6.1 Amortization Schedules

LEARNING OBJECTIVES

- Construct a full or partial amortization schedule for a loan.

At some point in your life, you will probably take out a loan from a bank, credit union, or some other financial institution. You might need a loan to buy a new car, purchase a home, go back to school, or start a new business. When you borrow money, you have to repay the amount of money you borrowed plus the interest the loan accumulates over the term of the loan. You repay the loan by making regular payments over the term of the loan. Each payment does two things: it pays all of the interest due on the loan at the time the payment is made and the remainder of the payment goes to paying down the loan amount. This process of gradually repaying the loan with periodic payments over the term of the loan is called amortization.

What is Amortization?

Amortization is a process by which the principal of a loan is extinguished over the course of an agreed-upon time period through a series of regular payments that go toward both the accruing interest and principal reduction. Two components make up the agreed-upon time component.

- Amortization Term. The amortization term is the length of time for which the interest rate and payment agreement between the borrower and the lender will remain unchanged. Thus, if the agreement is for monthly payments at a 5% fixed rate over five years, it is binding for the entire five years. Or if the agreement is for quarterly payments at a variable rate of prime plus 2% for three years, then interest is calculated on this basis throughout the three years.

- Amortization Period. The amortization period is the length of time it will take for the principal to be reduced to zero. For example, if you agree to pay back your car loan over six years, then after six years you reduce your principal to zero and your amortization period is six years.

In most relatively small purchases, the amortization term and amortization period are identical. For example, a vehicle loan has an agreed-upon interest rate and payments for a fixed term. At the end of the term, the loan is fully repaid. However, larger purchases such as real estate transactions typically involve too much money to be repaid under short time frames. Financial institutions hesitate to agree to amortization terms of much more than five to seven years because of the volatility and fluctuations of interest rates. As a result, a term of five years may be established with an amortization period of 25 years. When the five years elapse, a new term is established as agreed upon between the borrower and lender. The conditions of the new term reflect prevailing interest rates and a payment plan that continues to extinguish the debt within the original amortization period.

Amortization Schedules

An amortization schedule shows the payment amount, principal component, interest component, and remaining balance for every payment in the annuity. As the title suggests, it provides a complete understanding of where the money goes, identifying how much of each payment goes to interest and how much goes to principal.

An amortization schedule has five columns:

- Payment Number. There is a row for every payment made to repay the loan.

- Payment. The periodic payment made to repay the loan. All of the payments are the same (PMT), except for the last payment.

- Interest Paid. For each row, the interest paid entry is the amount of interest due on the loan at the time of the corresponding payment.

- Principal Paid. For each row, the principal paid entry is the amount of principal repaid at the time of the corresponding payment, after the interest is paid.

- Balance. For each row, the balance records how much of the original loan amount remains after the payment is made.

To fill in an amortization schedule, you first need to have all of the details about the loan, including the loan amount (PV), the payment (PMT), the number of payments (N), and the interest rate. If any of these quantities are missing, calculate out the missing value before completing the amortization schedule.

| Payment Number | Payment | Interest Paid (INT) | Principal Paid (PRN) | Balance (BAL) |

| 0 | Loan Amount1 | |||

| 1 | PMT2 | INT3 | PRN4 | BAL5 |

| 2 | PMT2 | INT3 | PRN4 | BAL5 |

| [latex]\vdots[/latex] | [latex]\vdots[/latex] | [latex]\vdots[/latex] | [latex]\vdots[/latex] | [latex]\vdots[/latex] |

| N-1 | PMT2 | |||

| N | Final Payment10 | Final INT9 | Final PRN8 | 07 |

| Totals | Total Amount Paid12 | Total Interest Paid13 | Total Principal Paid11 |

Follow these steps to fill in the amortization schedule.

- In row 0, the only entry is the loan amount in the balance column.

- Fill in the rounded loan payment down the payment column, except for the last payment.

- Calculate the interest paid portion of the payment. The interest is the balance from the previous row times the periodic interest rate: [latex]\mbox{Interest Paid}=\mbox{Balance from Previous Row} \times i[/latex]. Note: this calculation assumes that the payment frequency and the compound frequency for the interest rate are the same (i.e. a simple annuity).

- Calculate the principal paid portion of the payment. The principal paid is the difference between the payment and the interest paid: [latex]\mbox{Principal Paid}=PMT-\mbox{Interest Paid}[/latex].

- Calculate the outstanding balance on the loan after the payment is made. The balance is difference between the balance in the previous row and the principal paid: [latex]\mbox{Balance}=\mbox{Balance from Previous Row}-\mbox{Principal Paid}[/latex].

- For each payment, repeat steps 2 through 5, except for the last row.

- The last balance entry is 0. Because this is the last payment, the loan must be paid off, which means the balance is reduced to 0.

- The final principal paid entry equals the balance entry from row N-1.

- Calculate the final interest paid portion in the same way as in step 3.

- The final payment is the sum of the final interest paid entry and the final principal paid entry: [latex]\mbox{Final Payment}=\mbox{Final INT}+\mbox{Final PRN}[/latex].

- The total principal paid is the sum of the principal paid column, and is just the loan amount: [latex]\mbox{Total Principal Paid}=\mbox{Loan Amount}[/latex].

- The total amount paid is the sum of the payment column: [latex]\mbox{Total Amount Paid}=(N-1) \times PMT+\mbox{Final Payment}[/latex].

- The total interest paid is the sum of the interest paid column, and equals the difference between the other two column totals: [latex]\mbox{Total Interest Paid}=\mbox{Total Amount Paid}-\mbox{Total Principal Paid}[/latex].

NOTES

- The manual calculation of the interest paid entry above is based on the assumption that the payment frequency and the compounding frequency are equal. If the payment frequency and the compounding frequency are not equal, an interest conversion is required to convert the interest rate to the equivalent rate with the compounding frequency equal to the payment frequency. However, if you use the TI BAII Plus’s built-in amortization worksheet (described below), no interest conversion is required.

- As you fill in the schedule, round the entries to two decimal places.

- Make sure that you are using the payment rounded to two decimal places in the schedule. In real life, your loan payment is rounded to two decimal places and all of the loan calculations are based on this rounded payment.

- The final payment must be the exact amount that will result in a 0 balance in the last row. You do not want the last payment to be too large (i.e. an overpayment) because then you are giving the bank more money than necessary. You do not want the last payment to be too small (i.e. an underpayment) because you must have the loan completely paid off with the final payment. Consequently, the last row of the schedule is reverse engineered, working from right to left.

EXAMPLE

A $3,000 loan at 8% compounded quarterly is repaid with quarterly payments of $800. Construct the amortization schedule for the loan.

Solution:

Step 1: Calculate the number of payments.

| PMT Setting | END |

| N | ? |

| PV | [latex]3,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-800[/latex] |

| I/Y | [latex]8[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]4[/latex] |

[latex]N=3.936...\rightarrow 4 \mbox{ payments}[/latex]

Step 2: Complete the amortization schedule. Because the payment frequency and the compounding frequency are equal, no interest conversion is required. The calculations for each entry are shown in blue. The periodic interest rate is [latex]i=\frac{8\%}{4}=2\%[/latex].

| Payment Number | Payment | Interest Paid (INT) | Principal Paid (PRN) | Balance (BAL) |

| 0 | [latex]\$3,000[/latex] | |||

| 1 | [latex]\$800[/latex] | [latex]\$60[/latex] [latex]\textcolor{blue}{(3,000 \times 0.02)}[/latex] | [latex]\$740[/latex][latex]\textcolor{blue}{(800-60)}[/latex] | [latex]\$2,260[/latex][latex]\textcolor{blue}{(3,000-740)}[/latex] |

| 2 | [latex]\$800[/latex] | [latex]\$45.20[/latex][latex]\textcolor{blue}{(2,260 \times 0.02)}[/latex] | [latex]\$754.80[/latex][latex]\textcolor{blue}{(800-45.20)}[/latex] | [latex]\$1,505.20[/latex][latex]\textcolor{blue}{(2,260-754.80)}[/latex] |

| 3 | [latex]\$800[/latex] | [latex]\$30.10[/latex][latex]\textcolor{blue}{(1,505.20 \times 0.02)}[/latex] | [latex]\$769.90[/latex][latex]\textcolor{blue}{(800-30.10)}[/latex] | [latex]\$735.30[/latex][latex]\textcolor{blue}{(1,505.20-735.30)}[/latex] |

| 4 | [latex]\$750.37[/latex] [latex]\textcolor{blue}{(15.07+735.30)}[/latex] |

[latex]\$15.07[/latex][latex]\textcolor{blue}{(735.30 \times 0.02)}[/latex] | [latex]\$735.30[/latex] | [latex]\$0[/latex] |

| Totals | [latex]\$3,150.37[/latex][latex]\textcolor{blue}{(3 \times 800+735.30)}[/latex] | [latex]\$150.37[/latex][latex]\textcolor{blue}{(3150.37-3000)}[/latex] | [latex]\$3,000[/latex] |

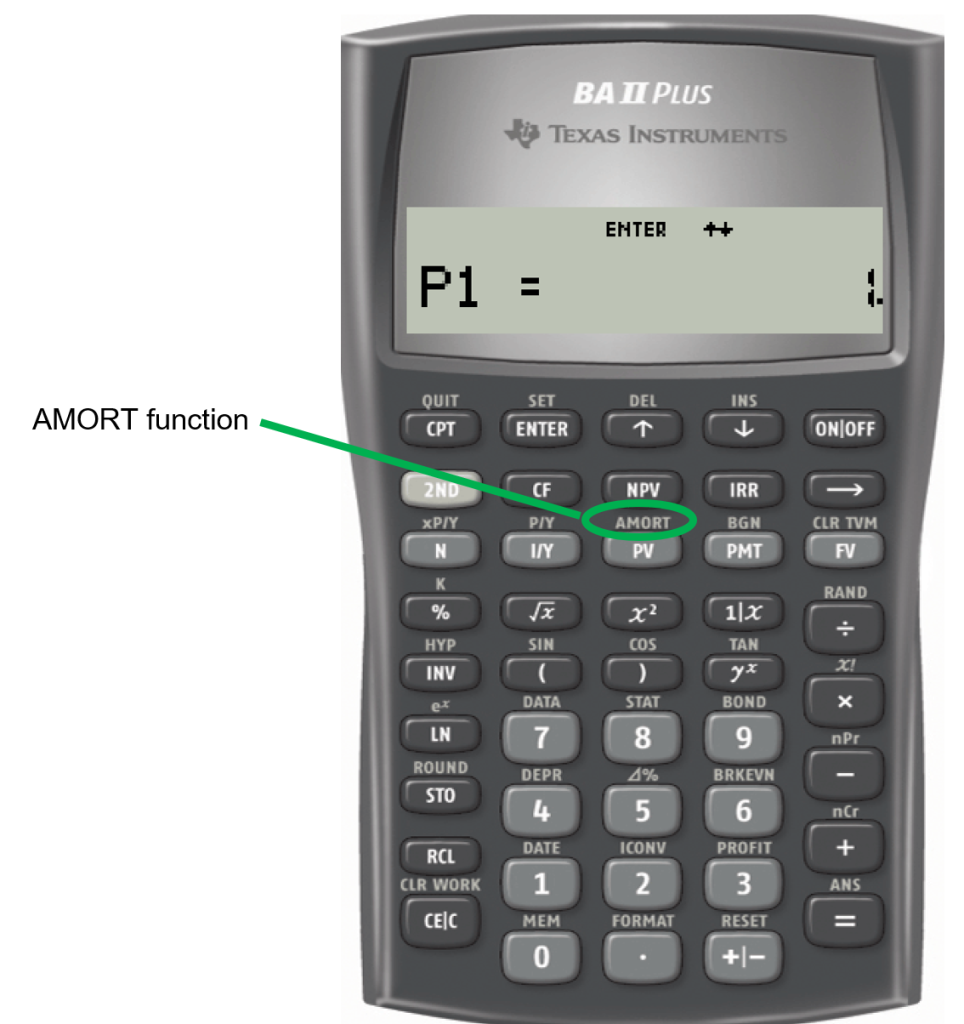

Using a Financial Calculator

Although the calculations in an amortization schedule are relatively straightforward, the manual calculations are time-consuming, especially when the schedule has a lot of rows. A financial calculator, such as the TI BAII Plus, has a built-in amortization worksheet that can quickly calculate the entries for each row of the schedule, with the exception of the last row.

USING THE TI BAII PLUS CALCULATOR TO CONSTRUCT AN AMORTIZATION SCHEDULE

The amortization worksheet has five variables (P1, P2, BAL, PRN, INT). You use the up and down arrows to scroll through the amortization worksheet.

- P1 is the starting payment number. The calculator works with a single payment or a series of payments.

- P2 is the ending payment number. This number is the same as P1 when you work with a single payment (i.e. to find the entries for a row of the amortization schedule). When you work with a series of payments later in this chapter, you set it to a number higher than P1.

- BAL is the principal balance remaining after the P2 payment number. The cash flow sign is correct as indicated on the calculator display.

- PRN is the principal portion of the payments from P1 to P2 inclusive. Ignore the cash flow sign.

- INT is the interest portion of the payments from P1 to P2 inclusive. Ignore the cash flow sign.

To use the amortization worksheet to complete an amortization schedule:

- Solve for any unknown quantities about the loan. You need to know all of the information about the loan first before you can use the amortization worksheet.

- Enter the values of all seven time value of money variables into the calculator (N, PV, FV, PMT, I/Y, P/Y, C/Y). If you calculated PMT in the first step, you must re-enter it rounded to two decimals and with the correct cash flow sign. Make sure the payment setting is set to END, and obey the cash flow sign convention. Because this is a loan, PV (the loan amount) is positive and PMT is negative.

- Go to the amortization worksheet by pressing 2nd AMORT (the PV button).

- To view the entries for a specific row of the schedule, set P1 and P2 to the row number. For example, to view the entries for row 5, set P1=5 and P2=5.

- At the P1 prompt, enter the row number and press ENTER.

- Press the down arrow.

- At the P2 prompt, enter the row number and press ENTER.

- Press the down arrow.

- The BAL entry is the balance entry for the corresponding row.

- Press the down arrow.

- The PRN entry is the principal paid entry for the corresponding row.

- Press the down arrow.

- The INT entry is the interest paid entry for the corresponding row.

- Press the down arrow the return to the P1 screen.

- Repeat the previous step with a different row number to view the entries for a different row.

NOTES

- Because you can enter P/Y and C/Y, there is no need to do an interest conversion if the payment frequency and compounding frequency are different. You simply have to tell the calculator the P/Y and C/Y given in the question, and the calculator will handle any interest conversion internally.

- Make sure to re-enter PMT rounded to 2 decimal places before using the amortization worksheet. If you enter PMT with all of the decimal places, you will not get the correct entries for the amortization schedule.

- The amortization worksheet on the calculator will only work with loans that have payments at the end of the interval (i.e. an ordinary annuity).

- The amortization worksheet gives you the entries for the schedule in reverse order, from right to left: BAL, PRN, and INT.

- As you read the entries off of the amortization worksheet on the calculator and put them in the schedule, round the entries to 2 decimal places.

- For the last row, the amortization worksheet will NOT give you the correct BAL and PRN entries. But, the INT entry for the last row is correct. You will still have to reverse engineer the last row using the steps described above, but you get the INT entry for the last row from the amortization worksheet on the calculator.

Amortization Schedule using BAII Plus by Joshua Emmanuel [3:55] (transcript available).

EXAMPLE

You take out a $50,000 business loan at 5% compounded quarterly. The loan requires semi-annual payments for three years. Construct the amortization schedule for the loan.

Solution:

Step 1: Calculate the payment.

| PMT Setting | END |

| N | [latex]2 \times 3=6[/latex] |

| PV | [latex]50,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | ? |

| I/Y | [latex]5[/latex] |

| P/Y | [latex]2[/latex] |

| C/Y | [latex]4[/latex] |

[latex]PMT=\$9,082.24[/latex]

Step 2: Enter the information into the time value of money buttons on the calculator. Make sure that you re-enter the payment rounded to 2 decimal places.

| PMT Setting | END |

| N | [latex]6[/latex] |

| PV | [latex]50,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-9,082.24[/latex] |

| I/Y | [latex]5[/latex] |

| P/Y | [latex]2[/latex] |

| C/Y | [latex]4[/latex] |

Step 3: Complete the amortization schedule using the amortization worksheet on the calculator.

| Payment Number | Payment | Interest Paid (INT) | Principal Paid (PRN) | Balance (BAL) |

| 0 | [latex]\$50,000[/latex] | |||

| 1 | [latex]\$9,082.24[/latex] | [latex]\$1,257.81[/latex] | [latex]\$7,824.43[/latex] | [latex]\$42,175.57[/latex] |

| 2 | [latex]\$9,082.24[/latex] | [latex]\$1,060.98[/latex] | [latex]\$8,021.26[/latex] | [latex]\$34,154.31[/latex] |

| 3 | [latex]\$9,082.24[/latex] | [latex]\$859.19[/latex] | [latex]\$8,223.05[/latex] | [latex]\$25,931.27[/latex] |

| 4 | [latex]\$9,082.24[/latex] | [latex]\$652.33[/latex] | [latex]\$8,429.91[/latex] | [latex]\$17,501.36[/latex] |

| 5 | [latex]\$9,082.24[/latex] | [latex]\$440.27[/latex] | [latex]\$8,641.97[/latex] | [latex]\$8,859.39[/latex] |

| 6 | [latex]\$9,082.26[/latex] | [latex]\$222.87[/latex] | [latex]\$8,859.39[/latex] | [latex]\$0[/latex] |

| Totals | [latex]\$54,493.46[/latex] | [latex]\$4,493.46[/latex] | [latex]\$50,000[/latex] |

- Row 1: In the amortization worksheet, set P1=1 and P2=1.

- Row 2: In the amortization worksheet, set P1=2 and P2=2.

- Row 3: In the amortization worksheet, set P1=3 and P2=3.

- Row 4: In the amortization worksheet, set P1=4 and P2=4.

- Row 5: In the amortization worksheet, set P1=5 and P2=5.

- Row 6:

- The principal paid (PRN) entry is the balance (BAL) entry from row 5.

- Get the interest paid (INT) entry from the calculator by setting P1=6 and P2=6.

- The payment is the sum of the principal paid and interest paid entries:[latex]222.87+8,859.39=9,082.26[/latex].

- Totals Row:

- The principal paid total is the loan amount ($50,000).

- The payments total is the sum of the payments: [latex]5 \times 9,082.24+9,082.26=54,493.46[/latex].

- The interest paid total is the difference in the other two column totals: [latex]54,493.46-50,000=4,493.46[/latex].

TRY IT

A farmer purchased a John Deere combine for $369,930. The equipment dealership sets up a financing plan to allow for end-of-quarter payments of $51,000 at 7.8% compounded monthly. Construct a complete amortization schedule including the totals.

Click to see Solution

| PMT Setting | END |

| N | ? |

| PV | [latex]369,930[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-51,000[/latex] |

| I/Y | [latex]7.8[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]12[/latex] |

[latex]N=7.901...\rightarrow 8 \mbox{ payments}[/latex]

| Payment Number | Payment | Interest Paid (INT) | Principal Paid (PRN) | Balance (BAL) |

| 0 | [latex]\$369,930[/latex] | |||

| 1 | [latex]\$51,000[/latex] | [latex]\$7,260.63[/latex] | [latex]\$43,739.37[/latex] | [latex]\$326,190.63[/latex] |

| 2 | [latex]\$51,000[/latex] | [latex]\$6,402.15[/latex] | [latex]\$44,597.85[/latex] | [latex]\$281,592.78[/latex] |

| 3 | [latex]\$51,000[/latex] | [latex]\$5,526.83[/latex] | [latex]\$45,473.17[/latex] | [latex]\$236,119.61[/latex] |

| 4 | [latex]\$51,000[/latex] | [latex]\$4,634.33[/latex] | [latex]\$46,365.67[/latex] | [latex]\$189,753.93[/latex] |

| 5 | [latex]\$51,000[/latex] | [latex]\$3,724.31[/latex] | [latex]\$47,275.69[/latex] | [latex]\$142,478.24[/latex] |

| 6 | [latex]\$51,000[/latex] | [latex]\$2,796.42[/latex] | [latex]\$48,203.58[/latex] | [latex]\$94,274.66[/latex] |

| 7 | [latex]\$51,000[/latex] | [latex]\$1,850.33[/latex] | [latex]\$49,149.69[/latex] | [latex]\$45,124.99[/latex] |

| 8 | [latex]\$46,010.66[/latex] | [latex]\$885.67[/latex] | [latex]\$45,124.99[/latex] | [latex]\$0[/latex] |

| Totals | [latex]\$403,010.66[/latex] | [latex]\$33,080.66[/latex] | [latex]\$369,930[/latex] |

Partial Amortization Schedules

Sometimes, businesses are interested only in creating partial amortization schedules, which are amortization schedules that show only certain payments or a specified range of payments, and not the entire amortization schedule. This may occur for a variety of reasons. For instance, the complete amortization schedule may be too long (imagine weekly payments on a 25-year loan), or maybe you are solely interested in the principal and interest portions during a specific period of time for accounting and tax purposes.

The TI BAII Plus calculator makes it easy to calculate the entries for a specific row of the schedule by setting P1 and P2 equal to the row number you want to veiw.

EXAMPLE

You borrowed $45,000 to purchase a new car. The loan agreement calls for monthly payments of $900 at 3.5% compounded monthly. Construct a partial amortization schedule showing the details for the first two payments, payment #14, the last two payments, and the totals.

Solution:

Step 1: Calculate the number of payments.

| PMT Setting | END |

| N | ? |

| PV | [latex]45,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-900[/latex] |

| I/Y | [latex]3.5[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

[latex]N=54.122...\rightarrow 55 \mbox{ payments}[/latex]

Step 2: Enter the information into the time value of money buttons on the calculator.

| PMT Setting | END |

| N | [latex]55[/latex] |

| PV | [latex]45,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-900[/latex] |

| I/Y | [latex]3.5[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

Step 3: Complete the partial amortization schedule using the amortization worksheet on the calculator.

| Payment Number | Payment | Interest Paid (INT) | Principal Paid (PRN) | Balance (BAL) |

| 0 | [latex]\$45,000[/latex] | |||

| 1 | [latex]\$900[/latex] | [latex]\$131.25[/latex] | [latex]\$768.75[/latex] | [latex]\$44,231.25[/latex] |

| 2 | [latex]\$900[/latex] | [latex]\$129.01[/latex] | [latex]\$770.99[/latex] | [latex]\$43,460.26[/latex] |

| 14 | [latex]\$900[/latex] | [latex]\$101.59[/latex] | [latex]\$798.41[/latex] | [latex]\$34,031.06[/latex] |

| 54 | [latex]\$900[/latex] | [latex]\$2.94[/latex] | [latex]\$897.06[/latex] | [latex]\$110.51[/latex] |

| 55 | [latex]\$110.83[/latex] | [latex]\$0.32[/latex] | [latex]\$110.51[/latex] | [latex]\$0[/latex] |

| Totals | [latex]\$48,710.83[/latex] | [latex]\$3,710.83[/latex] | [latex]\$45,000[/latex] |

- Row 1: In the amortization worksheet, set P1=1 and P2=1.

- Row 2: In the amortization worksheet, set P1=2 and P2=2.

- Row 14: In the amortization worksheet, set P1=14 and P2=14.

- Row 54: In the amortization worksheet, set P1=54 and P2=54.

- Row 55:

- The principal paid (PRN) entry is the balance (BAL) entry from row 54.

- Get the interest paid (INT) entry from the calculator by setting P1=55 and P2=55.

- The payment is the sum of the principal paid and interest paid entries:[latex]0.32+110.51=110.83[/latex].

- Totals Row:

- The principal paid total is the loan amount ($45,000).

- The payments total is the sum of the payments: [latex]54 \times 900+110.83=48,710.83[/latex].

- The interest paid total is the difference in the other two column totals: [latex]48,710.83-45,000=3,710.83[/latex].

TRY IT

Ron and Natasha had Oasis Leisure and Spa install an in-ground swimming pool for $51,000. The financing plan through the company allows for end-of-month payments for five years at 6.9% compounded quarterly. Construct a partial amortization schedule showing the last two rows and the totals.

Click to see Solution

| PMT Setting | END |

| N | [latex]60[/latex] |

| PV | [latex]51,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | ? |

| I/Y | [latex]6.9[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]4[/latex] |

[latex]PMT=\$1,006.51[/latex]

| Payment Number | Payment | Interest Paid (INT) | Principal Paid (PRN) | Balance (BAL) |

| 59 | [latex]\$1,006.51[/latex] | [latex]\$11.41[/latex] | [latex]\$995.10[/latex] | [latex]\$1,000.98[/latex] |

| 60 | [latex]\$1,006.70[/latex] | [latex]\$129.01[/latex] | [latex]\$1,000.98[/latex] | [latex]\$0[/latex] |

| Totals | [latex]\$60,390.79[/latex] | [latex]\$9,390.79[/latex] | [latex]\$51,000[/latex] |

Exercises

- A $27,000 loan at 6.8% compounded quarterly is repaid with quarterly payments over two years. Construct the amortization schedule for the loan.

Click to see Answer

Payment Number Payment Interest Paid (INT) Principal Paid (PRN) Balance (BAL) 0 [latex]\$27,000[/latex] 1 [latex]\$3,638.26[/latex] [latex]\$459[/latex] [latex]\$3,179.26[/latex] [latex]\$23,820.74[/latex] 2 [latex]\$3,638.26[/latex] [latex]\$404.95[/latex] [latex]\$3,233.31[/latex] [latex]\$20,587.43[/latex] 3 [latex]\$3,638.26[/latex] [latex]\$349.99[/latex] [latex]\$3,288.27[/latex] [latex]\$17,299.16[/latex] 4 [latex]\$3,638.26[/latex] [latex]\$294.09[/latex] [latex]\$3,344.17[/latex] [latex]\$13,954.98[/latex] 5 [latex]\$3,638.26[/latex] [latex]\$237.23[/latex] [latex]\$3,401.03[/latex] [latex]\$10,553.96[/latex] 6 [latex]\$3,638.26[/latex] [latex]\$179.42[/latex] [latex]\$3,458.84[/latex] [latex]\$7,095.12[/latex] 7 [latex]\$3,638.26[/latex] [latex]\$120.62[/latex] [latex]\$3,517.64[/latex] [latex]\$3,577.47[/latex] 8 [latex]\$3,638.29[/latex] [latex]\$60.82[/latex] [latex]\$3,577.47[/latex] [latex]\$0[/latex] Totals [latex]\$29,106.11[/latex] [latex]\$2,106.11[/latex] [latex]\$27,000[/latex] - A $192,000 loan at 4.75% compounded semi-annually is repaid with semi-annual payments of $26,640. Construct the amortization schedule for the loan.

Click to see Answer

Payment Number Payment Interest Paid (INT) Principal Paid (PRN) Balance (BAL) 0 [latex]\$192,000[/latex] 1 [latex]\$26,640[/latex] [latex]\$4,560[/latex] [latex]\$22,080[/latex] [latex]\$169,920[/latex] 2 [latex]\$26,640[/latex] [latex]\$4,035.60[/latex] [latex]\$22,604.40[/latex] [latex]\$147,315.60[/latex] 3 [latex]\$26,640[/latex] [latex]\$3,498.75[/latex] [latex]\$23,141.25[/latex] [latex]\$124,174.35[/latex] 4 [latex]\$26,640[/latex] [latex]\$2,949.14[/latex] [latex]\$23,690.86[/latex] [latex]\$100,483.49[/latex] 5 [latex]\$26,640[/latex] [latex]\$2,386.48[/latex] [latex]\$24,253.52[/latex] [latex]\$76,229.97[/latex] 6 [latex]\$26,640[/latex] [latex]\$1,810.46[/latex] [latex]\$24,829.54[/latex] [latex]\$51,400.43[/latex] 7 [latex]\$26,640[/latex] [latex]\$1,220.76[/latex] [latex]\$25,419.24[/latex] [latex]\$25,981.19[/latex] 8 [latex]\$26,598.24[/latex] [latex]\$617.05[/latex] [latex]\$25,981.19[/latex] [latex]\$0[/latex] Totals [latex]\$239,718.24[/latex] [latex]\$47,718.24[/latex] [latex]\$192,000[/latex] - A $450,000 loan at 7.3% compounded semi-annually is repaid with monthly payments for 25 years. Construct a partial amortization schedule showing the details of payment 100, the last three payments and the totals.

Click to see Answer

Payment Number Payment Interest Paid (INT) Principal Paid (PRN) Balance (BAL) 100 [latex]\$3,235.66[/latex] [latex]\$2,262.04[/latex] [latex]\$973.62[/latex] [latex]\$376,483.42[/latex] 298 [latex]\$3,235.66[/latex] [latex]\$57.48[/latex] [latex]\$3,178.18[/latex] [latex]\$6,412.91[/latex] 299 [latex]\$3,235.66[/latex] [latex]\$38.43[/latex] [latex]\$3,197.23[/latex] [latex]\$3,215.68[/latex] 300 [latex]\$3,234.95[/latex] [latex]\$19.27[/latex] [latex]\$3,215.68[/latex] [latex]\$0[/latex] Totals [latex]\$970.697.29[/latex] [latex]\$520,697.29[/latex] [latex]\$450,000[/latex] - Jennifer purchased a new $60,000 car for $5,000 down and monthly payments of $750 at 11.2% compounded monthly. Construct a partial amortization schedule showing the details of payment 30, the last two payments and the totals.

Click to see Answer

Payment Number Payment Interest Paid (INT) Principal Paid (PRN) Balance (BAL) 30 [latex]\$750[/latex] [latex]\$440.16[/latex] [latex]\$309.84[/latex] [latex]\$46,849.89[/latex] 124 [latex]\$750[/latex] [latex]\$8.02[/latex] [latex]\$741.98[/latex] [latex]\$116.81[/latex] 125 [latex]\$117.90[/latex] [latex]\$1.09[/latex] [latex]\$116.81[/latex] [latex]\$0[/latex] Totals [latex]\$93,117.90[/latex] [latex]\$38,117.90[/latex] [latex]\$55,000[/latex] - To purchase a piece of land, Hillary took out a $118,000 loan at 7.95% compounded semi-annually. The loan agreement required her to make quarterly payments for 15 years. Construct a partial amortization schedule showing the details of the first two payments, payment 28, the last two payments and the totals.

Click to see Answer

Payment Number Payment Interest Paid (INT) Principal Paid (PRN) Balance (BAL) 0 [latex]\$118,000[/latex] 1 [latex]\$3,368.48[/latex] [latex]\$2,322.40[/latex] [latex]\$1,046.08[/latex] [latex]\$116,953.92[/latex] 2 [latex]\$3,368.48[/latex] [latex]\$2,301.81[/latex] [latex]\$1,066.67[/latex] [latex]\$115,887.24[/latex] 28 [latex]\$3,368.48[/latex] [latex]\$1,597.93[/latex] [latex]\$1,770.55[/latex] [latex]\$79,419.86[/latex] 59 [latex]\$3,368.48[/latex] [latex]\$128.78[/latex] [latex]\$3,239.70[/latex] [latex]\$3,303.30[/latex] 60 [latex]\$3,368.31[/latex] [latex]\$65.01[/latex] [latex]\$3,303.30[/latex] [latex]\$0[/latex] Totals [latex]\$202,108.63[/latex] [latex]\$84,108.63[/latex] [latex]\$118,000[/latex]

Attribution

“13.1: Calculating Interest and Principal Components” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“13.1: Calculating Interest and Principal Components” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.

“13.3: Amortization Schedules” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“13.3: Amortization Schedules” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.