3.1 Gross Earnings

You work hard at your job, and you want to be compensated properly for all the hours you put in. Assume you work full time with an hourly rate of pay of $10. Last week you worked eight hours on Sunday and eight hours on Monday, which was a statutory holiday. Then you took Tuesday off, worked eight hours on each of Wednesday and Thursday, took Friday off, and worked 10 hours on Saturday. That’s a total of 42 hours of work for the week. What is your gross pay? Give or take a small amount depending on provincial employment standards, it should be about $570. But if you don’t understand how to calculate gross earnings, you could be underpaid without ever realizing it.

Here are some notes about the content in this chapter: About 10% of Canadian workers fall under federal employment standards, which are not discussed here. This textbook generalizes the most common provincial employment standards; however, to calculate your earnings accurately requires you to apply your own provincial employment standards legislation. Part-time employment laws are extremely complex, so this textbook assumes in all examples that the employee is full time.

This section addresses the calculation of gross earnings, which is the amount of money earned before any deductions (taxes, employment insurance, Canada Pension Plan, union dues etc.) from your paycheque. The four most common methods of employee remuneration include salaries, hourly wages, commissions, and piecework wages.

Salary and Hourly Wages

Suppose you are considering two job offers. One is offering compensation of $3,100 biweekly, while the other offers wages of $1,400 semi-monthly. If both job ads are similar in every other way, which job has the higher annual gross earnings? To make this assessment, you must understand how salaries work. A salary is a fixed compensation paid to a person on a regular basis for services rendered. Most employers pay employees by salary in occupations where the employee’s work schedule generally remains constant.

In contrast, an hourly wage is a variable compensation based on the time an employee has worked. In contrast to a salary, this form of compensation generally appears in occupations where the number of hours is unpredictable or continually varies from period to period.

Pay Frequency

Salaried and hourly employees typically get paid over regular periods.

An agreement with the employer outlines the terms of the employment, including the overall time frame and the frequency of pay.

- Overall time frame. For salaried employees, the time frame that the salary covers must be clearly stated. For hourly employees, the time frame requires identification of the wage earned per hour.For example, you could receive a salary of $2,000 monthly or $50,000 annually. Notice that each of these salaries is followed by the specific time frame for the compensation.

- Frequency. This is how often the gross earnings are paid out to the employee.

- Monthly: Earnings are paid once per month. By law, employees must receive compensation from their employer at least once per month, which equals 12 times per year.

- Daily: Earnings are paid at the end of every day. This results in about 260 paydays per year (5 days per week multiplied by 52 weeks per year). In a leap year, there might be one additional payday.

- Weekly: Earnings are paid once every week. This results in 52 paydays in any given year since there are 52 weeks per year.

- Biweekly: Earnings are paid once every two weeks. This results in 26 paydays in any given year since there are 52 ÷ 2 = 26 biweekly periods per year.

- Semi-monthly: Earnings are paid twice a month, usually every half month (meaning on the 15th and last day of the month). This results in 24 paydays per year.

Thus, the earnings structure specifies both the time frame and the frequency of earnings. For a salaried employee, this may appear as “$2,000 monthly paid semi-monthly” or “$50,000 annually paid biweekly.” For an hourly employee, this may appear as “$10 per hour paid weekly.” No matter whether you are salaried or hourly, earnings determined by your regular rate of pay are called your regular earnings.

Be careful about the language of the payment frequency. It is very common to confuse semi and bi, and sometimes businesses use the terms incorrectly. Use the following guide:

- semi: twice per

- bi: every two

Therefore, to be paid semi-monthly means to be paid twice per month and to be paid biweekly means to be paid every two weeks.

A note on using 52 weeks for the number of weeks in a year, which is a convention:

In calculating the pay for a salaried employee, this textbook assumes for simplicity that a year has exactly 52 weeks. In reality, there are 52 weeks plus one day in any given year. In a leap year, there are 52 weeks plus two days. This extra day or two has no impact on semi-monthly or monthly pay, since there are always 24 semi-months and 12 months in every year. However, weekly and biweekly earners are impacted as follows:

- If employees are paid weekly, approximately once every six years there are 53 pay periods in a single year. This would “reduce” the employees’ weekly paycheque in that year. For example, assume they earn $52,000 per year paid weekly. Normally, they are paid $52,000 ÷ 52 = $1,000 per week. However, since there are 53 pay periods approximately every sixth year, this results in $52,000 ÷ 53 = $981.13 per week for that year.

- If employees are paid biweekly, approximately once every 12 years there are 27 pay periods in a single year. This has the same effect as the extra pay period above. For example, if they are paid $52,000 per year biweekly they normally receive $52,000 ÷ 26 = $2,000 per biweekly cheque. Approximately every twelfth year, they are paid $52,000 ÷ 27 = $1,925.93 per biweekly cheque for that year.

Many employers ignore these technical nuances in pay structure since the extra costs incurred to modify payroll combined with the effort required to calm down employees who don’t understand the smaller paycheque are not worth the savings in labour. Therefore, most employers treat every year as if it has 52 weeks (26 biweeks) regardless of the reality. In essence, employees receive a bonus paycheque approximately once every six or twelve years!

To calculate regular earnings per pay period, we can use the following relationship:

[latex]\text{regular earnings per pay period }=\frac{\text{annual salary}}{\text{# pay periods per year}}[/latex]

Equivalent Hourly Rate

Sometimes we are interested in what an equivalent hourly rate is, given the salary and regular hours worked. For example, how does the pay per hour of a person working 40 regular hours per week and earning an annual salary of $65,000 compare with the hourly pay equivalent of a person paid $2,658.24 semi-monthly and a regular work week of 38 hours?

We also need to know the equivalent hourly rate of a salaried employee when calculating their overtime pay.

[latex]\begin{align*} \text{equivalent hourly }&\text{ rate of pay }\\ &\\ &=\frac{\text{annual pay}}{\text{# of regular hours worked per year}} \end{align*}[/latex]

Important: when using the equivalent hourly rate of pay in overtime calculations, non-rounded value must be used.

Overtime

Overtime is work time in excess of your regular workday, regular workweek, or both. In most jurisdictions it is paid at 1.5 times your regular hourly rate (called time-and-a-half), though your company may voluntarily pay more or a union may have negotiated a more favourable rate such as two times your regular hourly rate (called double time). A contract with an employer will specify your regular workday and workweek, and some occupations are exempt from overtime. Due to the diversity of occupations, there is no set rule on what constitutes a regular workday or workweek. In most jurisdictions, a regular workweek is eight hours per day, or 40 hours per week, but it could also be 35 hours per week (7 hours per day) or 37.5 hours per week, etc. Once the employee exceeds their regular hours, they are eligible to receive overtime, or premium earnings, which are based on your overtime rate of pay.

The rounding rules for individual components in the calculations will depend on the setting (jurisdiction, employer choice etc.) so in this course we will follow the rule of no-rounding in intermediate calculations (no rounding until the final answer).

[latex]\begin{align*} &\text{overtime pay}=(\text{overtime factor})\cdot(\text{# overtime hrs})\cdot(\text{hourly pay rate})\\ &\\ &=(\text{overtime factor})\cdot(\text{# overtime hrs})\cdot\frac{\text{annual pay}}{\text{# of regular hours per year}} \end{align*}[/latex]

Remember: when using the equivalent hourly rate of pay in overtime calculations, for the purposes of our course the non-rounded value must be used.

Recall also that the usual overtime factor is 1.5, or time-and-a-half.

Example 3.1 A: Salary with Overtime

Tristan is compensated with an annual salary of $65,000 paid biweekly. His regular workweek consists of four 10-hour days, and he is eligible for overtime at 1.5 times pay for any work in excess of his regular requirements. Tristan worked regular hours for the first two weeks. Over the next two weeks, Tristan worked his regular hours and 11 hours of overtime, paid at time-and-a-half.

- Determine Tristan’s gross earnings for the first two-week pay period.

- Determine Tristan’s gross earnings for the second two-week pay period.

Answer:

a.

[latex]\text{first period gross pay}=\frac{\text{annual salary}}{\text{# pay periods per year}}=\frac{65000}{26}=\$2,500[/latex]

b.

[latex]\begin{align*} &\text{second period gross pay }=(\text{regular pay})+(\text{overtime pay})\\ &\\ &=\frac{\text{annual salary}}{\text{# pay periods per year}}\\ &\ \ \ +(\text{overtime factor})\cdot(\text{# overtime hrs})\cdot\frac{\text{annual pay}}{\text{# of regular hours per year}}\\ &\\ &=\frac{65000}{26}+1.5\cdot 11\cdot \frac{65000}{4\cdot 10\cdot 52}\\ &=\$3,015.63 \end{align*}[/latex]

Important note: remember not to round individual components of the calculation; only round the final answer, as appropriate.

Example 3.1 B: A Week in the Life of an Hourly Wage Earner

Marcia receives an hourly wage of $32.16 working on an automotive production line and gets paid semi-monthly. Her union has negotiated a regular work day of 7.25 hours for five days per week, totaling 36.25 hours per week. Overtime is paid at 1.5 times her regular rate for any work that exceeds the daily or weekly limits. During the last pay period, Maria worked 9.75 hours in overtime. Calculate Marcia’s gross earnings for that pay period.

Answer:

[latex]\begin{align*} &\text{gross pay }=(\text{regular pay})+(\text{overtime pay})\\ &=\frac{\overset{?}{\text{annual salary}}}{\text{# pay periods per year}}\\ &\ \ \ +(\text{overtime factor})\cdot(\text{# overtime hrs})\cdot(\text{regular pay per hour})\\ &\\ &=\frac{(\text{hourly wage})\cdot(\text{# reg hrs per week})\cdot (\text{# weeks per year})}{\text{# pay periods per year}}\\ &\ \ \ +(\text{overtime factor})\cdot(\text{# overtime hrs})\cdot{(\text{regular pay per hour})}\\ &\\ &=\frac{32.16\cdot 36.25\cdot 52}{24}+1.5\cdot 9.75\cdot 32.16\\ &=\$2,996.24 \end{align*}[/latex]

Commission

Over the last two weeks you sold $50,000 worth of machinery as a sales representative for IKON Office Solutions Canada. IKON’s compensation plan involves a straight commission rate of 3.5%. What are your gross earnings? If you sold an additional $12,000 in machinery, how much more would you earn?

Particularly in the fields of marketing and customer service, many workers are paid on a commission basis. A commission is an amount or a fee paid to an employee for performing or completing some form of transaction. The commission typically takes the form of a percentage of the dollar amount of the transaction. Marketing and customer service industries use this form of compensation as an incentive to perform: If the representative doesn’t sell anything then the representative does not get paid. Issues to be discussed about commission include what constitutes regular earnings, how to handle holidays and overtime, and the three different types of commission structures.

Types of Commission

Commission earnings typically follow one of the following three structures:

- Straight commission. If your entire earnings are based on your dollar transactions and calculated strictly as a percentage of the total net sales, you are on straight commission.

[latex]\text{total commission amount }=\left(\text{commission rate}\right)\cdot\left(\text{net sales}\right)[/latex]

-

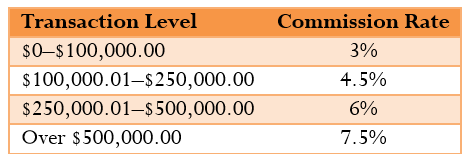

- Graduated commission. Within a graduated commission structure, you are offered different rates of commission for higher levels of performance. The theory behind this method of compensation is that the higher rewards motivate employees to perform better. To calculate the graduated commission with [latex]n[/latex] levels with commission rates [latex]r_i, i=1,\ldots,n[/latex], we use the following:

[latex]\begin{array}{rcl} \text{commission amount }&=&(\text{commission amt at 1st level, if any})\\ &&+(\text{commission amt at 2nd level, if any})\\ &&+\ldots\\ &&+(\text{commission amt at n-th level, if any})\\ &&\\ &=&r_1\cdot(\text{net sales at 1st level, if any})\\ &&+r_2\cdot(\text{net sales at 2nd level, if any})\\ &&+\ldots\\ &&+r_n\cdot(\text{net sales at n-th level, if any})\\ \end{array}[/latex]

An example of a graduated commission scale is found in the table below.

Recognize that the commission rates are applied against the portion of the sales falling strictly into the particular category, not the entire balance. Thus, in the example above, if the total net sales equal $150,000, then the first $100,000 is paid at 3% while the next $50,000 is paid at 4.5%.

- Commission over sales quota. This is a special case of a graduate commission, where the first level of sales earns no commission, i.e., the commission rate is for a base amount of net sales is 0%. This occurs when there is an expectation on the part of the employer that the employee will make at least a certain amount of sales in a given pay period and the commission is earned only on the amounts over that base amount of net sales, or sales quota.

- Salary plus commission. If your earnings combine a basic salary together with commissions on your dollar transactions, you have a salary plus commission structure. To calculate the total, or gross earnings, you must combine the salary calculations with either a straight commission or graduated commission, as applicable. Usually this form of compensation pays a low commission rate since a basic salary is already provided.

The relationship between earnings components

[latex]\begin{align*} \text{gross earnings per pay period }=& (\text{regular pay for the pay period, if any})\\ &+(\text{overtime pay for the pay period, if any})\\ &\ \ +(\text{commission for the pay period, if any}) \end{align*}[/latex]

Example 3.1 C: Different Types of Commissions

Josephine is a sales representative for Kraft Foods Canada. Over the past two weeks, she closed $325,000 in retail distribution contracts. Calculate the total gross earnings that Josephine earns if :

- She is paid a straight commission of 3.45%.

- She is paid 2% for sales on the first $100,000, 3% on the next $100,000, and 4% on all remaining sales.

- She is paid a base salary of $2,000 plus a commission of 3.5% on all sales above $100,000.

Answer:

a. commission amt = ?, straight commission

[latex]\begin{align*} \text{commission amt}&=(\text{commission rate})\cdot(\text{net sales})\\ &=0.0345\cdot 325000\\ &=\$11,212.50 \end{align*}[/latex]

b. commission amt = ?, graduated commission, at three levels, net sales = $325,000, in the third level (> 1st level + 2nd level)

[latex]\begin{align*} \text{commission amt}&=(\text{comm. rate 1st level})\cdot(\text{net sales 1st level})\\ &\ \ \ +(\text{comm. rate 2nd level})\cdot(\text{net sales 2nd level})\\ &\ \ \ +(\text{comm. rate 3rd level})\cdot(\text{net sales 3rd level})\\ &=0.02(100000)+0.03(100000)+0.04(325000-200000)\\ &=\$10,000 \end{align*}[/latex]

c. commission amt = ?, base salary + commission above sales quota

[latex]\begin{align*} \text{commission amt}&=\text{base salary})+(\text{commission rate})\cdot(\text{net sales-sales quota})\\ &=2000+0.035\cdot (325000-100000)\\ &=\$9,875 \end{align*}[/latex]

Piecework

Have you ever heard the phrase “pay-for-performance”? Although this phrase has many interpretations in different industries, for some people this phrase means that they get paid based on the quantity of work that they do. For example, many workers in clothing manufacturing are paid a flat rate for each article of clothing they produce. As another example, employees in fruit orchards may get paid by the number of pieces of fruit that they harvest, or simply by the kilogram. As you can see, these workers are neither salaried nor paid hourly, nor are they on commission. They earn their paycheque for performing a specific task. Therefore, a piecework wage compensates such employees on a per-unit basis.

This section focuses on the regular earnings only for piecework wage earners. Similar to workers on commission, piecework earners are eligible to receive overtime earnings, holiday earnings, and statutory holiday worked earnings. However, the standards vary widely from province to province, and there is not necessarily any one formula to calculate these earnings. As with commissions, this textbook leaves those calculations for a payroll administration course.

To calculate the regular gross earnings for a worker paid on a piecework wage, you require the piecework rate and how many units they are to be paid for:

Pay careful attention to units of the values you are using in the calculations. In some industries, the piecework rate and the units of production do not match. For example, a company could pay a piecework rate per kilogram, but a single unit may not represent a kilogram. This is typical in some canning industries, where workers are paid per kilogram for canning the products, but the cans may only be 200 grams in size. Therefore, if workers produce five cans, they are not paid for five units produced. Rather, they are paid for only one unit produced since five cans × 200 g = 1,000 g = 1 kg. Before calculating piecework earnings, ensure that both the piecework rate and the eligible units are in the same terms, whether it be metric tons, kilograms, or otherwise.

Concept Check

Check your understanding of calculating compensation by piecework.

MathMatize: Piecework

Example 3.1 D: A Telemarketer Earning Piecework Wages

In outbound telemarketing, some telemarketers are paid on the basis of “completed calls.” This is not commission since their pay is not based on actually selling anything. Rather, a completed call is defined as simply any phone call for which the agent speaks with the customer and a decision is reached, regardless of whether the decision was to accept, reject, or request further information. If a telemarketer produces five completed calls per hour and works 7½-hour shifts five times per week, what are the total gross earnings she can earn over a biweekly pay period if her piecework wage is $3.25 per completed call?

Answer:

[latex]\begin{align*} \text{gross earnings}&=(\overset{\checkmark}{\text{call pay rate}})\cdot(\overset{?}{\text{eligible calls}})\\\\ &=(\overset{\checkmark}{\text{call pay rate}})\cdot(\overset{\checkmark}{\text{calls per hour}})\cdot(\overset{\checkmark}{\text{# hrs per shift}})\\\\ &\ \ \ \ \cdot(\overset{\checkmark}{\text{# shifts per week}})\cdot(\overset{\checkmark}{\text{weeks per biweekly pay period}})\\\\ &=3.25\cdot 5\cdot 7.5\cdot 5\cdot 2\\\\ &=\$1,218.75\end{align*}[/latex]

Section Exercises

Work on section 3.1 exercises in Fundamentals of Business Math Exercises. Discuss your solutions with your peers and/or course instructor.

You may consult answers to select exercises: Fundamentals of Business Math Exercises – Select Answers