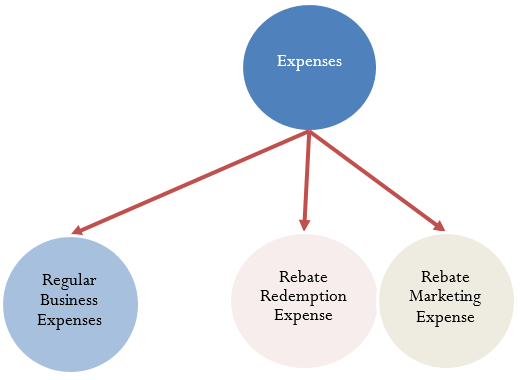

4 Marketing Applications

Chapter 4 Topics

4.1 Discounts

4.2 Markup

4.3 Markdown

4.4 Merchandising

When you buy an iPod, it is very important that the right price is set. The price should:

- be seen as fair by you the buyer,

- pay for the costs (plastics, battery, buttons, circuit boards, headset) and expenses (employees, factory, electricity, distribution) of making the iPod, and

- allow the seller’s business to make some extra money as profit so that it can grow its business further.

If your business is selling a product, you will need to pay close attention to price adjustments because they affect profitability. Various discounts, like putting items on sale, may increase sales while lowering the amount of profit per transaction. How do you know where to set the balance to maximize profit overall?

As a student in a business program, consider this chapter essential to the success of any business. Whether your pricing strategy is high or low, the company must ensure that it can still pay its bills as a minimum requirement. And that requires careful juggling of many factors. If it fails to manage its pricing properly, the company will go bankrupt!

This chapter will make you a smarter business professional and a wiser consumer. You shop retail almost every day and regularly purchase goods and services. If you understand how product pricing works, you can make sense of “deals.” You can easily explain why the same product sells for two different prices at two different stores.

In this chapter, you must learn the language of marketers to perform merchandising mathematics involving product costs, expenses, prices, markups, markdowns, and ultimately profitability. Once the study of the various pricing components is complete, we will see how the various pieces of the pricing puzzle fit together into a cohesive merchandising environment.

4.1 Discounts

You mutter in exasperation, “Why can’t they just set one price and stick with it?” Your mind boggles at all the competing discounts you encounter at the mall in your search for that perfect Batman toy for your nephew. Walmart is running their Rollback promotion and is offering a Batmobile for 25% off, regularly priced at $49.99. Toys R’ Us has an outlet in the parking lot where the regular price for the same toy is $59.99, but all Batman products are being cleared out at 40% off. You head over to The Bay for a warehouse clearance event that has the same toy priced at $64.99 but at 35% off. It is also Bay Days, which means you can scratch and win a further 10% to 20% off the sale price. You go to Dairy Queen for a Blizzard to soothe your headache while you figure things out.

The cost of a product is the amount of money required to obtain the merchandise. If you are a consumer, the ticketed price tag on the product is your cost. If you are a reseller (also known as a middleman or intermediary), what you pay to your supplier for the product is your cost. If you are a manufacturer, then your cost equals all of the labour, materials, and production expenditures that went into creating the product.

A discount is a reduction in the price of a product. As a consumer, you are bombarded with discounts all the time. Retailers use various terms for discounts, including sales or clearance. If your business purchases a product from a supplier, any discount it receives lowers how much the business pays to acquire the product. When a business buys products, the price paid is the cost to the business. Therefore, a lower price means a lower cost.

If your business is the one selling the product, any discount offered lowers the selling price and reduces revenue per sale. Since the revenue must cover all costs and expenses associated with the product, the lower price means that the business reduces profits per sale. In business, it is common practice to express a discount as a percentage off the regular price.

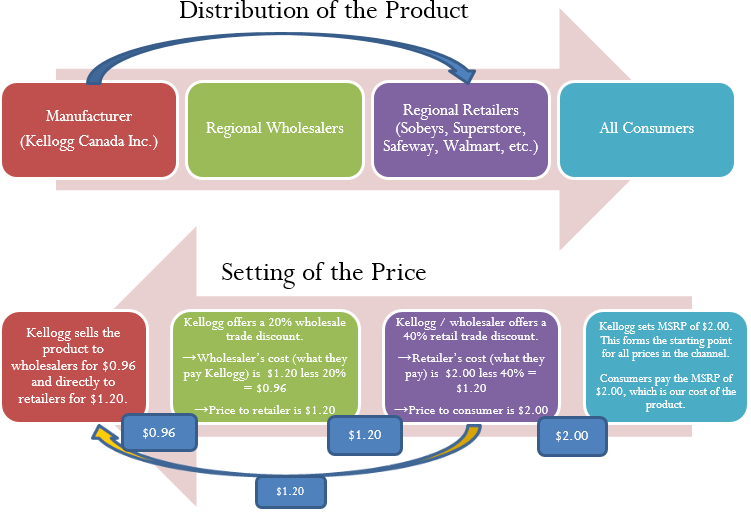

How Distribution and Pricing Work

Start with distribution in the top half of the figure and work left to right. As an example, let’s look at a manufacturer such as Kellogg Canada Inc. (which makes such products as Pop-Tarts, Eggo Waffles, and Rice Krispies). Kellogg’s Canadian production plant is located in London, Ontario. To distribute its products to the rest of Canada, Kellogg Canada uses various regional wholesalers. Each wholesaler then resells the product to retailers in its local trade area; however, some retailers (such as the Real Canadian Superstore) are very large, and Kellogg Canada distributes directly to these organizations, bypassing the wholesaler as represented by the blue arrow. Finally, consumers shop at these retailers and acquire Kellogg products.

The relationship of distribution to pricing is illustrated in the bottom half of the figure, working right to left. For now, focus on understanding how pricing works; the mathematics used in the figure will be explained later in this chapter. Kellogg Canada sets a manufacturer’s suggested retail price, known as the MSRP. This is a recommended retail price based on consumer market research. Since grocery retailers commonly carry thousands or tens of thousands of products, the MSRP helps the retailer to determine the retail price at which the product should be listed. In this case, assume a $2.00 MSRP, which is the price consumers will pay for the product.

The retailer must pay something less than $2.00 to make money when selling the product. Kellogg Canada understands its distributors and calculates that to be profitable most retailers must pay approximately 40% less than the MSRP. Therefore, it offers a 40% discount. If the retailer purchases directly from Kellogg, as illustrated by the yellow arrow, the price paid by the retailer to acquire the product is $2.00 less 40%, or $1.20. Smaller retailers acquire the product from a wholesaler for the same price. Thus, the retailer’s cost equals the wholesaler’s price (or Kellogg Canada’s price if the retailer purchases it directly from Kellogg).

The wholesaler’s price is $1.20. Again, Kellogg Canada, knowing that the wholesaler must pay something less than $1.20 to be profitable, offers an additional 20% discount exclusively to the wholesaler. So the price paid by the wholesaler to acquire the product from Kellogg Canada is $1.20 less 20%, or $0.96. This $0.96 forms Kellogg Canada’s price to the wholesaler, which equals the wholesaler’s cost.

In summary, this discussion illustrates two key pricing concepts:

- Companies higher up in the distribution channel pay lower prices than those farther down the channel. Companies receive discounts off the MSRP based on their level in the distribution system. This may result in multiple discounts, such as a wholesaler receiving both the retailer’s discount and an additional discount for being a wholesaler.

- One organization’s price becomes the next organization’s cost (assuming the typical distribution channel structure):

Manufacturer’s Price = Wholesaler’s Cost

Wholesaler’s Price = Retailer’s Cost

Retailer’s Price = Consumer’s Cost

Types of Discounts

You will perform discount calculations more effectively if you understand how and why single pricing discounts and multiple pricing discounts occur. Businesses or consumers are offered numerous types of discounts, of which five of the most common are trade, quantity, loyalty, sale, and seasonal.

- Trade Discounts. A trade discount is a discount offered to businesses only based on the type of business and its position in the distribution system (e.g., as a retailer, wholesaler, or any other member of the distribution system that resells the product). Consumers are ineligible for trade discounts. In the discussion of the figure, two trade discounts are offered. The first is a 40% retail trade discount, and the second is a 20% wholesale trade discount. Typically, a business that is higher up in the distribution system receives a combination of these trade discounts. For example, the wholesaler receives both the 40% retail trade discount and the 20% wholesale trade discount from the MSRP. The wholesaler’s cost is calculated as an MSRP of $2.00 less 40% less 20% = $0.96.

- Quantity Discounts. A quantity discount (also called a volume discount) is a discount for purchasing larger quantities of a certain product. If you have ever walked down an aisle in a Real Canadian Superstore, you probably noticed many shelf tags that indicate quantity discounts, such as “Buy one product for $2” or “Take two products for $3.” Many Shell gas stations offer a Thirst Buster program in which customers who purchase four Thirst Busters within a three-month period get the fifth one free. If the Thirst Busters are $2.00 each, this is equivalent to buying five drinks for $10.00 less a $2.00 quantity discount.

- Loyalty Discounts. A loyalty discount is a discount that a seller gives to a purchaser for repeat business. Usually no time frame is specified; that is, the offer is continually available. As a consumer, you see this regularly in marketing programs such as Air Miles or with credit cards that offer cash back programs. For example, Co-op gas stations in Manitoba track consumer gasoline purchases through a loyalty program and mails an annual loyalty discount cheque to its customers, recently amounting to 12.5¢ per litre purchased. In business-to-business circles, sellers typically reward loyal customers by deducting a loyalty discount percentage, commonly ranging from 1% to 5%, from the selling price.

- Sale Discounts. A sale discount is a temporary lowering of the price from a product’s regular selling price. Businesses put items on sale for a variety of reasons, such as selling excess stock or attracting shoppers. You see such promotional events all the time: LED monitors are on sale at Best Buy; Blu-Ray discs are half off at Walmart; The Brick is having a door crasher event Saturday morning.

- Seasonal Discounts. A seasonal discount is a discount offered to consumers and businesses for purchasing products out of season. At the business level, manufacturers tend to offer seasonal discounts encouraging retailers, wholesalers, or distributors to purchase products before they are in season. Bombardier Inc. manufactures Ski-Doos, which are sold in Canada from approximately November through March—a time of year when most of the country has snow and consumers would want to buy one. To keep production running smoothly from April through October, Bombardier could offer seasonal discounts to its wholesalers and retailers for the coming winter season. At a retail level, the examples are plentiful. On November 1 most retailers place their Halloween merchandise on seasonal discount to clear out excess inventory, and many retailers use Boxing Day (or Boxing Week) to clear their out-of-season merchandise.

Single Discounts

Let’s start by calculating the cost when only one discount is offered. Later in this section you will learn how to calculate a cost involving multiple discounts.

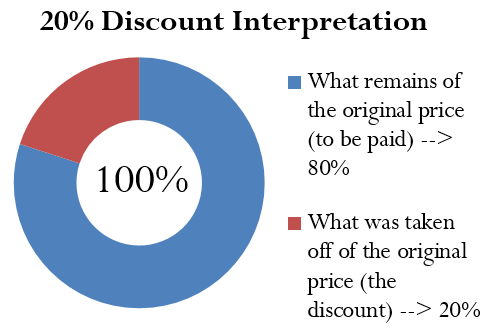

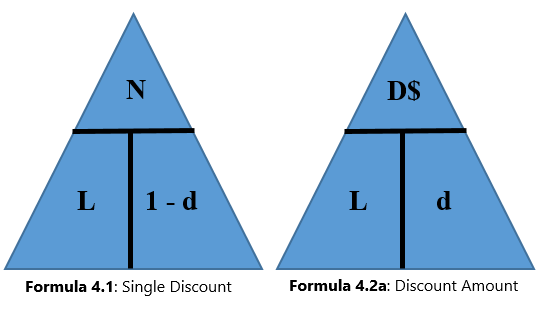

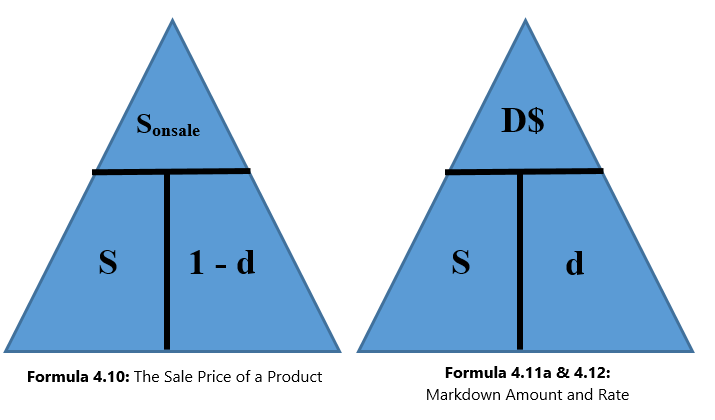

Figuring out the price after applying a single discount is called a net price calculation. When a business calculates the net price of a product, it is interested in what you still have to pay, not in what has been removed. Note in Formula 4.1 below that you take 1 and subtract the discount rate to determine the rate owing. If you are eligible for a 20% discount, then you must pay 80% of the list price, as illustrated in the figure below:

Formula 4.1 – Single Discount

![]()

![]() is the Net Price: The price of the product after the discount is removed from the list price. It is a dollar amount representing what price remains after you have applied the discount.

is the Net Price: The price of the product after the discount is removed from the list price. It is a dollar amount representing what price remains after you have applied the discount.

![]() is the List Price: The normal or regular dollar price of the product before any discounts. It is the Manufacturer's Suggested Retail Price (MRSP).

is the List Price: The normal or regular dollar price of the product before any discounts. It is the Manufacturer's Suggested Retail Price (MRSP).

![]() is the Discount Rate: The percentage (in decimal format) of the list price that is deducted.

is the Discount Rate: The percentage (in decimal format) of the list price that is deducted.

Formula 4.1 includes rate, portion, and base, where the list price is the base, the ![]() is the rate, and the net price represents the portion of the price to be paid.

is the rate, and the net price represents the portion of the price to be paid.

Formula 4.2a and Formula 4.2b – Discount Amount

Formula 4.2a

![]()

Formula 4.2b

![]()

![]() is Discount Amount: Determine the discount amount in one of two ways, depending on what information is known:

is Discount Amount: Determine the discount amount in one of two ways, depending on what information is known:

If the list price and discount rate are known, apply Formula 4.2a.

If the list price and net price are known, apply Formula 4.2b.

![]() is List Price: The dollar amount of the price before any discounts.

is List Price: The dollar amount of the price before any discounts.

![]() is Net Price: The dollar amount of the price after you have deducted all discounts.

is Net Price: The dollar amount of the price after you have deducted all discounts.

![]() is Discount Rate: The percentage (in decimal format) of the list price to be deducted. This time, you are interested in figuring out the amount of the discount, therefore you do not take it away from 1.

is Discount Rate: The percentage (in decimal format) of the list price to be deducted. This time, you are interested in figuring out the amount of the discount, therefore you do not take it away from 1.

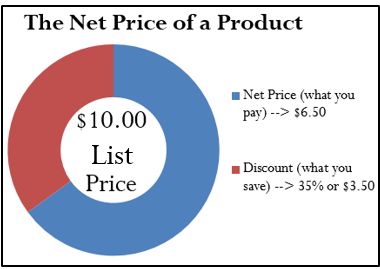

Notice that Formula 4.1 requires the discount to be in a percentage (decimal) format; sometimes a discount is expressed as a dollar amount, though, such as “Save $5 today.” Formulas 4.2a and 4.2b relate the discount dollar amount to the list price, discount percent, and net price. Choose one formula or the other depending on which variables are known.

How It Works

Follow these steps to calculate the net price involving a single discount. These steps are adaptable if the net price is a known variable and one of the other variables is unknown.

Step 1: Identify any known variables, including list price, discount rate, or discount amount.

Step 2: If the list price is known, skip this step. Otherwise, solve for list price using an appropriate formula.

Step 3: Calculate the net price.

- If the list price and discount are are known, apply Formula 4.1.

- If the list price and discount amount are known, apply Formula 4.2b and rearrange for

.

.

Assume a product sells for $10 and is on sale at 35% off the regular price. Calculate the net price for the product.

Step 1: The list price of the product is ![]() . It is on sale with a discount rate of

. It is on sale with a discount rate of ![]() .

.

Step 2: List price is known, so this step is not needed.

Step 3: Applying Formula 4.1 results in a new price of

![]() .

.

Note that if you are interested in learning the discount amount, you apply Formula 4.2b to calculate:

![]() .

.

You can combine Formula 4.1 and either version of Formula 4.2 in a variety of ways to solve any single discount situation for any of the three variables. As you deal with increasingly complicated pricing formulas, your algebraic skills in solving linear equations and substitution become very important.

Many of the pricing problems take multiple steps that combine various formulas, so you need to apply the PUPP model systematically. In any pricing problem, you must understand which variables are provided and match them up to the known formulas. To get to your end goal, you must look for formulas in which you know all but one variable. In these cases, solving for variables will move you forward toward solving the overall pricing problem.

If you find you cannot produce a formula with only one unknown variable, can you find two formulas with the same two unknowns? If so, recall from Chapter 1 that you can use your algebraic skills to find the roots of the two equations simultaneously. Alternatively, you can solve one formula for a variable then substitute it into the other formula, allowing you to isolate the remaining variable. Throughout the examples in this chapter you will see many applications of these algebraic skills.

Remember to apply the rounding rules:

1. Until you arrive at the final solution, avoid rounding any interim numbers unless you have some special reason to do so.

2. Round all dollar amounts to the nearest cent. If the dollar amount has no cents, you may write it either without the cents or with the “.00” at the end.

3. Round all percentages to four decimals when in percent format.

When working with single discounts, you are not always solving for the net price. Sometimes you must calculate the discount percent or the list price. At other times you know information about the discount amount but need to solve for list price, net price, or the discount rate. The triangle technique can remind you how to rearrange the formulas for each variable, as illustrated in the figure below.

Give It Some Thought:

- Will you pay more than, less than, or exactly $10.00 for a product if you are told that you are paying:

a. a net price of $10.00 when there is a discount of 25%?

b. a list price of $10.00 when there is a discount of 25%? - If an item is subject to a 40% discount, will the net price be more than or less than half of the list price of the product?

Example 4.1A – Determining the Retailer’s Net Price for a Pair of Jeans

A manufacturer that sells jeans directly to its retailers uses market research to find out it needs to offer a 25% trade discount. In doing so, the retailers will then be able to price the product at the MSRP of $59.99. What price should retailers pay for the jeans?

Plan:

Calculate how much a retailer should pay for the jeans after the regular price has been discounted to accommodate the trade discount. This is called the net price for the product, or ![]() .

.

Understand:

Step 1: The list price and the discount rate are known.

![]()

![]()

Step 2: List price is known, so skip this step.

Step 3: Apply Formula 4.1

Perform:

Step 3:

![]()

Present:

The manufacturer should sell the jeans to the retailers for $44.99.

Example 4.1B – Determining the List Price of a Jacket

Winners pays a net price of $27.50 for a winter jacket after receiving a retail trade discount of 45%. What was the MSRP of the jacket?

Plan:

Calculate the MSRP for the jacket before Winners received the retail trade discount to arrive at the net price. This is called the list price for the product, or ![]() .

.

Understand:

Step 1: The net price and the discount rate are known:

![]()

![]()

Step 2: List price is the unknown variable; skip this step.

Step 3: Apply Formula 4.1, rearranging for L.

Perform:

Step 3:

Present:

The MSRP, or list price, of the winter jacket is $50.00.

Example 4.1C – Determining the Discount Percent and Discount Amount

You are shopping at Mountain Equipment Co-op for a new environmentally friendly water bottle. The price tag reads $14.75, which is $10.24 off the regular price. Determine the discount rate applied.

Plan:

You need to find out how the sale price translates into the discount rate, or ![]() .

.

Understand:

Step 1: The discount amount and net price are known:

![]()

![]()

Step 2: Use Formula 4.2b to calculate the list price, rearranging for ![]() .

.

Step 3: Convert the discount amount into a percentage by applying Formula 4.2a, rearranging for ![]() .

.

Perform:

Step 2:

List price:

![]()

Step 3:

Discount rate:

![]()

Present:

The water bottle today has been reduced in price by the amount of $10.24. This represents a sale discount of 40.9674%.

Multiple Discounts

You are driving down the street when you see a large sign at Old Navy that says, “Big sale, take an additional 25% off already reduced prices!” In other words, products on sale (the first discount) are being reduced by an additional 25% (the second discount). Because Formula 4.1 handles only a single discount, you must use an extended formula in this case.

Businesses commonly receive more than one discount when they make a purchase. Consider a transaction in which a business receives a 30% trade discount as well as a 10% volume discount. First, you have to understand that this is not a 30% + 10% = 40% discount. The second discount is always applied to the net price after the first discount is applied. Therefore, the second discount has a smaller base upon which it is calculated. If there are more than two discounts, you deduct each subsequent discount from continually smaller bases. Formula 4.3 expresses how to calculate the net price when multiple discounts apply.

Formula 4.3 – Multiple Discounts

![]()

![]() is Net Price: The dollar amount of the price after all discounts have been deducted.

is Net Price: The dollar amount of the price after all discounts have been deducted.

![]() is List Price: The dollar amount of the price before any discounts.

is List Price: The dollar amount of the price before any discounts.

![]() is First Discount,

is First Discount, ![]() is Second Discount,

is Second Discount, ![]() is nth Discount:

is nth Discount:

When there is more than one discount, you must extend beyond Formula 4.1 by multiplying another discount expression. These discounts are represented by the same d symbol; however, each discount receives a subscript to make its symbol unique. Therefore, the first discount receives the symbol of ![]() , the second discount receives the symbol

, the second discount receives the symbol ![]() , and so on. Recall that the symbol

, and so on. Recall that the symbol ![]() represents the number of pieces of data (a count), so you can expand or contract this formula to the exact number of discounts being offered.

represents the number of pieces of data (a count), so you can expand or contract this formula to the exact number of discounts being offered.

It is often difficult to understand exactly how much of a discount is being received when multiple discounts are involved. Often it is convenient to summarize the multiple discount percentages into a single percentage. This makes it easier to calculate the net price and aids in understanding the discount benefit. Simplifying multiple percent discounts into a single percent discount is called finding the single equivalent discount. Whether you apply the multiple discounts or just the single equivalent discount, you arrive at the same net price. The conversion of multiple discount percentages into a single equivalent discount percent is illustrated in Formula 4.4.

Formula 4.4 – Single Equivalent Discount

![]()

![]() (or just

(or just ![]() ) is the single equivalent discount rate that is equal to the series of multiple discounts. Recall that taking

) is the single equivalent discount rate that is equal to the series of multiple discounts. Recall that taking ![]() calculates what you pay. Therefore, if you take 1, which represents the entire amount, and reduce it by what you pay, the rate left over must be what you did not pay. In other words, it is the discount rate.

calculates what you pay. Therefore, if you take 1, which represents the entire amount, and reduce it by what you pay, the rate left over must be what you did not pay. In other words, it is the discount rate.

![]() is First Discount,

is First Discount, ![]() is Second Discount,

is Second Discount, ![]() is nth Discount:

is nth Discount:

This is the same notation as in Formula 4.3. Since there are multiple discounts, each discount receives a numerical subscript to give it a unique identifier. You can expand or contract the formula to the exact number of discounts being offered.

How It Works

Refer back to the steps in calculating net price. The procedure for calculating a net price involving a single discount extends to a more generic procedure involving multiple discounts. As with the single discount procedures, you can adapt the model if the net price is known and one of the other variables is unknown. Follow these steps to calculate the net price involving any number of discounts:

Step 1: Identify any known variables, including list price, discount rate(s), or discount amount.

Step 2: If the list price is known, skip this step. Otherwise, solve for list price.

- If only one discount is involved, apply Formula 4.2a.

- If more than one discount is involved, the discount amount represents the total discount amount received from all of the discounts combined. This requires you first to convert the multiple discount rates into an equivalent single discount rate using Formula 4.4 and then to apply Formula 4.2a.

Step 3: Calculate the net price.

- If the list price and only a single known discount rate are involved, apply Formula 4.1.

- If the list price and multiple discount rates are known and involved, apply Formula 4.3.

- If the list price and the total discount amount are known, apply Formula 4.2b and rearrange for

.

.

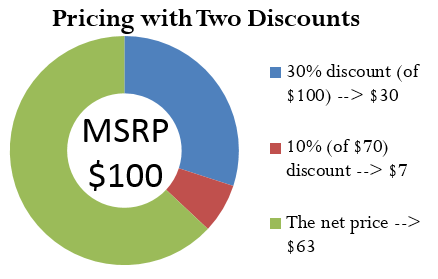

Assume a product with an MSRP of $100 receives a trade discount of 30% and a volume discount of 10%. Calculate the net price.

Step 1: The list price and discounts are

![]()

![]()

![]() .

.

Step 2: List price is known, so skip this step.

Step 3: Apply Formula 4.3 to calculate the net price:

![]()

The net price is $63, which is illustrated in the following diagram:

If you are solely interested in converting multiple discounts into a single equivalent discount, you need only substitute into Formula 4.4. In the above example, the product received a trade discount of 30% and a volume discount of 10%. To calculate the single equivalent discount, apply Formula 4.4:

Therefore, whenever discounts of 30% and 10% are offered together, the single equivalent discount is 37%. Whether it is the multiple discounts or just the single equivalent discount that you apply to the list price, the net price calculated is always the same.

Order of Discounts:

The order of the discounts does not matter in determining the net price. Remember from the rules of BEDMAS that you can complete multiplication in any order. Therefore, in the above example you could have arrived at the $63 net price through the following calculation:

![]()

The order of the discounts does matter if trying to interpret the value of any single discount. If the trade discount is applied before the quantity discount and you are wanting to know the quantity discount amount, then the quantity discount needs to be second. Thus,

![]()

which is the amount of the quantity discount.

Price Does Not Affect Single Equivalent Discount:

Notice in Formula 4.4 that the list price and the net price are not involved in the calculation of the single equivalent discount. When working with percentages, whether you have a net price of $6.30 and a list price of $10, or a net price of $63 and a list price of $100, the equivalent percentage always remains constant at 37%.

A common mistake when working with multiple discounts is to add the discounts together to calculate the single equivalent discount. This mistaken single discount is then substituted into Formula 4.1 to arrive at the wrong net price. Remember that if two discounts of 30% and 10% apply, you cannot sum these discounts. The second discount of 10% is applied on a smaller price tag, not the original price tag. To calculate the net price you must apply Formula 4.3.

If you happen to know any two of the net price (![]() ), list price (

), list price (![]() ), or the total discount amount (

), or the total discount amount (![]() ), then you could also use Formula 4.2 to solve for the single equivalent discount,

), then you could also use Formula 4.2 to solve for the single equivalent discount, ![]() .

.

For example, if you know the net price is $63 and the total discount amount for all discounts is $37, you could use Formula 4.2b to figure out that the list price is $100, then convert the discount amount into a percentage using Formula 4.2a. This method will also produce a single equivalent discount of 37%.

Another method of calculating the single equivalent discount is to recognize Formula 4.2a as an application of Formula 3.1 involving percent change. The variable d is a discount rate, which you interpret as a negative percent change. The discount amount, D, is the difference between the list price (representing the Old price) and the net price (representing the New price after the discount). Therefore, Formula 4.2a can be rewritten as follows:

![]()

becomes

![]()

or

![]()

Therefore, any question about a single equivalent discount where net price and list price are known can be solved as a percent change. Using our ongoing net price example, you have:

This is a discount of 37%.

Give It Some Thought:

3. If you are offered discounts in the amount of 25%, 15%, 10%, and 5%, will your total discount percent be 55%, less than 55%, or more than 55%?

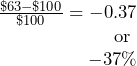

Example 4.1D – Retailer Purchasing Ski-Doos with Multiple Discounts

A retail dealership purchases some Expedition TUV Yeti II Ski-Doos to stock in its stores. Examining the merchandising terms of the manufacturer, Bombardier, the dealership notices that it would be eligible to receive a 35% trade discount, 15% volume discount, and 3% loyalty discount. Because it is June and Ski-Doos are out of season, Bombardier offers a seasonal discount of 12% for purchases made before June 30. If the MSRP for the Ski-Doo is $12,399.00 and the dealership purchases this item on June 15, what price would it pay?

Plan:

You are looking for the net price that the retail dealership will pay for the Ski-Doo, or ![]() .

.

Understand:

Step 1: The retail dealership is eligible for all four discounts (it qualifies for the seasonal discount since it is purchasing before June 30). Therefore,

![]()

![]()

![]()

![]()

![]()

Step 2: You know the list price, so skip this step.

Step 3: Apply Formula 4.3.

Perform:

Step 3:

![]()

Present:

After all four discounts, the retail dealership could purchase the Ski-Doo for $5,847.54.

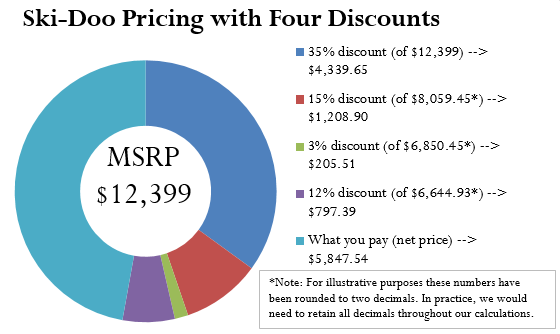

Example 4.1E – Reducing Multiple Discounts to a Single Equivalent Discount

The retail dealership in Example 4.1D purchases more products subject to the same discounts. It needs to simplify its calculations. Using the information from Example 4.1D, what single equivalent discount is equal to the four specified discounts?

Plan:

You are looking for a single equivalent discount that is equal to the four discount percentages, or ![]() (or just

(or just ![]() ).

).

Understand:

You know the discount rates:

![]()

![]()

![]()

![]()

Apply Formula 4.4.

Perform:

Present:

The retail dealership can apply a 52.8386% discount to all the products it purchases.

Example 4.1F – Making a Smart Consumer Purchase

You are shopping on Boxing Day for an 80″ HDTV. You have just one credit card in your wallet, a cashback Visa card, which allows for a 1% cash rebate on all purchases. While scanning flyers for the best deal, you notice that Visions is selling the TV for $5,599.99 including taxes, while Best Buy is selling it for $5,571.99 including taxes. However, because of a computer glitch Best Buy is unable to accept Visa today. Where should you buy your television?

Plan:

You want to know which store you should buy the television at. You must calculate the net price (N) for each of the stores.

Understand:

Step 1: You know the list price for each of the stores. You also know the discount available from Visa. Thus,

![]() with no discounts since Visa cannot be used there

with no discounts since Visa cannot be used there

![]() ,

, ![]() , since you can use your Visa card there

, since you can use your Visa card there

Step 2: List price is known, so skip this step.

Step 3: Apply Formula 4.1.

Perform:

Step 3:

Best Buy: No discounts apply, so the list price equals the net price.

![]()

Visions:

![]()

Present:

The net price for Visions is $5,543.99. You save $5,571.99 – $5,543.99 = $28.00 by purchasing your TV at Visions.

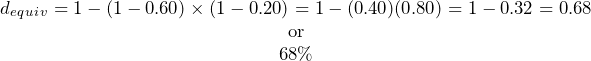

Example 4.1G – Understanding the Price

An advertisement claims that at 60% off, you are saving $18. However, today there is an additional 20% off. What price should you pay for this item? What percent savings does this represent?

Plan:

You are looking for how much you should pay after the discounts (N), and the single equivalent percentage that represents the two discounts (dequiv or just d).

Understand:

Step 1: You know the discount amount for the first discount only, as well as the two discount rates:

![]()

![]()

![]()

Step 2: Calculate the list price by applying Formula 4.2a and rearranging for L.

Step 3: To calculate the net price, apply Formula 4.3.

Step 4: To calculate the single equivalent discount, apply Formula 4.4.

Perform:

Step 2:

![]()

Step 3:

![]()

Step 4:

Present:

You should pay $9.60 for the item, which represents a 68% savings.

Give It Some Thought Answers

- a. Exactly $10. The net price is the price after the discount.

b. Less than $10. The discount needs to be removed from the list price. - More than half. A 40% discount means that you will pay 60% of the list price.

Exercises

Round all money to two decimals and percentages to four decimals in each of the following questions.

Mechanics

For questions 1–4, solve for the unknown variables (identified with a ?) based on the information provided. “N/A” indicates that the particular variable is not applicable in the question.

| List Price or MRSP | First Discount | Second Discount | Third Discount | Net Price | Equivalent Single Discount Rate | Total Discount Amount | |

| 1. | $980.00 | 42% | N/A | N/A | ? | N/A | ? |

| 2. | ? | 25% | N/A | N/A | $600.00 | N/A | ? |

| 3. | $1,975.00 | 25% | 15% | 10% | ? | ? | ? |

| 4. | ? | 18% | 4% | 7% | $366.05 | ? | ? |

Applications

5. A wholesaler of stereos normally qualifies for a 35% trade discount on all electronic products purchased from its manufacturer. If the MSRP of a stereo is $399.95, what net price will the wholesaler pay?

6. Mary is shopping at the mall where she sees a sign that reads, “Everything in the store is 30% off, including sale items!” She wanders in and finds a blouse on the clearance rack. A sign on the clearance rack states, “All clearance items are 50% off.” If the blouse is normally priced at $69.49, what price should Mary pay for it?

7. A distributor sells some shoes directly to a retailer. The retailer pays $16.31 for a pair of shoes that has a list price of $23.98. What trade discount percent is the distributor offering to its retailers?

8. A retailer purchases supplies for its head office. If the retailer pays $16.99 for a box of paper and was eligible for a 15% volume discount, what was the original MSRP for the box of paper?

9. Mountain Equipment Co-op has purchased a college backpack for $29 after discounts of 30%, 8%, and 13%. What is the MSRP for the backpack? What single discount is equivalent to the three discounts?

10. Walmart purchased the latest CD recorded by Selena Gomez. It received a total discount of $10.08 off the MSRP for the CD, which represents a discount percent of 42%.

a. What was the MSRP?

b.What was the net price paid for the CD?

11. Best Buy just acquired an HP Pavilion computer for its electronics department. The net price on the computer is $260.40 and Best Buy receives discounts of 40% and 38%.

a. What single discount is equivalent to the two discounts?

b. What is the list price?

c. What is the total discount amount?

12. TELUS retails a Samsung cellphone at the MSRP of $399.99. TELUS can purchase the phone from its supplier and receive a 20% trade discount along with a 5% volume discount.

a. What is the single equivalent percent discount?

b. What net price does TELUS pay for the phone?

c. How much of a discount in dollars does this represent?

13. A wholesaler offers the following discounts: 10% seasonal discount for all purchases made between March 1 and May 1, 15% cumulative quantity discount whenever more than 5,000 units are purchased in any month, 5% loyalty discount for customers who have made regular purchases every month for at least one year, and a 33% trade discount to any retailer. Ed’s Retail Superstore makes a purchase of 200 watches, MSRP $10, from the wholesaler on April 29. This month alone, Ed’s has ordered more than 5,000 watches. However, Ed’s has purchased from the wholesaler for only the past six months. Determine the total price that Ed’s should pay for the watches.

14. If a distributor is eligible for a 60% trade discount, 5% volume discount, and 3% seasonal discount, what single equivalent discount rate would it be eligible to receive? If the trade discount is applied first and equals a trade discount of $48, calculate the net price for the item.

Challenge, Critical Thinking, & Other Applications

As mentioned previously, discount percentages share a commonality with negative percent changes (Section 2.1). Use the formulas from this chapter to solve questions 15–17 involving percent change.

15. A human resource manager needs to trim labour costs in the following year by 3%. If current year labour costs are $1,231,498, what are the labour costs next year?

16. At an accounting firm, the number of accountants employed is based on the ratio of 1:400 daily manual journal entries. Because of ongoing increases in automation, the number of manual journal entries declines at a constant rate of 4% per year. If current entries are 4,000 per year, how many years and days will it take until the firm needs to lay off one accountant? (Hint: An accountant is laid off when the number of journal entries drops below 3,600.)

17. An economist is attempting to understand how Canada reduced its national debt from 1999 to 2008. In 1999, Canada’s national debt was $554.143 billion. In 2008, the national debt stood at $457.637 billion. What percentage had the national debt been reduced by during this time period?

18. Sk8 is examining an invoice. The list price of a skateboard is $109.00, and the invoice states it received a trade discount of 15% and quantity discount of 10% as well as a loyalty discount. However, the amount of the loyalty discount is unspecified.

a. If Sk8 paid $80.88 for the skateboard, what is the loyalty discount percent?

b. If the loyalty discount is applied after all other discounts, what amount of loyalty dollars does Sk8 save per skateboard?

19. Currently, a student can qualify for up to six different tuition discounts at a local college based on such factors as financial need or corporate sponsorships. Mary Watson just applied to the college and qualifies for all six discounts: 20%, 15%, 23%, 5%, 3%, and 1%.

a. She is confused and wants the college to tell her what single discount percent she is receiving. What should the college tell her?

b. If her total list tuition comes to $6,435.00, how much should she pay?

20. Sumandeep is very loyal to her local hairstylist. Because she is loyal, her hairstylist gives her three different discounts: 10%, 5%, and 5%. These discounts amount to $14.08 in savings.

a. What was the list price her hairstylist charged her?

b. What amount did she pay her hairstylist?

c. If her hairstylist increases prices by 5%, what are the list price, net price, and total discount amount?

4.2 Markup

As you wait in line to purchase your Iced Caramel Macchiato at Starbucks, you look at the pricing menu and think that $4.99 seems like an awful lot of money for a frozen coffee beverage. Clearly, the coffee itself doesn’t cost anywhere near that much. But then gazing around the café, you notice the carefully applied colour scheme, the comfortable seating, the high-end machinery behind the counter, and a seemingly well-trained barista who answers customer questions knowledgeably. Where did the money to pay for all of this come from? You smile as you realize your $4.99 pays not just for the macchiato, but for everything else that comes with it.

The process of taking a product’s cost and increasing it by some amount to arrive at a selling price is called markup. This process is critical to business success because every business must ensure that it does not lose money when it makes a sale. From the consumer perspective, the concept of markup helps you make sense of the prices that businesses charge for their products or services. This in turn helps you to judge how reasonable some prices are (and hopefully to find better deals).

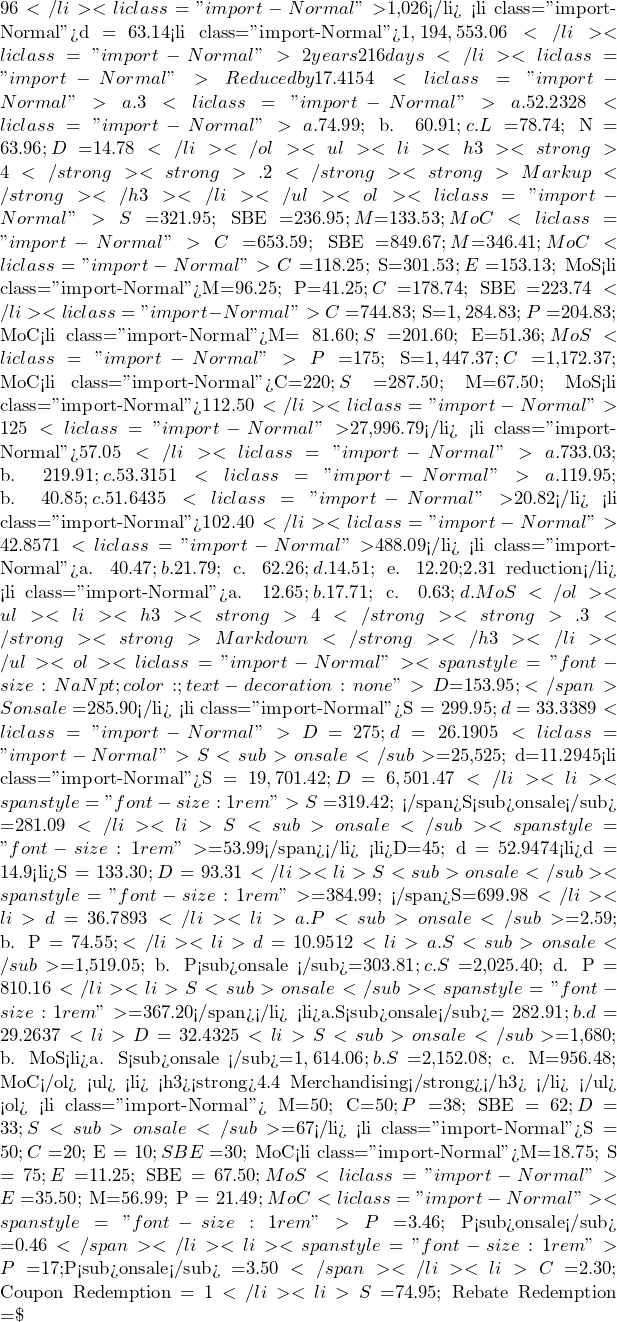

The Components in a Selling Price

Before you learn to calculate markup, you first have to understand the various components of a selling price. Then, in the next section, markup and its various methods of calculation will become much clearer.

When your business acquires merchandise for resale, this is a monetary outlay representing a cost. When you then resell the product, the price you charge must recover more than just the product cost. You must also recover all the selling and operating expenses associated with the product. Ultimately, you also need to make some money, or profit, as a result of the whole process.

Most people think that marking up a product must be a fairly complex process. It is not. Formula 4.5 illustrates the relationship between the three components of cost, expenses, and profits in calculating the selling price.

Formula 4.5 – The Selling Price of a Product

![]()

S is Selling Price: Once you calculate what the business paid for the product (cost), the bills it needs to cover (expenses), and how much money it needs to earn (profit), you arrive at a selling price by summing the three components.

C is Cost: The cost is the amount of money that the business must pay to purchase or manufacture the product. If manufactured, the cost represents all costs incurred to make the product. If purchased, this number results from applying an appropriate discount formula from Section 4.1. There is a list price from which the business will deduct discounts to arrive at the net price. The net price paid for the product equals the cost of the product. If a business purchases or manufactures a product for $10 then it must sell the product for at least $10. Otherwise, it fails to recover what was paid to acquire or make the product in the first place—a path to sheer disaster!

E is Expenses: Expenses are the financial outlays involved in selling the product. Beyond just purchasing the product, the business has many more bills to pay, including wages, taxes, leases, equipment, electronics, insurance, utilities, fixtures, décor, and many more. These expenses must be recovered and may be calculated as:

- A fixed dollar amount per unit.

- A percentage of the product cost. For example, if a business forecasts total merchandise costs of $100,000 for the coming year and total business expenses of $50,000, then it may set a general guideline of adding 50% ($50,000 ÷ $100,000) to the cost of a product to cover expenses.

- A percentage of the product selling price based on a forecast of future sales. For example, if a business forecasts total sales of $250,000 and total business expenses of $50,000, then it may set a general guideline of adding 20% ($50,000 ÷ $250,000) of the selling price to the cost of a product to cover expenses.

P is Profit: Profit is the amount of money that remains after a business pays all of its costs and expenses. A business needs to add an amount above its costs and expenses to allow it to grow. If it adds too much profit, though, the product’s price will be too high, in which case the customer may refuse to purchase it. If it adds too little profit, the product’s price may be too low, in which case the customer may perceive the product as shoddy and once again refuse to purchase it. Many businesses set general guidelines on how much profit to add to various products. As with expenses, this profit may be expressed as:

- A fixed dollar amount per unit.

- A percentage of the product cost.

- A percentage of the selling price.

How It Works

Follow these steps to solve pricing scenarios involving the three components:

Step 1: Four variables are involved in Formula 4.5. Identify the known variables. Note that you may have to calculate the product’s cost by applying the single or multiple discount formulas (Formulas 4.1 and 4.3, respectively). Pay careful attention to expenses and profits to capture how you calculate these amounts.

Step 2: Apply Formula 4.5 and solve for the unknown variable.

Assume a business pays a net price of $75 to acquire a product. Through analyzing its finances, the business estimates expenses at $25 per unit, and it figures it can add $50 in profit. Calculate the selling price.

Step 1: The net price paid for the product is the product cost. The known variables are:

![]()

![]()

![]()

Step 2: According to Formula 4.5, the unit selling price is:

![]()

In applying Formula 4.5 you must adhere to the basic rule of linear equations requiring all terms to be in the same unit. That is, you could use Formula 4.5 to solve for the selling price of an individual product, where the three components are the unit cost, unit expenses, and unit profit. When you add these, you calculate the unit selling price. Alternatively, you could use Formula 4.5 in an aggregate form where the three components are total cost, total expenses, and total profit. In this case, the selling price is a total selling price, which is more commonly known as total revenue. But you cannot mix individual components with aggregate components.

The most common mistake in working with pricing components occurs in the “Understand” portion of the PUPP model. It is critical to identify and label information correctly. You have to pay attention to details such as whether you are expressing the expenses in dollar format or as a percentage of either cost or selling price. Systematically work your way through the information provided piece by piece to ensure that you do not miss an important detail.

Give It Some Thought:

- What three components make up a selling price? In what units are these components commonly expressed?

- In what three ways are expenses and profits expressed?

- What is the relationship between net price and cost?

Example 4.2A – Setting a Price on Fashion in Dollars

Mary’s Boutique purchases a dress for resale at a cost of $23.67. The owner determines that each dress must contribute $5.42 to the expenses of the store. The owner also wants this dress to earn $6.90 toward profit. What is the regular selling price for the dress?

Plan:

You are looking for the regular selling price for the dress, or ![]() .

.

Understand:

Step 1: The unit cost of the dress and the unit expense and the unit profit are all known:

![]()

![]()

![]()

Step 2: Apply Formula 4.5.

Perform:

Step 2:

![]()

Present:

Mary’s Boutique will set the regular price of the dress at $35.99.

Example 4.2B – Setting the Price Using Percentage of Cost

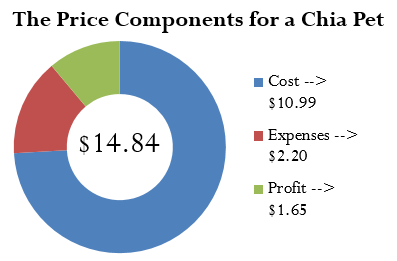

John’s Discount Store just completed a financial analysis. The company determined that expenses average 20% of the product cost and profit averages 15% of the product cost. John’s Discount Store purchases Chia Pets from its supplier for an MSRP of $19.99 less a trade discount of 45%. What will be the regular selling price for the Chia Pets?

Plan:

You are looking for the regular selling price for the Chia pets, or ![]() .

.

Understand:

Step 1: The list price, discount rate, expenses, and profit are known:

![]()

![]() = 0.45

= 0.45

![]() = 20% of cost, or 0.20C

= 20% of cost, or 0.20C

![]() = 15% of cost, or 0.15C

= 15% of cost, or 0.15C

Although the cost of the Chia Pets is not directly known, you do know the MSRP (list price) and the trade discount. The cost is equal to the net price. Apply Formula 4.1.

Step 2: To calculate the selling price, apply Formula 4.5.

Perform:

Step 1:

![]()

Step 2:

![]()

![]()

![]()

Present:

John’s Discount Store will sell the Chia Pet for $14.84.

Example 4.2C – Setting the Price Using Percentage of Selling Price

Based on last year’s results, Benthal Appliance learned that its expenses average 30% of the regular selling price. It wants a 25% profit based on the selling price. If Benthal Appliance purchases a fridge for $1,200, what is the regular unit selling price?

Plan:

You are looking for the regular unit selling price for the fridge, or ![]() .

.

Understand:

Step 1: The cost, expenses, and profit for the fridge are known:

![]() = 30% of

= 30% of ![]() , or

, or ![]()

![]() = 25% of

= 25% of ![]() , or

, or ![]()

![]() = $1,200.00

= $1,200.00

Step 2: Apply Formula 4.5.

Perform:

Step 2:

![]()

![]()

![]()

![]()

![]()

Present

Benthal Appliance should set the regular selling price of the fridge at $2,666.67.

![A circle diagram illustrating price components for a fridge. The circle represents the regular selling price ($2,666.67.) The blue portion of the circle represents cost ($1,200.00). The red portion of the circle represents expenses [0.3($2,666.67) = $800.00.] The green portion of the circle represents profit [0.25($2,666.67) = $666.67]](https://ecampusontario.pressbooks.pub/app/uploads/sites/862/2020/08/4.2c-fridge-price.png)

Example 4.2D – Using Selling Price to Figure Out the Cost

If a company knows that its profits are 15% of the selling price and expenses are 30% of cost, what is the cost of an MP3 player that has a regular selling price of $39.99?

Plan:

You are looking for the cost of the MP3 player, or ![]() .

.

Understand:

Step 1: The expenses, profits, and the regular unit selling price are as follows:

![]() = $39.99

= $39.99

![]() = 15% of

= 15% of ![]() , or

, or ![]()

![]() = 30% of cost, or

= 30% of cost, or ![]()

Step 2: Apply Formula 4.5, rearranging for ![]() .

.

Perform:

Step 2:

![]()

![]()

![]()

![]()

Present:

The cost of the MP3 Player is $26.15.

![A circle diagram illustrating price components of an MP3 player. The circle represents the regular selling price ($39.99.) The blue portion of the circle represents cost ($26.15.) The red portion of the circle represents expenses [0.3($26.15) = $7.84.] The green portion of the circle represents profit [0.13($39.99) = $6.00.]](https://ecampusontario.pressbooks.pub/app/uploads/sites/862/2020/08/4.2d-mp3-player.png)

Example 4.2E – Determining Profitability

Peak of the Market considers setting the regular unit selling price of its strawberries at $3.99 per kilogram. If it purchases these strawberries from the farmer for $2.99 per kilogram and expenses average 40% of product cost, does Peak of the Market make any money?

Plan:

In asking whether Peak of the Market makes money, you are looking for the profit, or ![]() .

.

Understand:

Step 1: The cost, expenses, and proposed regular unit selling price for the strawberries are as follows:

![]() = $3.99

= $3.99

![]() = $2.99

= $2.99

![]() = 40% of cost, or

= 40% of cost, or ![]()

Step 2: Apply Formula 4.5, rearranging for ![]() .

.

Perform:

Step 2:

![]()

![]()

![]()

Present:

The negative sign on the profit means that Peak of the Market would take a loss of $0.20 per kilogram if it sells the strawberries at $3.99. Unless Peak of the Market has a marketing reason or sound business strategy for doing this, the company should reconsider its pricing.

Calculating the Markup Dollars

Most companies sell more than one product, each of which has different price components with varying costs, expenses, and profits. Can you imagine trying to compare 50 different products, each with three different components? You would have to juggle 150 numbers! To make merchandising decisions more manageable and comparable, many companies combine expenses and profit together into a single quantity, either as a dollar amount or a percentage. This section focuses on the markup as a dollar amount.

One of the most basic ways a business simplifies its merchandising is by combining the dollar amounts of its expenses and profits together as expressed in Formula 4.6.

Formula 4.6 – Markup Amount

![]()

![]() is Markup Amount: Markup is taking the cost of a product and converting it into a selling price. The markup amount represents the dollar amount difference between the cost and the selling price.

is Markup Amount: Markup is taking the cost of a product and converting it into a selling price. The markup amount represents the dollar amount difference between the cost and the selling price.

![]() is Expenses: The expenses associated with the product.

is Expenses: The expenses associated with the product.

![]() is Profit: The profit earned when the product sells.

is Profit: The profit earned when the product sells.

Note that since the markup amount (![]() ) represents the expenses (

) represents the expenses (![]() ) and profit (

) and profit (![]() ) combined, you can substitute the variable for markup amount into Formula 4.5 to create Formula 4.7, which calculates the regular selling price.

) combined, you can substitute the variable for markup amount into Formula 4.5 to create Formula 4.7, which calculates the regular selling price.

Formula 4.7 – Selling Price Using Markup

![]()

![]() is Selling Price: The regular selling price of the product.

is Selling Price: The regular selling price of the product.

![]() is Cost: The amount of money needed to acquire or manufacture the product. If the product is being acquired, the cost is the same amount as the net price paid.

is Cost: The amount of money needed to acquire or manufacture the product. If the product is being acquired, the cost is the same amount as the net price paid.

![]() is Markup Amount: From Formula 4.6, this is the single number that represents the total of the expenses and profit.

is Markup Amount: From Formula 4.6, this is the single number that represents the total of the expenses and profit.

How It Works

Follow these steps when you work with calculations involving the markup amount:

Step 1: You require three variables in either Formula 4.6 or Formula 4.7. At least two of the variables must be known. If the amounts are not directly provided, you may need to calculate these amounts by applying other discount or markup formulas.

Step 2: Solve either Formula 4.6 or Formula 4.7 for the unknown variable.

Recall from Example 4.2D that the MP3 player’s expenses are $7.84, the profit is $6.00, and the cost is $26.15. Calculate the markup amount and the selling price.

Step 1: The known variables are

![]() = $7.84

= $7.84

![]() = $6.00

= $6.00

![]() = $26.15.

= $26.15.

Step 2: According to Formula 4.6, the markup amount is the sum of the expenses and profit, or

![]() .

.

Applying Formula 4.7, add the markup amount to the cost to arrive at the regular selling price, resulting in

![]()

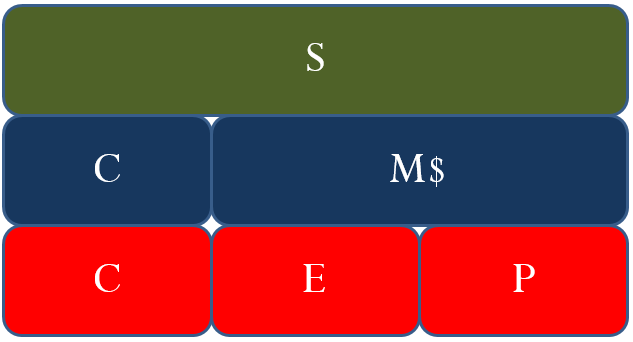

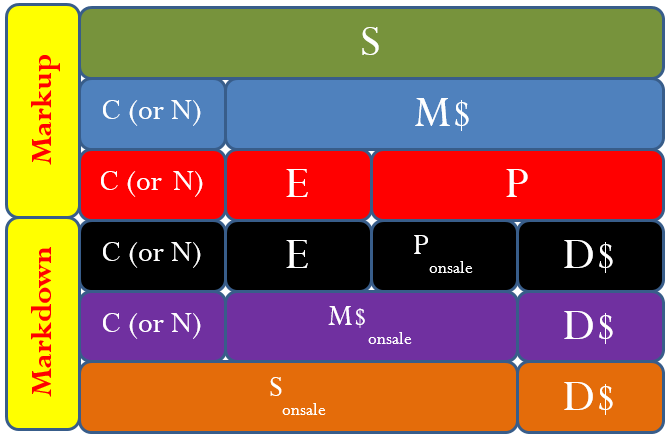

You might have already noticed that many of the formulas in this chapter are interrelated. The same variables appear numerous times but in different ways. To help visualize the relationship between the various formulas and variables, many students have found it helpful to create a markup chart, as shown below.

This chart demonstrates the relationships between Formulas 4.5, 4.6, and 4.7. It is evident that the selling price (the green line) consists of cost, expenses, and profit (the red line representing Formula 4.5); or it can consist of cost and the markup amount (the blue line representing Formula 4.7). The markup amount on the blue line consists of the expenses and profit on the red line (Formula 4.6).

Example 4.2F – Markup as a Dollar Amount

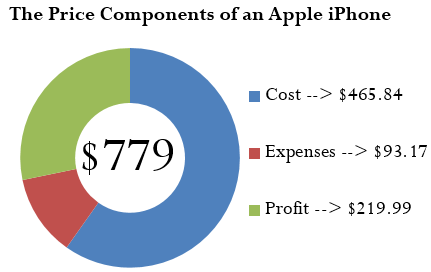

A cellular retail store purchases an iPhone with an MSRP of $779 less a trade discount of 35% and volume discount of 8%. The store sells the phone at the MSRP.

a. What is the markup amount?

b. If the store knows that its expenses are 20% of the cost, what is the store’s profit?

Plan:

First of all, you need to calculate the markup amount (![]() ). You also want to find the store’s profit (

). You also want to find the store’s profit (![]() ).

).

Understand:

Step 1: The smartphone MSRP and the two discounts are known, along with the expenses and selling price:

![]() = $270

= $270

![]() = 0.35

= 0.35

![]() = 0.08

= 0.08

![]() = 20% of cost, or

= 20% of cost, or ![]()

![]() = $779

= $779

Calculate the cost of the iPhone by applying Formula 4.3.

Step 2: Calculate the markup amount using Formula 4.7.

Calculate the profit by applying Formula 4.6, rearranging for ![]() .

.

Perform:

Step 1:

![]()

![]()

Step 2:

![]()

![]()

![]()

![]()

![]()

Present:

The markup amount for the iPhone is $313.16. When the store sells the phone for $779.00, its profit is $219.99.

Calculating the Markup Percent

It is important to understand markup in terms of the actual dollar amount; however, it is more common in business practice to calculate the markup as a percentage. There are three benefits to converting the markup dollar amount into a percentage:

- Easy comparison of different products having vastly different price levels and costs, to help you see how each product contributes toward the financial success of the company. For example, if a chocolate bar has a 50¢ markup included in a selling price of $1, while a car has a $1,000 markup included in a selling price of $20,000, it is difficult to compare the profitability of these items. If these numbers were expressed as a percentage of the selling price such that the chocolate bar has a 50% markup and the car has a 5% markup, it is clear that more of every dollar sold for chocolate bars goes toward list profitability.

- Simplified translation of costs into a regular selling price—a task that must be done for each product, making it helpful to have an easy formula, especially when a company carries hundreds, thousands, or even tens of thousands of products. For example, if all products are to be marked up by 50% of cost, an item with a $100 cost can be quickly converted into a selling price of $150.

- An increased understanding of the relationship between costs, selling prices, and the list profitability for any given product. For example, if an item selling for $25 includes a markup on selling price of 40% (which is $10), then you can determine that the cost is 60% of the selling price ($15) and that $10 of every $25 item sold goes toward list profits.

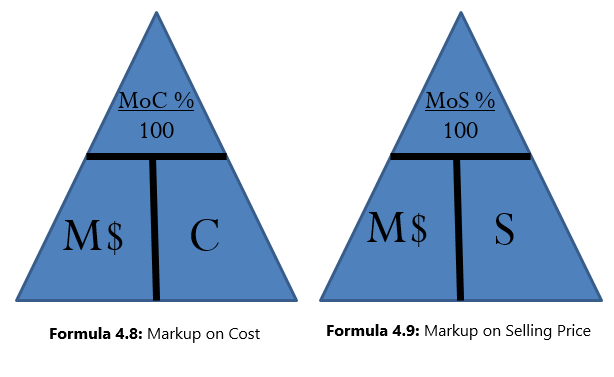

You can translate the markup dollars into a percentage using two methods, which express the amount either as a percentage of cost or as a percentage of selling price:

- Method 1: Markup as a Percentage of Cost.

This method expresses the markup rate using cost as the base. Many companies use this technique internally because most accounting is based on cost information. The result, known as the markup on cost percentage, allows a reseller to convert easily from a product’s cost to its regular unit selling price. - Method 2: Markup as a Percentage of Selling Price.

This method expresses the markup rate using the regular selling price as the base. Many other companies use this method, known as the markup on selling price percentage, since it allows for quick understanding of the portion of the selling price that remains after the cost of the product has been recovered. This percentage represents the list profits before the deduction of expenses and therefore is also referred to as the list profit margin.

The markup on cost percentage is expressed in Formula 4.8, while the markup on selling price percentage is expressed in Formula 4.9.

Formula 4.8 – Markup On Cost Percentage

![]()

![]() is Markup on Cost Percentage: This is the percentage by which the cost of the product needs to be increased to arrive at the selling price for the product.

is Markup on Cost Percentage: This is the percentage by which the cost of the product needs to be increased to arrive at the selling price for the product.

![]() is Markup Amount: The total dollars of the expenses and the profits; this total is the difference between the cost and the selling price.

is Markup Amount: The total dollars of the expenses and the profits; this total is the difference between the cost and the selling price.

![]() is Cost: The amount of money needed to acquire or manufacture the product. If the product is being acquired, the cost is the same amount as the net price paid.

is Cost: The amount of money needed to acquire or manufacture the product. If the product is being acquired, the cost is the same amount as the net price paid.

× 100 is Percent Conversion: The markup on cost is always a percentage.

Formula 4.9 – Markup On Selling Price Percentage

![]()

![]() is Markup on Selling Price Percentage: This is the percentage of the selling price that remains available as list profits after the cost of the product is recovered.

is Markup on Selling Price Percentage: This is the percentage of the selling price that remains available as list profits after the cost of the product is recovered.

![]() is Markup Amount: The total dollars of the expenses and the profits; this total is the difference between the cost and the selling price.

is Markup Amount: The total dollars of the expenses and the profits; this total is the difference between the cost and the selling price.

![]() is Selling Price: The regular selling price of the product.

is Selling Price: The regular selling price of the product.

× 100 is Percent Conversion: The markup on cost is always a percentage.

How It Works

Refer back to the steps in calculating markup. The steps you must follow for calculations involving markup percent are almost identical to those for working with markup dollars:

Step 1: Three variables are required in either Formula 4.8 or Formula 4.9. For either formula, at least two of the variables must be known. If the amounts are not directly provided, you may need to calculate these amounts by applying other discount or markup formulas.

Step 2: Solve either Formula 4.8 or Formula 4.9 for the unknown variable.

Continuing to work with Example 4.2D, recall that the cost of the MP3 player is $26.15, the markup amount is $13.84, and the selling price is $39.99. Calculate both markup percentages.

Step 1: The known variables are

![]() = $26.15

= $26.15

![]() = $13.84

= $13.84

![]() = $39.99.

= $39.99.

Step 2: To calculate the markup on cost percentage, apply Formula 4.8:

![]()

In other words, you must add 52.9254% of the cost on top of the unit cost to arrive at the regular unit selling price of $39.99.

To calculate the markup on selling price percentage, apply Formula 4.9:

![]()

In other words, 34.6087% of the selling price represents list profits after the business recovers the $26.15 cost of the MP3 player.

Businesses are very focused on profitability. Your Texas Instruments BAII Plus calculator is programmed with the markup on selling price percentage. The function is located on the second shelf above the number three. To use this function, open the window by pressing 2nd 3. You can scroll between lines using your ↑ and ↓ arrows. There are three variables:

- CST is the cost. Use the symbol

.

. - SEL is the selling price. Use the symbol

.

. - MAR is the markup on selling price percentage. Use the symbol

.

.

As long as you know any two of the variables, you can solve for the third. Enter any two of the three variables (you need to press ENTER after each), making sure the window shows the output you are seeking, and press CPT.

Merchandising involves many variables. Nine formulas have been established so far, and a few more are yet to be introduced. Though you may feel bogged down by all of these formulas, just remember that you have encountered most of these merchandising concepts since you were very young and that you interact with retailers and pricing every day. This chapter merely formalizes calculations you already perform on a daily basis, whether at work or at home. The calculation of discounts is no different than going to Walmart and finding your favourite CD on sale. You know that when a business sells a product, it has to recoup the cost of the product, pay its bills, and make some money. And you have worked with percentages since elementary school.

Do not get stuck in the formulas. Think about the concept presented in the question. Change the scenario of the question and put it in the context of something more familiar. Ultimately, if you really have difficulties then look at the variables provided and cross-reference them to the merchandising formulas. Your goal is to find formulas in which only one variable is unknown. These formulas are solvable. Then ask yourself, “How does knowing that new variable help solve any other formula?”

You do not need to get frustrated. Just be systematic and relate the question to what you already know.

The triangle method simplifies rearranging both Formulas 4.8 and 4.9 to solve for other unknown variables as illustrated in the figure below.

Sometimes you need to convert the markup on cost percentage to a markup on selling price percentage, or vice versa. Two shortcuts allow you to convert easily from one to the other:

![]()

![]()

Notice that these formulas are very similar. How do you remember whether to add or subtract in the denominator? In normal business situations, the ![]() is always larger than the

is always larger than the ![]() . Therefore, if you are converting one to the other you need to identify whether you want the percentage to become larger or smaller.

. Therefore, if you are converting one to the other you need to identify whether you want the percentage to become larger or smaller.

- To calculate

, you want a larger percentage. Therefore, make the denominator smaller by subtracting

, you want a larger percentage. Therefore, make the denominator smaller by subtracting  from 1.

from 1. - To calculate

, you want a smaller percentage. Therefore, make the denominator larger by adding

, you want a smaller percentage. Therefore, make the denominator larger by adding  to 1.

to 1.

Give It Some Thought:

Answer the following true/false questions.

4. The markup on selling price percentage can be higher than 100%.

5. The markup dollar amount can be more than the selling price.

6. The markup on cost percentage can be higher than 100%.

7. The markup on cost percentage in most business situations is higher than the markup on selling price percentage.

8. If you know the markup on cost percentage and the cost, you can calculate a selling price.

9. If you know the markup on selling price percentage and the cost, you can calculate a selling price.

Example 4.2G – Markup as a Percentage

A large national retailer wants to price a Texas Instruments BAII Plus calculator at the MSRP of $39.99. The retailer can acquire the calculator for $17.23.

a. What is the markup on cost percentage?

b. What is the markup on selling price percentage?

Plan:

You have been asked to solve for the markup on cost percentage (![]() ) and the markup on selling price percentage (

) and the markup on selling price percentage (![]() ).

).

Understand:

Step 1: The regular unit selling price and the cost are provided:

![]() = $39.99

= $39.99

![]() = $17.23

= $17.23

You need the markup dollars. Apply Formula 4.7, rearranging for ![]() .

.

Step 2: To calculate markup on cost percentage, apply Formula 4.8.

To calculate markup on selling price percentage, apply Formula 4.9.

Perform:

Calculator Instructions:

| CST | SEL | MAR |

| 17.23 | 39.99 | Answer: 56.9142 |

Step 1:

![]()

![]()

Step 2:

![]()

![]()

Present:

The markup on cost percentage is 132.0952%. The markup on selling price percentage is 56.9142%.

Break-Even Pricing

In running a business, you must never forget the “bottom line.” In other words, if you fully understand how your products are priced, you will know when you are making or losing money. Remember, if you keep losing money you will not stay in business for long! 15% of new businesses will not make it past their first year, and 49% fail in their first five years. This number becomes even more staggering with an 80% failure rate within the first decade.[1] Do not be one of these statistics! With your understanding of markup, you now know what it takes to break even in your business. Break-even means that you are earning no profit, but you are not losing money either. Your profit is zero.

If the regular unit selling price must cover three elements—cost, expenses, and profit—then the regular unit selling price must exactly cover your costs and expenses when the profit is zero. In other words, if Formula 4.5 is modified to calculate the selling price at the break-even point (![]() ) with

) with ![]() =0, then:

=0, then:

![]()

This is not a new formula. It just summarizes that at break-even there is no profit or loss, so the profit (![]() ) is eliminated from the formula.

) is eliminated from the formula.

How It Works

The steps you need to calculate the break-even point are no different from those you used to calculate the regular selling price. The only difference is that the profit is always set to zero.

Recall Example 4.2D that the cost of the MP3 player is $26.15 and expenses are $7.84.

The break-even price (![]() ) is

) is

![]()

This means that if the MP3 player is sold for anything more than $33.99, it is profitable; if it is sold for less, then the business does not cover its costs and expenses and takes a loss on the sale.

Example 4.2H – Knowing Your Break-Even Price

John is trying to run an eBay business. His strategy has been to shop at local garage sales and find items of interest at a great price. He then resells these items on eBay. On John’s last garage sale shopping spree, he only found one item—a Nintendo Wii that was sold to him for $100. John’s vehicle expenses (for gas, oil, wear/tear, and time) amounted to $40. eBay charges a $2.00 insertion fee, a flat fee of $2.19, and a commission of 3.5% based on the selling price less $25. What is John’s minimum list price for his Nintendo Wii to ensure that he at least covers his expenses?

Plan:

You are trying to find John’s break-even selling price (![]() ).

).

Understand:

Step 1: John’s cost for the Nintendo Wii and all of his associated expenses are as follows:

![]() = $100.00

= $100.00

![]() (vehicle) = $40.00

(vehicle) = $40.00

![]() (insertion) = $2.00

(insertion) = $2.00

![]() (flat) = $2.19

(flat) = $2.19

![]() (commission) = 3.5%(SBE − $25.00)

(commission) = 3.5%(SBE − $25.00)

You have four expenses to add together that make up the ![]() in the formula.

in the formula.

Step 2: Formula 4.5 states ![]() . Since you are looking for the break-even point, then

. Since you are looking for the break-even point, then ![]() is set to zero and

is set to zero and ![]() .

.

Perform:

Step 1:

![]()

![]()

![]()

Step 2:

![]()

![]()

![]()

![]()

![]()

Present:

At a price of $148.51 John would cover all of his costs and expenses but realize no profit or loss. Therefore, $148.51 is his minimum price.

Give It Some Thought Answers

- Cost, expenses, and profit. They are expressed either per unit or as a total.

- A specific dollar amount, a percentage of cost, or a percentage of the selling price.

- The net price paid for a product is the same as the cost of the product.

- False. The markup amount is a portion of the selling price and therefore is less than 100%.

- False. The markup amount plus the cost equals the selling price. It must be less than the selling price.

- True. A cost can be doubled or tripled (or increased even more) to reach the price.

- True. The base for markup on cost percentage is smaller, which produces a larger percentage.

- True. You could combine Formulas 4.7 and 4.8 to arrive at the selling price.

- True. You could convert the

to a

to a  and solve as in the previous question.

and solve as in the previous question.

Exercises

Round all money to two decimals and percentages to four decimals for each of the following exercises.

Mechanics

For questions 1–8, solve for the unknown variables (identified with a ?) based on the information provided.

| Regular Unit Selling Price | Cost | Expenses | Profit | Markup Amount | Break-Even Price | Markup on Cost | Markup on Selling Price | |

| 1. | ? | $188.42 | $48.53 | $85.00 | ? | ? | ? | ? |

| 2. | $999.99 | ? | 30% of |

23% of |

? | ? | ? | ? |

| 3. | ? | ? | ? | 10% of |

$183.28 | ? | 155% | ? |

| 4. | $274.99 | ? | 20% of |

? | ? | ? | ? | 35% |

| 5. | ? | ? | 45% of |

? | $540.00 | $1,080.00 | ? | ? |

| 6. | ? | $200 less 40% | ? | 15% of |

? | ? | 68% | ? |

| 7. | ? | ? | $100.00 | ? | $275.00 | ? | ? | 19% |

| 8. | ? | ? | 15% of |

12% of |

? | $253.00 | ? | ? |

Applications

9. If a pair of sunglasses sells at a regular unit selling price of $249.99 and the markup is always 55% of the regular unit selling price, what is the cost of the sunglasses?

10. A transit company wants to establish an easy way to calculate its transit fares. It has determined that the cost of a transit ride is $1.00, with expenses of 50% of cost. It requires $0.75 profit per ride. What is its markup on cost percentage?

11. Daisy is trying to figure out how much negotiating room she has in purchasing a new car. The car has an MSRP of $34,995.99. She has learned from an industry insider that most car dealerships have a 20% markup on selling price. What does she estimate the dealership paid for the car?

12. The markup amount on an eMachines desktop computer is $131.64. If the machine regularly retails for $497.25 and expenses average 15% of the selling price, what profit will be earned?

13. Manitoba Telecom Services (MTS) purchases an iPhone for $749.99 less discounts of 25% and 15%. MTS’s expenses are known to average 30% of the regular unit selling price.

a. What is the regular unit selling price if a profit of $35 per iPhone is required?

b. What are the expenses?

c. What is the markup on cost percentage?

d. What is the break-even selling price?

14. A snowboard has a cost of $79.10, expenses of $22.85, and profit of $18.00.

a. What is the regular unit selling price?

b. What is the markup amount?

c. What is the markup on cost percentage?

d. What is the markup on selling price percentage?

e. What is the break-even selling price? What is the markup on cost percentage at this break-even price?

Challenge, Critical Thinking, & Other Applications

15. A waterpark wants to understand its pricing better. If the regular price of admission is $49.95, expenses are 20% of cost, and the profit is 30% of the regular unit selling price, what is the markup amount?

16. Sally works for a skateboard shop. The company just purchased a skateboard for $89.00 less discounts of 22%, 15%, and 5%. The company has standard expenses of 37% of cost and desires a profit of 25% of the regular unit selling price. What regular unit selling price should Sally set for the skateboard?

17. If an item has a 75% markup on cost, what is its markup on selling price percentage?

18. A product received discounts of 33%, 25%, and 5%. A markup on cost of 50% was then applied to arrive at the regular unit selling price of $349.50. What was the original list price for the product?

19. Mountain Equipment Co-op (MEC) wants to price a new backpack. The backpack can be purchased for a list price of $59.95 less a trade discount of 25% and a quantity discount of 10%. MEC estimates expenses to be 18% of cost and it must maintain a markup on selling price of 35%.

a. What is the cost of backpack?

b. What is the markup amount?

c. What is the regular unit selling price for the backpack?

d. What profit will Mountain Equipment Co-op realize?

e. What happens to the profits if it sells the backpack at the MSRP instead?