8.1 Net Present Value

LEARNING OBJECTIVES

- Calculate the net present value of an investment.

- Evaluate and compare investment decisions using the net present value.

If you decide to pursue a course of action, what is the net benefit or cost of making that decision? How can you tell systematically which choice is financially superior?

Suppose that your marketing department thinks it has stumbled onto the next hot product to hit the market. The estimated research and development costs are $10 million today with an expected $5 million revitalization cost in five years. The product hits shelves in two years. Estimated year-end profits are $4 million in the first three years and $3 million for the subsequent two years. At that time, the rapid pace of technology will end the life cycle of the new product. This last year will earn an estimated $1 million in profits. The funds needed for this project will be obtained at 12% compounded annually. Does this project make financial sense? Your co-worker argues that the decision is clear: You would spend $15 million to earn $19 million, so the project should go forward. What do you think?

Your co-worker’s analysis summed the nominal numbers. This clearly violates the fundamental concept of time value of money—for example, you know that the projected profit of $1 million in the last year of the product is not worth $1 million today. To get an accurate picture of the potential benefit of this product, we need a technique that takes into account the time value of money.

What Is Involved in Making Monetary Business Decisions?

Investment decisions must consider both the type of decision being made along with the source of funding, which influences the interest rate used in financial calculations.

What type of decision is begin made?

Although there is no such thing as a “standard” or “normal” decision, many business decisions seem to fall into the same three categories.

- Making One Choice from Multiple Options. When you face a variety of options that will solve your problem, which option is financially the best?

- Deciding Whether to Pursue One Course of Action. When you face only one particular course of action, do you do it or not?

- Making Multiple Choices under Constraints. If you have limited resources and many different opportunities from which you can choose more than one, how do you select which opportunities to pursue and which to let pass by?

What monetary source is being used and what does it cost?

The structure of many decisions follows the old adage that you have to spend money to make money. Many courses of action require an investment up front (costs) to receive the reward (profits) in the future. This means you need to tap a source of money before you can go forward with any course of action. Individuals and corporations can access many of the same monetary sources, but businesses have additional options that are not available to individuals.

- Personal Funding Sources. You have limited options for obtaining money. Typically, you can either use debt financing such as a loan from a bank or a line of credit, or you can withdraw money from an investment fund or savings account.

- If you borrow, the financial cost of the project is the interest rate that is being charged on the borrowed funds. For example, if you fund the project using a loan at 8.5% compounded annually, the loan’s interest rate becomes the nominal rate you should use in the required time value of money calculations.

- If you withdraw money from an investment, the cost of this project is the interest rate you forego on those funds. For example, if you take the money out of a GIC earning 4% compounded annually, you should use the GIC’s interest rate in the decision calculations.

- Business Funding Sources. Businesses have substantially more choices than individuals when obtaining financing. In addition to debt financing and current investments, businesses also can issue bonds or use equity financing, such as offering company shares. Bartering with business partners is also possible. The same principle applies, though: whatever interest rate the funding source involves carries forward into any decision-making calculations.

Rate of return and cost of capital

The rate of return is the required rate of return that a business expects to receive from investing in the project. That is, the rate of return is what the business would earn by investing the same amount into a similar investment with the same risk. The rate of return is also know as the cost of capital, which is the cost of investing. Unless otherwise specified, the cost of capital is an interest rate that compounds annually.

As mentioned above, if the business does not have the funds on hand to invest in the project, some alternative funding source is required to carry out the project. In these cases the source of funding you use determines the cost of capital or interest rate in these calculations. If you use multiple sources to gather the needed funds, your interest rate is a weighted average of all the debt and equity financing rates. If you use a single source then the weighted average is simply the one source’s rate. This weighted interest rate is the cost of capital.

Cash Flows

A cash flow is a movement of money into or out of a particular project. Therefore, any time you incur a cost or receive a benefit on a particular project, you have a cash flow.

- When money is received, such as revenue or profit, you have a cash in-flow. Cash in-flows are recorded as positive.

- When money is paid out, such as an expense or a cost, you have a cash out-flow. Cash out-flows are recorded as negative.

As you work with these continuous cash flows, where to put an amount on the timeline depends on whether it is a cost or a benefit.

- Costs. Unless otherwise noted, capital costs are spent at the beginning of any time segment. Thus, if there are capital costs in year two, you can assume you incur them at the beginning of year two, which is the same as the end of year one.

- Benefits. Revenues, net profits (product sales minus product costs), or other benefits are realized at the end of any time segment. Thus, if there are net profits in year two, you can assume you realize them at the end of year two.

Net Present Value

The net present value ([latex]NPV[/latex]) method calculates the difference between all benefits and costs for any given project in today’s dollars. This decision-making technique calculates the value of all future cash in-flows and cash out-flows brought back to today (which serves as the focal date), using the rate of return or cost of capital as the interest rate. The word net means that the technique considers the invested money, all costs or expenses, along with all rewards such as profits in its calculations.

[latex]\displaystyle{NPV=\mbox{Sum of the }PV\mbox{ of Future Cash Flow}-\mbox{Initial Investment}}[/latex]

To calculate the sum of the present value of the future cash flows:

- Using today, or year 0, as the focal date, find the present value of all future cash flows, inflows and outflows, where the interest rate is the cost of capital.

- Add up the present values of the cash inflows and subtract the present values of the cash outflows.

The initial investment is money spent today, and so is already at the focal date. Because most projects require advance funding, this amount represents a cash outflow today, against which you must net the present value of all future cash flows.

An alternative way to think of the net present value is that [latex]NPV[/latex] is the sum of the present value of the cash inflows minus the sum of the present value of the cash outflows. Because the initial investment is a cash outflow, the initial investment is included in the second sum. As above, today is used as the focal date and the present value of each cash flow is found at the focal date.

[latex]\displaystyle{NPV=\mbox{Sum of the } PV \mbox{ of Cash Inflows}-\mbox{Sum of the }PV \mbox{ of Cash Outflows}}[/latex]

The net present value nets out all costs and benefits. Here is how to interpret the [latex]NPV[/latex]:

- [latex]NPV=0.[/latex]The project repays the amounts of its investments plus the required cost of capital. In other words, the project breaks even. The business should accept the project.

- [latex]NPV>0.[/latex] The project provides returns that exceed its investments and the cost of capital. The project makes financial sense because it will add value to the company. The business should accept the project.

- [latex]NPV<0.[/latex] The project does not provide enough return to pay for its investments and the cost of capital. The project does not make financial sense because it will lose money for the business. The business should reject the project.

Of course, businesses often have many nonfinancial reasons for pursuing or not pursuing certain courses of action. These reasons are beyond the scope of this textbook.

Observe how [latex]NPV[/latex] relates to each of the three common types of business decision categories.

- Making One Choice from Multiple Options. You should choose the project with the highest NPV.

- Choosing Whether to Pursue One Course of Action. You should pursue the project if the NPV is greater than or equal to $0.

- Making Multiple Choices under Constraints. You should choose the projects that maximize the total [latex]NPV[/latex].

EXAMPLE

A local business is considering purchasing a new machine. The machine costs $80,000. The machine will reduce costs by $25,000 in year 1, $17,000 in year 2 and $10,000 in year 3. At the end of year 3, the business can sell the machine for $20,000. The business’s cost of capital is 8%.

- Calculate the net present value for the machine.

- Should the business purchase the machine?

Solution:

Step 1: Record the cash flows in a table. Calculate the net cash flow for each year.

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| 0 | 0 | -80,000 | -80,000 |

| 1 | 25,000 | 0 | 25,000 |

| 2 | 17,000 | 0 | 17,000 |

| 3 | 10,000 20,000 |

0 | 30,000 |

Step 2: Calculate the [latex]PV[/latex] for each future net cash flow.

| Year 1 | Year 2 | Year 3 | |

| N | 1 | 2 | 3 |

| PV | 23,148.15 | 14,574.76 | 23,814.97 |

| FV | -25,000 | -17,000 | -30,000 |

| PMT | 0 | 0 | 0 |

| I/Y | 8 | 8 | 8 |

| P/Y | 1 | 1 | 1 |

| C/Y | 1 | 1 | 1 |

Step 3: Calculate the [latex]NPV[/latex].

[latex]\begin{eqnarray*} NPV & = & \mbox{Sum of the } PV \mbox{ of future cash flows}-\mbox{Initial Investment} \\ & = & 23,148.15+14,574.76+23,814.97-80,000 \\ & = & -\$18,462.12 \end{eqnarray*}[/latex]

The [latex]NPV[/latex] for the machine is -$18,462.12.

Because the [latex]NPV<0[/latex], the business should not purchase the machine.

NOTES

- Create a table to record the cash flows for each time period. The table should record the cash inflows, the cash outflows, and the net cash flow for each time period. Alternatively, use a timeline to illustrate the cash flows for each time period.

- Because cash flows can be inflows or outflows, write all numbers with their cash flow sign conventions in the table to avoid any confusion. That is, cash inflows are recorded as positive and cash outflows are recorded as negative. This helps you keep track of the different flows and minimizes the possibility of incorrectly netting out all present values.

Although the net present value can be found by finding the present value of all the future cash flows, as illustrated in the above example, this can be a cumbersome calculation when there are numerous cash flows over an extended period of time, even with the aid of a financial calculator. Most financial calculators include a cash flow worksheet and a built-in function to calculate the net present value.

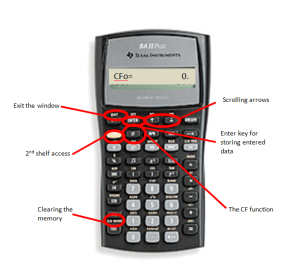

USING THE TI BAII PLUS CASH FLOW WORKSHEET TO CALCULATE NET PRESENT VALUE

The photo illustrates the buttons used in the cash flow function of your BAII Plus calculator. Access the cash flow function by pressing the CF button on the keypad. Immediately clear the memory using 2nd CLR WORK to delete any previously entered data. Use the up arrow and down arrow to scroll through the various lines. You must strictly obey the cash flow sign convention and press ENTER after keying in any data.

Here are the various lines appearing in the cash flow function:

- CFo = any cash flow today (i.e. the initial investment).

- CXX = a particular cash flow, where XX is the cash flow number starting with 01. You must key in the cash flows in order from the first time segment to the last. You cannot skip a time segment even if it has a value of zero. Each time segment is a placeholder on the timeline.

- FXX = the frequency of a particular cash flow, where XX is the cash flow number. It is how many times in a row the corresponding cash flow amount occurs. This allows you to enter recurring amounts instead of keying them in separately. By default, the calculator sets this variable to 1.

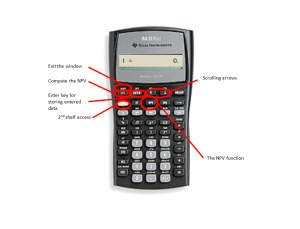

Once you have entered all cash flows, you must access other functions to generate the output. For net present value, press NPV on the keypad as illustrated in the photo.

In the NPV menu:

- I = the matching periodic interest rate for the interval of each time segment. If the timeline is drawn with yearly intervals, then this must be the annual cost of capital. If the timeline is drawn with semi-annual intervals, this needs to be the matching semi-annual periodic cost of capital.

- NPV = net present value. Press CPT to calculate this amount. The output nets all future cash flows against any initial investment.

Cash Flows 1: Net Present Value (NPV) and IRR Calculations by Joshua Emmanuel [2:52] (transcript available).

NOTES

- For each period, only one cash flow can be entered in the financial calculator. If more than one cash flow exists for a certain period, enter the NET cash flow for that period. The net cash flow for a period is the sum of the cash inflows minus the sum of the cash outflows.

- When using the cash flow worksheet on a financial calculator, you must enter a cash flow for EVERY period. If there is no cash flow for a certain period, a 0 is recorded as the net cash flow for that period. Enter 0 for C0 on the calculator for that period and 1 for F0.

EXAMPLE

A local business is considering purchasing a new machine. The machine costs $80,000. The machine will reduce costs by $25,000 in year 1, $17,000 in year 2 and $10,000 in year 3. At the end of year 3, the business can sell the machine for $20,000. The business’s cost of capital is 8%.

Find the net present value.

Solution:

Step 1: Record the cash flows in a table. Calculate the net cash flow for each year.

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| 0 | 0 | -80,000 | -80,000 |

| 1 | 25,000 | 0 | 25,000 |

| 2 | 17,000 | 0 | 17,000 |

| 3 | 10,000 20,000 |

0 | 30,000 |

Step 2: Enter the net cash flow data into the cash flow worksheet on the financial calculator.

- Press CF.

- Press 2nd CLR WORK. (This step clears any previously recorded data from the CF worksheet.)

- At the CFo screen, enter -80,000 and press ENTER. (This step enters the -80,000 net cash flow for year 0.)

- Press the down arrow.

- At the C01 screen, enter 25,000 and press ENTER. (This step enters the 25,000 net cash flow for year 1.)

- Press the down arrow.

- At the F01 screen, enter 1 and press ENTER. (This records the frequency of the 25,000 net cash flow from year 1.)

- Press the down arrow.

- At the C02 screen, enter 17,000 and press ENTER. (This step enters the 17,000 net cash flow for year 2.)

- Press the down arrow.

- At the F02 screen, enter 1 and press ENTER. (This records the frequency of the 17,000 net cash flow from year 2.)

- Press the down arrow.

- At the C03 screen, enter 30,000 and press ENTER. (This step enters the 30,000 net cash flow for year 3.)

- Press the down arrow.

- At the F03 screen, enter 1 and press ENTER. (This records the frequency of the 30,000 net cash flow from year 3.)

- Press 2nd QUIT. (This step exits the CF worksheet.)

Step 3: Calculate the NPV on the financial calculator.

| I | 8 |

| NPV | -$18,462.12 |

- Press NPV.

- At the I screen, enter 8 and press ENTER. (This step enters the 8% cost of capital.)

- Press the down arrow.

- At the NPV screen, press CPT.

TRY IT

A company wants to develop an app for its business over the course of five years. The development requires an investment of $900,000 today and another investment of $200,000 one year from now. Starting in year three, the company forecasts that the app will generate profits of $150,000 every year for three years. At the end of the fifth year, the company plans to sell the app to a competitor for $1,250,000. The company’s cost of capital is 7%.

- Calculate the NPV for this project.

- Is this a sound investment decision?

Click to see Solution

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| 0 | 0 | -900,000 | -900,000 |

| 1 | 0 | -200,000 | -200,000 |

| 2 | 0 | 0 | 0 |

| 3 | 150,000 | 0 | 150,000 |

| 4 | 150,000 | 0 | 150,000 |

| 5 | 150,000 1,250,000 |

0 | 1,400,000 |

| I | 7 |

| NPV | $148,143.73 |

Because the NPV=$148,143.73>0, this is a sound investment decision.

EXAMPLE

Lethbridge Community College is considering purchasing new industrial photocopier equipment. The college has narrowed down the choices to two comparable machines from Xerox and Canon.

- The Xerox machine can be aquired for $81,900 today and is expected to have a life span of four years. The machine is expected to reduce labour and materials costs by $31,000 each year. A $10,000 maintenance package is expected to be purchased at the end of year two. After the four years, the machine can be sold for $16,000.

- The Canon machine retails for $74,800 and is expected to have a life span of four years. The machine is forecasted to save $26,000 in labour and materials each year. A $4,000 maintenance procedure is needed at the end of both years two and three. The salvage value of the machine is estimated at $11,750.

The cost of capital is 11%. Which machine should be purchased, and how much money will it save over the alternative?

Solution:

Step 1: Calculate the [latex]NPV[/latex] for the Xerox machine.

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| 0 | 0 | -81,900 | -81,900 |

| 1 | 31,000 | 0 | 31,000 |

| 2 | 31,000 | -10,000 | 21,000 |

| 3 | 31,000 | 0 | 31,000 |

| 4 | 31,000 16,000 |

0 | 47,000 |

| I | 11 |

| NPV | $16,699.29 |

Step 2: Calculate the [latex]NPV[/latex] for the Canon machine.

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| 0 | 0 | -74,800 | -74,800 |

| 1 | 26,000 | 0 | 26,000 |

| 2 | 26,000 | -4,000 | 22,000 |

| 3 | 26,000 | -4,000 | 22,000 |

| 4 | 26,000 11,750 |

0 | 37,750 |

| I | 11 |

| NPV | $7,432.42 |

The college should pick the Xerox machine because it has the higher [latex]NPV[/latex]. By choosing the Xerox machine, the college will save $16,699.29-7,432.42=$9,266.87

TRY IT

The operations team at an engineering firm is considering investing in two different projects, but they only have the funds to invest in one project.

- Project 1 requires an initial investment of $650,000 and another investment of $250,000 at the end of year 2. The project will generate annual profits of $200,000 starting in year 2 until the end of the project in year 5. At the end of the project, the firm can sell the project for $500,000.

- Project 2 requires an initial investment of $800,000 and another investment of $200,000 at the end of year 3. The project will generate annual profits of $150,000 starting in year 1 until the end of the project in year 5. At the end of the project, the firm can sell the project for $600,000.

The firm’s cost of capital is 9%. Which project should the firm pick?

Click to see Solution

Project 1:

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| 0 | 0 | -650,000 | -650,000 |

| 1 | 0 | 0 | 0 |

| 2 | 200,000 | -250,000 | -50,000 |

| 3 | 200,000 | 0 | 200,000 |

| 4 | 200,000 | 0 | 200,000 |

| 5 | 200,000 500,000 |

0 | 700,000 |

| I | 9 |

| NPV | $58,989.71 |

Project 2:

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| 0 | 0 | -800,000 | -800,000 |

| 1 | 150,000 | 0 | 150,000 |

| 2 | 150,000 | 0 | 150,000 |

| 3 | 150,000 | -200,000 | -50,000 |

| 4 | 150,000 | 0 | 150,000 |

| 5 | 150,000 600000 |

0 | 750,000 |

| I | 9 |

| NPV | $18,969.83 |

The firm should select Project 1 because it has the higher NPV.

Exercises

- A new diamond deposit has been found in northern Alberta. Your researchers have determined that it will cost $2.5 million to purchase the land and prepare it for mining. At the end of both the first and second years, another $1 million investment will be required to establish the mining operations. Starting at the end of the second year, the deposit is expected to earn net profits of $3 million, which will be sustained for three years before the deposit is depleted. If the cost of capital is 16%, should your company pursue this venture? Provide calculations to support your decision.

Click to see Answer

NPV=$1,703,103.15; pursue project

- A company can pursue only one of two available projects, both of which require a $3 million investment today. In project A, another investment of $2 million is required at the end of the first year, and three years of $2.5 million in year-end profits will start in the second year. In project B, another investment of $2 million is required at the end of the third year, and four years of $1.7 million in year-end profits will start in the first year. If the cost of capital is 12%, which project should be chosen? How much better is your chosen alternative?

Click to see Answer

NPV of Project A=$575,516.22; NPV of Project B=$739,933.36; Project B

- A new marketing project requires initial research and development costs of $550,000 today with further investments of $100,000 and $75,000 in the third and fifth year, respectively. Initially the project will lose $50,000 in its first year and then earn profits of $200,000 for the next four years followed by profits of $140,000 in the last two years. At the end of the project, its capital goods can be sold for an estimated $50,000. If the cost of capital is 13%, should the marketing project be pursued? Show calculations to support your recommendation.

Click to see Answer

NPV=-$29,798.58; do not pursue project

- One of your company’s clients has proposed a contract offering an estimated $150,000 in net profits for the next six years; however, your company would be required to invest $585,000 today to acquire the needed resources for the project. Determine whether the project should be accepted if the cost of capital is

- 10%

- 13%

- 16%

Click to see Answer

a. NPV=$68,289.10; accept project b. NPV=$14,632.47; accept project c. NPV=-$32,289.61; do not accept project.

- To replace an aging production machine, Johnston Distributors is considering the purchase of a new robotic machine for $950,000. The machine is expected to have a service life of eight years and an estimated residual value of $75,000. In each of the first four years, the machine is expected to produce production efficiencies and labour savings of $250,000. In the last four years, the annual savings are expected to rise to $300,000. Hydro costs for the machine are estimated at $25,000 starting at the end of the first year and increasing by 5% each year thereafter. Maintenance costs are estimated at the end of the second, fourth, and sixth years in the amounts of $40,000, $60,000, and $80,000, respectively. If the cost of capital is 16%, determine if the new robotic machine should be purchased. Provide calculations to support your answer.

Click to see Answer

NPV=$15,496.12; purchase machine

Attribution

“15.1: Net Present Value” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.