4.1 Discounts

Section Exercises - after the reading

Work on section 4.1 exercises in Fundamentals of Business Math Exercises after reading this section. Discuss your solutions with your peers and/or course instructor.

You may consult answers to select exercises: Fundamentals of Business Math Exercises – Select Answers

You mutter in exasperation, “Why can’t they just set one price and stick with it?” Your mind boggles at all the competing discounts you encounter at the mall in your search for that perfect Batman toy for your nephew. Walmart is running their Rollback promotion and is offering a Batmobile for 25% off, regularly priced at $49.99. Toys R’ Us has an outlet in the parking lot where the regular price for the same toy is $59.99, but all Batman products are being cleared out at 40% off. You head over to The Bay for a warehouse clearance event that has the same toy priced at $64.99 but at 35% off. It is also Bay Days, which means you can scratch and win a further 10% to 20% off the sale price. You go to Dairy Queen for a Blizzard to soothe your headache while you figure things out.

The cost of a product is the amount of money required to obtain the merchandise. If you are a consumer, the ticketed price tag on the product is your cost. If you are a reseller (also known as a middleman or intermediary), what you pay to your supplier for the product is your cost. If you are a manufacturer, then your cost equals all of the labour, materials, and production expenditures that went into creating the product.

A discount is a reduction in the price of a product. As a consumer, you are bombarded with discounts all the time. Retailers use various terms for discounts, including sales or clearance. If your business purchases a product from a supplier, any discount your business receives will lower how much the business pays to acquire the product. When a business buys products, the price paid is the cost to the business. Therefore, a lower price means a lower cost. If your business is the one selling the product, any discount offered lowers the selling price and reduces revenue per sale. Since the revenue must cover all costs and expenses associated with the product, the lower price means that the business reduces profits per sale. In business, it is common practice to express a discount as a percentage of the regular price.

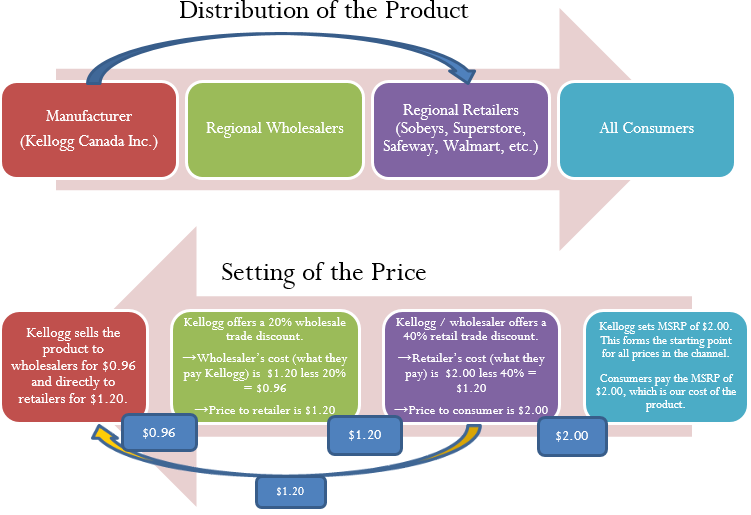

How Distribution and Pricing Work

Start with distribution in the top half of the figure and work left to right. As an example, let’s look at a manufacturer such as Kellogg Canada Inc. (which makes such products as Pop-Tarts, Eggo Waffles, and Rice Krispies). Kellogg’s Canadian production plant used to be located in London, Ontario. To distribute its products to the rest of Canada, Kellogg Canada used various regional wholesalers. Each wholesaler then resells the product to retailers in its local trade area; however, some retailers (such as the Real Canadian Superstore) are very large, and Kellogg Canada distributed directly to these organizations, bypassing the wholesaler as represented by the blue arrow. Finally, consumers shop at these retailers and acquire Kellogg products.

The relationship of distribution to pricing is illustrated in the bottom half of the figure, working right to left. For now, focus on understanding how pricing works; the mathematics used in the figure will be explained later in this chapter. Kellogg Canada set a manufacturer's suggested retail price, known as the MSRP. This is a recommended retail price based on consumer market research. Since grocery retailers commonly carry thousands or tens of thousands of products, the MSRP helps the retailer to determine the retail price at which the product should be listed. In this case, assume a $2.00 MSRP, which is the price consumers will pay for the product.

The retailer must pay something less than $2.00 to make money when selling the product. Kellogg Canada understands its distributors and calculates that to be profitable most retailers must pay approximately 40% less than the MSRP. Therefore, it offers a 40% discount. If the retailer purchases directly from Kellogg, as illustrated by the yellow arrow, the price paid by the retailer to acquire the product is $2.00 less 40%, or $1.20. Smaller retailers acquire the product from a wholesaler for the same price. Thus, the retailer's cost equals the wholesaler's price (or Kellogg Canada's price if the retailer purchases it directly from Kellogg).

The wholesaler's price is $1.20. Again, Kellogg Canada, knowing that the wholesaler must pay something less than $1.20 to be profitable, offers an additional 20% discount exclusively to the wholesaler. So the price paid by the wholesaler to acquire the product from Kellogg Canada is $1.20 less 20%, or $0.96. This $0.96 forms Kellogg Canada's price to the wholesaler, which equals the wholesaler's cost.

In summary, this discussion illustrates two key pricing concepts:

- Companies higher up in the distribution channel pay lower prices than those farther down the channel. Companies receive discounts off the MSRP based on their level in the distribution system. This may result in multiple discounts, such as a wholesaler receiving both the retailer’s discount and an additional discount for being a wholesaler.

- One organization’s price becomes the next organization’s cost (assuming the typical distribution channel structure):

Manufacturer’s Price = Wholesaler’s Cost

Wholesaler’s Price = Retailer’s Cost

Retailer’s Price = Consumer’s Cost

Types of Discounts

You will perform discount calculations more effectively if you understand how and why single pricing discounts and multiple pricing discounts occur. Businesses or consumers are offered numerous types of discounts, of which five of the most common are trade, quantity, loyalty, sale, and seasonal.

- Trade Discounts. A trade discount is a discount offered to businesses only based on the type of business and its position in the distribution system (e.g., as a retailer, wholesaler, or any other member of the distribution system that resells the product). Consumers are ineligible for trade discounts. In the discussion of the figure, two trade discounts are offered. The first is a 40% retail trade discount, and the second is a 20% wholesale trade discount. Typically, a business that is higher up in the distribution system receives a combination of these trade discounts. For example, the wholesaler receives both the 40% retail trade discount and the 20% wholesale trade discount from the MSRP. The wholesaler's cost is calculated as an MSRP of $2.00 less 40% less 20% = $0.96.

- Quantity Discounts. A quantity discount (also called a volume discount) is a discount for purchasing larger quantities of a certain product. If you have ever walked down an aisle in a Real Canadian Superstore, you probably noticed many shelf tags that indicate quantity discounts, such as “Buy one product for $2” or “Take two products for $3.” Many Shell gas stations offer a Thirst Buster program in which customers who purchase four Thirst Busters within a three-month period get the fifth one free. If the Thirst Busters are $2.00 each, this is equivalent to buying five drinks for $10.00 less a $2.00 quantity discount.

- Loyalty Discounts. A loyalty discount is a discount that a seller gives to a purchaser for repeat business. Usually no time frame is specified; that is, the offer is continually available. As a consumer, you see this regularly in marketing programs such as Air Miles or with credit cards that offer cash back programs. For example, Co-op gas stations in Manitoba track consumer gasoline purchases through a loyalty program and mails an annual loyalty discount cheque to its customers, recently amounting to 12.5¢ per litre purchased. In business-to-business circles, sellers typically reward loyal customers by deducting a loyalty discount percentage, commonly ranging from 1% to 5%, from the selling price.

- Sale Discounts. A sale discount is a temporary lowering of the price from a product’s regular selling price. Businesses put items on sale for a variety of reasons, such as selling excess stock or attracting shoppers. You see such promotional events all the time: LED monitors are on sale at Best Buy; Blu-Ray discs are half off at Walmart; The Brick is having a door crasher event Saturday morning.

- Seasonal Discounts. A seasonal discount is a discount offered to consumers and businesses for purchasing products out of season. At the business level, manufacturers tend to offer seasonal discounts encouraging retailers, wholesalers, or distributors to purchase products before they are in season. Bombardier Inc. manufactures Ski-Doos, which are sold in Canada from approximately November through March—a time of year when most of the country has snow and consumers would want to buy one. To keep production running smoothly from April through October, Bombardier could offer seasonal discounts to its wholesalers and retailers for the coming winter season. At a retail level, the examples are plentiful. On November 1 most retailers place their Halloween merchandise on seasonal discount to clear out excess inventory, and many retailers use Boxing Day (or Boxing Week) to clear their out-of-season merchandise.

Single Discounts

Let’s start by calculating the cost when only one discount is offered. Later in this section you will learn how to calculate a cost involving multiple discounts.

Figuring out the price after applying a single discount is called a net price calculation. When a business calculates the net price of a product, it is interested in what you still have to pay, not in what has been removed. This is illustrated below in the fundamental relationship in calculations involving a single discount. You will note that to determine the rate owing, you must take 1 and subtract from it the discount rate. The 1 represents 100% and so, if you are eligible for a 20% discount, then you must pay 80% of the list price ([latex]100\% - 20\%[/latex]).

There are a number of relationships we can build between quantities related to single discount:

- list price, discount rate, and net price

- discount amount, discount rate, and list price

- discount amount, list price, and net price

Single discount - fundamental relationships between list price, discount rate, discount amount, and net price

[latex]\begin{align*} \text{net price}&=(\text{list price})(1-(\text{discount rate}))\\ N&= L\cdot (1-d)\\ &\\ \text{discount rate}&=\frac{\text{discount amount}}{\text{list price}}\\ d&=\frac{D}{L}\\ &\\ \text{discount amount}&=(\text{list price})-(\text{net price})\\ D&=L-N \end{align*}[/latex]

where

[latex]N[/latex] is the Net Price: The price of the product after the discount is removed from the list price. It is a dollar amount representing what price remains after you have applied the discount.

[latex]L[/latex] is the List Price: The normal or regular dollar price of the product before any discounts. It is the the Manufacturer’s

Suggested Retail Price (MSRP - a price for a product that has been published or advertised in some way), or any dollar amount before you remove the discount.

[latex]d[/latex] is the Discount Rate: The percentage (in decimal format) of the list price that is deducted.

[latex]D[/latex] is Discount Amount: The amount removed from the list price to get the net price.

For example, assume a product sells for $10 and is on sale at 35% off the regular price and that you want to calculate the net price for the product.

The task is to find the net price [latex]N[/latex], and we are given the list price [latex]L[/latex] and the discount rate [latex]d[/latex]. So,

[latex]\text{net price}=N= L(1-d)=10\cdot(1-0.35)= \$ 6.50[/latex]

You can combine the relationships described above in a variety of ways to solve any single discount situation for any of the four quantities involved in single discount problems: list price, net price, discount rate and/or discount amount. As you deal with increasingly complicated pricing formulas, your algebraic skills in solving linear equations and substitution become very important.

Many of the pricing problems take multiple steps that combine various formulas, so you need to apply the analytical approach to problem solving, not just focus on formulas. In any pricing problem, you must understand which variables are provided and match them up to the known relationships. To get to your end goal, you must look at combining and rearranging relationships until you are able to express the quantity you are looking for using the quantities whose values you know. In these cases, solving for unknowns will move you forward toward solving the overall pricing problem.

Throughout the examples in this chapter you will see many applications of these algebraic skills.

Remember to apply the rounding rules:

1. Until you arrive at the final solution, avoid rounding any interim numbers unless you have some special reason to do so.

2. Round all dollar amounts to the nearest cent. If the dollar amount has no cents, you may write it either without the cents or with the “.00” at the end.

3. Round all percentages to four decimals when in percent format.

Give It Some Thought:

- Will you pay more than, less than, or exactly $10.00 for a product if you are told that you are paying:

a. a net price of $10.00 when there is a discount of 25%?

b. a list price of $10.00 when there is a discount of 25%? - If an item is subject to a 40% discount, will the net price be more than or less than half of the list price of the product?

Example 4.1A - Determining the Retailer's Net Price for a Pair of Jeans

A manufacturer that sells jeans directly to its retailers found out using market research that it needs to offer the retailers a 25% trade discount. In doing so, the retailers will then be able to price the product at the MSRP of $59.99. What price should the manufacturer charge the retailer for the jeans?

Answer: price to charge to accommodate the trade discount? [latex]\rightarrow[/latex] net price ? [latex]\rightarrow N=?[/latex]

Conditions: list price (MSRP) [latex]L=59.99[/latex], discount rate [latex]d=25\%[/latex]

[latex]\text{net price}=N= L(1-d)=59.99\cdot(1-0.25)= \$ 44.99[/latex]

The manufacturer should sell the jeans to the retailers for $44.99.

Example 4.1B - Determining the List Price of a Jacket

Winners pays a net price of $27.50 for a winter jacket after receiving a retail trade discount of 45%. What was the MSRP of the jacket?

Answer: MSRP = ? [latex]\rightarrow[/latex] list price = ? [latex]\rightarrow L =?[/latex]

Conditions: net price [latex]N=\$27.50[/latex], discount rate [latex]d=45\%[/latex]

[latex]\begin{align*} N&=L(1-d)\\ \\ &\Rightarrow L=\frac{N}{1-d}=\frac{27.50}{1-0.45}= 50.00\\ \end{align*}[/latex]

Therefore, the MSRP, or list price, of the winter jacket is $50.00.

Example 4.1C - Determining the Discount Percent and Discount Amount

You are shopping at Mountain Equipment Co-op for a new environmentally friendly water bottle. The price tag reads $14.75, which is $10.24 off the regular price. Determine the discount rate applied.

Answer: discount rate = ? [latex]\rightarrow d=?[/latex].

Conditions: net price [latex]N=\$14.75[/latex], discount amount [latex]D=\$10.24[/latex]

[latex]\begin{align*} \text{discount rate}&=\frac{\overset{\checkmark}{\text{amount of discount}}}{\underset{?}{\text{regular price}}}\\ \\ &=\frac{\overset{\checkmark}{\text{amount of discount}}}{\underset{\checkmark}{(\text{net price})}+\underset{\checkmark}{(\text{discount amount})}}\\ \\ &=\frac{10.24}{14.75+10.24}\\ &\\ &=0.409764 =40.9764\% \end{align*}[/latex]

The water bottle has been reduced in price by the amount of $10.24, which represents a sale discount of 40.9674%.

Multiple Discounts

You are driving down the street when you see a large sign at Old Navy that says, “Big sale, take an additional 25% off already reduced prices!” In other words, products on sale (the first discount) are being reduced by an additional 25% (the second discount). Therefore we cannot use the single discount relationships here.

Businesses commonly receive more than one discount when they make a purchase. Consider a transaction in which a business receives a 30% trade discount as well as a 10% volume discount. First, you have to understand that this is not a 30% + 10% = 40% discount. The second discount is always applied to the net price after the first discount is applied. Therefore, the second discount has a smaller base upon which it is calculated. If there are more than two discounts, you deduct each subsequent discount from continually smaller bases. We call this the discount series. The relationship below expresses how to calculate the net price when a discount series apply.

Discount series - the fundamental relationship between list price, multiple discount rates, and net price

[latex]\begin{align*} \text{net price}&=(\text{list price})(1-(\text{1st disc. rate}))(1-(\text{2nd disc. rate}))\cdots(1-(n\text{th disc. rate }))\\ \\ N&=L(1-d_1)(1-d_2)\ldots(1-d_n) \end{align*}[/latex]

where

[latex]N[/latex] is net price: The dollar amount of the price after all discounts have been deducted.

[latex]L[/latex] is list price: The dollar amount of the price before any discounts.

[latex]d_1[/latex] is the first discount rate, [latex]d_2[/latex]is the second discount rate, [latex]\ldots d_n[/latex]is nth discount rate

It is often difficult to understand exactly how much of a discount is being received when multiple discounts are involved. Often it is convenient to summarize the multiple discount percentages into a single percentage. This makes it easier to calculate the net price and aids in understanding the discount benefit. Simplifying multiple percent discounts into a single percent discount is called finding the single equivalent discount. Whether you apply the multiple discounts or just the single equivalent discount, you arrive at the same net price. The conversion of multiple discount percentages into a single equivalent discount percent is derived from the fundamental discount series relationship described above.

Single Equivalent Discount

[latex]\begin{align*} \text{equivalent }&\text{single rate of discount}\\ &=1-(1-(\text{1st disc. rate}))(1-(\text{2nd disc. rate}))\cdots(1-(n\text{th disc. rate}))\\ \\ d_{equiv}&=1-(1-d_1)(1-d_2)\cdots(1-d_n) \end{align*}[/latex]

[latex]d_{equiv}[/latex](or just [latex]d[/latex]) is the single equivalent discount rate that is equal to the series of multiple discounts. Recall that taking [latex](1-d)[/latex]calculates what you pay. Therefore, if you take 1, which represents the entire amount, and reduce it by what you pay, the rate left over must be what you did not pay. In other words, it is the discount rate.

[latex]d_1[/latex]is the first discount rate, [latex]d_2[/latex]is the second discount rate, [latex]d_n[/latex]is [latex]n[/latex]th discount rate

For example, suppose a product with an MSRP of $100 receives a trade discount of 30% and a volume discount of 10%. Calculate the net price.

The task is to find the net price and we are given the list (MSRP) price [latex]L[/latex] and a series of discount rates [latex]d_1[/latex] and [latex]d_2[/latex]. Therefore,

[latex]\begin{align*} \text{net price}&=N=L(1-d_1)(1-d_2)\\ &=100\cdot(1-0.30)\cdot(1-0.10)=\$ 63 \end{align*}[/latex]

If you are solely interested in converting multiple discounts into a single equivalent discount, then

[latex]\begin{align*} d_{equiv}&=1-(1-0.30)\cdot(1-0.10)\\ &=0.37=37\% \end{align*}[/latex]

Therefore, whenever discounts of 30% and 10% are offered together, the single equivalent discount is 37%. Whether it is the multiple discounts or just the single equivalent discount that you apply to the list price, the net price calculated is always the same.

Order of Discounts

The order of the discounts does not matter in determining the net price. Remember from the rules of order of operations that you can complete multiplication in any order. Therefore, in the above example you could have arrived at the $63 net price through the following calculation:

[latex]\begin{align*} 100\cdot(1-0.10)\cdot(1-0.30)= 63\\ \end{align*}[/latex]

The order of the discounts does matter if trying to interpret the value of any single discount. If the trade discount is applied before the quantity discount and you are wanting to know the quantity discount amount, then the quantity discount needs to be second. Thus, in the example above.

[latex]\begin{align*} \text{price after trade discount}&=\text{list price}(1-(\text{trade discount rate})\\ &=100\cdot(1-0.30)=$ 70\\ &\\ \Rightarrow\text{quantity disc. amount}&= (\text{quantity disc. rate})(\text{price after trade disc.})\\ &=0.10\cdot 70=\$ 7 \end{align*}[/latex]

Price Does Not Affect Single Equivalent Discount

Notice that the list price and the net price are not involved in the calculation of the single equivalent discount. When working with percentages, whether you have a net price of $6.30 and a list price of $10, or a net price of $63 and a list price of $100, the equivalent percentage always remains constant at 37%.

A common mistake when working with multiple discounts is to add the discounts together to calculate the single equivalent discount. This mistaken single discount will arrive at the wrong net price. Remember that if two discounts of 30% and 10% apply, you cannot sum these discounts. The second discount of 10% is applied on a smaller price tag, not the original price tag. To calculate the net price you must apply the discount series formula.

If you happen to know any two of the net price ([latex]N[/latex]), list price ( [latex]L[/latex]), or the total discount amount ([latex]D[/latex]), then you could also use the single discount formulas to solve for the single equivalent discount, [latex]d_{equiv}[/latex].

For example, if you know the net price is $63 and the total discount amount for all discounts is $37, you could figure out that the list price is the sum of the two, or $100, then calculate the discount amount as a percentage of the list price. This method will also produce a single equivalent discount of 37%.

Another method of calculating the single equivalent discount is to recognize the calculation of the net price using a list price and a discount rate as a calculation involving percent change. The variable [latex]d[/latex] is a discount rate, which you interpret as a negative percent change rate. The discount amount, [latex]D[/latex], is the difference between the list price (representing the original price) and the net price (representing the new price after the discount). Therefore, the single discount relationships can be rewritten as follows:

[latex]\begin{align*} \text{net price}&=(\text{list price})(1-(\text{discount rate}))\\ &=(\text{list price})-(\text{discount rate})(\text{list price})\\ &\\ \text{new price}&=(\text{orig. price})(1-\%(\text{decrease})\\ &=(\text{orig. price})-\%(\text{ decrease})(\text{orig. price}) \end{align*}[/latex]

Therefore, any question about a single equivalent discount where net price and list price are known can be solved as a percent change. Using our ongoing net price example, you have:

[latex]\begin{align*} \text{% change in price}&=\frac{\text{amount of change in price}}{\text{original price}}\\ &=\frac{63-100}{$ 100}=-0.37=-37\% \end{align*}[/latex]

This is a discount of 37%.

Give It Some Thought:

3. If you are offered discounts in the amount of 25%, 15%, 10%, and 5%, will your total discount percent be 55%, less than 55%, or more than 55%?

Example 4.1D - Retailer Purchasing Ski-Doos with Multiple Discounts

A retail dealership purchases some Expedition TUV Yeti II Ski-Doos to stock in its stores. Examining the merchandising terms of the manufacturer, Bombardier, the dealership notices that it would be eligible to receive a 35% trade discount, 15% volume discount, and 3% loyalty discount. Because it is June and Ski-Doos are out of season, Bombardier offers a seasonal discount of 12% for purchases made before June 30. If the MSRP for the Ski-Doo is $12,399.00 and the dealership purchases this item on June 15, what price would it pay?

Answer: Ski-Doo price after discounts? [latex]\rightarrow N=?[/latex]

Conditions: list (MSRP) price [latex]L=\$12,399.00[/latex],

discount series: [latex]d_{\text{trade}}=35\%, d_{\text{volume}}=15\%, d_{\text{loyalty}}=3\%, d_{\text{early}}=12\%[/latex]

[latex]\begin{align*} N&=L(1-d_{\text{trade}})(1-d_{\text{volume}})(1-d_{\text{loyalty}})(1-d_{\text{early}})\\ \\ &= 12399\cdot(1-0.35)\cdot(1-0.15)\cdot(1-0.03)\cdot(1-0.12)\\ \\ &=\$ 5,847.54 \end{align*}[/latex]

Therefore, after all four discounts, the retail dealership could purchase the Ski-Doo for $5,847.54.

Example 4.1E - Reducing Multiple Discounts to a Single Equivalent Discount

The retail dealership in Example 4.1D purchases more products subject to the same discounts. It needs to simplify its calculations. Using the information from Example 4.1D, what single equivalent discount is equal to the four specified discounts?

Answer: single equivalent discount? [latex]\rightarrow d_{equiv} =?[/latex]

Conditions: discount series: [latex]d_{\text{trade}}=35\%, d_{\text{volume}}=15\%, d_{\text{loyalty}}=3\%, d_{\text{early}}=12\%[/latex]

[latex]\begin{align*} d_{equiv}&=1-(1-d_{\text{trade}})(1-d_{\text{volume}})(1-d_{\text{loyalty}})(1-d_{\text{early}})\\ \\ &=1-(1-0.35)(1-0.15)(1-0.03)(1-0.12)\\ \\ &=0.528386=52.8386\%\\ \end{align*}[/latex]

Therefore, the retail dealership can apply a 52.8386% discount to all the products it purchases.

Example 4.1F - Making a Smart Consumer Purchase

You are shopping on Boxing Day for an 80" HDTV. You have just one credit card in your wallet, a cashback Visa card, which allows for a 1% cash rebate on all purchases. While scanning flyers for the best deal, you notice that Visions is selling the TV for $5,599.99 including taxes, while Best Buy is selling it for $5,571.99 including taxes. However, because of a computer glitch Best Buy is unable to accept Visa today. Where should you buy your television?

Answer: cheaper price after discounts? [latex]\rightarrow[/latex] net price at each store?

Visions conditions: list price =$5,999.99, cash discount rate 1%

[latex]\begin{align*} \text{Visions price after rebate}&=(\text{list price})(1-(\text{cash discount rate}))\\ \\ &=5999.99(1-0.01)=\$ 5,543.99 \end{align*}[/latex]

Best Buy conditions: list price =$5,571.99, no discounts apply [latex]\rightarrow[/latex] the list price equals the net price, or $5,571.99.

Therefore, the net price for Visions is lower of the two. You save $5,571.99 – $5,543.99 = $28.00 by purchasing your TV at Visions.

Example 4.1G - Understanding the Price

An advertisement claims that at 60% off, you are saving $18. However, today there is an additional 20% off. What price should you pay for this item? How much will you save? What percent savings does this represent?

Answer:

Task(s): net price?; savings? (discount amount?); equivalent single discount rate?

Net price?

conditions: first discount amount = $18, two discount rates: [latex]d_1=60\%, d_2=20\%[/latex]

[latex]\begin{align*} \text{net price}&=(\overset{?}{\text{list price}})(1-\overset{\checkmark}{(\text{1st disc. rate}))}\overset{\checkmark}{(1-(\text{2nd disc. rate}))}\\ \end{align*}[/latex]

Since we know the discount amount resulting from list price reduced by first discount rate,

[latex]\begin{align*} \text{1st disc. amount}&=(\text{1st disc. rate})(\text{list price})\\ \\ &\Rightarrow \text{list price}=\frac{\text{1st disc. amount}}{\text{1st disc. rate}} \end{align*}[/latex]

we have

[latex]\begin{align*} \text{net price}&=\frac{\overset{\checkmark}{\text{1st disc. amount}}}{\underset{\checkmark}{\text{1st disc. rate}}}\cdot (1-\overset{\checkmark}{(\text{1st disc. rate}))}\overset{\checkmark}{(1-(\text{2nd disc. rate}))}\\ \\ &=\frac{18}{0.60}(1-0.6)(1-0.2)\\ \\ &=\$9.60 \end{align*}[/latex]

Savings?

[latex]\begin{align*} \text{savings}&=(\text{list price})-(\text{net price})\\ \\ &=\frac{{\text{1st disc. amount}}}{{\text{1st disc. rate}}}-(\text{net price})\\ \\ &=\frac{18}{0.60}-9.60\\ \\ &=\$20.40 \end{align*}[/latex]

Equivalent single discount rate?

[latex]d_{equiv}=1-(1-d_1)(1-d_2)=1-(1-0.6)(1-0.2)=0.68=68\%[/latex]

Hence, you should pay $9.60 for the item, which represents savings of $20.40 or a 68% savings.

Give It Some Thought Answers

- a. Exactly $10. The net price is the price after the discount.

b. Less than $10. The discount needs to be removed from the list price. - More than half. A 40% discount means that you will pay 60% of the list price.

- Less than (approx. 45.49%).

Section Exercises - after the reading

Work on section 4.1 exercises in Fundamentals of Business Math Exercises after reading this section. Discuss your solutions with your peers and/or course instructor.

You may consult answers to select exercises: Fundamentals of Business Math Exercises – Select Answers