10.5 Online Surveys: Gathering Data

Online Surveys: Gathering Data

When creating surveys, the integration of both qualitative and quantitative data is achievable, contingent upon the formulation of the questions. Online surveys, a method of quantitative research conducted through the Internet to gather information about a population, offer the advantage of immediate data capture and facilitate swift and straightforward data analysis. Utilizing email or the web for survey administration proves to be a cost-effective means of overcoming geographical constraints in data collection.

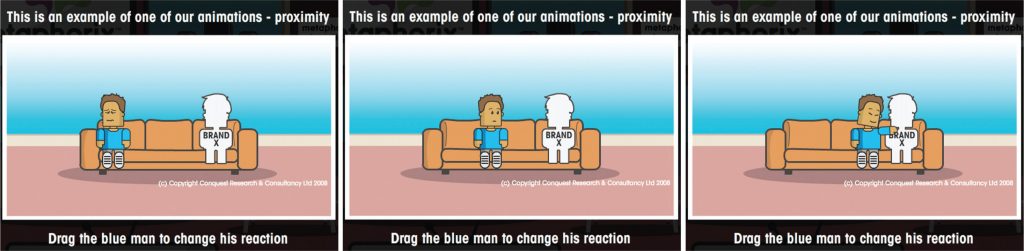

Advancements in technology further enable the creation of sophisticated and user-friendly surveys. For instance, instead of merely expressing opinions on a sliding scale, respondents can convey their emotional responses, adding nuance and depth to the gathered data.

Compare the images above to the following survey question:

| Rate how you feel about a brand: | ||

|---|---|---|

| negative | neither positive nor negative | positive |

Developing Surveys: Asking Questions

The effectiveness of a survey in collecting valuable data depends significantly on the survey’s design, with a particular emphasis on the formulation of questions. A survey may include various types and quantities of questions, and it is crucial to organize them to ensure more complex questions are presented only after respondents have acclimated to the survey.

Exercise caution during the question creation process to avoid introducing bias, which can influence the research process and compromise the objectivity of analyzing research results. This risk is particularly pertinent when formulating leading questions.

Example of Leading Question Bias

An illustrative query could be as follows:

“Recent enhancements have been implemented on the website to elevate its status as a premier online destination. What are your reflections on the modifications made to the site?”

Transform this into a more neutral version:

“What are your thoughts on the alterations to the website?”

Survey queries should be concise, easily comprehensible, and above all, straightforward to respond to.

Types of Survey Questions

Open-Ended Types

Open-ended questions allow respondents to answer in their own words. This usually results in qualitative data. Take the following example:

Example Open-Ended Questions

What features would you like to see on the eMarketing textbook’s website?

If there are enough respondents to an open-ended question, the responses can be used quantitatively. For example, you can confidently say that “37 percent of people thought that case studies were an important feature.”

Closed-Ended Types

Closed-ended questions give respondents specific responses to choose from (i.e., they are multiple-choice, with one answer or multiple answers). This results in quantitative data. Take the following examples:

Example Closed-Ended Questions

Do you use the eMarketing textbook website? Choose one that applies.

- Yes

- No

What features of the eMarketing textbook website do you use? Check all that apply.

- Blog

- Case Studies

- Free Downloads

- Additional resources

Ranked or Ordinal Questions

These questions ask respondents to rank items in order of preference or relevance. Respondents are given a numeric scale to indicate order. This results in quantitative data. Take the following example:

Example: Ranked / Ordinal Questions

Rate the features of the eMarketing textbook Web site, where 1 is the most useful, and 4 is the least useful:

- Blog

- Case studies

- Free downloads

- Additional resources

Matrix and Rating Types

These types of questions can be used to quantify qualitative data. Respondents are asked to rank their behaviour or attitude. Take the following example:

Example: Matrix and Rating Questions

| Strongly Disagree | Disagree | Neutral | Agree | Strongly Agree |

| 1 | 2 | 3 | 4 | 5 |

OR

| Strongly Disagree | Strongly Agree | |||

| 1 | 2 | 3 | 4 | 5 |

Rating scales can be balanced or unbalanced. When creating the questions and answers, choosing balanced or unbalanced scales will affect whether you collect data where someone can express a neutral opinion.

| Balanced | ||||

|---|---|---|---|---|

| Very Poor | Poor | Neutral | Good | Very Good |

| 1 | 2 | 3 | 4 | 5 |

OR

| Unbalanced | ||||

|---|---|---|---|---|

| Very Poor | Poor | Good | Very Good | Excellent |

| 1 | 2 | 3 | 4 | 5 |

How to Get Responses: Incentives and Assurances

As the researcher, you know what’s in it for you in sending out a survey: you will receive valuable data that will aid in making business decisions. But what is in it for the respondents?

According to SurveyMonkey, the ways in which the surveys are administered play a role in response rates for surveys, and these can be relative:

- Mail – 50 percent adequate, 60 to 70 percent good to very good.

- Phone – 80 percent good.

- E-mail – 40 percent average, 50 to 60 percent good to very good.

- Online – 30 percent average.

- Classroom pager – More than 50 percent good.

- Face-to-face – 80 to 85 percent good (SurveyMonkey, 2008, June 12).

Response rates can be improved by offering respondents an incentive for completing the survey, such as a chance at winning a grand prize, a lower-priced incentive for every respondent, or even the knowledge that they are improving a product or service that they care about.

There is a train of thought that paying incentives is not always a good thing. It may predispose less affluent or educated respondents to feel that they need to give so-called good or correct answers that may bias your results. Alternatively, you may attract respondents who are interested in it just for the reward. One approach could be to run the survey with no incentive, with the option to offer one if responses are limited.

Designing the survey so as to assure respondents of the time commitment and privacy implications of completing the survey can also help increase responses.

Conducting Research Surveys: A Step-by-Step Guide

As with all things eMarketing, careful planning goes a long way to determining success. As market research can be an expensive project, it is important that planning helps to determine the cost versus the benefit of the research. Qualitative research and secondary research are critical steps in determining whether a larger-scale research project is called for.

Bear in mind that many tasks that fall under the umbrella of research should be ongoing requirements of eMarketing activities, such as conversion testing and optimizing and online reputation management. Polls and small surveys can also be conducted regularly and non-intrusively among visitors to your website.

Step 1: Establish the Goals of the Project—What You Want to Learn

Secondary research can be used to give background and context to the business problem and the context in which the problem can be solved. It should also be used to determine alternative strategies for solving the problem, which can be evaluated through research. Qualitative research, particularly using established online research communities, can also help determine what business problems need to be solved. Ultimately, determine what actions you will be considering after the research is completed and what insights are required to make a decision on those actions.

Step 2: Determine Your Sample—Whom You Will Interview

You do not need to survey the entire population of your target market. Instead, a representative sample group of people is used to represent the population referred to in the research. It can be used to determine statistically relevant results. In selecting a sample, be careful to try to eliminate bias from the sample. Highly satisfied customers, for example, could give very different results than highly dissatisfied customers.

Step 3: Choose Research Methodology—How You Will Gather Data

The Internet provides a multitude of channels for gathering data. Surveys can be conducted online or via e-mail. Online research panels and online research communities can all be used to gather data. Web analytics can also be used to collect data, but this is a passive form of data collection. Determine what will provide you with the information you need to make decisions. Be sure to consider whether your research calls for qualitative or quantitative data, as this also determines the methodology.

Step 4: Create Your Questionnaire—What You Will Ask

Keep the survey and questions simple, and ensure that the length of the survey does not overwhelm respondents. A variety of questions can be used to make sure that the survey is not repetitive.

Be sure when creating the questions that you keep your goals in mind: don’t be tempted to try to collect too much data, or you will likely overwhelm respondents.

Step 5: Pretest the Questionnaire, If Practical—Whether You Are Asking the Right Questions

Test a questionnaire to determine if it is clear and renders correctly in various browsers or e-mail clients. Ensure that test respondents understand the questions and that they are able to answer them satisfactorily.

Step 6: Conduct Interviews and Enter Data—How You Will Find Out Information

Run the survey! Online surveys can be completed by respondents without your presence; you need to make sure that you get them in front of the right people. A survey can be sent to an e-mail database or can be advertised online.

Step 7: Analyze the Data—What You Find Out

Remember that quantitative data must be analyzed for statistical significance. The reports should aid in the decision-making process and produce actionable insights.

Room for Error

With all research, a given amount of error needs to be dealt with. Errors may result from the interviewers administering a questionnaire (and possibly leading the respondents) to the design and wording of the questionnaire itself, sample errors, and respondent errors. Using the Internet to administer surveys and questionnaires removes the bias that may arise from an interviewer. However, with no interviewer to explain questions, there is potential for greater respondent error. This is why survey design is so important and why it is crucial to test and run pilots of the survey before going live.

The Types of Errors

Respondent error: An error that occurs when respondents become desensitized to the research process. It also arises when respondents become too used to the survey process. There is the possibility of respondents becoming desensitized. There is even a growing trend of professional survey takers, especially when an incentive is involved. The general industry standard is to limit respondents to being interviewed once every six months.

Sample error: Inaccuracy in the results of research occurs when a population sample is used to explain the behaviour of the total population. Is a fact of market research. Some people are just not interested in, nor will ever be interested in, taking part in surveys. Are these people fundamentally different, with different purchasing behaviour, from those who do? Is there a way of finding out? To some extent, Web analytics, which tracks the behaviour of all visitors to your website, can be useful in determining the answer to this question.

When conducting any survey, it is crucial to understand who is in the target universe and the best way to reach it. Web surveys exclude elements of the population due to access or ability. It is vital to determine if this is acceptable to the survey and to use other means of capturing data if it is not.

Conducting Research: Who’s Going to Pay?

Regular research is an important aspect of the growth strategy of any business, but it can be tough to justify the budget necessary for research without knowing the benefit to the business. Conducting research can cost little more than the time of someone who works for a company, depending on the skills base of employees, or it can be an expensive exercise involving external experts. Deciding where your business needs are on the investment scale depends on the depth of the research required and what the expected growth will be for the business. When embarking on a research initiative, the cost-to-benefit ratio should be determined.

Testing should be an ongoing feature of any eMarketing activity. Tracking is a characteristic of most eMarketing that allows for constant testing of the most basic hypothesis: is this campaign successful in reaching the goals of the business?

Key Takeaways

- Conducting surveys online allows for data to be captured immediately.

- Developing technology allows for sophisticated and user-friendly surveys to be compiled.

- The success of a survey can be determined by how the survey is designed.

- Questions should be worded in a way that allows for an honest answer from the user. All questions should be easy to understand and answer.

-

There are four main types of survey questions:

- Open-ended

- Closed-ended

- Ranked or ordinal

- Matrix and rating

- Survey respondents should get something in return for the data they provide you.

- Response rates improve greatly when there is an incentive for the respondents. However, some people do not believe this is good to do, as responses may be biased. Survey takers may be in it just for the incentive.

- Careful planning is essential to any market research initiative.

-

The steps to executing market research properly are as follows:

- Establish the goals of the project.

- Determine your sample.

- Choose research methodology.

- Create your questionnaire.

- Pretest the questionnaire if practical.

- Conduct interviews and enter data.

- Analyze the data.

- Be aware that there is room for error.

- Costs for a research initiative can vary, depending on the scope of the project. It may be appropriate to do the study from within the company, or it may be necessary to hire external experts.

“18.4 Online Surveys: Gathering Data” from eMarketing: The Essential Guide to Online Marketing by Saylor Academy is licensed under a Creative Commons Attribution NonCommercical ShareAlike International 3.0 Licence, except where otherwise noted.