3.2 Simple Interest: Maturity Value

LEARNING OBJECTIVES

- Calculate the maturity value for simple interest transactions.

The maturity value of a transaction is the amount of money resulting at the end of a transaction. That is, the maturity value is the sum of the principal and the interest together. It is called a maturity value because, in the financial world, the termination of a financial transaction is known as the "maturing" of the transaction. The amount of principal with interest at some point in the future, but not necessarily the end of the transaction, is known as the future value.

For any financial transaction involving simple interest, the following is true

Applying algebra, you can summarize this expression by the following equation, where the future value or maturity value is commonly denoted by the symbol [latex]S[/latex].

[latex]\displaystyle{S = P + I}[/latex]

Substituting in [latex]I=P \times r \times t[/latex] for [latex]I[/latex] yields the equation

[latex]\begin{eqnarray*} S & = & P + P \times r \times t \\ & = & P \times (1+ r \times t) \end{eqnarray*}[/latex]

The Maturity Value Formula

The maturity value ([latex]S[/latex]) is

[latex]\begin{eqnarray*} S & = & P \times (1+ r \times t) \end{eqnarray*}[/latex]

where

- [latex]S[/latex] is the maturity value. This is the total principal plus interest.

- [latex]P[/latex] is the present value or principal. This is the amount borrowed or invested at the beginning of the time period.

- [latex]r[/latex] is the simple interest rate. This is the rate of interest that is charged or earned during a specified time period. The simple interest rate is expressed as a percent for a given time period, usually annually or per year, unless otherwise specified.

- [latex]t[/latex] is the period of time or term of the investment or loan. The time period is the length of time for which interest is earned or charged on the investment or loan respectively.

From the maturity value formula [latex]S=P\times(1+r\times t)[/latex] you can derive the following formula to calculate the principal [latex]P[/latex]:

[latex]\begin{eqnarray*}P & = & \frac{S}{1+r\times t}\end{eqnarray*}[/latex]

Given the maturity value and principal, the amount of simple interest is:

[latex]\displaystyle{I=S-P}[/latex]

EXAMPLE

Assume that today you have $10,000 that you are going to invest at 7% simple interest for 11 months. How much money will you have in total at the end of the 11 months? How much interest do you earn?

Solution:

Step 1: The given information is

[latex]\begin{eqnarray*} P & = & \$10,000 \\ r & = & 7\% \\ & = & 0.07 \\ t & = & 11 \mbox{ months} \end{eqnarray*}[/latex]

Step 2: Convert the time period from years to months.

[latex]\displaystyle{t=\frac{11}{12}}[/latex]

Step 3: Solve for the maturity value, [latex]S[/latex].

[latex]\begin{eqnarray*} S & = & P \times (1+ r \times t) \\ & = & 10,000 \times \left(1+0.07 \times \frac{11}{12} \right) \\ & = & \$10,641.67 \end{eqnarray*}[/latex]

The total amount after 11 months is $10,641.67.

Step 4: Solve for the interest amount, [latex]I[/latex].

[latex]\begin{eqnarray*} I & = & S-P \\ & = & 10,641.67-10,000 \\ & = & \$641.67 \end{eqnarray*}[/latex]

The $10,000 earns $641.67 in simple interest over the next 11 months, resulting in $10,641.67 altogether.

EXAMPLE

You just inherited $35,000 from your uncle's estate and plan to purchase a house four months from today. If you use your inheritance as your down payment on the house, how much will you be able to put down if your money earns 4.25% simple interest? How much interest will you have earned?

Solution:

Step 1: The given information is

[latex]\begin{eqnarray*} P & = & \$35,000 \\ r & = & 4.25\% \\ & = & 0.0425 \\ t & = & 4 \mbox{ months} \end{eqnarray*}[/latex]

Step 2: Convert the time period from years to months.

[latex]\displaystyle{t=\frac{4}{12}}[/latex]

Step 3: Solve for the maturity value, [latex]S[/latex].

[latex]\begin{eqnarray*} S & = & P \times (1+ r \times t) \\ & = & 35,000 \times \left(1+0.0425 \times \frac{3}{12} \right) \\ & = & \$35,495.83 \end{eqnarray*}[/latex]

Step 4: Solve for the interest amount, [latex]I[/latex].

[latex]\begin{eqnarray*} I & = & S-P \\ & = & 35,495.83-35,000 \\ & = & \$495.83 \end{eqnarray*}[/latex]

Four months from now you will have $35,495.83 as a down payment toward your house, which includes $35,000 in principal and $495.83 in interest.

EXAMPLE

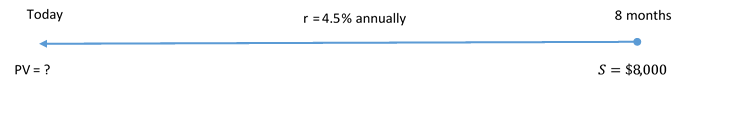

You need $8,000 for tuition in the fall and the best simple interest rate you could find was 4.5%. Assume you have eight months before you need to pay your tuition. How much money do you need to invest today?

Solution:

Step 1: The given information is

[latex]\begin{eqnarray*} S & = & \$8,000 \\ r & = & 4.5\% \\ & = & 0.045 \\ t & = & 8 \mbox{ months} \end{eqnarray*}[/latex]

Step 2: Convert the time period from months to years.

[latex]\displaystyle{t=\frac{8}{12}}[/latex]

Step 3: Solve for the principal, [latex]P[/latex].

[latex]\begin{eqnarray*} P & = & \frac{S}{1+r \times t} \\ & = & \frac{8000}{1+0.045 \times \frac{8}{12}} \\ & = & \$7,766.99 \end{eqnarray*}[/latex]

If you place $7,766.99 into the investment, it will grow to $8,000 in eight months.

EXAMPLE

You are sitting in an office at your local financial institution on August 4, 2023. The bank officer says to you, "We will make you a great deal. If we advance that line of credit and you borrow $20,000 today, when you want to repay that balance on September 1, 2023 you will only have to pay us $20,168.77, which is not much more!" Before answering, you decide to evaluate the statement. Calculate the simple interest rate that the bank officer used in her calculations.

Solution:

Step 1: Calculate the number of days between August 4, 2023 and September 1, 2023 using the financial calculator.

| DT1 | 8.0423 |

| DT2 | 9.0123 |

| DBD | 28 |

Step 2: The given information is

[latex]\begin{eqnarray*} P & = & \$20,000 \\ S & = & \$20,168.77 \\ t & = & 28 \mbox{ days} \end{eqnarray*}[/latex]

Step 3: Convert the time period from days to years.

[latex]\displaystyle{t=\frac{28}{365}}[/latex]

Step 4: Solve for the interest, [latex]I[/latex].

[latex]\begin{eqnarray*}I & = & S-P \\& = & 20,168.77-20,000 \\ & = & \$168.77 \end{eqnarray*}[/latex]

Step 5: Solve for the rate, [latex]r[/latex].

[latex]\begin{eqnarray*} r & = & \frac{I}{P \times t} \\ & = & \frac{168.77}{20,000 \times \frac{28}{365}} \\ & = & 0.110002 \\ & \rightarrow & 11.0002\% \end{eqnarray*}[/latex]

The interest rate on the offered line of credit is 11.0002%. (Note: The rate is probably exactly 11%. The extra 0.0002% is most likely due to the rounded amount of interest used in the calculation.)

NOTE

In the previous example, you could also solve for the interest rate directly from the maturity value formula, without having to calculate the interest separately.

\begin{eqnarray*} S & = & P \times (1+r \times t) \\ 20,168.77 & = & 20,000 \times \left(1+r \times \frac{28}{365}\right) \\ 1.0084385 & = & 1+r \times \frac{28}{365} \\ 0.084385 & = & r \times \frac{28}{365} \\ 0.110002 & = & r \end{eqnarray*}

But, it is much easier to solve for [latex]r[/latex] in the simple interest formula [latex]I=P \times r \times t[/latex] than it is to solve for [latex]r[/latex] in the maturity value formula [latex]S=P \times (1+r \times t)[/latex].

TRY IT

An accountant needs to allocate the principal and simple interest on a loan payment into the appropriate ledgers. If the amount received was $10,267.21 for a loan that spanned April 14, 2023 to July 31, 2023 at 9.1%, how much was the principal and how much was the interest?

Click to see Solution

[latex]\begin{eqnarray*} P & = & \frac{S}{1+r \times t} \\ & = & \frac{10,267.21}{1+0.091 \times \frac{108}{365}} \\ & = & \$9,998 \\ \\ I & = & S-P \\ & = & 10,267.21-9,998 \\ & = & \$269.21 \end{eqnarray*}[/latex]

TRY IT

Suppose Robin borrowed $3,600 on October 21, 2022 and repaid the loan on February 21, 2023 of the following year. What simple interest rate was charged if Robin repaid $3,694.63?

Click to see Solution

[latex]\begin{eqnarray*} I & = & S-P \\ & = & 3,694.63-3,600 \\ & = & \$94.63 \\ \\ r & = & \frac{I}{P \times t} \\ & = & \frac{94.63}{3,600 \times \frac{123}{365}} \\ & = & 0.078 \\ & \rightarrow & 7.8\% \end{eqnarray*}[/latex]

Equivalent Payments

- Late Payments. If a debt is paid late, then a financial penalty that is fair to both parties involved should be imposed. That penalty should reflect a current rate of interest and be added to the original payment. Assume you owe $100 to your friend and that a fair current rate of simple interest is 10%. If you pay this debt one year late, then a 10% late interest penalty of $10 should be added, making your debt payment $110. This is no different from your friend receiving the $100 today and investing it himself at 10% interest so that it accumulates to $110 in one year.

- Early Payments. If a debt is paid early, there should be some financial incentive (otherwise, why bother?). Therefore, an interest benefit, one reflecting a current rate of interest on the early payment, should be deducted from the original payment. Assume you owe your friend $110 one year from now and that a fair current rate of simple interest is 10%. If you pay this debt today, then a 10% early interest benefit of $10 should be deducted, making your debt payment today $100. If your friend then invests this money at 10% simple interest, one year from now he will have the $110, which is what you were supposed to pay.

Notice in these examples that a simple interest rate of 10% means $100 today is the same thing as having $110 one year from now. This illustrates the concept that two payments are equivalent payments if, once a fair rate of interest is factored in, they have the same value on the same day. Thus, in general you are finding two amounts at different points in time that have the same value, as illustrated in the figure below.

NOTE

The steps required to calculate an equivalent payment are no different from those for single payments.

- If an early payment is being made, then you know the maturity or future value, so you solve for the present value or principal, which removes the interest.

- If a late payment is being made, then you know the present value or principal, so you solve for the maturity or future value, which adds the interest penalty.

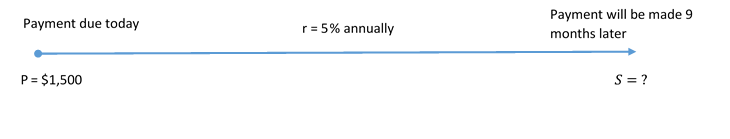

EXAMPLE

Erin owes Charlotte $1,500 today. Unfortunately, Erin had some unexpected expenses and is unable to make her debt payment. After discussing the issue, they agree that Erin can make the payment nine months late and that a fair simple interest rate on the late payment is 5%. Use 9 months from now as your focal date and calculate how much Erin needs to pay. What is the amount of her late penalty?

Solution: A late payment is a maturity value amount, [latex]S[/latex]. The late penalty is equal to the interest, [latex]I[/latex].

Step 1: The given information is

[latex]\begin{eqnarray*} P & = & \$1,500 \\ r & = & 5\% \\ & = & 0.05 \\ t & = & 9 \mbox{ months} \end{eqnarray*}[/latex]

Step 2: Convert the time period from months to years.

[latex]\displaystyle{t=\frac{9}{12}}[/latex]

Step 3: Solve for the maturity value, [latex]S[/latex].

[latex]\begin{eqnarray*} S & = & P \times (1+r \times t) \\ & = & 1,500 \times \left(1+0.05 \times \frac{9}{12} \right) \\ & = & \$1,556.25 \end{eqnarray*}[/latex]

Step 4: Solve for the interest, [latex]I[/latex].

[latex]\begin{eqnarray*}I & = & S-P \\& = & 1,556.25-1,500 \\ & = & \$56.25 \end{eqnarray*}[/latex]

Erin's late payment is for $1,556.25, which includes a $56.25 interest penalty for making the payment nine months late.

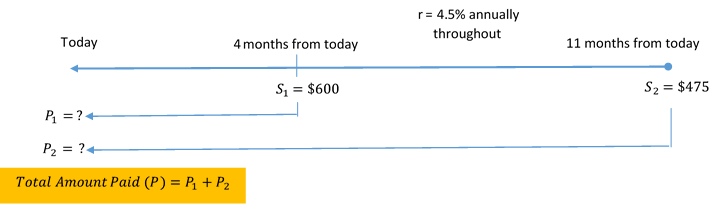

EXAMPLE

Rupert owes Aminata two debt payments: $600 four months from now and $475 eleven months from now. Rupert came into some money today and would like to pay off both of the debts immediately. Aminata has agreed that a fair interest rate is 7%. Using today as a focal date, what amount should Rupert pay? What is the total amount of his early payment benefit?

Solution: An early payment is a present value amount, [latex]P[/latex]. Both payments will be moved to today and summed. The early payment benefit will be the total amount of interest removed, [latex]I[/latex].

Step 1: The given information is

| Payment #1 | [latex]\begin{eqnarray*} S_1 & = & \$600 \\ r & = & 7\% \\ & = & 0.07 \\ t & = & 4 \mbox{ months} \end{eqnarray*}[/latex] |

| Payment #2 | [latex]\begin{eqnarray*} S_2 & = & \$475 \\ r & = & 7\% \\ & = & 0.07 \\ t & = & 11 \mbox{ months} \end{eqnarray*}[/latex] |

Step 2: Convert the time periods from months to years.

- Payment #1: [latex]\displaystyle{t=\frac{4}{12}}[/latex]

- Payment #2: [latex]\displaystyle{t=\frac{11}{12}}[/latex]

Step 3: Solve for the principal for each payment.

- Payment #1: Solve for [latex]P_1[/latex]

[latex]\begin{eqnarray*} P_1 & = & \frac{S_1}{1+r \times t} \\ & = & \frac{600}{1+0.07 \times \frac{4}{12}} \\ & = & \$586.32 \end{eqnarray*}[/latex]

- Payment #2: Solve for [latex]P_2[/latex]

[latex]\begin{eqnarray*} P_2 & = & \frac{S_1}{1+r \times t} \\ & = & \frac{475}{1+0.07 \times \frac{11}{12}} \\ & = & \$446.36 \end{eqnarray*}[/latex]

The total amount paid today, [latex]P,[/latex] is

[latex]\begin{eqnarray*} P & = & P_1+P_2 \\ & = & 586.32+446.36 \\ & = & \$1,032.68\end{eqnarray*}[/latex]

Step 4: Calculate the total amount of interest [latex]I[/latex].

[latex]\begin{eqnarray*} \mbox{Interest for Payment 1} & = & S_1-P_1 \\ & = & 600-586.32 \\ & = & \$13.68 \\ \\ \mbox{Interest for Payment 2} & = & S_2-P_2 \\ & = & 475-446.36 \\ & = & \$28.64 \\ \\ I & = & 13.68+28.64 \\ & = & \$42.32 \end{eqnarray*}[/latex]

To clear both debts today, Rupert pays $1,032.68, which reflects a $42.32 interest benefit reduction for the early payment.

Exercises

- On January 23, 2023, a loan is taken out for $15,230 at 8.8% simple interest. What is the maturity value of the loan on October 23, 2023?

Click to see Answer

$16,232.34

- How many weeks will it take $5,250 to grow to $5,586 at a simple interest rate of 10.4%? Assume 52 weeks in a year.

Click to see Answer

32 weeks

- Jayne needs to make three payments to Jade requiring $2,000 each 5 months, 10 months, and 15 months from today. She proposes instead making a single payment on a focal date eight months from today. If Jade agrees to a simple interest rate of 9.5%, what amount should Jayne pay?

Click to see Answer

$5,911.32

- Over a period of nine months, $40.85 of simple interest is earned at 1.75% per quarter. Calculate both the principal and maturity value for the investment.

Click to see Answer

P=$778.10, S=$818.95

- The Home Depot is clearing out lawn mowers for $399.75 in an end-of-season sale that ends on September 30, 2022. Alternatively, you could wait until April 1, 2023 and pay $419.95 on the same lawn mower. Assume your money can earn simple interest of 4.72% on a short-term investment.

- Which option should you choose?

- How much money will you have saved on September 30 by making that choice?

Click to see Answer

a. September, price is lower by $399.75, b. savings of $10.49

- Alia took out three back-to-back short-term simple interest investments. On November 10, 2023, Alia had saved up a total of $12,986.75. Her interest rate for each investment is listed below:

Date Interest Rate March 2, 2023 to June 19, 2023 4.13% June 19, 2023 to October 7, 2023 4.63% October 7, 2023 to November 10, 2023 4.43% How much did Alia originally invest on March 2, 2023? Assume that the principal and interest from a prior investment are both

placed into the next investment.Click to see Answer

$12,600

Attribution

“8.2: Moving Money Involving Simple Interest” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“8.2: Moving Money Involving Simple Interest” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.