13.1: Financial Planning

Before we go any further, you need to understand a couple of key concepts. First, what exactly is meant by personal finances? Finance itself concerns the flow of money from one place to another, and your personal finances concern your money and what you plan to do with it as it flows in and out of your possession. Essentially, then, personal finance is the application of financial principles to the monetary decisions that you make either for your individual benefit or for that of your family.

Second, as suggested earlier, monetary decisions work out much more beneficially when they’re planned rather than improvised. Thus, our emphasis on financial planning—the ongoing process of managing your personal finances in order to meet goals that you’ve set for yourself or your family.

Financial planning requires you to address several questions, some of them relatively simple:

- What’s my annual income?

- How much debt do I have, and what are my monthly payments on that debt?

Others will require some investigation and calculation:

- What’s the value of my assets?

- How can I best budget my annual income?

Still others will require some forethought and forecasting:

- How much wealth can I expect to accumulate during my working lifetime?

- How much money will I need when I retire?

Financial Planning Life Cycle

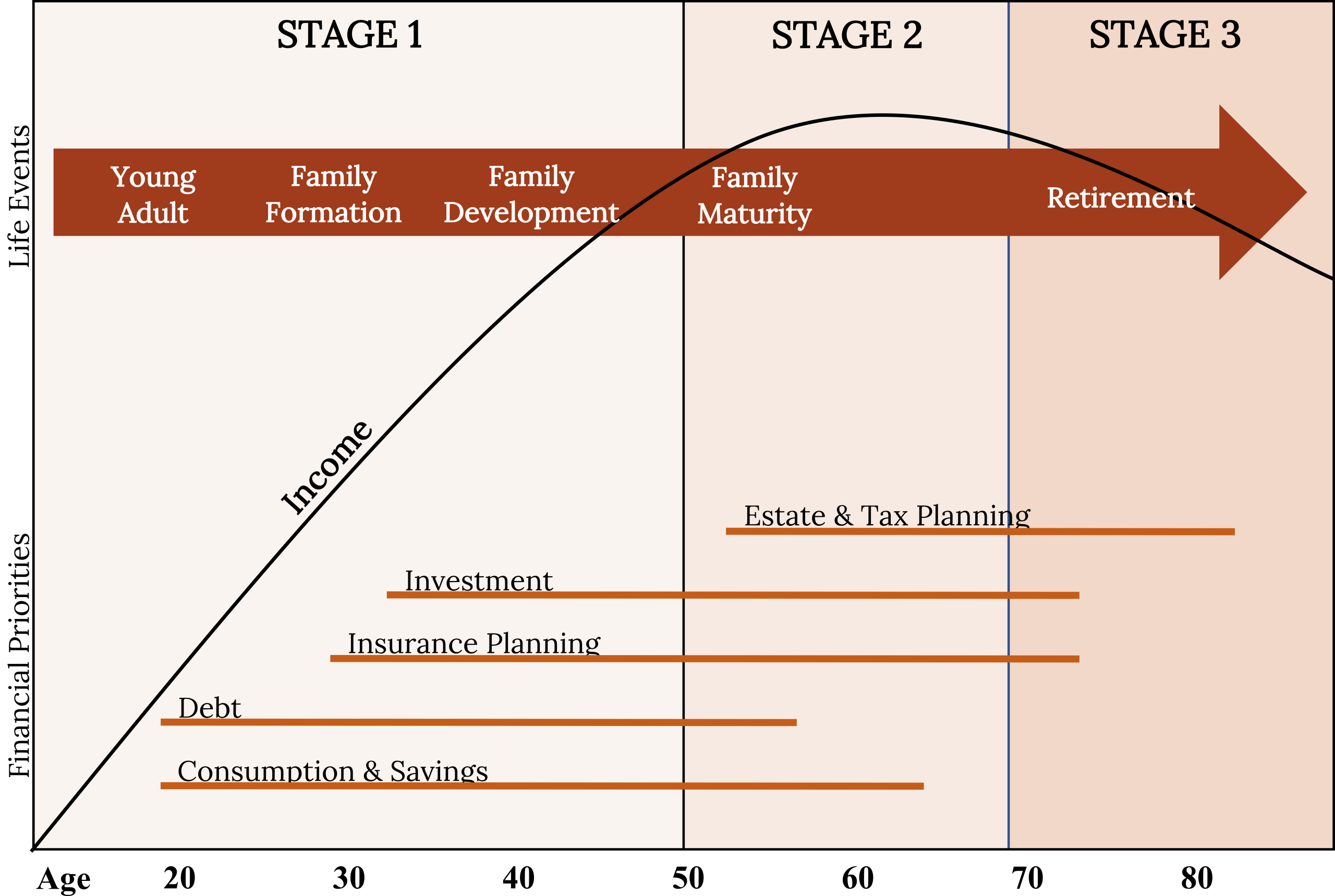

Another question that you might ask yourself—and certainly would do if you worked with a professional in financial planning—is, “How will my financial plans change over the course of my life?” Figure 13.1 illustrates the financial planning life cycle of a typical individual, one whose financial outlook and likely outcomes are probably a lot like yours.[1] As you can see, the diagram divides this individual’s life into three stages, each of which is characterized by different life events (such as beginning a family, buying a home, planning an estate, and retiring).

At each stage, there are recommended changes in the focus of the individual’s financial planning:

- Stage 1 focuses on building wealth.

- Stage 2 shifts the focus to the process of preserving and increasing wealth that one has accumulated and continues to accumulate.

- Stage 3 turns the focus to the process of living on (and, if possible, continuing to grow) one’s saved wealth after retirement.

At each stage, of course, complications can set in—changes in such conditions as marital or employment status or in the overall economic outlook, for example. Finally, as you can also see, your financial needs will probably peak somewhere in stage 2, at approximately age 55, or 10 years before the typical retirement age.

Until you’re on your own and working, you’re probably living on your parents’ wealth right now. In our hypothetical life cycle, financial planning begins in the individual’s early twenties. If that seems like rushing things, consider a basic fact of life: this is the age at which you’ll be choosing your career, not only the sort of work you want to do during your prime income-generating years, but also the kind of lifestyle you want to live.

Media Attributions

“Figure 13.1: The Financial Life Cycle” is reused from The Financial Life Cycle, © 2022 by Kindred Grey, licensed CC BY 4.0.

Image descriptions

Figure 13.1

A graphical representation of the financial life cycle. The x-axis shows age from 20 to 80 in ten-year increments. The graph is split into three stages. Stage 1 extends from 20 to 50. Stage 2 extends from 50 to 70. Stage 3 extends from 70 to 80. A large right-sided arrow lies at the top of the graph, labelled “Life Events.” Five events lie on the life events arrow, representing events at different ages. Age and events from left to right: Age 20, Young Adult; Age 25, Family Formation; Age 35, Family Development; Age 50, Family Maturity; Age 75, Retirement. A curved line representing income begins at the origin of the graph, steadily increases and peaks around 60 years old, then steadily decreases at the same rate. Five straight orange lines representing “Financial Priorities” lie under the income line vertically, beginning and ending at different ages. Age ranges and priorities listed from bottom to top are: Age 20 to 70, Consumption and savings; Age 20 to 60, Debt; Age 30 to 75, Insurance planning; Age 35 to 75, Investment; Age 50 to 80, Estate and tax planning.

- Gallager, T. J., & Andrews, J. D. Jr., (2003). Financial management: Principles and practice, 3rd ed. Prentice Hall. pp. 34, 196. ↵

The application of financial principles to the monetary decisions that you make, either for your individual benefit or for that of your family.

The ongoing process of managing your personal finances in order to meet goals that you’ve set for yourself or your family.