10.4: The Role of Accounting

Understanding the numbers on the organization’s balance sheet can indicate its current financial position and show whether it’s on a trajectory for success or failure. By examining its cash flow statement, a business can gain insight into how cash is being generated and used. Through reviewing its income statement, a business can gauge how it is doing in relation to its expected performance.[1]

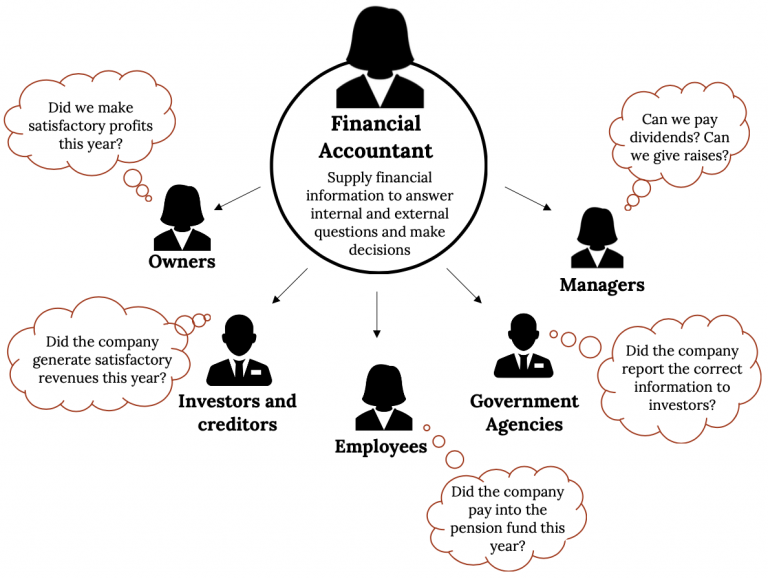

Financial accounting provides information not only to internal managers but also to people outside the organization (such as investors, creditors, government agencies, suppliers, employees, and labour unions) to assist them in assessing a firm’s financial performance.

Fields of Accounting

Accountants typically work in one of two major fields.

Managerial Accounting

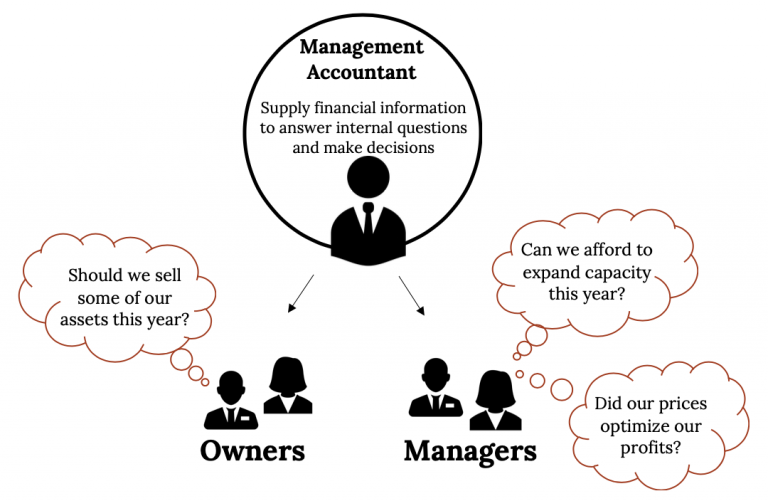

Management accountants provide information and analysis to decision makers inside the organization in order to help them run it. The main objective of managerial accounting is to assist the management of a company in efficiently performing its functions: planning, organizing, directing, and controlling. Because the information that it provides is intended for use by people who perform a wide variety of jobs, the format for reporting information is flexible. Reports are tailored to the needs of individual managers, and the purpose of such reports is to supply relevant, accurate, and timely information that will aid managers in making decisions. In preparing, analyzing, and communicating such information, accountants work with individuals from all the functional areas of the organization—human resources, operations, marketing, etc.

Financial Accounting

A financial accountant provides information to individuals and groups both inside and outside the organization in order to help them assess the organization’s financial performance. Their primary focus, however, is on external parties. In other words, management accounting helps you keep your business running while financial accounting tells the outside world how well you’re running it.

Financial accounting is responsible for preparing the organization’s financial statements—including the income statement, the statement of owners’ equity, the balance sheet, and the statement of cash flows—that summarize a company’s past performance and evaluate its current financial condition. If a company is traded publicly on a stock market such as the TSX or the NASDAQ, these financial statements must be made public, which is not true of the internal reports produced by management accountants. In preparing financial statements, financial accountants adhere to a set of standards or guidelines, known as Generally Accepted Accounting Principles (GAAP). GAAP is used mainly by companies headquartered in the U.S., while most other countries, including Canada, follow the International Financial Reporting Standards (IFRS). These multinational standards, which are issued by the International Accounting Standards Board (IASB), differ from US GAAP in a number of important ways, but exploring these fine distinctions is not part of this chapter. Bear in mind, however, that, according to most experts, a single set of worldwide standards will eventually emerge to govern the accounting practices of both US and non-US companies.

In Canada, as of 2011, the Accounting Standards Board (AcSB) requires that all publicly accountable enterprises use the International Financial Reporting Standards (IFRS) when preparing financial statements. While IFRS is mandatory for publicly owned companies, private companies can choose to use the Canadian Generally Accepted Accounting Principles (Canadian GAAP)[2] also known as Accounting Standards for Private Enterprises (ASPE). Users want to be sure that financial statements have been prepared according to IFRS or Canadian GAAP because they want to be sure that the information reported in them is accurate. They also know that when financial statements have been prepared using the same rules, they can be compared from one company to another.

Figures 10.1 and 10.2 illustrate the main users of management and financial accounting and the types of information produced by accountants in the two areas. In the rest of this chapter, we’ll learn how to prepare a set of financial statements and how to interpret them. We’ll also discuss issues of ethics in the accounting community and career opportunities in the accounting profession.

Who Uses Financial Accounting Information?

The users of managerial accounting information are pretty easy to identify—basically, they’re a firm’s managers. In summarizing the outcomes of a company’s financial activities over a specified period of time, financial statements are, in effect, report cards for owners and managers. They show, for example, whether the company made a profit and furnish other information about the firm’s financial condition. They also provide some information that managers and owners can use in order to take corrective action, though reports produced by management accountants offer a much greater level of depth.

Investors and creditors furnish the money that a company needs to operate, and not surprisingly, they want to know how that business is performing. Because they know that it’s impossible to make smart investment and loan decisions without accurate reports on an organization’s financial health, they study financial statements to assess a company’s performance and to make decisions about continued investment.

Businesses are required to furnish financial information to a number of government agencies. Publicly-owned companies, for example, the ones whose shares are traded on a stock exchange, must provide annual information forms to the Canadian Securities Administration (CSA), an organization that regulates stock trades and which is charged with ensuring that companies tell the truth with respect to their financial positions. Companies must also provide financial information to taxation agencies, including the Canada Revenue Agency (CRA).

A number of other external users have an interest in a company’s financial statements. Suppliers, for example, need to know if the company to which they sell their goods is having trouble paying its bills or may even be at risk of going under. Employees and labour unions are interested because salaries and other forms of compensation are dependent on an employer’s performance.

Media Attributions

“Figure 10.1: The Role of Managerial Accounting” is reused from The role of managerial accounting. © 2022 by Kindred Grey, licensed CC BY 4.0, and includes woman, manager, and manager, used under the Noun Project license.

“Figure 10.2: The Role of Financial Accounting” is reused from The role of financial accounting. © 2022 by Kindred Grey, licensed CC BY 4.0, and includes woman and manager, used under the Noun Project license.

Image descriptions

Figure 10.1

A concept diagram illustrating the role of a management accountant in an organization. At the top, there is a silhouette of a person symbolizing the management accountant, with the caption “supply financial information to answer internal questions and make decisions.” Below, two groups labelled “Owners” and “Managers” are depicted with silhouettes of people. Both groups have thought bubbles showing different questions they might have. The owners on the left ask, “Should we sell some of our assets this year?” The managers on the right have two thought bubbles asking, “Can we afford to expand capacity this year?” and “Did our prices optimize our profits?” Arrows connect the management accountant to the owners and managers, suggesting the flow of information.

Figure 10.2

A concept diagram illustrating the role of a financial accountant and their interactions with various stakeholders. In the center, a silhouette of a person labelled “Financial Accountant” is shown inside a large circle, with text stating their role: “Supply financial information to answer internal and external questions and make decisions.” Arrows extend from the accountant to five different groups: Owners, Investors and creditors, Employees, Government Agencies, and Managers. Each group is represented by a figure in silhouette with a speech bubble indicating their primary concern or question. Owners ask about profits, Investors and creditors inquire about revenues, Employees are concerned with pension fund contributions, Government Agencies question the accuracy of company information reporting, and Managers are interested in dividends and raises.

- Gavin, M. (2020, June 2). 5 ways managers can use finance to make better decisions. Harvard Business School Online. ↵

- Quickbooks Canada Team. (2020, September 18). Understanding IFRS and GAAP. Quickbooks. ↵

The process of identifying, measuring, analyzing, and interpreting financial information for use by internal management to plan, control, and make decisions within an organization.

A professional responsible for preparing and reporting a company’s financial information in accordance with established accounting standards, such as GAAP or IFRS.

GAAP (Generally Accepted Accounting Principles) are standardized rules and guidelines used by publicly traded companies in the U.S. to ensure financial statements are consistent, transparent, and comparable.

A set of global accounting standards that provide guidelines for how companies should prepare and present their financial statements. IFRS is used in over 140 countries, including Canada.