1.6 Calculating the Term

Learning Objectives

- Calculate the number of compounding periods

- Calculate the term of a loan or investment

Formula & Symbol Hub

Symbols Used

- [latex]f[/latex] or [latex]EFF[/latex] = Effective interest rate

- [latex]FV[/latex] = Future value or maturity value

- [latex]i[/latex] = Periodic interest rate

- [latex]j[/latex] or [latex]I/Y[/latex] = Nominal interest rate per year

- [latex]m[/latex] or [latex]C/Y[/latex] = Number of compounds per year or compounding frequency

- [latex]n[/latex] or [latex]N[/latex] = Total number of compound periods for the term

- [latex]PV[/latex] = Present value of principal

Formulas Used

-

Formula 1.1 - Total Number of Compounds

[latex]n=m \times \mbox{time in years}[/latex]

-

Formula 1.2 - Periodic Interest Rate

[latex]i=\frac{j}{m}[/latex]

-

Formula 1.3 - Future Value

[latex]FV=PV \times (1+i)^n[/latex]

-

Formula 1.4 - Present Value

[latex]PV=FV \times (1+i)^{-n}[/latex]

Introduction

How long will it take to reach a financial goal? At a casual get-together at your house, a close friend discusses saving for a 14-day vacation to the Blue Bay Grand Esmeralda Resort in the Mayan Riviera of Mexico upon graduation. The estimated cost from Travelocity.ca is [latex]\$1,998.94[/latex] including fares and taxes. He has already saved [latex]\$1,775[/latex] into a fund earning [latex]8\%[/latex] compounded quarterly. Assuming the costs remain the same and he makes no further contributions, can you tell him how soon he will be basking in the sun on the beaches of Mexico?

Using a Financial Calculator

Although it is possible to find the number of compounding periods by using the future value or present value formulas, it is much more practical to use a financial calculator. You use the financial calculator in the same way as described previously, but the only difference is that the unknown quantity is [latex]N[/latex] (the number of compoundings). You must still load the other six variables into the calculator and apply the cash flow sign conventions carefully.

Using the TI BAII Plus Calculator to Find the Number of Compoundings for Compound Interest

Enter values for the known variables ([latex]PV[/latex], [latex]FV[/latex],[latex]I/Y[/latex], [latex]PMT[/latex], [latex]P/Y[/latex] and [latex]C/Y[/latex]) following the steps below and paying close attention to the cash flow sign convention for [latex]PV[/latex] and [latex]FV[/latex].

- For the main button keys in the TVM row (i.e. [latex]N[/latex], [latex]I/Y[/latex], [latex]PV[/latex], [latex]PMT[/latex], [latex]FV[/latex]), enter the number first and then press the corresponding button.

- For example, to enter [latex]N=34[/latex], enter [latex]34[/latex] on the calculator and then press N.

- For [latex]P/Y[/latex] and [latex]C/Y[/latex], press 2nd I/Y. At the [latex]P/Y[/latex] screen, enter the value for [latex]P/Y[/latex] and then press ENTER. Press the down arrow to access the [latex]C/Y[/latex] screen. At the [latex]C/Y[/latex] screen, enter the value for [latex]C/Y[/latex] and then press ENTER. Press [latex]2\text{nd QUIT}[/latex] (the CPT button) to exit the menu.

- For example, to enter [latex]P/Y=4[/latex] and [latex]C/Y=4[/latex], press 2nd I/Y. At the [latex]P/Y[/latex] screen, enter [latex]4[/latex] and press ENTER. Press the down arrow. At the [latex]C/Y[/latex] screen, enter [latex]4[/latex] and press ENTER. Press 2nd QUIT to exit.

After all of the known quantities are loaded into the calculator, press CPT and then [latex]N[/latex] to solve for the number of compounding periods.

Things to Watch Out For

When entering both [latex]PV[/latex] and [latex]FV[/latex] into the calculator, ensure proper application of cash flow sign convention to [latex]PV[/latex] and [latex]FV[/latex]. One number must be negative and the other must be positive. An ERROR message will appear on the calculator display if [latex]PV[/latex] and [latex]FV[/latex] are entered with the same signs (i.e. both are negative or both are positive).

Example 1.6.2

Jenning Holdings invested [latex]\$43,000[/latex] at [latex]6.65\%[/latex] compounded quarterly. A report from the finance department shows the investment is currently valued at [latex]\$67,113.46[/latex]. How long has the money been invested?

Solution

Step 1: Calculate the value of [latex]N[/latex].

| N | ? |

| PV | [latex]-43,000[/latex] |

| FV | [latex]67,113.46[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | [latex]6.65[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]4[/latex] |

[latex]\displaystyle{N=26.9999....}[/latex]

Step 2: Convert [latex]N[/latex] to years and months.

[latex]\begin{eqnarray*} \mbox{Number of Years} & = & \frac{N}{C/Y} \\ & = & \frac{26.999...}{4} \\ & = & 6.74999... \\ & \rightarrow & 6 \mbox{ years} \\ \\ \mbox{Number of Months} & = & 0.74999... \times 12 \\ & = & 8.999... \\ & \rightarrow & 9 \mbox{ months} \end{eqnarray*}[/latex]

Step 3: Write as a statement.

Jenning Holdings has had the money invested for six years and nine months.

Example 1.5.3

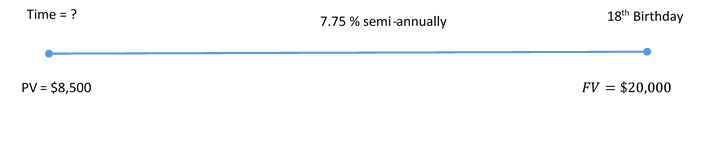

Tabitha estimates that she will need at least [latex]\$20,000[/latex] for her daughter's postsecondary education when she turns [latex]18[/latex]. If Tabitha is able to save up [latex]\$8,500[/latex], how far in advance of her daughter's [latex]18[/latex]th birthday would she need to invest the money at [latex]7.75\%[/latex] compounded semi-annually? Answer in years and months.

Solution

The timeline for the investment is shown below.

Step 1: Calculate the value of [latex]N[/latex].

| N | ? |

| PV | [latex]-8,500[/latex] |

| FV | [latex]20,000[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | [latex]7.75[/latex] |

| P/Y | [latex]2[/latex] |

| C/Y | [latex]2[/latex] |

[latex]\displaystyle{N=22.50682....}[/latex]

Step 2: Convert [latex]N[/latex] to years and months.

[latex]\begin{eqnarray*} \mbox{Number of Years} & = & \frac{N}{C/Y} \\ & = & \frac{22.50682...}{2} \\ & = & 11.2534... \\ & \rightarrow & 11 \mbox{ years} \\ \\ \mbox{Number of Months} & = & 0.2534... \times 12 \\ & = & 3.0409... \\ & \rightarrow & 4 \mbox{ months} \end{eqnarray*}[/latex]

Step 3: Write as a statement.

If Tabitha invests the [latex]\$8,500 11[/latex] years and [latex]4[/latex] months before her daughter's [latex]18[/latex]th birthday, it will grow to [latex]\$20,000[/latex].

Try It

1) You just took over another financial adviser's account. A client invested [latex]\$15,500[/latex] at [latex]6.92\%[/latex] compounded monthly and now has [latex]\$24,980[/latex]. How long (in years and months) has this client had the money invested?

Solution

| N | ? |

| PV | [latex]-15,500[/latex] |

| FV | [latex]24,980[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | [latex]6.92[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

[latex]\displaystyle{N=82.9959....}[/latex]

[latex]\begin{eqnarray*} \mbox{Number of Years} & = & \frac{N}{C/Y} \\ & = & \frac{82.9959...}{12} \\ & = & 6.91633... \\ & \rightarrow & 6 \mbox{ years} \\ \\ \mbox{Number of Months} & = & 0.9163... \times 12 \\ & = & 10.995... \\ & \rightarrow & 11 \mbox{ months} \end{eqnarray*}[/latex]

The money has been invested for [latex]6[/latex] years and [latex]11[/latex] months.

Section 1.6 Exercises

- How long will it take an investment of [latex]\$68,000[/latex] to mature to at least [latex]\$89,032[/latex] if the interest rate is [latex]4.91\%[/latex] compounded monthly?

Solution

[latex]5[/latex] years, [latex]6[/latex] months

- What is the term of an investment of [latex]\$41,790[/latex] that has a maturity value of [latex]\$120,000[/latex] at [latex]8.36\%[/latex] compounded quarterly?

Solution

[latex]12[/latex] years, [latex]9[/latex] months

- How long did it take a [latex]\$111,244[/latex] investment to earn [latex]\$888,756[/latex] in interest if the interest rate is [latex]8.8\%[/latex] compounded semi-annually?

Solution

[latex]25[/latex] years, [latex]6[/latex] months

- A debt of [latex]\$7,500[/latex] is owed. Suppose prevailing interest rates are [latex]4.9\%[/latex] compounded quarterly. How far in advance was the debt paid if the creditor accepted a payment of [latex]\$6,721.25[/latex]?

Solution

[latex]2[/latex] years, [latex]4[/latex] months

- Wayne was late in making a [latex]\$3,500[/latex] payment to Dora. If Dora accepted a payment of [latex]\$3,801[/latex] and charged [latex]5.59\%[/latex] compounded semi-annually, how late was the payment?

Solution

[latex]1[/latex] year, [latex]6[/latex] months

- How long will it take [latex]\$5,800[/latex] to become [latex]\$10,000[/latex] at [latex]6.25\%[/latex] compounded quarterly?

Solution

[latex]8[/latex] years, [latex]10[/latex] months

- A friend of yours just won the [latex]6[/latex]/[latex]7[/latex] category on the Lotto Max (matching six out of seven numbers), and her share of the prize was [latex]\$275,000[/latex]. She wants to pay cash for a new home that sells for [latex]\$360,000[/latex]. If she can invest the money at [latex]7.45\%[/latex] compounded semi-annually, how long will she have to wait to purchase the home assuming its sale price remains the same?

Solution

[latex]3[/latex] years, [latex]9[/latex] months

- Lakewood Properties anticipates that the City of Edmonton in the future will release some land for a development that costs [latex]\$30[/latex] million. If Lakewood can invest [latex]\$17.5[/latex] million today at [latex]9.5\%[/latex] compounded monthly, how long will it take before it will have enough money to purchase the land?

Solution

[latex]5[/latex] years, [latex]9[/latex] months

- As marketing manager, you want to pursue a new product development for which you require [latex]\$1[/latex] million for research. However, budgetary constraints mean you can only receive [latex]\$850,000[/latex]. If you take your budget and invest it at [latex]8.7\%[/latex] compounded monthly, how long will it be before you can pursue the necessary research for the project?

Solution

[latex]1[/latex] year, [latex]11[/latex] months

- How long will it take money to triple if it earns [latex]8.2\%[/latex] compounded quarterly?

Solution

[latex]13[/latex] years, [latex]7[/latex] months

Attribution

"9.7: Determining the Number of Compounds" from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

"9.7: Determining the Number of Compounds" from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.