1.2 Invoices, Terms of Payments, and Cash Discounts

LEARNING OBJECTIVES

- Solve problems involving cash discounts for full and partial payments.

In the world of business, most purchases are not paid for in cash. Instead, businesses tend to work through an invoicing system in which they send out bills to their clients on a regular basis. In accounting, this means that the purchase is placed into accounts receivables until such time as a cheque arrives and the purchase is converted to cash. Invoices provide detailed transaction information, listing the amount owed and also indicating the terms on which payment is expected. Companies may offer what are known as cash discounts as incentives for early invoice payment. The rationale for these discounts is simple—a sale is not a sale until you have the cash in hand. The longer an invoice remains in accounts receivable, the less likely that it will be paid. Thus, it might turn into bad debt, which the creditor cannot collect at all.

Invoicing is less common in consumer purchases because of the sheer volume of transactions involved and the higher risk of nonpayment. Imagine purchasing items at Walmart and receiving an invoice to pay your bill next month instead of paying cash. It is hard to fathom the number of invoices Walmart would have to distribute monthly. How much would it cost to collect those debts? How many of those invoices would go unpaid? That is why consumer purchases typically do not involve invoicing.

Invoicing does commonly occur at a consumer level on credit card transactions, along with many services where the business may not be able to assess the exact amount of the bill at the time of the transaction or until the service is delivered. Two examples illustrate this point:

- Think of your MasterCard bill. You are able to make purchases, say, from March 9 to April 8. Then on April 9 the company sends out a statement saying you have until April 29 to pay your bill. If you do not, interest and late payment penalties are involved.

- You have a dental visit for a regular cleaning. Before charging you, the dentist’s office needs to determine how much your insurance will cover. It may not find out the answer for a day or two, so it sends you an invoice at a later date once it hears from the insurance company. The invoice terms indicate that payment is due upon receipt and you will incur late penalties if payment is not forthcoming.

This section explores the most common aspects of invoicing, including terms of payments and cash discounts. You will learn to calculate the amount required to pay invoices and how to reduce the outstanding balance of an invoice if a partial payment is received.

Invoice Terms

You must know how to read a business invoice. A typical invoice includes the following information:

- Invoicing Company. The invoice must identify who is sending and issuing the invoice.

- Invoice Date. The date on which the invoice was printed, along with the invoice tracking number. When an invoice is paid, the cheque must reference the invoice number so that the invoicing company can identify which invoice to credit the payment to.

- Transaction Details. The details of the transaction might include number of units, unit prices, and any discounts for which the item is eligible.

- Invoice Total. The total amount owing is indicated, including any taxes or additional charges.

- Terms of Payment. The terms of payment include any cash discounts and due dates. The date of commencement is determined from this part of the invoice.

- Late Penalty. A penalty, if any, for late payments is indicated on the invoice. Whether or not a company enforces these late penalties is up to the invoice-issuing organization.

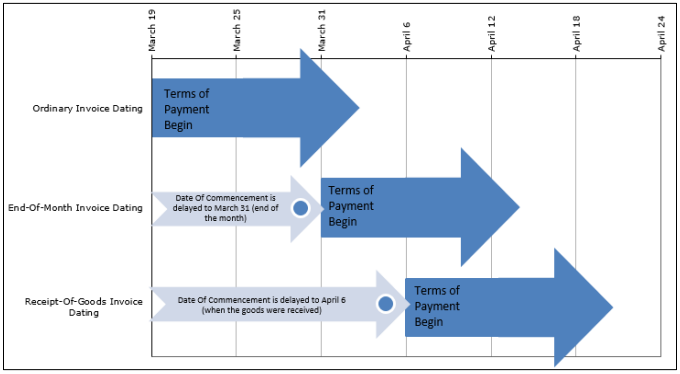

Dates of Commencement

All invoice terms are affected by what is known as the date of commencement, which is the first day from which all due dates stated on the invoice will stem. The date of commencement is determined in one of three ways, as illustrated below.

- Ordinary Dating. In ordinary invoice dating, or just invoice dating for short, the date of commencement is the same date as the invoice date. Therefore, if the invoice is printed on March 19, then all terms of payment commence on March 19. This is the default manner in which most companies issue their invoices, so if an invoice does not specify any other date of commencement you can safely assume it is using ordinary dating.

- End-of-Month Dating (EOM). End-of-month invoice dating applies when the terms of payment include the wording “end-of-month” or the abbreviation “EOM” appears after the terms of payment. In end-of-month dating, the date of commencement is the last day of the same month as indicated by the invoice date. Therefore, if the invoice is printed on March 19, then all terms of payment commence on the last day of March, or March 31. Many companies use this method of dating to simplify and standardize all of their due dates, in that if the date of commencement is the same for all invoices, then any terms of payment will also share the same dates.

- Receipt-of-Goods Dating (ROM). Receipt-of-goods invoice dating applies when the terms of payment include the wording “receipt-of-goods” or the abbreviation “ROG” appears after the terms of payment. In receipt-of-goods dating, the date of commencement is the day on which the customer physically receives the goods. Therefore, if the invoice is printed on March 19 but the goods are not physically received until April 6, then all terms of payment commence on April 6. Companies with long shipping times involved in product distribution or long lead times in production commonly use this method of dating.

NOTE

- In this section, we will focus on ordinary dating only.

- If an invoice does not specifically state EOM or ROM, it is assumed to use ordinary dating.

Terms of Payment

The most common format for the terms of paying an invoice are

[latex]\displaystyle{3/10, n/30}[/latex]

where

- [latex]3[/latex] is the cash discount. A cash discount is the percentage of the balance owing on an invoice that can be deducted for payment received either in full or in part during the discount period. In this case, 3% is deducted from the total invoice amount.

- [latex]10[/latex] is the discount period. The discount period is the number of days from the date of commencement in which the customer is eligible to take advantage of the cash discount. For this example, there is a period of 10 days during which a payment received in full or any portion thereof is eligible for the 3% cash discount.

- [latex]n/30[/latex] is the credit period. The credit period is the number of interest-free days from the date of commencement that the customer has to pay the invoice in full before the creditor applies any penalties to the invoice.

EXAMPLE

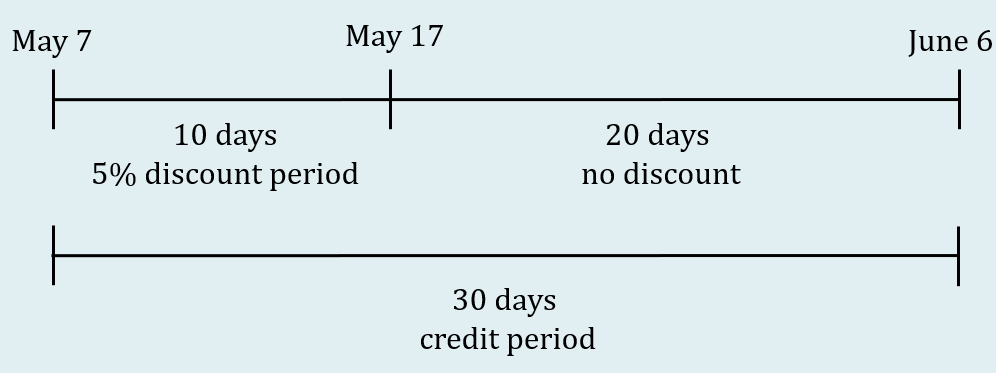

An invoice dated May 7 has payment terms [latex]5/10, n/30[/latex].

- Using ordinary dating, the terms of payment begin on May 7.

- For the first 10 days, there is a 5% discount period. Any payments made during this period receive a 5% discount. This discount period ends on May 17 (10 days after the invoice date).

- After May 17, there is no discount period. Any payments made during this period receive no discount.

- The terms of payment end 45 days after the date of the invoice on June 6.

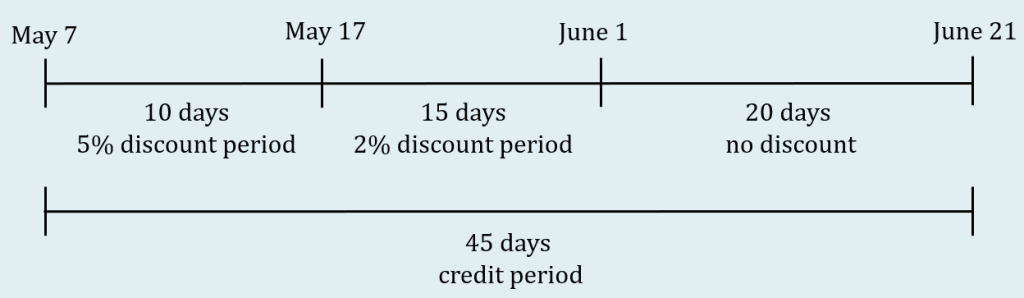

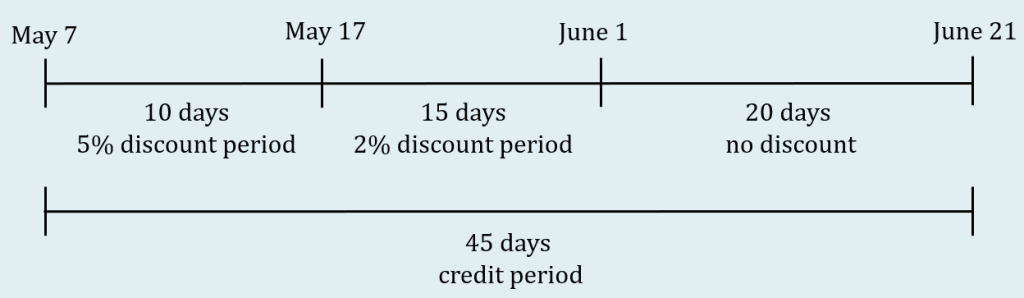

EXAMPLE

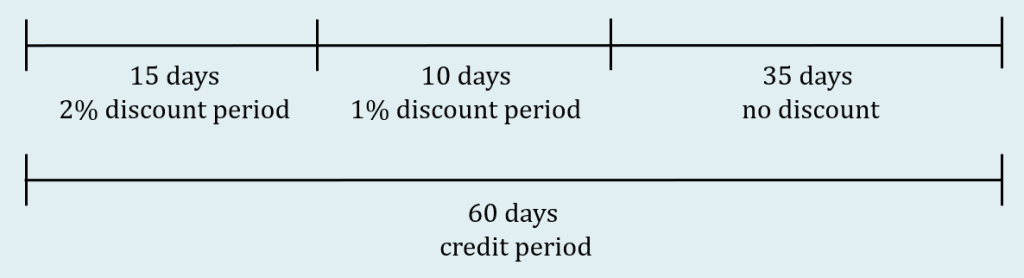

An invoice dated May 7 has payment terms [latex]5/10, 2/25, n/45[/latex].

- Using ordinary dating, the terms of payment begin on May 7.

- For the first 10 days, there is a 5% discount period. Any payments made during this period receive a 5% discount. This discount period ends on May 17 (10 days after the invoice date). During this period, only the larger discount of 5% is applied.

- For the next 15 days, there is a 2% discount period. Any payments made during this period receive a 2% discount. This discount period ends on June 1 (25 days after the invoice date).

- After June 1, there is no discount period. Any payments made during this period receive no discount.

- The terms of payment end 45 days after the date of the invoice on June 6.

NOTE

When there are multiple discount periods, as in the above example, only one discount applies at a time. The second discount period begins after the first discount period.

Some common business practices are implemented across most industries. Note that you must always check with the invoicing organization to ensure it is applying these practices.

- No Net Figure. If no net figure is stated in the terms of payment, you should assume that the credit period is 20 days after the last discount period. If there are no discount periods, then the credit period is 20 days from the date of commencement. For example, [latex]3/10[/latex], [latex]2/15[/latex] means that the credit period ends 20 days after the second discount period of 15 days. Hence, the credit period is 35 days after the date of commencement.

- No Cash Discount. Not every invoice receives a cash discount. If no terms indicate a cash discount, then the invoicing company seeks full payment only. For example, [latex]n/30[/latex] means that no cash discount applies and the credit period ends 30 days from the date of commencement.

- Nonbusiness Days. Most businesses operate Monday through Friday and are closed on weekends and holidays. As such, any date falling on a nonworking day is moved to the next business day. For example, if an invoice is ordinary dated December 21 and lists a cash discount of [latex]2/10[/latex], the end of the discount period falls on January 1. Because this is New Year’s Day, the discount period extends to January 2. In this textbook, you should apply this practice to any of the five known statutory holidays (New Year’s Day, Good Friday or Easter Monday in Quebec only, Canada Day, Labor Day, and Christmas Day).

Types of Payments

When businesses pay invoices, three situations can occur:

- Full Payment. A full payment means that the company wants to pay its invoice in full and reduce its balance owing to zero dollars. This is the most common practice.

- Partial Payment. A partial payment means that the company wants to lower its balance owing but will not reduce that balance to zero. A company will generally employ this method when it wants to either lower its accounts payable or demonstrate good faith in paying its invoices. Partial payment may also occur if the company wants to take advantage of a cash discount but lacks the funds to clear the invoice in its entirety.

- Late Payment. A late payment occurs when the company pays its invoice either in full or partially after the credit period has elapsed. Late payments occur for a variety of reasons, but the most common are either insufficient funds to pay the invoice or a simple administrative oversight.

Full Payments

The good news is that a cash discount is just another type of discount similar to what you encountered in the previous section, and you do the calculations using the exact same formula.

[latex]\displaystyle{\mbox{Amount Paid}=\mbox{Amount Credited} \times (1-d)}[/latex]

where

- Amount Credited is the amount deducted from the invoice balance as a result of the payment. It is what the payment is worth once the cash discount has been factored into the calculation.

- Amount Paid is the actual payment amount made that must be converted into its value toward the invoice total. Because the payment represents an amount after the discount has been removed, you need to find out what it is worth before the cash discount was removed.

- [latex]d[/latex] is the cash discount rate. Any payment received within any discount period, whether in full or partial, is eligible for the specified cash discount indicated in the terms of payment.

EXAMPLE

An invoice for $5,000 is dated May 7 with payment terms [latex]5/10, 2/25, n/45[/latex].

- What amount paid on May 15 will clear the invoice?

- What amount paid on May 31 will clear the invoice?

- What amount paid on June 10 will clear the invoice?

Solution:

The timeline for this invoice is

Step 1: May 15 is during the first discount period, so the payment qualifies for the 5% discount.

[latex]\begin{eqnarray*} \mbox{Amount Paid} & = & \mbox{Amount Credited} \times (1-d) \\ & = & 5,000 \times (1-0.05) \\ & = & 5,000 \times 0.95 \\ & = & \$4,750 \end{eqnarray*}[/latex]

On May 15, a payment of $4,750 will clear the invoice.

Step 2: May 31 is during the second discount period, so the payment qualifies for the 2% discount.

[latex]\begin{eqnarray*} \mbox{Amount Paid} & = & \mbox{Amount Credited} \times (1-d) \\ & = & 5,000 \times (1-0.02) \\ & = & 5,000 \times 0.098 \\ & = & \$4,900 \end{eqnarray*}[/latex]

On May 31, a payment of $4,900 will clear the invoice.

Step 3: A payment on June 10 occurs during the no discount period. So a payment of $5,000 will clear the invoice on June 10.

NOTE

If there is one area of invoicing that causes the most confusion, it is assigning information to the net price and invoice amount variables. These are commonly assigned backwards. Remember these rules so that you always get the correct answer.

- The invoice amount or any reference to the balance owing on an invoice is always a list price.

List Price = Invoice Amount = Amount Credited

- The payment of an invoice, whether in full, partial, or late, is always a net price.

Net Price = Payment Amount = Amount Paid

TRY IT

You receive an invoice for $35,545.50 dated August 14. The terms of payment are listed as [latex]3/10, 1/20, n/30[/latex].

- What amount paid on August 24 will clear the invoice?

- What amount paid on September 3 will clear the invoice?

- What amount paid on September 13 will clear the invoice?

Click to see Solution

1. August 24 is the last day of the first discount period.

[latex]\begin{eqnarray*} \mbox{Amount Paid} & = & \mbox{Amount Credited} \times (1-d) \\ & = & 35,545.50 \times (1-0.03) \\ & = & 35,545.50 \times 0.97 \\ & = & \$34,479.14 \end{eqnarray*}[/latex]

On August 24, a payment of $34,479.14 will clear the invoice.

2. September 3 is the last day of the second discount period.

[latex]\begin{eqnarray*} \mbox{Amount Paid} & = & \mbox{Amount Credited} \times (1-d) \\ & = & 35,545.50 \times (1-0.01) \\ & = & 35,545.50 \times 0.99 \\ & = & \$35,190.05 \end{eqnarray*}[/latex]

On September 3, a payment of $35,190.05 will clear the invoice.

3. September 13 is the last day of the credit period when there is no discount. A payment of $35,545.50 will clear the invoice on September 13.

Who cares about 1% or 2% discounts when paying bills? While these percentages may not sound like a lot, remember that these discounts occur over a very short time frame. For example, assume you just received an invoice for $102.04 with terms of [latex]2/10, n/30[/latex]. When taking advantage of the 2% cash discount, you must pay the bill 20 days early, resulting in a $100 payment. That is a $2.04 savings over the course of 20 days. To understand the significance of that discount, imagine that you had $100 sitting in a savings account at your bank. Your savings account must have a balance of $102.04 twenty days later. This requires your savings account to earn an annual interest rate of 44.56%! Therefore, a 20-day 2% discount is the same thing as earning interest at 44.56%.

Partial Payments

Suppose you receive a $21,000 invoice with payment terms [latex]2/15,1/25, n/60[/latex]. You do not have sufficient funds to take full advantage of the 2% discount period. Not wanting to lose out entirely, you decide to submit a partial payment of $10,000 before the first discount period elapses. What is the balance remaining on the invoice after you make this $10,000 payment?

Unless you pay attention to invoicing concepts, it is easy to get confused. Perhaps you think that $10,000 should be removed from the $21,000 invoice total, thereby leaving a balance owing of $11,000. Or maybe you think the payment should receive the discount of 2%, which would be $200. Are you credited with $9,800 off of your balance? Or maybe $10,200 off of your balance? In all of these scenarios, you would be committing a serious mistake and miscalculating your balance owing. Let’s look at the correct way of handling this payment.

Recall that

[latex]\displaystyle{\mbox{Amount Paid}=\mbox{Amount Credited} \times (1-d)}[/latex]

Rearranging this formula

[latex]\displaystyle{\mbox{Amount Credited}=\frac{\mbox{Amount Paid}}{1-d}}[/latex]

where

- Amount Credited is the amount deducted from the invoice balance as a result of the payment. It is what the payment is worth once the cash discount has been factored into the calculation.

- Amount Paid is the actual payment amount made that must be converted into its value toward the invoice total. Because the payment represents an amount after the discount has been removed, you need to find out what it is worth before the cash discount was removed.

- [latex]d[/latex] is the cash discount rate. Any payment received within any discount period, whether in full or partial, is eligible for the specified cash discount indicated in the terms of payment.

EXAMPLE

You receive a $21,000 invoice with payment terms [latex]2/15, 1/25, n/60[/latex]. You submit a partial payment of $10,000 during the first discount period. What is the balance remaining on the invoice after you make this $10,000 payment?

Solution:

The timeline for this invoice is

Step 1: The given information is

[latex]\begin{eqnarray*} \mbox{Amount Paid} & = & \$10,000 \\ d & = & 2\% \end{eqnarray*}[/latex]

Step 2: Calculate the amount credited.

[latex]\begin{eqnarray*} \mbox{Amount Credited} & = & \frac{\mbox{Amount Paid}}{1-d} \\ & = & \frac{10,000}{1-0.02} \\ & = & \frac{10,000}{0.98} \\ & =& \$10,204.08 \end{eqnarray*}[/latex]

When the $10,000 payment is made during the first discount period, $10,204.08 will be credited against the invoice.

Step 3: Calculate the balance on the invoice.

[latex]\begin{eqnarray*} \mbox{Balance} & =& 21,000-10,204.08 \\ & = & \$10,795.92 \end{eqnarray*}[/latex]

The balance on the invoice is $10,795.92.

NOTE

In the case where a payment falls within a cash discount period, the amount credited toward an invoice total is always larger than the actual payment amount. If the payment does not fall within any discount period, then the amount credited toward an invoice total is equal to the actual payment amount (because there is no cash discount).

To help you understand why a partial payment works in this manner, assume an invoice is received in the amount of $103.09 and the customer pays the invoice in full during a 3% cash discount period. What amount is paid? The answer is [latex]\mbox{Amount Paid} = 103.09 \times (1− 0.03) = 100[/latex]. Therefore, any payment of $100 made during a 3% cash discount period is always equivalent to a pre-discount invoice credit of $103.09. If the balance owing is more than $103.09, that does not change the fact that the $100 payment during the discount period is worth $103.09 toward the invoice balance.

EXAMPLE

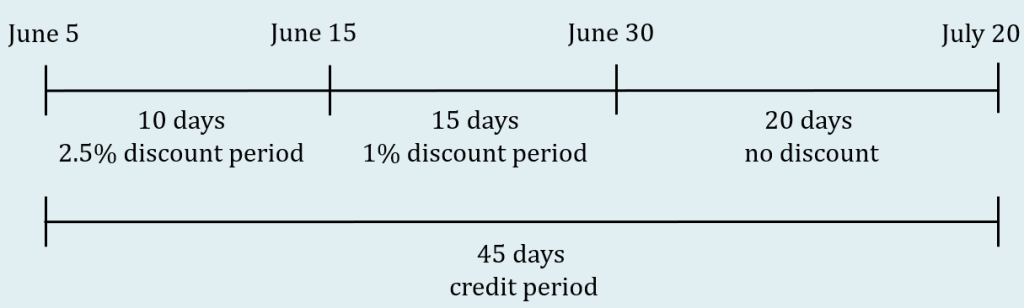

Heri just received an invoice from his supplier for $68,435.27 and is dated June 5 with terms of [latex]2.5/10, 1/25, n/45[/latex]. Heri sent two partial payments in the amounts of $20,000 on June 15 and $30,000 on June 29. He wants to clear his invoice by making a final payment on July 18. What is the amount of the final payment?

Solution:

The timeline for the invoice is

Step 1: Calculate the amount credited for the $20,000 payment. The $20,000 payment on June 15 occurs during the first discount period.

[latex]\begin{eqnarray*} \mbox{Amount Credited} & = & \frac{\mbox{Amount Paid}}{1-d} \\ & = & \frac{20,000}{1-0.025} \\ & = & \frac{20,000}{0.975} \\ & =& \$20,512.82 \end{eqnarray*}[/latex]

Step 2: Calculate the amount credited for the $30,000 payment. The $30,000 payment on June 29 occurs during the second discount period.

[latex]\begin{eqnarray*} \mbox{Amount Credited} & = & \frac{\mbox{Amount Paid}}{1-d} \\ & = & \frac{30,000}{1-0.01} \\ & = & \frac{30,000}{0.99} \\ & =& \$30,303.03 \end{eqnarray*}[/latex]

Step 3: Calculate the balance on the invoice after the two payment are made.

[latex]\begin{eqnarray*} \mbox{Balance} & =& 68,435.27-20,512.82-30,303.03 \\ & = & \$17,619.42 \end{eqnarray*}[/latex]

The first two payments receive a credit of $20,512.82 and $30,303.03 toward the invoice total, respectively. This leaves a balance on the invoice of $17,619.42. Because the final payment is made during the credit period, but not within any cash discount period, the final payment is the exact amount of the balance owing and equals $17,619.42.

TRY IT

An invoice of $4,700 has payment terms [latex]4/15,n/45[/latex]. A payment of $2,500 was made during the discount period. What payment made after the discount period will clear the invoice?

Click to see Solution

[latex]\begin{eqnarray*}\mbox{Amount Credited} & = & \frac{\mbox{Amount Paid}}{1-d} \\ & = & \frac{2,500}{1-0.04} \\ & = & \frac{2,500}{0.96} \\ & = & \$2,604.17 \end{eqnarray*}[/latex]

[latex]\begin{eqnarray*} \mbox{Balance} & = & 4,700-2,604.17 \\ & = & \$2,905.83 \end{eqnarray*}[/latex]

A payment of $2,905.83 after the discount period will clear the invoice.

TRY IT

An invoice for $50,000 is dated April 7 with payment terms [latex]3.5/10, 2/30, n/60[/latex]. A payment of $15,000 is made on April 15 and another payment of $9,000 is made on May 6. What amount must be paid on June 6 to clear the invoice? What is the total amount paid to clear the invoice?

Click to see Solution

1. Calculate the amount credited on April 15.

[latex]\begin{eqnarray*}\mbox{Amount Credited} & = & \frac{\mbox{Amount Paid}}{1-d} \\ & = & \frac{15,000}{1-0.035} \\ & = & \frac{15,000}{0.965} \\ & = & \$15,544.04 \end{eqnarray*}[/latex]

2. Calculate the amount credited on May 6.

[latex]\begin{eqnarray*}\mbox{Amount Credited} & = & \frac{\mbox{Amount Paid}}{1-d} \\ & = & \frac{9,000}{1-0.02} \\ & = & \frac{9,000}{0.98} \\ & = & \$9,183.67 \end{eqnarray*}[/latex]

3. Calculate the payment on June 6.

[latex]\begin{eqnarray*} \mbox{Payment} & = & 50,000-15,544.04-9,138.67 \\ & = & \$25,317.29 \end{eqnarray*}[/latex]

4. Calculate the total amount paid.

[latex]\begin{eqnarray*} \mbox{Total Paid} & = & 15,000+9,000+25,317.29 \\ & = & \$49,317.29 \end{eqnarray*}[/latex]

Exercises

- An invoice of $136,294.57 is dated January 14 with terms [latex]2/10, n/30[/latex]. What payment on January 22 will clear the invoice?

Click to see Answer

$133,568.68

- An invoice of $57,775 is dated June 16 with terms [latex]3/15,1.5/25, n/45[/latex]. A payment of $20,000 is made on July 1 and a payment of $15,000 is made on July 10. Calculate the remaining balance on the invoice.

Click to see Answer

$21,928.01

- A company received an invoice dated July 13 in the amount of $206,731.75. The terms are [latex]2/10,1/20,n/30[/latex]. If the full payment is made on August 1, what amount is paid?

Click to see Answer

$204,664.43

- Time Bomb Traders Inc. received an invoice dated March 27 in the amount of $36,448.50 with terms [latex]1.5/15,0.5/30,n/45[/latex].

- What amount is the full payment if the payment is made on April 4?

- What amount is the full payment if the payment is made on April 20?

- What amount is the full payment if the payment is made on May 1?

Click to see Answer

a. $35,901.77; b. $36,266.28; c. $36,448.50

- An invoice for $23,694.50 dated April 13 has payment terms [latex]3/15,2/25,n/60[/latex]. A $10,000 payment was made on April 20 and a payment of $5,000 was made on May 3. The final payment to clear the invoice was made on May 31.

- Calculate the final payment.

- What was the total amount paid to clear the invoice?

Click to see Answer

a. $8,283.18; b. $23,283.18

- Family Foods received an invoice dated July 2 from Kraft Canada in the amount of $13,002.96 with terms of [latex]2/15, 1/30, n/45[/latex]. Payments of $4,000 are made on July 17 and August 1. What payment amount is required to pay the remaining balance on the invoice on August 10?

Click to see Answer

$4,880.92

- An invoice dated November 6 in the amount of $38,993.65 with terms [latex]2.5/10,1/25/n/45[/latex] is received by your company. You make a partial payment of $15,000 on November 15 and a partial payment of $20,000 on November 30. You make a final payment on December 10.

- Calculate the final payment.

- What was the total amount paid to clear the invoice?

Click to see Answer

a. $3,407.01; b. $38,407.01

- An invoice for $100,000 has payment terms [latex]3.5/10,n/30[/latex]. What payment must be made during the discount period to reduce the balance on the invoice to $60,000?

Click to see Answer

$38,600

- An invoice for $75,000 has payment terms [latex]2/15,n/30[/latex]. What payment must be made during the discount period to reduce the balance on the invoice by $20,000?

Click to see Answer

$19,600

- You receive an invoice dated August 20 for your office supplies totaling $10,235.97. The terms of payment on invoice are [latex]3.75/15,1.5/30,n/45[/latex]. You make three equal payments of $2,000 on August 25, September 4 and September 19. What payment on September 29 will settle the invoice?

Click to see Answer

$4,049.67

- An invoice for [latex]\$100,000[/latex] dated March 2 has terms of [latex]4/10, 3/20, 2/30, 1/40, n/60[/latex]. If four equal payments are made on March 10, March 17, March 31, and April 5 resulting in full payment of the invoice, calculate the amount of each payment.

Click to see Answer

$24,371.79

Attribution

“4.2: Invoicing: Terms of Payment and Cash Discounts” from Introduction to Business Math by Margaret Dancy is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“7.4: Invoicing — Terms of Payment and Cash Discounts” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.