7 Week 7 Cost Volume Profit

Week 7 Cost Volume Profit

Introduction

Learning Objectives

Learning Objectives

By the end of this week you will be able:

- Understand concept of Cost-Volume-Profit

- Learn how to apply Target Profit

- Use of CVP relationship for pricing or profitability decisions

This chapter should take you 10 minutes to read and plus time to complete an In-Class Case Study.

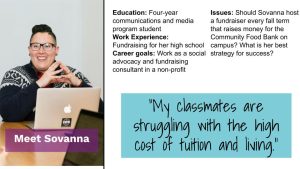

Meet Sovanna

Imagine this, Sovanna just became the VP of Events for the Creative Industries Course Union at Toronto Metropolitan University. She ran for the position with the goal to host a fundraiser every fall term that raises money for the Community Food Bank on campus.

She wanted to take on this role because of her experience meeting students who had struggles with paying rent and groceries.

Case Study: Meet Sovanna

Case Study: Meet Sovanna

Cost-Volume-Profit

Cost-Volume-Profit (CVP) is a method for identifying how changes in sales price, variable costs and fixed costs affect the profitability of a company or single product/service. The formula and definitions for doing this were covered in Week 6 and can be found highlighted below. CVP is most commonly referred to as a Break Even, but using applications like Target Profit it has multiple different uses.

Below are some examples of how CVP can be used for different situations…

Existing Businesses with Multiple Products. Have you ever been to a restaurant with a menu which has multiple items at different prices? From time to time the restaurants will use the CVP formula to help them determine the optimal price for menu items in a process called Menu Engineering. Depending upon volume of sales and cost of ingredients, the prices on the menu will be adjusted.

Start-up Business. When just starting out a business, entrepreneurs need to identify the sales level which will cover their start-up costs or the sales level which will achieve a target profit.

One-Time Pop-up Opportunities. Artists will frequently rent space at festivals or farmers markets to promote and sell their work. The artist can use the CVP method to help determine how many items need to be sold in order to break even or reach a target profit for the day.

In all the prior situations, the CVP method is used to support decision making.

Successful creative practices require more than just imaginative and entrepreneurial spirit. Creative teams must also weigh carefully the financial implications of their decisions -whether that means paying for social media ads or charging companies appropriate rates for freelance services (i.e. writing public relations material, websites, programming skills etc.)

While this part of the business is not often on display, making sensible financial decisions is important for a number of reasons. Depending on the context, it could mean ensuring that you are changing industry-driven rates for the services you provide others or, on the other hand, ensuring that you are sticking to your team’s media budget when hiring freelance professionals. In this module, we will look at some of the factors that better illustrate pricing and budgeting concerns connected with a few different creative fields. Let’s get started by looking at some different pricing models at work within a range of creative fields.

Understanding Pricing Models:

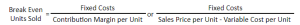

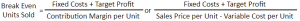

Break Even Formula from Week Week 6 Budgeting for Creatives

Fixed Costs. A fixed cost is something that does not change when you directly sell something. Common fixed costs are salaries, start-up costs, marketing, rent, staffing and insurance.

Contribution Margin Per Unit. The formula for contribution margin is (Sales price per Unit less Variable Cost per Unit). It is the measure of how much money is left over after you sell something that is available to offset your fixed costs.

Sales Price per Unit. This is the price you sell your product or service to the consumer for. It is usually things like direct labour costs to produce or create something and the raw materials that go into making something.

Variable Cost per Unit. In simple terms these are costs that vary with the level of sales. While this sounds simple, it is a concept that is difficult for people to understand. Some people think variable means cost change then they are variable. However variable costs are only those that are directly related to the product or service sold.

One of the more common uses of the CVP approach is for starting up a new venture or business. Recognizing that many students may have considered or are operating their own business on the side, we have collected a series of start-up videos from Shopify that you may find helpful.

Shopify Online Start-Up Guides

Shopify, the global online retailer platform that started in Canada, has created a series of “how to” blogs with videos about selling different forms of creative outputs online. They are excellent guides for reference and all require some form of establishing a price for the product.

Video Activity: How to Sell Art Online in 2023: A Complete Guide [29 minute read – 13:36 Video]

Video Activity: How to Sell Art Online in 2023: A Complete Guide [29 minute read – 13:36 Video]

https://www.shopify.com/blog/211990409-how-to-sell-art-online

Video Activity: How to Start a Successful T-Shirt Business Online in 2023 [20 Minute read – 8:00 Video]

Video Activity: How to Start a Successful T-Shirt Business Online in 2023 [20 Minute read – 8:00 Video]

https://www.shopify.com/blog/start-online-tshirt-business

Video Activity: How to Start a Clothing Line from Scratch: 12 Easy Steps (2023) [22 minute read – 23:10 Video]

Video Activity: How to Start a Clothing Line from Scratch: 12 Easy Steps (2023) [22 minute read – 23:10 Video]

https://www.shopify.com/blog/206934729-how-to-start-a-clothing-line

Video Activity: How to Start a Jewellery Business in 7 Steps (2023) [18 minute read – 20:18 Video]

Video Activity: How to Start a Jewellery Business in 7 Steps (2023) [18 minute read – 20:18 Video]

https://www.shopify.com/ca/blog/203365449-start-a-jewellery-making-business

Video Activity: How to Sell Food Online: A Step-by-Step Startup Guide (2023) [26 minute read – 22:52 Video]

Video Activity: How to Sell Food Online: A Step-by-Step Startup Guide (2023) [26 minute read – 22:52 Video]

https://www.shopify.com/ca/blog/213396233-how-to-start-a-food-business

Video Activity: How to Price a Product in 3 Simple Steps (2023) [9 minute read – 8:19 video]

Video Activity: How to Price a Product in 3 Simple Steps (2023) [9 minute read – 8:19 video]

https://www.shopify.com/ca/blog/how-to-price-your-product

Video Activity: If you want to learn more about CVP analysis watch the short video in the link below.

Video Activity: If you want to learn more about CVP analysis watch the short video in the link below.

Cost-Volume-Profit (CVP Analysis: What It Is and the Formula for Calculating It [5 minute read – 1:24 video]

https://www.investopedia.com/terms/c/cost-volume-profit-analysis.asp#:~:text=Cost%2Dvolume%2Dprofit%20(CVP)%20analysis%20is%20a%20way,a%20certain%20minimum%20profit%20margin.

Target Profit

Target profit is the expected amount of profit that you want to receive at the end of an accounting cycle. The accounting cycle could be as short as a one-off event or an entire year. For people who produce creative items or work, it is a useful way to budget and plan for the value of time. The formula for target profit is the same as the break-even, however you simply consider your target profit as an additional fixed cost. If you wanted to add it to the formula, it would look like below:

As you can see from the above formula, it is simply an adaptation of the break even formula whereby you add target profit to fixed costs.

Check For Understanding

Check For Understanding

Making Decisions with CVP

Exercises: In-Class Case Study: Asma Jewelry

Remember Asma from Chapter 1 Personal Finance and Google Sheets. Asma was a Professional Communications student who specialised in social media. She has always had a passion to make silver jewellery and sell it at a local farmers market on Saturdays. Now that she has a good steady job, she has a design for a necklace and needs to purchase equipment to make it happen. Before she invests her savings, she wants to do a cost-volume-profit analysis to understand her risk.

Asma has identified that she wanted to sell her necklaces through Shopify. The Shopify account was going to cost her $1,200 for the year and she would need to pay a graphic artist $500 to create the images for the Shopify website. The selling price for each necklace was going to be $200 and Shoipfy would charge her a credit card fee of 2.7% for every transaction and a credit card fee of $.30 per transaction. To help get the word out and to personally sell the necklaces she found a local farmers Market that would rent her a table for the season at a cost of $2,000.

Her research identified that she would need to invest $2,000 in Silversmith Equipment and $500 in Merchandise Materials for the Farmers market. Asma would need to spend $50 to purchase silver and $10 for clasps and stones for each necklace.

With all this information, you need to help Asma make decisions about pricing and feasibility for her jewellery venture.

Make a copy with the ‘Make a copy’ feature in Google Sheets of this Week 7 In-Class Case Study Spreadsheet or copy and paste the URL below.

https://docs.google.com/spreadsheets/d/1GDXBWj7gdXmEjAuBi_MqcxdHm3izxew88FsAgSsCGf4/edit?usp=sharing

Ask Yourself

How many necklaces would Asma need to sell in order to break even?

If Asma wanted to make a profit of $3,000.00, how many necklaces would she need to sell?

Would you recommend Asma increase or decrease the price of necklaces?

This chapter was written by Chris Gibbs from Toronto Metropolitan University.