2.4 Calculating the Payment

Learning Objectives

- Calculate the payment for an annuity

Formula & Symbol Hub

Symbols Used

- [latex]FV[/latex] = Future value or maturity value

- [latex]PV[/latex] = Present value of principal

- [latex]PMT[/latex] = Annuity payment amount

- [latex]I/Y[/latex] = Nominal interest rate

- [latex]P/Y[/latex] = Number of payments per year or payment frequency

- [latex]C/Y[/latex] = Number of compounds per year or compounding frequency

- [latex]n[/latex] or [latex]N[/latex] = Total number of annuity payments

Formulas Used

-

Formula 2.1 - Total Number of Payments (Annuity)

[latex]n=P/Y \times t[/latex]

-

Formula 2.2 - Future Value of Ordinary Annuity

[latex]FV=PMT \times \left[\frac{(1+i_2)^n-1}{i_2}\right][/latex]

-

Formula 2.3 - Future Value of Annuity Due

[latex]FV=PMT \times (1+i_2) \times \left[\frac{(1+i_2)^n-1}{i_2}\right][/latex]

-

Formula 2.4 - Present Value of Ordinary Annuity

[latex]PV=PMT \times \left[\frac{1-(1+i_2)^{-n}}{i_2}\right][/latex]

-

Formula 2.5 - Present Value of Annuity Due

[latex]PV=PMT \times (1+i_2) \times \left[\frac{1-(1+i_2)^{-n}}{i_2}\right][/latex]

Introduction

Whether you are acquiring merchandise, property or saving up toward some future goal such as retirement, you will deal with annuity payments. When you graduate college and land that promising entry-level position with your employer, a lot of demands are going to get placed on your limited income. If you do not already own a place of your own, perhaps you will get one. This means the purchase of a starter home for which you will make monthly mortgage payments. To fill that home, acquiring some furniture and electronics might take you to The Brick, Sleep Country Canada, Best Buy, or The Home Depot. Then you may be staggered by all the home maintenance items you need. If you make a lot of purchases all at once, you will probably take advantage of various payment plans. These place even more demands on your monthly income. Do not forget that you will need some wheels too. You can either lease or purchase a car. Great, another payment to make! Finally, you remember what your math instructor taught you about the importance of getting started early on your RRSP, so you should begin making those monthly contributions soon, too.

Similarly, businesses also make annuity payments for a wide variety of purposes, such as saving up for future corporate goals or acquiring products and property, businesses have regular bills, too. Marketers develop payment plans for their consumers. Financial agents make investments involving periodic payments. Companies issue marketable bonds that require regular interest payments to investors. Human resource personnel look after employee benefits, including RRSP contributions and pension plan payments. Production departments need expensive machinery, so they must keep payment plans within operating budgets. No matter your choice of profession, as a business manager you will encounter annuity payment calculations.

You need to calculate an annuity payment in many situation:

- Figuring out loan or mortgage payments.

- Determining membership or product payment plans.

- Calculating lease payments.

- Determining the periodic payment necessary to achieve a savings goal.

- Determining the maximum payment that an investment annuity can sustain over period of time.

Using a Financial Calculator

Recall that the annuity payment, [latex]PMT[/latex], is one of the variables in the future value and present value formulas for annuities. Calculating the payment requires you to determine which formula to use (depending on the type of annuity and whether you have the future value or present value), and then rearranging the formula to solve for [latex]PMT[/latex].

As we have seen, a financial calculator can quickly find the payment amount. You use the financial calculator in the same way as described previously, but the only difference is that the unknown quantity is [latex]PMT[/latex] (the payment). You must still load the other six variables into the calculator, set the calculator to the correct payment setting, and apply the cash flow sign conventions carefully.

Using the TI BAII Plus Calculator to Find an Annuity Payment

- Set the calculator to the correct payment setting (END or BGN).

- Enter values for the known variables ([latex]PV[/latex], [latex]FV[/latex], [latex]N[/latex], [latex]I/Y[/latex], [latex]P/Y[/latex] and [latex]C/Y[/latex]), paying close attention to the cash flow sign convention for [latex]PV[/latex] and [latex]FV[/latex].

- After all of the known quantities are loaded into the calculator, press [latex]CPT[/latex] and then [latex]PMT[/latex] to solve for the payment.

HOW TO

- Ensure that the calculator is set to the required payment setting. The payment will be different for END and BGN.

- The values you enter for [latex]PV[/latex] and [latex]FV[/latex] must adhere to the cash flow sign convention.

Video: Ordinary Annuity Calculations (PV, PMT, FV) by Joshua Emmanuel [4:31] Transcript Available.

Video: BAII Plus Down Payment Questions|PV and PMT by Joshua Emmanuel [3:54] Transcript Available.

Example 2.4.1

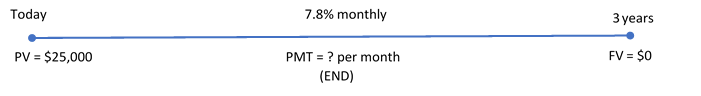

Morgan wants to consolidate a lot of smaller debts into a single three-year loan for [latex]\$25,000[/latex]. If the loan is charged interest at [latex]7.8\%[/latex] compounded monthly, what is her payment amount at the end of every month?

Solution

The timeline for the loan appears below.

| PMT Setting | END |

| [latex]N[/latex] | [latex]12 \times 3=36[/latex] |

| [latex]PV[/latex] | [latex]25,000[/latex] |

| [latex]FV[/latex] | [latex]0[/latex] |

| [latex]PMT[/latex] | ? |

| [latex]I/Y[/latex] | [latex]7.8[/latex] |

| [latex]P/Y[/latex] | [latex]12[/latex] |

| [latex]C/Y[/latex] | [latex]12[/latex] |

[latex]PMT=\$781.10[/latex]

To pay off her consolidated loan, Morgan's month-end payments for the next three years are [latex]\$781.10[/latex].

Example 2.4.2

You plan to retire in [latex]20[/latex] years. When you do, you want to have saved [latex]\$200,000[/latex] in an RRSP. To accomplish this goal, you will make quarterly payments into an RRSP that earns [latex]3.1\%[/latex] compounded semi-annually.

- Calculate the size of the quarterly payments.

- How much interest does the RRSP earn?

Solution

Step 1: Calculate the quarterly payments.

| PMT Setting | END |

| [latex]N[/latex] | [latex]4 \times 20=80[/latex] |

| [latex]PV[/latex] | [latex]0[/latex] |

| [latex]FV[/latex] | [latex]200,000[/latex] |

| [latex]PMT[/latex] | ? |

| [latex]I/Y[/latex] | [latex]3.1[/latex] |

| [latex]P/Y[/latex] | [latex]4[/latex] |

| [latex]C/Y[/latex] | [latex]2[/latex] |

[latex]PMT=\$1,816.29[/latex]

Step 2: Calculate the interest.

[latex]\begin{eqnarray*} I & = & FV-n \times PMT \\ & = &200,000- 80 \times 1,816.29 \\ & = & \$54,696.80 \end{eqnarray*}[/latex]

Step 3: Write as a statement.

You need to make quarterly payments of [latex]\$1,816.29[/latex] to accomplish your goal. You will earn [latex]\$54,696.80[/latex] in interest over the [latex]20[/latex] years.

Example 2.4.3

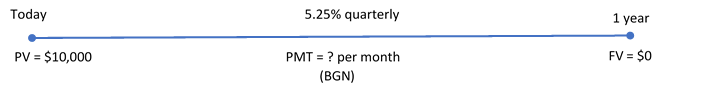

Franco has placed [latex]\$10,000[/latex] into an investment fund with the goal of receiving equal amounts at the beginning of every month for the next year while he backpacks across Europe. If the investment fund can earn [latex]5.25\%[/latex] compounded quarterly, how much money can Franco expect to receive each month?

Solution

The timeline for the vacation money appears below.

| PMT Setting | BGN |

| N | [latex]12 \times 1=12[/latex] |

| PV | [latex]-10,000[/latex] |

| FV | [latex]0[/latex] |

| PMT | ? |

| I/Y | [latex]5.25[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]4[/latex] |

[latex]PMT=\$853.40[/latex]

While backpacking across Europe, Franco's annuity will pay him [latex]\$853.40[/latex] at the beginning of every month.

Try It

1) To save approximately [latex]\$30,000[/latex] for a down payment on a home four years from today, what amount needs to be invested at the end of every month at [latex]4.5\%[/latex] compounded semi-annually?

Solution

| PMT Setting | END |

| [latex]N[/latex] | [latex]48[/latex] |

| [latex]PV[/latex] | [latex]0[/latex] |

| [latex]FV[/latex] | [latex]30,000[/latex] |

| [latex]PMT[/latex] | ? |

| [latex]I/Y[/latex] | [latex]4.5[/latex] |

| [latex]P/Y[/latex] | [latex]12[/latex] |

| [latex]C/Y[/latex] | [latex]2[/latex] |

[latex]PMT=\$572.08[/latex]

Example 2.4.4

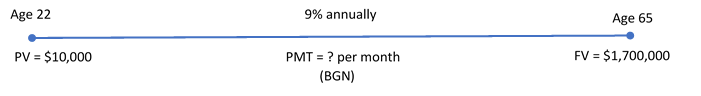

Kingsley's financial adviser has determined that when he reaches age [latex]65[/latex], he will need [latex]\$1.7[/latex] million in his RRSP to fund his retirement. Kingsley is currently [latex]22[/latex] years old and has saved up [latex]\$10,000[/latex] already. His adviser thinks that his RRSP will average [latex]9\%[/latex] compounded annually throughout the years. To meet his RRSP goal, how much does Kingsley need to invest every month starting today?

Solution

The timeline for Kingsley’s RRSP contributions appears below.

| PMT Setting | BGN |

| N | [latex]12 \times 43=516[/latex] |

| PV | [latex]-10,000[/latex] |

| FV | [latex]1,700,000[/latex] |

| PMT | ? |

| I/Y | [latex]9[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]1[/latex] |

[latex]PMT=\$233.24[/latex]

To meet his retirement goals, Kingsley needs to invest [latex]\$233.24[/latex] at the beginning of every month for the next [latex]43[/latex] years.

Example 2.4.5

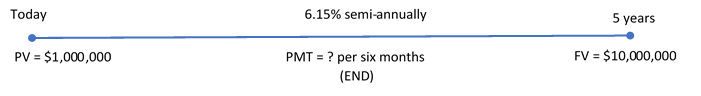

The production department just informed the finance department that in five years’ time the robotic systems on the production line will need to be replaced. The estimated cost of the replacement is [latex]\$10[/latex] million. To prepare for this purchase, the finance department immediately deposits [latex]\$1,000,000[/latex] into a savings annuity earning [latex]6.15\%[/latex] compounded semi-annually, and it plans to make semi-annual contributions starting in six months. How large do those contributions need to be?

Solution

The timeline for the machinery fund appears below.

| PMT Setting | END |

| N | [latex]2 \times 5=10[/latex] |

| PV | [latex]-1,000,000[/latex] |

| FV | [latex]10,000,000[/latex] |

| PMT | ? |

| I/Y | [latex]6.15[/latex] |

| P/Y | [latex]2[/latex] |

| C/Y | [latex]2[/latex] |

[latex]PMT=\$751,616.87[/latex]

To have adequate funding for the production line machinery replacement five years from now, the finance department needs to deposit [latex]\$751,616.87[/latex] into the fund every six months.

Try It

2) Sinclair does not believe in debt and will only pay cash for all purchases. He has already saved up [latex]\$140,000[/latex] toward the purchase of a new home with an estimated cost of [latex]\$300,000[/latex]. Suppose his investments earn [latex]7.5\%[/latex] compounded monthly. How much does he need to contribute at the beginning of each quarter if he wants to purchase his home in five years?

Solution

| PMT Setting | BGN |

| [latex]N[/latex] | [latex]20[/latex] |

| [latex]PV[/latex] | [latex]-140,000[/latex] |

| [latex]FV[/latex] | [latex]300,000[/latex] |

| [latex]PMT[/latex] | ? |

| [latex]I/Y[/latex] | [latex]7.5[/latex] |

| [latex]P/Y[/latex] | [latex]4[/latex] |

| [latex]C/Y[/latex] | [latex]12[/latex] |

[latex]PMT=\$3,943.82[/latex]

Example 2.4.6

Over the next [latex]15[/latex] years, you will invest [latex]\$900[/latex] every month into an RRSP that earns [latex]4.3\%[/latex] compounded semi-annually. At the end of the [latex]15[/latex] years, you plan to retire and will transfer the money in the RRSP to a RIF earning [latex]2.9\%[/latex] compounded quarterly. Over the next [latex]20[/latex] years, you will receive quarterly payments from the RIF. Calculate the size of the quarterly RIF payments.

Solution

Step 1: Calculate the future value at the end of the RRSP.

| PMT Setting | END |

| [latex]N[/latex] | [latex]12 \times 15=180[/latex] |

| [latex]PV[/latex] | [latex]0[/latex] |

| [latex]FV[/latex] | ? |

| [latex]PMT[/latex] | [latex]-900[/latex] |

| [latex]I/Y[/latex] | [latex]4.3[/latex] |

| [latex]P/Y[/latex] | [latex]12[/latex] |

| [latex]C/Y[/latex] | [latex]2[/latex] |

[latex]FV=\$226,289.88...[/latex]

Step 2: Calculate the payment for the RIF. The future value from the RRSP becomes the present value for the RIF: [latex]PV=\$226,289.88...[/latex]

| PMT Setting | END |

| [latex]N[/latex] | [latex]4 \times 20=80[/latex] |

| [latex]PV[/latex] | [latex]-226,289.88...[/latex] |

| [latex]FV[/latex] | [latex]0[/latex] |

| [latex]PMT[/latex] | ? |

| [latex]I/Y[/latex] | [latex]2.9[/latex] |

| [latex]P/Y[/latex] | [latex]4[/latex] |

| [latex]C/Y[/latex] | [latex]4[/latex] |

[latex]PMT=\$3,737.74[/latex]

Step 3: Write as a statement.

You will receive quarterly payments of [latex]\$3,737.74[/latex] from the RIF.

Example 2.4.7

When you retire, you want to receive beginning-of-month payments of [latex]\$750[/latex] for [latex]30[/latex] years from a RIF earning [latex]4.1\%[/latex] compounded quarterly. To plan for this, you want to make beginning-of-quarter payments for the next [latex]25[/latex] years leading up to your retirement into your RRSP that earns [latex]2.7\%[/latex] compounded semi-annually. What payments do you need to make to your RRSP?

Solution

Step 1: Calculate the present value at the start of the RIF.

| PMT Setting | BGN |

| [latex]N[/latex] | [latex]12 \times 30=360[/latex] |

| [latex]PV[/latex] | ? |

| [latex]FV[/latex] | [latex]0[/latex] |

| [latex]PMT[/latex] | [latex]750[/latex] |

| [latex]I/Y[/latex] | [latex]4.1[/latex] |

| [latex]P/Y[/latex] | [latex]12[/latex] |

| [latex]C/Y[/latex] | [latex]4[/latex] |

[latex]PV=\$156,005.04...[/latex]

Step 2: Calculate the payment for the RRSP. The present value from the RIF becomes the future value for the RRSP: [latex]FV=\$156,005.04...[/latex]

| PMT Setting | BGN |

| [latex]N[/latex] | [latex]4 \times 25=100[/latex] |

| [latex]PV[/latex] | [latex]0[/latex] |

| [latex]FV[/latex] | [latex]156,005.04...[/latex] |

| [latex]PMT[/latex] | ? |

| [latex]I/Y[/latex] | [latex]2.7[/latex] |

| [latex]P/Y[/latex] | [latex]4[/latex] |

| [latex]C/Y[/latex] | [latex]2[/latex] |

[latex]PMT=\$1,091.40[/latex]

Step 3: Write as a statement.

You will need to make quarterly payments of [latex]\$1,091.40[/latex] into the RRSP.

Try It

3) The Kowalskis’ only child is eight years old. They want to start saving into an RESP so that their son will be able to receive [latex]\$5,000[/latex] at the end of every quarter for four years once he turns [latex]18[/latex] and starts attending postsecondary school. When the annuity is paying out, it is forecast to earn [latex]4\%[/latex] compounded monthly. While they make contributions at the end of every month to the RESP, it will earn [latex]8\%[/latex] compounded semi-annually. What is the monthly contribution payment by the Kowalskis?

Solution

| PMT Setting | END | END |

| [latex]N[/latex] | [latex]16[/latex] | [latex]120[/latex] |

| [latex]PV[/latex] | [latex]\color{blue}{-73,569.219...}[/latex] | [latex]0[/latex] |

| [latex]FV[/latex] | [latex]0[/latex] | [latex]73,569.219...[/latex] |

| [latex]PMT[/latex] | [latex]5,000[/latex] | [latex]\color{blue}{405.06}[/latex] |

| [latex]I/Y[/latex] | [latex]4[/latex] | [latex]8[/latex] |

| [latex]P/Y[/latex] | [latex]4[/latex] | [latex]12[/latex] |

| [latex]C/Y[/latex] | [latex]12[/latex] | [latex]2[/latex] |

[latex]\displaystyle{PMT=\$405.06}[/latex]

Section 2.4 Exercises

- In [latex]5[/latex] years, Joan wants to have [latex]\$25,000[/latex] in her savings account. What beginning-of-month payments does she need to make if the account earns [latex]8.25\%[/latex] compounded monthly? How much interest does the account earn over the [latex]5[/latex] years?

Solution

[latex]\$335.72, \$4,856.80[/latex]

- You have [latex]\$500,000[/latex] in an investment fund that earns [latex]5.9\%[/latex] compounded semi-annually. Over the next [latex]15[/latex] years, you will receive quarterly payments from the fund. Calculate the size of the payments. How much interest does the fund pay?

Solution

[latex]\$12,580.44, \$254,826.40[/latex]

- You retire today with [latex]\$1,000,000[/latex] saved up in your RRSP. You immediately transfer the funds to an RIF earning [latex]4.75\%[/latex] compounded semi-annually. You will receive beginning-of-month payments from the RIF for [latex]25[/latex] years. What is the size of the monthly payments you will receive?

Solution

[latex]\$5,652.40[/latex]

- How much does Alex need to deposit ever year into his savings account if he wants to have [latex]\$1,500,000[/latex] in [latex]35[/latex] years? The savings account earns interest at [latex]9\%[/latex] compounded annually.

Solution

[latex]\$6,953.76[/latex]

- You purchase a [latex]\$58,000[/latex] car. You pay [latex]\$4,500[/latex] as a down payment and take out a loan for the balance at [latex]3.65\%[/latex] quarterly. You repay the loan with monthly payments for [latex]6.5[/latex] years. What is the size of your monthly loan payment? How much interest did you pay to buy the car?

Solution

[latex]\$771.25, \$6,657.50[/latex]

- Your business needs to save up for a major capital expense planned in [latex]4[/latex] years that will cost [latex]\$5,000,000[/latex]. Currently the business has [latex]\$450,000[/latex] saved in an investment fund earning [latex]4.35\%[/latex] compounded monthly. How much does the business need to deposit into the fund at the end of every year to have enough money saved for the project?

Solution

[latex]\$1,044,548.68[/latex]

- At age [latex]60[/latex], Tiger has managed to save [latex]\$850,000[/latex] and decides to retire. He wants to receive equal payments at the beginning of each month for the next [latex]25[/latex] years. The annuity can earn [latex]5.4\%[/latex] compounded quarterly.

- If he plans on depleting the annuity, how much are his monthly payments?

- If he wants to have [latex]\$50,000[/latex] left over at the end of the annuity, how much are his monthly payments?

Solution

a. [latex]\$5,133.93[/latex]; b. [latex]\$5,054.93[/latex]

- To purchase his new [latex]\$50,000[/latex] car, Scooby-Doo pays [latex]\$10,000[/latex] down and obtains a six-year loan for the balance at [latex]8.8\%[/latex] compounded semi-annually.

- Determine the monthly payments required on the loan.

- How much interest does he pay on the loan?

Solution

a. [latex]\$713.95[/latex]; b. [latex]\$11,404.40[/latex]

- Gold's Gym wants to offer its clients a monthly payment option on its annual membership dues of [latex]\$490[/latex]. If the gym charges [latex]7.75\%[/latex] compounded quarterly on its membership fee, what beginning-of-month payments should it advertise?

Solution

[latex]\$42.29[/latex]

- Carling Industries needs to acquire some real estate to expand its operations. In negotiations with the Province of Nova Scotia, it will be allowed to purchase the [latex]\$15[/latex] million parcel of land today and start making payments at the end of every six months for the next [latex]10[/latex] years. If interest will be charged at [latex]7.6\%[/latex] compounded semi-annually, what will be the required payments? (Round to the nearest dollar.)

Solution

[latex]\$1,084,268[/latex]

- You want to have saved [latex]\$100,000[/latex] in your savings account in [latex]12[/latex] years. For the first [latex]5[/latex] years, when the account earns [latex]2.3\%[/latex] compounded monthly you make monthly payments of [latex]\$235[/latex]. For the last [latex]7[/latex] years the account earns [latex]3.62\%[/latex] compounded quarterly. What monthly payments do you need to make during the last [latex]7[/latex] years to accomplish your goal? How much interest does your savings account earn?

Solution

[latex]\$846.83, \$14,766.28[/latex]

- In ten years, your daughter will go to university. During the four years she is in university, you want the RESP you set-up for your daughter to pay her [latex]\$3,000[/latex] at the start of every six months. What beginning-of-month deposits do you need to make into the RESP over the next ten years if the RESP earns [latex]3.89\%[/latex] compounded semi-annually?

Solution

[latex]\$153.16[/latex]

- For the next [latex]20[/latex] years, you deposit [latex]\$1500[/latex] every quarter into your RRSP that earns [latex]2.67\%[/latex] compounded semi-annually. At the end of the [latex]20[/latex] years, you retire and convert the money saved in your RRSP to a RIF that earns [latex]3.52\%[/latex] compounded quarterly. You want to receive monthly payments from the RIF for [latex]25[/latex] years. What are the size of the monthly RIF payments?

Solution

[latex]\$790.63[/latex]

- Santana wants his retirement money to pay him [latex]\$3,000[/latex] at the beginning of every month for [latex]20[/latex] years. He expects the annuity to earn [latex]6.15\%[/latex] compounded monthly during this time. If his RRSP can earn [latex]10.25\%[/latex] compounded annually and he contributes for the next [latex]30[/latex] years, how much money does he need to invest into his RRSP at the end of every month? He has already saved [latex]\$15,000[/latex] to date.

Solution

[latex]\$62.65[/latex]

Attribution

"11.4: Annuity Payment Amounts" from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

"11.4: Annuity Payment Amounts" from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.