2. Legal Risk Management

A Model for Evaluating Legal Risk

This section seeks to provide a simple, non-mathematical model for evaluating legal risk. A “model” is a simplified framework for evaluating a real-life situation. It is not intended to capture all of the nuances involved in a particular choice, but it may be useful to decision makers. The model presented here relies on simple categorization of the likelihood of an event, the consequences of that event, and the decisionmaker’s approach to evaluating risk.

The initial step is to evaluate the likelihood of the event to determine if it is “low” (unlikely), “medium” (somewhat likely), or “high” (very likely). For example, you might think of a low probability event as one that rarely occurs in a cohort of similar companies, a medium probability event as one that has occurred several times in the last year for similar companies, and a high probability event as one that will almost certainly result in litigation.

Next, categorize the severity of the outcome as “slight”, “manageable”, or “severe”. For modeling purposes, a slight outcome is one which would not harm the financial health of the company in a significant way. An example might be a somewhat frivolous lawsuit which is settled as a “nuisance suit” for a few thousand dollars. A manageable outcome is one which would generate discussion among managers about potential budgets for a loss, such as a small-business customer injured in an accident who has major medical bills. This kind of outcome might worry managers but does not risk the future of the business. A severe outcome is one which risks bankruptcy, criminal charges, or other substantial long-term consequences for the firm.

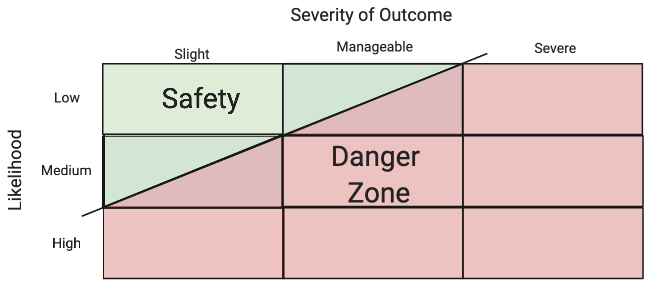

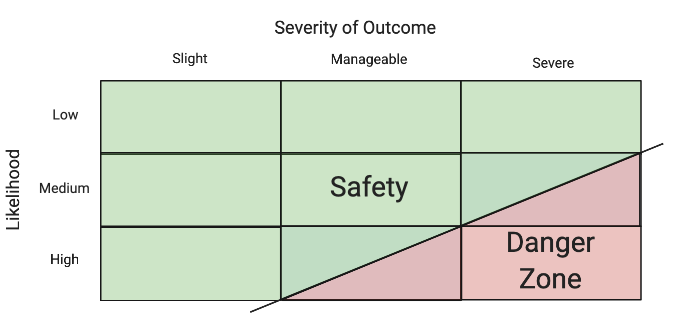

Finally, identify the attitude towards risk. Is the firm risk averse, risk neutral, or risk seeking? In our model, the attitude towards risk forms the shaded “danger zone” in the grid, dividing causes of little from significant concern. The more risk averse the individual or firm, the farther up and to the left we shift the dividing line, and the more risk-seeking the firm, the farther lower and to the right we shift the line. An extremely risk adverse firm would avoid even low probability severe events (as shown in the first figure below), while an extremely risk-seeking firm might avoid only high probability severe events (as shown in the second figure below).

Applying this model might look something like the following. We (1) classify the risk tolerance of the firm, (2) then the likelihood of the legal event, and (3) the severity of the consequence. Finally, (4) we analyze how those three interact and offer a conclusion: is this a high-risk decision, in the legal danger zone, or a low-risk decision, in the zone of safety?

Suppose a ride-sharing firm was considering whether to expand to a city that has somewhat hostile regulations for ridesharing. At the same time, the consequences for entering the market and losing a legal challenge are simply to withdraw or pay an insubstantial fine. Let’s apply the model:

- We might thus classify this firm as risk seeking based on its past attitude towards the law and the potential rewards at stake.

- As the new market appears hostile, the likelihood of legal challenge is assessed to be medium or high.

- Relative to the size of the firm, a modest fine is a small consequence. We might then classify the severity of outcome as low.

- Although the likelihood of legal action is medium to high, the potential consequence is slight.

- This decision is likely a low-risk legal decision, in the legal safety zone for the firm. They might also be classified as risk-neutral because the company simply finds it advantageous to engage in legally risky behaviour.