4.5 Calculating the Interest Rate

LEARNING OBJECTIVES

- Calculate the interest rate of a loan or investment.

You need to calculate the nominal interest rate under many circumstances including (but not limited to) the following.

- Determining the interest rate on a single payment loan.

- Understanding what interest rate is needed to achieve a future savings goal.

- Calculating the interest rate that generated a specific amount of interest.

- Finding a fixed interest rate that is equivalent to a variable interest rate.

Using a Financial Calculator

Although it is possible to find the interest rate by using the future value or present value formulas, it is much more practical to use a financial calculator. You use the financial calculator in the same way as described previously, but the only difference is that the unknown quantity is I/Y (the nominal interest rate). You must still load the other six variables into the calculator and apply the cash flow sign conventions carefully.

USING THE TI BAII PLUS CALCULATOR TO FIND THE INTEREST RATE FOR COMPOUND INTEREST

Enter values for the known variables (PV, FV, N, PMT, P/Y and C/Y) following the steps below and paying close attention to the cash flow sign convention for PV and FV.

- For the main button keys in the TVM row (i.e. N, I/Y, PV, PMT, FV), enter the number first and then press the corresponding button.

- For example, to enter N=34, enter 34 on the calculator and then press N.

- For P/Y and C/Y, press 2nd I/Y. At the P/Y screen, enter the value for P/Y and then press ENTER. Press the down arrow to access the C/Y screen. At the C/Y screen, enter the value for C/Y and then press ENTER. Press 2nd QUIT (the CPT button) to exit the menu.

- For example, to enter P/Y=4 and C/Y=4, press 2nd I/Y. At the P/Y screen, enter 4 and press ENTER. Press the down arrow. At the C/Y screen, enter 4 and press ENTER. Press 2nd QUIT to exit.

After all of the known quantities are loaded into the calculator, press CPT and then I/Y to solve for the interest rate.

NOTE

When entering both PV and FV into the calculator, ensure proper application of cash flow sign convention to PV and FV. One number must be negative and the other must be positive. An ERROR message will appear on the calculator display if PV and FV are entered with the same signs (i.e. both are negative or both are positive).

EXAMPLE

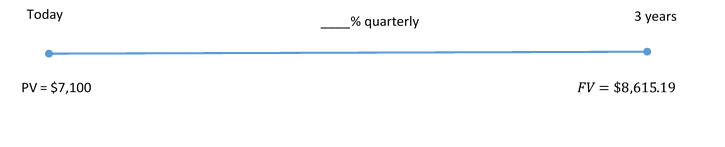

When Sandra borrowed $7,100 from Sanchez, she agreed to reimburse him $8,615.19 three years from now including interest compounded quarterly. What nominal quarterly compounded rate of interest is being charged?

Solution:

The timeline for the loan is shown below.

| N | [latex]4 \times 3=12[/latex] |

| PV | [latex]7,100[/latex] |

| FV | [latex]-8,615.19[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | ? |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]4[/latex] |

[latex]\displaystyle{I/Y=6.5\%}[/latex]

Sanchez is charging an interest rate of 6.5% compounded quarterly on the loan to Sandra.

EXAMPLE

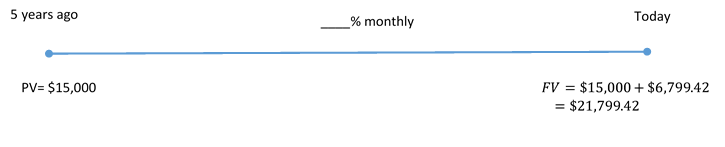

Five years ago, Taryn placed $15,000 into an RRSP that earned $6,799.42 of interest compounded monthly. What was the nominal interest rate for the investment?

Solution:

The timeline for the investment is shown below.

Step 1: Calculate the future value.

[latex]\begin{eqnarray*} FV & = & PV+I \\ & = & 15,000+6,799.42 \\ & = & \$21,799.42 \end{eqnarray*}[/latex]

Step 2: Calculate I/Y.

| N | [latex]12 \times 5=60[/latex] |

| PV | [latex]15,000[/latex] |

| FV | [latex]-21,799.42[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | ? |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

[latex]\displaystyle{I/Y=7.5\%}[/latex]

Taryn’s investment in his RRSP earned 7.5% compounded monthly over the five years.

TRY IT

Your company paid an invoice five months late. If the original invoice was for $6,450 and the amount paid was $6,948.48, what monthly compounded interest rate is your supplier charging on late payments?

Click to see Solution

| N | [latex]12 \times \frac{5}{12}=5[/latex] |

| PV | [latex]6,450[/latex] |

| FV | [latex]-6,948.48[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | ? |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

[latex]\displaystyle{I/Y=18\%}[/latex]

TRY IT

At what monthly compounded interest rate does it take five years for an investment to double?

Click to see Solution

| N | [latex]12 \times 5=60[/latex] |

| PV | [latex]-1[/latex] |

| FV | [latex]2[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | ? |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

[latex]\displaystyle{I/Y=13.94\%}[/latex]

Exercises

- What is the interest rate compounded monthly if a $101,000 loan is repaid 10 years later with a payment of $191,981.42?

Click to see Answer

6.44%

- You invested $59,860.48 five and half years ago. Today the investment is worth $78,500. What interest rate compounded semi-annually did your investment earn?

Click to see Answer

4.99%

- If a $5,000 investment grew to $20,777.73 in five years, what interest rate compounded daily did the investment earn?

Click to see Answer

28.5%

- In a civil lawsuit, a plaintiff was awarded damages of $15,000 plus $4,621.61 in interest for a period of 3¼ years. What quarterly compounded rate of interest was used in the settlement?

Click to see Answer

8.35%

- Muriel just received $4,620.01 including $840.01 of interest as payment in full for a sum of money that was loaned 2 years and 11 months ago. What monthly compounded rate of interest was charged on the loan?

Click to see Answer

6.9%

- At what monthly compounded interest rate does it take five years for an investment to double?

Click to see Answer

13.94%

- In 2003, a home in Winnipeg was purchased for $214,000. In 2011, the same home was appraised at $450,000. What annually compounded rate of growth does this reflect?

Click to see Answer

9.74%

- On October 1, 1975, the minimum wage in Manitoba was $2.60 per hour. It rose to $10 per hour by October 1, 2011. What is the annually compounded growth rate for minimum wage in Manitoba during this period?

Click to see Answer

3.81%

- Jean-Luc’s first month’s gross salary in June 1994 was $800. By June 2012 his monthly gross salary was $1,969.23 higher. What monthly compounded rate did his salary increase by over the period?

Click to see Answer

6.92%

Attribution

“9.5: Determining the Interest Rate” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“9.5: Determining the Interest Rate” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.