11 Monthly Food Costs

Monthly food costs are determined by taking a monthly physical inventory of food stock, evaluating the inventory, and then adjusting the valuation to more accurately reflect the cost of food consumed.

The basic formula to determine the cost of food in a month is:

cost of food = opening inventory + purchases – closing inventory

Example

For example, if opening inventory is $10 000 and purchases amount to $7500, and the closing inventory (which is also the beginning inventory for the next month) is $9000, then the basic cost of food is:

cost of food = opening inventory + purchases – closing inventory

= $10 000 + $7500 – $9000

= $17 500 – $9000

= $8500

The value of the inventory is the critical component in deriving an accurate cost figure from the basic formula given above.

The information needed to accurately assess the value of inventory is obtained from daily receiving reports (that is, purchases), perpetual inventory cards (that is, inventory records that indicate what is in storage and what supplies have been removed from storage at the request of the kitchen), and by doing a physical inventory.

Adjusting (Credits and Transfers) the Evaluation of Food Costs

Some food inventory is used for purposes other than generating direct sales. For example, if employees are fed or are given a significant discount, the food cost for these meals is usually subtracted from the total found by the basic food cost formula. The cost of employee meals should not be ignored, but it might better be considered a labour cost and not a true food cost.

Promotional expenses are also subtracted from the basic cost of food figure. These include “2 for 1 specials,” coupon discounts, and other promotions. The deduction made, remember, is not the menu price but the actual cost of the food to the operation. Again, this expense cannot be ignored, but should be included as a different type of operating expense.

In some restaurant and hotel operations, food is transferred to the bar where it is served as as hors d’oeuvre to promote the sale of alcoholic beverages. This is really an expense of the bar and should not be considered a kitchen expense. The cost of transferred food should be deducted from the basic food cost figure. This cost is best considered a promotional expense borne by the bar.

Other adjustments might have to be made to the gross cost of food, depending on how the individual restaurant operates. For example, in some cases, the kitchen might acquire wine or liquor from the bar for cooking or flambéing, and that should be considered a food cost.

Net cost of food for an operation

In general, the net cost of food for an operation is summarized in the following equation:

net food cost = basic food cost – (employee meal cost + promotional expenses + transferred out food costs) + transferred in food costs

Food Cost Report

A monthly food cost report is often required by management. The basic form of the food cost report tends to be a comparison of food cost percentages. Percentages are used instead of actual net food cost as such costs vary according to sales. Percentage food cost tends to remain constant regardless of sales.

Food cost percentages

Food cost percentages are computed by using the following equation:

food cost percentage = net food cost/food sales

For example, if net food costs are $5500 and food sales were $13 700, then

food cost percentage = net food cost/food sales

= $5500/$13 700

= 0.401

= 40%

The food cost report often compares the current month’s results with the food cost percentage of the previous month or the cost percentage of the same month a year ago (Figure 14). Management can then decide if monthly food costs are under control.

| Date | Food Costs | Food Sales | Food Cost Percentage |

| Last month | $8000 | $32 000 | 25.0% |

| Previous month | $8500 | $30 000 | 28.3% |

| Same month last year | $9500 | $31 000 | 30.6% |

Figure 14: Comparative monthly sales

Other costs must also be taken into account to properly understand where the food income dollar is going within the operation. In some restaurant businesses, the breakdown of expenses is recorded in a monthly percentage costing report on a form as shown in Figure 15.

| Year: ….. Month: | |||

| Amount | % | Remarks | |

| Total sales | |||

| Food cost | |||

| Labour cost | |||

| Rent/Lease | |||

| Other operating expenses | |||

| Total cost | |||

| Profit |

Figure 15: Percentage costing report

The cost percentages are determined by dividing the individual costs by the total sales. Near the beginning of each month, the percentage costing form of the previous month is completed and compared to the results on past forms.

Food costs can be further analyzed by investigating the costs and percentage of total food cost of individual categories of food items, as shown in the example in Figure 16.

| October | November | December | ||

| Item | Cost | % of Total Cost | Cost | % of Total Cost |

| Meat | $ 874.70 | 27.1% | $ 811.12 | 28.2% |

| Fish | $ 264.67 | 8.2% | $ 184.08 | 6.4% |

| Poultry | $ 390.55 | 12.1% | $ 330.77 | 11.5% |

| Dairy | $ 532.56 | 16.5% | $ 440.07 | 15.3% |

| Eggs | $ 203.34 | 6.3% | $ 212.85 | 7.4% |

| Bakery | $ 129.11 | 4.0% | $ 143.82 | 5.0% |

| Produce | $ 254.99 | 7.0% | $ 238.73 | 8.3% |

| Dry goods | $ 490.60 | 15.2% | $ 414.19 | 14.4% |

| Beverages | $ 87.15 | 2.7% | $ 100.67 | 3.5% |

| Total cost | $3227.67 | 100% | $2876.30 | 100% |

| Total sales | $9143.50 | $8560.35 | ||

| Food cost % | 35.3% | 33.6% |

Figure 16: Food cost analysis report

An important line in the chart shown in Figure 16 is the last one, “Food cost %.” In the example, total sales have dropped in November, but the food cost percentage has also decreased. As long as labour costs have not changed markedly from October, the food cost percentages suggest that this operation copes well with changing sales and is probably in a strong financial position even though demand is down. Sales have dropped by 6.4%, but food costs have decreased by 10.9%.

Describe Daily Food Cost Controls

A month is a long time between reports, particularly if the reports are financial in nature and will determine if the operation is keeping costs under control. If costs are not controlled, the business is likely to fail.

Daily food costs are calculated much the same way as the basic monthly food costs and the monthly net food costs. However, the inventory used is the actual amount of money that is spent daily on direct supplies or directs (that is, supplies that are purchased and used that day, such as breads and dairy products in many operations) and the value of stores used (that is, the value of the materials already on hand that have been requested and received from the storage area).

Basic daily food costs

Basic daily food costs can be expressed as:

daily food costs = cost of direct supplies + cost of stores

The daily food costs found by using the basic formula can be adjusted in much the same way as the basic monthly food cost. That is,

net daily food costs = daily food cost – (employee meal costs + promotional expenses + transferred out food costs) + transferred in food costs

Cumulative Cost Records

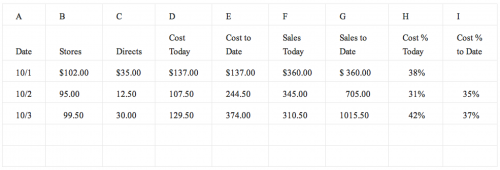

The easiest way to keep track of daily food costs is to use a form like the one shown in Figure 17. On this form, the cost of direct supplies, the cost of stores, total costs today, cumulative cost for the month, sales for the day, cumulative sales for the month, cost percentages for the day, and cost percentages for the month can be entered. Note that the form does not take into account transfers.

Some POS systems have this feature and can be used to track daily food costs.

| Date | Stores | Directs | Cost Today | Cost to Date | Sales Today | Sales to Date | Cost % Today | Cost % to Date |

Figure 17: Daily cumulative food cost record

A new form is started each month. Nothing is carried forward from month to month. The month-end totals should be close to the figures obtained using other monthly food cost procedures, such as those calculated after doing a physical inventory.

The information needed to fill in the food cost record are the daily food purchase reports for direct costs, copies of requisitions for stores, and the daily sales figures.

The following example explains how to fill out the form.

Example

On the first day of the month, $35.00 was spent on directs, $102.00 on stores, and total sales were $360.00. On the second day of the month, $12.50 was spent on directs, $95.00 on stores, and sales were $345.00. On the third day, $30.00 was spent on directs, $99.50 on stores, and total sales for the day were $310.50.

- On the first day, the date is inserted.

- Next to the date in Column B the cost from stores is entered.

- In Column C the cost of directs is entered.

- In Column F the days sales is entered.

- Column G is the same as F or is left blank.

- Column H is determined by dividing Column D by Column F.

- Column I is blank or has the same value as Column H.

Columns A, B, C, D, F, and H for the second day are filled in with the cost and sales information given. Column E is the sum of the previous day’s value in Column E and today’s value in Column D. Similarly, Column G is the sum of the previous day’s Column G and today’s Column F. The value of Column I is determined by dividing Column E by Column G.

The costs and sales of the rest of the month are entered in the same way as on the second day. The final result is shown in Figure 18.

Figure 18: Daily cumulative food cost record

The daily cumulative food cost record will quickly indicate if daily food costs are getting out of hand. A single bad food cost percentage day may not be anything to worry about as supplies charged against that day may not have been entirely used that day. For example, directs might be received only twice a week and so on those days, costs will look high. However, the directs might be used over a period of two or three days. Changes in the pattern of the cost percentages may indicate problems.

Daily Reports

The daily report is usually a simple statement containing total food costs, total food sales, and cost percentages. The form can contain other columns that indicate cumulative totals or totals for the same day a month ago. A sample form is shown in Figure 19.

Date: 10/3

| Today | Month to Date | Year to Date | Last Year to Date | |

| Food cost | $129.50 | $2025 | $32 600 | $31 750 |

| Food sales | $310.50 | $5330 | $92 500 | $85 750 |

| Food cost % | 42% | 38% | 35% | 37% |

Figure 19: Daily report

Small variations will show up in the daily reports and are to be expected. However, if changes seem to be part of a pattern, managers who receive the daily reports will have a maximum of warning time to remedy the possible problem.

Causes of cost percentage overruns include:

- Short weights and counts on deliveries

- Waste in the kitchen

- Theft

- Poor recipe control

- Improper costing and menu pricing

- Poor use of leftovers

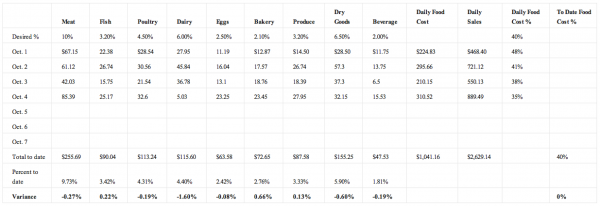

In many food service operations, daily food costs are broken down into the daily costs of individual categories of raw food items. A typical form is shown in Figure 20.

- The “Desired %” line values are determined by the restaurant analyzing the daily food cost percentages of the individual groups of food over a period of time. In the example, the total of these desired percentages is 40%. These percentages are calculated by dividing the cost of each food category by the total food cost.

- At the “Total to Date” line, trial cost percentages are determined so that the actual cost percentages of individual categories can be compared to the desired percentages. If an area is excessively high, then an investigation should be made to determine the causes.

Figure 20: Daily food cost control sheet

Key Takeaway

Managing food costs is one of the most critical aspects of running a successful food service operation. Having procedures and tools in place to track sales and costs help to identify any possible issues and create the opportunity to remedy the problem before it gets out of control.