Equivalent Interest Rates

For example, 10% compounded quarterly and 10.125% compounded semiannually are equivalent nominal interest rates. If you calculate the future value of $100 invested at either rate for one year, you will obtain $110.38.

You can see that equivalent interest rates have different numerical values but produce the same effect.

The term “equivalent rates” carries with it the same concept as “effective rates” but takes into account interest rates that are compounded more than once per year. Note that “effective rates” refer to interest rates that are compounded annually.

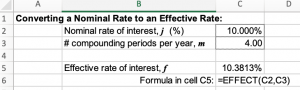

To use Excel to find equivalent interest rates we can use the EFFECT and NOMINAL functions

Steps:

- First, find the effective rate using the EFFECT function for the given nominal rate.

- Then, using the effective rate and the new compounding frequency to compute the new nominal rate using the NOMINAL function.

Example:

To be equivalent to 10% compounded quarterly, what must be the nominal rate with monthly compounding?

Given:

- nominal rate j1=10%

- compounding frequency m1=4

Step 1:

Find the Effective rate to 10% compounded quarterly. We can use the EFFECT function.

We have now found the effective rate of 10.3813%.

However, we are looking for the equivalent rate to 10% compounded quarterly.

Step 2

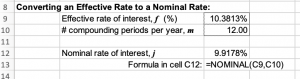

Find the nominal rate that is compounded monthly that is equivalent to the effective rate of 10.3813%.

We will use the compounding frequency m2=12 and the NOMINAL function.

Hence, the 9.9178% compounded monthly is equivalent to 10% compounded quarterly.

To see the spreadsheet used for this example:equivalent rates – template