1.3 Calculating the Present Value

Learning Objectives

- Calculate present value for compound interest

Formula & Symbol Hub

Symbols Used

- [latex]f[/latex] or [latex]EFF[/latex] = Effective interest rate

- [latex]FV[/latex] = Future value or maturity value

- [latex]i[/latex] = Periodic interest rate

- [latex]j[/latex] or [latex]I/Y[/latex] = Nominal interest rate per year

- [latex]m[/latex] or [latex]C/Y[/latex] = Number of compounds per year or compounding frequency

- [latex]n[/latex] or [latex]N[/latex] = Total number of compound periods for the term

- [latex]PV[/latex] = Present value of principal

Formulas Used

-

Formula 1.1 – Total Number of Compounds

[latex]n=m \times \mbox{time in years}[/latex]

-

Formula 1.2 – Periodic Interest Rate

[latex]i=\frac{j}{m}[/latex]

-

Formula 1.3 – Future Value

[latex]FV=PV \times (1+i)^n[/latex]

-

Formula 1.4 – Present Value

[latex]PV=FV \times (1+i)^{-n}[/latex]

Introduction

The principal of the loan or investment is called the present value ([latex]PV[/latex]). The present value is the amount of money borrowed for a loan or the amount of money invested for an investment at the start of the term. The present value is the amount at some earlier point in time than when the future value is known, and so excludes the future interest.

[latex]\boxed{1.4}[/latex] The Present Value Formula

By solving for [latex]PV[/latex] in the future value formula from the previous section, the present valuefor compound interest is

[latex]{\color{red}{PV}}\;\text{is the Present Value:}[/latex] the present value is the starting amount upon which compound interest is calculated.

[latex]{\color{blue}{FV}}\;\text{is the Future Value:}[/latex] the future value includes the principal plus all of the interest accumulated over the term.

[latex]{\color{green}{i}}\;\text{is the Periodic Interest Rate:}[/latex] the periodic interest rate is the interest rate per compounding period: [latex]i=\frac{j}{m}[/latex] where [latex]j[/latex] is the nominal interest rate and [latex]m[/latex] is the compounding frequency.

[latex]{\color{purple}{n}}\;\text{is the Total Number of Compounding Periods Over the Term:}[/latex] [latex]n=m \times t[/latex] where [latex]m[/latex] is the compounding frequency and [latex]t[/latex] is the length of the term in years.

Example 1.3.1

Castillo’s Warehouse will need to purchase a new forklift for its warehouse operations three years from now, when its new warehouse facility becomes operational. If the price of the new forklift is [latex]\$38,000[/latex] and Castillo’s can invest its money at [latex]7.25\%[/latex] compounded monthly, how much money should it put aside today to achieve its goal?

Solution

The timeline for the investment is shown below.

Step 1: Write what you get from the question.

[latex]\begin{eqnarray*} FV & = & \$38,000 \\ j & = & 7.25\% \\ m & = & 12 \\ t & = & 3 \mbox{ years} \end{eqnarray*}[/latex]

Step 2: Calculate the periodic interest rate.

[latex]\begin{eqnarray*} i & = & \frac{j}{m} \\ & = & \frac{7.25\%}{12} \\ & = & 0.60416...\% \\ & = & 0.0060416...\end{eqnarray*}[/latex]

Step 3: Calculate the total number of compoundings.

[latex]\begin{eqnarray*} n & = & m \times t \\ & = & 12 \times 3 \\ & = & 36 \end{eqnarray*}[/latex]

Step 4: Calculate the present value.

[latex]\begin{eqnarray*} PV & = & FV \times (1+i)^{-n} \\ & = & 38,000 \times (1+0.0060416...)^{-36} \\ & = & \$30,592.06 \end{eqnarray*}[/latex]

Step 5: Write as a statement.

If Castillo’s Warehouse places [latex]\$30,592.06[/latex] into the investment, it will earn enough interest to grow to [latex]\$38,000[/latex] three years from now to purchase the forklift.

Using a Financial Calculator

As in the previous section, a financial calculator can be used to solve for the present value in compound interest problems. You use the financial calculator in the same way as described previously, but the only difference is that the unknown quantity is [latex]PV[/latex] instead of [latex]FV[/latex].You must still load the other six variables into the calculator and apply the cash flow sign convention carefully.

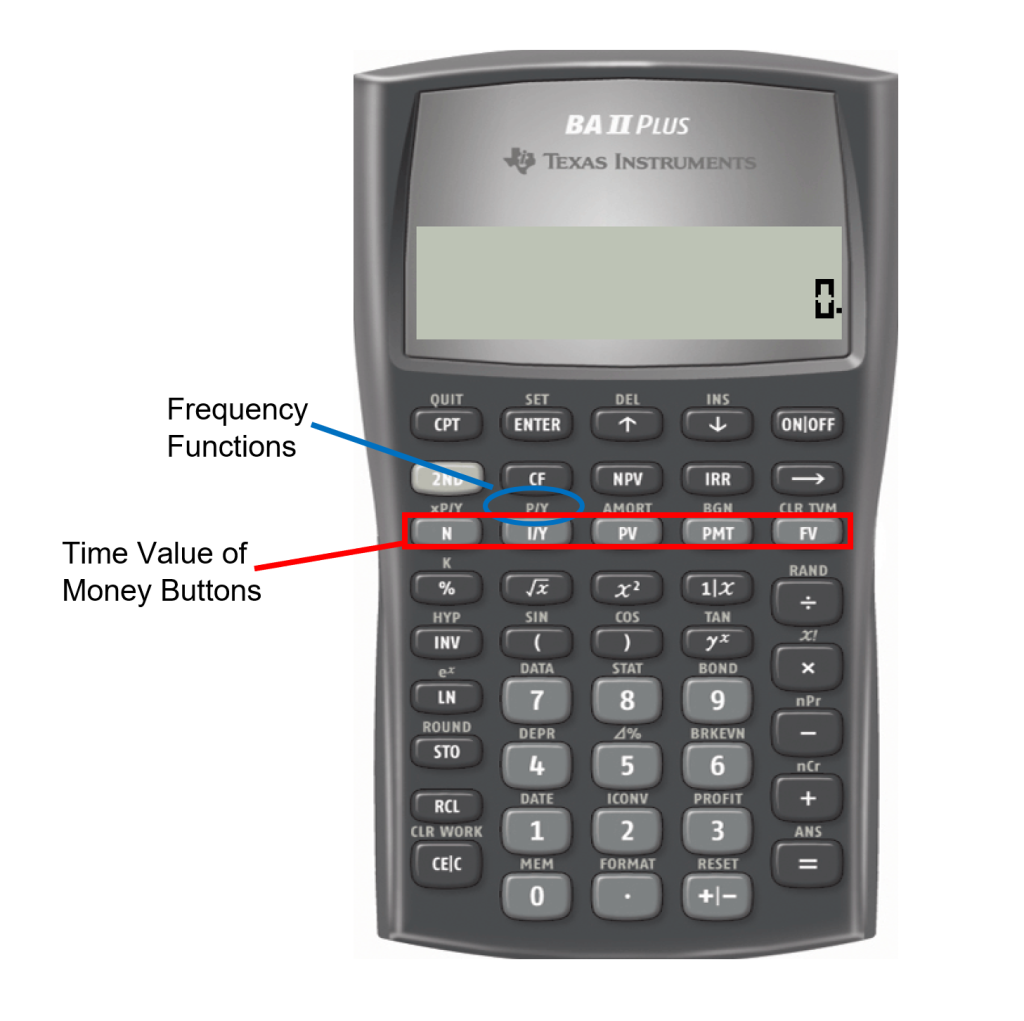

Using the TI BAII Plus Calculator to Find the Present Value for Compound Interest

The time value of money buttons are located in the [latex]TVM[/latex] row (the third row from the top) of the calculator. The five buttons located on the third row of the calculator are five of the seven variables required for time value of money calculations. This row’s buttons are different in colour from the rest of the buttons on the keypad. The other two variables are in a secondary menu above the [latex]I/Y[/latex] key and are accessed by pressing 2nd [latex]I/Y[/latex].

Altogether, there are seven variables required to complete time value of money calculations. Note that [latex]P/Y[/latex] and [latex]C/Y[/latex] are not main button keys in the [latex]TVM[/latex] row. The P/Y and C/Y variables are located in the secondary function accessed by pressing 2nd [latex]I/Y[/latex].

| Variable | Meaning |

| N | Total number of compounding periods. This is the same value as [latex]n[/latex] in the future value/present value formulas:

[latex]N=\mbox{time in years} \times \mbox{compounding frequency}[/latex] |

| I/Y | Interest rate per year (i.e. the nominal interest rate). The interest rate is entered in percent form (without the % sign). For example, [latex]5\%[/latex] is entered as [latex]5[/latex]. |

| PV | Present value or principal. |

| PMT | Periodic annuity payment. For compound interest only calculations, PMT=[latex]0[/latex]. (Note: in later chapters you will learn about annuities where PMT will not be [latex]0[/latex].) |

| FV | Future value or maturity value. |

| P/Y | Payment frequency for annuity payment. For compound interest only calculations, P/Y is set to the same value as C/Y. (Note: in later chapters you will learn about annuities where P/Y will be set to the frequency of the payments.) |

| C/Y | Compounding frequency. This is the value of [latex]m[/latex]. |

To enter values into the calculator:

- For the main button keys in the [latex]TVM[/latex] row (i.e. [latex]N[/latex], [latex]I/Y[/latex], [latex]PV[/latex], [latex]PMT[/latex], [latex]FV[/latex]), enter the number first and then press the corresponding button.

- For example, to enter [latex]N=34[/latex], enter [latex]34[/latex] on the calculator and then press [latex]N[/latex].

- For [latex]P/Y[/latex] and [latex]C/Y[/latex], press 2nd [latex]I/Y[/latex]. At the [latex]P/Y[/latex] screen, enter the value for [latex]P/Y[/latex] and then press ENTER. Press the down arrow to access the [latex]C/Y[/latex] screen. At the [latex]C/Y[/latex] screen, enter the value for [latex]C/Y[/latex] and then press ENTER. Press 2nd QUIT (the CPT button) to exit the menu.

- For example, to enter [latex]P/Y=4[/latex] and [latex]C/Y=4[/latex], press 2nd [latex]I/Y[/latex]. At the [latex]P/Y[/latex] screen, enter [latex]4[/latex] and press ENTER. Press the down arrow. At the [latex]C/Y[/latex] screen, enter [latex]4[/latex] and press ENTER. Press 2nd QUIT to exit.

After all of the known quantities are loaded into the calculator, press CPT and then [latex]PV[/latex] to solve for the present value.

Video: Compound Interest (Present and Future Values) by Joshua Emmanuel [6:56] (Transcript Available).

Example 1.3.2

Castillo’s Warehouse will need to purchase a new forklift for its warehouse operations three years from now, when its new warehouse facility becomes operational. If the price of the new forklift is [latex]\$38,000[/latex] and Castillo’s can invest its money at [latex]7.25\%[/latex] compounded monthly, how much money should it put aside today to achieve its goal?

Try It

1) A debt of [latex]\$37,000[/latex] is owed [latex]21[/latex] months from today. If prevailing interest rates are [latex]6.55\%[/latex] compounded quarterly, what amount should the creditor be willing to accept today?

Solution

| N | [latex]4 \times 1.75=7[/latex] |

| PV | ? |

| FV | [latex]-37,000[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | [latex]6.55[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]4[/latex] |

[latex]\displaystyle{PV=\$33,023.56}[/latex]

Present Value Calculations with Variable Changes

Addressing variable changes in present value calculations follows the same techniques as future value calculations discussed in the previous section. You must break the timeline into separate time segments, each of which involves its own calculations. Solving for the unknown [latex]PV[/latex] at the left of the timeline means you must start at the right of the timeline. You must work from right to left, one time segment at a time using the formula for [latex]PV[/latex] each time. Note that the present value for one time segment becomes the future value for the next time segment to the left.

- Read and understand the problem. Identify the future value. Draw a timeline broken into separate time segments at the point of any change. For each time segment, identify any principal changes, the nominal interest rate, the compounding frequency, and the length of the time segment in years.

- Starting with the future value in the last time segment (starting on the right), solve for the present value.

- Let the present value calculated in the previous step become the future value for the next segment to the left. If the principal changes, adjust the future value accordingly.

- Calculate the present value of the next time segment.

- Repeat the previous steps until you obtain the final present value from the leftmost time segment.

HOW TO

To use your calculator efficiently in working through multiple time segments, follow a procedure similar to that for future value.

- Load the calculator with all known compound interest variables for the last time segment (on the right).

- Compute the present value at the beginning of the segment.

- With the answer still on your display, adjust the principal if needed, change the cash flow sign by pressing the [latex]\pm[/latex] key, and then store the unrounded number back into the future value button by pressing [latex]FV[/latex]. Change the [latex]N[/latex], [latex]I/Y[/latex], and [latex]C/Y[/latex] as required for the next segment.

- Return to step [latex]2[/latex] for each time segment until you have completed all time segments.

Example 1.3.3

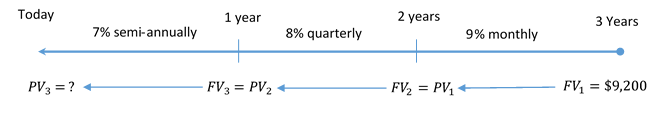

Sebastien needs to have [latex]\$9,200[/latex] saved up three years from now. The investment he is considering pays [latex]7\%[/latex] compounded semi-annually, [latex]8\%[/latex] compounded quarterly, and [latex]9\%[/latex] compounded monthly in successive years. To achieve his goal, how much money does he need to place into the investment today?

Solution

The timeline shows today through to the future value three years from now

Step 1: Calculate the present value at the start of the last segment on the right.

| N | [latex]12 \times 1=12[/latex] |

| PV | ? |

| FV | [latex]9,200[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | [latex]9[/latex] |

| P/Y | [latex]12[/latex] |

| C/Y | [latex]12[/latex] |

[latex]\displaystyle{PV_1=\$8,410.991...}[/latex]

Step 2: Calculate the present value at the start of the second segment on the right. The present value from the first step becomes the future value for the second step: [latex]PV_1=\$8,410.991...=FV_2[/latex].

| N | [latex]4 \times 1=4[/latex] |

| PV | ? |

| FV | [latex]8,410.991...[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | [latex]8[/latex] |

| P/Y | [latex]4[/latex] |

| C/Y | [latex]4[/latex] |

[latex]\displaystyle{PV_2=\$7,770.4555...}[/latex]

Step 3: Calculate the present value at the end of the third segment on the right. The present value from the second step becomes the future value for the third step: [latex]PV_2=\$7,770.455...=FV_3[/latex].

| N | [latex]2 \times 1=2[/latex] |

| PV | ? |

| FV | [latex]7,770.455..[/latex] |

| PMT | [latex]0[/latex] |

| I/Y | [latex]7[/latex] |

| P/Y | [latex]2[/latex] |

| C/Y | [latex]2[/latex] |

[latex]\displaystyle{PV_3=\$7,253.80}[/latex]

Step 4: Write as a statement.

Sebastien needs to place [latex]\$7,253.80[/latex] into the investment today to have [latex]\$9,200[/latex] three years from now.

Try It

2) For the first [latex]4.5[/latex] years, a loan was charged interest at [latex]4.5\%[/latex] compounded semi-annually. For the next [latex]4[/latex] years, the rate was [latex]3.25\%[/latex] compounded annually. If the maturity value was [latex]\$45,839.05[/latex] at the end of the [latex]8.5[/latex] years, what was the principal of the loan?

Solution

| N | [latex]4[/latex] | [latex]9[/latex] |

| PV | [latex]\color{blue}{40,334.378...}[/latex] | [latex]\color{blue}{33,014.56}[/latex] |

| FV | [latex]-45,839.05[/latex] | [latex]-40,334.378...[/latex] |

| PMT | [latex]0[/latex] | [latex]0[/latex] |

| I/Y | [latex]3.25[/latex] | [latex]4.5[/latex] |

| P/Y | [latex]1[/latex] | [latex]2[/latex] |

| C/Y | [latex]1[/latex] | [latex]2[/latex] |

[latex]\displaystyle{PV=\$33,014.56}[/latex]

Section 1.3 Exercises

- A loan is repaid with [latex]\$14,000[/latex]. If the loan was taken out [latex]14[/latex] years ago at [latex]9\%[/latex] compounded semi-annually, how much money was borrowed? How much interest was paid on the loan?

Solution

[latex]PV=\$4,081.99[/latex], [latex]I=\$9,9180.01[/latex]

- In [latex]9[/latex] years and [latex]3[/latex] months, you want to have [latex]\$97,000[/latex] in your savings account. How much money must you invest today if the savings account earns [latex]6\%[/latex] compounded monthly?

Solution

[latex]\$55,762.07[/latex]

- Eight and a half years ago, Tom took out a loan. The interest rate on the loan was [latex]4.5\%[/latex] compounded semi-annually for the first four and half years and [latex]3.25\%[/latex] compounded annually for the last four years. Tom repaid the loan today with a payment of [latex]\$45,839.05[/latex]. How much money did Tom borrow? How much interest did Tom pay?

Solution

[latex]PV=\$33,014.56[/latex], [latex]I=\$12,824.49[/latex]

- George wants to invest some money today. In [latex]6.5[/latex] years, George wants to have [latex]\$7,223.83[/latex] in his investment. The investment earns [latex]8.05\%[/latex] compounded semi-annually for the first [latex]2[/latex] years and [latex]6[/latex] months, then [latex]7.95\%[/latex] compounded quarterly for [latex]1[/latex] year and [latex]3[/latex] months, and then [latex]7.8\%[/latex] compounded monthly for [latex]2[/latex] years and [latex]9[/latex] months. How much money does George need to invest?

Solution

[latex]\$4,340[/latex]

- Dovetail Industries needs to save [latex]\$1,000,000[/latex] for new production machinery that it expects will be needed six years from today. If money can earn [latex]8.35\%[/latex] compounded monthly, how much money should Dovetail invest today?

Solution

[latex]\$606,976.63[/latex]

- A debt of [latex]\$37,000[/latex] is owed [latex]21[/latex] months from today. If prevailing interest rates are [latex]6.55\%[/latex] compounded quarterly, what amount should the creditor be willing to accept today?

Solution

[latex]\$33,023.56[/latex]

- Rene wants to invest a lump sum of money today to make a [latex]\$35,000[/latex] down payment on a new home in five years. If he can place his money in an investment that will earn [latex]4.53\%[/latex] compounded quarterly in the first two years followed by [latex]4.76\%[/latex] compounded monthly for the remaining years, how much money does he need to invest today?

Solution

[latex]\$27,736.24[/latex]

- In August 2004, Google Inc. made its initial stock offering. The value of the shares grew to [latex]\$531.99[/latex] by July 2011. What was the original value of a share in August 2004 if the stock has grown at a rate of [latex]26.8104\%[/latex] compounded monthly?

Solution

[latex]\$85[/latex]

- If a three-year and seven-month investment earned [latex]\$8,879.17[/latex] of interest at [latex]3.95\%[/latex] compounded monthly, what amount was originally placed into the investment?

Solution

[latex]\$58,499.97[/latex]

- A lottery ticket advertises a [latex]\$1[/latex] million prize. However, the fine print indicates that the winning amount will be paid out on the following schedule: [latex]\$250,000[/latex] today, [latex]\$250,000[/latex] one year from now, and [latex]\$100,000[/latex] per year thereafter. If money can earn [latex]9\%[/latex] compounded annually, what is the value of the prize today?

Solution

[latex]\$836,206.54[/latex]

- Option A: [latex]\$520,000[/latex] today plus [latex]\$500,000[/latex] one year from now.

- Option B: [latex]\$200,000[/latex] today, [latex]\$250,000[/latex] six months from now, and [latex]\$600,000 15[/latex] months from now.

- Option C: [latex]\$70,000[/latex] today, [latex]\$200,000[/latex] in six months, then four quarterly payments of [latex]\$200,000[/latex] starting six months later.Your company is selling some real estate and has received three potential offers:

- Prevailing interest rates are expected to be [latex]6.75\%[/latex] compounded semi-annually in the next year, followed by [latex]6.85\%[/latex] compounded quarterly afterwards. Rank the three offers from best to worst based on their values today.

Attribution

“9.3: Determining the Present Value” from Business Math: A Step-by-Step Handbook Abridged by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

“9.3: Determining the Present Value” from Business Math: A Step-by-Step Handbook (2021B) by J. Olivier and Lyryx Learning Inc. through a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License unless otherwise noted.