5.1: Principal, Rate, Time

Formula & Symbol Hub

For this section you will need the following:

Symbols Used

- [latex]I=[/latex] Simple Interest

- [latex]P=[/latex] Present Value or Principal

- [latex]r=[/latex] Interest rate

- [latex]t=[/latex] Time period over which interest is charged

Formulas Used

-

Formula 5.1 - Simple Interest

[latex]I=Prt[/latex]

-

Formula 3.1b - Rate, Portion, and Base

[latex]\begin{align*}\text{Rate}=\frac{\text{Portion}}{\text{Base}}\end{align*}[/latex]

Introduction

Your investments may be at risk if stock and bond markets slump, as a story in the Globe and Mail predicts. You wonder if you should shift your money into relatively secure short-term investments until the market booms again. You consider your high-interest savings account, but realize that only the first [latex]\$60,000[/latex] of your savings account is insured. Perhaps you should put some of that money into treasury bills instead.

Looking ahead, what income will you live on once you are no longer working? As your career develops, you need to save money to fund your lifestyle in retirement. Some day you will have [latex]\$100,000[/latex] or more that you must invest and reinvest to reach your financial retirement goals.

To make such decisions, you must first understand how to calculate simple interest. Second, you need to understand the characteristics of the various financial options that use simple interest. Armed with this knowledge, you can make smart financial decisions!

The world of finance calculates interest in two different ways:

- Simple Interest: A simple interest system primarily applies to short-term financial transactions, with a time frame of less than one year. In this system, which is explored in this chapter, interest accrues but does not compound.

- Compound Interest: A compound interest system primarily applies to long-term financial transactions, with a time frame of one year or more. In this system, which the next chapter explores, interest accrues and compounds upon previously earned interest.

Simple Interest

In a simple interest environment, you calculate interest solely on the amount of money at the beginning of the transaction. When the term of the transaction ends, you add the amount of the simple interest to the initial amount. Therefore, throughout the entire transaction the amount of money placed into the account remains unchanged until the term expires. It is only on this date that the amount of money increases. Thus, an investor has more money or a borrower owes more money at the end.

The figure illustrates the concept of simple interest. In this example, assume [latex]\$1,000[/latex] is placed into an account with [latex]12\%[/latex] simple interest for a period of [latex]12[/latex] months. For the entire term of this transaction, the amount of money in the account always equals [latex]\$1,000[/latex]. During this period, interest accrues at a rate of [latex]12\%[/latex], but the interest is never placed into the account. When the transaction ends after [latex]12[/latex] months, the [latex]\$120[/latex] of interest and the initial [latex]\$1,000[/latex] are then combined to total [latex]\$1,120[/latex].

A loan or investment always involves two parties—one giving and one receiving. No matter which party you are in the transaction, the amount of interest remains unchanged. The only difference lies in whether you are earning or paying the interest.

- If you take out a personal loan from a bank, the bank gives you the money and you receive the money. In this situation, the bank earns the simple interest and you are being charged simple interest on your loan. In the figure, this means you must pay back not only the [latex]\$1,000[/latex] you borrowed initially but an additional [latex]\$120[/latex] in interest.

- If you place your money into an investment account at the bank, you have given the money and the bank has received the money. In this situation, you earn the simple interest on your money and the bank pays simple interest to your investment account. In the figure, this means the bank must give you back your initial [latex]\$1,000[/latex] at the end plus an additional [latex]\$120[/latex] of interest earned.

The best way to understand how simple interest is calculated is to think of the following relationship:

[latex]\text{Amount of Interest}=\underbrace{\text{How Much}}\text{ at }\underbrace{\text{What Simple Interest Rate}}\text{ for }\underbrace{\text{How Long}}[/latex]

Notice that the key variables are the amount, the simple interest rate, and time. Formula 5.1 combines these elements into a formula for simple interest.

[latex]\boxed{5.1}[/latex] Simple Interest

[latex]\color{red}{I\;}\color{black}{\text{is Interest Amount:}}[/latex] The interest amount is the dollar amount of interest that is paid or earned. To interpret the interest amount properly, remember who you are in the transaction. If you are borrowing the money, this is the interest amount charged to you. If you are investing the money, this is the interest amount you earn.

[latex]\color{blue}{P\;}\color{black}{\text{is Present Value or Principal:}}[/latex] The amount of money at the beginning of the time period being analyzed is known as the present value, or [latex]P[/latex]. If this is in fact the amount at the start of the financial transaction, it is also called the principal, which is the original amount of money that is borrowed or invested. Or it can simply be the amount at some earlier time before the future value was known. In any case, the amount excludes the interest.

[latex]\color{purple}{t}\color{black}{\;\text{is Time:}}[/latex] The time period or term is the length of the financial transaction for which interest is charged or earned.

[latex]\color{green}r\;{\color{black}{\text{is Interest Rate:}}}[/latex] The interest rate is the rate of interest that is charged or earned during a specified time period. It is usually expressed in percent format. Unless noted otherwise, interest rates are expressed on an annual basis. An interest rate is the result of Formula 3.1b[latex]\begin{align*}\text{Rate}=\frac{\text{Portion}}{\text{Base}}\end{align*}[/latex], where:

[latex]\begin{align*}\text{Rate}=\frac{\text{Portion}}{\text{Base}}\end{align*}[/latex]

In this case, you calculate an annual interest rate in its decimal format as follows:

[latex]\begin{align*}\text{Annual Interest Rate}=\frac{\text{Annual Interest Amount}}{\text{Principal}}\end{align*}[/latex]

Thus, if you are earning [latex]\$3[/latex] of interest annually on a [latex]\$100[/latex] principal, then your annual interest rate is [latex]\frac{3}{100}=0.03[/latex] or [latex]3\%[/latex].

HOW TO

Calculate Simple Interest

Follow these steps when you calculate the amount of simple interest:

Step 1: Formula 5.1[latex]I=Prt[/latex] has four variables, and you need to identify three for any calculation involving simple interest. If necessary, draw a timeline to illustrate how the money is being moved over time.

Step 2: Ensure that the simple interest rate and the time period are expressed with a common unit. If they are not already, you need to convert one of the two variables to the same units as the other.

Step 3: Apply Formula 5.1[latex]I=Prt[/latex] and solve for the unknown variable. Use algebra to manipulate the formula if necessary.

Assume you have [latex]\$500[/latex] earning [latex]3\%[/latex] simple interest for a period of nine months. How much interest do you earn?

Step 1: Note that your principal is [latex]\$500[/latex], or [latex]P=\$500[/latex]. The interest rate is assumed to be annual, so [latex]r=3\%[/latex] per year. The time period is nine months.

Step 2: Convert the time period from months to years: [latex]t=\frac{9}{12}[/latex].

Step 3: According to Formula 5.1:

[latex]\begin{eqnarray*}I&=&Prt\\I&=&\$500\times3\%\times\frac9{12}\\I&=&\$11.25\end{eqnarray*}[/latex]

Therefore, the amount of interest you earn on the [latex]\$500[/latex] investment over the course of nine months is [latex]\$11.25[/latex].

Key Takeaways

Recall that algebraic equations require all terms to be expressed with a common unit. This principle remains true for Formula 5.1[latex]I=Prt[/latex], particularly with regard to the interest rate and the time period. For example, if you have a [latex]3\%[/latex] annual interest rate for nine months, then either

- The time needs to be expressed annually as [latex]\frac{9}{12}[/latex] of a year to match the yearly interest rate, or

- The interest rate needs to be expressed monthly as [latex]\frac{3\%}{12}=0.25\%[/latex] per month to match the number of months.

It does not matter which you do so long as you express both interest rate and time in the same unit. If one of these two variables is your algebraic unknown, the unit of the known variable determines the unit of the unknown variable. For example, assume that you are solving Formula 5.1[latex]I=Prt[/latex] for the time period. If the interest rate used in the formula is annual, then the time period is expressed in number of years.

Paths To Success

Paths To Success

Four variables are involved in the simple interest formula, which means that any three can be known, requiring you to solve for the fourth missing variable. To reduce formula clutter, the triangle technique illustrated in the video helps you remember how to rearrange the formula as needed.

Concept Check

Try It

1) Answer the following:

- If you have money in your savings account (or any other investment) and it earns simple interest over a period of time, would you have more or less money in your account in the future?

- If you have a debt for which you haven’t made any payments, yet it is being charged simple interest on the principal, would you owe more or less money in the future?

Solution

- More, because the interest is earned and therefore is added to your savings account.

- More, because you owe the principal and you owe the interest, which increases your total amount owing

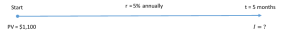

Example 5.1.1

Julio borrowed [latex]\$1,100[/latex] from Maria five months ago. When he first borrowed the money, they agreed that he would pay Maria [latex]5\%[/latex] simple interest. If Julio pays her back today, how much interest does he owe her?

Solution

Step 1: What are we looking for?

You need to calculate the amount of interest that Julio owes Maria.

Step 2: What do we already know?

The terms of their agreement are as follows:

[latex]P=\$1,100[/latex] [latex]r=5\%[/latex] [latex]t=5\;\text{months}[/latex]

Step 3: Make substitutions using the information known above.

The rate is annual, and the time is in months. Convert the time to an annual number. Since five months out of [latex]12[/latex] months in a year is [latex]\frac{5}{12}[/latex] of a year, [latex]t=\frac{5}{12}[/latex].

Apply Formula 5.1[latex]I=Prt[/latex].

[latex]\begin{eqnarray*}I&=&\$1,100\times5\%\times\frac5{12}\\[1ex]I&=&\$1,100\times0.05\times\frac5{12}\\[1ex]I&=&\$22.92\end{eqnarray*}[/latex]

Step 4: Provide the information in a worded statement.

For Julio to pay back Maria, he must reimburse her for the [latex]\$1,100[/latex] principal borrowed plus an additional [latex]\$22.92[/latex] of simple interest as per their agreement.

Example 5.1.2

A [latex]\$3,500[/latex] investment earned [latex]\$70[/latex] of interest over the course of six months. What annual rate of simple interest did the investment earn?

Solution

Step 1: What are we looking for?

You need to calculate the annual interest rate ([latex]r[/latex]).

Step 2: What do we already know?

The principal, interest amount, and time are known:

[latex]P=\$3,500[/latex] [latex]I=\$70[/latex] [latex]t=6\;\text{months}[/latex]

Step 3: Make substitutions using the information known above.

The computed interest rate needs to be annual, so you must express the time period annually as well. Since six months out of [latex]12[/latex] months in a year is [latex]\frac{6}{12}[/latex] of a year, [latex]t=\frac{6}{12}[/latex].

Apply Formula 5.1[latex]I=Prt[/latex], rearranging for [latex]r[/latex].

[latex]\begin{eqnarray*}\$70&=&\$3,500\times r\times\frac6{12}\\[1ex]r&=&\frac{\$70}{\$3,500\times\frac6{12}}\\[1ex]r&=&\frac{\$70}{\$1,750}\\[1ex]r&=&0.04\;\text{or}\;4\%\end{eqnarray*}[/latex]

Step 4: Provide the information in a worded statement.

For [latex]\$3,500[/latex] to earn [latex]\$70[/latex] simple interest over the course of six months, the annual simple interest rate must be [latex]4\%[/latex].

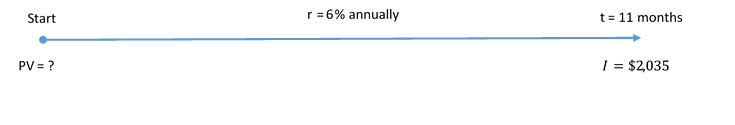

Example 5.1.3

What amount of money invested at [latex]6\%[/latex] annual simple interest for [latex]11[/latex] months earns [latex]\$2,035[/latex] of interest?

Solution

Step 1: What are we looking for?

You need to calculate the amount of money originally invested, which is known as the present value or principal, symbolized by [latex]P[/latex].

Step 2: What do we already know?

The interest rate, time, and interest earned are known:

[latex]r=6\%[/latex] [latex]t=11\;\text{months}[/latex] [latex]I=\$2,035[/latex]

Step 3: Make substitutions using the information known above.

Convert the time from months to an annual basis to match the interest rate. Since eleven months out of [latex]12[/latex] months in a year is [latex]\frac{11}{12}[/latex] of a year, [latex]t=\frac{11}{12}[/latex].

Apply Formula 5.1[latex]I=Prt[/latex], rearranging for [latex]\text{P}[/latex].

[latex]\begin{eqnarray*}\$2,035&=&P\times6\%\times\frac{11}{12}\\[1ex]P&=&\frac{\$2,035}{6\%\times\frac{11}{12}}\\[1ex]P&=&\frac{\$2,035}{0.06\times0.916}\\[1ex]P&=&\$37,000\end{eqnarray*}[/latex]

Step 4: Provide the information in a worded statement.

To generate [latex]\$2,035[/latex] of simple interest at [latex]6\%[/latex] over a time frame of [latex]11[/latex] months, [latex]\$37,000[/latex] must be invested.

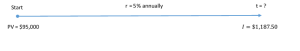

Example 5.1.4

For how many months must [latex]\$95,000[/latex] be invested to earn [latex]\$1,187.50[/latex] of simple interest at an interest rate of [latex]5\%[/latex]?

Solution

Step 1: What are we looking for?

You need to calculate the length of time in months ([latex]t[/latex]) that it takes the money to acquire the interest.

Step 2: What do we already know?

The amount of money invested, interest earned, and interest rate are known:

[latex]P=\$95,000.00[/latex] [latex]I=\$1,187.50[/latex] [latex]r=5\%[/latex]

Step 3: Make substitutions using the information known above.

Express the time in months. Convert the interest rate to a "per month" format. [latex]5\%[/latex] per year converted into a monthly rate is [latex]r=\frac{0.05}{12}[/latex].

Apply Formula 5.1[latex]I=Prt[/latex], rearranging for [latex]t[/latex].

[latex]\begin{eqnarray*}\$1,187.50&=&\$95,000\times\frac{0.05}{12}\times t\\[1ex]t&=&\frac{\$1,187.50}{\$95,000\times\frac{0.05}{12}}\\[1ex]t&=&\frac{\$1,187.50}{\$95,000\times0.00416}\\[1ex]t&=&3\;\text{months}\end{eqnarray*}[/latex]

Step 4: Provide the information in a worded statement.

For [latex]\$95,000[/latex] to earn [latex]\$1,187.50[/latex] at [latex]5\%[/latex] simple interest, it must be invested for a three-month period.

Try It

2) If you want to earn [latex]\$1,000[/latex] of simple interest at a rate of [latex]7\%[/latex] in a span of five months, how much money must you invest?

Solution

Step 1: Given information:

[latex]I=\$1,000[/latex]; [latex]r=7\%\;\text{annually}[/latex]; [latex]t=5\;\text{months}[/latex]

Step 2: Convert monthly [latex]t[/latex] to match annual [latex]r[/latex]:

[latex]t=\frac{5}{12}[/latex]

Step 3: Solve for [latex]P[/latex].

[latex]\begin{eqnarray*}P&=&\frac I{rt}\\[1ex]P&=&\frac{\$1,000}{0.07\left(\frac5{12}\right)}\\[1ex]P&=&\$34,285,71\end{eqnarray*}[/latex]

Step 4: Write as a statement.

I must invest [latex]\$34,285.71[/latex].

Try It

3) If you placed [latex]\$2,000[/latex] into an investment account earning [latex]3\%[/latex] simple interest, how many months does it take for you to have [latex]\$2,025[/latex] in your account?

Solution

Step 1: Given information:

[latex]I=\$2,025-\$2,000=\$25[/latex]; [latex]P=\$2,000[/latex]; [latex]r=3\%\;\text{annually}[/latex]

Step 2: Convert annual [latex]r[/latex] to match monthly [latex]t[/latex]:

[latex]r=\frac{3\%}{12}[/latex]

Step 3: Solve for [latex]t[/latex].

[latex]\begin{eqnarray*}t&=&\frac I{Pr}\\[1ex]t&=&\frac{\$25}{\$2,000\left(\frac{0.03}{12}\right)}\\[1ex]t&=&5\;\text{months}\end{eqnarray*}[/latex]

Step 4: Write as a statement.

It takes [latex]5[/latex] months to have [latex]\$2,025[/latex] in the account.

Try It

4) A [latex]\$3,500[/latex] investment earned [latex]\$70[/latex] of interest over the course of six months. What annual rate of simple interest did the investment earn?

Solution

Step 1: Given information:

[latex]P=\$3,500[/latex]; [latex]I=\$70[/latex]; [latex]t=6\;\text{months}[/latex]

Step 2: Convert the time period from months to years:

[latex]t=\frac{6}{12}[/latex]

Step 3: Solve for [latex]r[/latex].

[latex]\begin{eqnarray*}r&=&\frac I{Pt}\\[1ex]r&=&\frac{\$70}{\$3,500\left(\frac6{12}\right)}\\[1ex]r&=&0.04\;\text{or}\;4\%\end{eqnarray*}[/latex]

Step 4: Write as a statement.

The investment earned [latex]4\%[/latex] simple interest.

Time and Dates

In the examples of simple interest so far, the time period was given in months. While this is convenient in many situations, financial institutions and organizations calculate interest based on the exact number of days in the transaction, which changes the interest amount.

To illustrate this, assume you had money saved for the entire months of July and August, where [latex]t = \frac{2}{12}[/latex] or [latex]t = 0.16666...=0.1\overline{6}[/latex] of a year. However, if you use the exact number of days, the [latex]31[/latex] days in July and [latex]31[/latex] days in August total [latex]62[/latex] days. In a [latex]365[/latex]-day year that is [latex]t=\frac{62}{365}[/latex] or [latex]t=0.169863[/latex] of a year. Notice a difference of [latex]0.003196[/latex] ([latex]0.169863-0.16[/latex]) occurs. Therefore, to be precise in performing simple interest calculations, you must calculate the exact number of days involved in the transaction.

Using The BA 2+ Plus Date Function to Calculate the Exact Number of Days

In the video below we'll demonstrate how to use the BA2+ Date Function:

Key Takeaways

When solving for [latex]t[/latex], decimals may appear in your solution. For example, if calculating t in days, the answer may show up as [latex]45.9978[/latex] or [latex]46.0023[/latex] days; however, interest is calculated only on complete days. This occurs because the interest amount ([latex]I[/latex]) used in the calculation has been rounded off to two decimals. Since the interest amount is imprecise, the calculation of [latex]t[/latex] is imprecise. When this occurs, round [latex]t[/latex] off to the nearest integer.

Example 5.1.5

On September 13, 2011, Aladdin decided to pay back the Genie on his loan of [latex]\$15,000[/latex] at [latex]9\%[/latex] simple interest. If he paid the Genie the principal plus [latex]\$1,283.42[/latex] of interest, on what day did he borrow the money from the Genie?

Solution

Step 1: Given variables:

[latex]P=\$15,000[/latex]; [latex]I=\$1,283.42[/latex]; [latex]r=9\%\;\text{per year}[/latex]; [latex]\text{End Date}=\text{September 13, 2011}[/latex]

Step 2: The time is in days, but the rate is annual. Convert the rate to a daily rate:

[latex]\begin{align*}r=\frac{9\%}{365}\end{align*}[/latex]

Step 3: Solve for the time, [latex]t[/latex].

[latex]\begin{eqnarray}t&=&\frac I{Pr}\\[1ex]t&=&\frac{\$1,\!283.42}{\$15,\!000\times\frac{0.09}{365}}\\[1ex]t&=&346.998741=347\;\text{days}\end{eqnarray}[/latex]

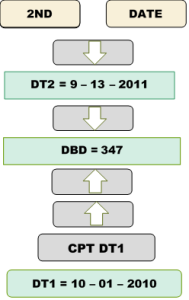

Step 4: Use the DATE function to calculate the start date (DT1). Use the time in days.

Calculator Instructions:

Step 5: Write as a statement.

If Aladdin owed the Genie [latex]\$1,283.42[/latex] of simple interest at [latex]9\%[/latex] on a principal of [latex]\$15,000[/latex], he must have borrowed the money [latex]347[/latex] days earlier, which is October 1, 2010.

Section 5.1 Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- Brynn borrowed [latex]\$25,000[/latex] at [latex]1\%[/latex] per month from a family friend to start her entrepreneurial venture on December 2, 2011. If she paid back the loan on June 16, 2012, how much simple interest did she pay?

Solution

Step 1: Given information:

[latex]P=\$25,000[/latex]; [latex]r=1\%\;\text{monthly}[/latex]; [latex]t=\text{December 2, 2011 to June16, 2012}[/latex]

Use DATE function on calculator to get the number of days. Total days for [latex]t=197[/latex]

Step 2: Convert both the monthly [latex]r[/latex] and the daily [latex]t[/latex] annual numbers:

[latex]r=1\%\times 12=12\%\;\text{annually}[/latex]; [latex]t=197365[/latex]

Step 3: Solve for [latex]I[/latex].

[latex]\begin{eqnarray*}I&=&Prt\\I&=&\$25,000\left(0.12\right)\left(\frac{197}{365}\right)\\I&=&\$1,619.18\end{eqnarray*}[/latex]

Step 4: Write as a statement.

She payed [latex]\$1,619.18[/latex] simple interest.

- If [latex]\$6,000[/latex] principal plus [latex]\$132.90[/latex] of simple interest was withdrawn on August 14, 2011, from an investment earning [latex]5.5\%[/latex] interest, on what day was the money invested?

Solution

Need to calculate [latex]t[/latex] in days first:

Step 1: Given information:

[latex]I=\$132.90[/latex]; [latex]P=\$6,000[/latex]; [latex]r=5.5\%\;\text{annually}[/latex]

Step 2: Convert annual [latex]r[/latex] to match daily [latex]t[/latex]:

[latex]\begin{align*}r=\frac{5.5\%}{365}\end{align*}[/latex]

Step 3: Solve for [latex]t[/latex].

[latex]\begin{eqnarray*}t&=&\frac I{Pr}\\[1ex]t&=&\frac{\$132.90}{\$6,000\left(0.055365\right)}\\[1ex]t&=&146.995454\;\text{days}\rightarrow147\;\text{days}\end{eqnarray*}[/latex]

Use the DATE function on the calculator to find the date when the money was invested.

Step 4: Write as a statement.

The money was invested on March 20, 2011.

THE FOLLOWING LATEX CODE IS FOR FORMULA TOOLTIP ACCESSIBILITY. NEITHER THE CODE NOR THIS MESSAGE WILL DISPLAY IN BROWSER.[latex]\begin{align*}\text{Rate}=\frac{\text{Portion}}{\text{Base}}\end{align*}[/latex][latex]I=Prt[/latex]

Attribution

"8.1 Simple Interest: Principal, Rate, Time" from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.