Topic 1: Introduction

rsinha

Financing old age or pensions are a major concern for public policy and individuals as they will determine future outcomes for old age poverty; economic growth and the health of public finances. On a more positive note they also have the potential for financing intertemporal transformative choices relating to climate change and sustainability of social and economic systems.

Longevity has been rising across the world. More relevant to retirement, life expectancy at age 60 has also been on the increase. (Global Health Observatory Data of the World Health Organization). For example, in Canada, life expectancy at age 60 went up from 22.7 years in the year 2000 to 25.7 years in the year 2016. With rising longevity there is a growing concern whether individuals and societies are prepared to take on the responsibility of financing retirement at expected and sustainable levels. A recent analysis notes a decline in the rate of increase of life expectancy in developed countries since 2011. However, the long-term outlook of longevity increases and impact on sustainability of pensions remains uncertain.

From a finance perspective there is another reason why we need to study pensions. Much of what we discuss in standard finance curriculum assumes an individual decision maker motivated by self interest and capable of utilizing all available information in its decisions. However, as Global Asset Tables show (Wills Towers Watson, 2018), most financial assets are managed in institutional settings where agency conflicts are typical. In an organizational or institutional setting, multiple decision makers are involved in principal agent relationship. Given their differing objective functions, agency conflicts will be pervasive. It is important that we explore how stylized decision rules of finance play out in an organizational setting. The pension sector is an example of a sector where decisions are taken in an institutional setting and agency conflicts are endemic. As a sector it offers a unique opportunity to explore how financial decisions are taken in an institutional setting with inherent agency conflicts.

The Three Major Financial Decisions

Financing education, home ownership and old age are three major personal financial decisions that an individual or a household will make over their lifetime. Of the three, financing old age is the more complex decision. Education and home ownership decisions are relatively less challenging for an individual as the costs are over the long-term and are contractual. Also, the benefits of these decisions become apparent almost immediately. If you enroll in an educational program you gain knowledge, skills and understanding. You improve your career and earning prospects in the medium and long-term, and experience other socio-economic benefits over a lifetime and over generations. When you buy a house, you start living in it and experience a change in your cash outflow from paying rent to contributing to a long-term asset – the house. Thus, the benefits of education and home ownership are front loaded and there is a contractual obligation to pay back borrowed money over the long term.

In contrast, the sequencing of benefits and costs are flipped in financial planning for retirement. The costs are non-contractual and represent a unique challenge to an individual as they are incurred in the present and benefits are expected in the distant future. Longevity and health have a degree of variability at the individual level and this makes the expected benefits from current savings in retirement uncertain. In the discussion that follows, we analyze and explore this unique financial planning decision challenge. Two specific areas of knowledge are relevant for this analysis: our understanding of human rationality as it applies to long-term decisions; and our understanding of the rules of co-operation between individuals in a society, the social contract.

Explore

Click on the following links to explore major personal financial decisions

Major Financial Decisions: https://www.canada.ca/en/services/finance.html

Pensions and Retirement https://www.canada.ca/en/services/finance/pensions.html

Why this Textbook?

Sustainable and acceptable financing of retirement will require finance professionals who are not just narrowly focused on managing assets but understand the challenges to implementing stylized finance decision rules in an institutional setting. The eText recognises the diversity of viewpoints and decisions that are proposed towards sustainable pensions and financing of old age retirement. This open textbook will bring together a body of knowledge that can inform us about how these lifetime financial accumulation and de-accumulation pension decisions are taken. There is no presumption that there is unanimity on what is the best approach to superior pension outcomes. The objective of this open access electronic textbook is to support professional and informed engagement on pensions and old age financial security in a finance curriculum by bringing together appropriate tools and concepts to support financing of retirement. The only starting premise of this eText is that a simple extrapolation of human behavior motivated by self-interest cannot be relied upon to counter the effects of the flipped nature of the cost benefit structure of savings for pensions and old age financial security.

This eText will support a more informed and comprehensive discussion of the financing of pensions that brings together insights from a variety of disciplines like psychology, biology, political science and of course economics. The dominant voices in the conversation on pensions are those of providers and the financial services industry. This results in outcomes that shift the responsibility of financial security to individuals, emphasize choice, and generate expectations about savings that cannot be delivered across the board for all. This could be either a deliberate response of vested interests, or a result of the lack of integration of the knowledge base that exists on pensions and old age financial security systems. For example, often the choice in occupational pension plans is presented as between defined benefit or a defined contribution plans. The response to the unsustainable defined benefit (DB) plans has been a growing adoption of defined contribution (DC) plans and policies aimed to promote private savings. Though this is consistently presented in policy discussions and labor market negotiations as a reasonable response, there is no evidence that it works for most individuals. Nevertheless, DC and private savings continue to be promoted at tremendous costs and uncertainty in contract negotiations and through tax incentives. It is instructive to note here that the data on DC plans such as the 401(K) plans in the US show a low level of average savings closer to retirement. Furthermore, in Canada data suggests that the popularity of DB plans continues to rise for plans with membership of 100 or less subscribers and contradicts the overall switch of large plans with 1000 or more members from DB to DC plans (Baldwin, 2017)

The discussion on pensions is a highly contested one and further complicated by the growing expectations gap. For the workforce and retirees, pensions are not only about financial sustenance of post working years, but also an earned option that enables working adults to withdraw from the workforce in their later years to pursue what they value. Gallup polls suggest that only one-third of employees are engaged in their work and workplace. Many employees work “pointless jobs” to which they feel indifferent ( BBC World Service, 2018; Graeber, 2018). A financially secure retirement is a deferred wage that the workforce expects to rely onto pursue what they value.

Table 1 demonstrates that expectations from retirement are by no means universal. Different socio-economic and cultural segments have different expectations of retirement. An expectations gap emerges when the social contract to provide for old age is continuously being renegotiated by the requirements of competitiveness and profitability of the production system. The challenge to bridge this growing expectations gap is exacerbated by rising costs of healthcare, increasing longevity, labour market changes, and the goals and objectives of various interest groups associated with the financing and provisioning of retirement funds, such as the financial services industry.

Note. Adapted from Baldwin (2017), p. 3

What Will you Learn?

National pension systems are often discussed in terms of a five pillar typology developed by the World Bank (2005) based on its global over view of pension systems around the world. The five pillars are a mix of publicly or privately managed and funded or unfunded plans. Not all pillars are necessarily present or emphasised equally in a country’s pension system. How does a national pension system evolve its own unique mix and emphasis between these pillars? This will be the focus of our discussion in the next module. We analyze inter-temporal choice and the three different approaches to rationality: classical; bounded and ecological. We also explore social contracts that underpin all socio economic policies including pensions. These examinations allow us to develop a general approach to national pension systems and the basis of the choice and emphasis in the five pillar typology of the World Bank.

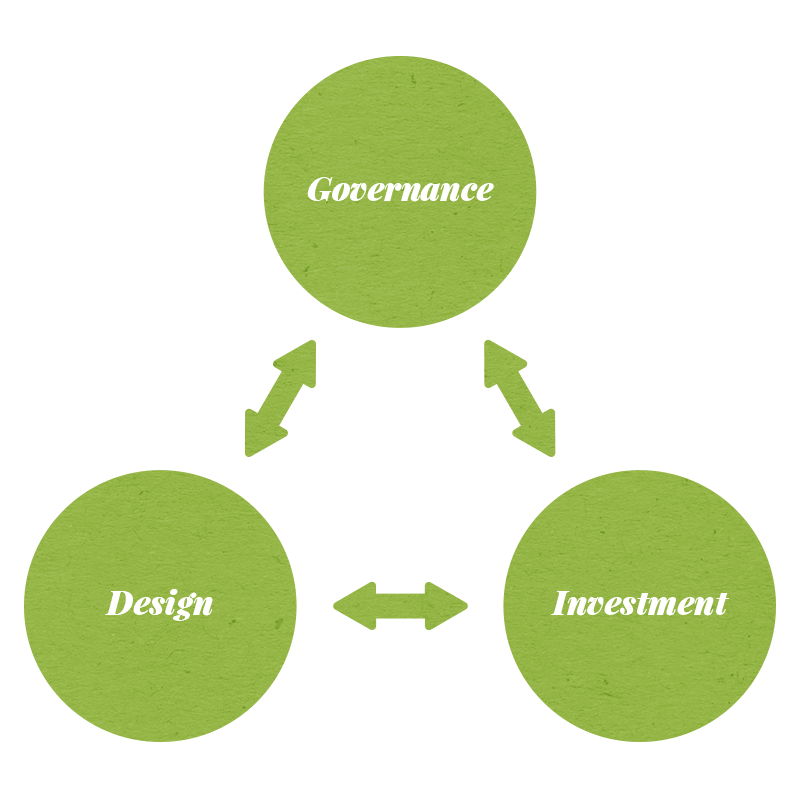

Next for a given pension system we evaluate consideration that will apply to an efficient implementation of a pension plan. Following Ambachtsheer (2016), we examine the provisioning of pensions as an integrated and interdependent system of design, governance, and investment principles. Pension outcomes are visualized as an interactive and interdependent outcome of pension design (D), governance (G), and investment decisions (I) and we call this the DGI framework. Governance of pensions will depend upon its management (public or private) and funding status (funded or pay as you go from tax revenues). The governance and design will influence the choice of decision makers in the investment management of national pension systems. We will explore their inter dependencies and interaction between D, G & I in the subsequent modules.

The goal of a pension system is to promote funded pensions that are affordable to subscribers and sponsors and provide payment security. Affordability and payment security can be facilitated by examining the architecture of the pension organizations. An integrated view of the DGI architecture of pensions is shown in the figure above. The goal of pension provision is an integration of three principal interdependent considerations: design, governance, and investment . The challenge is to bring together this integration between design, governance and investment at the system, organizational and individual levels.

How is This Open Textbook Organized?

The organization of this open textbook acknowledges the contested nature of the field. There are opposing perspectives on individual responsibility and social contract and the use of collective versus individual instruments. This open textbook will have a collection of standalone topics grouped into four modules

Module 0. The Pension Landscape

Topic 1: Introduction

Topic 2: Gathering Stories & Other Activities

Module 1. Design

Topic 1: The World Bank’s Five Pillar Framework

Topic 2: Pensions as Intertemporal Choice

Topic 3: Social Contracts and Pension Design

Topic 4: The Pension Design Framework

Topic 5: The Constraints on Pension System

Module 2. Governance of Pensions

Topic 1: Governance of Pension Plans

Topic 2: Pension Governance – The Role of Learning

Topic 3: Modes of Learning

Topic 4: Enablers of Pension Governance

Module 3. Investments of Pension Assets Pension Assets

Topic 1: Pension Investments: An Overview

Topic 2: The Investment Policy Statement

more topics to follow….

This open textbook is visualized as an evolving and living resource that will reflect the latest thinking and innovations in the important field of old age financial planning.The organization of the eText into individual topics and modules supports the continuous evolution and updating of the knowledge base on pensions.

How Will You Learn?

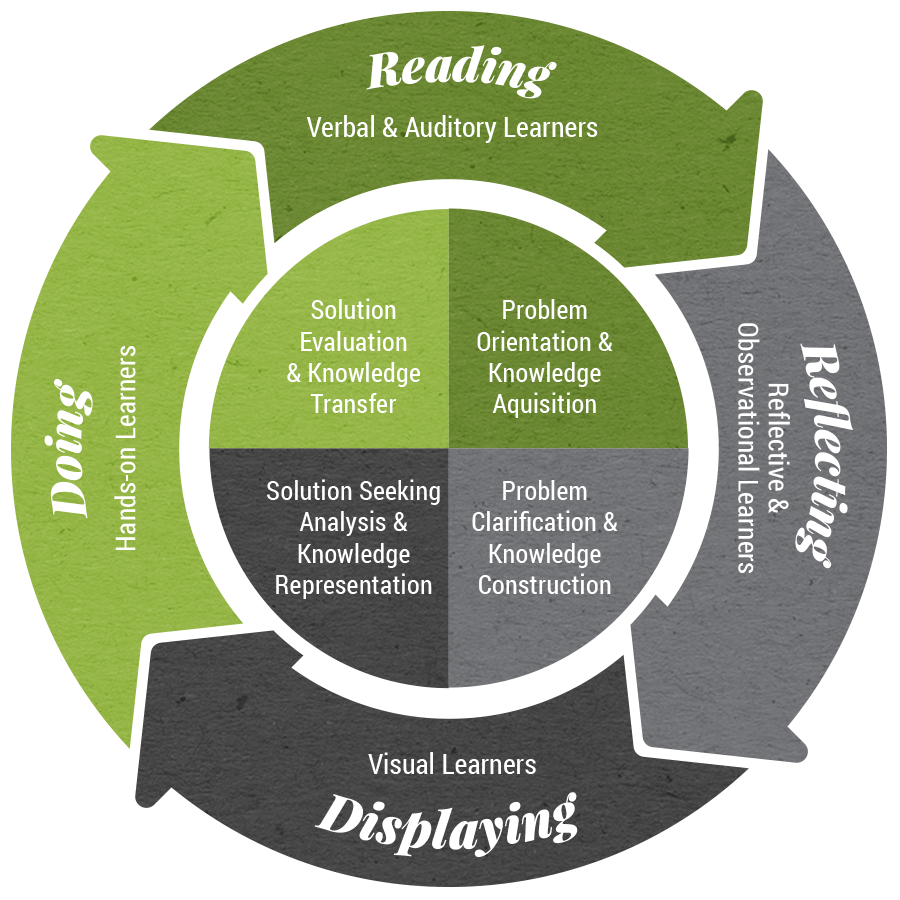

The overall pedagogy is influenced by Bonk & Zhang’s (2006, 2008) R2D2 model (see Figure 1), which involves students interacting with verbal and visual content, reflecting on those stimuli, displaying visual representations of the disciplinary elements (instructor and student led), and the ‘doing’ or practice exercises.

Figure 2. Bonk & Zhang’s (2006, 2008) R2D2 model.

Below are the suggested study steps according to this model:

1. Read (& Listen)

- Before class, read all assigned readings (article, website, video, podcast, etc.)

- Read all messages from your instructor and peers (announcement/emails, discussion forum posts), not just your own posts!

- In class, listen to instructor and peers (be present)

2. Reflect (& Observe)

- Before, during, and after class, critically reflect on what you’ve read/heard

- Record your ideas, thoughts, feelings

- Differentiate your ideas from others’ ideas (problem clarification)

- Construct knowledge, deepen understanding

3. Display

- Be creative with representing your knowledge!

- In addition to traditional tables and charts created using Word, Excel, PowerPoint, etc., you can use concept maps, tables, charts, audio, video, info graphics, etc.

- Free software is available for concept mapping:

Coggle https://coggle.it/

Bubbl.us https://bubbl.us/

Cmap Cloud https://cmapcloud.ihmc.us/ - Free software is available to create podcasts and video

Audacity https://www.audacityteam.org/

APowersoft https://www.apowersoft.com/free-online-screen-recorder - Free software is available for info graphics

Venngage https://venngage.com/

Easel.ly https://www.easel.ly/

Doing (Applying)

- Hands-on, active learning

- Problem solution evaluation

- Knowledge transfer

- Contributor to the open textbook

Building, implementing and sustaining pensions is a work in progress, a challenge that needs to continuously responds to ongoing changes in the socioeconomic environment that current and future generations are inevitably faced with. This work cannot be delegated to a few individuals and organizations. All of us have a vested interest in sustainable and adequate pensions, and everyone must be encouraged to have the mindsets, skills and tools to pension plan now and in the future. This open access electronic textbook is designed to inform the learners’ thinking about pension design, governance and investment decisions to build a community or professional practice that can contribute to the long-term project of building sustainable and adequate pensions for all.

It can be used as a course resource, for communities of practices, and other self-organized learning groups involving citizens interested in contributing to building a pension system that will benefit the maximum number of citizens no matter their economic, political and social status. This open textbook platform will be eclectic, and a living resource will evolve to respond to new developments, data and information and emerging challenges.

Global Pension Assets Study (2020

Download the PDF file and review the latest Global Report on Pension

The Global Pension Assets Study covers 22 major pension markets (the P22), which now totals US$46,734 billion in pension assets and account for 62% of the GDP of these economies. The study includes an analysis of the seven largest markets (the P7) which includes Australia, Canada, Japan, Netherlands, Switzerland, UK and US and comprises 92% of total pension assets.

Exercises

TOPIC REVIEW

- Global Longevity Trends

- Canadian Longevity Trends

- Major Financial Decisions in an Individual’s Lifetime

- Defined Benefit Pension Plans

- Defined Contribution Plans

- Deaccumulation

Exercises

SAMPLE REVIEW QUESTIONS

- What are the global and Canadian longevity trends? How do they impact long term financial planning?

- What are global trends in pension asset ownership? Summarize key findings.

- How is rationality visualized in financial decisions? Assess how they apply to the management of pension assets.

- What are defined benefit and defined contribution pension plans? Explain.

- What is the DGI framework? Explain with examples the inter dependencies between design; governance and investments of pension assets.