2 Transaction Analysis

TRANSACTION ANALYSIS: GETTING TO THE NUMBERS

Information from financial statements helps managers answer many crucial strategic questions:

- How have this organization’s past decisions about fundraising, investing in new buildings, and launching of new programs shaped its current financial position?

- How might the timing of a key management decision – such as selling a building or hiring a new staff member – affect this organization’s financial position?

- How do accounting policy choices regarding depreciation methods, allowances for uncollectables, and expense recognition, among other areas affect this organization’s financial position?

- Why is a government’s government-wide financial position different from the position in its governmental funds? Or its enterprise funds?

- Should this organization consider recognizing in-kind contributions of volunteer time and other services?

- Why are this organization’s long-term liabilities portrayed differently in its financial statements compared to its budget?

The City of Rochester, NY is like most classic “Rust Belt” cities. It was once a global center of skilled manufacturing, but since the mid-1980s it has shed thousands of manufacturing jobs. Tax revenues have lagged, and the City’s overall financial position has slowly eroded. Throughout the past two decades the mayor and other local leaders have invested substantial public resources in local programs to promote economic and community development.

Communities like Rochester face a financial dilemma. Some local leaders believe the City should do much more to promote economic and community development. Despite its financial problems Rochester does have one key financial strength: a comparatively low debt burden ($775/capita). Unlike many of its peers it has not issued a lot of bonds or other long-term debt that it will need to repay over time. Some leaders believe it could borrow money to invest in infrastructure projects that would spur economic growth, grow the local tax base and, in effect, pay for themselves. Or at least that’s the theory.

Others disagree. They concur that the City has carefully managed its borrowing and does not owe investors much money. However, they point out that Rochester’s has an enormous amount ($3,927/capita) of “other” long-term debts. Principal among them is “other post-employment benefits” or OPEB. Rochester, like many of its peers, allows its retired city workers to remain on its health insurance plan. Moreover, it pays most of the insurance premiums for those retirees and for their families. Many thousands of retired City workers are expected to take advantage of this benefit for many years to come.

Under governmental accounting rules, the money Rochester expects to spend on OPEB benefits over the next 30 years must be recognized as a long-term liability. Those rules follow from the idea that employees earn OPEB benefits as part of their salary. Once earned, those benefits become a long-term liability that appears on the City’s balance sheet. Rochester can change those benefits any time, but until they do, they constitute a major long-term liability.

This anecdote highlights one of the key points of this chapter: How we account for – or “recognize” – financial activity can have a major impact on how an organization perceives its own financial strengths and weaknesses, and how it might choose to manage its finances in response. That’s why all public managers must know how to analyze financial statements, and know the origins of the numbers that appear in those statements. In other words, they need to know a bit of accounting. That’s the focus of this chapter.

Learning Objectives

After reading this chapter you should be able to:

- Identify an organization’s assets and liabilities.

- Understand how typical financial transactions affect the fundamental equation of accounting.

- Contrast an organization’s assets and liabilities with its revenues and expenses.

- Recognize revenues and expenses on the accrual basis of accounting.

- Contrast the recognition concepts in accrual accounting with cash accounting and fund accounting.

- Understand how routine financial transactions shape an organization’s basic financial statements.

- Prepare rudimentary versions of the three basic financial financial statements.

Core Concepts of Accounting

Now that we’ve toured the basic financial statements, let’s take a step back and go over how we produce those statements. Financial statements are useful because they’re prepared according to generally accepted accounting principles (GAAP). To understand financial statements you must know a few of those principles, and you must know how typical financial transactions shape the numbers you see in those statements. This section covers both these topics.

The Accrual Concept

Most of us organize our personal finances around the cash basis of accounting. When we pay for something, we reduce our bank account balance by that amount. When we receive a paycheck, we increase our bank account balance by that amount. In other words, we recognize financial activity when we receive or spend cash.

Many small organizations also use cash basis accounting. Many small non-profits and small governmental entities like irrigation districts and mosquito abatement districts, for instance, keep separate checkbooks to track the taxes they collect and to account for their payroll and other operating expenses.

But for larger and more complex organizations, cash basis accounting tells an incomplete story. For instance, imagine that Treehouse (the organization in our previous examples) is planning to purchase $20,000 of furniture for its main office. Treehouse will purchase that equipment on credit. That is, they will order the equipment, the manufacturer will deliver that equipment and send an invoice requesting payment, and a few weeks later Treehouse will write the manufacturer a check and pay off that invoice.

This transaction will have a big impact on Treehouse’s balance sheet. It will draw down its cash, and it will bring in a large capital item that will stay with on the balance sheet for several years. Treehouse’s stakeholders should know about this transaction sooner than later.

But on the cash basis those stakeholders won’t know about this transaction until Treehouse pays off the invoice. That might be several weeks away. If it’s toward the end of the fiscal year – and many large purchases happen toward the end of the fiscal year – that transaction might not appear on Treehouse’s financial statements until the following year. That’s a problem.

That’s why most public organizations use the accrual basis of accounting. On the accrual basis, an organization records an expense when it receives a good or service, whether or not cash changes hands. In this case, as soon as Treehouse signs the purchase order to receive the equipment, that equipment will appear as a $20,000 increase in non-current assets on its balance sheet. It will also record – or recognize, in accounting speak – an account payable for $20,000. On the accrual basis we can see how this transaction will affect Treehouse’s financial position now and in the future.

Keep in mind also that accrual accounting assumes the organization is a going concern. That is, it assumes the organization will continue to deliver services indefinitely. If we’re not willing to make that assumption, then accrual accounting does not add value. In some rare cases the audit report will suggest that the auditor believes the organization is not a going concern. In other words, the auditor believes the organization’s financial position is so tenuous, that it might cease operations before the close of the next fiscal year.

We can apply a similar logic on the revenue side. Imagine that Treehouse staff run a day-long outreach program at a local school. This program was designed to sensitize public school teachers about the unique challenges faced by children in the foster care system. They typically charge $2,500 for this type of event. Assume that Treehouse staff deliver the program and then send the school district a bill for their services. Treehouse used a lot of staff time, supplies, travel, and other expenses to produce this program, but they might not get paid for the program for several weeks.

On the cash basis it will be several weeks before we know those expenses had been incurred and that Treehouse had earned $2,500 in revenue. But on the accrual basis, Treehouse would recognize both those expenses and the expected revenue immediately after delivering the program.

These two simple transactions illustrate a key point: If the goal of accounting and financial reporting is to help stakeholders understand an organization’s ability to achieve its mission, then accrual accounting is far better than cash accounting. That’s why the accrual concept is a central principle of GAAP. From this point forward we’ll focus exclusively on how to apply accrual accounting to public organizations.

Recognition and the Fundamental Equation

Accountants spend much of their time on revenue and expense recognition. When accountants recognize a transaction, they identify how that transaction affects the organization’s financial position. We’ll recognize transactions relative to the fundamental equation of accounting. Recall that equation is:

Assets = Liabilities + Net Assets

One of accounting’s central concepts is that the fundamental equation must always balance. In other words, the net effect of any transaction on the fundamental equation must be zero. This is also known as double-entry bookkeeping.

The General Ledger and Chart of Accounts

A chart of accounts is a listing of all the organization’s financial accounts, along with definitions that make clear how to classify or place financial activity within those accounts. When accountants record a transaction they record it in the organization’s general ledger. The general ledger is a listing of all the organization’s financial accounts. When the organization produces its financial statements, it combines its general ledger into aggregated account categories. At the moment, the GAAP produced by the FASB and GASB do not specify a uniform chart of accounts, so account titles and definitions will vary across organizations. Some state governments require non-profits and governments to follow such a chart, but for the most part, public organizations are free to define their chart of accounts on their own.

Consider the previous example:

Transaction 1: Treehouse signs a purchase agreement with Furniture Superstores, Inc. for $20,000 in office furniture. It agrees to pay later.

| Assets = | Liabilities + | Net Assets |

| Furniture + $20,000 | Accounts Payable + $20,000 |

Here we recognize – or “book” – the equipment on the asset side of the equation. Because Treehouse paid on credit, we book an equivalent amount as an account payable on the liability side. Note that the equipment is a non-current asset because Treehouse expects to use it for several years. The account payable, however, is a current liability because Treehouse can expect to pay it off within the fiscal year. This transaction adds to both sides of the fundamental equation, and the net effect on the equation is zero.

What happens three weeks later when Treehouse pays for the equipment?

Transaction 2: Treehouse pays the invoice for audiology equipment received in Transaction 1.

| Assets = | Liabilities + | Net Assets |

| Cash – $20,000 | Accounts Payable – $20,000 |

This transaction decreases both sides of the equation. Cash decreases, but so does accounts payable.

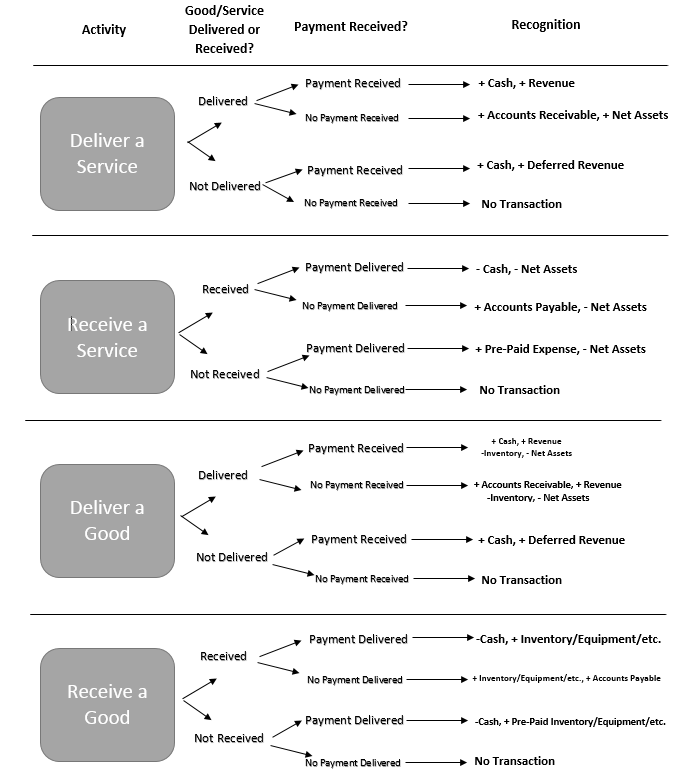

Public organizations execute many different types of transactions in their day-to-day operations. For most of those transactions you can identify the correct accounting recognition by asking a few simple questions:

- Did the organization deliver a good or service?

- Did the organization receive a good or service?

- Did the organization make a payment?

- Did the organization receive a payment?

If the organization delivered a service or received a service, then the transaction probably affects revenues and expenses. Note that revenues increase net assets and expenses decrease net assets. If the organization delivered or received a good, then the transaction likely affects assets, revenues, and expenses. Whether or not the transaction affects a liability has to do with whether a payment was made or received for those goods or services.

Debits and Credits

You’ve probably heard accountants talk about debits and credits. They are the basis for a system of accounting shorthand. In this system every transaction has a debit and a credit. A debit increases an asset or expense account, or decreases a liability or net assets account. Debits are always on the left of the account entry. A credit increases a liability or net assets account, or decreases an asset or expense account. Credits are always on the right of the account entry. Debits and credits must always balance.

To illustrate, let’s say Treehouse delivers a service for $1,000 and is paid in cash. Here we would debit cash and credit services revenue. That entry is as follows:

| Debit | Credit | |

| Cash | 1,000 | |

| Services Revenue | 1,000 |

Note that in this shorthand we don’t include dollar signs.

For another illustration, imagine that Treehouse receives $500 cash in payment of an account receivable. That entry is:

| Debit | Credit | |

| Cash | 500 | |

| Accounts Receivable | 500 |

If Treehouse purchased $750 of supplies on credit, we would debit supplies and credit accounts payable:

| Debit | Credit | |

| Supplies | 750 | |

| Accounts Payable | 750 |

This system is popular because it’s fast, easy to present, and appeals to our desire for symmetry. However, it also assumes you’re familiar with the fundamental equation and how different types of transactions affect it. If you’re new to accounting, this can be a big conceptual leap. That’s why throughout this text we present transactions relative to the fundamental equation of accounting rather than as debits and credits. We encourage you to try out debits and credits as you work the practice problems throughout this text.

The chart below presents these concepts as a flow chart. Take Transaction 1 as an example. Recall that in this transaction Treehouse agreed to purchase audiology equipment and pay for it later. Has it received a good or service? Yes, it has received a good. To reference the flow chart, this transaction therefore starts on the bottom left corner of the chart at “Receive a Good – Received.” Has it made a payment for that good? No. That’s why we follow the “Payment Not Delivered” line of the chart, and we see we would recognize this transaction as an increase in equipment (in this case office furniture) along with an increase in accounts payable, since Treehouse will pay for this equipment later.

With this simple framework we can do the accounting recognition for most of the basic types of transactions a typical public organization will encounter. That said, this framework does cover certain types of transactions, and sometimes different types of non-profit and governmental transactions have unique rules that apply just in those contexts. We’ll cover those more nuanced accounting rules in the lectures on non-profit financial management and government financial management.

Transactions that Affect the Balance Sheet

Transaction 1 and Transaction 2 are good examples of financial activity that affect the balance sheet. You should be aware of a few others.

Some transactions affect only the asset side of the equation. For instance, imagine if Treehouse had purchased the audiology equipment with cash rather than on credit.

LIFO and FIFO

Inventory presents some unique challenges for accounting recognition. Organizations use inventory all the time, so most have to estimate the value of inventory assets at any moment. There are several ways to produce those estimates, including First In, First Out (FIFO) and Last In, First Out (LIFO). Organizations that use a lot of inventory, small changes to inventory valuation can produce big changes to the reported value of inventory and inventory expense. That said, for most public managers, the technical aspects of inventory valuation fall squarely within the realm of “know what you don’t know.”

Transaction 1a: Treehouse buys $20,000 of office furniture with cash.

| Assets = | Liabilities + | Net Assets |

| Cash – $20,000 | ||

| Equipment + $20,000 |

Here Treehouse has swapped a liquid asset (cash) for a less liquid asset (equipment). Cash decreases but equipment increases, so the effect on the fundamental equation is zero. This same approach also applies to current assets like supplies and inventory.

Treehouse needs services that it purchases and then uses later. Examples include insurance, certifications, subscriptions, professional association memberships, and the like. Treehouse will purchase these services in advance, and then use or “expense” them throughout the fiscal year. These are known as pre-paid expenses. Conversely, this is also why assets are sometimes called “unexpired costs.” For example:

Transaction 3: Treehouse pays $1,500 for three of its staff to renew their annual memberships to the National Association for Social Workers .

| Assets = | Liabilities + | Net Assets |

| Cash – $1,500 | ||

| Pre-Paid Expense + $1,500 |

Organizations like Treehouse almost always have financial assets. Assets like buildings and equipment are tangible; they have physical substance. Financial assets are intangible assets. They do not have physical substance, but they’re valuable because they represent a contractual claim. For instance, if Treehouse owns shares of Boeing stock, they have a right to the dividends and other benefits that Boeing imparts on its shareholders. Treehouse can also sell its Boeing stock to another investor in exchange for cash. So even though Boeing stock is intangible, it’s quite valuable.

We account for financial assets differently. If Treehouse buys $500 of supplies, it will record those supplies on its balance sheet at the $500 it cost to acquire them. In accounting, this is known as historical cost. Supplies are valuable because they help Treehouse deliver its services. They’re not valuable as an investment. That is, we would not expect Treehouse to buy supplies at one price and sell them at a higher price as a way of earning revenue. That’s why historical cost is the appropriate way to value most of Treehouse’s assets.

Financial assets are different because they are, by definition, for investment. Treehouse invests in Boeing stock precisely because it expects the price of that stock to increase. For that reason, if we want to know if investments are adding value to Treehouse’s mission, we need to see the market value of those investments. If those investments have become more valuable, they’re contributing to the mission. If they’ve lost value, they’re taking resources away from the mission.

That’s why we record financial assets at fair value rather than historical cost. Financial assets are still “goods”, but we account for them differently.

For most financial assets fair value means the current, observed market price. Investments the organization intends to hold less than a year that have a clear market price and can be easily liquidated are known as marketable securities. Investments the organization intends to hold longer than one year, or that are less liquid, are known simply as investments. Marketable securities are a current asset. You’ll see investments classified as both a current and non-current asset.

Reliability and Fair Value Estimates

GAAP (specifically, FASB Statement 157) classifies investments by a three-level scheme according to availability of market prices. Level 1 assets have a quoted price on a public exchange. This includes stocks and money market funds, among others. Level 2 assets are primarily sold “over-the-counter,” like corporate bonds, futures contracts, stock options, and others. Here the owner must report an estimated price based on prices of comparable assets that have traded recently. Level 3 assets are not bought and sold and therefore do not have a market price. This includes more exotic investments like hedge funds and private equity. For Level 2 and Level 3 assets, the owner must discount the reported asset value to account for uncertainty in that valuation.

When an organization puts money into an investment we record that investment at the purchase price. In that sense, at the time of the initial investment, fair value is not altogether different from historical cost. For example:

Transaction 4: Treehouse purchases 500 shares of Boeing stock at $145 per share.

| Assets = | Liabilities + | Net Assets |

| Cash – $72,500 | ||

| Investments + $72,500 |

If Treehouse later sells this stock before the end of the fiscal period for more than the original recorded value, the increase in value is called a realized gain and is recorded as an increase in net assets.

For example:

Transaction 5: Treehouse sells its 500 shares of Boeing stock at $155 per share. Recall that it originally purchased that stock at $145 per share.

| Assets = | Liabilities + | Net Assets |

| Cash + $77,500 | Realized Gain on Investments + $5,000 | |

| Investments – $72,500 |

Realized gains have roughly the same effect on Treehouse’s financial position as a profitable program. Both increase Treehouse’s overall net assets and available liquid resources. However, since Treehouse did not “earn” this realized gain by providing a good or service, we don’t call that gain a revenue. The opposite is also true. If Treehouse sold its Boeing stock for less than the original purchase price, it would record a realized loss.

Fair value accounting is a bit more complex – and interesting! – than historical cost, because it requires organizations to restate the value of their financial assets at the end of every fiscal period. For Treehouse, this means they must record a new value for their Boeing stock at the end of the fiscal year, even if they don’t buy or sell it. If the stock’s price at the time of the re-statement is greater than the previously-recorded price, Treehouse will record an increase in investments on the balance sheet and an unrealized gain on the income statement. For example:

Transaction 6: At the end of the current fiscal period, Treehouse’s accountant estimates and records a fair value for Boeing stock of $150 per share. Recall that during this same fiscal period Treehouse purchased 500 shares of Boeing stock at $145 per share.

| Assets = | Liabilities + | Net Assets |

| Investments + $5,000 | Unrealized Gain on Investments + $5,000 |

Unrealized gains and losses do not directly affect cash or any other resources that Treehouse has available to deliver services. That’s why we euphemistically call unrealized gains paper gains and unrealized losses paper losses. But they do matter indirectly because they represent a potential gain or loss in available resources. If Treehouse’s holdings of Boeing stock contribute substantial unrealized gains for several years, management might consider selling those holdings, realizing those gains, and investing in capital projects, equipment, or some other resources that directly benefit service delivery.

Of course, sometimes organizations must borrow money to purchase equipment, build a new facility, or cover other expenses. The most typical form of borrowed money is a loan from a bank. The initial accounting recognition of such a loan is simple. The borrowed money, or loan principal, is recognized as a liability that offsets the cash received from the loan:

Transaction 7: Treehouse borrows $30,000 from a local bank to finance the purchase of a van to transport students. The loan is for 5 years at 7% annual interest, and interest is paid on an annual basis. Treehouse purchases the van immediately after the loan closes.

| Assets = | Liabilities + | Net Assets |

| a) Cash + $20,000 | Loan Payable +20,000 | |

| b) Capital Item: Van + $20,000 | ||

| Cash – $20,000 |

Public organizations can also borrow money using bonds, notes payable, mortgages, or lines of credit. Bonds typically have a longer maturity than loans (i.e. the organization pays them off over a longer time). Moreover, they are always paid back at a fixed rate of interest, whereas some loans, have variable rates or floating rates that fluctuate over time. Notes payable are short-term loans, usually less than 18 months. A mortgage is a loan secured by with a real estate purchase. A line of credit is an agreement between a public organization and a bank that allows that organization to borrow money on short notice, at a pre-determined interest rate. A line of credit can be especially useful if an organization has unpredictable cash flows, or if it is considering taking on a large capital project.

That said, transactions related to repaying debt present some special accounting considerations. Consider the previous example. Here the $20,000 loan principal is clearly a liability. At the same time, the interest on that loan principal is not necessarily a separate liability. Treehouse has agreed to pay interest on the loan each year the loan is active. It has not agreed in advance to pay the full amount of interest on the loan for all five years the loan might be active. So instead, interest payments on this loan, and most loans like it, is considered an expense. Treehouse pays the bank to use the bank’s money. It’s paying the bank for the “service” called access to credit. So to illustrate:

Transaction 8: Treehouse makes its first annual principal and interest payment on the loan described in Transaction 7.

| Assets = | Liabilities + | Net Assets |

| Cash – $5,400 | Loan Payable – $4,000 | Interest Expense – $1,400 |

Since the $20,000 loan is paid off over five years, the annual payment on the principal is $4,000 or ($20,000/5 years). The interest rate was 7%, so we compute the annual interest payment as ($20,000 X 7% = $1,400). That interest payment becomes the interest expense. In year 2 the loan balance would be $16,000, so Treehouse would pay $5,120 in cash to cover a $4,000 payment on the loan principal and $1,120 of interest expense ($16,000 X 7%). If Treehouse chose to not make its interest payments, the interest expense would instead be recognized as a liability.

Transactions that Affect the Income Statement

Treehouse’s mission demands that it focus most of its efforts on delivering services. As a result, most of its day-to-day financial activity will involve revenues and expenses. Revenues and expenses affect the income statement.

For instance, recall from the earlier discussion that that Treehouse delivers outreach programs at local schools. When one of those programs is delivered it records a revenue.

Transaction 9: Treehouse delivers an outreach program at a local school and sends that school district an invoice for $2,500.

| Assets = | Liabilities + | Net Assets |

| Accounts Receivable + $2,500 | Program Revenue + $2,500 |

Here Treehouse has earned revenue because it delivered a program. It recognizes those earned revenues as a “program revenue.” This increases net assets. Did it receive a payment? No. Therefore, it recognizes accounts receivable on the asset side. Three weeks later, when it collects payment it will convert that receivable into cash. That transaction is as follows:

Transaction 10: Treehouse receives payment from the school district for the outreach program delivered three weeks ago.

| Assets = | Liabilities + | Net Assets |

| Cash + $2,500 | ||

| Accounts Receivable – $2,500 |

Transaction 10 does not affect the income statement, but keep in mind that the transaction that resulted in the original accounts receivable did.

In Transaction 9 Treehouse earned a revenue. Of course, that revenue didn’t just appear. It incurred a variety of expenses – staff time, travel, supplies, etc. – to deliver that service. When should it recognize the expenses incurred to deliver that program? One of the core principles of GAAP is the matching principle. That is, when we recognize a revenue we try to recognize the expense that was incurred to produce that revenue. This is not always clear for services. Services are driven by personnel, and we incur personnel expenses constantly. Services also require equipment, certifications, and other assets where it’s not always what it means to “use” that asset.

The matching principle is much more applicable when the transaction in question involves a good rather than a service. When an organization sells a good, it presumably knows what it cost to produce that good. Those costs, known generally as cost of goods sold, are immediately netted against the revenue collected from the transaction. That’s why in the flow chart above you see some additional recognition related to delivering goods.

That said, public organizations do encounter a few typical transactions that account for many of their expenses. First, and most important, when Treehouse pays its staff it recognizes an expense for salaries.

Transaction 11: Treehouse recognizes and pays bi-weekly payroll of $15,000.

| Assets = | Liabilities + | Net Assets |

| Cash – $15,000 | Wages and Salaries Expense – $15,000 |

Payroll is critical because personnel is the largest expense for most public organizations. From the organization’s perspective, payroll is an expense because the organization is receiving a service from its employees. That “service” is their day-to-day work. This is different than if the organization were to hire the one-time services of, say, a plumber from another company to fix some leaky pipes. But the accounting recognition is essentially the same.

Treehouse incurred other expenses to deliver the school outreach program. The program was held at a school 100 miles from Treehouse headquarters. The two staff members who delivered that program rode together to that off-site location in one of their personal vehicles. They will expect to be reimbursed. Many non-profits and government organizations follow the federal government’s guidance and reimburse mileage at a fixed rate of 57.5 cents per mile.

Transaction 12: Treehouse pays mileage expenses of 57.5 cents/mile for a 200 mile round trip.

| Assets = | Liabilities + | Net Assets |

| Cash + $115 | Mileage expense – $115 |

To deliver the outreach program staff also used up $50 of construction paper, duct tape, and other supplies. Recall that supplies are an asset. To account for the full cost of the outreach program we should also recognize that Treehouse “used up” or “expensed” these assets. For example:

Transaction 13: Treehouse expenses $50 in supplies related to its outreach program.

| Assets = | Liabilities + | Net Assets |

| Supplies – $50 | Supplies Expense – $50 |

Recall that Treehouse also pre-pays for many of its ongoing expenses, such as insurance and certifications. The choice of when to expense pre-paid items is admittedly arbitrary. Most organizations have accounting policies and assumptions that state when and how this happens. Most will record those expenses monthly or quarterly. Recall that Treehouse pre-paid $1,500 for some annual professional association memberships. Assume that it expenses those memberships quarterly. At the end of the first quarter since the membership was paid, it would record:

Transaction 14: Treehouse records quarterly professional association membership expenses. Recall that annual association dues are $1,500.

| Assets = | Liabilities + | Net Assets |

| Prepaid Expenses – $375 | Association Membership Expense – $375 |

Keep in mind that after this first portion is expensed $1,125 in pre-paid association membership expenses remains on the balance sheet. This transaction simply expenses out one-quarter of the original $1,500 asset.

Another crucial set of accounting assumptions are around depreciation. Depreciation is when an organization expenses a long-term asset. To deliver its services, Treehouse must use up some portion of its building, vehicles, audiology equipment, and other capital items. Like with salaries and pre-paid expenses, it’s not always clear when and how those assets are “used up.” Some of that use is normal wear and tear. Some of it might happen if the asset bears a particularly heavy workload. Some capital items might be largely out of use, but they will lose value because each year that goes by, they’ll become harder for Treehouse to sell should they choose to liquidate them.

In the absence of a detailed way to measure that wear and tear, accountants typically deal with depreciation through simplifying assumptions. One of the most common is to use straight-line depreciation also known as the straight-line method. Under the straight line method, when an organization purchases a new capital asset it determines the length of time it can use that asset to deliver services. This is known as the useful life. The organization must also determine the value of that asset once it’s no longer useful for delivering services. This is the salvage value or residual value or value at write-off. If we subtract the salvage value from the historical cost, and divide by the useful life, we get the annual depreciation expense.

There are many other methods to calculate and allocate depreciation expenses, including the accelerated method, declining balance, sum-of-the-years method, and others. Different assumptions can produce rather different estimates and allocations of depreciation expenses.

For an example let’s return to Treehouse’s office furniture. Recall that it purchased that furniture for $20,000. Say that equipment has a useful life of 10 years. Assume also that at the end of its useful life Treehouse will be able to sell it for $2,500 to a used furniture distributor. To calculate the annual depreciation expense using the straight-line method, we take ($20,000 – $2,500)/10 = $1,750 per year. Using this assumption, we could record the following transaction:

Transaction 15: Treehouse records annual depreciation expense on its audiology equipment of $1,750.

| Assets = | Liabilities + | Net Assets |

| Equipment – $1,750 | Depreciation Expense – $1,750 |

After this first recording for depreciation expense, the value of the audiology equipment reflected on Treehouse’s balance sheet will be $18,250, or ($20,000 – $1,750).

This same concept of spreading out the useful life also applies to intangible assets. Say, for example, Treehouse purchases some specialized case management software that allows it to safely store foster care children’s school and medical records. That software requires Treehouse to purchase a five-year license. That license is an intangible asset, but it has a lot of value with respect to Treehouse’s capacity to deliver services over the next five years. In this case, Treehouse would amortize that asset. It would use up some portion of that license – usually an equal amount, akin to straight-line depreciation – value each year in an amortization expense. If it purchased a five-year license for $5,000 it would record a $5,000 at the time of that purchase. Thereafter, if it amortized that license in equal annual installments, the effect on the fundamental equation is as follows:

Transaction 16: Treehouse records amortization expense on its cash management software license of $1,000.

| Assets = | Liabilities + | Net Assets |

| Software License – $1,000 | Amortization Expense – $1,000 |

Following this first amortization expense, the license would remain on Treehouse’s balance sheet at $4,000.

Finally, we must consider what happens if Treehouse is paid for a service before it delivers that service. This is known as deferred revenue or unearned revenue. Deferred revenue is a liability because it represents a future claim on Treehouse resources. By taking payment for a service not yet delivered, Treehouse is committing future resources to deliver that service. Once it delivers that service it incurs expenses and removes that liability.

For example, imagine that Treehouse arranges another $1,500 outreach program with a different local school district. That school district is nearing the end of its fiscal year, so it agrees to pay Treehouse for the program several weeks in advance. Once it receives that payment it would recognize that transaction as follows:

Transaction 17: Treehouse takes a $1,500 payment for a school outreach program to be delivered in the future.

| Assets = | Liabilities + | Net Assets |

| Cash + $1,500 | Deferred Revenue + $1,500 |

This initial transaction does not affect the income statement. However, when Treehouse delivers the program a few weeks later, it records the following:

Transaction 18: Treehouse delivers the school outreach program for which it was paid previously.

| Assets = | Liabilities + | Net Assets |

| Deferred Revenue – $1,500 | Program Revenue + $1,500 |

The key take-away from all these income statement transactions is simple: For Treehouse to be profitable, it must take in more revenue from its programs and services than the total payroll and other expenses it incurs to deliver those programs. If those revenues do exceed those expenses, then its net assets will increase. If expenses exceed revenues, then net assets will decrease. That’s why, as previously mentioned, change in net assets is the focal point for much of our analysis of an organization’s financial position.

Recognition Concepts for Special Circumstances

Pledges and Donor Revenues

Non-profits aren’t traditionally paid for their services. In fact, large parts of the non-profit sector exist precisely to provide services to those who can’t pay for those services. The homeless, foster children, endangered species, and others come to mind immediately. Non-profits depend on donations and contributions to fund those services.

At the outset, it might seem like the accrual concept breaks down here. How can a non-profit recognize a revenue if the recipients of its services don’t pay for those services? In non-profit accounting, we address this problem by simply drawing a parallel between donations and payments for service. Donors who support a non-profit are, in effect, paying that non-profit to pursue its mission. Donors may not benefit directly from their contribution, but they benefit indirectly through tax benefits and a feeling of generosity. Those indirect benefits are substantial enough to support the accrual concept in this context.

Practically speaking we address this with a category of net assets called “donor revenue” and a category of assets called “pledges receivable.” For example:

Transaction 19: Treehouse received pledges of gifts in the amount of $2,500 to be used as its Board of Directors considers appropriate.

| Assets = | Liabilities + | Net Assets |

| Pledges Receivable + $2,500 | Donor Revenue + $2,500 |

Most donor revenues happen through the two-step process suggested here. A donor pledges to donate and that pledge is recognized as pledges receivable. GAAP stipulates that a signed donor card or other documented promise to give constitutes a pledge that can be recognized. Once the donor writes Treehouse a check for the pledged amount, Treehouse would book the following:

Transaction 20: Treehouse collects the $2,500 pledge recognized in Transaction 19.

| Assets = | Liabilities + | Net Assets |

| Cash + $2,500 | ||

| Pledges Receivable – $2,500 |

Restricted Net Assets

One of the big financial questions for any non-profit is how much control does it have over where its money comes from and where its money goes? In a perfect world, non-profit managers would fund all their operations through unrestricted program revenues and donations. It’s much easier to manage an organization when there are no strings attached to its money.

Most non-profit managers aren’t so lucky. Virtually all non-profits have some sort of restrictions on when and how their organization can spend money. Donors who want to ensure the organization accomplishes specific goals will restrict how and when their donation can be spent. Governments do the same with restricted grants or loans. Some resources, namely endowments, can’t ever be spent.

Restricted resources usually appear as restricted net assets. There are two types: temporarily restricted net assets, and permanently restricted net assets. Temporarily restricted net assets are restricted with respect to purpose and/or timing. Permanently restricted net assets can never be spent or converted to cash. Consider this example:

Transaction 21: Treehouse receives a cash donation of $5,000. That gift was accompanied by a letter from the donor to Treehouse’s executive director requesting that the donation be used for staff development.

| Assets = | Liabilities + | Net Assets |

| Cash + 5,000 | Donor Revenue (temporarily restricted) + $5,000 |

This is a typical temporarily restricted contribution. The donor has specified how Treehouse will use these donated resources. We’d see a similar restriction if the donor had specified that the donation could not be spent for some period of time.

Our accounting recognition for net asset restrictions is not unlike other transactions that affect the income statement. The main difference is that with restricted net assets we have to take the additional step of “undoing” the restriction once the donor’s conditions have been satisfied. For instance:

Transaction 22: Treehouse staff attend a national training conference. Travel, lodging, and conference registration expenses were $3,990. Staff are reimbursed from the resources donated in Transaction 21.

| Assets = | Liabilities + | Net Assets |

| a) | Donor Revenue (temporarily restricted) – $3,990 | |

| Donor Revenue (unrestricted) + $3,990 | ||

| b) Cash – $3,990 | Professional Development Expense – $3,990 |

The first part of this transaction converts the temporarily restricted donor revenue to unrestricted revenue. Treehouse is able to do this conversion because it has met the donor’s condition: staff attended a professional development conference. Once that restriction is satisfied, the second part of the transaction recognizes the professional development expenses. After this transaction, $1,010 of the original temporarily restricted net assets remain on Treehouse’s balance sheet and income statement.

We often think of temporarily restricted net assets in terms of restricted donor contributions. But keep in mind that long-term assets like equipment donated for a specific programmatic goal also tend to appear as temporarily restricted net assets. The same applies to donated buildings, equipment, furniture, or other long-term assets where the donor requires that the recipient organization not sell the asset for some period of time.

Permanently restricted net assets most often appear as endowments. An endowment is a pool of resources, usually investments, that exists to generate other assets to support the organization’s mission. By definition, the donation that comprises the original endowment – also known as the corpus – cannot be spent. In practice, the accounting recognition for the formation of an endowment looks like this:

Transaction 23: An anonymous benefactor donates to Treehouse 3,500 shares of Vanguard’s Global Equity Investor Fund (a mutual fund). The gift stipulates that the annual investment proceeds from that stock support general operations, and that Treehouse cannot under any circumstances liquidate the endowment. At the time of the gift, the investment had a fair market value of $100,000.

| Assets = | Liabilities + | Net Assets |

| Endowment Investments $100,000 | Donor Revenue (permanently restricted) + $100,000 |

Once the endowment is established it generates investment earnings that become unrestricted net assets. These unrestricted net assets are usually recorded as a “distribution from endowment,” or “endowment revenue.”

Transaction 24: At the end of the Endowment’s first fiscal year, Treehouse receives a dividend check from Vanguard (the mutual fund manager) for $4,500.

| Assets = | Liabilities + | Net Assets |

| Cash $4,500 | Distribution from Endowment (unrestricted) + $4,500 |

Note that endowment earnings do not always immediately become unrestricted net assets. In fact, many non-proft boards prefer to reinvest endowment earnings back into the endowment. This allows the permanently restricted net assets to grow and produce more unrestricted net assets later. Also note that some endowments are structured so that the investment proceeds fund specific programmatic needs. In those cases the investment proceeds are temporarily restricted net assets, not unrestricted net assets.

In-Kind Contributions

In addition to donated revenue, non-profits also depend on donations of goods and services. These are called in-kind contributions. According to GAAP, a non-profit can record as an in-kind contribution specialized services that it would otherwise purchase. In most cases this means professional services like attorneys, counselors, accountants, or professional development coaches. We recognize in-kind services once they’ve been received, and all the recognition happens in the net assets part of the fundamental equation. For instance:

Transaction 25: A local attorney agrees to represent Treehouse “pro bono” in a lawsuit filed by the family of a former student. The attorney’s regular rate is $500/hour, and the case requires 10 billable hours. Without these pro bono services Treehouse would have had to hire outside counsel.

| Assets = | Liabilities + | Net Assets |

| Donated Services Revenue + $5,000 | ||

| Donated Services Expense – $5,000 |

If in-kind contributions don’t result in a net increase or decrease in net assets, then why do we bother recognizing them? Because recognizing them helps us understand the organization’s capacity to deliver its services. If it had to pay for otherwise donated goods and services, those purchases would certainly affect its financial position and its service-delivery capacity.

Some in-kind contributions produce both an in-kind contribution and a donated asset. This is especially important for services like carpentry or plumbing. For example:

Transaction 26: A local contractor agrees to donate the labor and materials to construct a new playground at Treehouse. Total labor expenses for the project were $3,000, and the contractor purchased the new playground equipment for $8,000.

| Assets = | Liabilities + | Net Assets |

| Donated Services Revenue + $3,000 | ||

| Donated Services Expense – $3,000 | ||

| Equipment + $8,000 | Donated Equipment + $8,000 |

Bad Debt

Unfortunately, pledges don’t always materialize into contributions. Sometimes the donors’ financial situation changes after making a pledge. Sometimes they have a bit too much wine at a gala event and promise more than they can give. Sometimes they simply change their mind. For these and many other reasons, non-profits rarely collect 100% of their pledged revenues.

Most non-profits re-evaluate at regular intervals, usually quarterly or semi-annually, the likelihood they’ll collect their pledges receivable. Once they determine a pledge cannot or will not be collected, the amount of pledges receivable is adjusted accordingly. The accounting mechanism to make this happen is an expense called “bad debt.” Bad debt is specific type of reconciliation entry known as a contra-account. Like with depreciation, amortization, and other reconciliations, entries in contra-accounts do not affect cash flows. They are simply “write-off” transactions to offset the reduction of an asset, in this case pledges receivable. Consider this example:

Transaction 27: Treehouse determines it will not be able to collect $3,000 of pledges made earlier in the fiscal year.

| Assets = | Liabilities + | Net Assets |

| Pledges Receivable – $3,000 | Bad Debt Expense – $3,000 |

When is a pledge deemed uncollectable? That depends on the organization’s policies. GAAP rules only state that an organization must have a policy that dictates how it will determine collectability. Non-profits’ policies to that effect state that a pledge is uncollectable after a certain number of days past the close of the fiscal year, or if the donor provides documentation that the pledge is cancelled.

Pledges receivable among non-profits is the most common type of asset to be offset by bad debt expense. However, be aware that bad debt is not unique to non-profits or to pledges receivable. For-profits and governments can and often do record bad debt expenses, and those expenses can apply to any receivable, including accounts receivable for goods services previously delivered, or grants receivable from a donor or a government.

For Governments – Recognition Concepts for Modified Accrual Accounting

Governmental funds and the modified accrual basis of accounting on which they are prepared, focus on expendable financial resources. Taxpayers want to know their government used its current financial resources to meet its current financial needs. This is, once again, a core part of how accountants think about inter-period equity. If a government pushes costs into future fiscal periods, then future taxpayers will have to either pay more taxes or expect less in services.

For this reason, when thinking about the fund financial statements, we need to re-think how we recognize certain revenues. Instead of focusing recognition on when a government “earns” a revenue, we focus instead on whether that revenue is or will be available to cover costs during that same fiscal period. Specifically, GAAP for governments requires that for a revenue to be recognized in the current fiscal period is must be measurable and available.

- Measurable means the government can reasonably estimate how much it will collect. For taxes like property taxes, this is easy. They’re measurable because the government determines what a taxpayer owes and then sends a bill. But for sales taxes, income taxes, or other revenues measurable might require some reasonable estimates.

- According to GAAP, available means a revenue is recognized during the fiscal period for which it’s intended to pay liabilities or up to 60 days after the close of that fiscal period. Again, this is not always clear. For instance, when does an intergovernmental grant become available if it requires the government to perform certain services or incur certain expenditures?

To address this problem, government GAAP establishes a few basic types of revenues and a set of recognition concepts that applies to each. Here’s a few hypothetical transactions to illustrate those concepts. We’ll recognize all these transactions in the fund financial statements, and thus, on the modified accrual basis. If we recognized these transactions in the government-wide statements the normal accrual concepts would apply. To simplify, we restate the fundamental equation as Assets = Liabilities + Fund Balance.

In Chapter 1 we said the property tax is the local revenue workhorse. So let’s start there[1].

Let’s assume Overland Park sends out its annual property tax bills in January. Those bills are based on the City’s assessed value, property tax rates, and any applicable tax preferences. After running these calculations OP determines it will send out $515 million in property tax bills. From past experience, it also knows it won’t collect a certain portion of those bills.

Property taxes are imposed non-exchange revenues, meaning they are not related to a specific transaction. As such, they become measurable and available when the government imposes them. As soon as they’re imposed, OP has a legal claim to them. In this case, to impose them means to levy them, or to send out property tax bills.

Transaction 28: In January 2015 Overland Park levies property taxes of $515 million for the year. It estimates $15 million will be uncollectible.

| Assets = | Liabilities + | Fund Balance |

| Property Taxes Receivable +$515 | Deferred Property Tax Revenue + $500 | |

| Allowance for Uncollectible Property Taxes + $15 |

This recognition records OP’s property tax levy. What happens then when OP collects these property taxes?

Transaction 29: Throughout 2015 Overland Park collects $410 million of property taxes. It collects $30 million of the remaining 2015 taxes during each of the first three months of 2016 and estimates that the $15 million balance will be uncollectible.

| Assets = | Liabilities + | Fund Balance |

| a) Cash +$470 | ||

| Property Taxes Receivable -$470 | ||

| b) | Deferred Property Tax Revenue -$410 | Property Tax Revenue +$410 |

| c) | Deferred Property Tax Revenue -$60 | Property Tax Revenue +$60 |

| d) Property Taxes Receivable -$15 | Property Taxes Receivable – Delinquent $-15 |

We recognize these collections in four different parts. Part a) recognizes the collections of property taxes during 2015 and during the first two months of 2016. OP collected $30 million in each of the first three months, but according to GAAP, only the first 60 days are available. Part b) converts deferred revenues into property tax revenues for the taxes collected during 2015. Part c) does the same for the taxes collected during the first two months of 2016. Part d) recognizes a write-down of the uncollectible property taxes.

Note that this recognition approach would also apply to the other main type of imposed non-exchange revenues: fines and fees. Those revenues are also recognized when they are levied or imposed.

Sales and income taxes are the most common type of derived taxes, meaning the taxes collected are derived from some other transaction. For derived taxes, the revenues become measurable and available when the underlying transaction takes place. For sales taxes, those transactions are taxable retail sales. For income taxes, it’s a bit more abstract. There the “transaction” in question is when an employer pays wages to an employee, and that transaction denotes the earnings on which the income tax is based.

Let’s look at a hypothetical sales tax recognition in OP:

Transaction 30: In December 2015 merchants in Overland Park collect $20 million in local sales taxes; $12 million are collected prior to December 15 and must be remitted by February 15, 2016; the remaining $8 million must be remitted by March 15, 2016. How should OP recognize these December 2015 sales?

| Assets = | Liabilities + | Fund Balance |

| Sales Taxes Receivable +$20 | Sales Tax Revenue +$12 |

|

| Deferred Sales Tax Revenue + $8 |

According to GAAP, OP should recognize the assets from derived revenues during the period when the underlying transaction takes place. That’s why it records all $20 million as sales taxes receivable. At the same time, it will only collect $12 million within 60 days of the end of the fiscal year, so only that portion is considered available and should be recognized now. The remaining $8 million will become available later, so for now, it’s considered deferred revenue. We would see a similar pattern with income taxes and other derived revenues.

A government recognizes an inter-governmental grant when it has satisfied all the eligibility requirements. Only then are grants considered measurable and available.

Transaction 31: In October 2015 Overland Park is notified that it will receive a $15 million grant from the state’s Clean Water Revolving Fund. The funds, transmitted by the state in December 2015, must be used for stormwater infrastructure upgrades, but may be spent at any time.

| Assets = | Liabilities + | Fund Balance |

| Cash +$15 | ||

| Grant Revenue + $15 |

The State has placed a purpose restriction on this grant. Purpose restrictions do not affect the measurability or availability of the grant revenues. That said, because they are subject to a purpose restriction, OP should recognize these revenues in a special revenue fund.

Many intergovernmental grants take the form of reimbursements. In this case, the revenues are not available until the government incurs the allowable costs stipulated by the grant.

Transaction 32: In December 2015 Overland Park is awarded a grant of $400,000 to train community police officers. During the year it spends $300,000 in allowable costs, for which it is reimbursed $250,000. It expects to be reimbursed for the $50,000 balance in January 2016 and to expend, and be reimbursed, for the remaining $100,000 of its grant throughout 2016. It must incur allowable costs to remain eligible for the grant.

| Assets = | Liabilities + | Fund Balance | |

| a) CashBalance -$300,000 | Expenditures to train police officers -$300,000 | ||

| b) Cash +$250,000 | Grant revenue +$300,000 | ||

| Grants Receivable +$50,000 |

For this grant OP must first incur the requisite expenditures before it recognizes the grant revenues. In part a) it incurs those expenditures. In part b) it recognizes that it was reimbursed $250,000 cash, it records grants receivable for the portion it expects to collect within 60 days of the end of the fiscal year, and records the $300,000 in grant revenue.

And finally, let’s look at another unique revenue recognition treatment: sales of fixed assets. It’s not uncommon for governments to sell buildings and other fixed assets. In the fund financial statements the value of such a sale is equal to the sale proceeds. This seems simple, but it’s quite different from the government-wide statements, where we’d recognize the difference between the sale proceeds and historical cost plus accumulated depreciation.

Transaction 33: On December 31, 2015 Overland Park purchases a new police car for $40,000. On January 2, 2016 the vehicle is damaged in an accident. The City is able to sell the nearly demolished vehicle for $5,000.

| Assets = | Liabilities + | Fund Balance |

| Cash +5,000 | ||

| Other Financing Sources – Sale of Vehicle + $5,000 |

It might seem strange that $35,000 worth of a $40,000 vehicle was lost, but the only impact on OP’s governmental funds financial statements is an increase in cash. And yet, that’s precisely how we would recognize this transaction on the modified accrual basis. Why? Because we do not recognize fixed assets in the governmental fund statements, because those funds are focused on near-term financial resources. Fixed assets are, of course, a long-term financial resource. Fortunately for the readers of OP’s financial statements, on its Statement of Net Position OP would recognize the lost $35,000 of asset value as an asset “write off” or similar expense.

Expenditure Recognition Concepts

An expenditures in the governmental funds is, according to GAAP, a decrease in the net financial resources. An expense is, on the accrual basis, a reduction of overall net assets. How are they different? Or, to put it more practically, when are expenses not expenditures?

Most of governments’ major expense items result are expenditures because they result in a reduction of financial resources. When a government pays salaries it has less cash and, in turn, less current financial resources to apply elsewhere. So practically speaking, expenditures and expenses are not that different.

There are, however a few instances where expenses are not expenditures. If a government agrees to pay a legal settlement, it will recognize an expenditure only if that settlement is paid out of current financial resources. If that payment is paid by the government’s insurance company, or is paid out of long-term financial reserves, then no expenditure is recognized. Another is repayments of long-term debt. Here a government reports an expenditure as payments are made, but unlike on the accrual basis, interest on the debt is not accrued. This also applies to other occasional transactions in areas like inventory and pre-paid items. But in general, most expenditures are recognized much the same as expenses. For a full treatment of expenditure recognition concepts consult one of the many fine textbooks on governmental accounting.

Practice Problems

- The Museum of Contemporary Art (MCA) is the recipient of a $1,000,000 cash gift from Mr. and Mrs. Carter. The donors have asked the museum to create an endowment in their name in the amount of $750,000 and use all other funds to curate a collection of contemporary music. The donors expect MCA to put up the contemporary music collection in summer 2017. What impact, if any, would this transaction have on MCA’s assets, liabilities, and/or net assets. Be sure to identify whether they are affected negatively (-) or positively (+).

- The Evans Schools of Public Policy and Governance held its annual Fellowship Dinner on October 29, 2015. The event raised $560,000 in pledges and cash contributions. As of November 30th, the school had received $350,000 of the $560,000.

- The Director of Finance and Administration projects 5 percent of all pledges would not be collected. How much should the Evans School report in pledges receivable?

- Following a successful fundraiser event, Dean Archibald awarded current and incoming students $450,000 in financial aid and support beginning July 2016. What impact, if any, would this transaction have on the School’s assets, liabilities, and/or net assets. Be sure to identify whether they are affected negatively (-) or positively (+).

- Dorchester Home Health Services (DHHS) is a private, nonprofit home health agency founded in 1992 by four retired nurses. At the start of FY 2015, DHHS reported $593,298 in fixed assets (net of depreciation). The nonprofit purchased four vehicles, in cash, at cost of $75,000. Assuming that these vehicles have a useful life of four years and a salvage value of $10,000, how much should DHHS report in fixed assets (net of depreciation) at the end of year if depreciation expense on the existing fixed assets was expected to be $33,450.

- The Museum of Contemporary Art (MCA) operates a gift shop and coffee bar. The gift shop reported $1,249,066 in revenues (all cash sales). Payroll expenses for the year were $210,235. The Museum purchased $328,805 in inventory (for the gift shop) and $140,707 in supplies (for the coffee bar) and reported a balance of $44,380 in inventory and $7,035 in supplies. Assuming all purchases and expenses had been paid in full, how much did the gift shop report in profits or losses in its gift shop operaitons for FY 2015.

- The National Breast Cancer Foundation (NBCF) has over the years assigned 2/3rds of its assets to investments (mutual funds, equities, bonds etc.). At the start of FY 2015, NBCF reported $4,759,863 in investments. Over the next 12 months, NBCF transferred $607,938 from cash to investments. It also received $144,057 in investment income (i.e., dividend and interest). At the end of the year, the investment manager reported realized gains of $75,452 and unrealized gains of $257,345. The investment manager also invoiced NBCF for services rendered ($35,263 for the year) – these were paid in full. Assuming there were no restrictions on investment income, how much did the nonprofit report in investments and investment income (net of expenses) at the end of FY 2015.

- The Seattle Community Foundation (herein Foundation), a nonprofit entity that supports charitable organizations in the Puget Sound area, reported the following transactions for FY 2016 (July 1, 2015 – June 30, 2016). Use this information to prepare a Statement of Activities for FY 2016. How much did the Foundation report as Change in Unrestricted Net Assets? Change in Total Net Assets?

- The Foundation has a large portfolio of investments. At the beginning of the year, the fair value of the portfolio was $76,850,000. In the 12-month period, the Foundation transferred $4,250,000 from cash to investments.

- The Foundation received $650,000 in interest and dividend payments. At the end of the year, investment managers reported $675,000 in realized gains and $215,000 in unrealized losses. The Foundation reports investment income (interest and dividend payments, realized gains or losses and unrealized gains or losses) as unrestricted support.

- The Foundation held its annual fundraising dinner event on March 18th, 2016. The dinner raised $1,600,000 in unrestricted support and $3,200,000 in restricted support.

- As of June 30, 2016 the Foundation had received $825,000 of the $1,600,000 in unrestricted support and $1,250,000 of the $3,200,000 in restricted support. Historically, 1.5 percent of all pledges have been uncollectible.

The Foundation’s expenses were as follows - The Foundation made $2,100,000 in cash awards to various charitable organizations. Of the total, $1,250,000 were funded with restricted public support. The remainder were funded with unrestricted revenues.

- Foundation salaries and benefits were $420,000 for the year. Of the total, $35,000 remained unpaid at the end of the year. Fundraising and marketing costs for the year were $150,000. All fundraising and marketing expenses had been paid in full by year end. Other expenses, paid in full included rent and utilities ($144,000), equipment lease ($12,000), office supplies ($8,500), and miscellaneous expenses ($15,000).

- On June 28th, the investment manager sent the Foundation an invoice for services rendered in FY 2016 of $82,000. The Foundation expected to write a check for the full amount on July 15th, 2016.

- The Foundation purchased $21,000 in computing equipment in cash. The new equipment is expected to have a useful life of 3 years and zero salvage value. Depreciation expenses on existing equipment for FY 2016 was expected to be $32,500.

- For FY 2016, the Foundation reported $25,000 in interest expense on its long-term debt. The Foundation had also made $75,000 in principal payments for the year.

- The City of Davidson engages in the following transactions during its fiscal year ending September 30, 2015. Show what impact, if any, each has on the city’s assets, liabilities, and fund balance, assuming it prepares its fund financial statements on the modified accrual basis.

- During fiscal 2015 the City levied property taxes of $154,000, of which it collected $120,000 prior to September 2015, and $5,000 over each of the next six months. It estimated that $4,000 will be uncollectible.

- On November 20, 2015 it received $12,000 from the state for sales taxes recorded on its behalf. The payment was for sales made in September that merchants were required ti remit to the state by October 15.

- In April the city was awarded a state training grant of $400 for the period June 1, 2015 through May 31, 2016. In fiscal 2015 the city received the entire $400 but spent only $320. Although the funds were received in advance, the city would have to return to the state any amounts that were not used to cover allowable training grants.

- The city requires each vendor who sells in its “farmers market” to obtain an annual permit. The funds generated by the sale of these permits are used to maintain the market. The permits, which cover the period from June 1 through May 31, are not refundable. In May 2015 the city issued $36 of permits.

- A few years ago the City received a donation of a parcel of land, upon which it expected to build a new community center. During fiscal 2015 it opted to sell the land instead for $135. When acquired by the town, the land had a market value of $119.

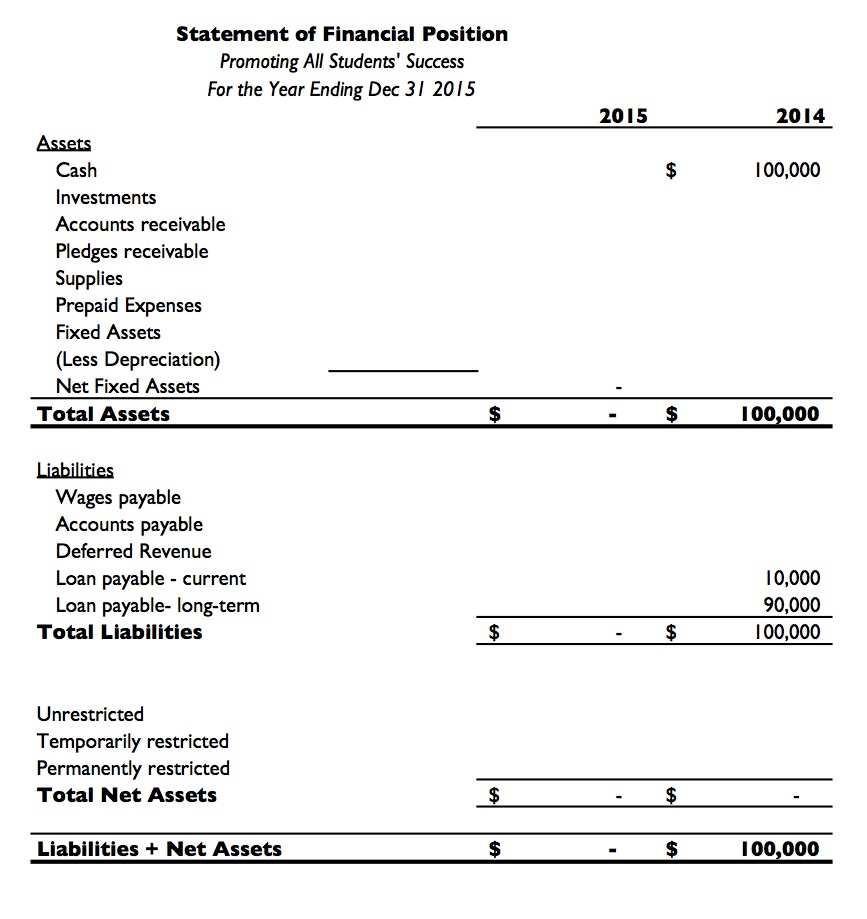

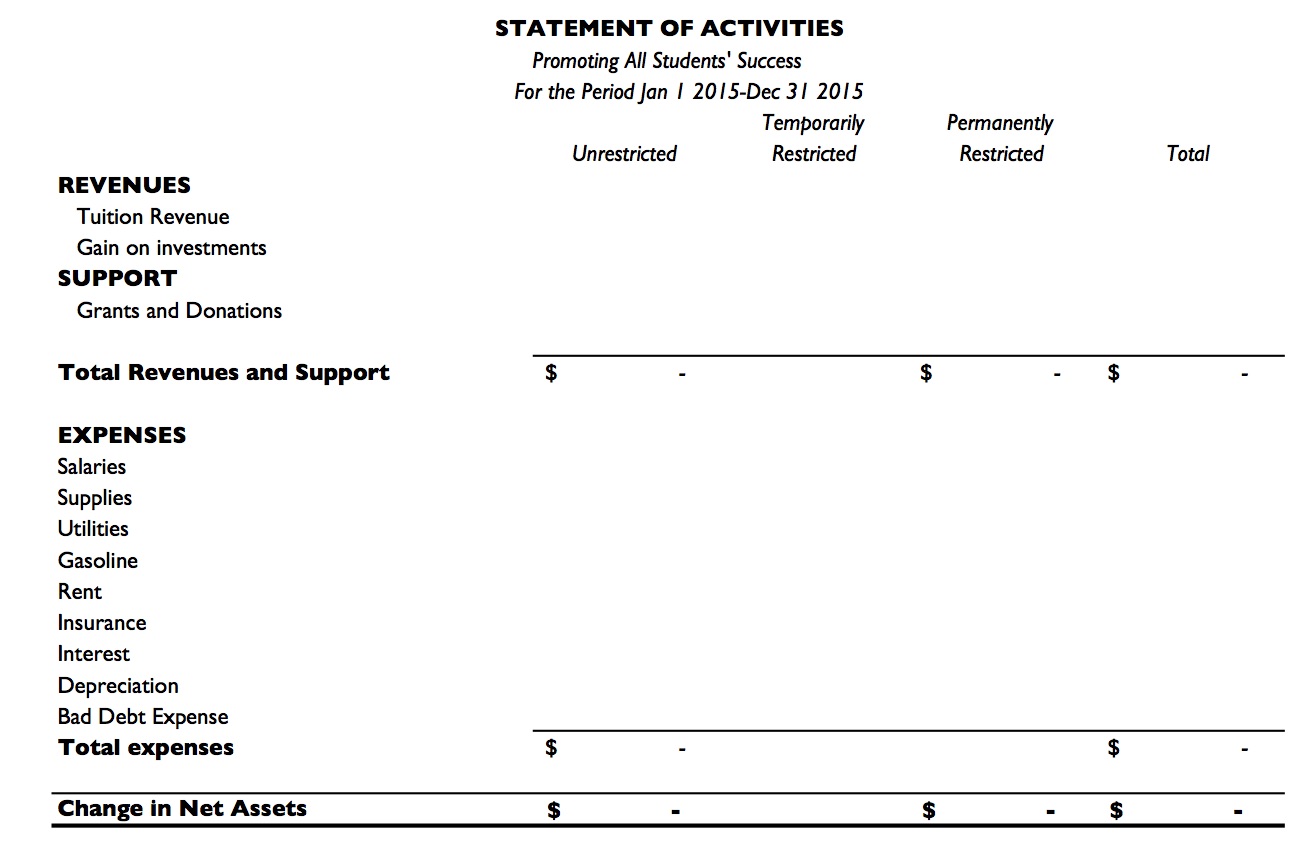

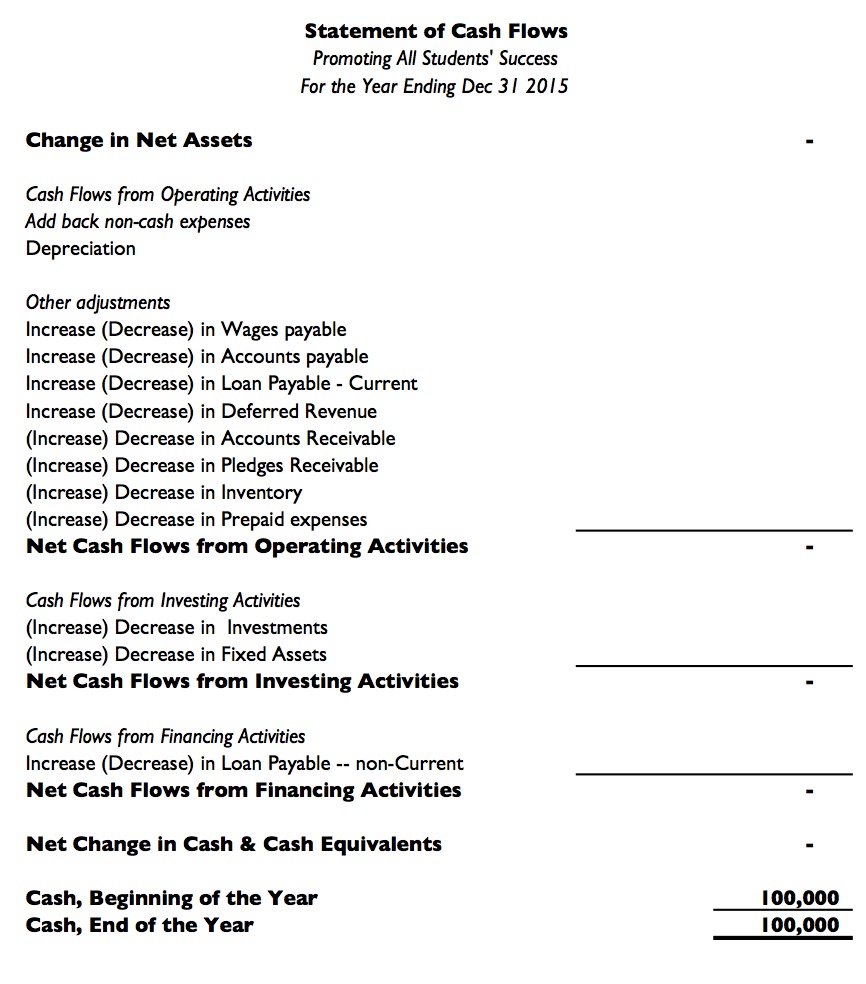

Case: Promoting All Student Success (PASS)

Background

The small not-for-profit Christine Chang started in graduate school, Promoting All Students’ Success (PASS), was more successful than she had imagined. She had taken an education policy course in graduate school in which she learned about the disparities in achievement gaps as a result of chronic underfunding in the public schools. Her interest in after-school tutoring was prompted by recent changes in state policy that would require students to pass a series of end-of-year exams to qualify for graduation. However, the last three years of budget deficits meant that school districts had to cut back on after-school programs and services, including after-school tutoring and test-prep courses. The state was also not willing to fund these programs arguing learning and test-prep should happen during regular school hours. This meant that students, more likely those from low-income families, that needed assistance would fail their qualifying exams if they did not have access to free or low-cost after-school tutoring sessions.

Recognizing this need, Chang enlisted a group of friends including a number of students taking courses at the School of Education and began offering free after-school tutoring services at local high schools. They began contacting schools over the summer, and by August 2013, they had more students than they could handle. It was evident to her there was an urgent need to provide after-school tutoring services – it was time for her to launch Promoting All Students’ Success or simply PASS![2]

Financial Information

In November, a local newspaper ran a story about PASS’s efforts which attracted the interest of a local entrepreneur, Charles Duncan. Duncan had been a borderline student in high school and had been lucky to graduate, so he contacted Chang to discuss her program. He was impressed enough with her vision and commitment and offered her a $100,000 low-interest loan to turn PASS into a full-time venture (See Exhibit 1).

Chang was a bit daunted by Duncan’s generosity but immediately went to work. She resigned from her position at a local nonprofit and rented office space, signing a one-year $2,500 per month lease, with rent due on the first of each month. Chang and Duncan met up the day before Christmas. At that meeting, she briefed Duncan on her initial thoughts for PASS’s operational structure including Duncan serving as the chair of the Board of Directors. As he wrote her the check for $100,000, Duncan noted that there would be a conflict of interest, as he was the initial and sole investor in PASS. Nonetheless, he knew she needed his support and he would be able to use his networks in the business community to solicit additional financial support for PASS. Chang immediately deposited the funds in a checking account and went home to celebrate the holiday with her family, knowing she had an exciting year ahead of her.

January 5, 2015, PASS officially opened for business. Her first order of business was to invest $20,000 of the $100,000 she had received from Duncan. She wanted to make sure she could earn some interest on these funds. After conversations with a local bank manager, she decided to engage the services of a local investment manager and invest the funds in a low-risk US equities fund. She wrote a check from the checking account on the 8th of January (see Exhibit 3).

Utilities (e.g., electric, water and sewer, garbage) for the new office space were expected to average $500 per month. Payments on outstanding balances were due on the 15th of the following month. She decided to take advantage of the after Christmas sale and purchase computers, laptops, tablets, phones, and printers for $10,000 (see Exhibit 4).

Chang was initially the only employee, serving as Executive Director, sole tutor and chief fundraiser. At the initial board meeting, the board voted to pay a salary of $3,500 per month and to contribute an additional $175 per month toward her health insurance. She also presented preliminary estimates for operating expenses. Her initial thoughts were that she would need to invest $1,000 in student workbooks and other teaching supplies. She would also engage the services of a local supplier that would deliver an additional $300 in supplies per month. Chang worked out an agreement with the supplier in which they would deliver two months of supplies on the first of every other month, starting February 1, with payment due on the 15th of the month of delivery.

By March 2015, Chang and Duncan had some good fundraising success. Duncan had received commitments from his network of family, friends, and business associates. They had agreed to provide PASS with $25,000 in unrestricted public support. The donors agreed to make payments on these commitments in July ($5,500), August ($3,500), October ($4,000), and December ($5,000). He suspected a few of the donors would likely not make payments on their commitments. PASS would need to adjust for $1,000 in bad debt expense at the end of the year. The remainder of pledges would be received no later than January 2016.

Chang had also worked really hard in the initial month and submitted a grant proposal to the McNamara Foundation. After an intensive vetting process, she received the news that the Foundation would support PASS efforts in closing the achievement gap. She received a check from the foundation in April for $25,000. The foundation did not impose any restrictions on the grant.

Despite initial successes, Chang and the Board of Directors realized they would not be able to run the program strictly through grants and contributions – the school districts would have to contribute toward the cost of the program. In April, she contacted the districts she had been working with and told each that she would have to begin charging $75 per student per month. Each student would receive tutoring services in September through May. This was still well below what it would cost the districts to provide the services themselves, so two districts agreed to continue the program. Each signed up 25 students. Chang agreed to delay charging the fee until the next school year started in September 2015.

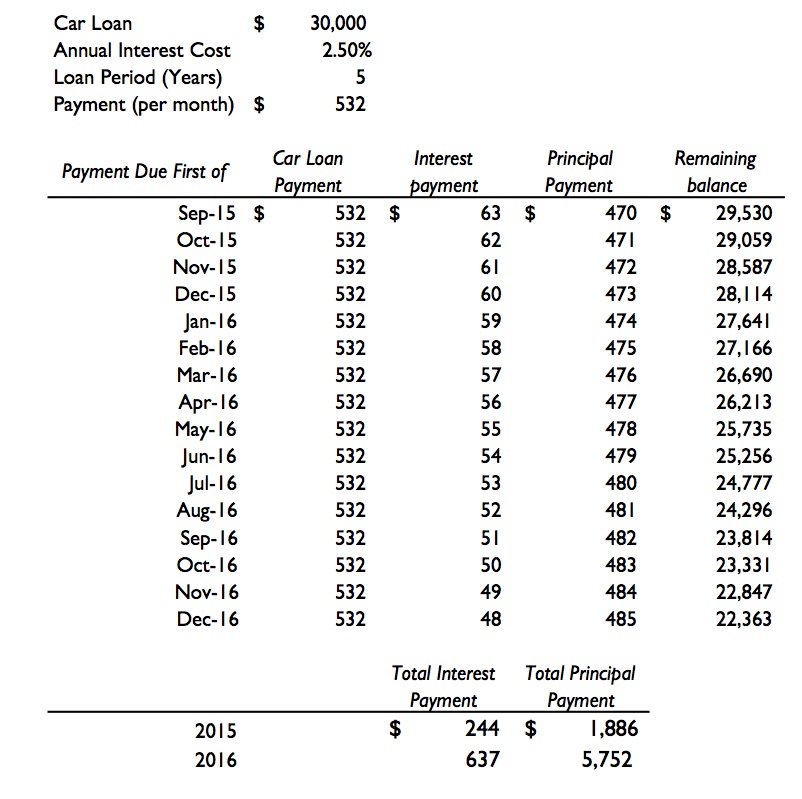

Chang spent the summer preparing to expand the program in the fall. She hired five part-time tutors at $15 per hour, for 80 hours each per month, from September 1 to May 31. To keep costs down, she decided she would continue to tutor while running the program. She also decided that the organization’s most pressing need, particularly with new tutors on board, was transportation. After shopping around, she decided to purchase a minivan for $35,000. She made a $5,000 down payment and took out a five-year loan at 2.5% interest to finance the rest. Monthly payments of $532 were due at the beginning of each month, starting on September 1 (see Exhibit 2). She was also required to take out insurance on the car, with payments of $540 per quarter due in advance every three months, starting on September 1. The tutors and Chang coordinated the schedules so that the car would be available for tutoring visits. They drove quite a few miles and used an average of $100 per month in gas, starting in September.

Starting October 1, she began billing the school districts monthly for services from the previous month and gave the school districts one month to pay. In other words, if she sent a bill for September on October 1st, payment would be due no later than October 31. Even though the districts never paid early, the did make payments within the 30 day grace period.

By November, Chang was already looking ahead to next year. On the first of December, she received more good news from the McNamara Foundation: it had decided to donate an additional $25,000 to PASS. The grant had strings attached. PASS was to invest the money and use the earnings to subsidize as many participants as possible. This would allow more students to participate in the program, at no cost to the school districts. After depositing the check, she initiated a wire transfer to the low-risk US equities fund. The investment manager told her that the additional investments would not yield any substantial returns by the end of the year given that the fund transfer occurred in the last month of the fiscal year.

By Christmas 2015, Duncan was impressed enough with Chang’s work and PASS’s accomplishments that he agreed to forgive $40,000 of the $100,000 loan. Because the long-term obligation was to be forgiven, PASS would need to recognize the value of the forgiven loan as unrestricted revenue. Duncan expected to receive payment on the balance of the loan as agreed.

Before the end of the year, a Mrs. Hughes and four other parents came to Chang’s office. They had heard about the initiative and student achievements to date. They wanted to enroll their children in the tutoring program starting January 2016. They knew they would not be able to pay the full cost of PASS’s tutoring services. Nevertheless, they had raised $2,000 amongst themselves and hoped that Chang would tutor their children in the upcoming year. While the $2,000 was $500 more than what the school districts was billed for on a per student basis, Chang was not sure she could provide the service directly to the parents without the additional vetting and review processes the school districts, especially the teachers, provided her. She knew this was an issue she needed to bring to the Board first.

The Board expected to meet at the start of the new year to review to review events of the past year. Chang was excited about all PASS achievements and future. Ahead of the meeting, Duncan asked Chang for copies of PASS’s financial statements so he could evaluate the organization’s operating performance and financial position. Chang panicked. While she had kept good records, she had not prepared any formal financial documents. Looking back, she wished she hadn’t avoided that financial management class in graduate school.

Assignment

- Demonstrate the impact of each transaction on the organization’s assets, liabilities, or net assets. You may assume at the start of the year, PASS reported $100,000 in cash and $100,000 in long-term obligations and zero in net assets. Revenues for the year can be reported as either unrestricted or restricted, that simply depends on whether the donor-imposed restrictions or whether the income is earned-income not support or contributions. All expenses are to be reported under unrestricted net assets. Additional assumptions:

- The fiscal year runs from January 1 to December 31 and all transactions are material.

- Employees are paid monthly on the 7th of the following month.