5.1 Sales Taxes

Section Exercises – after the reading

Work on section 5.1 exercises in Fundamentals of Business Math Exercises after reading this section. Discuss your solutions with your peers and/or course instructor.

You may consult answers to select exercises: Fundamentals of Business Math Exercises – Select Answers

On your recent cross-Canada road trip, you made purchases at many different Tim Hortons’ stores. At each store, your products retailed for $6.99. When you review your credit card receipts after returning home from your trip, you notice that you paid different totals everywhere. In Alberta, they only added GST and your combo cost $5.34. In British Columbia, they added both PST and GST, resulting in total cost of $7.83. In Ontario, they added something called HST, resulting in a total cost of $7.90. You find it interesting that the same combo came to different totals as you travelled across Canada.

Three Sales Taxes

A sales tax is a percent fee levied by a government on the supply of products. In Canada, there are three types of sales taxes: the goods and services tax (GST), provincial sales tax (PST), and the harmonized sales tax (HST). In this section you will learn the characteristics of each of these taxes and then the mathematics for calculating any sales tax.

Goods & Services Tax (GST)

The goods and services tax, better known as GST, is a national federal tax of 5% that applies to the purchase of most goods and services in Canada. Every province and territory has GST. The consumer ultimately bears the burden of this sales tax.

Businesses must collect GST on most of their sales and pay GST on most purchases in the daily course of operations. However, when remitting these taxes, businesses claim a credit with the federal government to recover the GST they paid on eligible purchases. The net result is that businesses do not pay the GST on these eligible purchases. While this may outrage some people, the logic is simple. If a business pays the GST, it becomes a cost of the business, which is then passed on to consumers as it is incorporated into retail prices. When the consumer purchases the product, the consumer would be charged the GST again! In essence, a consumer would be double-taxed on all purchases if businesses paid the GST.

Some goods and services are exempt from GST. While there are many complexities and nuances to the exemptions, generally items that are deemed necessities (such as basic groceries), essential services (such as health, legal aid, and childcare), and charitable activities are nontaxable. You can find a complete listing of exemptions on the Canada Revenue Agency website at www.cra.gc.ca.

Provincial Sales Tax (PST)

Provincial sales taxes, or PST, are provincially administered sales taxes that are determined by each individual provincial or territorial government in Canada. The table here lists the current PST rates in Canada.

Similar to GST, PST applies to the purchase of most goods and services in the province, and consumers bear the burden. For the same reasons as with GST, businesses typically pay the PST on purchases for non-resale items (such as equipment and machinery) and do not pay the PST on resale items. Businesses are responsible for collecting PST on sales and remitting the tax to the provincial government. Individual provincial websites list the items and services that are exempt from PST.

Harmonized Sales Tax (HST)

The harmonized sales tax, or HST, is a combination of GST and PST into a single number. Since most goods and services are subjected to both taxes anyway, HST offers a simpler method of collecting and remitting the sales tax—a business has to collect and remit only one tax instead of two. Because there are pros and cons to HST, not all provinces use this method of collection, as summarized in the table below.

Pros of HST

- Items that are previously PST payable to a business are now refunded, lowering input costs and lowering consumer prices

- Results in overall lower corporate taxes paid

- Increases the competitiveness of businesses and results in job creation

- Businesses only remit one tax and not two, resulting in financial and auditing savings

Cons of HST

- Many items such as utilities, services, and children’s clothing that are ineligible for PST become taxed at the full HST rate

- Consumer cost of living increases

- Tax-exempt items see prices rise because HST is being applied to services and goods such as transportation and gasoline

Here is the summary of sales taxes across Canadian provinces and territories (as of 2021):

| Province/Territory | PST | GST | HST |

|---|---|---|---|

| British Columbia | 7% | 5% | |

| Alberta | 5% | ||

| Saskatchewan | 6% | 5% | |

| Manitoba | 7% | 5% | |

| Ontario | 13% | ||

| Quebec | 9.975% | 5% | |

| New Brunswick | 15% | ||

| Nova Scotia | 15% | ||

| Prince Edward Island | 15% | ||

| Newfoundland and Labrador | 15% | ||

| Nunavut | 5% | ||

| Northwest Territories | 5% | ||

| Yukon | 5% |

Calculating the Sales Tax Amount

A sales tax is a percent rate calculated on the base selling price of the product. Therefore, if you are interested solely in the amount of the sales tax (the portion owing), apply the general rule of rate calculation:

[latex]\text{rate of one quantity in relation to another quantity} = \frac{\text{one quantity}}{\text{another quantity}}[/latex]

In the context of sales tax rate, this becomes:

[latex]\text{rate of sales tax on price before tax} = \frac{\text{tax amount}}{\text{price before tax}}[/latex]

Rearranging this formula to solve for the tax amount gives the following:

[latex]\text{ tax amount} = (\text{tax rate})\cdot(\text{price before taxes})[/latex]

Calculating a Price Including Tax

When calculating a selling price including the tax, you take the regular selling price and increase it by the sales tax percentage. This is a percent change calculation we did in Chapter 2:

The change is from price before taxes to price after taxes and the percent change is the sales tax percentage:

[latex]\text{price after tax}=(\text{price before tax})+(\text{tax rate})\cdot(\text{price before tax})[/latex]

or, equivalently,

[latex]\text{price after tax}=(\text{price before tax})(1+\text{tax rate})[/latex]

For example, assume a $549.99 product is sold in British Columbia and you wish to calculate the amount of the sales taxes and the price including the sales taxes.

The price before taxes is S = $549.99. In British Columbia, GST is 5% and PST is 7% (from the PST Table).

[latex]\begin{align*} \text{price}_{at}&= \text{price}_{bt}+(\text{GST}(\text{price}_{bt})+(\text{PST}(\text{price}_{bt})\\ &=549.99+(0.05\cdot 549.99)+(0.07\cdot 549.99)\\ &=549.99+27.50+38.50\\ &= \$615.99 \end{align*}[/latex]

Therefore, on a $549.99 item in British Columbia, $27.50 in GST and $38.50 in PST are owing, resulting in a price including sales taxes of $615.99.

A note on rounding

Round the price after tax to two decimals.

If two taxes are involved in the tax-inclusive price (such as GST and PST), you cannot combine the rates together into a single rate. For example, Manitoba has 5% GST and 8% PST. This is not necessarily equivalent to 13% tax since each tax is rounded to two decimals separately and then summed. If you use a single rate of 13%, you may miscalculate by a penny. Instead, expand the formula to include two separate tax amount calculations:

[latex]\text{total price after tax}=\text{price before tax}+\text{ROUND}(\text{PST tax amount})+\text{ROUND}(\text{GST tax amount})[/latex]

Paths To Success

You will often need to manipulate the tax rate formula. Most of the time, prices are advertised without taxes and you need to calculate the price including the taxes. However, sometimes prices are advertised including the taxes and you must calculate the original price of the product before taxes. When only one tax is involved, this poses no problem, but when two taxes are involved (GST and PST), combine them into a single amount before you solve for price before tax.

Give it Some Thought

- On any given product selling for the same price, put the following provinces in order from highest price to lowest price including taxes (GST and PST, or HST): Alberta, Saskatchewan, British Columbia, Ontario, Prince Edward Island.

Example 5.1 A: Calculating Sales Taxes Across Canada

Dell Canada lists a complete computer system on its Canadian website for $1,999.99. Calculate the price including taxes if the Canadian buyer is located in:

| a. Alberta | b. Ontario | c. Quebec | d. British Columbia (BC) |

Answer:

a. Alberta: 5% GST

[latex]\begin{align*} (\text{price after tax})_{AB}&=(\text{price before tax})(1+\text{tax rate})\\ \\ &=1999.99(1+0.05)=\$2,099.99 \end{align*}[/latex]

b. Ontario: 13% HST

[latex]\begin{align*} (\text{price after tax})_{ON}&=(\text{price before tax})(1+\text{tax rate})\\ \\ &=1999.99(1+0.13)=\$2,259.99 \end{align*}[/latex]

c. Quebec: 9.975% PST, 5% GST

[latex]\begin{align*} (\text{price a.t.})_{QC}&=\text{price b.t.}+(\text{PST rate})(\text{price b.t.})+(\text{GST rate})(\text{price b.t.})\\ \\ &=1999.99+0.09975\cdot 1999.99+0.05\cdot 1999.99\\ \\ &=1999.99+199.50+100\\ \\ &=\$2,299.49 \end{align*}[/latex]

d. British Columbia: 7% PST, 5% GST

[latex]\begin{align*} (\text{price a.t.})_{BC}&=\text{price b.t.}+(\text{PST rate})(\text{price b.t.})+(\text{GST rate})(\text{price b.t.})\\ \\ &=1999.99+0.07\cdot 1999.99+0.05\cdot 1999.99\\ \\ &=1999.99+140+100\\ \\ &=\$2,239.99 \end{align*}[/latex]

Example 5.1 B: Calculating Taxes on a Tax-Inclusive Price

“The Brick is having its Midnight Madness sale! Pay no taxes on products purchased during this event!” While this is good marketing, it probably goes without saying that governments do not give up the sales taxes. Essentially The Brick is advertising a tax-inclusive price. Calculate GST and PST amounts for a product advertised at $729.95, including GST and PST, in Saskatchewan.

Answer: PST tax amount = ?, GST tax amount = ?

Saskatchewan: 6% PST, 5% GST [latex]\Rightarrow[/latex] total tax rate = 11%

To calculate tax amounts, we need the price before taxes.

[latex]\begin{align*} &\text{price after tax}=(\text{price before tax})(1+\text{tax rate})\\ \\ &\Rightarrow \text{price before tax}=\frac{\text{price after tax}}{1+\text{tax rate}}=\frac{729.95}{1+0.11}=\$657.61 \end{align*}[/latex]

[latex]\text{PST amount}=0.06\cdot 657.61=\$39.46[/latex]

[latex]\text{GST amount}=0.05\cdot 657.61=\$32.88[/latex]

The GST/HST Remittance

When a business collects sales taxes, it is a go-between in the transaction. These sales tax monies do not belong to the business. On a regular basis, the business must forward this money to the government. This payment is known as a tax remittance.

The Tax Remit Formula

Generally speaking, a business does not pay sales taxes. As a result, the government permits a business to take all eligible sales taxes that it paid through its acquisitions and net them against all sales taxes collected from sales. The end result is that the business is reimbursed for any eligible out-of-pocket sales tax that it paid. The formula below expresses this relationship.

[latex]\begin{align*} \text{tax remit}&=\text{tax collected through sales}-\text{tax paid on expenses}\\\\ &=(\text{tax rate})(\text{sales before tax})-(\text{tax rate})(\text{expenses before tax}) \end{align*}[/latex]

Note: Tax remit is the dollar amount due or owed by the business to the government or vice versa

- If the tax remit amount is positive, it means that the business collected more tax than it paid out; the company must remit this balance to the government.

- If the tax remit amount is negative, it means that the business paid out more taxes than it collected; the government must refund this balance to the company.

Tax collected and tax paid: Both of these parts of the formula represent the total amount of sales tax from all taxable amounts at the appropriate sales tax rate. The taxes collected are based on total tax-eligible revenues. The taxes paid are based on the total tax-eligible expenses.

Important note: The tax rate is always applied to the amount before the tax has been added. As a result, given an amount that already includes tax, to calculate the tax amount we first have to calculate the amount before tax, i.e.,

[latex]\text{amount before tax}=\dfrac{\text{amount after tax}}{1+\text{tax rate}}[/latex]

For example, assume a business has tax-eligible expenses of $153,000, including GST. It has also collected GST on sales of $358,440. Calculate the GST remittance.

Solution: GST remittance = ?

[latex]\begin{align*} \text{tax remit}&=\text{tax collected} -\text{tax paid}\\ \\ &=(\text{tax rate})(\text{sales before tax})-(\text{tax rate})(\text{expenses before tax})\\ \\ &=(\text{tax rate})(\text{sales before tax})-(\text{tax rate})\left(\frac{\text{expenses after tax}}{1+\text{tax rate}}\right)\\ \\ &=0.05\cdot 358440-0.05\cdot \frac{153000}{1+0.05}\\ \\ &=\$10,636.29 \end{align*}[/latex]

The business should remit $10,636.29 to the government.

Example 5.1 C: Calculating GST/HST Remittance

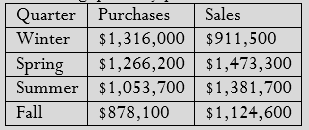

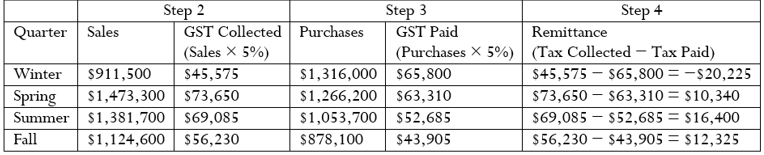

An Albertan lumber company reported the following quarterly purchases and sales in its 2013 operating year:

Assuming all purchases and sales are eligible and subject to GST, calculate the GST remittance or refund for each quarter.

Answer: remit for each quarter = ?

Give it Some Thought Answers:

- PEI (15% HST), Ontario (13% HST), British Columbia (5% GST, 7% PST), Saskatchewan (6% GST, 5% PST), Alberta (5% GST, no PST)

Section Exercises – after the reading

Work on section 5.1 exercises in Fundamentals of Business Math Exercises after reading this section. Discuss your solutions with your peers and/or course instructor.

You may consult answers to select exercises: Fundamentals of Business Math Exercises – Select Answers