Topic 1: Governance of Pension Plans

rsinha

Learning Objectives

At the end of this topic, you should be able to answer these questions:

- What is governance?

- Why is governance required?

- What are the differences between Corporate Governance and Pension Governance

What is the Governance?

Governance is a term that is widely used in a variety of contexts to describe the process of accountability between two parties where one is obligated, through formal or informal contract, to implement tasks and responsibilities on behalf of the other. For businesses or firms, Shleifer and Vishny (1997) define corporate governance as “…the ways in which suppliers of finance assure themselves of getting a return on their investment.” For pensions, the suppliers of finance, or principals, are the pension plan subscribers. Their agents , the other party in the contracting relationship are the various service providers tasked with different responsibilities in the pension management process. The governance framework is not only to ensure accountability and compliance but also to create a decision-making context that leads to superior outcomes or returns on investments.

There are four topics in the governance module. In this topic we discuss a standard view of the structure of pension management and governance. In the following topic we learn that the requirement of pension governance arises because of ‘broken agency’ and strongly non-contractible incomplete contacts. The analysis shows that effective pension governance requires the reduction of opportunism as a behavior. This sets up the discussion in the third topic, for an examination of the role of learning mechanisms and the specific form of learning that will reduces the scope and scale of opportunistic behavior between principals (pension subscribers) and their agents (financial service providers). In the fourth and final topic we discuss some mechanisms that will facilitate the effective working of the learning mode that reduces opportunism in pension governance.

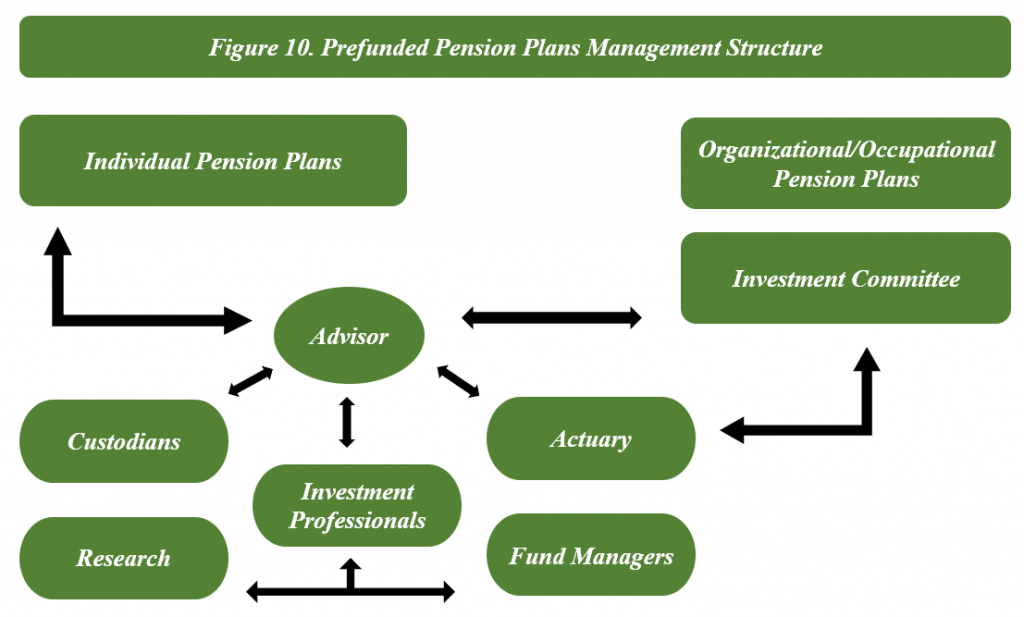

Figure 10 provides a standardized overview of various players and relations in the management of asset based pensions, that are prefunded by accumulating financial assets or savings during the working life of the pension subscribers. Such prefunded pension plans can be of two types. They can be either individually subscribed and managed or they can be managed at an organizational level. The organizational level pension plans can be part of the workplace benefits, or they can be the outcome of public policy. The public policy plans are also called compulsory payroll deductions and are mandated by law with a defined benefit component, which can be means tested. Typically, most organizational pension plans do not have an opt out feature and are mandatory for all members of the organization or the society that sponsors such a pension policy. In Canada, the Canada Pension Plan is an example of such a plan.

If the plan is individually owned, the pension subscriber interacts with the advisor. The other relations depicted in Figure 10 are part of the back-office function of the pension management process.The standard framework of the pension management structure as in Figure 10, identifies the different intermediaries and their interactions. These intermediaries can be other individuals, or they can be organizations that specialize in the provision of specific services required in the management of pensions. Thus, the pension management process involves multiple layers of agents. Governance of pensions is the framework that facilitates the process of accountability, identifies tasks and responsibilities and provides the context for superior decisions amongst these multiple layers of intermediaries and the principal(s).

Figure 10. Prefunded Pension Plans Management Structure

The back-office functionaries such as custodians, market research consultants, portfolio managers, etc., are individuals or organizations independently owned with their own separate organizational structure. The service provider, such as the custodian or the investment fund, may be a separate organization or a functionally distinct part of the same organization. For example, an individual may have a pension plan such as the Registered Retirement Savings Plan (RRSP) with a bank and be advised by a bank advisor or representative. The decisions will then be sourced out to mutual funds, which may be managed by the investment banking division of the same bank.

For organizational pension plans there will be a pension committee or a pension board that will act on behalf of the individual plan members. Depending on the size and expertise of the collective entity, one or more or part of the pension management functions may be internally managed or outsourced to special purpose organizations, as in the case of individual plan members. Thus, we could have an organizational pension plan with an investment committee made up of volunteers co-opted from the employees and employers of the organization. Depending on the pension design the investment committee may employ representatives. If it is a defined contribution plan there may be employer representation to a committee to decide on the broad savings, investment and strategic goals. However, the actual asset allocation decisions will be left to the employees and their investment advisors; often with limits set by the investment committee in terms of permitted assets. As in defined contribution plans, if the pension plan is a defined benefit or target benefit plan then the employer may take a leadership role in the investment committee as the pension outcomes are part of the benefit package and are viewed as obligations of the employing organizations. If the employing organization is large or if pension plans develop a sectoral blueprint and have pension subscribers from multiple organizations in a sector, as in the case of Ontario’s teachers, then such pension organizations may decide to in source or develop intra-organizational expertise in some or most of the pension management roles identified in Figure 10. Alternatively, the pension plan organization may outsource it to a special purpose organization or individuals.

Why is governance required?

To analyze why we need governance we must first make a distinction between principals and agents. In the case of pensions, the principals are the pension plan subscribers and the agents are the various intermediaries who are contracted to manage the pension assets. Principals are entities, who under the system of property rights, have ownership of the resource that is being managed in a contractual relationship. This resource in funded pension plans are pension assets. Depending on pension design, the principals could be individual plan subscribers, as in the case of individual pension plans like RRSPs or the defined contribution plans or it could be organization as the plan provider in the case of defined benefit or target benefit plans. Agents, on the other hand, are the intermediaries that manage the pension assets on behalf of the principals. Examples of agents are custodians, advisers, fund managers, etc., involved in providing advisory investment and back-office functions in pension management.

Governance is required because the goals or objectives of the principals or pension plan subscribers and the agents or plan managers are not the same. The goal of the owners of the pension assets or the plan subscribers (principals) is to get the maximum value of their savings assets in retirement at the least costs or contributions during their working years. Managers or agents tasked with pension management have a different goal. The agent’s goal is to preserve their human capital, their professional reputation. The principals and agents thus pursue different objective or goals in pension management. Principals seek to maximize their finance capital and agents will seek to minimize their human capital risk.The agent’s earnings are from the services they offer to various pension subscribers. The agents, by providing their expertise, put their human capital at risk. If the returns from the invested pension assets are not as expected or if they are shown to have under performed, the future earnings of the agents from their human capital will be reduced. A basic tenet of finance is that higher returns carry higher risks. Pension subscribers desire for higher returns will have the consequence of increasing the human capital risk of the agents that are tasked with the responsibility of realizing these higher returns.

In addition to having different objectives, principals and agents do not have the same level of information about the management of the assets. Principals are the owners of financial assets. Agents are suppliers of expertise to manage the assets on behalf of the principals. Information asymmetry arises as the agents who are entrusted with day-to- day management know more than the principals and have greater control over decisions regarding the deployment of the assets. There are two sources of tension in pension governance that provides the justification for the use of various mechanisms to manage the relationship between pension subscribers (principals) and the various service providers (agents). First, the differences in interest/objectives between the principals and the agents . The principals will seek the highest possible returns at the lowest possible costs. The agents on the other hand will seek to maximise their future earnings by taking decisions that minimise the risks to human capital. The second source of differences is the information asymmetry between the principals and the agents. This creates the governance challenge. In the system of property rights, the owners or plan subscribers (principals) have the right to expect that the pensions assets be managed to realize their goals and not the goals of the managers or agents. The challenge of governance is to design mechanisms that, given the information asymmetry and the different objectives, agents manage the pension assets in the best interest of the principals.

Given the differences in objectives and the information asymmetry between the principals and agents what can be the contracts that govern their relationships and the decision environment? One possibility is that the principals write a complete contract specifying every eventuality that may arise and make the agent sign that contract. This will ensure that the agents or pension service providers’ decisions are in the interest of the principals or the plan subscribers. However, It may be impossible to write a complete contract. Given the central role of expectations in finance the future cannot be specified completely as not all eventualities in the principal agent relationship can be anticipated and negotiated in advance. Furthermore, it is expected that the agents will have greater expertise in the management of the assets and their professional judgement cannot be second guessed and should not be constrained by the principal. Thus, contracts between principals and their agents being incomplete. Agents will be hired by principals on the basis of specified expectations. These expectations will be periodically reviewed in light of new information. In such a contracting relationship, governance mechanisms are used to interpret the incomplete contracts between the principals and their agents on an ongoing basis.

Corporate Governance versus Pension Governance

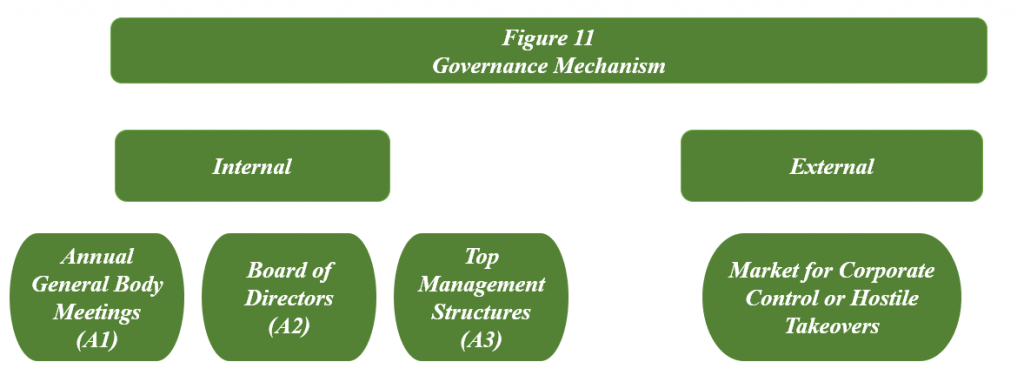

The governance of publicly listed corporations has been evaluated by several studies. (World Bank, Love 2016). The emphasis in these studies has been on the structure of the governance mechanisms required to interpret the incomplete contract between the shareholders (owners) – the principals and the firm’s top management the agents. The corporate governance mechanisms that have proposed to bridge the incomplete contracts between the principals and agents can be classified in terms of external and internal mechanisms. As shown in Figure 11 the internal governance mechanisms are the board of directors, the compensation mechanism of the top management, and the proxy process in annual general body meetings of publicly listed corporations. The external governance mechanism is the market for corporate control or the hostile takeover of corporations.

The corporate governance literature also focuses on the structure of the internal and external mechanisms that increases the accountability of the agents towards the principals. According to this literature, a greater percentage of outside or non-executive directors on the corporate board, or the separation of the posts of the chairperson and the chief executive officer will increase the accountability of the agents towards the principals. Similarly, stock options or paying a greater percentage of the top management compensation in the company’s stocks that can only be sold later, is expected to align the management’s interests with the shareholder’s or the owners of the firm. If the shareholders do not like the decisions of the top management or the board of directors, they can bring resolutions at the annual general body meeting (or the AGBM) and vote against the continuation of the existing top management or board members by bringing in resolutions in person or through a proxy process in a general body meeting of the shareholders.

Figure 11. Governance Mechanism

Figure 11. Governance Mechanism

The external control mechanism is the market for corporate control or the hostile takeover market. If internal control mechanisms fail, the shareholders of publicly listed corporations have the option of selling their shares in the company. The hypothesis is that if shareholders are not happy with the management they can sell their ownership, which will lower the company’s stock value. This will invite the interest of outside management teams or bidders who will see the prospect for gain in the form of undervalued stocks of the company, because of the poor decisions of the existing management. The outside management team or bidders will start buying the company’s stock and will soon have enough voting stock in their command to oust the incumbent management and appoint new management and possibly restructure the company.

The corporate governance literature can provide important insights into the governance of pensions. However, there are important caveats that must be applied to the applicability of the external and internal mechanisms of corporate governance of publicly listed corporations, to the governance of pensions. In the case of pensions, the principal-agent relationship is involuntary for a retiree. You can choose to become shareholders, however you do not have a choice whether to retire. You may defer retirement but not decline to be a retiree. Thus, the level of information gathering and involvement that may be the norm for a shareholder cannot be expected of a pension holder. By choosing to invest in the financial market the investor is expected to be cognizant of the risk- return trade-off. The same cannot be said of pension plan holders. Pensions are involuntary intertemporal choices that have multi-generational implications and represent a challenge for both individuals and societies. This was discussed in the module on design. In intertemporal choice, the long-term is not represented by merely applying exponential discounting of the future. Our choices and decision behavior reflect our bounded rationality. Evidence from studies on ecological rationality as discussed in the topic on intertemporal choice, show that the process and fairness of decisions are important concerns in intertemporal decisions.

Furthermore, not all the mechanisms of corporate governance available to public listed corporations, are available for pension plan governance. To recap, pension subscribers, can have individual pension plans, or they would be members of a pension plan sponsored by their employers or be contributing to publicly mandated plans like the CPP. The availability of the different mechanisms for these various pension plans is summarised in Table 11. In organizational pension plans, pension subscribers as principals, only have an indirect role. The extent of the individual plan members’ influence on internal pension mechanisms will depend upon pension design. In employer sponsored defined benefit plans the influence will be indirect through committees tasked with governance. However, these committees owe their primary obligation to employers. Both the employers and the employees consider the accrued pension benefits as deferred compensation. Hence the expectation is that this is the employer’s obligation and therefore pension governance of defined benefit plans owe their primary accountability and control to the employers. In publicly managed pension plans, like the CPP, influence of plan subscribers is nearly non-existent. Influence is primarily exercised though the electoral voting process. The preferences of the plan subscribers are embedded in the social choice functions.

In privately managed individual plans, internal governance mechanisms is ineffective in reducing the agency problem as financial advisers are in possession of superior information and training and the levels of financial literacy amongst plan subscribers is low.Furthermore the oversight from regulators is low or non-existent. Financial services has resisted the demands that they be fiduciaries in their advice to the clients. They also are likely to be self-policed by their industry associations and statutory bodies are often subjected to the revolving door of regulatory capture.

The market for corporate control is available to plan members. Individual plan members can move to a new advisor. However, the effectiveness of this external mechanism is doubtful. The evidence on financial literacy and financial capability shows that access to the market for corporate control is of little practical value for individual plan members. Most individual plan subscribers lack the financial education and access to information to effectively hire and fire financial advisors based on performance. There is a lack of evidence to support any conclusion about the input organizational plan members may have on the hiring and firing of managers.

In governance of organizational pensions, the market for corporate control is not an option. In publicly managed and privately funded plans, like the CPP and the occupational pension plans, there is no market for corporate control. Membership or enrollment to these organizational plans is mandatory. There is no conception of exiting an occupational pension plan. It is unreasonable to expect that a person will change their job because of dissatisfaction with the way pensions are being managed. There may be significant decisions required and costs to be incurred in the reassignment of accrued benefits of occupational pension plans if the employee were to leave the organization.

The accountability of the internal governance mechanisms to pension asset owners is limited as they do not have voting rights that shareholders can exercise as in the case of Annual General Body Meetings of publicly listed corporations. The CPP for example, is a crown corporation and the government in effect is the only shareholder. The governing boards of pension organizations are typically industry professionals who may have potential for conflicts of interests in their ongoing or potential future relationships with the financial services industry. The situation is very similar in occupational pension plans but more so in a defined benefit plan. If the organization offers a defined benefit plan, participation is mandatory. However, given the defined benefits promised by employers typically they do not recognize the need for a transparent governance. Too often occupational pension plans are managed as a subset of the organizational goal and often the assets are either underfunded or utilized in the larger context of the organization’s financial expediency. Employees are often blindsided by corporate or organizational developments that make the promised benefits uncertain. As in the case of prominent corporate and municipal bankruptcies like Norton; Detroit and now Sears employees find out too late and even then, are powerless to intervene when they find out that their pension assets were only book values and in jeopardy from creditors or simply not have any backing of real assets.

In the individual pension plans and in the occupational pension plans with defined contributions, the governance challenge is severe. There is in effect no governance in place. The only recourse is the legal framework that is often insufficiently referenced by the regulatory framework. The contested relationship in these individual plans and defined contribution plans,is between the individual and the organizational infrastructure of the agents. The governance challenge of information asymmetry could be between the individual as a principal and the multi layered agency fronted by the financial advisor. The laws and rules are severely contested. The plan subscribers or principals are at a disadvantage in their

Examples

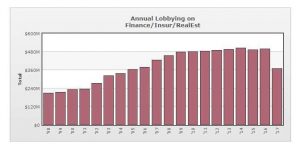

The financial sector is far and away the largest source of campaign contributions to federal candidates and parties, with insurance companies, securities and investment firms, real estate interests and commercial banks providing the bulk of that money.–Alex Glorioso

Updated March 2016 from the Centre for Responsive Politics the US Case is not unique. It is the probably the only one where we have collated information.

ability to access the regulatory framework to constrain the agents and their organizations to work in their interest. The agents have have a disproportionate interest and resources at their command to interpret the regulatory framework in their interest vis a vis their principals. In fact given the complexity and technical expertise required to interpret, maintain and evolve the regulatory framework the agents play an active role in the formulation and interpretation of the regulatory framework. Thus the regulatory framework is often subject to what has been termed as regulatory capture. Regulatory capture has been widely recognized in the literature as a phenomenon where top professional financial services have a revolving door of responsibilities alternating between agencies intending to regulate financial services and jobs in the financial sector. This relationship is further skewed in favor of the agents by their insistence on suitability as a basis for their advice and recommendation to the pension subscribers. Further, the industry’s insistence on self-policing any dispute in the quality of services provided by the agents to the principals through its industry association is not very reassuring to the individual pension subscribers.

In the case of individual and defined contribution pension plans the governance challenge is further exacerbated by the individual plan holder’s limited financial capability. Often the government and the industry seeks to remedy this challenge in financial cognition by sponsoring programs and initiatives on financial literacy. However, meta-analysis of the research on financial literacy demonstrates that it is not effective in enhancing the financial capability of the individuals or to better manage the old age security or retirement outcomes.

These factors make pension governance a daunting challenge that requires a fundamental rethink of the approach to governance. Mere rule making or setting up the structure in terms of internal (or external) governance mechanism will not deliver the outcome of a sustainable pension. Dramatic examples of a failure of corporate occupational pension plans, like the case of Sears most recently, and the many instances of financial misrepresentation in individual plans highlight a severe governance deficit in funded plans. Identification of effective governance is important for sustainability and reducing dependence on the pay as you go (PAYGO) component of the pension plan system.

The focus of corporate governance of publicly listed companies is on accountability. Designing governance such that it provides a superior decisions context is not the primary concern. This is a major drawback of the corporate governance literature on publicly listed companies. Given the goals of pension governance – financial security in retirement providing a superior decision context is important. How pension governance can be structured to provide a better decision context will be discussed in the next two topics in this module.

Topics to Explore

- Human Capital Risk

- Information Asymmetry

- Agency Problem

- Incomplete Contracts

- Internal and External Governance Mechanisms

- Stock-Options

- Market for Corporate Control

SAMPLE QUESTIONS FOR REVIEW

SAMPLE QUESTIONS FOR REVIEW

- Why is governance required? Explain using the insights from finance and human capital risks; information asymmetry and incomplete contracts.

- What are the various mechanisms available to bridge the incomplete contracts between shareholders and managers. Which of these mechanisms be applied to pension governance?