8 Week 8 Introduction to Financial Statements

Week 8 Introduction to Financial Statements

Introduction

Learning Objectives

Learning Objectives

By the end of this week you will be able:

- Discover what kind of accounting statement is needed under which circumstances

- How to report and interpret financial information

- Understand and construct the accounting equation

This chapter should take you 25 minutes to read and plus time to complete activities.

[1][2]

Accounting is often called “the language of business” because it communicates so much of the information that owners, managers, and investors need to evaluate a company’s financial performance. These people are stakeholders in the business—they’re interested in its activities because they’re affected by them. The financial futures of owners and other investors may depend heavily on strong financial performance from the business, and when performance is poor, managers may be replaced or laid off in a downsizing. In fact, a key purpose of accounting is to help stakeholders make better business decisions by providing them with financial information.

You shouldn’t try to run an organization or make investment decisions without accurate and timely financial information, and it is the accountant who prepares this information. More importantly, accountants make sure that stakeholders understand the meaning of financial information, and they work with both individuals and organizations to help them use financial information to deal with business problems. Actually, collecting all the numbers is the easy part. The hard part is analyzing, interpreting, and communicating the information. Of course, you also have to present everything clearly while effectively interacting with people from every business discipline. In any case, we’re now ready to define accounting as the process of measuring and summarizing business activities, interpreting financial information, and communicating the results to management and other decision makers.

Video Activity: What does an accountant do and why is it so important? [1:58].

Video Activity: What does an accountant do and why is it so important? [1:58].

This is a short video that speaks to how an account support decisions within an organization.

The Role of Accounting

Accounting is often called “the language of business” because it communicates so much of the information that owners, managers, and investors need to evaluate a company’s financial performance. These people are stakeholders in the business—they’re interested in its activities because they’re affected by them. The financial futures of owners and other investors may depend heavily on strong financial performance from the business, and when performance is poor, managers may be replaced or laid off in a downsizing. In fact, a key purpose of accounting is to help stakeholders make better business decisions by providing them with financial information. You shouldn’t try to run an organization or make investment decisions without accurate and timely financial information, and it is the accountant who prepares this information. More importantly, accountants make sure that stakeholders understand the meaning of financial information, and they work with both individuals and organizations to help them use financial information to deal with business problems. Actually, collecting all the numbers is the easy part. The hard part is analyzing, interpreting, and communicating the information. Of course, you also have to present everything clearly while effectively interacting with people from every business discipline. In any case, we’re now ready to define accounting as the process of measuring and summarizing business activities, interpreting financial information, and communicating the results to management and other decision makers.

Fields of Accounting

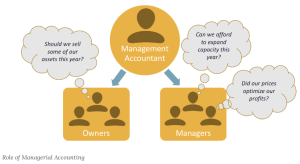

Accountants typically work in one of two major fields. Management accountants provide information and analysis to decision makers inside the organization in order to help them run it. Financial accountants furnish information to individuals and groups both inside and outside the organization in order to help them assess its financial performance. Their primary focus, however, is on external parties. In other words, management accounting helps you keep your business running while financial accounting tells the outside world how well you’re running it.

Management Accounting

Management accounting, also known as managerial accounting, plays a key role in helping managers carry out their responsibilities. Because the information that it provides is intended for use by people who perform a wide variety of jobs, the format for reporting information is flexible. Reports are tailored to the needs of individual managers, and the purpose of such reports is to supply relevant, accurate, timely information that will aid managers in making decisions. In preparing, analyzing, and communicating such information, accountants work with individuals from all the functional areas of the organisation—human resources, operations, marketing, etc.

Role of Managerial Accounting

Financial Accounting

Financial accounting is responsible for preparing the organization’s financial statements—including the income statement (also called the profit/loss statement), the statement of owner’s equity, the balance sheet, and the statement of cash flows—that summarize a company’s past performance and evaluate its current financial condition. If a company is traded publicly on a stock market such as the TSX (Toronto Stock Exchange), these financial statements must be made public, which is not true of the internal reports produced by management accountants. In preparing financial statements, Canadian financial accountants adhere to a uniform set of rules called international financial reporting standards (IFRS)—the basic principles for financial reporting issued by an independent agency called the Financial Accounting Standards Board (FASB). Users want to be sure that financial statements have been prepared according to IFRS because they want to be sure that the information reported in them is accurate. They also know that when financial statements have been prepared by the same rules, they can be compared from one company to another.

Who Uses Financial Accounting Information?

The users of managerial accounting information are pretty easy to identify—basically, they’re a firm’s managers. We need to look a little more closely, however, at the users of financial accounting information, and we also need to know a little more about what they do with the information that accountants provide them. Publicly Traded companies will provide their financial accounting information to a wider set of stakeholders, including shareholders, potential investors, etc., than compared to a privately held company that will generate a single set of financial statements according to the International Financial Reporting Standards. Publicly Traded companies will also provide their financial accounting information to the general public in order to showcase to potential investors the company’s performance. Therefore, Publicly Traded companies will typically generate two sets of financial statements, one set of detailed statements in accordance with Canadian International Financial Reporting Standards (IFRS) and another set of simplified financial statements that can be more easily consumed by the general public. For example, Tim Hortons provides access to their simplified financial statements through annual reports which can be found at http://www.rbi.com/Annual-Reports

Owners and Managers

In summarizing the outcomes of a company’s financial activities over a specified period of time, financial statements are, in effect, report cards for owners and managers. They show, for example, whether the company did or didn’t make a profit and furnish other information about the firm’s financial condition. They also provide some information that managers and owners can use in order to take corrective action, though reports produced by management accountants offer a much greater level of depth.

Investors and Creditors

Investors and creditors furnish the money that a company needs to operate, and not surprisingly, they want to know how that business is performing. Because they know that it’s impossible to make smart investment and loan decisions without accurate reports on an organization’s financial health, they study financial statements to assess a company’s performance and to make decisions about continued investment.

According to the world’s most successful investor, Warren Buffett, the best way to prepare yourself to be an investor is to learn all the accounting you can. Buffett, chairman and CEO of Berkshire Hathaway, a company that invests in other companies, turned an original investment of $10,000 into a net worth of $66 billion[3] in four decades, and he did it, in large part, by paying close attention to financial accounting reports.

Government Agencies

Businesses are required to furnish financial information to a number of government agencies. Publicly-owned companies, for example—the ones whose shares are traded on a stock exchange—must provide annual financial reports to their respective provincial Securities Commission. For example, companies located in Ontario would provide financial reports to the Ontario Securities Commission (OSC), a federal agency that regulates stock trades and which is charged with ensuring that companies tell the truth with respect to their financial positions. Companies must also provide financial information to the Canadian Revenue Agency (CRA).

The Role of Financial Accounting

Other Users

A number of other external users have an interest in a company’s financial statements. Suppliers, for example, need to know if the company to which they sell their goods is having trouble paying its bills or may even be at risk of going under. Employees and labour unions are interested because salaries and other forms of compensation are dependent on an employer’s performance.

The previous figures illustrate the main users of management and financial accounting and the types of information produced by accountants in the two areas. In the rest of this chapter, we’ll learn how to prepare a set of financial statements and how to interpret them. We’ll also discuss issues of ethics in the accounting communities and career opportunities in the accounting profession.

Understanding Financial Statements

We hope that, so far, at least one thing is clear: If you’re in business, you need to understand financial statements. The law no longer allows high-ranking executives to plead ignorance or fall back on delegation of authority when it comes to responsibility for a firm’s financial reporting. In a business environment tainted by episodes of fraudulent financial reporting and other corporate misdeeds, top managers are now being held responsible for the financial statements issued by the people who report to them. Top managers need to know how well the company is performing. Financial information helps managers identify signs of impending trouble before it is too late.

The Function of Financial Statements

Put yourself in the place of Connor, who runs Connor’s Confections out of his home. He loves what he does, and he feels that he’s doing pretty well. In fact, he has an opportunity to take over a nearby store at very reasonable rent, and he can expand by getting a modest bank loan and investing some more of his own money. So it’s decision time for Connor: He knows that the survival rate for start-ups isn’t very good, and before taking the next step, he’d like to get a better idea of whether he’s actually doing well enough to justify the risk. The basic financial statements will give him some answers. Here, three common statement types are introduced.

- Income Statement = Shows sales, expenses, and whether or not a profit was made.

- Balance Sheet = Show assets and liabilities, the amount invested in the business.

- Statement of Cash Flows = Show how much cash is coming in and going out.

- Even from this basic overview, match which financial statement answers each of Connor’s questions.

Check your understanding

Check Your Understanding

Since this book is for an introductory course, attention is on the income statement, balance sheet, and cash flow statement only, even though other financial statements are mentioned.

Toying with a Business Idea

To bring this concept closer to home, let’s assume that you need to earn money while you’re in college and that you’ve decided to start a small business. Your business will involve selling stuff to other college students, and to keep things simple, we’ll assume that you’re going to operate on a “cash” basis: you’ll pay for everything with cash, and everyone who buys something from you will pay in cash.

You may have at least a little cash on you right now—some currency, or paper money, and coins. In accounting, however, the term cash refers to more than just paper money and coins. It also refers to the money that you have in chequing and savings accounts and includes items that you can deposit in these accounts, such as money orders and different types of cheques.

Your first task is to decide exactly what you’re going to sell. You’ve noticed that with homework, exams, social commitments, and the hectic lifestyle of the average college student, you and most of the people you know always seem to be under a lot of stress. Sometimes you wish you could just lie back between meals and bounce a ball off the wall. And that’s when the idea hits you: Maybe you could make some money by selling a product called the “Stress-Buster Play Pack.” Here’s what you have in mind: you’ll buy small toys and other fun stuff—instant stress relievers—at a local dollar store and pack them in a rainbow-colored plastic treasure chest labeled “Stress-Buster.”

And here’s where you stand: You have enough cash to buy a month’s worth of plastic treasure chests and toys. After that, you’ll use the cash generated from sales of Stress-Buster Play Packs to replenish your supply. Each plastic chest will cost $1.00, and you’ll fill each one with a variety of five simple toys, all of which you can buy for $1.00 each.

You plan to sell each Stress-Buster Play Pack for $10 from a rented table stationed outside a major dining hall. Renting the table will cost you $20 a month. In order to make sure you can complete your school work, you decide to hire fellow students to staff the table at peak traffic periods. They’ll be on duty from noon until 2:00 p.m. each weekday except Fridays, and you’ll pay them a generous $7.50 an hour. Wages, therefore, will cost you $240 a month (2 hours × 4 days × 4 weeks = 32 hours × $7.50). Finally, you’ll run ads in the college newspaper at a monthly cost of $40. Thus your total monthly costs will amount to $300 ($20 + $240 + $40).

The Income Statement

Let’s say that during your first month, you sell one hundred play packs. Not bad, you say to yourself, but did I make a profit? To find out, you prepare an income statement showing revenues, or sales, and expenses—the costs of doing business. You divide your expenses into two categories:

- Cost of goods sold: the total cost of the goods that you’ve sold

- Operating expenses: the costs of operating your business except for the costs of things that you’ve sold.

Now you need to do some subtracting:

- The difference between sales and cost of goods sold is your gross profit, also known as gross margin.

- The difference between gross profit and operating expenses is your net income or profit, which is the proverbial “bottom line.” Note we’ve assumed you’re making money, but businesses can also have a net loss.

Below is your income statement for the first month. (Remember that we’ve made things simpler by handling everything in cash.)

Stress-Buster Company – Income Statement

Stress-Buster Company – Income Statement

Month Ended April 30, 2018

Sales (100 x $10.00) $1,000

Less cost of goods sold (100 x $6) $600

Gross profit (100x ($10 – $6)) $400

Less operating expenses

Salaries $240

Advertising $40

Table rental $20

Total Expenses $300

Net income (Profit) ($400-$300) $100

Did You Make Any Money?

What does your income statement tell you? It has provided you with four pieces of valuable information:

- You sold 100 units at $10 each, bringing in revenues or sales of $1,000.

- Each unit that you sold cost you $6 – $1 for the treasure chest plus 5 toys costing $1 each. So your cost of goods sold is $600 (100 units × $6 per unit).

- Your gross profit—the amount left after subtracting cost of goods sold from sales—is $400 (100 units × $4 each).

- After subtracting operating expenses of $300 – the costs of doing business other than the cost of products sold—you generated a positive net income or profit of $100.

The Balance Sheet

A balance sheet reports the following information:

- Assets: the resources from which it expects to gain some future benefit

- Liabilities: the debts that it owes to outside individuals or organizations

- Owner’s equity: the investment in the business

Whereas your income statement tells you how much income you earned over some period of time, your balance sheet tells you what you have at a specific point in time.

Companies prepare financial statements on at least a twelve-month basis—that is, for a fiscal year which ends on December 31 or some other logical date, such as June 30 or September 30. Fiscal years can vary because companies generally pick a fiscal-year end date that coincides with the end of a peak selling period; thus a crabmeat processor might end its fiscal year in October, when the crab supply has dwindled. Most companies also produce financial statements on a quarterly or monthly basis. For Stress-Buster, you’ll want to prepare them monthly to stay on top of how your new business is doing. Let’s prepare a balance sheet at the start and end of your first month in business.

The Accounting Equation

To prepare a balance sheet, one must first understand the fundamental accounting equation:

Assets = Liabilities + Owner’s Equity

This simple but important equation highlights the fact that a company’s assets came from somewhere: either from investments made by the owners (owner’s equity) or from loans (liabilities). This means that the asset section of the balance sheet on the one hand and the liability and owner’s-equity section on the other must be equal, or balance. Thus the term balance sheet.

Let’s prepare the two balance sheets we mentioned: one for the first day you started and one for the end of your first month of business. We’ll assume that when you started Stress-Buster, you borrowed $400 from your parents and put in $200 of your own money. If you look at your first balance sheet below, you’ll see that your business has $600 in cash (your assets): Of this total, you borrowed $400 (your liabilities) and invested $200 of your own money (your owner’s equity). So far, so good: your assets section balances with your liabilities and owner’s equity section as follows:

Stress-Buster Company – Balance Sheet

Stress-Buster Company – Balance Sheet

As of April 1, 2018

Assets

Cash $600

Liabilities and Owner’s Equity

Liabilities $400

Owner’s Equity $200

Total Liabilities and Owner’s Equity $600

Now let’s see how things have changed by the end of the month. Recall that Stress- Buster earned $100 during the month of September and that you decided to leave these earnings in the business. This $100 profit increases two items on your balance sheet: the assets of the company (its cash) and your investment in it (its owner’s equity). Below shows what your balance sheet will look like on April 30. You now have $700 in cash: $400 that you borrowed plus $300 that you’ve invested in the business (your original $200 investment plus the $100 profit from the first month of operations, which you’ve kept in the business).

Stress-Buster Company – Balance Sheet

Stress-Buster Company – Balance Sheet

As of April 30, 2018

Assets

Cash (Original $600 plus $100 earned) $700

Liabilities and Owner’s Equity

Liabilities $400

Owner’s Equity ($200 invested by owner plus $100 profits retained) $300

Total Liabilities and Owner’s Equity $700

To help you understand the balance sheet a bit more and how it is related to the Accounting Equation, check out this video.

Video Activity: The Accounting Equation for Beginners [4:57]

Video Activity: The Accounting Equation for Beginners [4:57]

Breakeven Analysis

While you have covered breakeven analysis in prior chapters, let’s see how it looks in financial statements.

Let’s take a short detour to see how this information might be put to use. As you look at your first financial statements, you might ask yourself: is there some way to figure out the level of sales you need to avoid losing money—to “break even”? This can be done using breakeven analysis. To break even (have no profit or loss), your total sales revenue must exactly equal all your expenses (both variable and fixed). Variable costs depend on the quantity produced and sold; for example, each Stress-Buster includes the treasure chest and the toys inside. Fixed costs don’t change as the quantity sold changes; for example, you’ll pay for your advertising whether you sell Stress-Busters or not. The balance between revenue and expenses will occur when gross profit equals all other (fixed) costs. To determine the level of sales at which this will occur, you need to do the following (using data from the previous example):

- Determine your total fixed costs: Fixed costs = $240 salaries + $40 advertising + $20 table = $300

- Identify your variable costs on a per-unit basis: Variable cost per unit = $6 ($1 for the treasure chest and $5 for the toys)

- Determine your contribution margin per unit: Selling price per unit – variable cost per unit: Contribution margin = $10 selling price – $6 variable cost per unit = $4

- Calculate your breakeven point in units: fixed costs: Contribution margin per unit: Breakeven in units = $300 fixed costs ÷ $4 contribution margin per unit = 75 units

Your calculation means that if you sell 75 units, you’ll end up with zero profit (or loss) and will exactly break even. To test your calculation, you can prepare a what-if income statement for 75 units in sales (your breakeven number). The resulting statement is shown in the table below.

Of course you want to do better than just break even, so you could modify this analysis to a targeted level of profit by adding that amount to your fixed costs and repeating the calculation. Breakeven analysis is rather handy. It enables you to determine the level of sales that you must reach to avoid losing money and the level of sales that you have to reach to earn a certain profit. Such information will be vital to planning your business.

Stress-Buster Company – Income Statement

Stress-Buster Company – Income Statement

Month Ended April 30, 2018

(at breakeven level sales of 75 units)

Sales (75 x $10.00) $750

Less cost of goods sold (75 x $6) $450

Gross profit (75x ($10 – $6)) $300

Less operating expenses

Salaries $240

Advertising $40

Table rental $20

Total Expenses $300

Net income (Profit) ($400-$300) $0

The Cash Flow Statement

The Cash Flow Statement provides valuable information about a company’s expenses and receipts and allows insights into its future income needs in order to be able to meet its future obligations (expenses and receipts). The cash flow statement reports cash inflows and outflows, and it will identify the amount of cash the company currently holds, which is also reported in the balance sheet.

Typically the cash flow statement is reported on a month to month basis, however, a statement of cash flow will consolidate month to month cash flow to meet the requirements of the International Financial Reporting Standards.

A statement of cash flow will report cash in three distinct areas of business:

- Cash from Operations

- Cash from Investing

- Cash from Financing

Now let’s prepare the statement of cash flow for Stress-Buster company for the one month period ending April 30, 2018. Stress-Buster would have incurred cash from Operations in the form of Net Income incurred after deducting the month’s expenses from the month’s revenues and would have also incurred cash from Financing from the initial $400 loan taken out to start the business and the additional $200 of personal income. As Stress-Buster did not invest in new equipment, machinery or other assets for the business or use prior cash flows and/or retained earning to earn further investment income, Stress-Buster would not report any cash from investing activities.

Stress-Buster Company – Statement of Cash Flow

Stress-Buster Company – Statement of Cash Flow

Month Ended April 30, 2018

Beginning Cash $0

Operating Activities $100

Net Income from Operations $100

Investing Activities

Financial Activities $600

Increase in Short Term Debt $400

Increase in Retained Earnings $200

Ending Cash Balance (Net Change) $700

Check Your Understanding

Check Your Understanding