Topic 5: The Constraints on the Pension System

rsinha

Learning Objectives

After readubg this topic, you should be able to answer these questions:

- What are the constraints to implementing a pension plan in a pension system?

- What is financial capability?

- How can financial advisers support long-term financial goals like pensions?

- How do labor market challenges affect pension systems?

From the discussion on pension design in this module we conclude the following. First, a national pension system will incorporate a number of pension plans. This will be a reflection of the multiple but not mutually exclusive interpretations of rationality in our decision behaviour. Second. these individual pension plans will be variations of the individual ‘five pillars’ typology of global pension systems identified by the World Bank. Third, a country’s emphasis on the different pension plans or pillars will be a reflection of the country’s location on the individualist versus collectivist spectrum and its interpretation of the three tenets of (bio)social contract – survival; equity; and reciprocity. This interpretation of the social contract is not static but dynamic and will be continuously evolving in response to changes or constraints in our environment that will challenge existing scope and coverage of national pension systems. This dynamic attribute of national pension systems is consistent with ecological rationality. There is no optimal national pension system design. A pension system design has to continuously evolve in response to its environmental attributes or constraints.

In this topic we will discuss three constraints that apply to the implementation of a pension system.

- Financial Capability;

- Financial Advice; and

- Labour Market.

Constraint 1: Financial Capability

What do we mean by financial capability? Financial capability is the combined outcome of the ability to and the opportunity to take financial decisions . At this point it will be useful to clarify the distinction between financial capability and other terminologies that have been used to indicate capacity to plan for financing old age or pensions. We often tend to use interchangeably terminologies like financial knowledge; financial literacy; financial inclusion and financial capability. Financial capability is distinct from financial knowledge; financial literacy; or financial inclusion. Financial capability as defined above is the outcome of the interaction between both the ability and the opportunity to take financial decisions. The terminologies of financial literacy; financial knowledge or financial inclusion are focused on either the ability or opportunity attribute of financial capability and ignore the significance of the process of interaction between ability and opportunity.

Our understanding of financial capability has evolved over the years and we can identify three distinct phases. We will discuss each of these phases to understand how financial capability can impact retirement outcomes in any pension system design. The discussion of the three phases of evolution of financial capability also clarifies the confusion between terminologies like financial knowledge; financial literacy and financial inclusion and their roles in financial capability and pension outcome in any national pension system.

Phase 1

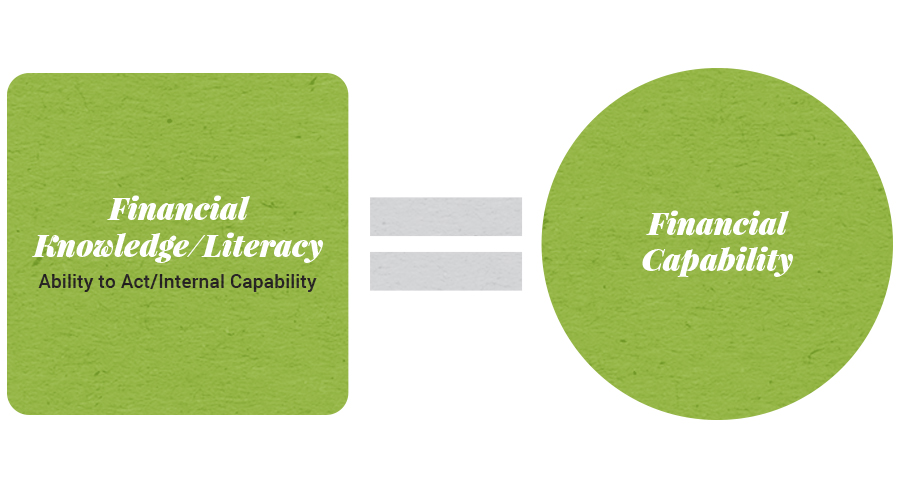

In phase 1, financial knowledge and literacy was considered analogous to financial capability. The primary responsibility of old age financial security was on the individual. Programs to educate and deepen/widen financial awareness are expected to help in the attainment of financial capability and contribute positively to old age financial security.

Figure 3. Phase 1 financial capability framework

Phase 2

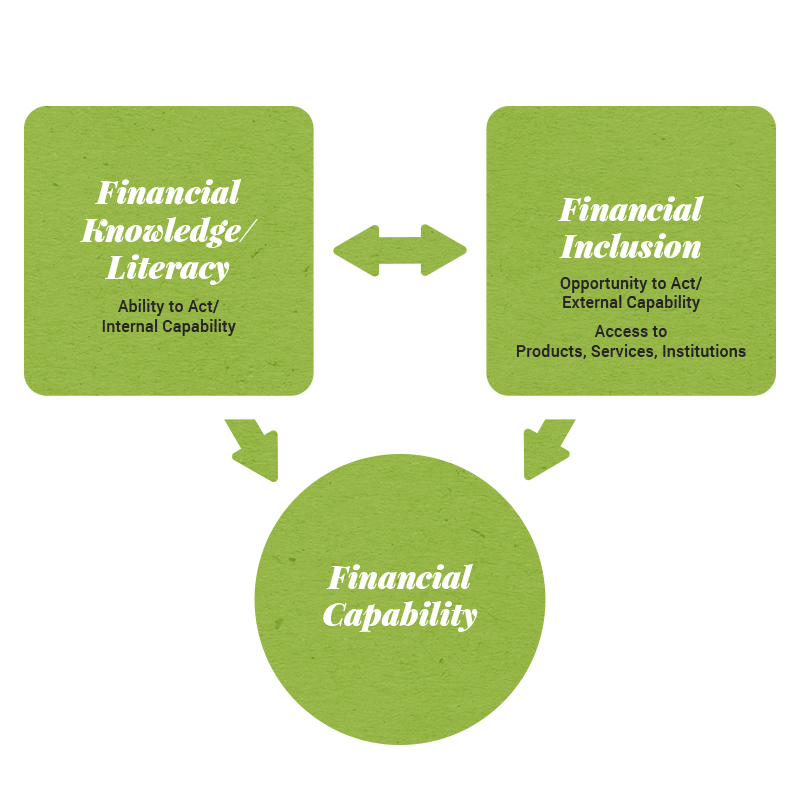

In phase 2, financial capability was considered to be the outcome of the interaction between financial knowledge/literacy and financial inclusion. As in the case of the first framework, the emphasis is on the policy framework that promotes and facilitates individual action on acquiring old age financial security. Financial education and awareness needs to be promoted and the government needs to incentivize the financial services industry to create the opportunity to acquire financial capability by promoting a supply and accessibility of financial products and services.

Figure 4. Phase 2 financial capability framework

Phase 3

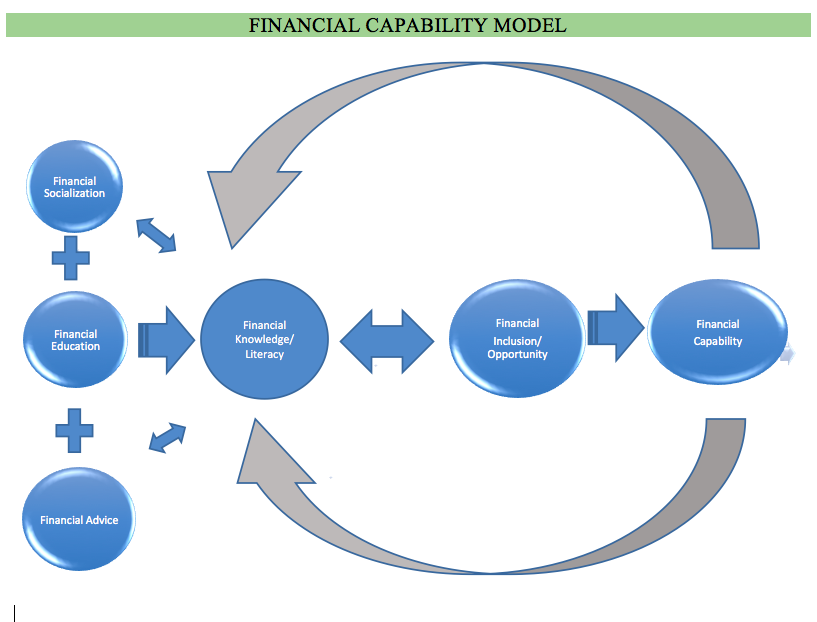

This is the most recent and current understanding of an individual’s ability to acquire financial capability and be able to finance their short, and more importantly, long term goals, like pensions. According to this latest thinking, financial capability as the joint outcome of three groups of influences. By far this is the most sophisticated understanding of how financial capability can help support pensions or retirement financing.

Figure 5. Phase 3 financial capability model

The phase 3 financial capability model is an interdependent system and a joint outcome of a number of influences (Sherraden, 2013). Figure 5 above, outlines the complex inter-relationships that are embedded in any individual’s effort to acquire financial capability and be able to save for retirement. In the phase 3 of the financial capability the combined interaction between financial knowledge and skills with financial inclusion will lead to financial capability.

From a pension design perspective, the emphasis on the individual is not likely to contribute to reduced dependence on the PAYGO quadrant of pension plans. The meta-analysis of nearly 188 studies shows that that financial literacy and capability interventions can have a positive impact in some areas (increasing savings and promoting financial skills such as record keeping) but not in others (credit default) (Miller, Reichelstein, Salas, & Zia, 2014).

This also explains the rather poor performance of programs seeking to promote individual savings such as RRSP and TFSA in Canada. Efforts to encourage individuals to save for their retirement have to navigate the complex interdependencies outlined in Figure 4. This underlines the complexity of promoting individual efforts in pension design to further promote the sustainability of the PAYGO pension plans.

Constraint 2: Financial Advice

Financial advising can a have significant role in individual and occupational pension designs. Financial advice can come in the form of the provision of technical expertise helping the consumer navigate through the technical characteristics of a product, or as a transactional agent intermediating in the buying and selling of financial products. Financial advisors can also be counsellors or coaches helping the savers through their cognitive and computational constraints as outlined in the topic on intertemporal choice and the discussion on bounded rationality. Does financial advice add value? Are individual investors and defined contribution plan members in the occupational pension plans supported and enabled by the financial advisors in their efforts to save for retirement?

A major concern about financial advice has been its underlying motivation. Given the involvement of the financial advisors or the firms and companies they belong to in both the buy and sell side of the business, it is unclear in whose financial interest the industry works. This confusion of the financial advisor’s allegiance is further exacerbated by the opposition of the industry to be recognized as fiduciaries in their role as advisors. A fiduciary is a professional standard of practice and care that assures the client that the professional, or the financial advisor in our case, is working in their best interest. The alternative standard of care to the fiduciary standard is the suitability standard, which does not require the financial adviser to work solely in the best interest of their client. The suitability standard of care criteria is satisfied if the advisor recommended products and services that are consistent with their client’s goals and objectives. Thus, if the risk tolerance of a person saving for retirement is moderate, and requires a balanced growth fund comprised of a fair mix of value stocks and bonds, then the balanced growth fund can be from a product of the financial advisor’s investment side of the business and not necessarily the best balanced growth fund in the financial services industry (Punko, 2015). We will explore the implications of the resistance to fiduciary standards in greater detail in the Module on governance.

Even if we were to assume that the advice given is in the best interest of the person saving for their pension, there is concern based on empirical evidence regarding who seeks or has access to the advice. As you will recall from Figure 3 in Topic 4, a major policy objective of having a multi-pillar pension system is to ensure the sustainability of the PAYGO pension plans by lowering the level and number of claimants on this quadrant of pension design. The privately funded and managed pension plans are either individually or occupationally managed and encouraged through tax and other incentives to minimise the potential burden on plans under the PAYGO quadrant. However, as described in the Topic 4 of this module, the beneficiaries of the tax incentivised individual plans are largely high net worth households. Similar trends are observed in the uptake of financial advice. There appears to be a self-selection bias in the use of financial advice and financial advisors. The evidence shows that wealth followed by high income, a college degree, and self-employment as the strongest predictor of the use of financial advice (Finke, Huston, & Winchester, 2011). However, evidence also points to clients who used advisors who had much greater financial experience, and often sought to use their services ‘like babysitters” allowing them to use (financial advisor’s) time that had a lower opportunity cost than their own.

What kind of financial advice is needed that could make the PAYGO component more sustainable? The evidence shows that there is a lack of trust in financial advice and the benefits of financial advice are largely skewed towards high net worth households. First, the financial adviser accept their role as fiduciary and move away from their insistence of suitable standard of care for their clients. Second, a more nuanced understanding of financial advice emerges if one were to make a distinction between four different types of financial advisors or advice. In his review of financial advice models and financial advice, Collins (2010) distinguishes between four types of financial advisors:

- Financial advisors who work as technical experts for a fee;

- Financial advisors who work as transactional agents who are not paid directly but indirectly through the purchase or sale of financial products;

- Financial Advisors who work as counsellors with clients on specific financial needs; and

- Financial Advisors who work as coaches, offering services designed to help clients reach their financial goals.

Much of the focus in the literature on financial advice is on the role of financial advisors as technical experts and as transactional agents. There is some evidence on the impact of financial advice in the form of counselling and as coaching on long term goals, but most of the evidence is not definitive as it does not either have a control group or normalize for other factors. Studies have also found that those who had the services of financial advisors were more likely to display reduced proclivity for behavioural biases (Shapira & Venza, 2001). However, Hung and Yoong (2010) use a combination of observed data and experimental data to identify causality and find that unsolicited financial advice does not add value. When advice is optional, individuals with low levels of financial literacy are likely to seek out and benefit from financial advice.

Consistent with ecological rationality and the primary goal of pension design being the minimisation of the size and dependence on PAYGO, there is a need to understand the roles of coaches and counsellors in supporting long term financial goals like pensions. Coaches and Counsellors typically work with low income and middle-income households. A better understanding of their impact will provide a superior framework for incentivising tax breaks (as in RRSP and TFSA) to promote the privately managed and funded quadrant of pension plans amongst low- and middle-income households and a more sustainable PAYGO quadrant.

Constraint 3: The Labour Market

Developments in the labour market have important implications for funded pension plans’ outcomes and the prospects for sustainability of the PAYGO quadrant (See Table 8). Mitchell and Turner (2010) are of the view, that the labour market may pose risks greater than or at par with financial market risks in the outcome of funded pension plans.

What are these labour market risks? The paragraphs that follow will explore some of the labour market risks in some detail.

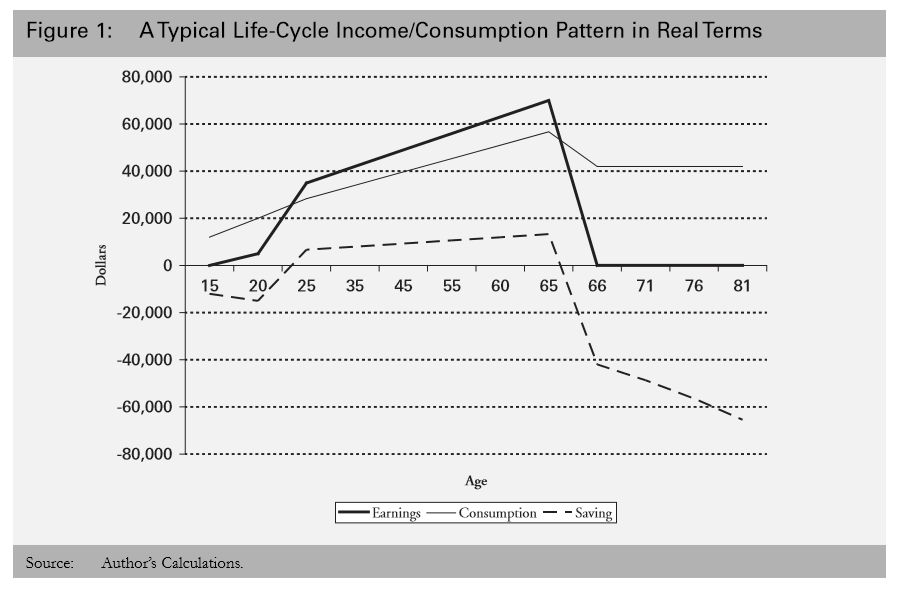

First, the assumption made about the labour market when estimating the outcomes of funded pension plans will be outlined. The prevailing belief in the design of funded pension plans is best represented by the Life Cycle Income Hypothesis. This is the assumptions made about the life time flow of income for a working individual over their life time. Figure 6 below is a representation of the Life Cycle Income Hypothesis.

Figure 6. Life Cycle Income Hypothesis. Adapted from “A Typical Life-Cycle Income/Consumption Pattern in Real Terms,” by K. P. Ambachtsheer(2016).

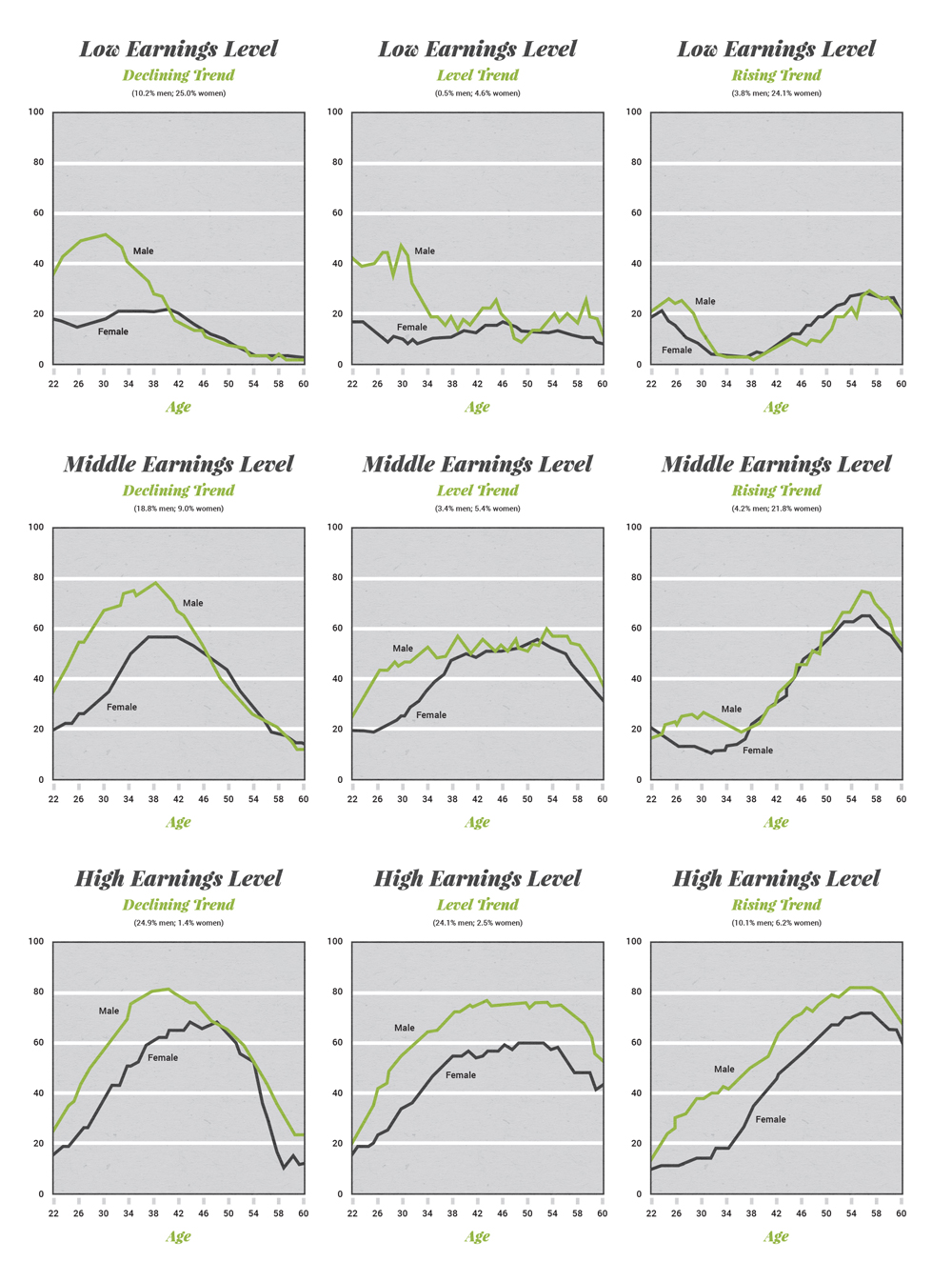

Most pension plan models are based on this assumption of a bell-shape earnings. As shown in Figure 6, The income of wage earners shows a gradual but continuous progression over the years till it drops off to zero with retirement. However, evidence suggest that this is true for fewer than 14% of workers in the US and differs considerably by gender and income levels. As shown in figures below, variances in income also differs by income level and demographic social group. These real-world income patterns have implications for pension design. Pension designs that are based on a smooth bell-shaped income profile over a lifetime of continuous income increase are inaccurate for most employees.

Figure 7. Basic earnings patterns of nine groups of workers in the 1931-1940 cohort (in percent).

Note. Adapted from Bosworth, Burtless, & Steurele (2000).

The labour market attributes: volatility in earnings, uncertainty of hours of work, uncertainty of working lives, and longevity (Statistics Canada, 2017) will have implications for national pension system design. Table 9 below provides a summary of labour market risks for pension outcomes. Thus, defined contribution plans will have the potential for a superior pension outcome than defined benefit plans for high income earners whose income peaks early in their careers. Defined benefit plans, by contrast, favour those whose income peaks later in their careers. Pension systems will also differ in terms of how pension designs handle job market changes and interruptions in employment. For example, in Canada, if a worker changes jobs and has a defined benefit plan, the accrued pension in the previous job is fixed in nominal terms and falls in value because of inflation.

Table 9

How Human Capital Risks Translate into Pension Outcomes: A Framework

|

Risk |

Pension Plan Type |

||

|

Defined Benefit |

Collective Defined Contribution (CDC) |

Defined Contribution (DC) |

|

|

|||

|

Skill obsolescence Health shock Disability shock |

Partly smoothed (depends on benefit formula) |

Like DB |

Contributions directly affected |

|

Labour force exit Death |

Benefit not bequeathed; survivor benefit possible

|

|

Accumulation may be bequeathed |

|

|||

|

Hours reduction Layoff/firing Retirement |

Accrual halted; nonvested benefit lost and final benefit may be very low

|

Like DB |

Accrual protected; assets keep earning investment returns |

Note. Adapted from Mitchell & Turner (2010).

These labour market attributes have to be incorporated into pension design. A literal application of the life cycle income hypothesis will have implications for the sustainability of national pension systems. Consistent with ecological rationality, the aim of any national pension system is to minimize the dependence on the PAYGO pension plans. However, the labour market constraints outlined above in combination with bounded rationality points to limited financial capability of individuals to save towards a pension. The data from Statistics Canada (2017) discussed above shows the cumulative impact of financial capability, advice, and the labour market indicates that tax incentivized individual savings plans or occupational pension plans, like the defined contribution plans, are failing in scope, or in the number of people who can build their pensions using these plans. This increases the prospect of a greater dependence of an increasing share of the current workers becoming dependent on the PAYGO pension plans such as Old Age Security (OAS), Guaranteed Income Supplement (GIS), and Guaranteed Annual Income Supplement (for Ontarians).

Reducing this increasing dependence on the PAYGO quadrant due to labour market changes, requires a greater emphasis and increased effectiveness of the publicly managed and privately funded quadrant of the pension system. An effective pension design in this quadrant will be consistent with ecological rationality as it reduces the potential for dependence on the PAYGO systems for many reasons. First, it can be the only response to the labour market changes outlined above. Second, greater emphasis on private funded publicly managed pension designs sidesteps the need to focus on the largely ineffective interventions on financial literacy. Finally, such a shift in pension design also reduces the scope of fiduciary risks from agency issues surrounding financial advice.

The publicly managed privately funded quadrant

As a response to the challenges faced by privately managed and funded occupational and individual pension plans outlined above, a trend can be noted globally among countries making efforts to expand existing pension plans or to launch new publicly managed and privately funded pension plans (Mayers, 2014). In Canada, gradual enhancements to the Canada Pension Plan have been introduced that means workers will receive higher benefits in exchange for making higher contributions (Government of Canada, 2017). Thus, from 2019, the changes in the CPP will increase the percentage of an average workers earnings from 25% to 33%. The contribution rates have also been changed. Currently, employees contribute 4.95% on these earnings to the CPP and employers make an equal contribution. If you are self-employed, you contribute both the employee and employer portions, which is equal to 9.9%. From 2019 to 2023, the contribution rate for employees will gradually increase by one percentage point (from 4.95% to 5.95%) on earnings between $3,500 and the original earnings limit. In 2024, employees will begin contributing 4% on an additional range of earnings. This range will start at the original earnings limit (estimated to be $69,700 in 2025) and go to the additional earnings limit, which will be 14% higher by 2025 (estimated to be $79,400).

Similar changes have already been introduced in the UK, Australia and Holland, and are being proposed in the USA. For example, in the United Kingdom, in 2008 the National Employment Savings Trust or NEST was launched (Sandbrook, & Gosling, 2014). It is evident from the welcome page of the website for NEST that a primary motivator for the launch of NEST was the sustainability of the PAYGO pension provisions. In the USA a similar proposal was made but has not yet been implemented (Sandbrook, & Gosling, 2014).

Are there design considerations that should guide the expansion of these national superfunds? The primary concern that pension subscribers have with such mega funds is governance. The track record of entrusting retirement with public entities or, for that matter, large corporations has not been very good. Pension funds of large corporations are underfunded as their liabilities or benefits accrued to pension plan members is in excess of the funds available to meet these obligations. In addition, current employees as plan members of these corporations are unsure if the organizations they hope to retire from after years of contributing to the pension funds will be around when their work life concludes. The experience with pension funds of public employees is also not reassuring. Funds like the ones for Illinois and Detroit have been severely underfunded and employees have been forced to take cuts in their accrued pension benefits because of budgetary malfeasance and under funding (Blinch, 2018). There are no easy fixes to the problem of underfunded pensions.

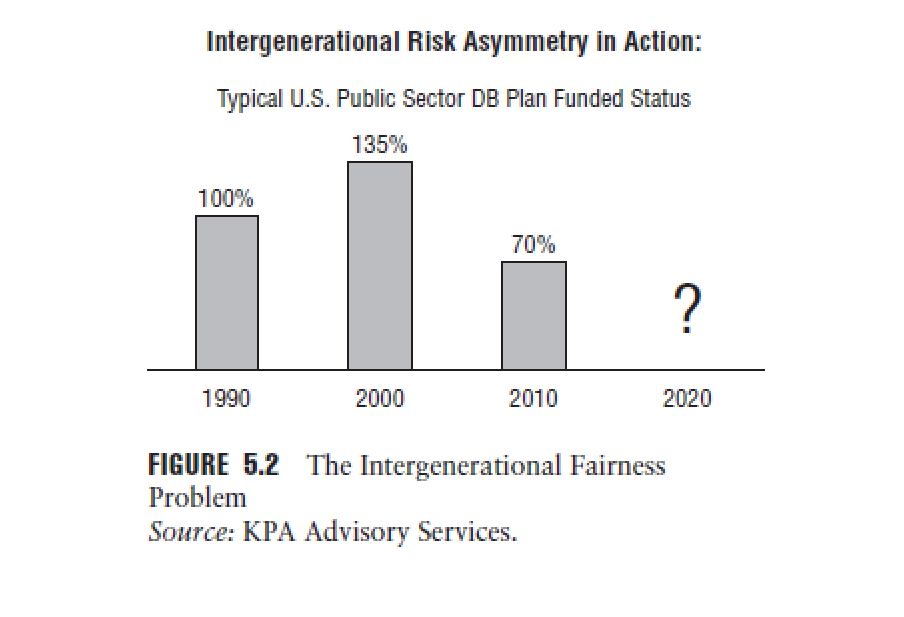

The guiding principle for avoiding these dismal long term prospects is intergenerational fairness or equity and complete contracts (Ambachtsheer, 2016). Intergenerational fairness arises when benefits are promised but not financed out of current earnings, leaving the responsibility of paying for the benefits to the next generation. A major reason for this is the absence of the future generation in the negotiation when these benefits are being allocated. An example of this intergenerational fairness asymmetry is shown in figure 8 below. When plans have a funding surplus, that is the funds are in excess of the cost of accrued benefits, it is not uncommon for current employees or their employers to take contribution reductions, holidays or boost their accrued benefits.

Example: Ontario Teachers’ Pension Plan

The buoyant market has led to a pension surplus in the The Ontario Teachers’ Pension Plan (OTTP). This is how their website explains how the surplus will be used. The OTTP reported a preliminary $11.5 billion surplus, as of January 1, 2017, on March 29, 2017. The Ontario Teachers’ Federation (OTF) and the Ontario government, which jointly sponsor the pension plan, will use surplus funds to restore full inflation protection for post-2009 pension credit and decrease contribution rates by 1.1%. Both changes are effective January 1, 2018.

For more details on the surplus utilization visit the Ontario Teacher’s Pension Plan website.

How quickly the funding status of a pension fund can change is best illustrated by Figure 8 below. As the bar charts show, much of the 1990s, with the tech stocks boom, saw pension plans reporting funding surpluses. Following the 2008 financial crisis, the funding surplus evaporated, and pension funds were reporting a deficit vis-à-vis accrued liabilities. Based on the current stock market performance, it is likely that the pension funding status of the funds included in this diagram have reverted back to a surplus for now.

Figure 8. The Intergenerational Fairness Problems

Figure 8. The Intergenerational Fairness Problems

Note. Adapted from KPA Advisory Services

Explore

For a discussion of pensions from an accounting perspective and issues in the treatment of surpluses, explore the Accounting Treatment of Pension Funds (Office of the Auditor General of Ontario, 2016):

http://www.auditor.on.ca/en/content/annualreports/arreports/en16/v1_401en16.pdf

Clearly, these changes from a funded surplus to a deficit status requires smoothing to ensure intergenerational fairness. However, pension plans and regulatory regimes, instead of building a surplus to provide a buffer against a downturn in asset prices, respond to these windfalls as a permanent gain. Pension plan sponsors move with a short-term horizon to either appropriate these surpluses or redistribute it to plan subscribers to comply with regulatory provisions.

End the Defined Benefit and Defined Contribution Dichotomy

A response at the design level to the multiple challenges faced by privately managed and funded pension plans in the lower left quadrant of Table 8 is to propose design changes in the Defined Benefit (DC) and Defined Contribution (DB) plans. Hybrid plans called Target Benefit or Defined Ambition Plans have been proposed that seek to reduce the uncertainty of pension outcomes associated with defined contribution plans for plan subscribers, as well the risk of unfunded outcomes for plan sponsors. So how is this middle-of-the-road solution of choosing between DC and DB plans devised?

The defined ambition and target benefit plans travel the middle road between DB and DC by taking the following steps. A good example of this is the QSuper Fund in Australia (Ambachtsheer, 2016):

- Recognition of a fiduciary responsibility towards pension plan subscribers;

- Move away from a one-size-fits-all approach to the architecture of benefits and expectations by engaging in constant and open communication with plan subscribers and offering them tools and advice. This allows for a reset and recalibration of expectations responses to changes in the financial, economic, healthcare and longevity market;

- Opening channels of involvement of the pension sponsor in the pension plan members deaccumulation decisions by designing products such as longevity protection purchase options; and

- Long horizon, wealth creation coupled with dynamic resetting of the asset management in response to changes in the financial market.

The discussion of the operational aspects of pension design leads to two specific conclusions:

- There is a need for greater emphasis on the pension design quadrant that is made up of plans that are publicly managed but privately funded.

- Typical plans in this quadrant have been of the defined benefit variety promising a guaranteed benefit to individual plan members. Given the challenges faced by privately managed and privately funded individual and occupational pension accounts, there is a need to expand the role of super funds like the CPP in Canada. However, the expansion of their role in pensions does not have to be a continuation of defined benefit plans or an adoption of defined contribution plans by default. Design hybrids like the target benefit and the defined ambition are viable alternatives and reflect the growing possibility of big data and disintermediation made possible by the new information age. Individual members do not have to be passive subscribers of one size fits all plans with set expectations. As the QSuper story demonstrates, the organization can be open, interactive and reflective of individual plan members’ requirements in both the accumulation and deaccumulation phase.

The promise of these possibilities, however, can only be realised by a radical reconsideration of governance and investment frameworks of these super funds. We will discuss this in the next two modules.

Exercises

Topics to Explore

- Interdependent Capability

- Financial Advice

- Labour Market and the Risks to Pensions

- Life Cycle Income Hypothesis

- Human Capital Risks

- Target Benefit or Defined Ambition Plans

- Fiduciary Standard

- Suitability Standard

Exercises

Sample Review Questions

- Discuss the constraints on sustainable pension design imposed by:

- Interdependence between design; governance & investment decisions

- Financial Capability

- Labor Market Changes

- The target for income is called the income replacement rate (IRR). What should be the IRR? Is it a policy question or an individual choice?

- What is the design; governance; and investment principles. How are they interdependent?

- Discuss the phases of evolution in financial capability using the financial capability model.

- How do labor market changes impact pension risks?