5. Business Organization – Business Structures

Business in Canada

It is generally understood that the purpose of a business is to generate profit for its owners. Businesses exist in various sizes and configurations. Some businesses make things in factories (manufacturers), others sell things that other enterprises make (retailers) or provide expertise to assist businesses in becoming more efficient and competitive (business consultants). Businesses may also exist to obtain profit by selling their services or by lending money.

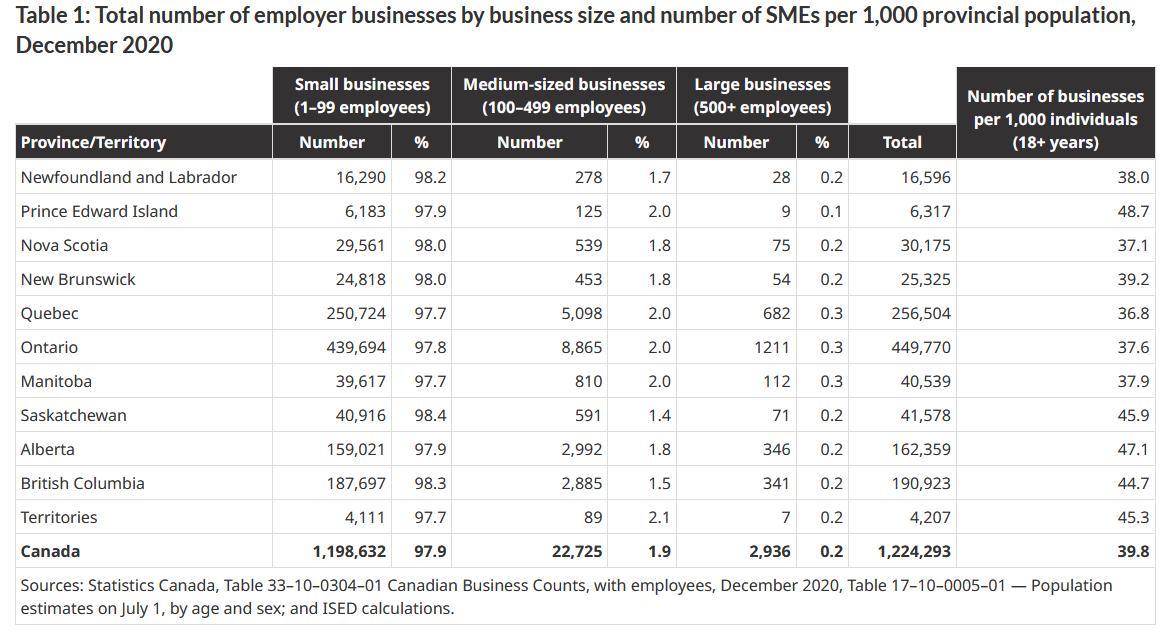

According to the Business Development Bank of Canada (BDC) small and medium-size companies (SMEs) (businesses with between 1 – 499 employees) account for 99.8% of businesses in Canada and data generated in 2020 showed 1.22 million SMEs operating throughout the country. Statistics Canada provides useful data showing the size and distribution of business in the following chart:

“Of the 1,224,293 employer businesses in Canada, 21.1 percent are in the goods-producing sector and 78.9 percent are in the services-producing sector (Table 2). Micro-enterprises (14 employees) make up 55.3 percent of Canadian businesses. By adding those businesses with 59 employees, this number increases to 73.9 percent. In other words, almost three out of four Canadian businesses have 19 employees. It should be noted that the distribution of businesses according to the number of employees varies slightly between the goods-producing and services-producing sectors.” [1]

Business Organization Considerations

If you’re starting a new business, you will need to decide which legal form of ownership is best for you and your business. Given the range and diversity of enterprises across Canada, there is no “one size fits all” approach to choosing a business organization. When choosing what form is best, several factors are important to consider:

- What is the cost and complexity involved in starting the business?

- Do you have all the skills needed to run the business?

- What are the challenges for growing or expanding the business?

- How much control would you like? How much responsibility are you willing to share?

- Do you have access to people with the skills needed to operate and sustain the business?

- Is there a financial strategy to minimize the taxes paid on earnings and income?

- Do you wish to protect your personal assets from claims (limited liability)?

Depending on the type of business and its goals, different business entities may be appropriate, so it is important to carefully consider the legal, financial, and regulatory consequences of each potential structure. A key recommendation is to think carefully about where the business is today and where it might be going to determine which business structure is best suited to meet the current and future business requirements.

The following four key elements are helpful to keep in mind when selecting a business structure:

- Legal liability risk of the business.

- Tax implications.

- Raising capital.

- Level of complexity.

Reflecting on each of these factors will help in choosing a business structure that aligns well with the intentions and aspirations of the enterprise. The following section identifies common forms of business organization in Canada.

- https://ised-isde.canada.ca/site/sme-research-statistics/en/key-small-business-statistics/key-small-business-statistics-2021#a01 ↵