6.2 Simple and Compound Interest

Section Exercises – after the reading

Work on section 6.2 exercises in Fundamentals of Business Math Exercises after reading this section. Discuss your solutions with your peers and/or course instructor.

You may consult answers to select exercises: Fundamentals of Business Math Exercises – Select Answers

Discussing interest starts with the principal, or amount your account starts with. This could be a starting investment, or the starting amount of a loan. Interest, in its most simple form, is calculated as a percent of the principal. For example, if you borrowed $100 from a friend and agree to repay it with 5% interest, then the amount of interest you would pay would just be 5% of 100: $100(0.05) = $5. The total amount you would repay would be $105, the original principal plus the interest.

Simple One-time Interest

[latex]\begin{align*} I &= Pr\\ A &= P + I \\ &= P + Pr \\ &= P( {1 + r})\\ \end{align*}[/latex]

[latex]I[/latex] is the interest

[latex]A[/latex] is the end amount: principal plus interest

[latex]P[/latex] is the principal (starting amount)

[latex]r[/latex] is the interest rate in decimal form. Example: [latex]5\% = 0.05[/latex]

Example 1

A friend asks to borrow $300 and agrees to repay it in 30 days with 3% interest. How much interest will you earn?

Answer:

Task: interest [latex]I=?[/latex]

Conditions: one-time interest, simple [latex]\Rightarrow I=Pr[/latex]

the principal: [latex]P = \$300[/latex]

one-time rate: [latex]r = 0.03[/latex]

[latex]\Rightarrow I = 300(0.03) = 9[/latex]

You will earn $9 interest.

One-time simple interest is only common for extremely short-term loans. For longer term loans, it is common for interest to be paid on a daily, monthly, quarterly, or annual basis. In that case, interest would be earned regularly. For example, bonds are essentially a loan made to the bond issuer (a company or government) by you, the bond holder. In return for the loan, the issuer agrees to pay interest, often annually. Bonds have a maturity date, at which time the issuer pays back the original bond value.

Example 2

Suppose your city is building a new park, and issues bonds to raise the money to build it. You obtain a $1,000 bond that pays 5% interest annually that matures in 5 years. How much interest will you earn?

Answer:

Task: interest [latex]I=?[/latex]

Conditions: annual interest, simple [latex]\Rightarrow I=Prt[/latex]

principal: [latex]P=1000[/latex]

annual rate: [latex]r=0.05[/latex]

time (years): [latex]5[/latex]

Interest each year: [latex]I_{annual}=Pr=1000\cdot 0.05=50[/latex]

Interest over five years: [latex]I=5\cdot I_{annual}=5\cdot 50=250[/latex]

Hence, over the course of five years, you would earn a total of [latex]\$250[/latex] in interest.

We can generalize this idea of simple interest over time.

Simple Interest over Time Formula

[latex]\begin{align*} I&=Prt\\ A&=P+I=P+Prt =P( {1 + rt}) \end{align*}[/latex]

where

[latex]I[/latex] is the interest

[latex]A[/latex] is the end amount: principal plus interest

[latex]P[/latex] is the principal (starting amount)

[latex]r[/latex] is the interest rate in decimal form

[latex]t[/latex] is time

Note that the units of measurement (years, months, etc.) for the time must match the time period for the interest rate.

APR – Annual Percentage Rate

Interest rates are usually given as an annual percentage rate (APR) – the total interest that will be paid in the year. If the interest is paid in smaller time increments, the APR will be divided up. For example, a [latex]6\%[/latex] APR paid monthly would be divided into twelve [latex]0.5\%[/latex] payments. A [latex]4\%[/latex] annual rate paid quarterly would be divided into four [latex]1\%[/latex] payments.

Example 3

Treasury Notes (T-notes) are bonds issued by the federal government to cover its expenses. Suppose you obtain a $1,000 T-note with a 4% annual rate, paid semi-annually, with a maturity in 4 years. How much interest will you earn?

Answer:

Task: interest [latex]I=?[/latex]

Conditions: semi-annual interest, simple [latex]\Rightarrow I=Prt[/latex]

principal: [latex]P = \$1000[/latex]

semi-annual rate: [latex]r = \frac{0.04}{2}= 0.02\Rightarrow[/latex] 2% rate per half-year

time (half-years): [latex]t=2\cdot 4=8[/latex]

[latex]\Rightarrow I= 1000(0.02)(8) = 160[/latex]

Therefore, you will earn $160 interest total over the four years.

Try it Now

- A loan company charges $30 interest for a one month loan of $500. Find the annual interest rate they are charging.

Compound Interest

With simple interest, we were assuming that we pocketed the interest when we received it. In a standard bank account, any interest we earn is automatically added to our balance, and we earn interest on that interest in future years. This reinvestment of interest is called compounding. We looked at this situation earlier, in the chapter on exponential growth.

Compound Interest Formula

[latex]\begin{align*} A = P{\left( {1 + \frac{r}{k}}\right)^{kt}} \end{align*}[/latex]

where

[latex]A[/latex] is the balance in the account after t years.

[latex]P[/latex] is the starting balance of the account (also called initial deposit, or principal)

[latex]r[/latex] is the annual interest rate in decimal form

[latex]k[/latex] is the number of compounding periods in one year (compounding frequency).

If the compounding is done annually (once a year), [latex]k = 1[/latex].

If the compounding is done quarterly, [latex]k = 4[/latex].

If the compounding is done monthly, [latex]k = 12[/latex].

If the compounding is done daily, [latex]k = 365[/latex].

The most important thing to remember about using the compound interest formula is that it assumes that we put money in the account once and let it sit there earning interest.

Concept in Action – Demo by Video

Example 4

A certificate of deposit (CD) is a savings instrument that many banks offer. It usually gives a higher interest rate, but you cannot access your investment for a specified length of time. Suppose you deposit $3000 in a CD paying 6% interest, compounded monthly. How much will you have in the account after 20 years?

Answer:

Task: final amount [latex]A= ?[/latex], compound interest

Conditions:

initial deposit: [latex]\$3000[/latex]

annual rate: [latex]r = 0.06[/latex]

compounding frequency: [latex]k = 12[/latex] (12 months in 1 year)

time (years): [latex]t = 20[/latex]

Hence

[latex]\begin{align*} A &= P\left( 1 + \frac{r}{k}\right)^{kt}=3000 \left( 1 + \frac{0.06}{12}\right)^{12\cdot 20}=\$9,930.61 \end{align*}[/latex]

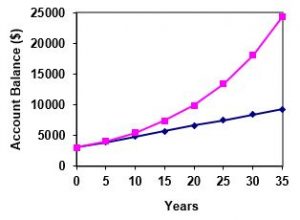

Let us compare the amount of money earned from compounding against the amount you would earn from simple interest

| Years | Simple Interest ($15 per month) | 6% compounded monthly = 0.5% each month |

| 5 | $3900 | $4046.55 |

| 10 | $4800 | $5458.19 |

| 15 | $5700 | $7362.28 |

| 20 | $6600 | $9930.61 |

| 25 | $7500 | $13394.91 |

| 30 | $8400 | $18067.73 |

| 35 | $9300 | $24370.65 |

As you can see, over a long period of time, compounding makes a large difference in the account balance. You may recognize this as the difference between linear growth and exponential growth.

Evaluating exponents on the calculator

When we need to calculate something like [latex]5^3[/latex], it is easy enough to just multiply [latex]5⋅5⋅5=125[/latex]. But when we need to calculate something like [latex]1.005^{240}[/latex], it would be very tedious to calculate this by multiplying 1.005 by itself 240 times! So to make things easier, we can harness the power of our calculators.

Most scientific calculators have a button for exponents. It is typically either labeled like:

^ , yx , or xy .

To evaluate 1.005240 we’d type 1.005 ^ 240, or 1.005 yx 240.

Try it out – you should get something around 3.3102044758.

Concept in Action – Demo by Video

Example 5

You know that you will need [latex]\$40,000[/latex] for your child’s education in 18 years. If your account earns [latex]4\%[/latex] compounded quarterly, how much would you need to deposit now to reach your goal?

Answer:

Task: principal [latex]P=?[/latex]

Conditions: compounded interest [latex]A = P{\left( {1 + \frac{r}{k}}\right)^{kt}}[/latex]

annual rate: [latex]r = 0.04[/latex]

compounding frequency: [latex]k = 4[/latex] (4 quarters in 1 year)

time (years): [latex]t = 18[/latex]

final amount ($): [latex]A=40000[/latex]

[latex]A = P\left( 1 + \frac{r}{k}\right)^{kt}[/latex], must solve for [latex]P[/latex]

In this case, we’re going to have to set up the equation, and solve for P.

[latex]\begin{align*} A = P\left( 1 + \frac{r}{k}\right)^{kt}&\Rightarrow \frac{A}{ \left( 1 + \frac{r}{k}\right)^{kt}}=P\Rightarrow P=A \left( 1 + \frac{r}{k}\right)^{-kt} \end{align*}[/latex]

[latex]\Rightarrow P=A \left( 1 + \frac{r}{k}\right)^{-kt}=40000 \left( 1 + \frac{0.04}{4}\right)^{-4\cdot 18}=19539.84[/latex]

Therefore you need to deposit $19,539.84 now to reach your goal.

Rounding

It is important to be very careful about rounding when calculating expressions involving exponents because exponents will make a small difference very large. Ideally, do not perform any calculations until the last step. If you must perform a calculation in the middle of the process, keep as many decimals during calculations as you can. Be sure to keep at least 6 decimals or 3 significant digits (numbers after any leading zeros), whichever is the greater number of decimals. Rounding 0.00012345 to 0.000123 will usually give you a “close enough” answer, but keeping more digits is always better. If your calculator allows it, do all your calculations without rounding in the calculator and only round the final answer.

Example 6

To see why rounding only at the end and not in mid-calculation is so important, suppose you were investing $1000 at 5% interest compounded monthly for 30 years and you wanted to find out the final amount.

Process:

Task: final amount [latex]A=?[/latex]

Conditions: compounded interest [latex]A = P{\left( {1 + \frac{r}{k}}\right)^{kt}}[/latex]

initial deposit: [latex]P = \$1000[/latex]

annual rate: [latex]r =0.05[/latex]

monthly compounding frequency: [latex]k = 12[/latex]

time (years): [latex]t = 30[/latex]

If we first compute [latex]\frac{r}{k}[/latex], we get 0.05/12 = 0.00416666666667

Here is the effect of rounding this to different values:

| [latex]\frac{r}{k}[/latex]rounded to: | Gives [latex]A[/latex] to be: | Error |

| [latex]0.004[/latex] | [latex]\$4208.59[/latex] | [latex]\$259.15[/latex] |

| [latex]0.0042[/latex] | [latex]\$ 4521.45[/latex] | [latex]\$53.71[/latex] |

| [latex]0.00417[/latex] | [latex]\$ 4473.09[/latex] | [latex]\$5.35[/latex] |

| [latex]0.004167[/latex] | [latex]\$ 4468.28[/latex] | [latex]\$0.54[/latex] |

| [latex]0.0041667[/latex] | [latex]\$ 4467.80[/latex] | [latex]\$0.06[/latex] |

| no rounding | [latex]\$ 4467.74[/latex] | [latex]\$0[/latex] |

If you’re working in a bank, of course you wouldn’t round at all. For our purposes, the answer we got by rounding to 0.00417, or three significant digits, is close enough [latex]-\$5[/latex] off of [latex]\$4500[/latex] isn’t too bad. Certainly keeping that fourth decimal place wouldn’t have hurt. Even better, use your calculator to not round at all by not performing any calculation until the last step.

Using your calculator

You can generally completely avoid rounding in mid-calculations by entering the full calculation into your scientific calculator. For example, in the example above, we needed to calculate

[latex]\begin{align*} A = 1000{\left( {1 + \frac{{0.05}}{{12}}} \right)^{12 * 30}} \end{align*}[/latex]

A scientific calculator will allow you to type in the entire expression to be evaluated. If you have a calculator like this, you will just need to enter, depending on your exponent key:

[latex]1000 \times (1+0.05\div 12)^{360}=[/latex]

or

[latex]1000 \times (1+0.05\div 12)\ y^x\ 360=[/latex]

Try it Now

2. If $70,000 are invested at 7% compounded monthly for 25 years, find the end balance.

Because of compounding throughout the year, the actual increase in a year is more than the annual percentage rate. If $1,000 were invested at [latex]10\%[/latex], the table below shows the value after 1 year at different compounding frequencies:

| Frequency | Value after 1 year |

| Annually | [latex]\$1100[/latex] |

| Semiannually | [latex]\$1102.50[/latex] |

| Quarterly | [latex]\$1103.81[/latex] |

| Monthly | [latex]\$1104.71[/latex] |

| Daily | [latex]\$1105.16[/latex] |

If we were to compute the actual percentage increase for the daily compounding, we can see that the increase by $105.16 from an original amount of $1,000 represents the percentage increase of:

[latex]\begin{align*} \frac{{105.16}}{{1000}} = 0.10516 = 10.516\% \end{align*}[/latex]

This quantity is called the annual percentage yield (APY).

Notice that, given any starting amount, the amount after one year would be

[latex]\begin{align*} A = P\left( 1 + \frac{r}{k}\right )^{k} \end{align*}[/latex]

To find the percentage change from the original to current amount, we would first find the total change by subtracting the original amount from the current amount, and then divide it by the original amount:

[latex]\begin{align*} &\text{% change from principal to current amount}\\\\ &=\frac{\text{current amount}-\text{principal}}{\text{principal}}\\\\ &=\frac{P\left( 1 + \frac{r}{k}\right)^k - P}{P} = \left( 1 +\frac{r}{k}\right )^k - 1 \end{align*}[/latex]

Annual Percentage Yield

The annual percentage yield is the actual percent a quantity increases in one year. It can be calculated as

[latex]\begin{align*} APY = \left( 1 +\frac{r}{k}\right )^k - 1 \end{align*}[/latex]

Note this is equivalent to finding the value of [latex]\$1[/latex] after 1 year, and subtracting the original dollar.

Example 7

Bank A offers an account paying 1.2% compounded quarterly. Bank B offers an account paying 1.1% compounded monthly. Which is offering a better rate?

Answer:

Task: Compare actual percent increase in a year (APY) and identify the larger percentage.

Conditions: compounded interest [latex]\Rightarrow APY = \left( 1 +\frac{r}{k}\right )^k - 1[/latex]

Bank A:

[latex]\begin{align*} APY&={({1+\frac{{0.012}}{4}} )^4}-1\\ &=0.012054\\ &=1.2054 \%\\ \end{align*}[/latex]

Bank B:

[latex]\begin{align*} APY&={({1+\frac{{0.011}}{{12}}} )^{12}}-1\\ &=0.011056\\ &= 1.1056\%\\ \end{align*}[/latex]

Bank B’s monthly compounding is not enough to catch up with Bank A’s better APY. Bank A offers a better rate.

Solving for the interest rates

Whether you are borrowing or investing, it is extremely important to know what compound interest rate you are being charged or earning. Unfortunately, most consumers pay attention just to the “don’t pay for one year” clause in the deals they are offered. They do not stop to consider they might be paying too much for credit.

For example, assume you are just about to sign the purchase papers for a new television set. The retail sales clerk says to you in a low voice, “Well, I ran the numbers and they show you could pay $4,000 today or if you take advantage of our ‘don’t pay for one year’ offer, you will owe us $4,925.76 one year from now.” You urgently want to get your new TV home, but you had better think twice about a financial decision this important. What interest rate did the sales clerk use in determining your $4,925.76 payment? Is this interest rate fair? Could you finance the TV for less elsewhere?

To calculate the annual interest rate on single payments when you know both the future value and the present value, you need to rearrange the basic compound interest formula to solve for the rate:

[latex]\begin{align*} A&=P\left(1+\frac{r}{m}\right)^{mt}\\\\ &\rightarrow\frac{A}{P}=\left(1+\frac{r}{m}\right)^{mt}\\\\ &\Rightarrow\left(\frac{A}{P}\right)^{\frac{1}{mt}}=1+\frac{r}{m}\\\\ &\Rightarrow\left(\frac{A}{P}\right)^{\frac{1}{mt}}-1=\frac{r}{m}\\\\ &r=m\left[\left(\frac{A}{P}\right)^{\frac{1}{mt}}-1\right] \end{align*}[/latex]

Concept in Action – Demo by Video

Example 8

When Sandra borrowed $7,100 from Sanchez, she agreed to reimburse him $8,615.19 three years from now including interest compounded quarterly. What interest rate is being charged?

Answer: interest rate? [latex]A=P\left(1+\frac{r}{m}\right)^{mt}[/latex]

Must solve for [latex]r[/latex].

[latex]\begin{align*} A&=P\left(1+\frac{r}{m}\right)^{mt}\\\\ &\rightarrow\frac{A}{P}=\left(1+\frac{r}{m}\right)^{mt}\\\\ &\Rightarrow\left(\frac{A}{P}\right)^{\frac{1}{mt}}=1+\frac{r}{m}\\\\ &\Rightarrow\left(\frac{A}{P}\right)^{\frac{1}{mt}}-1=\frac{r}{m}\\\\ &r=m\left[\left(\frac{A}{P}\right)^{\frac{1}{mt}}-1\right] \end{align*}[/latex]

We know final amount [latex]A[/latex], principal [latex]P[/latex], time [latex]t[/latex] and compounding frequency [latex]m[/latex]. Therefore,

[latex]\begin{align*} r&=m\left[\left(\frac{A}{P}\right)^{\frac{1}{mt}}-1\right]\\\\ &=4\left[\left(\frac{8615.19}{7100}\right)^{\frac{1}{4\cdot 3}}-1\right]\\\\ &=6.5\% \end{align*}[/latex]

Hence, the interest rate charged is 6.5%.

Example 9

Five years ago, Taryn placed $15,000 into an RRSP that earned $6,799.42 of interest compounded monthly. What was the annual interest rate for the investment?

Answer: annual interest rate? [latex]A=P\left(1+\frac{r}{m}\right)^{mt}[/latex]

Must solve for [latex]r[/latex].

[latex]\begin{align*} A&=P\left(1+\frac{r}{m}\right)^{mt}\\\\ &\rightarrow\frac{A}{P}=\left(1+\frac{r}{m}\right)^{mt}\\\\ &\Rightarrow\left(\frac{A}{P}\right)^{\frac{1}{mt}}=1+\frac{r}{m}\\\\ &\Rightarrow\left(\frac{A}{P}\right)^{\frac{1}{mt}}-1=\frac{r}{m}\\\\ &r=m\left[\left(\frac{A}{P}\right)^{\frac{1}{mt}}-1\right] \end{align*}[/latex]

We know interest [latex]I[/latex], principal [latex]P[/latex], time [latex]t[/latex] and compounding frequency [latex]m[/latex]. Since the final amount is the principal plus the interest, or [latex]A=P+I[/latex], we have

[latex]\begin{align*} r&=m\left[\left(\frac{A}{P}\right)^{\frac{1}{mt}}-1\right]\\\\ &=m\left[\left(\frac{P+I}{P}\right)^{\frac{1}{mt}}-1\right]\\\\ &=12\left[\left(\frac{15000+6799.42}{15000}\right)^{\frac{1}{12\cdot 5}}-1\right]\\\\ &=7.5\% \end{align*}[/latex]

Hence the annual interest rate for the RRSP is 7.5%.

Solving for the time using logarithms

Logarithms are the inverse of exponential functions – they allow us to undo exponential functions and solve for the exponent. They are also commonly used to express quantities that vary widely in size.

Logarithm Equivalent to an Exponential

The logarithm (base [latex]b[/latex]) function, written [latex]\log_b (x)[/latex], is the inverse of the exponential function (base [latex]b[/latex]), [latex]b^x[/latex].

This means the statement [latex]b^a=c[/latex] is equivalent to the statement [latex]\log_b (c)=a[/latex].

Example 10

Write these exponential equations as logarithmic equations:

- [latex]2^3=8[/latex]

- [latex]5^2=25[/latex]

- [latex]10^{-4}=\frac{1}{10000}[/latex]

Answer:

- [latex]2^3=8[/latex] is equivalent to [latex]\log_2(8)=3[/latex].

- [latex]5^2=25[/latex] is equivalent to [latex]\log_5(25)=2[/latex].

- [latex]10^{-4}=\frac{1}{10000}[/latex] is equivalent to [latex]\log_{10}\left(\frac{1}{10000}\right)=-4[/latex].

Example 11

Answer: By rewriting this equation using a logarithm, we get [latex]x=\log_2(10)[/latex].

While this does define an exact solution, you may find it somewhat unsatisfying since it is difficult to compare this expression to the decimal estimate we made earlier. Also, giving an exact expression for a solution is not always useful – often we need a decimal approximation to the solution. Luckily, this is a task calculators and computers are quite adept at. Unfortunately, most calculators and computers will only evaluate logarithms of two bases, base 10 and base [latex]e[/latex]. This ends up not being a problem, as we’ll see briefly.

Common and Natural Logarithms

The natural log is the logarithm with base [latex]e[/latex], and is typically written [latex]\ln(x)[/latex].

Example 12

Evaluate [latex]\log(1000)[/latex] using the definition of the common log.

Answer:

To evaluate [latex]\log(1000)[/latex], we can say [latex]x=\log(1000)[/latex], then rewrite into exponential form using the common log base of 10:[latex]10^x=1000.[/latex]

From this, we might recognize that 1000 is the cube of 10, i.e., [latex]10^3=1000[/latex], so [latex]x = 3[/latex].

We also can use the inverse property of logs to write [latex]\log_{10}\left(10^3\right) =3[/latex].

| Number | Number as exponential | log(number) |

| 1000 | [latex]10^3[/latex] | 3 |

| 100 | [latex]10^2[/latex] | 2 |

| 10 | [latex]10^1[/latex] | 1 |

| 1 | [latex]10^0[/latex] | 0 |

| 0.1 | [latex]10^{-1}[/latex] | -1 |

| 0.01 | [latex]10^{-2}[/latex] | -2 |

| 0.001 | [latex]10^{-3}[/latex] | -3 |

Example 13

Answer: Using a computer or calculator, we can evaluate and find that [latex]\log(500)\approx 2.69897[/latex].

Because logarithms are inverse functions of exponentials, we can use them to solve exponential equations that involve the unknown variable in an exponent. This is in much the same way as we use the inverse properties of addition vs. subtraction or multiplication vs. division when rearranging equations to solve for an unknown value.

Properties of Logarithms

Inverse Properties:

(1) [latex]\log_b(b^x)=x[/latex]

(2) [latex]b^{\log_b(x)}=x[/latex]

Exponent Property

(3) [latex]\log_b\left(A^r\right)=r\,\log_b(A)[/latex]

Here is an example how these properties are useful:

Suppose we have the following equation and had to determine the value of [latex]r[/latex]:

[latex]2\cdot 1.8^x=17.2[/latex]

To solve for [latex]x[/latex], we first have to determine which operations, and in which order, are acting on [latex]x[/latex], and then undo them in the opposite order. Because [latex]x[/latex] is first put into the exponent of 1.8, and then the new value is multiplied by 2, we first have to undo the last operation, i.e., we must divide by 2:

[latex]1.8^x=\frac{17.2}{2}[/latex]

Looking at the equation now, we can see that the only thing happening to [latex]x[/latex] is that [latex]x[/latex] is put into the exponent of 1.8. The opposite operation would be the inverse property (1), so we could apply [latex]log_{1.8}[/latex] to get just [latex]x[/latex]. However, the typical scientific calculator only calculates the common and the natural log, so [latex]log_{1.8}[/latex] won’t be helpful when applied to the other side of the equation. So instead we will apply either [latex]\log[/latex] or [latex]ln[/latex] to both sides of the equation, and then bring the exponent down by using the exponent property (3):

[latex]\begin{align*} \ln(1.8)^x&=\ln\left(\frac{17.2}{2}\right)\Rightarrow x\ln(1.8)=\ln\left(\frac{17.2}{2}\right)\\ &\Rightarrow x=\frac{\ln\left(\frac{17.2}{2}\right)}{\ln(1.8)}\approx 3.660788 \end{align*}[/latex]

General process for solving exponential equations (when the variable is in the exponent)

- Isolate the exponential expressions when possible.

- Take the logarithm of both sides.

- Utilize the exponent property for logarithms to pull the variable down from the exponent.

- Continue to use algebra to solve for the variable.

Concept in Action – Demo by Video

Example 14

If you invest $2000 at 6% compounded monthly, how long will it take the account to double in value?

Answer:

Task: time [latex]t=?[/latex]

Conditions: compound interest, [latex]A = P{\left( {1 + \frac{r}{k}}\right)^{kt}}[/latex]

principal: [latex]P=2000[/latex]

annual rate: [latex]r = 0.06[/latex]

monthly compounding frequency: [latex]k = 12[/latex]

final amount ($): [latex]A=2P=4000[/latex]

[latex]A = P\left( 1 + \frac{r}{k}\right)^{kt}[/latex], must solve for [latex]t[/latex]

In this case, we’re going to have to set up the equation, and solve for [latex]t[/latex].

[latex]\begin{align*} A = P\left( 1 + \frac{r}{k}\right)^{kt}&\Rightarrow \frac{A}{P}= \left( 1 + \frac{r}{k}\right)^{kt}\\ &\Rightarrow \ln\left(\frac{A}{P}\right)= \ln(\left( 1 + \frac{r}{k}\right)^{kt}\\ &\Rightarrow \ln\left(\frac{A}{P}\right)=kt \ln(\left( 1 + \frac{r}{k}\right)\\ &\Rightarrow \frac{\ln\left(\frac{A}{P}\right)}{k\ln(\left( 1 + \frac{r}{k}\right)}=t \end{align*}[/latex]

Therefore,

[latex]\begin{align*} t&= \frac{\ln\left(\frac{A}{P}\right)}{k\ln(\left( 1 + \frac{r}{k}\right)}\\\\ &= \frac{\ln\left(\frac{4000}{2000}\right)}{12\ln(\left( 1 + \frac{0.06}{12}\right)}\approx 11.581310\\\\ &=11 \text{ years } 0.581310\cdot 12 \text{ months}\\\\ &=11\text{ years }7\text{ months} \end{align*}[/latex]

Therefore it will take 11 years and 7 months for the investment to double in value.

Example 15

Suppose an investment of $2,000 at the annual rate of 1.89% can be compounded quarterly. Determine when the total amount, including interest, will reach $2,500.

Answer: [latex]t=?[/latex]

Compounding quarterly: [latex]A=P\left(1+\frac{r}{m}\right)^{mt}=2000\left(1+\frac{0.0189}{4}\right)^{4t}[/latex]

[latex]\begin{align*} A&=2500\Rightarrow 2000\left(1+\frac{0.0189}{4}\right)^{4t}=2500\\ &\Rightarrow\left(1+\frac{0.0189}{4}\right)^{4t}=\frac{2500}{2000}\\ &\Rightarrow\ln\left(\left(1+\frac{0.0189}{4}\right)^{4t}\right)=\ln\left(\frac{2500}{2000}\right)\\ &\Rightarrow 4t\cdot\ln\left(1+\frac{0.0189}{4}\right)=\ln\left(\frac{2500}{2000}\right)\\ &\Rightarrow t=\frac{\ln\left(\frac{2500}{2000}\right)}{4\cdot \ln\left(1+\frac{0.0189}{4}\right)}\\ &\Rightarrow t\approx 11.834 \end{align*}[/latex]

Since 11.834 years is between 11 years and three quarters and 12 years, the time it will for the investment to reach $2500 by compounding quarterly is 12 years.

Note that in this solution we performed the rearrangement process by first substituting the values, then rearranging the equation with the values to solve for [latex]t[/latex]. This is very inefficient and greatly increases the chance of error. The best approach is to first rearrange the original equation [latex]A=P\left(a+\frac{r}{m}\right)^{mt}[/latex] to solve for [latex]t[/latex], and then substitute all the values and calculate the final answer in a single calculation. This is a preferred approach.

Note also that in the solution above we did not do calculations in the process. The only calculation that was performed was in the last step. This is intentional and of great importance. Doing intermediate calculations would involve rounding, which in turn introduces an error into the final answer. As a result, don’t perform intermediate calculations when solving for time. Do a single calculation and only at the end.

Try it Now Answers

- [latex]r = ?[/latex], annual

simple interest over time [latex]\Rightarrow I = Prt[/latex]

solving for [latex]r[/latex]:

[latex]I=Prt\Rightarrow r=\frac{I}{Pt}=\frac{30}{500\cdot \frac{1}{12}}=0.72=72\%[/latex] per year - [latex]A = 70,000\left( 1 + \frac{0.07}{12} \right)^{12(25)} =\$ 400,779.27[/latex]

Section Exercises – after the reading

Work on section 6.2 exercises in Fundamentals of Business Math Exercises after reading this section. Discuss your solutions with your peers and/or course instructor.

You may consult answers to select exercises: Fundamentals of Business Math Exercises – Select Answers