Chapter 6: Summary

Formula & Symbol Hub Summary

For this chapter you used the following:

Symbols Used

- [latex]\text{C/Y}=[/latex] Compounds per year

- [latex]FV=[/latex] Future value or maturity value

- [latex]i=[/latex] Periodic interest rate

- [latex]\text{I/Y}=[/latex] Nominal interest rate per year

- [latex]\ln=[/latex] Natural logarithm

- [latex]n=[/latex] Total number of compounding periods

- [latex]PV=[/latex] Present value or principal value

Formulas Used

-

Formula 6.1 - Periodic Interest Rate

[latex]\begin{align*}i=\frac{\text{I/Y}}{\text{C/Y}}\end{align*}[/latex]

-

Formula 6.2a - Number of Compound Periods

[latex]n=\text{C/Y}\times\text{Number of Years}[/latex]

-

Formula 6.2b - Future (Maturity) Value

[latex]FV=PV\times(1+i)^n[/latex]

-

Formula 6.3 - Present Value (Principal)

[latex]\begin{align*}PV=\frac{FV}{\left(1+i\right)^n}\end{align*}[/latex]

-

Formula 6.6 - Interest Rate Conversion

[latex]\begin{align*}i_\textrm{new}=\left(1+i_\textrm{old}\right)^{\frac{\text{C/Y}_\textrm{old}}{\text{C/Y}_\textrm{new}}}-1\end{align*}[/latex]

Key Concepts Summary

6.1: Compound Interest Fundamentals

- How compounding works

- How to calculate the periodic interest rate

6.2: Determining the Future Value

- The basics of taking a single payment and moving it to a future date

- Moving single payments to the future when variables change

6.3: Determining the Present Value

- The basics of taking a single payment and moving it to an earlier date

- Moving single payments to the past when variables change

6.4: Equivalent Payments

- The concept of equivalent payments

- The fundamental concept of time value of money

- The fundamental concept of equivalency

- Applying single payment concepts to loans and payments

6.5: Determining the Interest Rate

- Solving for the nominal interest rate

- How to convert a variable interest rate into its equivalent fixed interest rate

6.6: Equivalent and Effective Interest Rates

- The concept of effective rates

- Taking any nominal interest rate and finding its equivalent nominal interest rate

6.7: Determining the Number of Compounds

- Figuring out the term when n is an integer

- Figuring out the term when n is a non-integer

The Language of Business Mathematics

compound interest A system for calculating interest that primarily applies to long-term financial transactions with a timeframe of one year or more; interest is periodically converted to principal throughout a transaction, with the result that theinterest itself also accumulates interest.

compounding frequency The number of compounding periods in a complete year.

compounding period The amount of time that elapses between the dates of successive conversions of interest to principal.

discount rate An interest rate used to remove interest from a future value.

effective interest rate The true annually compounded interest rate that is equivalent to an interest rate compounded at some other (non-annual) frequency.

equivalent payment streams Equating two or more alternative financial streams such that neither party receives financial gain or harm by choosing either stream.

equivalent interest rates Interest rates with different compounding that produce the same effective rate and therefore areequal to each other.

focal date A point in time to which all monies involved in all payment streams will be moved using time value of money calculations.

fundamental concept of equivalency Two or more payment streams are equal to each other if they have the same economic value on the same focal date.

fundamental concept of time value of money All monies must be brought to the same focal date before any mathematical operations, decisions, or equivalencies can be determined.

nominal interest rate A nominal number for the annual interest rate, which is commonly followed by words that state the compounding frequency.

periodic interest rate The percentage of interest earned or charged at the end of each compounding period.

present value principle for loans The present value of all payments on a loan is equal to the principal that was borrowed.

Rule of 72 A rule of thumb stating that [latex]72[/latex] divided by the annually compounded rate of return closely approximates the number of years required for money to double.

Technology Introduced

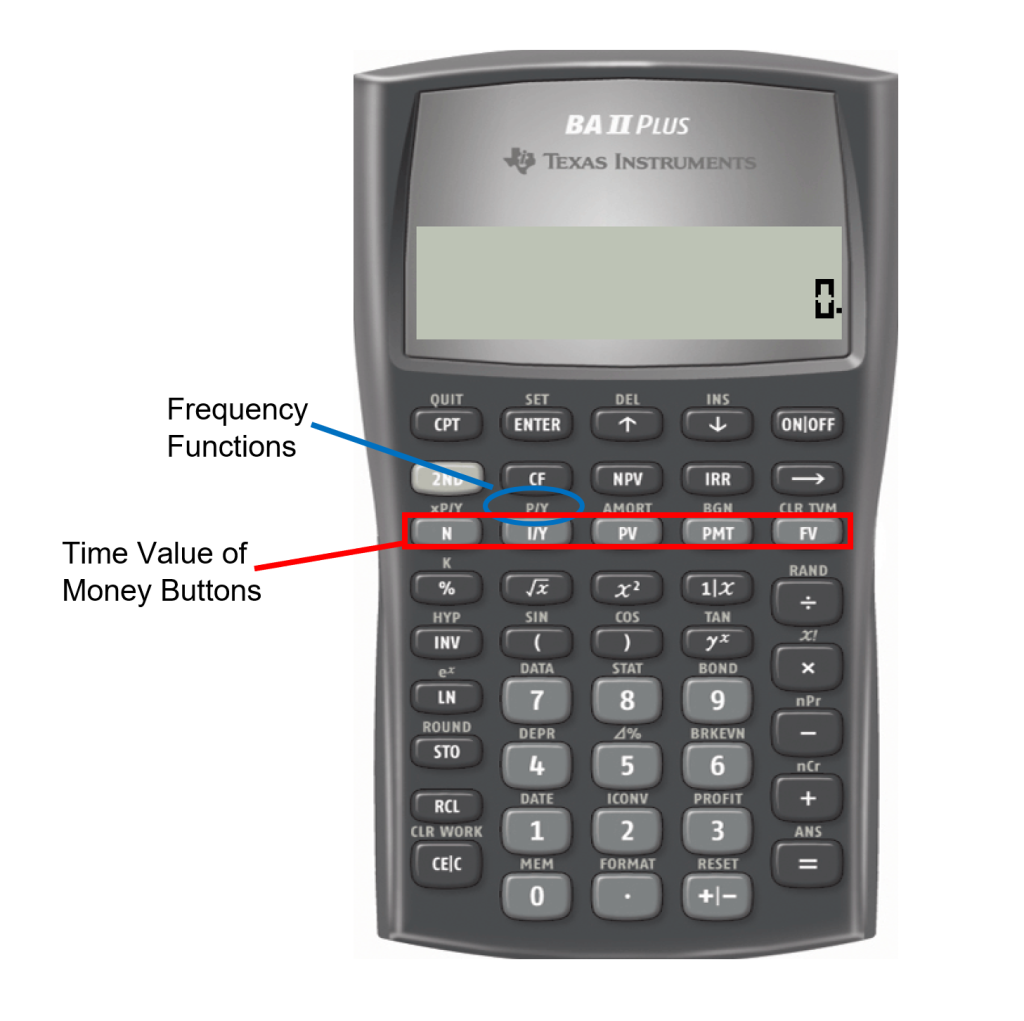

Calculator

Time Value of Money Buttons

- The time value of money buttons are the five buttons located on the third row of your calculator.

| Calculator Symbol | Characteristic | Data Entry Requirements |

|---|---|---|

| [latex]\text{N}[/latex] | The number of compounding periods | An integer or decimal number; no negatives |

| [latex]\text{I/Y}[/latex] | The nominal interest rate per year | Percent format without the [latex]\%[/latex] sign (i.e., [latex]7\%[/latex] is just [latex]7[/latex]) |

| [latex]\text{PV}[/latex] | Present value or principal | An integer or decimal number |

| [latex]\text{PMT}[/latex] | Used for annuity payment amounts (covered in Chapter 11) and is not applicable to lump-sum amounts; it needs to be set to zero for lump-sum calculations | An integer or decimal number |

| [latex]\text{FV}[/latex] | Future value or maturity value | An integer or decimal number |

To enter any information into any one of these buttons or variables, called loading the calculator, key in the information first and then press the appropriate button.

- The frequency function is logically placed above the [latex]\text{I/Y}[/latex] button and is labelled [latex]\text{P/Y}[/latex]. This function addresses compound interest frequencies, such as the compounding frequency. Access the function by pressing [latex]\text{2nd P/Y}[/latex] to find the following entry fields, through which you can scroll using your arrow buttons.

| Calculator Symbol | Characteristic | Data Entry Requirements |

|---|---|---|

| [latex]\text{P/Y}[/latex] | Annuity payments per year (payment frequency is introduced in Chapter 11); when working with lump-sum payments and not annuities, the calculator requires this variable to be set to match the [latex]\text{C/Y}[/latex] | A positive, nonzero number only |

| [latex]\text{C/Y}[/latex] | Compounds per year (compounding frequency) | A positive, nonzero number only |

- To enter any information into one of these fields, scroll to the field on your screen, key in the data, and press [latex]\text{Enter}[/latex].

- When you enter a value into the [latex]\text{P/Y}[/latex] field, the calculator will automatically copy the value into the [latex]\text{C/Y}[/latex] field for you. If in fact the [latex]\text{C/Y}[/latex] is different, you can change the number manually.

- To exit the [latex]\text{P/Y}[/latex] window, press [latex]\text{2nd Quit}[/latex].

Keying in a Question

- You must load the calculator with six of the seven variables.

- To solve for the missing variable, press [latex]\text{CPT}[/latex] followed by the variable.

Cash Flow Sign Convention

- The cash flow sign convention is used for the [latex]\text{PV}[/latex], [latex]\text{PMT}[/latex], and [latex]\text{FV}[/latex] buttons.

- If money leaves you, you must enter it as a negative.

- If money comes at you, you must enter it as a positive.

Clearing the Memory

- Once you enter data into any of the time value buttons, it is permanently stored until one of the following happens:

- You override it by entering another piece of data and pressing the button.

- You clear the memory of the time value buttons by pressing [latex]\text{2nd CLR TVM}[/latex] (a step that is recommended before you proceed with a separate question).

- You press the reset button on the back of the calculator.

Attribution

"Chapter 9 Key Concepts Summary & Chapter 9 Formulas & Chapter 9 Technology & Chapter 9 Glossary " from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.