6.7 Determining the Number of Compounds

Formula & Symbol Hub

For this section you will need the following:

Symbols Used

- [latex]FV=[/latex] Future value or maturity value

- [latex]PV=[/latex] Present value or principal value

- [latex]i=[/latex] Periodic interest rate

- [latex]\text{C/Y}=[/latex] Compounds per year

- [latex]\text{I/Y}=[/latex]Nominal interest rate per year

- [latex]n=[/latex]Total number of compounding periods

- [latex]\ln=[/latex] Natural logarithm

Formulas Used

-

Formula 6.1 - Periodic Interest Rate

[latex]\begin{align*}i=\frac{\text{I/Y}}{\text{C/Y}}\end{align*}[/latex]

-

Formula 6.2a - Number of Compound Periods

[latex]n=\text{C/Y}\times\text{Number of Years}[/latex]

-

Formula 6.2b - Future (Maturity) Value

[latex]FV=PV\times(1+i)^n[/latex]

-

Formula 6.3 - Present Value (Principal)

[latex]\begin{align*}PV=\frac{FV}{\left(1+i\right)^n}\end{align*}[/latex]

-

Formula 6.6 - Interest Rate Conversion

[latex]\begin{align*}i_\textrm{new}=\left(1+i_\textrm{old}\right)^{\frac{\text{C/Y}_\textrm{old}}{\text{C/Y}_\textrm{new}}}-1\end{align*}[/latex]

Determining the Number of Compounds

How long will it take to reach a financial goal? At a casual get-together at your house, a close friend discusses saving for a [latex]14[/latex]-day vacation to the Blue Bay Grand Esmeralda Resort in the Mayan Riviera of Mexico upon graduation. The estimated cost from Travelocity.ca is [latex]\$1,998.94[/latex] including fares and taxes. He has already saved [latex]\$1,775[/latex] into a fund earning [latex]8\%[/latex] compounded quarterly. Assuming the costs remain the same and he makes no further contributions, can you tell him how soon he will be basking in the sun on the beaches of Mexico?

This section shows you how to calculate the time frame for single payment compound interest transactions. You can apply this knowledge to any personal financial goal. Or in your career, if you work at a mid-size to large company, you might need to invest monies with the objective of using the funds upon maturity to pursue capital projects or even product development opportunities. So knowing the time frame for the investment to grow large enough will allow you to schedule the targeted projects.

The number of compounding periods could work out to be an integer. More challenging scenarios involve time frame computations with non-integer compounding periods.

HOW TO

Compute the Number of Compounding Periods

Follow these steps to compute the number of compounding periods, [latex]n[/latex].

Step 1: Draw a timeline to visualize the question. Most important at this step is to identify [latex]PV[/latex], [latex]FV[/latex], and the nominal interest rate (both [latex]\text{I/Y}[/latex] and [latex]\text{C/Y}[/latex]).

Step 2: Solve for the periodic interest rate ([latex]i[/latex]) using Formula 6.1

[latex]\begin{align*}i=\frac{\text{I/Y}}{\text{C/Y}}\end{align*}[/latex]

Step 3: Use the formula for the future value, rearrange, and solve for [latex]n[/latex]. Note that the value of [latex]n[/latex] represents the number of compounding periods. For example, if the compounding is quarterly, a value of [latex]n=9[/latex] is nine quarters.

Step 4: Take the value of [latex]n[/latex] and convert it back to a more commonly expressed format such as years and months. When the number of compounding periods calculated in Step 3 works out to an integer, you an solve for the number of years using the formula

[latex]\begin{align*}\text{Years} =\frac{n}{\text{C/Y}}\end{align*}[/latex]

-

- If the [latex]\text{Years}[/latex] is an integer, you are done.

- If the [latex]\text{Years}[/latex] is a non-integer, the whole number portion (the part in front of the decimal) represents the number of years. As needed, take the decimal number portion (the part after the decimal point) and multiply it by [latex]12[/latex] to convert it to months. For example, if you have [latex]\text{Years}=8.25[/latex] then you have [latex]8[/latex] years plus [latex]0.25\times 12=30.25\times 12=3[/latex] months, or [latex]8[/latex] years and [latex]3[/latex] months.

Concept Check

Example 6.7.1

Jenning Holdings invested [latex]\$43,000[/latex] at [latex]6.65\%[/latex] compounded quarterly. A report from the finance department shows the investment is currently valued at [latex]\$67,113.46[/latex]. How long has the money been invested?

Solution

Determine the amount of time that the principal has been invested. This requires calculating the number of compounding periods ([latex]n[/latex]).

Step 1: Given variables:

[latex]PV=\$43,000[/latex]; [latex]\text{I/Y}=6.65\%[/latex]; [latex]\text{C/Y}=\text{quarterly}=4[/latex]; [latex]FV=\$67,113.46[/latex]

Step 2: Solve for the periodic interest rate, [latex]i[/latex].

[latex]\begin{align*}i&=\frac{\text{I/Y}}{\text{C/Y}}\\[1ex]i&=\frac{6.65\%}{4}\\[1ex]i&=1.6625\%\end{align*}[/latex]

Step 3: Use the formula for the future value, rearrange, and solve for [latex]n[/latex].

[latex]\begin{align*} FV&=PV(1+i)^n\\ \$67,\!113.46&=\$43,\!000(1+0.016625)^n\\ 1.560778&=1.016625^n\\ \ln(1.560778)&=\ln(1.016625)^n\;\text{(by taking ln of both sides)}\\ \ln(1.560778)&=n \ln(1.016625)\; \text{(by using the property} \ln(x)^n=n\ln(x))\\[1ex] n&=\frac{\ln(1.560778)}{\ln(1.016625)}\\[1ex] n&=\frac{0.445184}{0.016488}\\[1ex] n&=26.99996\;\text{or}\; 27\;\text{quarterly compounds}\end{align*}[/latex]

Step 4: Convert [latex]n[/latex] to years and months.

[latex]\begin{align} \text{Years}&=\frac{n}{\text{C/Y}}\\[1ex] \text{Years}&=\frac{27}{4}\\[1ex] \text{Years}&=6.75\; \text{years}\\ \text{Years}&= 6\;\text{years}\; \text{and}\; .75\times 12=9\;\text{months} \end{align}[/latex]

Calculator instructions:

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| Answer: [latex]26.999996[/latex] | [latex]6.65[/latex] | [latex]-43,000[/latex] | [latex]0[/latex] | [latex]67,113.46[/latex] | [latex]4[/latex] | [latex]4[/latex] |

Step 5: Write as a statement.

Jenning Holdings has had the money invested for six years and nine months.

Non-integer Compounding Periods

When the number of compounding periods does not work out to an integer, the method of calculating n does not change.

Typically, the non-integer involves a number of years, months, and days.

As summarized in the table below, to convert the compounding period into the correct number of days you can make the following assumptions:

| Compounding Period | # of Days in the Period |

|---|---|

| Annual | [latex]365[/latex] |

| Semi-annual | [latex]182[/latex]* |

| Quarter | [latex]91[/latex]* |

| Month | [latex]30[/latex]* |

| Week | [latex]7[/latex] |

| Daily | [latex]1[/latex] |

HOW TO

Calculate Number of Compounding Periods for Non-Integer [latex]n[/latex]-values

You still use the same four steps to solve for the number of compounding periods when [latex]n[/latex] works out to a non-integer as you did for integers.

- Separate the integer from the decimal for your value of [latex]n[/latex].

- With the integer portion, apply the same technique used with an integer n to calculate the number of years and months as we discussed before.

- With the decimal portion, multiply by the number of days in the period to determine the number of days and round off the answer to the nearest day (treating any decimals as a result of a rounded interest amount included in the future value).

Example 6.7.2

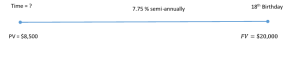

Tabitha estimates that she will need [latex]\$20,000[/latex] for her daughter's postsecondary education when she turns [latex]18[/latex]. If Tabitha is able to save up [latex]\$8,500[/latex], how far in advance of her daughter's 18th birthday would she need to invest the money at [latex]7.75\%[/latex] compounded semi-annually? Answer in years and days. Round to the nearest day.

Solution

Step 1: Given information:

The principal, future value, and interest rate are known, as illustrated in the timeline.

[latex]PV=\$8,500[/latex]; [latex]\text{I/Y}=7.75\%[/latex]; [latex]\text{C/Y}=\text{semi-annually}=2[/latex]; [latex]FV=\$20,000[/latex]

Step 2: Solve for the periodic interest rate, [latex]i[/latex].

[latex]\begin{align*}i&=\frac{\text{I/Y}}{\text{C/Y}}\\[1ex]i&=\frac{7.75\%}{2}\\[1ex]i&=3.875\%\end{align*}[/latex]

Step 3: Use the formula for the future value, rearrange, and solve for [latex]n[/latex].

[latex]\begin{align} FV&=PV(1+i)^n\\ \$20,\!000&=\$8,\!500(1+0.03875)^n\\ 2.352941&=1.03875^n\\ \ln(2.352941)&=\ln(1.03875)^n\;\text{(by taking ln of both sides)}\\ \ln(2.352941)&=n \ln(1.03875)\; \text{(by using the property} \ln(x)^n=n\ln(x))\\[1ex] n&=\frac{\ln(2.352941)}{\ln(1.03875)}\\[1ex] n&=\frac{0.855666}{0.038018}\\[1ex] n&=22.506828\;\text{semi-annual compounds} \end{align}[/latex]

Step 4: Convert [latex]n[/latex] to years and days.

Take the integer:

[latex]\begin{align*}\text{Years}&=\frac{n}{\text{C/Y}}\\[1ex]\text{Years}&=\frac{22}{2}\\[1ex]\text{Years}&=11\end{align*}[/latex]

Take the decimal:

[latex]\begin{align*}\text{Days}&=0.506828 \times 182\\[1ex]\text{Days}&=92\end{align*}[/latex]

Calculator instructions:

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| Answer: [latex]22.506828[/latex] | [latex]7.75[/latex] | [latex]-8,500[/latex] | [latex]0[/latex] | [latex]20,000[/latex] | [latex]2[/latex] | [latex]2[/latex] |

Step 5: Write as a statement.

If Tabitha invests the [latex]\$8,500[/latex] [latex]11[/latex] years and [latex]92[/latex] days before her daughter's 18th birthday, it will grow to [latex]\$20,000[/latex].

Section 6.7 Exercises

- You just took over another financial adviser's account. The client invested [latex]\$15,500[/latex] at [latex]6.92\%[/latex] compounded monthly and now has [latex]\$24,980.58[/latex]. How long (in years and months) has this client had the money invested?

Solution

Step 1: Given information:

[latex]PV=\$15,500[/latex]; [latex]\text{I/Y}=6.92\%[/latex]; [latex]FV=\$24,980.58[/latex]

Step 2: Calculate [latex]i[/latex].

[latex]\begin{align*}i&=\frac{\text{I/Y}}{\text{C/Y}}\\[1ex]i&=\frac{6.92\%}{12}\\[1ex]i&=0.57\overline{6}\%\end{align*}[/latex]

Step 3: Use Formula 6.2b for [latex]FV[/latex] and rearrange for [latex]n[/latex].

[latex]\begin{align*}FV&=PV\left(1+i\right)^n\\\$24,980.58&=\$15,500\left(1+0.0057\overline{6}\right)^n\\1.611650&=\left(1.0057\overline{6}\right)^n\\\ln\left(1.611650\right)&=n\times\ln\left(1.0057\overline{6}\right)\\0.477258&=n\times 0.005750\\[1ex]n&=83\;\text{monthly compounds}\end{align*}[/latex]

Step 4: Convert the time to years and months.

[latex]\text{Years}=\frac{83}{12}=6.91\overline{6}[/latex] which is [latex]6[/latex] years plus [latex]0.91\overline{6}\times 12=11[/latex] months

Step 5: Write as a statement. The client has had the money invested for [latex]6[/latex] years and [latex]11[/latex] months.

Calculator instructions:

Table 6.7.4 N PV I/Y PMT FV P/Y C/Y ? [latex]15,500[/latex] [latex]6.92[/latex] [latex]0[/latex] [latex]24,980.58[/latex] [latex]12[/latex] [latex]12[/latex] - Your organization has a debt of [latex]\$30,000[/latex] due in [latex]13[/latex] months and [latex]\$40,000[/latex] due in [latex]27[/latex] months. If a single payment of [latex]\$67,993.20[/latex] was made instead using an interest rate of [latex]5.95\%[/latex] compounded monthly, when was the payment made? Use today as the focal date.

Solution

Step 1: First figure out what the money is worth today.

Original Agreement:

[latex]\begin{align*}\text{Payment #1}&=\$30,000\;\text{due in 13 months}\\[1ex] \text{Payment #2}&=\$40,000\;\text{due in 27 months}\end{align*}[/latex]

[latex]\text{I/Y}=5.95\%[/latex]; [latex]\text{C/Y}=12[/latex]

Proposed Agreement:

[latex]\$67,993.20[/latex] due in [latex]x[/latex] months

Step 2:

[latex]\text{Focal date}=\text{today}[/latex]

Step 3: Calculate [latex]i[/latex].

[latex]\begin{align*}i&=\frac{\text{I/Y}}{\text{C/Y}}\\[1ex]i&=\frac{5.95\%}{12}\\[1ex]i&=0.4958\overline{3}\%\end{align*}[/latex]

Step 4: Calculate [latex]n[/latex] of the payments.

Payment #1:

[latex]\begin{align*}n&=\text{(Number of Years)}\times\text{(Compounds Per Year)}\\[1ex]n&=1\frac{1}{12}\times 12\\[1ex]n&=1.08\overline{3}\times 12\\n&=13\end{align*}[/latex]

Payment #2:

[latex]\begin{align*}n&=\text{(Number of Years)}\times\text{(Compounds Per Year)}\\[1ex]n&=2\frac{3}{12}\times 12\\[1ex]n&=2.25\times 12\\n&=27\end{align*}[/latex]

Step 5: Use Formula 6.3[latex]\begin{align*}PV=\frac{FV}{\left(1+i\right)^n}\end{align*}[/latex] to calculate [latex]PV[/latex] of the payments.

Payment #1:

[latex]\begin{align*}PV&=\frac{\$30,000}{\left(1.004958\right)^{13}}\\[1ex]PV&=\$28,131.73574\end{align*}[/latex]

Payment #2:

[latex]\begin{align*}PV&=\frac{\$40,000}{\left(1.004958\right)^{27}}\\[1ex]PV&=\$34,999.55193\end{align*}[/latex]

Step 6: Find the total [latex]PV[/latex] of the payments.

[latex]\begin{align*}\text{Total today}&=\$28,131.73574+\$34,999.55193\\\text{Total today}&=\$63,131.28768\end{align*}[/latex]

Now figure out where the payment occurs:

Step 1:

[latex]PV=\$63,131.28768[/latex]; [latex]FV=\$67,993.20[/latex]; [latex]\text{I/Y}=5.95\%[/latex]; [latex]\text{C/Y}=12[/latex]

Step 2: Find [latex]i[/latex].

[latex]\begin{align*}i&=\frac{\text{I/Y}}{\text{C/Y}}\\[1ex]i&=\frac{5.95\%}{12}\\[1ex]i&=0.4958\overline{3}\%\end{align*}[/latex]

Step 3: Use Formula 6.2b for [latex]FV[/latex] and rearrange for [latex]n[/latex].

[latex]\begin{align*}FV&=PV\left(1+i\right)^n\\\$67,993.20&=\$63,131.28768\left(1+0.004958\right)^n\\1.121112&=\left(1.004958\right)^n\\\ln\left(1.077012\right)&=n\times\ln\left(1.004958\right)\\0.074191&=n\times 0.004946\\n&=15\;\text{monthly compounds}\end{align*}[/latex]

Step 4: Convert the time to years and months.

[latex]\begin{align*}\text{Number of years}&=\frac{15}{12}\\[1ex]\text{Number of years}&=1.25\;\text{which is 1 year plus}\;0.25\times 12=3\;\text{months}\end{align*}[/latex]

Step 5: Write as a statement. Payment is made [latex]15[/latex] months from today.

Calculator instructions:

Calculation N I/Y PMT PV FV P/Y C/Y Payment #1 [latex]13[/latex] [latex]5.95[/latex] [latex]0[/latex] ? [latex]30,000[/latex] [latex]12[/latex] [latex]12[/latex] Payment #2 [latex]27[/latex] [latex]5.95[/latex] [latex]0[/latex] ? [latex]40,000[/latex] [latex]12[/latex] [latex]12[/latex] ? [latex]5.95[/latex] [latex]0[/latex] [latex]63,131.28768[/latex] [latex]67,993.2[/latex] [latex]12[/latex] [latex]12[/latex] - A [latex]\$9,500[/latex] loan requires a payment of [latex]\$5,000[/latex] after [latex]1\frac{1}{2}[/latex] years and a final payment of [latex]\$6,000[/latex]. If the interest rate on the loan is [latex]6.25\%[/latex] compounded monthly, when should the final payment be made? Use today as the focal date. Express your answer in years and months.

Solution

Step 1: Given information:

[latex]P=\$9,500[/latex]; [latex]\text{I/Y}=6.25\%[/latex]; [latex]\text{C/Y}=12[/latex]

[latex]\begin{align*}\text{Payment #1}&=\$5,000\;\text{due in}\;1\frac{1}{2}\;\text{years}\\[1ex]\text{Payment #2}&=\$6,000\;\text{due in}\;x\;\text{years}\end{align*}[/latex]

Step 2:

[latex]\text{Focal date}=\text{today}[/latex]

Step 3: Find [latex]i[/latex].

[latex]\begin{align*}i&=\frac{\text{I/Y}}{\text{C/Y}}\\[1ex]i&=\frac{6.25\%}{12}\\[1ex]i&=0.5208\overline{3}\%\end{align*}[/latex]

Step 4: Calculate [latex]n[/latex] for the first payment.

Payment #1:

[latex]\begin{align*}n&=\left(\text{Number of Years}\right)\times\left(\text{Compounds Per Year}\right)\\[1ex]n&=1\frac{1}{2}\times12\\[1ex]n&=1.5\times 12\\n&=18\end{align*}[/latex]

Payment #2:

[latex]n=?[/latex]

Step 5: Use Formula 6.3[latex]\begin{align*}PV=\frac{FV}{\left(1+i\right)^n}\end{align*}[/latex] to calculate [latex]PV[/latex] of the payments.

Payment #1:

[latex]\begin{align*}\$5,000&=PV\left(1+0.005208\overline{3}\right)^{18}\\[1ex]PV&=\frac{\$5,000}{\left(1.005208\overline3\right)^{18}}\\[1ex]PV&=$4,553.65956\end{align*}[/latex]

Payment #2:

[latex]\begin{align*}\$6,000&=PV\left(1+0.005208\overline{3}\right)^n\\[1ex] PV&=\frac{\$6,000}{\left(1.005208\overline{3}\right)^n}\end{align*}[/latex]

Step 6: Solve for n of the final payment.

[latex]\begin{align*}\$9,500&=\$4,553.65956+\frac{\$6,000}{\left(1.005208\overline{3}\right)^n}\\[1ex]\$4,946.34044&=\frac{\$6,000}{\left(1.005208\overline{3}\right)^n}\\[1ex]\left(1.005208\overline{3}\right)^n&=\frac{\$6,000}{\$4,946.34044}\\[1ex]\left(1.005208\overline{3}\right)^n&=1.213018\\n\times\ln\left(1.005208\right)&=\ln\left(1.213018\right)\\n\times 0.005194&=0.193111\\n&=37.173874\;\text{monthly compounds (round up to 38 months)}\end{align*}[/latex]

Step 7: Convert the time to years and months.

[latex]\begin{align*}\text{Number of years}&=\frac{38}{12}\\\text{Number of years}&=3.1\overline{6}\;\text{which is}\;3\;\text{years plus}\;0.1\overline{6}\times 12\\\text{Number of years}&=2\;\text{months}\end{align*}[/latex]

Step 8: Write as a statement. The final payment should be made in [latex]3[/latex] years and [latex]2[/latex] months

THE FOLLOWING LATEX CODE IS FOR FORMULA TOOLTIP ACCESSIBILITY. NEITHER THE CODE NOR THIS MESSAGE WILL DISPLAY IN BROWSER.[latex]FV=PV\times(1+i)^n[/latex][latex]\begin{align*}i=\frac{\text{I/Y}}{\text{C/Y}}\end{align*}[/latex][latex]\begin{align*}PV=\frac{FV}{\left(1+i\right)^n}\end{align*}[/latex]

Attribution

"9.7 Determining the Number of Compounds" from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.