4.5 Transportation and the Global Value Chain

Learning Objectives

4. Explain how transportation adds value to the global value chain.

Transportation adds value to the global value chain for many aspects such as reducing time delivery, efficiency, reliability, flexibility, increasing visibility, transparency, and enhancing customer satisfaction and service. Moreover, transport logistics can use data for analyzing costs and expenses for optimizing future transport planning for being more effective and adding value to the global value chain. In addition, various transportation networks can significantly impact global economic integration, export service, the connection between countries and continents, and help less economically developed regions stimulate foreign trade (Chen, Notteboom, Liu, Yu, Nikitakos, & Chen, 2019).

The global chain relies on efficiency and flexibility of transport; that is why many companies use intermodal modes. Internodal transportations and containers increase security, reduce loss and damage, and increase shipment speed and efficiency. Different organizations choose different transportation methods suitable for the firm’s objectives. Companies need to select the proper transport for moving their goods. Without transportation, businesses cannot exist. For example, raw materials should be moved to production and manufacturing destinations to create finished goods that should be delivered on time to customers. The global value chain adds a competitive advantage to businesses, organizations, and industries. Maximizing inbound and outbound logistics and operations are keys to success for the competitive world’s business field (Tarver, 2021). It’s self-evident that technical improvements help intermodal transportation be more efficient for connecting between modes of transport and the value chain.

The Role of Transportation Networks in Moving Canadian Trade

The following is from The Role of Transportation Networks in Moving Canadian Trade by Stephen Tapp (2016) under the Creative Commons/No Derivatives Licence 4.0:

The efficiency and reliability of a country’s transportation networks are key drivers of international competitiveness, and can help expand global trade and attract foreign investment. This is particularly true with the emergence of a “supply chain mindset” as production processes become more international. Jacques Roy (HEC Montréal, Professor of Logistics and Operations Management), examines the role of Canada’s transportation infrastructure in moving goods in and out of the country by four key transportation modes: road, rail, sea and air.

Overall, he finds that Canada’s transportation and logistics networks perform reasonably well compared with other countries. But he identifies several areas for improvement, namely for:

- roads: domestic congestion;

- rail: capacity constraints;

- sea: container port competitiveness; and

- air: cargo capacity, competitiveness and airport landing fees.

Roy points out that the countries that lead the global logistics performance rankings have all invested heavily in major hubs to connect various transportation modes efficiently. As the new federal government looks to increase infrastructure spending, he urges them to take advantage of the opportunity to enhance Canada’s trade-related infrastructure to support our trade, and thus our longer-term prosperity.

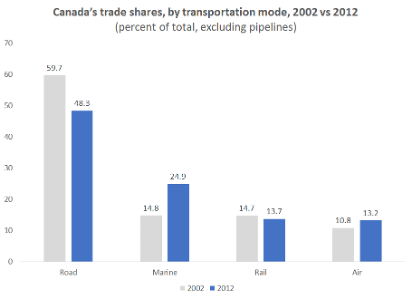

Over the past decade, Canada’s goods trade has become far more reliant on marine transportation and less reliant on roads — although roads remain the most common mode by a wide margin:

Figure 4.6

Canada’s trade shares, by transportation mode

The author suggests two key drivers of these trends.

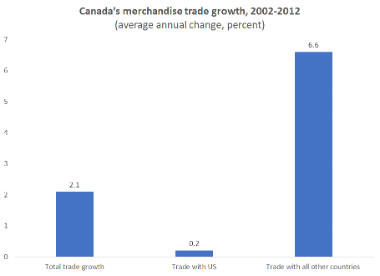

Note. Driver 1: Canadian trade has stagnated with US, but grew with rest of world over the past decade. [Chart description].

Figure 4.7

Canada’s merchandise trade growth

Note. Canada’s merchandise trade growth comparing total growth, trade with US, and other countries. [Chart description].

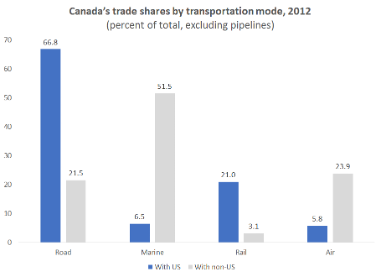

As a result of this differential performance, the share of Canada’s overall merchandise trade conducted with the US shrank from 76% in 2002 to 63% in 2012. These regional shifts matter for transportation because Canadian trade with the US relies heavily on roads (and, to a lesser extent, rail and pipelines), whereas Canadian trade with the rest of the world relies much more — and increasingly — on marine and air modes (figure below). Air is the dominant mode used for trade with Western Europe, while sea is primarily used for trade with Asia.

Figure 4.8

Canada’s trade shares by transportation mode

Note. Driver 2: Increased use containerized freight in recent decades. [Chart description].

The value of Canada’s trade moved by sea nearly doubled between 2002 and 2012. This is largely due to increased containerized freight, which has been a major development in marine (and other) transportation modes in recent decades. Containerization allows for standardized sizes and easier intermodal transportation changes, including the ability to transfer containers seamlessly from ships to rail or trucks. This opens up more possible routes between the origin and final destination.

Canada’s biggest increases in marine traffic were on the country’s West Coast at the ports of Vancouver and Prince Rupert (the latter only started handling containers in 2007), which likely relates to increased trade with Asia, particularly China.

The chapter describes some considerations and trade-offs that firms face when shipping goods in and out of Canada. Roy provides an overview of each transportation mode and some of the emerging issues — this table gives a quick summary:

Table 4.2

Overview the key features of various transportation modes

| Mode | Road | Marine | Rail | Air |

|---|---|---|---|---|

| Attributes | Most flexible delivery option; generally fast and reliable | Cheapest option; large capacity | Cheaper than road and air; large capacity | Most expensive, fastest, but less capacity |

| Examples of goods shipped | Manufactured goods: machinery and equipment, vehicles | Petroleum products, grains, potash, vehicles | Raw materials, agriculture, chemicals, forest products | Pharmaceuticals, aerospace, high-tech, fresh food, newsprint, fashion |

| Key challenges for Canada | Weak exports to United States; higher energy use and emissions; traffic congestion in major cities | Potential impacts of climate change on river depth; labour disputes | Adjusting capacity; new safety regulations | Limited connections to Asia; competitiveness |

The competitiveness of Canada’s global supply chains and the reliability and efficiency of its transportation infrastructure go hand in hand. Over the past decade, a greater share of Canada’s merchandise trade has been transported by sea and air, and relatively less by roads and rail. This is due, in part, to changing regional patterns of Canada’s trade away from the US to other countries, as well as increased use of containers to ship goods.

Nonetheless, although roads have lost significant trade share over this period, they remain the most commonly used transportation mode for Canadian trade by a wide margin. Here, international border crossings no long seem to be a major concern for Canadian businesses. Instead, the bigger outstanding issues are Canada’s weak trade performance with the US, and domestic road congestion in major cities (such as Toronto, Montreal and Vancouver), which causes delays and additional costs for Canadian traders.

For its part, Canada’s rail system has faced capacity constraints and service issues, as well as safety concerns and regulatory reviews after the tragic accident in Lac-Mégantic in 2013.

Canadian ports and airports have become bigger conduits of international trade over the past decade, and recently concluded trade deals (CETA with the European Union and the TPP with 11 other Pacific Rim countries), if implemented, could reinforce these trends.

Canadian ports are generally well-equipped to handle bulk products, but the competitiveness of container ports is more fragile. Recent challenges include labour disputes, in both Canada and the US, reduced rail capacity in the winter to transport containers further inland to their final destinations, and the longer-term concern over climate change, which could reduce river depth and handling capacity along the Saint Lawrence Seaway.

A perennial challenge for Canada’s air cargo is its limited market size. This limits freighter capacity and makes it hard to compete on costs relative to US alternatives, which increasingly have been used to transport Canada’s aerospace exports (a phenomenon called “international leakage”). Canada’s competitive disadvantage is exacerbated by relatively high taxes and landing fees.

Compared with other countries, Canada generally has a competitive transportation infrastructure and overall good logistics performance.

As the new federal government looks to increase infrastructure spending, it should adopt a long-term view and take advantage of the opportunity to enhance Canada’s trade-related infrastructure to support the country’s international trade and longer-term prosperity.

(Tapp, 2016). CC-ND-4.0

Check Your Understanding

Explain how transportation adds value to the global value chain.

Answer the question(s) below to see how well you understand the topics covered above. You can retake it an unlimited number of times.

Use this quiz to check your understanding and decide whether to (1) study the previous section further or (2) move on to the next section.

Overall Activity Feedback

Transportation adds value to the global value chain for many aspects such as reducing time delivery, efficiency, reliability, flexibility, increasing visibility, transparency, and enhancing customer satisfaction and service. The global chain relies on efficiency and flexibility of transport; that is why many companies use intermodal modes. Maximizing inbound and outbound logistics and operations are keys to success in the competitive world’s business field. It’s self-evident that technical improvements help intermodal transportation be more efficient for connecting between modes of transport and the value chain.