2.2 HR Budgets

An HR plan includes an HR budget. An HR budget refers to the funds that HR allocates to all HR activities and processes across the organization. The HR budget will include funds allocated to hiring, salaries, benefits, talent management, training, succession planning, workforce engagement, and employee wellness planning (Wolters Kluwer, n.d.)

All companies have limits on the amount of money or resources they can receive and pay. How these resources are used to reach their goals and objectives must be planned. The quantitative plan estimating when and how much cash or other resources will be received and when and how the cash or other resources will be used is the budget. Depending on the complexity, some budgets can take months or even years to develop. The most common period covered by a budget is one year, although the period may vary from strategic, long-term budgets to very detailed, short-term budgets. Generally, the closer the company is to the start of the budget period, the more detailed the budget becomes.

Understanding Costs

Before building a budget, managers need to understand costs. Costs can be classified in three ways:

-

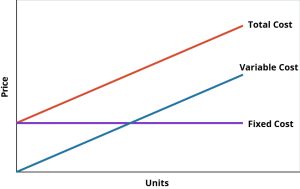

Figure 2.2.1. Variable and Fixed Costs. As can be seen in the graph, the total cost represents the sum of the variable and fixed costs. Variable costs change as the quantity of goods or services produced or provided changes.

- Fixed costs are exactly as the name implies – they remain the same regardless of the quantity/volume of goods or services produced within the period.

- Mixed costs are those a combination of variable and fixed components.

When costs are correctly classified, managers can use cost data to make decisions and plan for the future of the business.

HR Cost Examples

- An example of a variable cost is overtime pay, which varies based on the number of hours employees work.

- An example of a fixed cost is the salary of a full-time permanent HR staff. Salaries remain constant regardless of the fluctuations in the business.

- Software subscriptions are an example of a mixed cost, as these can often include fixed and variable components—a fixed monthly fee plus additional fees that vary depending on the number of users.

Budget Advantages & Disadvantages

There are many advantages to budgeting, including:

- Communication – Budgeting is a formal method to communicate a business’s or department’s plans to stakeholders interested in— or responsible for—monitoring the business’s performance.

- Planning – Budget preparation requires managers to consider and evaluate goals and strategy. It ensures the right staffing levels.

- Collaboration – Preparing a budget requires departments to work together.

- Evaluation – When compared to actual results, budgets provide early alerts of deviations from the plan.

As with every set of advantages, there are also disadvantages:

- Budgets can be inflexible.

- They are based on assumptions which may not turn out to be correct.

- They can take a long time to create

Management uses budgets to evaluate the performance of employees, projects, business units, and departments. In budgeting situations, employees may feel a tension between reporting actual results and reporting results that reach the predetermined goals created by the budget. This creates a situation where managers may choose to act unethically and pressure accountants to report favourable financial results not supported by the operations. Accountants need to be aware of this circumstance and use ethical standards when assisting in the development and creation of budgets.

HR Budget Process

Each organization’s approach to building an HR budget will be different, but typically, the process will include the following steps:

- Review past financial performance: this will help to understand what might happen in the future.

- Choose a budgeting approach: organizations may use incremental or zero-based budgets.

- Analyze current data: analyze HR performance data and budget actuals currently. This analysis should include revenue, departmental and organizational expenses, staffing (recruiting, hiring, turn-over), and employee compensation (Wolters Kluwer, n.d.)

Because budgets are used to evaluate a manager’s performance and the company’s, managers are responsible for specific expenses within their budget. Each manager’s performance is evaluated by how well he or she manages the revenues and expenses under control. Each individual who exercises control over spending should have a budget specifying limits on that spending.

Informed Business Decisions Competencies

- Align HR decisions with organizational strategy.

- Assess the organization’s financial and operating information for impact on HR strategy.

Source: HRPA Professional Competency Framework (2014), pg. 20. © HRPA, all rights reserved.

For a refresher on Financial Accounting, please see the content in the Additional Resources.

For a refresher on Financial Accounting, please see the content in the Additional Resources.

“Describe how and why managers use budgets” from Accounting and Accountability by Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“10.1 Budgeting Basics” from Financial and Managerial Accounting by Lolita Paff is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.