5.6 Calculating the Interest Rate for an Annuity

LEARNING OBJECTIVES

- Calculate the interest rate for an annuity.

You must calculate the interest rate on an annuity in a variety of situations:

- To determine the interest rate being charged on any debt.

- To determine the interest rate that an investment is earning.

- To calculate the required interest rate for savings to reach a goal within a certain time period.

- To calculate the required interest rate needed for a series of payments to be sustained over a certain time period.

Using a Financial Calculator

In the future value and present value formulas for annuities, there is no way to algebraic isolate the periodic interest rate. Consequently, calculating the interest rate for an annuity cannot be found by using the formulas. However, a financial calculator can quickly find the required interest rate. You use the financial calculator in the same way as described previously, but the only difference is that the unknown quantity is I/Y (the nominal interest rate). You must still load the other six variables into the calculator, set the calculator to the correct payment setting, and apply the cash flow sign conventions carefully.

USING THE TI BAII PLUS CALCULATOR TO FIND THE INTEREST RATE FOR ANNUITIES

- Set the calculator to the correct payment setting (END or BGN).

- Enter values for the known variables (PV, FV, N, PMT, P/Y and C/Y), paying close attention to the cash flow sign convention for PV, PMT, and FV.

- After all of the known quantities are loaded into the calculator, press CPT and then I/Y to solve for the interest rate.

NOTES

- Ensure that the calculator is set to the required payment setting. The interest rate will be different for END and BGN.

- Because the calculator is using a trial-and-error technique to calculate the interest rate, it may take your calculator a few seconds to compute the answer. If your screen goes blank and your calculator hesitates, this is normal.

- The values you enter for PV, FV, and PMT must adhere to the cash flow sign convention.

EXAMPLE

Smartchoice, a rent-to-own store, offers a Dell 10″ Mini Inspiron Netbook for a cash n’ carry price of $399. Alternatively, under its rent-to-own plan you could make $59.88 monthly payments in advance and own the laptop after one year. What effective interest rate is being charged on the rent-to-own plan?

Solution:

The timeline for the annuity appears below.

| PMT Setting | BGN |

| N | [latex]12 \times 1=12[/latex] |

| PV | [latex]399[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-59.88[/latex] |

| I/Y | ? |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

[latex]I/Y=337.98\%[/latex]

The effective interest rate being charged under the rent-to-own payment plan is 337.9759%.

EXAMPLE

Cubonic Industries deposits $30,000 at the end of every quarter to save up $550,000 for a capital project in four years. To achieve its goal, what nominal interest rate compounded quarterly does Cubonic Industries require on its investment?

Solution:

| PMT Setting | END |

| N | [latex]4 \times 4=16[/latex] |

| PV | [latex]0[/latex] |

| FV | [latex]550,000[/latex] |

| PMT | [latex]-30,000[/latex] |

| I/Y | ? |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]4[/latex] |

[latex]I/Y=7.15\%[/latex]

For Cubonic Industries to achieve its savings goal, the savings annuity must earn 7.15% compounded quarterly.

TRY IT

Francisco just changed occupations. Unfortunately, he is not able to transfer his company pension with him to his new company. The administrators of the pension plan offer him the choice of a lump-sum payout of $103,075 today or beginning-of-month payments of $535 for the next 25 years. What semi-annually compounded rate of return are the pension administrators using in their calculations?

Click to see Solution

| PMT Setting | BGN |

| N | [latex]12 \times 25=300[/latex] |

| PV | [latex]103,075[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-535[/latex] |

| I/Y | ? |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]2[/latex] |

[latex]I/Y=3.90\%[/latex]

EXAMPLE

Amadeus has already saved $5,000 in his RRSP today. Suppose he continues to make $250 contributions at the beginning of each month for the next 14 years. For him to achieve his goal of having $100,000, what effective rate of return must his investment earn?

Solution:

The timeline for RRSP contributions appears below.

| PMT Setting | BGN |

| N | [latex]12 \times 14=168[/latex] |

| PV | [latex]-5,000[/latex] |

| FV | [latex]100,000[/latex] |

| PMT | [latex]-250[/latex] |

| I/Y | ? |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

[latex]I/Y=9.17\%[/latex]

The nominal rate of interest that Amadeus must earn on his investment is 9.17% effective.

EXAMPLE

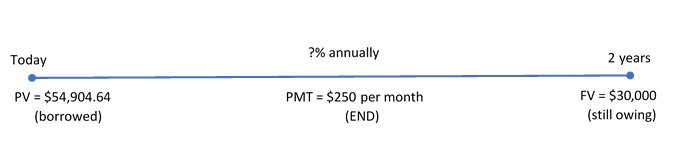

Gemma is looking to purchase a new Nissan Pathfinder for $54,904.64 including all fees and sales taxes. She can afford to pay no more than $1,500 at the end of every month, and she wants to have the balance owing reduced to $30,000 after two years, when she can pay off the vehicle with her trust fund. What is the maximum effective rate of interest she could be charged on the car loan to meet her goals?

Solution:

The timeline for the car loan appears below.

| PMT Setting | END |

| N | [latex]12 \times 2=24[/latex] |

| PV | [latex]54,904.64[/latex] |

| FV | [latex]-30,000[/latex] |

| PMT | [latex]-1,500[/latex] |

| I/Y | ? |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

[latex]I/Y=13.53\%[/latex]

Gemma will be able to purchase the car if she can obtain a car loan that has an effective interest rate lower than 13.53%.

TRY IT

An investment today requires $1,125.51 to purchase. In return, the investment pays out $30 after every six months for the next 20 years, along with an additional final lump-sum payout of $1,000. What semi-annually compounded interest rate is being earned on the investment?

Click to see Solution

| PMT Setting | END |

| N | [latex]2 \times 20=40[/latex] |

| PV | [latex]-1,125.51[/latex] |

| FV | [latex]1,000[/latex] |

| PMT | [latex]30[/latex] |

| I/Y | ? |

| P/Y | [latex]2[/latex] |

| C/Y | [latex]2[/latex] |

[latex]I/Y=5\%[/latex]

TRY IT

When you buy a car, a cash rebate is usually available if you finance the vehicle through your bank instead of the dealership. If you finance the vehicle through the dealership, you are not eligible for the cash rebate. Assume you can purchase a vehicle for $24,960 and finance it for four years with month-end payments at 0% through the dealership. Alternatively, you could get a loan from a bank and pay cash for your vehicle, which would entitle you to receive a $3,500 cash rebate. What monthly compounded interest rate would the bank have to charge to arrive at the same monthly payment as the dealership alternative? What decision rule can you create from this calculation?

Click to see Solution

Payments for financing through the dealership at 0% interest:

| PMT Setting | END |

| N | [latex]12 \times 4=48[/latex] |

| PV | [latex]-24,960[/latex] |

| FV | [latex]0[/latex] |

| PMT | ? |

| I/Y | [latex]0[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

[latex]PMT=\$520[/latex]

Interest rate for the bank with monthly payments of $520 and applying the $3,500 rebate to the present value:

| PMT Setting | END |

| N | [latex]12 \times 4=48[/latex] |

| PV | [latex]-21,460[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-520[/latex] |

| I/Y | ? |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

[latex]I/Y=7.61\%[/latex]

Exercises

- You purchase an annuity for $500,000. The annuity will pay you $8,000 every quarter for 21.5 years. What rate compounded quarterly does the annuity earn?

Click to see Answer

3.12%

- You invest $300 at the beginning of every month for 33.5 years. At the end of the 33.5 years, you have saved $750,000. What rate compounded semi-annually did your investment earn?

Click to see Answer

9.04%

- You have the opportunity to make an investment of $100,000 today and receive beginning of the month payments of $1,200 for 10 years. Calculate the rate compounded monthly on the investment.

Click to see Answer

7.90%

- Today, your RRSP has $25,000. Over the next 8 years you plan to deposit $6,250 every six months into the RRSP with the goal of having $200,000 in the account. Calculate the rate compounded semi-annually the RRSP must earn for you to achieve your goal.

Click to see Answer

9.76%

- You have $300,000 in your RIF. Over the next 13 years and 3 months, you receive beginning-of-quarter payments of $4,975 from the RIF. At the end of the 13 years and 3 months, the balance in your RIF is $150,000. What rate compounded quarterly does the RIF earn?

Click to see Answer

3.77%

- Following his financial adviser’s recommendations, Sanchez starts monthly contributions of $375 today to his RRSP. The plan is to have $240,000 in his RRSP after 20 years of monthly compounding. What nominal interest rate does the financial adviser think Sanchez’s RRSP will be able to realize?

Click to see Answer

8.61%

- Helen’s husband recently passed away. The life insurance company is offering her a lump-sum payout of $250,000 today, or month-end payments of $1,585 for 20 years.

- What monthly compounded rate is the life insurance company using in its calculations?

- Helen thinks she can take the lump sum and invest it herself at 4.75% effectively. How much will her monthly payment increase?

Click to see Answer

a. 4.53%; b. $16.89

- Under a wrongful dismissal suit, a court awarded a former employee $100,835.25 for end-of-month wages of $4,500 for the past 21 months. What effective interest rate is the court using in the judgment?

Click to see Answer

8%

- Jake’s Electronics wants to match a competitor’s advertised payment plan on an identical stereo system. If the system retails for $1,011.35 including all sales taxes and Jake wants to advertise six equal end-of-month payments of $174, what effective rate of interest does he need to charge?

Click to see Answer

11.56%

- The marketing manager for Gold’s Gym offers members a two-year membership for $650 in advance or beginning-of-month payments of $29. What monthly compounded interest is the marketing manager using in his pricing?

Click to see Answer

7.25%

- A retail store wants to offer its clients different two-year ordinary payment plans on their product purchases. The marketing manager understands the importance of odd-number pricing in these plans, where $499 is better than stating $500. On a typical $5,000 purchase, the marketing manager wants to offer payments of $229 monthly, $699 quarterly, or $1,399 semi-annually. The Competition Act of Canada requires full disclosure of the annual interest rate being charged on any plan. What interest rate must be published for each plan?

Click to see Answer

monthly plan: 9.95%, quarterly plan: 10.62%, semi-annual plan: 9.54%

- On a $3,500 purchase, a company is thinking of offering a year-long month-end payment plan that requires payments of $299, $319, $334, or $349.

- If the goal of the plan is to offer a competitive interest rate comparable to a bank credit card that averages 18% effectively, which payment plan should be chosen?

- If the goal of the plan is to offer a competitive interest rate comparable to a department store credit card that averages 28% effectively, which payment plan should be chosen?

Click to see Answer

$299 payments: 4.71%, $319 payments: 18.24%, $334 payments: 29.07%, $349 payments: 40.51%; a. choose $319 plan with 18.24% effective; b. choose $334 plan with 29.07% effective

- Margarite’s goal is to save up $100,000 after 10 years of monthly contributions into an investment annuity starting today. Depending on the level of risk she chooses, her adviser tells her that under low-risk conditions she would need to contribute $645.19, under medium-risk conditions her contribution needs to be $523.32, and if she puts her money into high-risk investments she would need $401.14 per month. Based on the adviser’s calculations, what are the effective interest rates on the low-, medium-, and high-risk investments?

Click to see Answer

low: 5%, medium: 9%, high: 14%

Attribution

“11.6: Annuity Interest Rates” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“11.6: Annuity Interest Rates” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.