Terms of Payment: Determining the discount and credit period dates.

Terms of Payment are the conditions under which the buyer has to pay the invoice.

- The customer may receive a cash discount rate if the account is paid before the end of the discount period.

- The credit period is the length of time for which the trade credit is granted, and no interest is charged on the outstanding amount until the credit period is over.

- The date of the invoice is when the discount and credit periods begin.

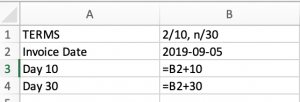

We usually see shorthand notation for terms of payment. For example, if the terms of payment are written:

We read this as “two ten net thirty.”

What this means:

- if the invoice is paid by day 10, that is, by the end of the discount period, there is a 2% cash discount (2/10).

- the entire invoice must be paid by day 30 (n/30).

- The invoice will also indicate the interest rate on overdue accounts.

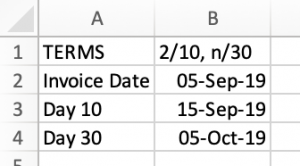

If for example, an invoice is dated September 5 and the terms of payment are 2/10, n/30:

- September 5 is day 0, so day 1 would be September 6, day 2 would be September 7, etc.

- The discount period is 10 days, so if the account is paid between day 0 and 10 (10 days), the retailer will get a 2% cash discount.

- The credit period is 30 days, that is, day 0 to day 30.

We can use MS Excel to calculate the exact dates for Day 10 and Day 30 for this example.

We entered the date (September 5th) into cell B2. To calculate the discount date (Day 10), we can use the formula =B2 + 10 and Excel will add 10 days to the Invoice Date. We can use a similar formula to calculate the date the invoice is due (Day 30).

For more information on adding and subtracting dates, go to the Microsoft support page