1.5 Market Segmentation

The segments or groups of people and organizations you decide to sell to are called a target market. Targeted marketing, or differentiated marketing, means that you may differentiate some aspect of marketing (offering, promotion, price) for different groups of customers selected. It is a relatively new phenomenon. Mass marketing, or undifferentiated marketing, came first. It evolved with mass production and involves selling the same product to everybody. You can think of mass marketing as a shotgun approach: you blast out as many marketing messages as possible on every medium available as often as you can afford (Spellings, 2009). Contrastingly, targeted marketing is more like shooting a rifle; you carefully aim at one type of customer with your message.

Age and Lifecycle Segments

Consumer needs and desires change with age. Many tourism organizations offer different marketing strategies to target various age and family lifecycle (or life stage) segments.

Example

An example is the tourism organization Retallack Resort, situated in Cornwall, south-west England, a luxury holiday resort catering for children and teenagers. Tour operators such as Saga Holidays and Contiki Tours (formerly Contiki Holidays for 18–35s) specialize by age. Saga Holidays specializes in holidays for the over-50s, whereas Contiki Tours targets youth and young adult travellers. Many tour operators, such as Exodus Travels, Wild Frontiers, and Highland Fling Bungee, target adventure-type holidays (bungee-jumping, cycling and white-water rafting, for example) aimed at consumers aged between 25 and 45. Similarly, the travel agency chain Student Flights targets the under 35s, the tour operator Contiki Tours 18–35s aims at the 18 to 35 market and the travel company Topdeck targets the “18 to 30 southings”. Tourism marketers must, however, be careful not to stereotype when using age and life cycle segmentation.

Some 75-year-olds might require disabled facilities at service providers such as B&Bs, while other 70-year-olds may take active sporting holidays. Similarly, some 40-year-old couples are sending their children off to university while others are beginning new families. Indeed, a marketer’s expectation that age equates to a life stage is eroding; the 30-year-old of the future may not be forming a family, and the 60-year-old is as likely to be running a business from their garage. Age should, therefore, not be used as an indicator of a person’s life cycle stage, family status, health, or buying power.

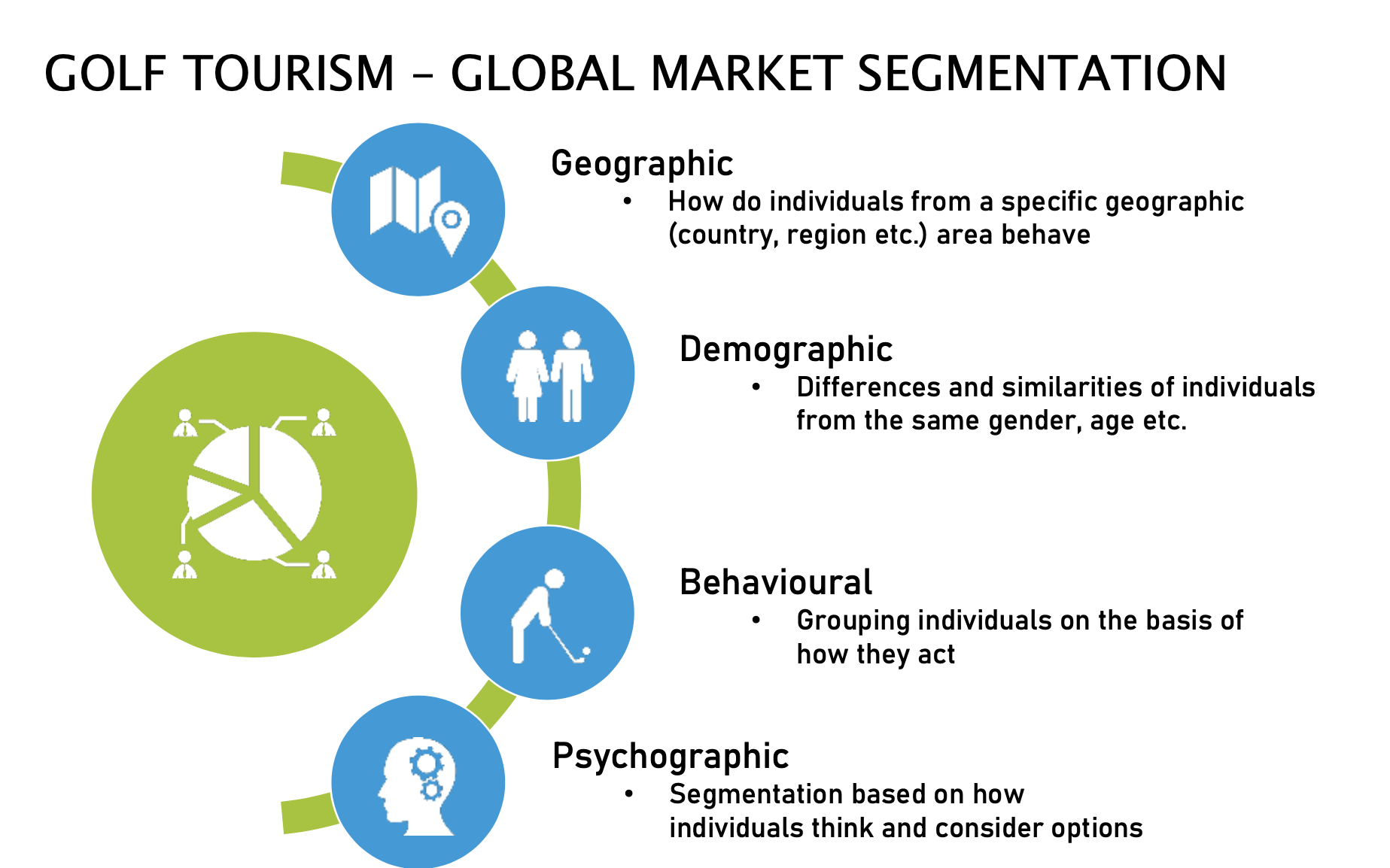

Types of Segmentation Bases

There are standard ways of segmenting buyers used to segment markets. Notice that the characteristics fall into one of four segmentation categories: behavioural, demographic, geographic, or psychographic. We’ll discuss each of these categories in a moment. For now, you can get a rough idea of what the categories consist of by looking at them in terms of how marketing professionals might answer the following questions:

- Behavioural segmentation. What benefits do customers want, and how do they use our product?

- Demographic segmentation. How do the ages, races, and ethnic backgrounds of our customers affect what they buy?

- Geographic segmentation. Where are our customers located, and how can we reach them? What products do they buy based on their locations?

- Psychographic segmentation. What do our customers think about and value? How do they live their lives?

Segmenting by Behaviour

Behavioural segmentation divides people and organizations into groups according to how they behave with or act toward products. Benefits segmentation—segmenting buyers by the benefits they want from products—is very common. Take toothpaste, for example. Which benefit is most important to you when you buy a toothpaste: The toothpaste’s price, ability to whiten your teeth, fight tooth decay, freshen your breath, or something else? Perhaps it’s a combination of two or more benefits. If marketing professionals know what those benefits are, they can tailor different toothpaste offerings to you (and others like you). For example, Colgate 2-in-1 Toothpaste & Mouthwash and Whitening Icy Blast are aimed at people who want the benefits of both fresher breath and whiter teeth.

Another way in which businesses segment buyers is by their usage rates—that is, how often, if ever, they use certain products. Harrah’s, an entertainment and gaming company, gathers information about the people who gamble at its casinos. High rollers, or people who spend a lot of money, are considered “VIPs.” VIPs get special treatment, including a personal “host” who looks after their needs during their casino visits. Companies are interested in frequent users because they want to reach other people like them. They are also keenly interested in nonusers and how they can be persuaded to use products. The membership model is based on repeat business driven by loyalty and member incentives to concentrate spending activity at the club.

Example

Segmenting by Demographics

Demographic segmentation segments buyers by personal characteristics such as age, income, ethnicity and nationality, education, occupation, religion, social class, and family size. Demographics are commonly utilized to segment markets because demographic information is publicly available in databases worldwide.

Age

| Generation | Also Known As | Birth Years | Characteristics |

|---|---|---|---|

| Seniors | “The Silent Generation,” “Matures,” “Veterans,” and “Traditionalists” | 1945 and prior |

|

| Baby Boomers | 1946-1964 |

|

|

| Generation X | 1965-1979 |

|

|

| Generation Y | “Millennials,” “Echo Boomers,” includes “Tweens” (preteens) | 1980–2000 |

|

| Note: Not all demographers agree on the cutoff dates between the generations. | |||

Although it’s hard to be all things to all people, many companies try to broaden their customer bases by appealing to multiple generations so they don’t lose market share when demographics change. Several companies have introduced lower-cost brands targeting Generation Xers with less spending power than boomers.

Golf Example

GGA Partners, the National Collegiate Club Golf Association (NCCGA), and The City Tour have jointly published a research study titled “Beyond Millennials: Emerging Generations and the Impact of Family” in the context of the contemporary golf landscape.

The surge in golf’s popularity amid the COVID-19 pandemic is widely acknowledged. In both 2020 and 2021, golf emerged as a low-risk outdoor activity, with 60% of respondents in our 2021 Industry Survey expressing an increased significance of golf in their lives due to the pandemic. While the figure dipped to 53% in 2022, the sustained interest in golf remains evident despite the easing of pandemic threats and associated restrictions. As the sport gains more attention, novel challenges are concurrently exerting additional pressures on golf enthusiasts.

Here are three notable insights derived from this year’s research:

- Millennials exhibit a notably lower engagement in golf compared to both Gen X and Gen Z. Intriguingly, singles tend to play slightly more golf than their partnered counterparts, with the highest participation observed among widowed, separated, or divorced players within this demographic.

- Generation Z is inclined to play golf more frequently with family members, in contrast to Gen X. Millennials, on the other hand, tend to favour playing with friends over family. Generation X is more likely to play with fellow members, while Generation Z exhibits lower-than-expected interest in playing with members.

- Gen Z golfers are identified as the group that spends the least on greens fees and additional expenses at the course. Conversely, millennials express the highest interest in investing more in greens fees, while Gen X is positioned as the cohort that spends the most during their time at the course.

Furthermore, survey findings reveal that two-thirds of respondents are willing to increase their spending on golf-related activities, with 50% expressing a willingness to invest up to $5,000 to join a private club. Interestingly, Gen X demonstrates a higher spending threshold ($6,758 USD) compared to both Gen Z and Millennials, who indicate a slightly lower willingness to spend ($6,100 USD). Respondents who are widowed or divorced express the highest willingness to spend ($6,818 USD), while singles exhibit the lowest willingness to spend ($6,022 USD) (GGA Partners, 2022).

Geography

Suppose your great new product or service idea involves opening a local store. Before opening the store, you will probably want to research to determine which geographical areas have the best potential. For instance, if your business is a high-end restaurant, should it be near the local college or country club? If you sell ski equipment, you probably will want to locate your shop in the vicinity of a mountain range with skiing. You might see a snowboard shop in the same area, but probably not a surfboard shop. By contrast, a surfboard shop will likely be located along the coast, but you probably would not find a snowboard shop on the beach.

Geographic segmentation divides the market into areas based on location and explains why the checkout clerks sometimes ask for your postal code. It’s also why businesses print codes on coupons that correspond to postal codes. When the coupons are redeemed, the store can find out where its customers are or are not. Geocoding is a process that takes data such as this and plots it on a map. Geocoding can help businesses see where prospective customers might be clustered and target them with various ad campaigns, including direct mail.

Proximity marketing is an interesting new technology firms use to segment and target buyers geographically within a few hundred feet of their businesses using wireless technology. In some areas, you can switch your mobile phone to a “discoverable mode” while you’re shopping and, if you want, get ads and deals from stores as you pass by them, which is often less expensive than hiring people to hand you a flier as you walk by.

In addition to figuring out where to locate stores and advertise to customers in that area, geographic segmentation helps firms tailor their products. Chances are you won’t be able to find the same heavy winter coat you see at a Walmart in Montana at a Walmart in Florida because of the climate differences between the two places. Market researchers also look at migration patterns to evaluate opportunities.

Psychographics

If your offering fulfills the needs of a specific demographic group, then the demographic can be an important basis for identifying groups of consumers interested in your product. What if your product crosses several market segments?

Example

Associating these specific needs with consumers in a particular demographic group could be difficult. Marketing professionals want to know why consumers behave the way they do, what is of high priority to them, or how they rank the importance of specific buying criteria. Psychographic segmentation can help fill in some of the blanks.

Psychographic information is frequently gathered via extensive surveys that ask people about their activities, interests, opinions, attitudes, values, and lifestyles. Based on responses to different questions, consumers were divided up into the following categories, each characterized by certain buying behaviours.

- Innovators. Innovators are successful, sophisticated, take-charge people with high self-esteem. Because they have such abundant resources, they exhibit all three primary motivations in varying degrees. They are change leaders and are the most receptive to new ideas and technologies. Innovators are very active consumers, and their purchases reflect cultivated tastes for upscale, niche products and services. Image is important to Innovators, not as evidence of status or power but as an expression of their taste, independence, and personality. Innovators are among the established and emerging leaders in business and government, yet they continue to seek challenges. Their lives are characterized by variety. Their possessions and recreation reflect a cultivated taste for the finer things in life.

- Thinkers. Thinkers are motivated by ideals. They are mature, satisfied, comfortable, and reflective people who value order, knowledge, and responsibility. They tend to be well-educated and actively seek out information in the decision-making process. They are well-informed about world and national events and are alert to opportunities to broaden their knowledge. Thinkers have a moderate respect for the status quo institutions of authority and social decorum but are open to considering new ideas. Although their incomes allow them many choices, Thinkers are conservative, practical consumers; they look for durability, functionality, and value in the products they buy.

- Achievers. Motivated by the desire for achievement, Achievers have goal-oriented lifestyles and a deep commitment to career and family. Their social lives reflect this focus and are structured around family, their place of worship, and work. Achievers live conventional lives, are politically conservative, and respect authority and the status quo. They value consensus, predictability, and stability over risk, intimacy, and self-discovery. With many wants and needs, Achievers are active in the consumer marketplace. Image is important to Achievers; they favour established, prestigious products and services that demonstrate success to their peers. Because of their busy lives, they are often interested in a variety of time-saving devices.

- Experiencers. Experiencers are motivated by self-expression. As young, enthusiastic, and impulsive consumers, Experiencers quickly become enthusiastic about new possibilities but are equally quick to cool. They seek variety and excitement, savouring the new, the offbeat, and the risky. Their energy finds an outlet in exercise, sports, outdoor recreation, and social activities. Experiencers are avid consumers and spend a comparatively high proportion of their income on fashion, entertainment, and socializing. Their purchases reflect the emphasis they place on looking good and having “cool” stuff.

- Believers. Like Thinkers, Believers are motivated by ideals. They are conservative, conventional people with concrete beliefs based on traditional, established codes: family, religion, community, and the nation. Many Believers express moral codes that are deeply rooted and literally interpreted. They follow established routines, organized in large part around home, family, community, and social or religious organizations to which they belong. As consumers, Believers are predictable; they choose familiar products and established brands and are generally loyal.

- Strivers. Strivers are trendy and fun-loving. Because they are motivated by achievement, Strivers are concerned about the opinions and approval of others. Money defines success for Strivers, who don’t have enough of it to meet their desires. They favour stylish products that emulate the purchases of people with greater material wealth. Many see themselves as having a job rather than a career, and a lack of skills and focus often prevents them from moving ahead. Strivers are active consumers because shopping is both a social activity and an opportunity to demonstrate to peers their ability to buy. As consumers, they are as impulsive as their financial circumstances will allow.

- Makers. Like Experiencers, Makers are motivated by self-expression. They express themselves and experience the world by working on it—building a house, raising children, fixing a car, or canning vegetables—and have enough skill and energy to carry out their projects successfully. Makers are practical people who have constructive skills and value self-sufficiency. They live within a traditional context of family, practical work, and physical recreation and have little interest in what lies outside that context. Makers are suspicious of new ideas and large institutions such as big business. They are respectful of government authority and organized labour but resentful of government intrusion on individual rights. They are unimpressed by material possessions other than those with a practical or functional purpose. Because they prefer value to luxury, they buy basic products.

- Survivors. Survivors live narrowly focused lives. With few resources with which to cope, they often believe that the world is changing too quickly. They are comfortable with the familiar and are primarily concerned with safety and security. Survivors do not show a strong primary motivation because they must focus on meeting needs rather than fulfilling desires. Survivors are cautious consumers. They represent a very modest market for most products and services. They are loyal to their favourite brands, especially if they can purchase them at a discount (Strategic Business Insights, n.d.).

Key Takeaways

Segmentation bases are criteria used to classify buyers. The buyer characteristics used to segment consumer markets are behavioural, demographic, geographic, and psychographic. Behavioural segmentation divides people and organizations into groups according to how they behave with or toward products. Segmenting buyers by personal characteristics such as their age, income, ethnicity, family size, and so forth is called demographic segmentation. Geographic segmentation involves segmenting buyers based on where they live. Psychographic segmentation seeks to differentiate buyers based on their activities, interests, opinions, attitudes, values, and lifestyles. Often, a firm uses multiple bases to get a fuller picture of its customers and create value for them. Marketing professionals develop consumer insight when they gather both quantitative and qualitative information about their customers. Many of the same bases used to segment consumer markets are used to segment business-to-business (B2B) markets. However, there are generally fewer behavioural-based segments in B2B markets.

“5.1 Targeted Marketing Versus Mass Marketing” & “5.2 How Markets Are Segmented” from Principles of Marketing by [Author removed at request of original publisher] is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.