, problem solving, and accountability. Within these factors are specific statements such as “procedural proficiency.” Each of these statements is given a point value in each category of know-how, problem solving, and accountability. Then job descriptions are reviewed and assigned a set of statements that most accurately reflect the job. The point values for each of the statements are added for each job description, providing a quantitative basis for job evaluation and eventually, compensation. An advantage of this method is its quantitative nature, but a disadvantage is the expense of performing an elaborate job evaluation.

Pay Systems

Once you have performed a job evaluation, you can move to the third step, which we call pay grading. This is the process of setting the pay scale for specific jobs or types of jobs.

The first method to pay grade is to develop a variety of pay grade levels. Then once the levels are developed, each job is assigned a pay grade. When employees receive raises, their raises stay within the range of their individual pay grade, until they receive a promotion that may result in a higher pay grade. The advantage of this type of system is fairness. Everyone performing the same job is within a given range and there is little room for pay discrimination to occur. However, since the system is rigid, it may not be appropriate for some organizations in hiring the best people. Organizations that operate in several cities might use a pay grade scale, but they may add percentages based on where someone lives. For example, the cost of living in rural Ontario is much lower than in Toronto. If an organization has offices in both places, it may choose to add a percentage pay adjustment for people living within a geographic area—for example, 10 percent higher in Toronto.

One of the downsides to pay grading is the possible lack of motivation for employees to work harder. They know even if they perform tasks outside their job description, their pay level or pay grade will be the same. This can incubate a stagnant environment. Sometimes this system can also create too many levels of hierarchy. For large companies, this may work fine, but smaller, more agile organizations may use other methods to determine pay structure.

For example, some organizations have moved to a delayering and banding process, which cuts down the number of pay levels within the organization. General Electric delayered pay grades in the mid-1990s because it found that employees were less likely to take a reassignment that was at a lower pay grade, even though the assignment might have been a good development opportunity.[1] So, delayering enables a broader range of pay and more flexibility within each level. Sometimes this type of process also occurs when a company downsizes. Let’s assume a company with five hundred employees has traditionally used a pay grade model but decided to move to a more flexible model. Rather than have, thirty pay levels, it may reduce this to five or six levels, with greater salary differentials within the grades themselves. This allows organizations to better reward performance, while still having a basic model for hiring managers to follow.

Rather than use a pay grade scale, some organizations use a going rate model. In this model, analysis of the going rate for a particular job at a particular time is considered when creating the compensation package. This model can work well if market pressures or labour supply-and-demand pressures greatly impact your particular business. For example, if you need to attract the best project managers, but more are already employed (lack of supply)—and most companies are paying $75,000 for this position—you will likely need to pay the same or more, because of labour supply and demand.

Compensation Strategies

In addition to the pay level models we just looked at, other considerations might include the following:

- Skill-based pay. With a skill-based pay system, salary levels are based on an employee’s skills, as opposed to job title. This method is implemented similarly to the pay grade model, but rather than job title, a set of skills is assigned a particular pay grade.

- Competency-based pay. Rather than looking at specific skills, the competency-based approach looks at the employee’s traits or characteristics as opposed to a specific skill set. This model focuses more on what the employee can become as opposed to the skills he or she already has.

- Broadbanding. Broadbanding is similar to a pay grade system, except all jobs in a particular category are assigned a specific pay category. For example, everyone working in customer service, or all administrative assistants (regardless of department), are paid within the same general band. McDonald’s uses this compensation philosophy in their corporate offices, stating that it allows for flexibility in terms of pay, movement, and growth of employees.[2]

- Variable pay system. This type of system provides employees with a pay basis but then links the attainment of certain goals or achievements directly to their pay. For example, a salesperson may receive a certain base pay but earn more if he or she meets the sales quota.

Pay Theories

Know your worth, and then ask for it by Casey Brown [8:12]

Now that we have discussed pay systems, it is important to look at some theories on pay that can be helpful to know when choosing the type of pay system your organization will use.

Employee Motivation: Equity Theory by Ben Baran [8:17]

The equity theory is concerned with the relational satisfaction employees get from pay and inputs they provide to the organization. It says that people will evaluate their own compensation by comparing their compensation to others’ compensation and their inputs to others’ inputs. In other words, people will look at their own compensation packages and at their own inputs (the work performed) and compare that with others. If they perceive this to be unfair, in that another person is paid more, but they believe that person is doing less work, motivational issues can occur. For example, people may reduce their own inputs and not work as hard. Employees may also decide to leave the organization as a result of the perceived inequity. In HR, this is an important theory to understand because even if someone is being paid fairly, they will always compare their own pay to that of others in the organization. The key here is perception, in that fairness is based entirely on what the employee sees, not what may be the actual reality. Even though HR or management may feel employees are being paid fairly, this may not be the employee’s belief. In HR, we need to look at two factors related to pay equity: external pay equity and internal pay equity. External pay equity refers to what other people in similar organizations are being paid for a similar job. Internal pay equity focuses on employees within the same organization. Within the same organization, employees may look at higher level jobs, lower level jobs, and years with the organization to make their decision on pay equity. Consider Walmart, for example. In 2010, Michael Duke, CEO of Walmart, earned roughly $35 million in salary and other compensation,[3] while employees earned the minimum wage or slightly higher in their respective states. While Walmart contends that its wages are competitive in local markets, the retail giant makes no apologies for the pay difference, citing the need for a specialized skill set to be able to be the CEO of a Fortune 500 company. There are hundreds of articles addressing the issue of pay equity between upper level managers and employees of an organization. To make a compensation strategy work, the perceived inputs (the work) and outputs (the pay) need to match fairly.

The expectancy theory is another key theory in relation to pay. The expectancy theory says that employees will put in as much work as what they expect to receive in return for it. In other words, if the employee perceives they are going to be paid favourably, they will work to achieve the outcomes. If they believe the rewards do not equal the amount of effort, they may not work as hard.

The reinforcement theory, developed by Edward L. Thorndike,[4] says that if high performance is followed by some reward, that desired behaviour will likely occur in the future. Likewise, if high performance isn’t followed by a reward, it is less likely the high performance will occur in the future. Consider an extreme example of the reinforcement theory in the world of finance. On Wall Street, bonuses for traders and bankers are a major part of their salary. The average bonus in 2010 was $128,530,[5] which does not take into account specific commissions on trades, which can greatly increase total compensation. One interesting consideration is the ethical implications of certain pay structures, particularly commission and bonus plans. Traditionally, a bonus structure is designed to reward performance, rather than be a guaranteed part of the compensation plan. Bonus and commission plans should be utilized to drive the desired behaviour and act as a reward for the desired behaviour, as the reinforcement theory states.

All these theories provide us with information to make better decisions when developing our own pay systems. Other considerations are discussed next.

Pay Decision Considerations

Besides the motivational aspect of creating a pay structure, there are some other considerations. First, the size of the organization and the expected expansion of the organization will be a factor. For example, if you are the HR manager for a ten-person company, you likely use a going rate or management fit model. While this is appropriate for your company today, as your organization grows, it may be prudent to develop a more formal pay structure.

If your organization also operates overseas, a consideration is how domestic workers will be paid in comparison to the global market. One strategy is to develop a centralized compensation system, which would be one pay system for all employees, regardless of where they live. The downside to this is that the cost of living may be much less in some countries, making the centralized system possibly unfair to employees who live and work in more expensive countries. Another consideration is in what currency employees will be paid. Most US companies pay even their overseas workers in dollars, not in the local currency where the employee is working. Currency valuation fluctuations could cause challenges in this regard.[6]

How you communicate your pay system is extremely important to enhance the motivation that can be created by fair and equitable wages. In addition, where possible, asking for participation from your employees through the use of pay attitude surveys, for example, can create a transparent compensation process, resulting in higher performing employees.

Organizations should develop market pay surveys and review their wages constantly to ensure the organization is within expected ranges for the industry.

Why you should know how much your coworkers get paid by David Burkus [7:20]

Table 6.2 Types of Pay

| Pay | Attributes |

| Salary | Fixed compensation calculated on a weekly, biweekly, or monthly basis. May/may not be paid overtime work. |

| Hourly Wage | Employees are paid on the basis of number of hours worked. |

| Piecework System | Employees are paid based on the number of items that are produced. |

| Types of Incentive Plans | Attributes |

| Commission Plans | An employee may or may not receive a salary but will be paid extra (e.g., a percentage for every sale made). |

| Bonus Plans | Extra pay for meeting or beating some goal previously determined. Bonus plans can consist of monetary compensation, but also other forms such as time off or gift certificates. |

| Profit-Sharing Plans | Annual bonuses paid to employees based on the amount of profit the organization earned. |

| Stock Options | When an employee is given the right to purchase company stock at a particular rate in time. Please note that a stock “option” is different from the actual giving of stock, since the option infers the employee will buy the stock at a set rate, obviously, usually cheaper than the going rate. |

| Other Types of Compensation | Attributes |

| Fringe Benefits | This can include a variety of options. Sick leave, paid vacation time, health club memberships, daycare services. |

| Health Benefits | Most organizations provide health and dental care benefits for employees. In addition, disability and life insurance benefits are offered. |

| Retirement Savings Plans | Some organizations provide a retirement plan for employees. The company would work with a financial organization to set up the plan so employees can save money, and often, companies will “match” a percentage of what the employee contributes to the plan. |

Types of Pay

After a pay system has been developed, we can begin to look at specific methods of paying our employees. Remember that when we talk about compensation, we are referring to not only an actual paycheck but additional types of compensation, such as incentive plans that include bonuses and profit sharing. We can divide our total pay system into three categories: pay, incentives, and other types of compensation. Pay is the hourly, weekly, or monthly salary an employee earns. An incentive, often called a pay-for-performance incentive, is given for meeting certain performance standards, such as meeting sales targets. The advantage to incentive pay is that company goals can be linked directly to employee goals, resulting in higher pay for the employee and goal achievement by the organization. The following are desirable traits of incentive plans:

- Clearly communicated

- Attainable but challenging

- Easily understandable

- Tied to company goals

Laws Relating to Pay

As you have already guessed from our earlier chapter discussions, people cannot be discriminated against when it comes to the development of pay systems. One issue hotly debated is the issue of comparable worth. Comparable worth states that people should be given similar pay if they are performing the same type of job. Evidence over the years shows this isn’t the case, with women earning less than men in many industries. On average, a woman earns 79 cents for every $1.00 a man earns.

Remember that gender is one of the protected categories in the Canadian Human Rights Act and thus gender should not be a factor in pay determination.

Other Types of Compensation

As you already know, there is more to a compensation package than just pay. There are many other aspects to the creation of a good compensation package, including not only pay but incentive pay and other types of compensation.

Some of the benefits are mandatory, and they are provided by the employer due to the laws and the provincial regulations. These include Canada and Quebec pension plans, Employment Insurance, leaves without pay (Compassion leave or other) as well as those that are governed by the Employment Standards (ex. holidays). These can be seen by direct deductions on your paycheck. Every pay has a deduction that is taken for the pension plans and for employment insurance. These deductions are there to protect the employee in the future during retirement or any lost income due to lose of job. By contributing to Employment Insurance if the employee would unfortunately lose their job, they would be entitled to unemployment benefits.

Other benefits are voluntary and are at the discretion of the employer. Many different benefits can be offered by the employer. The most common ones will be highlighted here. Most employers will offer health benefits, such as extended medical plans and dental coverage, with different providers such as SunLife or others. These can include private medical consultations, eye doctor examinations, private professional consultations, dental consultations and procedures etc.

In addition to the standard Quebec and Canada Pension Plans, some companies allow employees to contribute even further to their retirement plans. This can be done with a defined benefit or defined contribution plans, or Registered Retirement Savings Plans (RRSPs). (Employer-sponsored pension plans – Canada.ca).

Depending on the company/industry, some paid time off provisions are legislated (e.g., ESA), while some employers may offer additional paid time off (e.g., personal days). This will vary from organization to organization, and the details will be highlighted in the company policy and procedures.

More and more employers are also offering employees wellness programs that include access to mental wellness and alternate programs such as gym memberships, yoga, Employee Assistance programs and so forth.

Furthermore, some also allow educational assistance programs where they will reimburse for courses taken.

Another key benefit that some employees look for and that may be supplied by the employer includes childcare services and elderly care.

The range of offers depends on the employer, their size, and their capability to offer the benefits.

One aspect to note is that once these benefits are offered, the employer should not remove them as this will cause employees to feel unmotivated.

A Final Note on Compensation and Benefits Strategy

When creating your compensation plan, of course the ability to recruit and retain should be an important factor. But also, consideration of your workforce needs is crucial to any successful compensation plan. The first step in development of a plan is to ask the employees what they care about. Some employees would rather receive more pay with fewer benefits or better benefits with fewer days off. Surveying the employees allows you, as a company, to better understand the needs of your specific workforce. Once you have developed your plan, understand that it may change to best meet the needs of your business as it changes over time.

Once the plan is developed, communicating the plan with your employees is also essential. Inform your employees via an HR blog, e-mails, and traditional methods such as face to face. Your employees might not always be aware of the cost of the benefits to the company, so making sure they know is your responsibility. For example, if you pay for 80 percent of the medical insurance premiums, let your employees know this. This type of communication can go a long way to allowing the employees to see their value within the organization.

“Compensation” in Human Resources Management – 2nd Ontario Edition by Elizabeth Cameron is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

- Ferris, G., Handbook of Human Resource Management (Cambridge, MA: Blackwell, 1995) ↵

- McDonald’s Corporation, “Your Pay and Rewards,” accessed July 23, 2011, http://www.aboutmcdonalds.com/mcd/corporate_careers/benefits/highlights_of_what_we_offer/pay_and_rewards.html ↵

- Gomstyn, A., “Walmart CEO Pay,” ABC News Money, July 2, 1010, accessed July 23, 2011, http://abcnews.go.com/Business/walmart-ceo-pay-hour-workers-year/story?id=11067470 ↵

- Indiana University, “Edward L. Thorndike,” accessed February 14, 2011, http://www.indiana.edu/~intell/ethorndike.shtml ↵

- Smith, A., “The 2010 Wall Street Bonus,” CNN Money, February 24, 2011, accessed July 23, 2011, http://money.cnn.com/2011/02/24/news/economy/wall_street_bonus/index.htm ↵

- Watson, B., “Global Pay Systems, Compensation in Support of a Multinational Strategy,” Compensation Benefits Review 37, no. 1 (2005): 33–36 ↵