2 Week 2 Self-Employment and Personal Taxes

Week 2 Self-Employment and Personal Taxes

Introduction

Learning Objectives

Learning Objectives

By the end of this week, you will be able to use financial information to:

- Use financial information to prepare personal and sole proprietor taxes using Google Sheets

- Read and comprehend T4 Taxation forms

- Understand the difference between self-employment (contract work) and employment

- Assemble a summary of deductions available for self-employment

- Understand the guidelines around different deductions this lesson, students will be able to use financial information to prepare personal and sole proprietor taxes (including deductions)

This chapter should take you 28-30 minutes to read and time in class to complete an In-Class Case Study.

Meet Tomomi

Tomomi works on contract as a graphics designer, tutors on the side, does childcare in the summer, and buys and sells anime collectibles. Every year, Tomomi deposits $1,000 into her RRSP. She used a car loan to buy her car. Whatever cash is left over after she has paid her bills is saved in a high-interest savings account and invested in her tax-free savings account. At the end of 2020, she is trying to draw up a budget for 2021.

Remember that on a cash flow statement, negative and positive numbers indicate direction of flow. A negative number is cash flowing out, and a positive number is cash flowing in. Conventionally, negative numbers appear in parentheses. The following table shows income streams and taxes owing.

|

|

2018 |

2019 |

2020 |

2021 |

|

Incomes |

||||

|

Contract Earnings |

32,000 |

33,500 |

35,000 |

36,500 |

|

Tutoring |

3,000 |

4,000 |

2,500 |

2,000 |

|

Collectible Sales |

2,500 |

950 |

2,650 |

5,300 |

|

Childcare/Nanny |

10,000 |

11,000 |

4,500 |

10,250 |

|

Interest Income |

180 |

192 |

173 |

146 |

|

Total Income |

47,680 |

49,642 |

44,823 |

54,196 |

|

Payroll/Income Taxes |

(8,000) |

(8,375) |

(8,750) |

(9,125) |

|

Disposable Income |

39,680 |

41,267 |

36,073 |

45,071 |

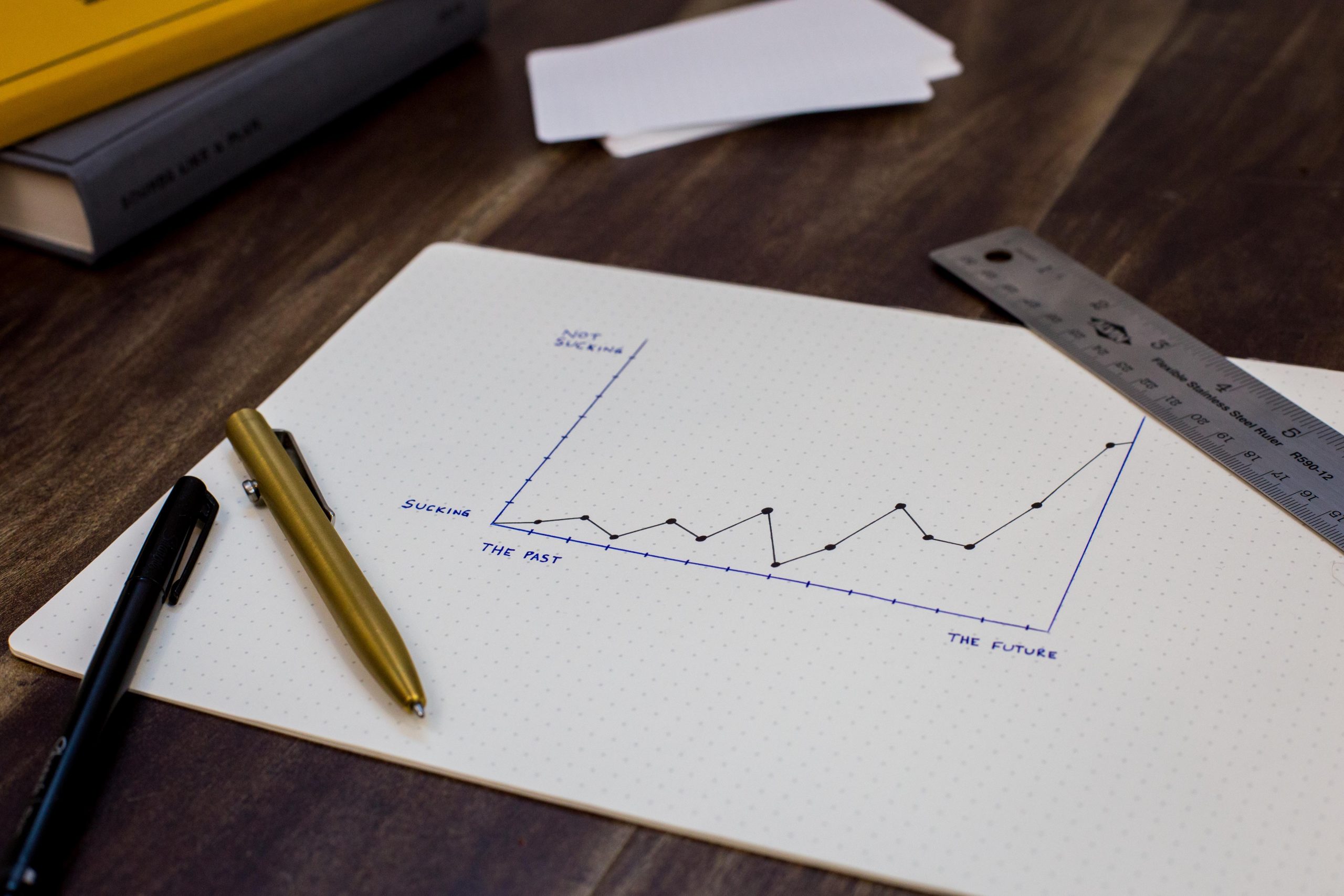

Tomomi has five sources of income—some more constant, some more reliable, and some more seasonal. Tomomi’s graphics design job provides a steady, year-round income. Childcare or nanny work can be more seasonal, although fairly reliable, source of income; in 2018, it was less because Tomomi fell on a slippery stairwell and was unable to care for kids for two months while her broken ankle healed. She had to spend money on crutches and the rental of a leg scooter.

A 2019 report from Toronto Arts Foundation highlighted that 72% of artists work on freelance or contract basis with multiple revenue sources (Artists fees, Grants, Family Support, Royalties and Other) and 78% supplement their arts business with revenue from part-time or full-time jobs.

Tutoring is also a seasonal source of income, which decreased in 2020 due to the COVID-19 pandemic. Anime collectible trading is a year-round, but unpredictable source of income. In 2020, she made some very lucrative trades including rare mint Mega Man Trading Cards , but in 2019 she made almost none. Interest income depends on the balance in the high interest savings account. She would include her graphics design, childcare, and interest incomes in her budget, but should be conservative about including her tutoring or collectible trading incomes because they have been very unpredictable.

By selecting a career in the creative industries, you are more likely to be working on a short-term contract, have a part-time/seasonal job and have two or more parallel jobs like Tomoni. While this precarious nature of work has many social issues which are important to understand, people who work like this need to understand taxation more than the person who simply has one full-time job. The person with one full-time job has their taxes removed with every paycheque and simply files a return at the end of the year to get a refund.

However, the creative worker who has multiple parallel sources of income ranging from employment to contract work, has many more sources of revenue and deductions and thus has a much more complex filing for taxes every year.

Think About It

Due to the unique nature of work and multiple sources of revenue, self-employment and personal taxes are an important topic that future creative workers must understand. You will either be the person who is working multiple jobs or hiring and working with people who have multiple jobs.

Introduction to Self Employment and Taxes

Many people tend to focus on taxes only in the lead-up to the Canadian April 30 deadline to file personal income tax. But successful financial planning requires an effective tax strategy throughout the whole year, as well as a basic understanding of the tax rules and regulations. As Kapoor et al. (2015) point out, there are common goals related to tax planning:

- knowing the current tax laws and regulations that affect you,

- maintaining complete and appropriate tax records, and

- making employment, purchase, and investment decisions that leave you with the greatest after tax cash flows and net wealth[1]. (p. 172)

Any government that needs to raise revenue and has the legal authority to do so may tax. Tax jurisdictions reflect government authorities. Taxation is used by governing bodies to fund public services such as “water, sewer, roads, garbage collection, education, and health care” (Wadden, 2016, p. 125).

In Canada, federal, provincial or territorial, and municipal governments impose taxes. Many Indigenous governments also impose taxes. Individuals and businesses in Canada must pay the following taxes: property tax, income tax, and sales tax. Similarly, in many countries there are national, provincial or state, county, and municipal taxes. Regional economic alliances, such as the European Union, may also levy taxes. The following are common taxes paid by people in Canada every year:

- Income taxes on employment and other income that you receive

- Sales taxes such as the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) and the Provincial Sales Taxes (PST)

- Property taxes, usually charged by local governments on the value of land and buildings

- Customs duties or tariffs on certain imported and exported products

- Contributions by employers and employees to social security plans such as the Employment Insurance (EI) system, the Canada Pension Plan (CPP), the Québec Pension Plan (QPP), or the Québec Parental Insurance Plan

- Health services taxes charged in some provinces for access to the provincial health-care system

- Other taxes such as motor vehicle licences and natural resource taxes. (FCAC, 2017)

Governments tax income because it is a way to tax broadly based on the ability to pay. Most adults have an income from some source, even if it is a government distribution. Those with higher incomes should be able to pay more taxes, and, in theory, they should be willing to do so, for they have been more successful in or have benefited more from the economy that the government protects.

According to the Financial Consumer Agency of Canada, the following are definitions of different types of taxes:

Income tax is usually a progressive tax: the higher the income or the more to be taxed, the greater the tax rate. The percentage of income that is paid in tax increases as income rises. Those income categories are called tax brackets as were shared when you met Tomomi.

Income tax is the main source of revenue for the federal government and is a direct tax on the income of individuals and businesses. Income tax can be levied by the federal, provincial or territorial, and Indigenous governments. The Income Tax Act provides the federal government with the authority to collect income tax.

With regard to the federal and provincial or territorial governments, your income, minus the deductions for which you qualify, must be calculated in order to arrive at a taxable income. You are taxed first by the federal government and then by your provincial or territorial government.

In Canada, we operate under a marginal tax rate system. Marginal tax is the amount of tax paid on an additional dollar of income. Unlike the flat tax rate, where you pay the same rate of tax no matter what your income, a marginal tax rate system increases the tax rate as income rises. Knowing one’s marginal tax rate can help you make effective long-term financial decisions.

For example, if you know you will be taxed at a much higher rate because you will be earning significantly more income in the coming year, you might want to consider investing in an RRSP. However, this strategy only makes sense if you can reasonably assume that you will be earning a much lower income in retirement and therefore paying a lower income tax in retirement.

The rate at which you are taxed is categorized into tax brackets and is determined by the government. The table below shows an overview of 2021 federal tax brackets.

|

If your taxable income was between |

Federal Marginal Tax Rate |

|

$49,020 or less |

15% |

|

$49,020 to $98,040 |

20.5% |

|

$98,040 to $151,978 |

26% |

|

$151,978 to $216,511 |

29% |

|

More than $216,511 |

33% |

Data Source: Canadian Tax Brackets, Financial Consumer Agency of Canada, Retrieved from https://www.canada.ca/en/financial-consumer-agency/services/financial-toolkit/taxes/taxes-2/5.html

Federal tax and tax for all provinces and territories (except Quebec) is calculated the same way. Marginal tax rates calculate the amount of combined federal and provincial taxes payable on the next dollar of income. To calculate your combined federal and provincial tax bill in each province and territory as of June 15, 2018, you can use the 2022 Tax Calculator found on Ernst & Young’s website.

Tax is levied on income from many sources:

- wages (selling labour),

- interest, dividends, and gains from investment (selling capital),

- self-employment (operating a business or selling a good or service),

- property rental,

- royalties (rental of intellectual property), and

- “other” income such as alimony, gambling winnings, or prizes.

A sales tax or consumption tax taxes the consumption financed by income. In Canada, sales taxes are imposed by the federal and provincial governments. Sales taxes are said to be more efficient and fair in that consumption reflects income (income determines one’s ability to consume and therefore one’s level of consumption). Consumption is also hard to hide, making sales tax a good way to collect taxes based on one’s ability to pay. Consumption taxes typically tax all consumption, including nondiscretionary items such as food, clothing, and housing. Opponents of sales tax argue that it is a regressive tax, because those with lower incomes must use a higher percentage of their incomes on nondiscretionary purchases than higher-income people do.

Sales tax is an example of an indirect tax because it involves an intermediary that collects tax from a person or organization and remits it to the entity that is imposing it (Wadden, 2016, p. 128). The seller (the taxation body) collects the tax from the buyer.

The value-added tax (VAT) or GST is a consumption tax, but it differs from the sales tax, which is paid only by the consumer as an end user. With a VAT or GST, the value added to the product is taxed at each stage of production. Governments use a VAT or GST instead of a sales tax to spread the tax burden among producers and consumers, and thus to reduce incentive to evade the tax. A consumption tax is a regressive tax. When travelling abroad, you should be aware that a VAT may add substantially to the cost of a purchase (i.e. a meal, accommodations, etc.).

Excise taxes are taxes on specific consumption items such as alcohol, cigarettes, motor vehicles, fuel, or highway use. In some provinces, excise taxes are justified by the discretionary nature of the purchases and may be criticized as exercises in “social engineering”—using the tax code to dictate social behaviours. For example, people addicted to nicotine or alcohol tend to purchase cigarettes or liquor even if an excise tax increases their cost and are therefore a reliable source of tax revenue.

Property taxes are used primarily by local—municipal, provincial or territorial, state, and county—governments, and are most commonly imposed on real property (land and buildings), but also on personal assets such as vehicles and boats. Property values theoretically reflect wealth (accrued income) and thus one’s ability to pay taxes. Property values are also a matter of public record (real property is deeded, whereas boats or automobiles are licensed), which allows more efficient tax collection. First Nations property may be taxed under bylaws passed by band councils, which may have authority under section 83 of the Indian Act or the 2005 First Nations Fiscal and Statistical Management Act. Most of these bylaws exempt property that is owned by band members (Wadden, 2016).

THE CANADIAN FEDERAL INCOME TAX PROCESS

The Canadian government relies most on income tax to provide for various types of government services. Income tax is the most relevant tax to consider for personal financial planning, as everyone has some sort of income over a lifetime. Most provinces and territories model their tax systems on the federal model or base their tax rates on federally defined income.

Taxable Entities

There are three taxable entities in the federal system: the individual or family unit, the corporation, and the trust. Personal financial planning focuses on your decisions as an individual or family unit, but other tax entities can affect individual income. Corporate profit may be distributed to individuals as a dividend, for example, which then becomes the individual’s taxable income. Likewise, funds established for a specific purpose may distribute money to an individual that is taxable as individual income. A trust, for example, is a legal arrangement whereby control over property is transferred to a person or organization (the trustee) for the benefit of someone else (the beneficiary). In Canada, the estate pays the taxes owed to the government, not the beneficiaries.

While Canadian tax rules do not allow spouses to file joint income tax returns, couples in Canada can reduce the total amount of taxes they have to pay. If you choose to use tax preparation software, it may include an option to prepare a “coupled” return that maximizes your benefits while still generating two separate returns.

All taxable entities, including non-residents who receive income from sources in Canada, have to file a declaration of incomes and pay any tax obligations annually. Under Canada’s tax system, what you pay in income tax is based on your residency status.

But not everyone who files a tax return actually pays taxes. For example, individuals with low incomes and tax exempt, non-profit corporations typically do not. All potential taxpayers nevertheless must declare income and show their obligations to the government. For the individual, that declaration is filed on the T1 General form, which can be accessed on the Canada Revenue Agency website.

Income

For individuals, the first step in the process is to calculate total income. Income may come from many sources, and each income must be calculated and declared. Some kinds of income have a separate form or schedule to show their more detailed calculations. The following schedules are the most common for reporting incomes separately by source [2].

Interest and Dividend Income

Interest income is income from selling liquidity. For example, the interest that your savings account, guaranteed investment certificate, and bonds earn in a year is income. You essentially are earning interest from lending cash to a bank, a government, or a corporation (though not all your interest income may be taxable). Dividend income, on the other hand, is income from investing in the stock market. Dividends are your share of corporate profits as a shareholder, distributed in proportion to the number of shares of corporate stock you own.

Employment Income

Employment income is payment received for personal effort, including salaries, wages, commissions, tips, bonuses, and taxable employee benefits.

Business Income

Business income is income from any sole proprietorship, partnership, corporation, or profession. For sole proprietors and partners in a partnership, business income is the primary source of income. Many other individuals rely on wages, but have a small business on the side for extra income. Business expenses can be deducted from business income, including, for example, business use of your car and home. If expenses are greater than income, the business is operating at a loss. Business losses can be deducted from total income, just as business income adds to total income.

The tax laws distinguish between a business and a hobby that earns or loses money. The CRA defines a business as “any activity that you do for profit,” and any profit from your hobby is considered business income (Ward, 2017). In addition, the self-employed must pay estimated income taxes in quarterly installments based on expected income depending on your earnings. According to the CRA, quarterly income tax installments are required if your net tax owing will be above the threshold for your province or territory and/or if your net tax owing in previous years was above the threshold for your province or territory.

Adam is thinking about turning his hobby into a business. He has been successful at selling his artwork at different tradeshows and online. He thinks he has found a large enough market to support a business enterprise. As a business, he would be able to deduct the costs of website promotion, his art sales trips, his home office, and shipping, which would reduce the taxes he would have to pay on his business income. Adam decides to enroll in online courses on becoming an entrepreneur, how to write a business plan, and how to find capital for a new venture.

Capital Gains (or Losses)

Gains or losses from investments derive from changes in asset value during ownership between the asset’s original cost and its market value at the time of sale. If you sell an asset for more than you paid for it, you have a gain. If you sell an asset for less than you paid for it, you have a loss. Capital losses are subtracted from capital gains in the same calendar year, and 50 per cent of the resulting amount is taxable, which means less tax is paid on capital gains than on income. Recurring gains or losses from investment are from returns on financial instruments such as stocks and bonds. One-time gains or losses, such as the sale of a home, are also reported.

When you invest in financial assets, such as stocks, bonds, mutual funds, property, or equipment, be sure to keep good records by noting the date when you bought them and the original price. These records establish the cost basis of your investments, which is used to calculate your gain or loss when you sell them.

Rental and Royalty Income; Income from Partnerships and Trusts

Rental or royalty income is income earned from renting an asset, either real property or a creative work such as a book or a song. This can be a primary source of income, although many individuals rely on wages and have some rental or royalty income on the side. Home ownership may be made more affordable, for example, if the second half of a duplex can be rented for extra income. Rental expenses can also be deducted from rental income, which can create a loss from rental activity rather than a gain. Unlike a business, which must become profitable to remain a business for tax purposes, rental activities may generate losses year after year. Such losses are a tax advantage, as they reduce total income. In Canada, any capital gained on a home (house, condominium, or a share in a co-operative housing corporation) is tax exempt as long as it is your primary residence. The revenue sale of a rental home is subject to capital gains tax.

Partnerships are alternative business structures for a business with more than one owner. For example, partnerships are commonly used by professional practices, such as accounting firms, law firms, medical practices, and the like, as well as by family businesses.

The partnership is not a taxable entity, but the share of its profits distributed to each owner is taxable income for the owner and must be declared.

Other Taxable and Non-Taxable Income

Other taxable income includes spousal support, retirement fund distributions from pension plans and RRSPs, as well as payments from government plans such as the Canada Pension Plan, Employment Insurance, or Old Age Security.

According to the CRA, income that is not taxed by the Canadian government and does not have to be reported as income includes the following:

- any GST/HST credit, Canada child benefit, or Canada child tax benefit payments, including those from related provincial and territorial programs;

- child assistance payments and the supplement for handicapped children paid by the province of Quebec;

- compensation received from a province or territory if you were a victim of a criminal act or a motor vehicle accident;

- most lottery winnings;

- most gifts and inheritances;

- amounts paid by Canada or an ally (if the amount is not taxable in that country) for disability or death due to war service;

- most amounts received from a life insurance policy following someone’s death;

- most payments of the type commonly referred to as strike pay you received from your union, even if you perform picketing duties as a requirement of membership;

- elementary and secondary school scholarships and bursaries;

- post-secondary school scholarships, fellowships, and bursaries are not taxable if you received them in 2016 for your enrollment in a program that entitles you to claim the full-time education amount in 2015 or 2016, or if you will be considered a full-time qualifying student for 2017. (CRA, 2018)

Note, however, that income earned on any of the above amounts (such as interest you earn when you invest lottery winnings) is taxable.

Any amount contributed to a Tax-Free Savings Account (TSFA) as well as any income earned in the TSFA (for example, investment income and capital gains) is generally tax-free, even when it is withdrawn. For more information, see RC4466 Tax-Free Savings Account (TFSA), Guide for Individuals (CRA, 2018).

More information on completing your tax return can be found on the Canada Revenue Agency website.

Deductions and Credits

Deductions are tax breaks created by government that allow individuals to reduce their overall taxable income by deducting certain expenditures.

Other deductions involve financial choices that the government encourages by providing an extra incentive in the form of a tax break. For example, one can deduct investment interest on borrowed money for the purpose of earning income from a business or property; this deduction is meant to encourage investment.

Deductions are also created for expenditures that may be considered nondiscretionary, such as court-ordered child support, spousal support, or medical expenses that you are required to pay. You have to read the instructions carefully in order to know what expenditures qualify as deductions. The following list provides examples of common deductions permitted in the calculation of net income:

- Contributions to deferred income plans such as registered pension plans, individual pension plans, and RRSPs are deductible. Income from these plans is taxed later down the road when withdrawals are made. Contributions to a tax-free savings account or a registered education savings plan (RESP) are not tax-deductible.

- Union and profession dues

- Child-care expenses

- Disability supports

- Moving expenses

- Other deductions include deductible business investment losses, spousal and child support payments, interest paid on loans (excluding loans for RRSP and RESP contributions), and employment expenses if, for example, one’s employer requires the employee to pay for travel or other costs of employment.

For a list of medical expenses that are tax-deductible, please visit the CRA webpage Lines 330 and 331 – Eligible medical expenses you can claim on your tax return.

Some deductions require an additional form to calculate specifics, such as unreimbursed employee or job-related expenses and investment interest. Once deductions are subtracted from total income, net income can be determined. Additional deductions and losses from previous years can be carried forward to determine taxable income once net income has been calculated. The final step in determining your taxable income is to factor in tax rates and tax credits.

A tax credit directly reduces the amount of tax you’ll pay versus a deduction which reduces your overall taxable income. A tax credit can be viewed as a deduction from the tax that is owed. Each taxpayer receives the same tax relief with a tax credit no matter the tax bracket one falls into as long as the credit can be used. Credits can be in the form of refundable credits or non-refundable credits. Refundable credits can be fully refunded if used. Even if you don’t owe any tax, you will still receive what is owed through the tax credit. An example of a refundable tax credit is the Working Income Tax Credit which provides tax relief for eligible working low-income individuals and families. In terms of nonrefundable tax credits, all taxpayers can claim a basic non-refundable tax credit, known as the personal amount, which can reduce your tax liability. If any portion from the non-refundable tax credit remains after your taxable income reaches zero, it is automatically forfeited by the taxpayer. Each province and territory also sets a personal amount for provincial or territorial taxes. A tax credit is applied to the amount of tax owed by the taxpayer after all deductions are made from his or her taxable income, and reduces the total tax bill of an individual.

Deductions reduce taxable income, while credits reduce taxes owed.

Deductions and credits are some of the more disputed areas of the tax code. Because of the depth of dispute about them, they tend to change more frequently than other areas of the tax code. As a taxpayer, you want to stay alert to changes that may be to your advantage or disadvantage. Usually, such changes are phased in and out gradually so you can include them in your financial planning process. For more information on deductions and credits, visit the Canadian government webpage Deductions, credits, and expenses.

Payments and Refunds

Once you have calculated your tax obligation for the year, you can compare that to any taxes you have paid during the year and calculate the amount still owed or the amount to be refunded to you.

You pay taxes during the tax year by having them withheld from your paycheque if you earn income through wages, or by making quarterly estimated tax payments if you have other kinds of income. When you begin employment, you fill out a form (Form TD1) that determines the taxes to be withheld from your regular pay. You may adjust this amount, within limits, at any time. If you have both wages and other incomes, but your wage income is your primary source of income, you may be able to increase the taxes withheld from your wages to cover the taxes on your other income, and thus avoid having to make estimated payments. However, if your non-wage income is substantial, you will have to make estimated payments to avoid a penalty and/or interest. The self-employed must pay estimated income taxes in quarterly installments based on expected income depending on your earnings. According to the CRA, quarterly income tax installments are required if your net tax owing will be above the threshold for your province or territory and/or if your net tax owing in previous years was above the threshold for your province or territory (CRA, 2017).

The government requires that taxes are withheld or paid quarterly during the tax year because it uses tax revenues to finance its expenditures, so it needs a steady and predictable cash flow. Steady payments also greatly decrease the risk of taxes being uncollectible. Provincial, territorial, and local income taxes must also be paid during the tax year and are similarly withheld from wages or paid quarterly.

If you have paid more during the tax year than your actual obligation, then you are due a refund of the difference. You may have that amount directly deposited to a bank account, or the government will send you a cheque.

If you have paid less during the tax year than your actual obligation, then you will have to pay the difference, and you may have to pay a penalty and/or interest, depending on the size of your payment.

The deadline for filing income tax returns and for paying any necessary amounts is April 30, following the end of the tax year on December 31. If you are self-employed, or the spouse or common-law partner of someone who is, the deadline to file your income tax and benefit return is June 15, although any balance owing is due April 30. You may file to request an extension of that deadline. Should you miss a deadline without filing for an extension, you will owe penalties and interest, even if your actual tax obligation results in a refund. It really pays to get your return in on time [3].

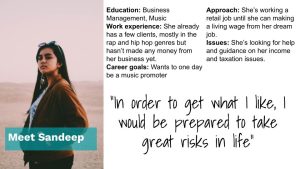

In -Class Case Study: Meet Sandeep

In -Class Case Study: Meet Sandeep

Education: Business Management, Music

Work experience: She already has a few clients, mostly in the rap and hip hop genres but hasn’t made any money from her business yet.

Career goals: Wants to one day be a music promoter

Approach: She’s working a retail job until she can making a living wage from her dream job.

Issues: She’s looking for help and guidance on her income and taxation issues.

In-Class Case Study: Can You Help Sandeep?

Exercise 1: Calculate Taxes for Sandeep

Sandeep went to school for music business management and has founded her music management business. She already has a few clients, mostly in the rap and hiphop genres but hasn’t made any money from her business yet.

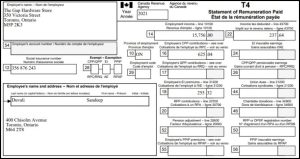

While she gets her business off the ground, she has taken a few shifts working at The Gap Hardware Store. Before she hands her info over to her accountant to prepare her tax return for the year, Sandeep wanted to do a little bit of calculating to see if she could determine how much she will owe in taxes. Assume she did not work anywhere else during the year. Assume that her tax rate is 20.5%.

Below is Sandeep’s T4 in the link from The Gap for the year.

Make a copy with the ‘Make a copy’ feature in Google Sheets of this spreadsheet

Video Tutorial: Google Sheets Exercise Walk Through (5:48 minutes)

Video Tutorial: Google Sheets Exercise Walk Through (5:48 minutes)

This guided walkthrough will walk you through the key features of Google Sheets and discuss the calculations you need to make.

Exercise 2: Sandeep Employment Income

Sandeep has some questions about expenses she can deduct for next year. She’s come up with all expenses that she has questions about and given you some hypothetical numbers. Quantify how much of each expense she will be able to claim for tax purposes and state your assumptions if any. For all expenses, assume they were incurred in a year where she was self employed starting January 1.

Use the same template as above to help calculate Sandeep’s total deductions.

https://docs.google.com/spreadsheets/d/12dMzaB6LLTBd0LAe2CLkEg95HtkYmZwkc1QNf4CCxzU/edit?usp=sharing

Check for Understanding

Video Tutorial: Google Sheet Guided Walkthrough (4:38 minutes)

Video Tutorial: Google Sheet Guided Walkthrough (4:38 minutes)

- Kapoor, J., L. Dlabay, R. Hughes, and F. Ahmad. (2015). Personal Finance. Toronto: McGraw-Hill Ryerson. ↵

- Financial Empowerment: Personal Finance for Indigenous and Non-Indigenous People by Bettina Schneider and Saylor Academy is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License ↵

- Financial Empowerment: Personal Finance for Indigenous and Non-Indigenous People by Bettina Schneider and Saylor Academy is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License ↵

A compulsory financial contribution imposed by law to raise government revenue

A charge (or list of charges) imposed by a government on imports or exports.

A specific tax imposed by law on imports or exports (same as tariffs).

A payment for services or for a particular privilege. (FCAC, 2017)