5.10 Chapter Summary

Key Concepts

- 5.1 Fundamentals of Annuities

- Understanding what an annuity is.

- The fours different types of annuities.

- 5.2 Future Value of Annuities

- The future value of ordinary annuities.

- The future value of annuities due.

- Variable changes in future value annuity calculations.

- 5.3 Present Value of Annuities

- The present value of ordinary annuities.

- The present value of annuities due.

- Variable changes in present value annuity calculations.

- 5.4 Calculating the Payment

- Calculating the annuity payment amount for both ordinary annuities and annuities due.

- 5.5 Calculating the Term of an Annuity

- Calculating the number of annuity payments for both ordinary annuities and annuities due.

- Calculating the term of an annuity for both ordinary annuities and annuities due.

- 5.6 Calculating the Interest Rate of an Annuity

- Calculating the interest rate for both ordinary annuities and annuities due.

- 5.7 Deferred Annuities

- The stages of deferred annuities.

- The four common unknown variables and how to solve for them.

- 5.8 Perpetuities

- An explanation of perpetuities.

- Ordinary perpetuities and perpetuities due.

- How to solve perpetuity scenarios.

Glossary of Terms

- Annuity. A continuous stream of equal periodic payments from one party to another for a specified period of time to fulfill a financial obligation.

- Annuity Due. Annuity payments that are each made at the beginning of a payment interval.

- Annuity Payment. The dollar amount of the equal periodic payment in an annuity environment.

- Deferred Annuity. A financial transaction where annuity payments are delayed until a certain period of time has elapsed.

- Down Payment. A portion of the purchase price required up front.

- Future Value of an Annuity. The sum of all the future values for all of the annuity payments when they are moved to the end of the last payment interval.

- General Annuity. An annuity in which the payment frequency and compounding frequency are unequal.

- General Annuity Due. An annuity where payments are made at the beginning of the payment intervals and the payment and compounding frequencies are unequal. The first payment occurs on the same date as the beginning of the annuity, while the end of the annuity is one payment interval after the last payment.

- Ordinary Annuity. Annuity payments that are each made at the end of a payment interval. This is the most common form of an annuity payment.

- Ordinary General Annuity. An annuity where payments are made at the end of the payment intervals and the payment and compounding frequencies are unequal. The first payment occurs one interval after the beginning of the annuity, while the last payment is on the same date as the end of the annuity.

- Ordinary Simple Annuity. An annuity where payments are made at the end of the payment intervals and the payment and compounding frequencies are equal. The first payment occurs one interval after the beginning of the annuity while the last payment is on the same date as the end of the annuity.

- Payment Frequency. The number of annuity payments in a complete year.

- Payment Interval. The amount of time between each continuous and equal annuity payment.

- Period of Deferral. The time segment of a deferred annuity where the single payment earns interest and no contributions are made to the investment.

- Perpetuity. A special type of annuity that has fixed, regular payments continuing indefinitely.

- Present Value of an Annuity. The sum of all the present values for all of the annuity payments when they are moved to the beginning of the first payment interval.

- Simple Annuity. An annuity in which the payment frequency and compounding frequency are equal.

- Simple Annuity Due. An annuity where payments are made at the beginning of the payment intervals and the payment and compounding frequencies are equal. The first payment occurs on the same date as the beginning of the annuity, while the end of the annuity is one payment interval after the last payment.

Formulas

-

Symbols Used

- [latex]FV[/latex] = Future value or maturity value

- [latex]PV[/latex] = Present value of principal

- [latex]PMT[/latex] = Annuity payment amount

- [latex]I/Y[/latex] = Nominal interest rate

- [latex]P/Y[/latex] = Number of payments per year or payment frequency

- [latex]C/Y[/latex] = Number of compounds per year or compounding frequency

- [latex]N[/latex] = Total number of annuity payments

-

Formulas Used

- Total Number of Payments: [latex]n=P/Y \times \mbox{time in years}[/latex]

- Future Value of Ordinary Annuity: [latex]FV=PMT \times \left[\frac{(1+i_2)^n-1}{i_2}\right][/latex]

- Future Value of Annuity Due: [latex]FV=PMT \times (1+i_2) \times \left[\frac{(1+i_2)^n-1}{i_2}\right][/latex]

- Present Value of Ordinary Annuity: [latex]PV=PMT \times \left[\frac{1-(1+i_2)^{-n}}{i_2}\right][/latex]

- Present Value of Annuity Due: [latex]PV=PMT \times (1+i_2) \times \left[\frac{1-(1+i_2)^{-n}}{i_2}\right][/latex]

- Present Value of Ordinary Perpetuity: [latex]PV=\frac{PMT}{i_2}[/latex]

- Present Value of Perpetuity Due: [latex]PV=(1+i_2) \times \frac{PMT}{i_2}[/latex]

Calculator

-

Time Value of Money Functions

- The time value of money buttons are the five buttons located on the third row of your calculator.

Calculator Symbol Characteristic Data Entry Requirements N The number of payment periods An integer or decimal number; no negatives I/Y The nominal interest rate per year Percent format without the % sign (i.e., 7% is just 7) PV Present value or principal An integer or decimal number PMT Annuity payment amounts An integer or decimal number FV Future value or maturity value An integer or decimal number To enter any information into any one of these buttons or variables, called loading the calculator, key in the information first and then press the appropriate button.

- The frequency function is logically placed above the I/Y button and is labeled P/Y. This function addresses payment frequencies and compound interest frequencies. Access the function by pressing 2nd P/Y to find the following entry fields, through which you can scroll using your arrow buttons.

Calculator Symbol Characteristic Data Entry Requirements P/Y Annuity payments per year (payment frequency) A positive, nonzero number only C/Y Compounds per year (compounding frequency) A positive, nonzero number only To enter any information into one of these fields, scroll to the field on your screen, key in the data, and press ENTER. When you enter a value into the P/Y field, the calculator will automatically copy the value into the C/Y field for you. If in fact the C/Y is different, you can change the number manually. To exit the P/Y window, press 2nd QUIT.

- To keying in a question, you must load the calculator with six of the seven variables. To solve for the missing variable, press CPT followed by the variable.

- The cash flow sign convention is used for the PV, PMT, and FV buttons. If money leaves you, you must enter it as a negative. If money comes at you, you must enter it as a positive.

- The time value of money buttons are the five buttons located on the third row of your calculator.

-

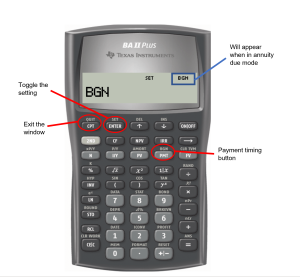

Payment Setting

- The calculator default is for END mode, which is the ordinary annuity.

- The annuity type (payment timing) setting can be found on the second shelf above the PMT key. This function works as a toggle.

- To toggle the setting, complete the following sequence:

- Press 2nd BGN (the payment button).

- Press 2nd SET (the ENTER button) to switch payment settings.

- Press 2nd QUIT (the CPT button) to exit the payment setting menu.

- When the calculator is in annuity due mode, a tiny BGN is displayed in the upper right of your calculator.

Figure 5.10.1

Ordinary Annuity Calculations (PV, PMT, FV) by Joshua Emmanuel [4:31] (transcript available).

Annuity Due Calculations Using the BAII Plus by Joshua Emmanuel [2:51] (transcript available).

Annuity Due Calculations Using BAII Plus-Part 2 by Joshua Emmanuel [2:05] (transcript available).

Attribution

“Chapter 11: Glossary of Terms” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“Chapter 11: Key Concepts Summary” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“Chapter 11: Symbols and Formulas Introduced” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“Chapter 11: Technology Introduced” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“Chapter 12: Glossary of Terms” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“Chapter 12: Key Concepts Summary” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“Chapter 12: Symbols and Formulas Introduced” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“Chapter 12: Technology Introduced” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“Chapter 11 & 12 Summary” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.