8.4 Chapter Summary

Key Concepts

- 8.1 Net Present Value

- The characteristics of making decisions including decision types, monetary sources, and interest rates.

- Making decisions through net present value.

- 8.2 Internal Rate of Return

- Using internal rate of return to choose whether to pursue one course of action.

Glossary of Terms

- Cash Flow. A movement of money into or out of a particular project.

- Cost of Capital. A weighted average of all of the debt and equity financing rates used to provide needed funds for a project.

- Internal Rate of Return (IRR). The annual rate of return on the investment being made such that the net present value of all cash flows in a particular project equals zero.

- Net Present Value (NPV). The difference in today’s dollars between all benefits and costs for any given project.

Formulas

-

Symbols Used

- [latex]NPV[/latex] = net present value

- [latex]IRR[/latex] = internal rate of return

-

Formulas Used

- Net Present Value: [latex]NPV = \mbox{(Sum of PV of All Future Cash Flows)} − \mbox{(Initial Investment)}[/latex] or [latex]NPV = \mbox{(Sum of PV of Cash Inflows)} − \mbox{(Sum of PV of Cash Outflows)}[/latex]

Calculator

-

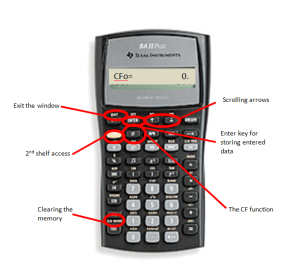

Cash Flow Worksheet

- Access the cash flow function by pressing CF on the keypad.

- Always clear the memory using 2nd CLR WORK so that any previously entered data is deleted.

- Use the up arrow and down arrow to scroll through the various lines.

- Strictly adhere to the cash flow sign convention when using this function and press ENTER after keying in the data.

- To exit the window, press 2nd QUIT.

- The various lines are summarized below:

- CFo = any cash flow today.

- CXX = a particular cash flow, where XX is one of a series of cash flow numbers starting with 01. You must key in cash flows in order from the first time segment to the last. You cannot skip a time segment, even if it has a value of zero, because each time segment is a placeholder on the timeline.

- FXX = the frequency of a particular cash flow, where XX is the cash flow number. It is how many times in a row the corresponding cash flow amount occurs. This allows you to enter recurring amounts together instead of keying them in separately. By default, the calculator sets this variable to 1.

-

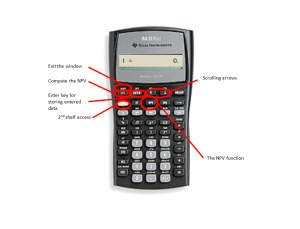

Net Present Value

- Use this function after you have entered all cash flows.

- Press NPV on the keypad to access the function.

- Use the up arrow and down arrow to scroll through the window.

- To exit the window, press 2nd QUIT.

- This window has two lines:

- I = the matching periodic interest rate for the interval of each time segment.

- NPV = the net present value. Press CPT to calculate this amount.

-

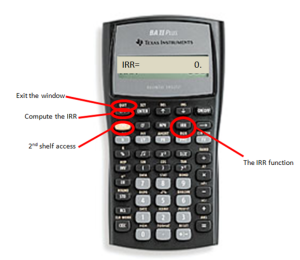

Internal Rate of Return

- Use this function after you have entered all cash flows.

- Press IRR on the keypad to access the function.

- Press CPT button to perform the calculation. The output is in percent format.

- To exit the window, press 2nd QUIT.

Figure 8.4.3

Cash Flows 1: Net Present Value (NPV) and IRR Calculations by Joshua Emmanuel [2:52] (transcript available).

Attribution

“Chapter 15 Summary” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.