Chapter 5: Summary

Formula & Symbol Hub Summary

For this chapter you used the following:

Symbols Used

- [latex]I=[/latex] Simple Interest

- [latex]P=[/latex] Present Value or Principal

- [latex]r=[/latex] Interest rate

- [latex]t=[/latex] Time period over which interest is charged

- [latex]S=[/latex] Maturity value or future value

Formulas Used

-

Formula 3.1b – Rate, Portion, and Base

[latex]\begin{align*}\text{Rate}=\frac{\text{Portion}}{\text{Base}}\end{align*}[/latex]

-

Formula 5.1 – Simple Interest

[latex]I=Prt[/latex]

-

Formula 5.2a – Simple Interest Future Value

[latex]S=P(1+rt)[/latex]

-

Formula 5.2b – Simple Interest Amount

[latex]I=S-P[/latex]

Key Concepts Summary

5.1: Principal, Rate, Time

- Calculating the amount of simple interest either earned or charged in a simple interest environment

- Calculating the time period when specific dates or numbers of days are involved

- Calculating the simple interest amount when the interest rate is variable throughout the transaction

5.2: Moving Money Involving Simple Interest

- Putting the principal and interest together into a single calculation known as maturity value

- Altering a financial agreement and establishing equivalent payments

5.3: Application: Savings Accounts and Short-Term GICs

- How to calculate simple interest for flat-rate and tiered savings accounts

- How to calculate simple interest on a short-term GIC

5.4 Application: Treasury Bills and Commercial Papers

- The characteristics of treasury bills

- The characteristics of commercial papers

- Calculating the price of T-Bills and commercial papers

- Calculating the yield of T-Bills and commercial papers

The Language of Business Mathematics

accrued interest Any interest amount that has been calculated but not yet placed (charged or earned) into an account.

commercial paper A short-term financial instrument with maturity no longer than one year that is issued by large corporations.

compound interest A system for calculating interest that primarily applies to long-term financial transactions with a time frame of one year or more; interest is periodically converted to principal throughout a transaction, with the result that the interest itself also accumulates interest.

current balance The balance in an account plus any accrued interest.

demand loan A short-term loan that generally has no specific maturity date, may be paid at any time without any interest penalty, and where the lender may demand repayment at any time.

discount rate An interest rate used to remove interest from a future value.

equivalent payments Two payments that have the same value on the same day factoring in a fair interest rate.

face value of a T-bill The maturity value of a T-bill, which ispayable at the end of the term. It includes both the principal and interest together.

fixed interest rate An interest rate that is unchanged for the duration of the transaction.

focal date A single date that is chosen to locate all values in a financial scenario so that equivalent amounts can be determined.

future value The amount of principal with interest at a future point of time for a financial transaction. If this future point is the same as the end date of the financial transaction, it is also called the maturity value.

guaranteed investment certificate (GIC) An investment that offers a guaranteed rate of interest over a fixed period of time.

interest amount The dollar amount of interest that is paid or earned.

interest rate The rate of interest that is charged or earned during a specified time period.

legal due date of a note Three days after the term specified in an interest-bearing promissory note is the date when a promissory note becomes legally due. This grace period allows the borrower to repay the note without penalty in the event that the due date falls on a statutory holiday or weekend.

maturity date The date upon which a transaction, such as a promissory note, comes to an end and needs to be repaid.

maturity value The amount of money at the end of a transaction, which includes both the interest and the principal together.

present value The amount of money at the beginning of a time period in a transaction. If this is in fact the amount at the start of the financial transaction, it is also called the principal. Or it can simply be the amount at some time earlier before the future value was known. In any case, the amount excludes the interest.

prime rate An interest rate set by the Bank of Canada that usually forms the lowest lending rate for the most secure loans.

principal The original amount of money that is borrowed or invested in a financial transaction.

proceeds The amount of money received from a sale.

promissory note An unconditional promise in writing made by one person to another person to pay a sum of money on demand or at a fixed or determinable future time.

repayment schedule A table that details the financial transactions in an account, including the balance, interest amounts, and payments.

savings account A deposit account that bears interest and has no stated maturity date.

secured loan Those loans that are guaranteed by an asset such as a building or a vehicle that can be seized to pay the debt in case of default.

simple interest A system for calculating interest that primarily applies to short-term financial transactions with a time frame of less than one year.

student loan A special type of loan designed to help students pay for the costs of tuition, books, and living expenses while pursuing postsecondary education.

time period The length of the financial transaction for which interest is charged or earned. It may also be called the term.

treasury bills Short-term financial instruments with maturities no longer than one year that are issued by both federal and provincial governments.

unsecured loan Those loans backed up by the general goodwill and nature of the borrower.

variable interest rate An interest rate that is open to fluctuations over the duration of a transaction.

yield The percentage increase between the sale price and redemption price on an investment such as a T-bill or commercial paper.

Technology Introduced

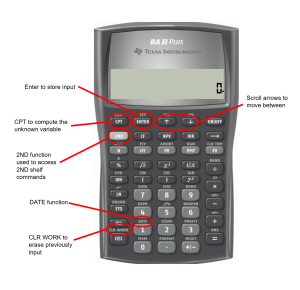

Calculator

The following calculator functions were introduced in this chapter:

Date Function

- [latex]\text{2nd DATE}[/latex] to access.

- Enter two of the three variables ([latex]\text{DT1}[/latex], [latex]\text{DT2}[/latex], [latex]\text{DBD}[/latex]) by pressing Enter after each input and using [latex]\uparrow[/latex] and [latex]\downarrow[/latex] to scroll through the display. The variables are:

- [latex]\text{DT1}=[/latex] The starting date of the transaction

- [latex]\text{DT2}=[/latex] The ending date of the transaction

- [latex]\text{DBD}=[/latex] The days between the dates, counting the first day but not the last, which is the time period of the transaction.

- [latex]\text{ACT / }360=[/latex] A setting for determining how the calculator determines the [latex]\text{DBD}[/latex]. In Canada, you should maintain this setting on [latex]\text{ACT}[/latex], which is the actual number of days. In other countries, such as the United States, they treat each year as having [latex]360[/latex] days (the [latex]360[/latex] setting) and each month as having [latex]30[/latex] days. If you need to toggle this setting, press [latex]\text{2nd SET}[/latex].

- Enter all dates in the format of MMDDYY, where MM is the numerical month, DD is the day, and YY is the last two digits of the year. DD and YY must always be entered with both digits.

- Press [latex]\text{CPT}[/latex] on the unknown (when it is on the screen display) to compute the answer.

Attribution

“Chapter 8: Key Concepts Summary & Chapter 8: Formulas & Chapter 8: Technology Introduced & Chapter 8: Glossary ” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.