6.2 Calculating the Principal and Interest Components of a Loan Payment

LEARNING OBJECTIVES

- Calculate the principal and interest components of any payment.

- Calculate the loan balance after any payment.

- Calculate the total principal paid and total interest paid for a series of payments.

How much of the principal do you pay off when you make a loan payment? One year ago you purchased your $250,000 dream home on a 25-year mortgage at a fixed 5% compounded semi-annually interest rate. With monthly contributions of $1,454.01, or $17,448.12 in total for the past year, you figure you must have put a serious dent in the balance owing. But you get a rude shock when you inspect your mortgage statement and see that the remaining balance is $244,806.89, reflecting a principal reduction of only $5,193.11! The other 70% of your hard-earned money, amounting to $12,255.01, went solely toward the bank's interest charges.

Many people do not fully understand how their loan payments are portioned out. Over the full course of the 25-year mortgage you will pay $186,204.46 in interest charges at 5% compounded semi-annually, or approximately 74.5% of the home's price tag. That is a total of $436,204.46 paid on a $250,000 home. Term, interest rates, payment amounts, and payment frequency all affect the amount of interest you pay.

These calculations should make it clear that both businesses and consumers need to understand the interest and principal components of loan payments, as well as the remaining balance after each loan payment is made. In the previous section, you already learned how to find the interest, principal, and balance for any loan payment—these are just the entries in the amortization schedule. In this section, we will review how to find these values for any payment, as well as learn how to calculate the total interest paid and total principal paid for a series of payments.

Calculating the Interest Paid, Principal Paid and Balance for a Single Payment

At any point during an amortized loan you can precisely calculate how much any single payment contributes toward principal and interest, and what your outstanding balance is on the loan after a payment is made. This is exactly what each row of the amortization schedule tells you—each row separates the payment into its interest paid and principal paid components, and the balance after the payment is made. Just like in the previous section, you can use the amortization worksheet on your financial calculator to find the interest paid (INT), principal paid (PRN), and balance (BAL) for any payment.

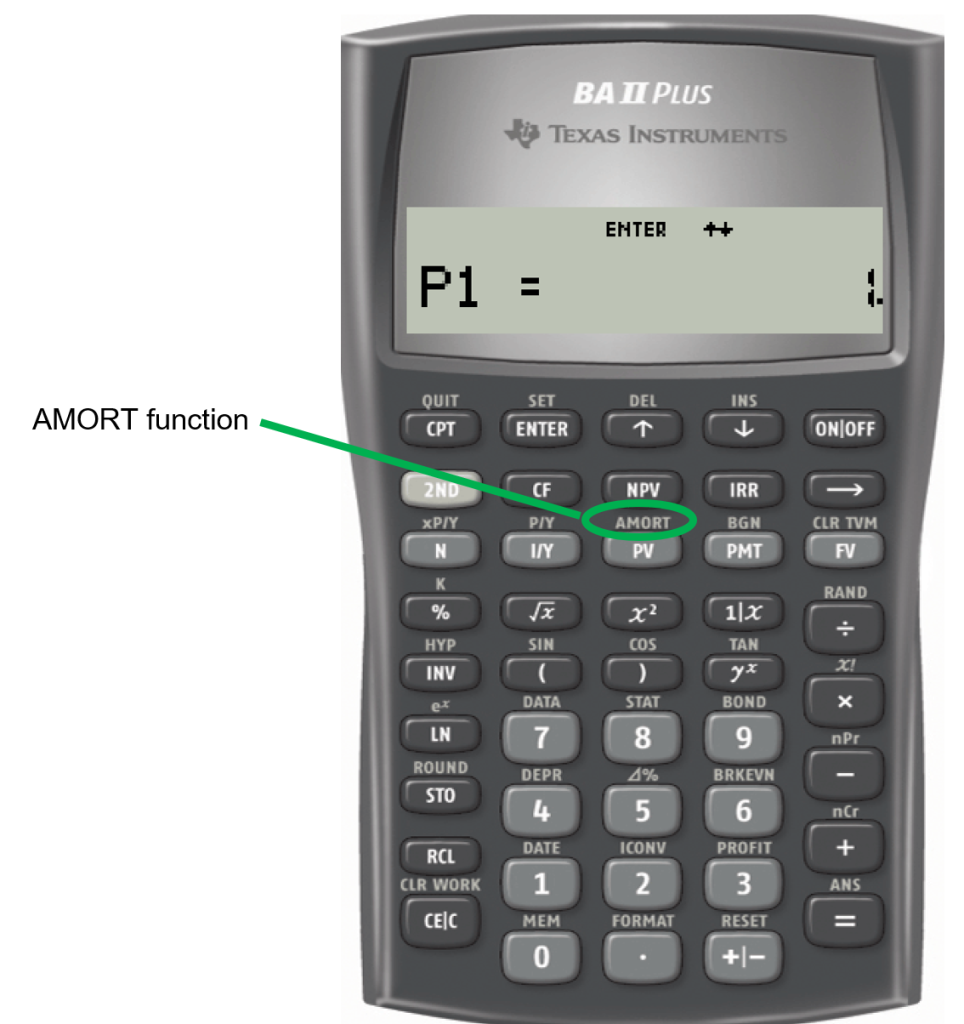

USING THE TI BAII PLUS CALCULATOR TO FIND THE INTEREST PAID, PRINCIPAL PAID, AND BALANCE OF A LOAN PAYMENT

The amortization worksheet has five variables (P1, P2, BAL, PRN, INT). You use the up and down arrows to scroll through the amortization worksheet.

- P1 is the starting payment number. The calculator works with a single payment or a series of payments.

- P2 is the ending payment number. This number is the same as P1 when you work with a single payment (i.e. to find the entries for a row of the amortization schedule). When you work with a series of payments later in this section, you set it to a number higher than P1.

- BAL is the principal balance remaining after the P2 payment number. The cash flow sign is correct as indicated on the calculator display.

- PRN is the principal portion of the payments from P1 to P2 inclusive. Ignore the cash flow sign.

- INT is the interest portion of the payments from P1 to P2 inclusive. Ignore the cash flow sign.

To use the amortization worksheet to find the interest paid, principal paid, and balance of a payment:

- Solve for any unknown quantities about the loan. You need to know all of the information about the loan first before you can use the amortization worksheet.

- Enter the values of all seven time value of money variables into the calculator (N, PV, FV, PMT, I/Y, P/Y, C/Y). If you calculated PMT in the first step, you must re-enter it rounded to two decimals and with the correct cash flow sign. Make sure the payment setting is set to END, and obey the cash flow sign convention. Because this is a loan, PV (the loan amount) is positive and PMT is negative.

- Go to the amortization worksheet by pressing 2nd AMORT (the PV button).

- To view the balance, principal paid, and interest paid for a payment, set P1 and P2 to the corresponding payment number. For example, to view the balance, principal paid, and interest paid for payment 5, set P1=5 and P2=5.

- At the P1 prompt, enter the payment number and press ENTER.

- Press the down arrow.

- At the P2 prompt, enter the payment number and press ENTER.

- Press the down arrow.

- The BAL entry is the balance entry for the corresponding row.

- Press the down arrow.

- The PRN entry is the principal paid entry for the corresponding row.

- Press the down arrow.

- The INT entry is the interest paid entry for the corresponding row.

- Press the down arrow the return to the P1 screen.

Remember, if you are interested in a single payment, you must set P1 and P2 to the exact same value. For example, if you want to see the details of the 22nd payment then both P1 = 22 and P2 = 22.

NOTE

As described above, you can find the interest paid and principal paid components of any payment by using the amortization worksheet on your calculator. To calculate these values by hand, use the following formulas.

- [latex]\mbox{Interest Paid for a Payment}=\mbox{Balance from the Previous Row} \times i[/latex]

- [latex]\mbox{Principal Paid for a Payment}=\mbox{Payment}-\mbox{Interest Paid}[/latex]

where [latex]i[/latex] is the periodic interest rate for the loan.

But, these formulas require two things: that you know the balance from the previous row and that the payment frequency and the compounding frequency for the loan are equal. Although it is possible to solve both of these problems, such as doing an interest conversion to find the equivalent rate with the compounding frequency equal to the payment frequency, the easiest way to find the interest and principal paid components is to use the amortization worksheet on a financial calculator.

EXAMPLE

Your repaid your student loan of $20,000 at 3.5% compounded quarterly with month-end payments over five years.

- What was the outstanding balance on the loan after you made payment 18?

- How much interest was paid with the 27th payment?

- How much principal was paid with the 42nd payment?

- What was the outstanding balance on the loan after three years?

Solution:

Step 1: Calculate the payment.

| PMT Setting | END |

| N | [latex]12 \times 5=60[/latex] |

| PV | [latex]20,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | ? |

| I/Y | [latex]3.5[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]4[/latex] |

[latex]PMT=\$363.74[/latex]

Step 2: Calculate the balance for payment 18. To find the balance for payment 18, set P1=18 and P2=18.

| PMT Setting | END |

| N | [latex]60[/latex] |

| PV | [latex]20,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-363.74[/latex] |

| I/Y | [latex]3.5[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]4[/latex] |

| P1 | [latex]18[/latex] |

| P2 | [latex]18[/latex] |

[latex]BAL=\$14,361.53[/latex]

After 18 payments, the balance on the loan is $14,361.53.

Step 3: Calculate the interest for payment 27. To find the interest for payment 27, set P1=27 and P2=27.

| PMT Setting | END |

| N | [latex]60[/latex] |

| PV | [latex]20,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-363.74[/latex] |

| I/Y | [latex]3.5[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]4[/latex] |

| P1 | [latex]27[/latex] |

| P2 | [latex]27[/latex] |

[latex]INT=\$34.20[/latex]

The interest paid for payment 27 is $34.20.

Step 4: Calculate the principal for payment 42. To find the principal for payment 42, set P1=42 and P2=42.

| PMT Setting | END |

| N | [latex]60[/latex] |

| PV | [latex]20,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-363.74[/latex] |

| I/Y | [latex]3.5[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]4[/latex] |

| P1 | [latex]42[/latex] |

| P2 | [latex]42[/latex] |

[latex]PRN=\$344.21[/latex]

The principal paid for payment 42 is $344.21.

Step 5: Calculate the balance after three years. To find the balance after three years, enter the payment number that corresponds to the last payment made in year three. There are 12 payments a year, so the last payment made in year three is 36 (3×12). So, to find the balance after three years, set P1=36 and P2=36.

| PMT Setting | END |

| N | [latex]60[/latex] |

| PV | [latex]20,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-363.74[/latex] |

| I/Y | [latex]3.5[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]4[/latex] |

| P1 | [latex]36[/latex] |

| P2 | [latex]36[/latex] |

[latex]BAL=\$8,420.49[/latex]

After three years, the balance on the loan is $8,420.49.

NOTE

The calculator thinks in terms of payment numbers, not years. That is, P1 and P2 must be payment numbers. In the last part of the previous example, a common mistake is to set P1=3 and P2=3 to find the balance at the end of year 3. But P1=P2=3 tells the calculator to find the balance after payment number 3, not after year 3. To find the balance at the end of a particular year, you need the number of the last payment to happen in that year. You can find this payment number by multiplying the payment frequency by the year.

For example, suppose a loan has quarterly payments and you want to find the balance at the end of year 5. The last payment to happen in year five is 20 (4×5). The balance at the end of year 5 is the same as the balance for payment 20. In the amortization worksheet you would set P1=20 and P2=20.

TRY IT

A $100,000 loan at 4% compounded semi-annually requires monthly payments of $650.

- How many payments will it take to pay-off the loan?

- How much principal is paid with the 97th payment?

- What is the balance on the loan after the 112th payment?

- How much interest is paid with the 175th payment?

- What is the balance on the loan at the end of year 10?

Click to see Solution

1. Calculate the number of payments.

| PMT Setting | END |

| N | ? |

| PV | [latex]100,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-650[/latex] |

| I/Y | [latex]4[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]2[/latex] |

[latex]N=215.725... \rightarrow 216 \mbox{ payments}[/latex]

2. Calculate the principal for payment 97.

| PMT Setting | END |

| N | [latex]216[/latex] |

| PV | [latex]100,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-650[/latex] |

| I/Y | [latex]4[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]2[/latex] |

| P1 | [latex]97[/latex] |

| P2 | [latex]97[/latex] |

[latex]PRN=\$438.48[/latex]

3. Calculate the balance for payment 112.

| PMT Setting | END |

| N | [latex]216[/latex] |

| PV | [latex]100,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-650[/latex] |

| I/Y | [latex]4[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]2[/latex] |

| P1 | [latex]112[/latex] |

| P2 | [latex]112[/latex] |

[latex]BAL=\$56,789.53[/latex]

4. Calculate the interest for payment 175.

| PMT Setting | END |

| N | [latex]216[/latex] |

| PV | [latex]100,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-650[/latex] |

| I/Y | [latex]4[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]2[/latex] |

| P1 | [latex]175[/latex] |

| P2 | [latex]175[/latex] |

[latex]INT=\$82.78[/latex]

5. Calculate the balance after 10 years.

| PMT Setting | END |

| N | [latex]216[/latex] |

| PV | [latex]100,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-650[/latex] |

| I/Y | [latex]4[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]2[/latex] |

| P1 | [latex]120[/latex] |

| P2 | [latex]120[/latex] |

[latex]BAL=\$53,048.37[/latex]

Calculating the Total Interest Paid and Total Principal Paid for a Series of Payments

Many times in business, you need to know the principal and interest portions for a series of payments. For example, you might need to know the total interest paid or total principal paid on a loan for a particular year. As above, you can use the amortization worksheet on your financial calculator to find the total principal paid or total interest paid for a series of payments.

USING THE TI BAII PLUS CALCULATOR TO FIND THE TOTAL INTEREST PAID OR TOTAL PRINCIPAL PAID FOR A SERIES OF LOAN PAYMENTS

To use the amortization worksheet to find the total interest paid or total principal paid:

- Solve for any unknown quantities about the loan. You need to know all of the information about the loan first before you can use the amortization worksheet.

- Enter the values of all seven time value of money variables into the calculator (N, PV, FV, PMT, I/Y, P/Y, C/Y). If you calculated PMT in the first step, you must re-enter it rounded to two decimals and with the correct cash flow sign. Make sure the payment setting is set to END, and obey the cash flow sign convention. Because this is a loan, PV (the loan amount) is positive and PMT is negative.

- Go to the amortization worksheet by pressing 2nd AMORT (the PV button).

- To view the total principal paid or total interest paid for a series of payments, set P1 to the first payment number of the series of payments and set P2 to the last payment number of the series of payments. For example, to view the total principal paid or total interest paid for payments four to seven, set P1=4 and P2=7. In the outputs from the amortization worksheet:

- The BAL entry is the balance after payment number P2. Note that the BAL entry is only tied to the value of P2 and does not depend on the value of P1.

- The PRN entry is the total principal paid from payment number P1 to payment number P2.

- The INT entry is the total interest paid from payment number P1 to payment number P2.

NOTES

- The PRN entry on the amortization worksheet is the sum of the principal paid entries in the amortization schedule starting at payment number P1 and ending at payment number P2. For example, if P1=4 and P2=7. the PRN entry tells you the sum of the principal paid column in the amortization schedule starting with payment number 4 and ending with payment number 7.

- The INT entry on the amortization worksheet is the sum of the interest paid entries in the amortization schedule starting at payment number P1 and ending at payment number P2. For example, if P1=4 and P2=7. the INT entry tells you the sum of the interest paid column in the amortization schedule starting with payment number 4 and ending with payment number 7.

Mortgage Calculations using BAII Plus by Joshua Emmanuel [4:13] (transcript available).

NOTE

A common mistake occurs in translating years into payment numbers. You often need to find the total interest paid or total principal paid for a particular year. To do this, you need to set P1 equal to the number of the first payment that occurs in that year and P2 equal to the number of the last payment that occurs in that year.

For example, suppose you have monthly payments and you want to know the total interest paid in the fourth year. In error, you might calculate that the fourth year begins with payment 36 and ends with payment 48, and so enter P1=36 and P2=48. But the 36th payment is actually the last payment of the third year. The first payment to occur in year four is the 37th. So, if you wanted to find the total interest paid in year 4, P1=37 and P2=48.

When you need to find the first payment number and last payment number for a particular year, there are two methods you can use to calculate the correct payment numbers.

- Calculate the payment number at the end of the year in question by multiplying P/Y by the year number: P/Y×year number. To find the payment number at the start of the year, subtract the payment frequency less one (P/Y - 1) from the last payment number of the year. For example, suppose the you have monthly payments and want to find the interest paid for year 4. The last payment in year 4 is 12×4=48. The first payment in year 4 is 48-(12-1)=37.

- Calculate the payment number at the end of the year in question by multiplying P/Y by the year number: P/Y×year number. To find the payment number for the first payment in the year, multiply P/Y by the previous year number and then add one to it: P/Y×(year-1)+1. For example, suppose the you have monthly payments and want to find the interest paid for year 4. The first payment in year 4 is 12×3+1=37. The last payment of the fourth year remains at payment 48.

EXAMPLE

You borrowed $25,000 to renovate your kitchen. The loan agreement calls for quarterly payments for ten years at 3.9% compounded semi-annually.

- What as the outstanding balance on the loan after four years?

- How much interest was paid in year two?

- How much principal was paid in year five?

- How much interest was paid in year eight?

Solution:

Step 1: Calculate the payment.

| PMT Setting | END |

| N | [latex]4 \times 10=40[/latex] |

| PV | [latex]25,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | ? |

| I/Y | [latex]3.9[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]2[/latex] |

[latex]PMT=\$757.10[/latex]

Step 2: Calculate the balance at the end of year four. To find the balance after four years, enter the payment number that corresponds to the last payment made in year four. There are 4 payments a year, so the last payment made in year four is 16 (4×4). So, to find the balance after four years, set P1=16 and P2=16.

| PMT Setting | END |

| N | [latex]40[/latex] |

| PV | [latex]25,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-757.10[/latex] |

| I/Y | [latex]3.9[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]2[/latex] |

| P1 | [latex]16[/latex] |

| P2 | [latex]16[/latex] |

[latex]BAL=\$16,140.48[/latex]

After four years, the balance on the loan is $16,140.48.

Step 3: Calculate the interest paid in year two. To find the interest paid in year two, set P1 to first payment number of year two and P2 to last payment of year two. There are 4 payments a year, so the last payment made in year two is 8 (4×2). The first payment made in year two is 5 (4×1+1). So, to find the interest paid in year two, set P1=5 and P2=8.

| PMT Setting | END |

| N | [latex]40[/latex] |

| PV | [latex]25,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-757.10[/latex] |

| I/Y | [latex]3.9[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]2[/latex] |

| P1 | [latex]5[/latex] |

| P2 | [latex]8[/latex] |

[latex]INT=\$857.91[/latex]

The total interest paid in year two is $857.91.

Step 4: Calculate the principal paid in year five. To find the principal paid in year five, set P1 to first payment number of year five and P2 to last payment of year five. There are 4 payments a year, so the last payment made in year five is 20 (4×5). The first payment made in year five is 17 (4×4+1). So, to find the principal paid in year five, set P1=17 and P2=20.

| PMT Setting | END |

| N | [latex]40[/latex] |

| PV | [latex]25,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-757.10[/latex] |

| I/Y | [latex]3.9[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]2[/latex] |

| P1 | [latex]17[/latex] |

| P2 | [latex]20[/latex] |

[latex]PRN=\$2,437.15[/latex]

The total principal paid in year five is $2,437.15.

Step 5: Calculate the interest paid in year eight. To find the interest paid in year eight, set P1 to first payment number of year eight and P2 to last payment of year eight. There are 4 payments a year, so the last payment made in year eight is 32 (4×8). The first payment made in year eight is 29 (4×7+1). So, to find the interest paid in year eight, set P1=29 and P2=32.

| PMT Setting | END |

| N | [latex]40[/latex] |

| PV | [latex]25,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-757.10[/latex] |

| I/Y | [latex]3.9[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]2[/latex] |

| P1 | [latex]29[/latex] |

| P2 | [latex]32[/latex] |

[latex]INT=\$291.84[/latex]

The total interest paid in year eight is $291.84.

TRY IT

Art Industries just financed a $50,000 purchase at 5.9% effective. It fixes the loan payment at $450 per month.

- How many payments will it take to pay-off the loan?

- How much principal is paid in year three?

- How much interest is paid in year ten?

- How much principal is paid in year seven?

- How much interest is paid in year eleven?

Click to see Solution

1. Calculate the number of payments.

| PMT Setting | END |

| N | ? |

| PV | [latex]50,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-450[/latex] |

| I/Y | [latex]5.9[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

[latex]N=158.969... \rightarrow 159 \mbox{ payments}[/latex]

2. Calculate the principal paid in year three.

| PMT Setting | END |

| N | [latex]159[/latex] |

| PV | [latex]50,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-450[/latex] |

| I/Y | [latex]5.9[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

| P1 | [latex]25[/latex] |

| P2 | [latex]36[/latex] |

[latex]PRN=\$2,909.70[/latex]

3. Calculate the interest paid in year ten.

| PMT Setting | END |

| N | [latex]159[/latex] |

| PV | [latex]50,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-450[/latex] |

| I/Y | [latex]5.9[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

| P1 | [latex]109[/latex] |

| P2 | [latex]120[/latex] |

[latex]INT=\$1,053.70[/latex]

4. Calculate the principal paid in year seven.

| PMT Setting | END |

| N | [latex]159[/latex] |

| PV | [latex]50,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-450[/latex] |

| I/Y | [latex]5.9[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

| P1 | [latex]73[/latex] |

| P2 | [latex]84[/latex] |

[latex]PRN=\$3,659.58[/latex]

5. Calculate the interest paid in year eleven.

| PMT Setting | END |

| N | [latex]159[/latex] |

| PV | [latex]50,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | [latex]-450[/latex] |

| I/Y | [latex]5.9[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

| P1 | [latex]121[/latex] |

| P2 | [latex]132[/latex] |

[latex]INT=\$797.27[/latex]

Exercises

- A $39,000 loan at 6% compounded semi-annually is repaid with quarterly payments over five years.

- How much interest is paid with the 10th payment?

- How much principal is paid with the 17th payment?

- What is the outstanding balance on the loan after the 7th payment is made?

- How much principal is paid in year 2?

- How much interest is paid in year 3?

- What is the outstanding balance on the loan after year 4?

Click to see Answer

a. $340.47, b. $2,138.84, c. $26,639.82, d. $7,326.61, e.$1,303.60, f. $8,748.41

- A $500,000 loan at 6.25% effective is repaid with semi-annual payments of $35,000.

- How much principal is paid with the 9th payment?

- How much interest is paid with the 16th payment?

- What is the outstanding balance on the loan after the 3rd payment is made?

- How much interest is paid in year 4?

- How much principal is paid in year 9?

- What is the outstanding balance on the loan after year 7?

Click to see Answer

a. $24,993.85, b. $4,098.15, c. $439,335.29, d. $22,228.78, e.$64,686.11, f. $163,138.14

- A $14,000 loan at 6% compounded monthly is repaid by monthly payments over four years.

- What is the size of the monthly payment?

- Calculate the principal portion of the 25th payment.

- Calculate the interest portion of the 33rd payment.

- Calculate the total interest paid in the second year.

- Calculate the principal portion of the payments in the third year.

- Calculate the outstanding balance at the end of first year.

Click to see Answer

a. $328.79, b. $291.70, c. $25.22, d. $556.26, e.$3,598.25, f. $10,807.68

- Quarterly payments are to be made against a $47,500 loan at 5.95% compounded annually with a six-year amortization.

- What is the size of the quarterly payment?

- Calculate the principal portion of the sixth payment.

- Calculate the interest portion of the 17th payment.

- Calculate how much the principal will be reduced in the fourth year.

- Calculate the total interest paid in the third year.

Click to see Answer

a. $2,359.13, b. $1,792.76, c. $257.53, d. $8,109.20, e.$1,782.27

- Cathy and Bill just acquired a new Honda Odyssey Touring Edition minivan for $60,531.56 under the dealership’s purchase financing of 5.65% compounded annually for eight years.

- What are their monthly car payments?

- In the first year, what total amount of interest will they pay?

- In the fourth year, by how much will the principal be reduced?

- What is the balance on the loan at end of sixth year?

Click to see Answer

a. $781.07, b. $3,179.72, c. $7,303.28, d. $17,711.66

- You took out a business loan of $75,000 at 2.9% compounded quarterly. You repay the loan with monthly payments of $1300.

- What is the outstanding balance on the loan after the 33rd payment is made?

- How much principal is paid with the 41st payment?

- How much interest is paid with the 29th payment?

- What is the outstanding balance on the loan after year 2?

- How much interest is paid in year 3?

- How much principal is paid in year 4?

Click to see Answer

a. $36,606.07, b. $1,232.35, c. $102.75, d. $47,381.49, e.$1,180.56, f. $14,842.18

Attribution

“13.1: Calculating Interest and Principal Components” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“13.1: Calculating Interest and Principal Components” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.