6 Insourcing, Outsourcing, Making, or Buying

Note. From Gieling, 2020. Licensed for reuse under the Unsplash License.

Learning Objectives

- Explain why companies outsource.

- Describe the reasons why the use of outsourcing and offshoring has grown.

- Explain some drawbacks companies face when they outsource their activities.

- Understand that choosing whether to make or to buy a product or choosing to have services performed by an outside company, are outsourcing decisions.

- Compare costs to keep the product or service in-house to the cost of buying the product or service from an outside party.

What do you know about insourcing and outsourcing?

Outsourcing

Watch this video on why you should consider outsourcing.

BigOutsource. (2013, February 17). Why Outsource? [Video]. YouTube. https://www.youtube.com/watch?v=aqhjNJkvC9w

Ford Motor Company no longer produces its own tires for its cars. It buys them from tire producers like Michelin and Goodyear. It’s still possible to “own” your supply chain, though. The diamond company DeBeers owns its own mines, distributorships, and retail diamond stores. The problem is that it’s very costly to own multiple types of companies and difficult to run them all well, too.

Firms look up and down their supply chains and outside them to see which companies can add the most value to their products at the least cost. If a firm can find a company that can add more value than it can to a function, it will often outsource the task to that company. After all, why do something yourself if someone else can do it better or more cost-effectively?

Rather than own fleets of trucks, ships, and airplanes, most companies outsource at least some of their transportation tasks to shippers such as Roadway and FedEx. Other companies hire freight forwarders to help them. You can think of freight forwarders as travel agents for freight. Their duties include negotiating rates for shipments and booking space for them on transportation vehicles and in warehouses. A freight forwarder also combines small loads from various shippers into larger loads that can be shipped more economically. However, it doesn’t own its own transportation equipment or warehouses.

Other companies go a step further and outsource their entire order processing and shipping departments to third-party logistics (3PLs) firms. FedEx Supply Chain Services and UPS Supply Chain Solutions (which are divisions of FedEx and UPS, respectively) are examples of 3PLs. A 3PL is a one-stop shipping solution for a company that wants to focus on other aspects of its business. Firms that receive and ship products internationally often hire 3PLs so they don’t have to deal with the headaches of transporting products abroad and completing import and export paperwork for them.

The Growth of Outsourcing and Offshoring

Beginning in the 1990s, companies began to outsource a lot of other activities besides transportation (McGrath, 2007). Their goal was twofold: (1) to lower their costs and (2) to focus on the activities they do best. You might be surprised by the functions firms outsource. In fact, many “producers” of products no longer produce them at all but outsource their production instead.

Most clothing companies, including Nike, design products, but they don’t make them. Instead, they send their designs to companies in nations with low labour costs. Likewise, many drug companies no longer develop their own drugs. They outsource the task to smaller drug developers, who, in recent years, have had a better track record of developing best-selling pharmaceuticals. The Crest SpinBrush (toothbrush) wasn’t developed by Procter & Gamble, the maker of Crest. A small company called Church & Dwight Co. developed the technology for SpinBrush, and P&G purchased the right to market and sell the product.

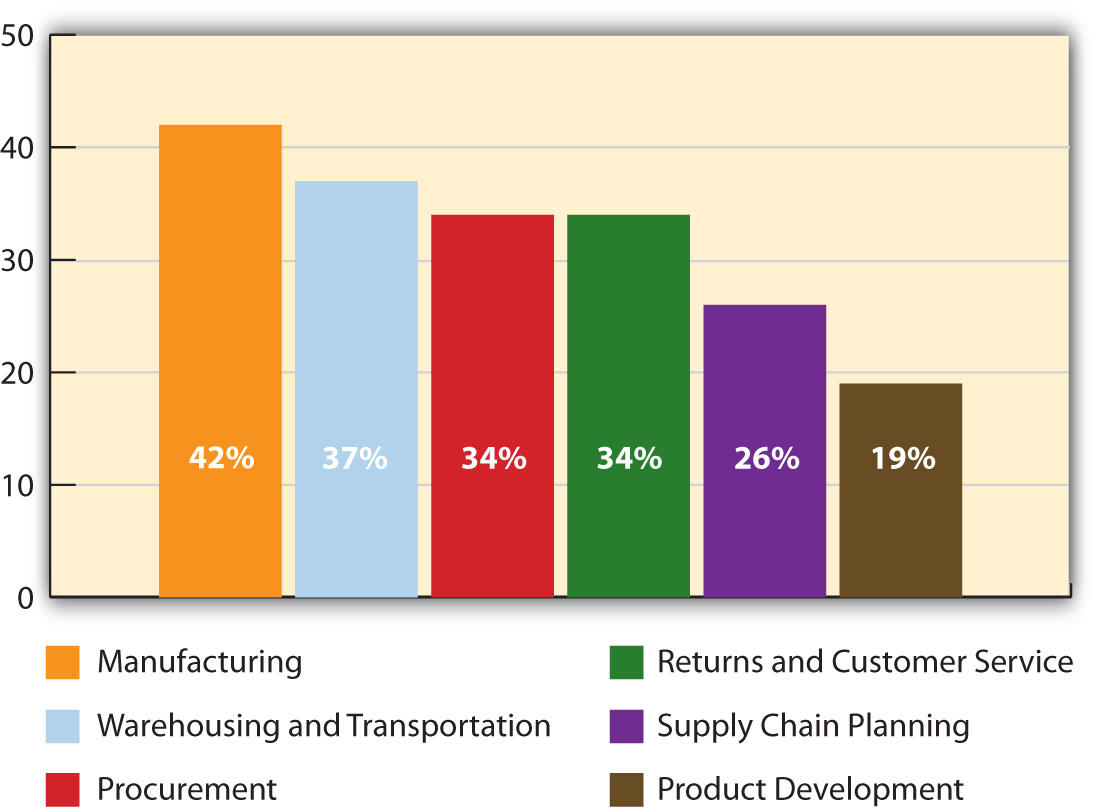

Outsourcing work to companies abroad is called offshoring. Figure 6.1 “Percentage of Supply Chain Functions Offshored in 2008” shows the percentage of supply chain functions three hundred global manufacturers and service organizations say they now offshore and the percentages these organizations expect to offshore by 2010.

Note. From Principles of Marketing, 2015. CC BY-NC-SA. [Image Description]

Some of the Ins and Outs of Outsourcing

A company faces a number of tradeoffs when it outsources an activity. The loss of control—particularly when it comes to product quality and safety—is one of them. Just ask Mattel. Beginning in 2007, Mattel was forced to recall tens of millions of toys it had outsourced for production because they were tainted with lead. But Mattel isn’t the only company to experience problems. In a recent global survey, more than one-fifth of the companies that outsource their production said they have experienced “frequent” and “serious” quality problems (PRTM Management Consultants, n.d.).

The U.S. Consumer Products Safety Commission randomly inspects products, but there is no way the commission’s personnel can begin to test them all. To protect their customers, many companies either test their suppliers’ products themselves or contract with independent labs to do so. For example, if you sell a product to Walmart, you need to be prepared to send it to such a lab, should Walmart ask you to (Walmart, n.d.). Companies also do on-site audits, or checks, of their suppliers. Other companies station employees with their suppliers on a permanent basis to be sure that the quality of the products they’re producing is acceptable.

The loss of control of their technology is another outsourcing risk that companies face. Some countries are better about protecting patented technologies and designs than others, and some supply chain partners are more trustworthy than others. How can you be sure your supply chain partner won’t steal your technology? A few years ago, General Motors began working with a Chinese firm to produce a car called the Spark for the Chinese market. But before GM could even get the automobile plant up and running, the U.S. automaker alleged that the design of the car had been stolen, sold to another company, and knockoffs of it were being driven around China’s streets (Bureau of International Information Programs, 2005).

One of the drawbacks of outsourcing is the time it takes for products to make their way to the United States and into the hands of consumers. The time it takes is a big issue because it affects how responsive a company is to its customers. Retailers don’t like to wait for products. Waiting might mean their customers will shop elsewhere if they can’t find what they want. For this reason and others, some companies are outsourcing their activities closer to home.

When firms can’t resolve their supplier problems, they find other suppliers to work with or they move the activities back in-house, which is a process called insourcing. Insourcing can actually help set your company apart these days. The credit card company Discover doesn’t outsource its customer service to companies abroad. Perhaps that helps explain why one survey ranked Discover number one in customer loyalty (Cuculich, 2019).

Evaluate and Determine Whether to Make or Buy a Component

One of the most common outsourcing scenarios is one in which a company must decide whether it is going to make a component that it needs in manufacturing a product or buy that component already made. For example, all of the components of the iPhone are made by companies other than Apple. Ford buys a truck and automobile seats, as well as many other components and individual parts, from various suppliers and then assembles them at Ford factories. With each component, Ford must decide if it is more cost-effective to make that component internally or to buy that component from an external supplier.

This type of analysis is also relevant to the service industry; for example, ADP provides payroll and data processing services to over 650,000 companies worldwide. Or a law firm may decide to hire certain research activities to be completed by outside experts rather than hire the necessary staff to keep that function in-house. These are all examples of outsourcing. Outsourcing is the act of using another company to provide goods or services that your company requires.

Many companies outsource some of their work, but why? Consider this scenario: Today, while driving home from class, one of your car’s engine warning lights goes on. You will most likely take your car to an auto repair specialist to have it analyzed and repaired, whereas your grandfather might have popped the hood, grabbed his toolbox, and attempted to diagnose and fix the problem himself. Why? It is often a matter of expertise and sometimes simply a matter of cost-benefit. In your grandfather’s time, car engines were more mechanical and less electronic, which made learning to repair cars a simpler process that required less expertise and only basic tools. Today, your car has many electronic components and often requires sophisticated monitors to assess the problem and may involve the replacement of computer chips or electronic sensors. Thus, you opt to outsource the repair of your car to someone who has the knowledge and facilities to provide the repair more cost-effectively than you could if you did it yourself. Your grandfather likely could have made the repair to his car several decades ago as cheaply as the mechanic with only a sacrifice of his time. To your grandfather, the cost of his time was worth the benefit of completing the repair himself.

Companies outsource for the same reasons. Many companies have found that it is more cost-effective to outsource certain activities, such as payroll, data storage, and web design and hosting. It is more efficient to pay an outside expert than to hire the appropriate staff to keep a particular task inside the company.

Fundamentals of the Decision to Make or to Buy

As with other decisions, the make-versus-buy decision involves both quantitative and qualitative analysis. The quantitative component requires cost analysis to determine which alternative is more cost-effective. This cost analysis can be performed by looking at the cost to buy the component versus the cost to produce the component, which allows us to decide based on an analysis of unavoidable costs. For example, the production costs will include direct materials, direct labour, variable overhead, and fixed overhead. If the business chooses to buy the component instead, the avoidable costs will go away, but unavoidable costs will remain and need to be considered part of the cost to buy the component.

Watch this video on the make or buy decision.

Edspira. (2016, February 1). Make or buy decision. [Video]. YouTube. https://www.youtube.com/watch?v=vxZSaDtQgrs

Sample Data

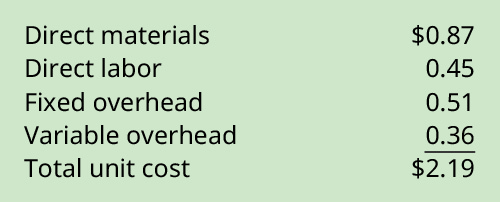

Thermal Mugs, Inc., manufactures various types of leak-proof personal drink carriers. Thermal’s T6 container, its most insulated carrier, maintains the temperature of the liquid inside for 6 hours. Thermal has designed a new lid for the T6 carrier that allows for easier drinking and pouring. The cost to produce the new lid is $2.19:

Figure 6.2

Thermal T6 Lid Costs

Note. From Graybeal, Franklin, and Cooper, 2019. CC BY-BC-SA. [Image Description]

Plato Plastics has approached Thermal and offered to produce the 120,000 lids Thermal will require for current production levels of the T6 carrier, at a unit price of $1.75 each. Is this a good deal? Should Thermal buy the lids from Plato rather than produce them themselves? Initially, the $1.75 presented by Plato seems like a much better price than the $2.19 that it would cost Thermal to produce the lids. However, more information about the relevant costs is necessary to determine whether the offer by Plato is the better offer. Remember that all the variable costs of producing the lid will only exist if the lid is produced by Thermal, thus the variable costs (direct materials, direct labour, and variable overhead) are all relevant costs that will differ between the alternatives.

What about the fixed costs? Assume all the fixed costs are not tied directly to the production of the lid and therefore will still exist even if the lid is purchased externally from Plato. This means the fixed costs of $0.51 per unit are unavoidable and therefore are not relevant.

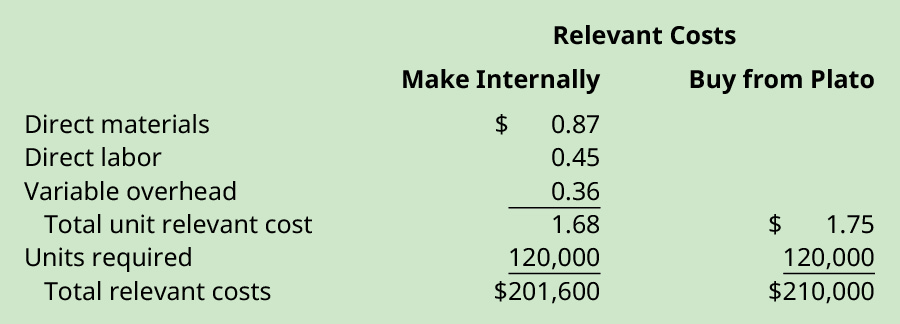

Calculations Using Sample Data

Calculations show (see Figure 6.3) that when the relevant costs are compared between the two alternatives, it is more cost-effective for Thermal to produce the 120,000 units of the T6 lid internally than to purchase it from Plato.

Figure 6.3

Thermal T6 lid Make Buy Comparison Version 1

Note. From Graybeal, Franklin, and Cooper, 2019. CC BY-BC-SA. [Image Description]

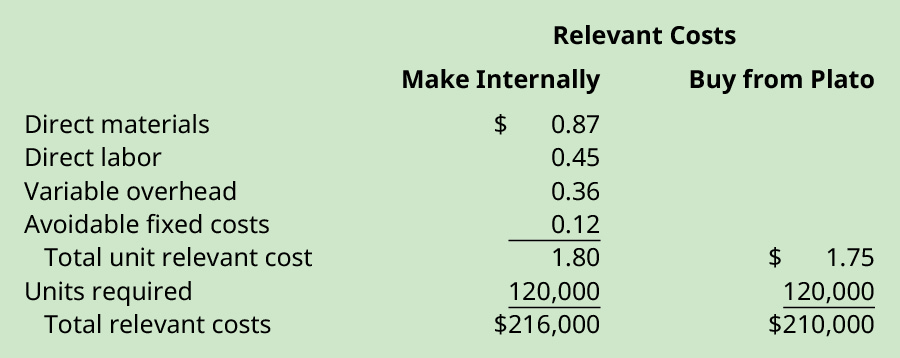

By producing the T6 lid internally, Thermal can save $8,400 ($210,000 − $201,600). How would the analysis change if a portion of the fixed costs were avoidable? Suppose that, of the $0.51 in fixed costs per unit of the T6 lid, $0.12 of those fixed costs are associated with interest costs and insurance expenses and thus would be avoidable if the T6 lid is purchased externally rather than produced internally (see Figure 6.4). How does that change the analysis?

Figure 6.4

Thermal T6 lid Make Buy Comparison Version 2

Note. From Graybeal, Franklin, and Cooper, 2019. CC BY-BC-SA.[Image Description]

In this scenario, it is more cost-effective for Thermal to buy the T6 lid from Plato, as Thermal would save $6,000 ($216,000 − $210,000).

Final Analysis of the Decision

The difference in these two presentations of the data emphasizes the importance of defining which costs are relevant, as improper cost identification can lead to bad decisions.

These analyses only considered the quantitative factors in a make-versus-buy decision, but there are qualitative factors to consider as well, including:

- Will the T6 lid made by Plato meet the quality requirements of Thermal?

- Will Plato continue to produce the T6 lid at the $1.75 price, or is this a teaser rate to obtain the business, with the plan for the rate to go up in the future?

- Can Plato continue to produce the quantity of the lids desired? If more or fewer are needed from Plato, is the adjusted production level obtainable, and does it affect the cost?

- Does using Plato to produce the lids displace Thermal workers or hamper morale?

- Does using Plato to produce the lids affect the reputation of Thermal?

In addition, if the decision is to buy the lid, Thermal is dependent on Plato for quality, timely delivery, and cost control. If Plato fails to deliver the lids on time, this can negatively affect Thermal’s production and sales. If the lids are of poor quality, returns, replacements, and the damage to Thermal’s reputation can be significant. Without long-term agreements on price increases, Plato can increase the price they charge Thermal, thus making the entire drink container more expensive and less profitable. However, buying the lid likely means that Thermal has an excess production capacity that can now be applied to making other products. If Thermal chooses to make the lid, this consumes some of the productive capacity and may affect the relationship Thermal has with the outside supplier if that supplier is already working with Thermal on other products.

Make versus buy, one of many outsourcing decisions should involve assessing all relevant costs in conjunction with the qualitative issues that affect the decision or arise because of the choice. Although it may appear that these types of outsourcing decisions are difficult to resolve, companies throughout the world make these decisions daily as part of the company’s strategic plan, and therefore, each company must weigh the advantages and disadvantages of outsourcing the production of goods and services. Some examples are shown in Table 6.1.

| Advantages of Outsourcing | Disadvantages of Outsourcing |

|---|---|

|

|

In an outsourcing decision, the relevant costs and qualitative issues should be analyzed thoroughly. If there are no qualitative issues that affect the decision and the leasing or purchasing price is less than the relevant (avoidable) costs of producing the good or service in-house, the company should outsource the product or service. The following example demonstrates this issue for a service entity.

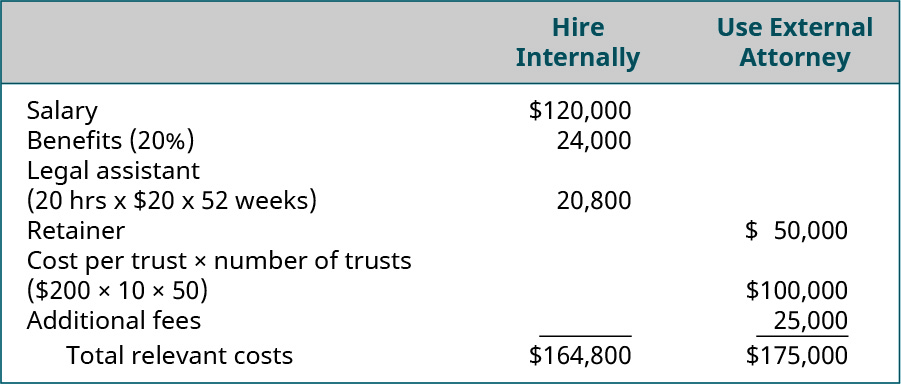

Lake Law has ten lawyers on staff who handle workers’ compensation and workplace discrimination lawsuits. Lake has an excellent success rate and frequently wins large settlements for their clients. Because of the size of their settlements, many clients are interested in establishing trusts to manage the investing and distribution of the funds. Lake Law does not have a trust or estate lawyer on staff and is debating between hiring one or using an attorney at a nearby law firm that specializes in wills, trusts, and estates to handle the trusts of Lake’s clients. Hiring a new attorney would require $120,000 in salary for the attorney, an additional 20% in benefits, a legal assistant for the new attorney for 20 hours per week at a cost of $20 per hour, and conversion of a storage room into an office. Lake spent $100,000 on redecorating the offices last year and has sufficient furniture for a new office. The attorney at the nearby firm would charge a retainer of $50,000 plus $200 per hour worked on each trust. The retainer is in addition to the $200 per hour charge for work on trusts. The average trust takes 10 hours to complete and Lake estimates approximately 50 trusts per year. In addition, an external attorney would charge $500 for each trust to cover office expenses and filing fees. Which option should Lake choose?

To determine the solution, first, find the relevant costs for hiring internally and for using an external attorney.

Figure 6.5

Hire Internally Versus Use External Attorney.

Note. From From Graybeal, Franklin, and Cooper, 2019. CC BY-BC-SA. [Image Description]

Based on the quantitative analysis, Lake should hire an estate attorney to have on staff. For the year, the firm would save $10,200 ($164,800 for internal versus $175,000 with the external attorney) by going with the internal hire. Other potential advantages would be that an in-house attorney could complete more than the estimated 50 trusts without incurring additional costs, and keeping the work in-house, helps to build the relationship between the firm and the clients. A disadvantage would be if there is not sufficient work to keep the in-house attorney busy, the company would still have to pay the $120,000 salary plus the additional costs of $44,800 for benefits and the legal assistant’s salary, even if the attorney is working at less than full capacity.

The iPhone is the ultimate example of outsourcing. Though created in the United States, it is produced all around the globe, with thousands of parts supplied by over 200 suppliers—none of which is Apple. Read this article from The New York Times on where parts for the iPhone are made to learn how an iPhone gets from the design phase in the United States to production of components around the world, to assembly in China, and then back to the United States for sale in a retail store.

Key Takeaways

Companies outsource to add value to their products or reduce costs. Deciding to outsource a component of the operations or manufacturing of a business is a choice between alternatives. Outsourcing has grown to lower companies’ costs as well as to allow them to focus on activities they do best. Outsourcing work to companies offshore is called offshoring and the growth of offshoring supply chain functions has grown. There are some downsides to outsourcing such as loss of control of quality, safety, and technology. Choosing whether to make or to buy a product or choosing to have services performed by an outside company, are outsourcing decisions. Outsourcing decisions involve comparing the cost to keep the product or service in-house to the cost of buying the product or service from an outside party. An important consideration in these types of decisions is unavoidable costs.

Review Questions

- What are some of the supply chain functions firms outsource and offshore?

- How does outsourcing differ from offshoring?

- Why might a company be better off insourcing an activity?

- What qualitative decisions should be considered in an outsourcing decision?

-

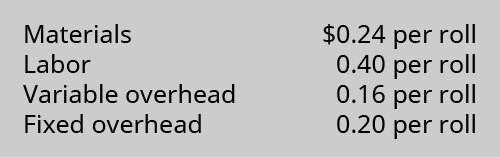

Reuben’s Deli currently makes rolls for deli sandwiches it produces. It uses 30,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are:

Note. From Graybeal, Franklin, and Cooper, 2019. CC BY-BC-SA.

-

A potential supplier has offered to sell Reuben the rolls for $0.90 each. If the rolls are purchased, 30% of the fixed overhead could be avoided. If Reuben accepts the offer, what will the effect on profit be?

Check your understanding of this chapter’s material by completing this quiz.

References

Bureau of International Information Programs, U.S. Department of State. (2005, January 13). China pressed to forcefully attack intellectual property theft. Share America. http://www.america.gov/st/washfile-english/2005/January/20050113180002asesuark0.9782831.html#ixzz0Mada2mLk

Cuculich, D. (2019, August 22). Press releases: Discover Card ranks highest in customer satisfaction by J.D. Power. Discover Investor Relations. https://investorrelations.discover.com/newsroom/press-releases/press-release-details/2019/Discover-Card-Ranks-Highest-in-Customer-Satisfaction-by-JD-Power/default.aspx

Graybeal, P., Franklin, M., Cooper, D., (2019, July 23) Principles of accounting, volume 2: managerial accounting. https://opentextbc.ca/principlesofaccountingv2openstax/

McGrath, S. (2007, December 14). China Shipping Advice. Smart Sourcing. http://www.smartchinasourcing.com/shipping/china-shipping-advice-cif-shipping-terms-explained.html

PRTM Management Consultants. Global Supply Chain Trends 2008–2010. http://www.prtm.com/uploadedFiles/Strategic_Viewpoint/Articles/Article_Content/Global_Supply_Chain_Trends_Report_%202008.pdf

Walmart. (n.d.). Quality Assurance through Testing. Walmart Suppliers. http://walmartstores.com/Suppliers/248.aspx

Principles of marketing. (2015, October 15). Universities of Minnesota Libraries. https://open.lib.umn.edu/principlesmarketing/

Attribution Statements

This chapter contains material adapted from Principles of Marketing by the University of Minnesota and is used under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

This chapter contains adapted material from Principles of Accounting, Volume 2: Managerial Accounting, by OSC Rice University, and is used under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License .

Image Descriptions:

Figure 6.1 Figure Description: This figure shows the percentage of Supply Chain Functions Offshored in 2008 by three hundred global manufacturers and service organizations. Manufacturing has 42% offshored, Warehousing and Transportation have 37% offshored, Procurement has 34% offshored, Returns and Customer Service have 34% offshored, Supply Chain Planning has 26% offshored, product development has 19% offshored. [Back to Figure]

Figure 6.2 Figure Description: This table shows the cost for the Thermal T6 lid. Direct materials are $0.87, direct labour is $0.45, fixed overhead is $0.51, variable overhead is $.36. Adding up the costs results in a total unit cost of $2.19. [Back to Figure]

Figure 6.3 Figure Description: This table compares the costs of making the Thermal T6 lid internally to buying them externally from Plato. The Direct Materials for making them internally are $0.87. The direct labour for making them internally is $0.45. The variable overhead for making them internally is $0.36. The total unit relevant cost for making them internally is $1.68. The total relevant cost when buying from Plato is $1.75. The total units required are 120,000. The Total Relevant cost for making them internally is $201,600. The total relevant costs for buying from Plato is $210,000. [Back to Figure]

Figure 6.4 Figure Description: This table compares the costs of making the Thermal T6 lid internally to buying them externally from Plato. This cost comparison has avoidable fixed costs included in the calculations. The Direct Materials for making them internally are $0.87. The direct labour for making them internally is $0.45. The variable overhead for making them internally is $0.36. The avoidable fixed costs making them internally are $0.12. The total unit relevant cost for making them internally is $1.80. The total relevant cost when buying from Plato is $1.75. The total units required are 120,000. The Total Relevant cost for making them internally is $216,000. The total relevant costs for buying from Plato is $210,000. [Back to Figure]

Figure 6.5 Figure Description: This table shows the cost analysis of hiring an attorney internally versus using an external attorney. The salary costs of hiring internally are $120,000. The benefits costs of hiring internally are $24,000. The legal assistant costs of hiring internally are $20,800. The retainer costs of using an external attorney are $50,000. The cost for trusts for using an external attorney is $100,000. The additional fees associated with using an external attorney are $25,000. The total relevant costs of hiring an attorney internally are $164,800 and the total relevant costs of using an external attorney are $175,000. [Back to Figure]