3 Ethics and Privacy

Learning Objectives

Differentiate between short-term and long-term perspectives

Differentiate between stockholder and stakeholder

Discuss the relationship among ethical behavior, goodwill, and profit

Explain the concept of corporate social responsibility

Identify key types of business-stakeholder relationships

Explain why laws do not dictate every ethical responsibility a company may owe key stakeholders

Discuss why stakeholders’ welfare must be at the heart of ethical business decisions

Introduction

Few directives in business can override the core mission of maximizing shareholder wealth, and today that particularly means increasing quarterly profits. Such an intense focus on one variable over a short time (i.e., a short-term perspective) leads to a short-sighted view of what constitutes business success.

Measuring true profitability, however, requires taking a long-term perspective. We cannot accurately measure success within a quarter of a year; a longer time is often required for a product or service to find its market and gain traction against competitors, or for the effects of a new business policy to be felt. Satisfying consumers’ demands, going green, being socially responsible, and acting above and beyond the basic requirements all take time and money. However, the extra cost and effort will result in profits in the long run. If we measure success from this longer perspective, we are more likely to understand the positive effect ethical behavior has on all who are associated with a business.

Profitability and Success: Thinking Long Term

Decades ago, some management theorists argued that a conscientious manager in a for-profit setting acts ethically by emphasizing solely the maximization of earnings. Today, most commentators contend that ethical business leadership is grounded in doing right by all stakeholders directly affected by a firm’s operations, including, but not limited to, stockholders, or those who own shares of the company’s stock. That is, business leaders do right when they give thought to what is best for all who have a stake in their companies. Not only that, firms actually reap greater material success when they take such an approach, especially over the long run.

Nobel Prize–winning economist Milton Friedman stated in a now-famous New York Times Magazine article in 1970 that the only “social responsibility of a business is to increase its profits.” This concept took hold in business and even in business school education. However, although it is certainly permissible and even desirable for a company to pursue profitability as a goal, managers must also have an understanding of the context within which their business operates and of how the wealth they create can add positive value to the world. The context within which they act is society, which permits and facilitates a firm’s existence.

Thus, a company enters a social contract with society as a whole, an implicit agreement among all members to cooperate for social benefits. Even as a company pursues the maximizing of stockholder profit, it must also acknowledge that all of society will be affected to some extent by its operations. In return for society’s permission to incorporate and engage in business, a company owes a reciprocal obligation to do what is best for as many of society’s members as possible, regardless of whether they are stockholders. Therefore, when applied specifically to a business, the social contract implies that a company gives back to the society that permits it to exist, benefiting the community at the same time it enriches itself.

In addition to taking this more nuanced view of profits, managers must also use a different time frame for obtaining them. The stock market’s focus on periodic (i.e., quarterly and annual) earnings has led many managers to adopt a short-term perspective, which fails to take into account effects that require a longer time to develop. For example, charitable donations in the form of corporate assets or employees’ volunteered time may not show a return on investment until a sustained effort has been maintained for years. A long-term perspective is a more balanced view of profit maximization that recognizes that the impacts of a business decision may not manifest for a longer time.

Example

What contributes to a corporation’s positive image over the long term? Many factors contribute, including a reputation for treating customers and employees fairly and for engaging in business honestly. Companies that act in this way may emerge from any industry or country. Examples include Fluor, the large U.S. engineering and design firm; illycaffè, the Italian food and beverage purveyor; Marriott, the giant U.S. hotelier; and Nokia, the Finnish telecommunications retailer. The upshot is that when consumers are looking for an industry leader to patronize and would-be employees are seeking a firm to join, companies committed to ethical business practices are often the first to come to mind.

Why should stakeholders care about a company acting above and beyond the ethical and legal standards set by society? Simply put, being ethical is simply good business. A business is profitable for many reasons, including expert management teams, focused and happy employees, and worthwhile products and services that meet consumer demand. One more and very important reason is that they maintain a company philosophy and mission to do good for others.

Year after year, the nation’s most admired companies are also among those that had the highest profit margins. Going green, funding charities, and taking a personal interest in employee happiness levels adds to the bottom line! Consumers want to use companies that care for others and our environment. During the years 2008 and 2009, many unethical companies went bankrupt. However, those companies that avoided the “quick buck,” risky and unethical investments, and other unethical business practices often flourished. If nothing else, consumer feedback on social media sites such as Yelp and Facebook can damage an unethical company’s prospects.

Example

Competition and the Markers of Business Success

Perhaps you are still thinking about how you would define success in your career. For our purposes here, let us say that success consists simply of achieving our goals. We each have the ability to choose the goals we hope to accomplish in business, of course, and, if we have chosen them with integrity, our goals and the actions we take to achieve them will be in keeping with our character.

Warren Buffet, whom many consider the most successful investor of all time, is an exemplar of business excellence as well as a good potential role model for professionals of integrity and the art of thinking long term. He had the following to say: “Ultimately, there’s one investment that supersedes all others: Invest in yourself. Nobody can take away what you’ve got in yourself, and everybody has potential they haven’t used yet. . . . You’ll have a much more rewarding life not only in terms of how much money you make, but how much fun you have out of life; you’ll make more friends the more interesting person you are, so go to it, invest in yourself.”5

The primary principle under which Buffett instructs managers to operate is: “Do nothing you would not be happy to have an unfriendly but intelligent reporter write about on the front page of a newspaper.” This is a very simple and practical guide to encouraging ethical business behavior on a personal level. Buffett offers another, equally wise, principle: “Lose money for the firm, even a lot of money, and I will be understanding; lose reputation for the firm, even a shred of reputation, and I will be ruthless.” As we saw in the example of Toyota, the importance of establishing and maintaining trust in the long term cannot be underestimated.

Stockholders, Stakeholders, and Goodwill

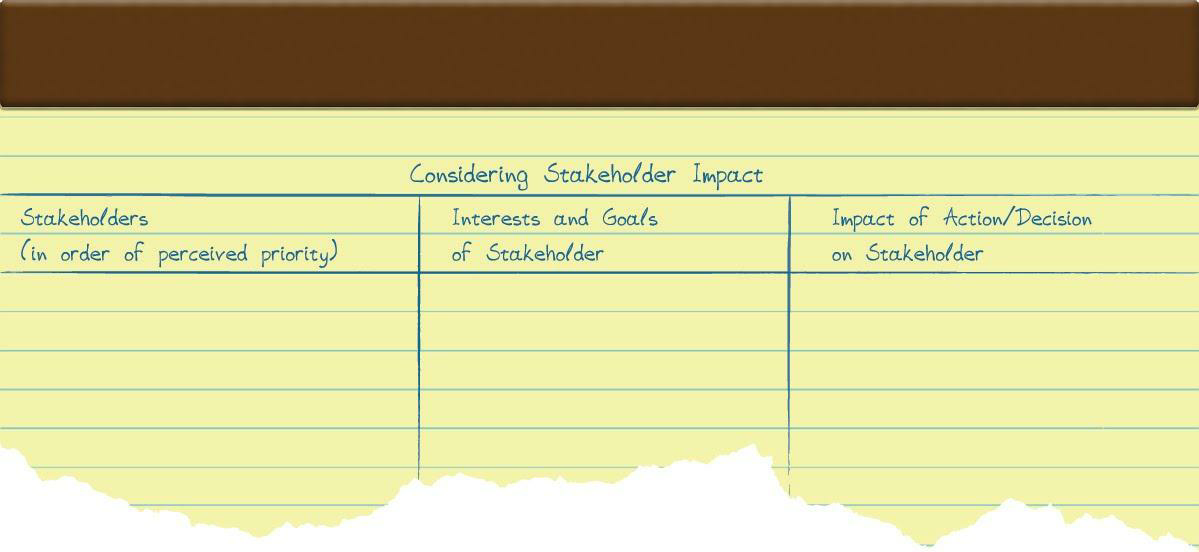

Earlier in this chapter, we explained that stakeholders are all the individuals and groups affected by a business’s decisions. Among these stakeholders are stockholders (or shareholders), individuals and institutions that own stock (or shares) in a corporation. Understanding the impact of a business decision on the stockholder and various other stakeholders is critical to the ethical conduct of business. Indeed, prioritizing the claims of various stakeholders in the company is one of the most challenging tasks business professionals face. Considering only stockholders can often result in unethical decisions; the impact on all stakeholders must be considered and rationally assessed.

Managers do sometimes focus predominantly on stockholders, especially those holding the largest number of shares, because these powerful individuals and groups can influence whether managers keep their jobs or are dismissed (e.g., when they are held accountable for the company’s missing projected profit goals). And many believe the sole purpose of a business is, in fact, to maximize stockholders’ short-term profits. However, considering only stockholders and short-term impacts on them is one of the most common errors business managers make. It is often in the long-term interests of a business not to accommodate stockowners alone but rather to take into account a broad array of stakeholders and the long-term and short-term consequences for a course of action.

Key Takeaways

The positive feeling stakeholders have for any particular company is called goodwill, which is an important component of almost any business entity, even though it is not directly attributable to the company’s assets and liabilities. Among other intangible assets, goodwill might include the worth of a business’s reputation, the value of its brand name, the intellectual capital and attitude of its workforce, and the loyalty of its established customer base. Even being socially responsible generates goodwill. The ethical behavior of managers will have a positive influence on the value of each of those components. Goodwill cannot be earned or created in a short time, but it can be the key to success and profitability.

A company’s name, its corporate logo, and its trademark will necessarily increase in value as stakeholders view that company in a more favorable light. A good reputation is essential for success in the modern business world, and with information about the company and its actions readily available via mass media and the Internet (e.g., on public rating sites such as Yelp), management’s values are always subject to scrutiny and open debate. These values affect the environment outside and inside the company. The corporate culture, for instance, consists of shared beliefs, values, and behaviors that create the internal or organizational context within which managers and employees interact. Practicing ethical behavior at all levels—from CEO to upper and middle management to general employees—helps cultivate an ethical corporate culture and ethical employee relations.

Key Takeaways

Which Corporate Culture Do You Value?

Imagine that upon graduation you have the good fortune to be offered two job opportunities. The first is with a corporation known to cultivate a hard-nosed, no-nonsense business culture in which keeping long hours and working intensely are highly valued. At the end of each year, the company donates to numerous social and environmental causes. The second job opportunity is with a nonprofit recognized for a very different culture based on its compassionate approach to employee work-life balance. It also offers the chance to pursue your own professional interests or volunteerism during a portion of every work day. The first job offer pays 20 percent more per year.

- Which of these opportunities would you pursue and why?

- How important an attribute is salary, and at what point would a higher salary override for you the nonmonetary benefits of the lower-paid position?

Positive goodwill generated by ethical business practices, in turn, generates long-term business success. As recent studies have shown, the most ethical and enlightened companies in the United States consistently outperform their competitors. Thus, viewed from the proper long-term perspective, conducting business ethically is a wise business decision that generates goodwill for the company among stakeholders, contributes to a positive corporate culture, and ultimately supports profitability.

You can test the validity of this claim yourself. When you choose a company with which to do business, what factors influence your choice? Let us say you are looking for a financial advisor for your investments and retirement planning, and you have found several candidates whose credentials, experience, and fees are approximately the same. Yet one of these firms stands above the others because it has a reputation, which you discover is well earned, for telling clients the truth and recommending investments that seemed centered on the clients’ benefit and not on potential profit for the firm. Wouldn’t this be the one you would trust with your investments?

Or suppose one group of financial advisors has a long track record of giving back to the community of which it is part. It donates to charitable organizations in local neighborhoods, and its members volunteer service hours toward worthy projects in town. Would this group not strike you as the one worthy of your investments? That it appears to be committed to building up the local community might be enough to persuade you to give it your business. This is exactly how a long-term investment in community goodwill can produce a long pipeline of potential clients and customers.

Example

The Equifax Data Breach

In 2017, from mid-May to July, hackers gained unauthorized access to servers used by Equifax, a major credit reporting agency, and accessed the personal information of nearly one-half the U.S. population.9 Equifax executives sold off nearly $2 million of company stock they owned after finding out about the hack in late July, weeks before it was publicly announced on September 7, 2017, in potential violation of insider trading rules. The company’s shares fell nearly 14 percent after the announcement, but few expect Equifax managers to be held liable for their mistakes, face any regulatory discipline, or pay any penalties for profiting from their actions. To make amends to customers and clients in the aftermath of the hack, the company offered free credit monitoring and identity-theft protection. On September 15, 2017, the company’s chief information officer and chief of security retired. On September 26, 2017, the CEO resigned, days before he was to testify before Congress about the breach. To date, numerous government investigations and hundreds of private lawsuits have been filed as a result of the hack.

Critical Thinking

- Which elements of this case might involve issues of legal compliance? Which elements illustrate acting legally but not ethically? What would acting ethically and with personal integrity in this situation look like?

- How do you think this breach will affect Equifax’s position relative to those of its competitors? How might it affect the future success of the company?

- Was it sufficient for Equifax to offer online privacy protection to those whose personal information was hacked? What else might it have done?

Stakeholder Relationships

Have you ever had a stake in a decision someone else was making? Depending on your relationship with that person and your level of interest in the decision, you may have tried to ensure that the choice made was in your best interests. Understanding your somewhat analogous role as a stakeholder in businesses large and small, local and global, will help you realize the value of prioritizing stakeholders in your own professional life and business decisions.

Many individuals and groups inside and outside a business have an interest in the way it brings products or services to market to turn a profit. These stakeholders include customers, clients, employees, shareholders, communities, the environment, the government, and the media (traditional and social), among others. All stakeholders should be considered essential to a business, but not all have equal priority. Different groups of stakeholders carry different weights with decision makers in companies and assert varying levels of interest and influence. As we examine their roles, consider how an organization benefits by working with its stakeholders and how it may benefit from encouraging stakeholders to work together to promote their mutual interests.

What are the roles of an organization’s many stakeholders? We begin with the internal stakeholders. The board of directors—in a company large enough to have one—is responsible for defining and evaluating the ongoing mission of a business after its founding. It broadly oversees decisions about the mission and direction of the business, the products or services offered, the markets in which the business will operate, and salary and benefits for the senior officers of the organization. The board also sets goals for income and profitability. Its most important function is to select and hire the chief executive officer (CEO) or president. The CEO is usually the only employee who reports directly to the board of directors, and he or she is charged with implementing the policies the board sets and consulting with them on significant issues pertaining to the company, such as a dramatic shift in products or services offered or discussions to acquire—or be acquired by—another firm.

In turn, the CEO hires executives to lead initiatives and carry out procedures in the various functional areas of the business, such as finance, sales and marketing, public relations, manufacturing, quality control, human resources (sometimes called human capital), accounting, and legal compliance. Employees in these areas are internal stakeholders in the success of both their division and the larger corporation. Some interact with the outside environment in which the business operates and serve as contact points for external stakeholders, such as media and government, as well.

In terms of external stakeholders for a business, customers certainly are an essential group. They need to be able to trust that products and services are backed by the integrity of the company. They also provide reviews, positive or negative, and referrals. Customers’ perceptions of the business matter, too. Those who learn that a business is not treating employees fairly, for instance, may reconsider their loyalty or even boycott the business to try to influence change in the organization. Stakeholder relationships, good and bad, can have compound effects, particularly when social media can spread word of unethical behavior quickly and widely.

Key external stakeholders are usually those outside of the organization who most directly influence a business’s bottom line and hold power over the business. Besides customers and clients, suppliers have a great deal of influence and command a great deal of attention from businesses of all sizes. Governments hold power through regulatory bodies, from federal agencies such as the Environmental Protection Agency to the local planning and zoning boards of the communities in which businesses exist. These latter groups often exercise influence over the physical spaces where businesses work and try to grow.

Businesses are responsible to their stakeholders. Every purchase of a product or a service carries with it a sort of promise. Buyers promise that their money or credit is good, and businesses promise a level of quality that will deliver what is advertised. The relationship can quickly get more complex, though. Stakeholders also may demand that the businesses they patronize give back to the local community or protect the global environment while developing their products or providing services. Employees may demand a certain level of remuneration for their work. Governments demand that companies comply with laws, and buyers in business-to-business exchanges (B2B, in business jargon) demand not only high-quality products and services but on-time delivery and responsive maintenance and service should something go wrong. Meeting core obligations to stakeholders is primarily about delivering good products and services, but it is also about communicating and preparing for potential problems, whether from within the company or from external circumstances like a natural disaster.

Ethical Responsibilities Often Extend Beyond Legal Requirements

We have seen that stakeholders include the people and entities invested in and influential in the success of an organization. It is also true that stakeholders can have multiple, and simultaneous, roles. For example, an employee can also be a customer and a stockholder.

Any transaction between a stakeholder and a business organization may appear finite. For instance, after you purchase something from a store you leave and go home. But your relationship with the store probably continues. You might want to repurchase the item or ask a question about a warranty. The store may have collected future marketing data about you and your purchases through its customer loyalty program or your use of a credit card.

Example

When a product does not live up to its maker’s claims for whatever reason, the manufacturer needs to correct the problem to retain or regain customers’ trust. Without this trust, the interdependence between the company and its stakeholders can fail. By choosing to recognize and repay its customer stakeholders, Samsung acted at an ethical maximum, taking the strongest possible action to behave ethically in a given situation. An ethical minimum, or the least a company might do that complies with the law, would have been to offer the warning and nothing more. This may have been a defensible position in court, but the warning might not have reached all purchasers of the defective machine and many children could have been hurt.

Each case of a faulty product or poorly delivered service is different. If laws reach above a minimum standard, they can grow cumbersome and impede business growth. If businesses adhere only to laws and ethical minimums, however, they can develop poor reputations and people can be harmed. The ethically minimal course of action is not illegal or necessarily unethical, but the company choosing it will have failed to recognize the value of its customers.

Example

Amazon Sets a Demanding Pace on the Job

In a visit to an Amazon distribution center, a group of business students and their professors met with the general manager.3 After taking them on an extensive tour of the five-acre facility, the general manager commented on the slowness of the visitors’ walking pace. He described the Amazon Pace, a fast, aggressive walk, and confirmed that the average employee walks eight or nine miles during a shift. These employees are called “pickers,” and their task is to fill an order and deliver it to the processing and packing center as quickly as possible. The design of the center is a trade secret that results in a random distribution of products. Therefore, the picker has to cover a number of directions and distances while filling an order. Those who cannot keep up the pace are usually let go, just as would be those who steal.

Critical Thinking

- Does the requirement to walk an average of eight or nine miles at a fast pace every day strike you as a reasonable expectation for employees at Amazon, or any other workplace? Why or why not? Should a company that wants to impose this requirement tell job applicants beforehand?

- Is it ethical for customers to patronize a company that imposes this kind of requirement on its employees? And if not, what other choices do customers have and what can they do about it?

- The center’s general manager may have been exaggerating about the Amazon Pace to impress upon his visitors how quickly and nimbly pickers fill customer orders for the company. If not, however, is such a pace sustainable without the risk of physiological and psychological stress?

The law only partly captures the ethical obligations firms owe their stakeholders. One way many companies go beyond the legally required minimum as employers is to offer lavish amenities—that is, resources made available to employees in addition to wages, salary, and other standard benefits. They include such offerings as on-site exercise rooms and other services, company discounts, complimentary or subsidized snacks or meals, and the opportunity to buy stock in the company at a discounted price. Astute business leaders see the increased costs of amenities as an investment in retaining employees as long-term stakeholders. Stakeholder loyalty within and outside the firm is essential in sustaining any business venture, no matter how small or large.

The Social Responsibility of Business

There are two opposing views about how businesses, and large publicly held corporations in particular, should approach ethics and social responsibility. One view holds that businesses should behave ethically within the marketplace but concern themselves only with serving shareholders and other investors. This view places economic considerations above all others. The other view is that stakeholders are not the means to the end (profit) but are ends in and of themselves as human beings. Thus, the social responsibility of business view is that being responsible to customers, employees, and a host of other stakeholders should be not only a corporate concern but central to a business’s mission. In essence, this view places a premium on the careful consideration of stakeholders. Consider what approach you might take if you were the CEO of a multinational corporation.

Key Takeaways

- Would your business be driven primarily by a particular social mission or simply by economics?

- How do you think stakeholder relationships would influence your approach to business? Why?

Read a detailed consideration of the social responsibility of business in the form of polite but fiercely oppositional correspondence between economist Milton Friedman and John Mackey, founder and CEO of Whole Foods to learn more.

One challenge for any organization’s managers is that not all stakeholders agree on where the company should strive to land when it chooses between ethical minimums and maximums. Take stockholders, for example. Logically, most stockholders are interested in maximizing the return on their investment in the firm, which earns profit for them in the form of dividends. Lynn Stout, late Professor of Law at Cornell Law School, described the role of shareholder in this way:

“Shareholders as a class want companies to be able to treat their stakeholders well, because this encourages employee and customer loyalty . . . Yet individual shareholders can profit from pushing boards to exploit committed stakeholders—say, by threatening to outsource jobs unless employees agree to lower wages, or refusing to support products customers have come to rely on unless they buy expensive new products as well. In the long run, such corporate opportunism makes it difficult for companies to attract employee and customer loyalty in the first place.”

Essential to Stout’s point is that shareholders do not necessarily behave as a class. Some will want to maximize their investment even at a cost to other stakeholders. Some may want to extend beyond the legal minimum and seek a long-term perspective on profit maximization, demanding better treatment of stakeholders to maximize future potential value and to do more good than harm.

In the long run, stakeholder welfare must be kept at the heart of each company’s business operations for these significant, twin reasons: It is the right thing to do and it is good for business. Still, if managers need additional incentive to act on the basis of policies that benefit stakeholders, it is useful to recall that stakeholders who believe their interests have been ignored will readily make their displeasure known, both to company management and to the much wider community of social media.

Thus far, we have discussed stakeholders mostly as individuals and groups outside the organization. This section focuses on the business firm as a stakeholder in its environment and examines the concept of a corporation as a socially responsible entity conscious of the influences it has on society. That is, we look at the role companies, and large corporations in particular, play as active stakeholders in communities. Corporations, by their sheer size, affect their local, regional, national, and global communities. Creating a positive impact in these communities may mean providing jobs, strengthening economies, or driving innovation. Negative impacts may include doing damage to the environment, forcing the exit of smaller competitors, and offering poor customer service, to name a few. This section examines the concept of a corporation as a socially responsible entity conscious of the influences it has on society.

Corporate Social Responsibility Defined

In recent years, many organizations have embraced corporate social responsibility (CSR), a philosophy in which the company’s expected actions include not only producing a reliable product, charging a fair price with fair profit margins, and paying a fair wage to employees, but also caring for the environment and acting on other social concerns. Many corporations work on prosocial endeavors and share that information with their customers and the communities where they do business. CSR, when conducted in good faith, is beneficial to corporations and their stakeholders. This is especially true for stakeholders that have typically been given low priority and little voice, such as the natural environment and community members who live near corporate sites and manufacturing facilities.

CSR in its ideal form focuses managers on demonstrating the social good of their new products and endeavors. It can be framed as a response to the backlash corporations face for a long track record of harming environments and communities in their efforts to be more efficient and profitable. Pushback is not new. Charles Dickens wrote about the effects of the coal economy on nineteenth-century England and shaped the way we think about the early industrial revolution. The twentieth-century writer Chinua Achebe, among many others, wrote about colonization and its transformative and often painful effect on African cultures. Rachel Carson first brought public attention to corporations’ chemical poisoning of U.S. waterways in her 1962 book Silent Spring.

Betty Friedan’s The Feminine Mystique (1963) critiqued the way twentieth-century industrialization boxed women into traditional roles and limited their agency. Kate Chopin’s novel The Awakening (1899) and the nineteenth-century novels of Jane Austen had already outlined how limited options were for women despite massive social and economic shifts in the industrializing West. Stakeholder communities left out of or directly harmed by the economic revolution have demanded that they be able to influence corporate and governmental economic practices to benefit more directly from corporate growth as well as entrepreneurship opportunities. The trend to adopt CSR may represent an opportunity for greater engagement and involvement by groups mostly ignored until now by the wave of corporate economic growth reshaping the industrialized world.

CSR and the Environment

Corporations have responded to stakeholder concerns about the environment and sustainability. In 1999, Dow Jones began publishing an annual list of companies for which sustainability was important. Sustainability is the practice of preserving resources and operating in a way that is ecologically responsible in the long term. The Dow Jones Sustainability Indices “serve as benchmarks for investors who integrate sustainability considerations into their portfolios.” There is a growing awareness that human actions can, and do, harm the environment. Destruction of the environment can ultimately lead to reduction of resources, declining business opportunities, and lowered quality of life. Enlightened business stakeholders realize that profit is only one positive effect of business operations. In addition to safeguarding the environment, other ethical contributions that stakeholders could lobby corporate management to make include establishing schools and health clinics in impoverished neighborhoods and endowing worthwhile philanthropies in the communities where companies have a presence.

Other stakeholders, such as state governments, NGOs, citizen groups, and political action committees in the United States apply social and legal pressure on businesses to improve their environmental practices. For example, the state of California in 2015 enacted a set of laws, referred to as the California Transparency in Supply Chains Act, which requires firms to report on the working conditions of the employees of their suppliers. The law requires only disclosures, but the added transparency is a step toward holding U.S. and other multinational corporations responsible for what goes on before their products appear in shiny packages in stores. The legislators who wrote California’s Supply Chains Act recognize that consumer stakeholders are likely to bring pressure to bear on companies found to use slave labor in their supply chains, so forcing disclosure can bring about change because corporations would rather adjust their relationships with supply-chain stakeholders than risk alienating massive numbers of customers.

As instances of this type of pressure on corporations increase around the world, stakeholder groups become simultaneously less isolated and more powerful. Firms need customers. Customers need employment, and the state needs taxes just as firms need resources. All stakeholders exist in an interdependent network of relationships, and what is most needed is a sustainable system that enables all types of key stakeholders to establish and apply influence.

People, Planet, Profit: The Triple Bottom Line

How can corporations and their stakeholders measure some of the effects of CSR programs? The triple bottom line (TBL) offers a way. TBL is a measure described in 1994 by John Elkington, a British business consultant, and it forces us to reconsider the very concept of the “bottom line.” Most businesses, and most consumers for that matter, think of the bottom line as a shorthand expression of their financial well-being. Are they making a profit, staying solvent, or falling into debt? That is the customary bottom line, but Elkington suggests that businesses need to consider not just one but rather three measures of their true bottom line: the economic and also the social and environmental results of their actions. The social and environmental impacts of doing business, called people and planet in the TBL, are the externalities of their operations that companies must take into account.

The TBL concept recognizes that external stakeholders consider it a corporation’s responsibility to go beyond making money. If increasing wealth damages the environment or makes people sick, society demands that the corporation revise its methods or leave the community. Society, businesses, and governments have realized that all stakeholders have to work for the common good. When they are successful at acting in a socially responsible way, corporations will and should claim credit. In acting according to the TBL model and promoting such acts, many corporations have reinvested their efforts and their profits in ways that can ultimately lead to the development of a sustainable economic system.

CSR as Public Relations Tool

On the other hand, for some, CSR is nothing more than an opportunity for publicity as a firm tries to look good through various environmentally or socially friendly initiatives without making systemic changes that will have long-term positive effects. Carrying out superficial CSR efforts that merely cover up systemic ethics problems in this inauthentic way (especially as it applies to the environment), and acting simply for the sake of public relations is called greenwashing. To truly understand a company’s approach toward the environment, we need to do more than blindly accept the words on its website or its advertising.

Example

When an Image of Social Responsibility May Be Greenwashing

Ben and Jerry’s Ice Cream started as a small ice cream stand in Vermont and based its products on pure, locally supplied dairy and agricultural products. The company grew quickly and is now a global brand owned by Unilever, an international consumer goods company co-headquartered in Rotterdam, The Netherlands, and London, United Kingdom.

According to its statement of values, Ben and Jerry’s mission is threefold: “Our Product Mission drives us to make fantastic ice cream—for its own sake. Our Economic Mission asks us to manage our Company for sustainable financial growth. Our Social Mission compels us to use our Company in innovative ways to make the world a better place.”

With its expansion, however, Ben and Jerry’s had to get its milk—the main raw ingredient of ice cream—from larger suppliers, most of which use confined-animal feeding operations (CAFOs). CAFOs have been condemned by animal-rights activists as harmful to the well-being of the animals. Consumer activists also claim that CAFOs contribute significantly to pollution because they release heavy concentrations of animal waste into the ground, water sources, and air.

- Does the use of CAFOs compromise Ben and Jerry’s mission? Why or why not?

- Has the growth of Ben and Jerry’s contributed to any form of greenwashing by the parent company, Unilever? If so, how?

Read Ben and Jerry’s Statement of Mission for more on the company’s values and mission.

Coca-Cola provides another example of practices some would identify as greenwashing. The company states the following on its website:

“Engaging our diverse stakeholders in long-term dialogue provides important input that informs our decision making, and helps us continuously improve and make progress toward our 2020 sustainability goals . . . We are committed to ongoing stakeholder engagement as a core component of our business and sustainability strategies, our annual reporting process, and our activities around the world. As active members of the communities where we live and work, we want to strengthen the fabric of our communities so that we can prosper together.” 27

Let us take a close look at this statement. “Engaging stakeholders in long-term dialogue” appears to describe an ongoing and reciprocal relationship that helps improvement be continuous. Commitment to “stakeholder engagement as a core component of business and sustainability strategies” appears to focus the company on the requirement to conduct clear, honest, transparent reporting.

Currently 20 percent of the people on Earth consume a Coca-Cola product each day, meaning a very large portion of the global population belongs to the company’s consumer stakeholder group. Depending on the process and location, it is estimated that it takes more than three liters of water to produce a liter of Coke. Each day, therefore, millions of liters of water are removed from the Earth to make Coke products, so the company’s water footprint can endanger the water supplies of both employee and neighbor stakeholders. For example, in Chiapas, Mexico, the Coca-Cola bottling plant consumes more than one billion liters of water daily, but only about half the population has running water.28 Mexico leads the world in per capita consumption of Coke products.

If consumers are aware only of Coca-Cola’s advertising campaigns and corporate public relations writings online, they will miss the very real concerns about water security associated with it and other corporations producing beverages in similar fashion. Thus it requires interest on the part of stakeholders to continue to drive real CSR practices and to differentiate true CSR efforts from greenwashing.

The Ultimate Stakeholder Benefit

CSR used in good faith has the potential to reshape the orientation of multinational corporations to their stakeholders. By positioning themselves as stakeholders in a broader global community, conscientious corporations can be exemplary organizations. They can demonstrate interest and influence on a global scale and improve the way the manufacture of goods and delivery of services serve the local and global environment. They can return to communities as much as they extract and foster automatic financial reinvestment so that people willing and able to work for them can afford not only the necessities but a chance to pursue happiness.

In return, global corporations will have sustainable business models that look beyond short-term growth forecasts. They will have a method of operating and a framework for thinking about sustained growth with stakeholders and as stakeholders. Ethical stakeholder relationships systematically grow wealth and opportunity in dynamic fashion. Without them, the global consumer economy may fail. On an alternate and ethical path of prosperity, today’s supplier is a consumer in the next generation and Earth is still inhabitable after many generations of dynamic change and continued global growth.

Key Takeaways

- True or false? According to Milton Friedman, a company’s social responsibility consists solely of bettering the welfare of society.

- What is corporate social responsibility (CSR)?

- Describe a practical way to prioritize the claims of stakeholders.

- Describe how a company’s ethical business practices affect its goodwill.

- Which of the following is not a stakeholder?

- the media

- corporate culture

- the environment

- customers

Exercises

- Maintaining trust between stakeholders and organizations is ________.

- the stakeholder’s responsibility

- an ethical minimum

- an ethical maximum

- a social contract

2. True or false? Companies are required to provide amenities to their employees to fulfill the social contract between management and employees as stakeholders.

3. Choose your favorite brand. List at least five of its key stakeholder groups.

4. A shareholder is a stakeholder who ________.

- holds stock for investment

- has a general interest in the fate of all publicly traded companies

- focuses on the means by which firms get their products to market

- always purchases the product or service of a particular company

6. Name the three components of the triple bottom line.

7. True or false? Corporate social responsibility is a voluntary action for companies.

Attributions

Access for free at https://openstax.org/books/business-ethics/pages/1-introduction

an individual or institution that owns stock or shares in a corporation, by definition a type of stakeholder; also called stockholder

a focus on the goal of maximizing periodic (i.e., quarterly and annual) profits

a broad view of profit maximization that recognizes the fact that the impact of a business decision may not manifest for a long time

individuals and entities affected by a business’s decisions, including customers, suppliers, investors, employees, the community, and the environment, among others

an individual or institution that owns stock or shares in a corporation, by definition a type of stakeholder; also called shareholder

an implicit agreement among societal members to cooperate for social benefit; when applied specifically to a business, it suggests a company that responsibly gives back to the society that permits it to incorporate, benefiting the community at the same time that it enriches itself

The owners of a corporation who hold shares of stock that carry certain rights.

the adherence to a code of moral values implying trustworthiness and incorruptibility because there is unity between what we say and what we do

the value of a business beyond its tangible assets, usually including its reputation, the value of its brand, the attitude of its workforce, and customer relations

the shared beliefs, values, and behaviors that create the organizational context within which employees and managers interact

the extent to which a company conducts its business operations in accordance with applicable regulation and statutes

the conduct by which companies and their agents abide by the law and respect the rights of their stakeholders, particularly their customers, clients, employees, and the surrounding community and environment

the practice in which a business views itself within a broader context, as a member of society with certain implicit social obligations and responsibility for its own effects on environmental and social well-being

Non-government organizations