2 Trade Finance: The Growing Use of Blockchain

Note. Retrieved from https://navi.com/blog/trade-finance/

By: Laura Alexandrescu, Jordan Cohen, Emily Graham & Shandru Nareshan

September 30, 2023 / University of Ottawa – Telfer School of Business Management

The FinTech Explorer: A Comprehensive Guide

“Blockchain is not just a technology; it’s a movement, a global phenomenon that is changing the way we do business, and trade finance is at the forefront of this revolution.”

– Chris Ballinger, CEO of the Mobility Open Blockchain Initiative (MOBI)

About Blockchain Technology

Since the introduction of Bitcoin in 2008 and the popularization of token-based digital currencies, Distributed Ledger Technology (DLT) has gained widespread notoriety (Bitcoin.com.au, n.d.). The system, which uses a public ledger of transactions, is maintained by a network of “miners” who operate computer nodes on the system. These nodes update the ledger with new transactions as they are made, with the ledger designed as a series of blocks of transactions linked together through various forms of cryptography – often referred to as blockchain. Using blockchain, parties can maintain a ledger of information without requiring oversight from any central authority (Chapman, J., 2017). Despite the resiliency of cryptocurrencies, several factors hinder their suitability for financial market infrastructures. In response to these limitations, fintech firms worldwide have been working to develop alternative DLT technologies that offer further restricted access to trusted counterparties, enhancing the use of blockchain in the trade finance sector (Chapman, J., 2017).

Central Bank Digital Currencies (CBDCs) offer a promising solution to the challenges “trustless” crypto ecosystems pose. By providing finality, liquidity, and integrity to the process, CBDCs can form the foundation of a more efficient and secure digital payment system with strong data governance and privacy standards, potentially revolutionizing cross-border payments and strengthening monetary sovereignty (Bank of International Settlements, 2021).

What is Trade Finance All About?

Trade finance is an essential part of global commerce. It enables the smooth flow of goods and services across borders. Letters of credit, guarantees, and insurance are some of the many important financial instruments needed to complete a trade transaction (Trade Finance Global, 2023). Despite how important trade finance is to our economy, its many risks and challenges hinder its efficiency.

A notable challenge resides in the intricate nature of trade finance processes. Numerous stakeholders’ engagement, complex regulatory frameworks, and diverse document requirements accentuate this complexity. Consequently, this intricate web often results in delays, errors, disputes, and financial losses for both buyers and sellers. The inherent opacity of this convoluted process further erodes trust among transaction participants, exacerbating the underlying complexities (Trade Finance Global, 2023).

This complexity also manifests in elevated operational costs, particularly burdening small and medium-sized enterprises (SMEs) (Trade Finance Global, 2023). These entities often encounter significant fees imposed by financial institutions and intermediaries, which fully hinder their ability to participate in international trade activities. This cost barrier restricts SMEs’ growth prospects and impedes their access to vital trade finance resources.

Technologies such as blockchain are being explored to address many of the challenges faced in trade finance, such as transparency, delays, high costs, uncertainties, complex procedures, and more (Trade Finance Global, 2023). Technological solutions such as blockchain have garnered attention in response to these challenges. Blockchain, renowned for its security, transparency, and decentralized structure, holds the potential to alleviate reliance on intermediaries within trade finance. Moreover, its implementation can foster streamlined information sharing through shared databases. The successes of Project Jasper, TradeLens, and We.Trade highlight the transformative capacity of blockchain in trade finance. Yet, as blockchain’s promise becomes increasingly evident, a central question remains: What challenges might accompany its integration, and how can these potential obstacles be effectively managed?

Project Jasper

In March 2016, the inception of Project Jasper marked a collaborative effort involving Payments Canada, the Bank of Canada, and the R3 consortium. Domestic financial institutions also contributed to this initiative, primarily investigating the potential advantages of employing DLT for interbank payments. A pivotal mandate undertaken by the Bank of Canada was to ensure the adherence of systemically important systems, such as Payments Canada’s Large Value Transfer System (LVTS), to risk management standards that bolster stability within the national financial landscape (Monetary Authority of Singapore, 2019). Throughout its evolution, Project Jasper encompassed three phases of experimentation and the development of a proof of concept centered on utilizing Wholesale Central Bank Digital Currencies (W-CBDCs) in conjunction with DLT. This progression yielded an enriched comprehension of how these systems could be harnessed to settle interbank payments.

During Phase 1, a prototype of Ethereum-based interbank transfers was formulated, emphasizing the latent potential and consequences of DLT and W-CBDCs in the context of interbank payments. This prototype operated on a Proof-of-Work (PoW) consensus protocol, enabling decentralized transaction validation. Addressing the limitations encountered in Phase 1, Phase 2 introduced critical enhancements such as bolstered settlement finality, escalated transaction throughput, augmented privacy measures, and optimized liquidity costs. To achieve this, a Corda-based interbank settlement system was crafted, complemented by integrating a Liquidity-Saving Mechanism (LSM). This novel mechanism facilitated the orderly queuing and netting of transactions, augmenting overall efficiency within the system (Monetary Authority of Singapore, n.d.).

Phase 3 extrapolated the PoW framework from Phase 2 to encompass the settlement of exchange-traded equities, delving into an integrated, end-to-end settlement process tailored for securities payments. This phase unveiled the capacity for immediate clearing and delivery-versus-payment settlements, underpinning the potential of effecting post-trade settlements via a DLT platform. Adopting instantaneous transaction settlement significantly curtailed counterparty risk while concurrently liberating valuable collateral (Monetary Authority of Singapore, n.d.).

Payments Canada, as the steward of the Canadian LVTS, is actively modernizing the core payment systems of Canada, a process buoyed by support from the Bank of Canada. Envisaged as an avenue to fortify the daily payment interactions of Canadian citizens, these modernized payment systems concurrently reinforce the bedrock of the Canadian financial ecosystem, ushering in heightened efficiency and security. It is noteworthy to distinguish the independent trajectory of Project Jasper from the ongoing modernization endeavors. The integration of DLT into the modernization roadmap remains unexplored, with no current intentions to align the two initiatives.

Architecture

The Jasper LSM uses periodic multilateral payment netting to process non-urgent payments. When a bank has a non-urgent payment, it can submit it to the payment queue, which waits with other queued payments until the beginning of a matching cycle. The matching cycle, characterized by an algorithmic assessment, aggregates submitted payments, computes net obligations for each participating bank and evaluates their respective liquidity positions (Chapman, J., 2017). This mechanism enables streamlining non-urgent payment processing, enhancing efficiency across the payment settlement landscape.

Overcoming centralization challenges inherent to DLT systems was a key concern in implementing the payment queue. The Canadian CBDC team devised an innovative “inhale/exhale” routine to address this. This routine introduces a deliberate delay between payment submission and ledger inclusion (Chapman, J., 2017). During the “inhale” phase, participating banks receive notifications urging them to send Digital Depository Receipts (DDRs) to the Bank of Canada. These payments undergo validation and subsequent ledger integration. The “exhale” phase involves the matching algorithm’s execution, leading to a subset of payments being cleared on a net basis using available funds. The Bank of Canada then reciprocates by disbursing DDR payments to participating banks, adjusting for obligations following the matching algorithm’s completion (Chapman, J., 2017).

Phase 3 of the project capitalizes on Corda-based Distributed Ledger Technology (DLT) to orchestrate the Canadian network and facilitate Hashed Time-Locked Contracts (HTLC) transactions. This phase entails the deployment of Corda nodes, encompassing entities like the Bank of Canada, banks, notaries, escrow services, and other components within Azure Virtual Machines (VMs) (Monetary Authority of Singapore, n.d.). The architectural scheme accommodates the execution of Proof-of-Work (PoW) use cases, encompassing CAD Wholesale Central Bank Digital Currency (W-CBDC) issuance and cross-border transactions via HTLC. Within the Corda-based DLT network, each participant operates a node with business-specific functionality instantiated through Corda Distributed Applications (CorDapps). CorDapps offers the infrastructure for peer-to-peer private transactions, encompassing states, contracts, transactions, and flows designed to accommodate diverse use cases (Monetary Authority of Singapore, n.d.).

A notable facet of the architectural configuration is the tokenization of cash, particularly W-CBDC. This process, employing the Digital Depository Receipt (DDR) model, facilitates the acquisition of CAD W-CBDC tokens by participating banks from the Bank of Canada. The issuance of tokens is underpinned by pledging cash from existing accounts at the bank (off-DLT ledger), and the redemption of tokens is enabled at the Bank of Canada. This redemption involves the transfer of the underlying cash from the pool account to the participant’s account, solidifying the tangible integration of traditional banking practices within the novel DLT framework (Monetary Authority of Singapore, 2019).

Benefits of Project Jasper

The potential advantages stemming from integrating a Central Bank Digital Currency (CBDC) into the Canadian trade finance landscape could fundamentally reshape the dynamics of cross-border payments within the nation. In 2020, the cumulative worth of cross-border payments from low-middle-income countries reached $450 billion CAD. By harnessing the digital competency of Project Jasper, underpinned by the steadfast backing of the Bank of Canada, the prospect arises for expeditious and secure cross-border money transfers. The predicted outcome is a mitigation of the intricacies and costs associated with cross-border payments, thereby simplifying international transactions for individuals and businesses. Furthermore, Project Jasper’s innovation could potentially contribute to diminishing the dependency on intermediaries, such as banks and money transfer entities, in the cross-border payment continuum, thereby fostering a more transparent and streamlined process.

A pivotal facet of Project Jasper lies in its capacity to extend financial inclusion, thereby catalyzing easier access and utilization of financial services, even for individuals traditionally excluded from mainstream financial institutions. The Government’s 2019 financial inclusion report statistics show that approximately 1 million individuals remain unbanked. Project Jasper’s influence could potentially contribute to narrowing such discrepancies, consequently augmenting the economic well-being of both individuals and communities.

Moreover, implementing CBDCs holds the potential to fortify the financial system’s stability by instituting a more resilient and dependable form of currency. The unique strength of CBDCs, derived from their issuance and endorsement by a central bank, translates into a more stabilized valuation and a decreased vulnerability to inflation, distinct from their physical cash counterparts. Notably, the advent of electronic change distribution, illustrated through a trial conducted by the Bank of Korea in 2017, accentuates the far-reaching benefits. This trial envisaged a coinless society, facilitating change deposits onto a prepaid card following transactions, ultimately resulting in substantial savings for the country. This resulted in the country saving almost €36.7 million. The upshot is a diminished propensity for financial instability and a curtailed necessity for central banks to resort to monetary policy instruments, such as interest rate manipulations, for economic management.

The unique role occupied by the central bank within the monetary framework plays a pivotal role in the discourse around CBDCs. Wholesale Central Bank Digital Currencies (W-CBDCs) are meticulously crafted for integration into the operations of regulated financial institutions. The essence of W-CBDCs lies in refining the prevailing two-tier system, harnessing the central bank’s operational records for interbank settlements and wholesale transactions, encompassing digital assets and cross-border payments (Bank for International Settlements, 2021). Analogous to the operational principles of central bank reserves, W-CBDCs for settlement engender novel prospects for payment conditionality, consequently invigorating the delivery-versus-payment mechanism within the domain of Real Time Gross Settlement (RTGS) systems. This transformative potential of W-CBDCs in payment infrastructure amplifies the seamless flow of financial transactions across regulated entities, fostering economic stability and nurturing growth prospects.

Limitations of Project Jasper

Project Jasper was a significant undertaking in understanding the potential impact of DLT on trade finance. The project provided valuable insights into how interbank payments can be completed on a distributed ledger and how different DLT platforms can be used for a wholesale payment system. It also explored how modern payment system features, such as queues, could be incorporated to increase efficiency by reducing collateral needs.

One of the key challenges in developing the project was transferring value while adhering to the PFMI requirements, which stipulate that an FMI should settle in central bank money whenever practical and available. The solution was to use digital depository receipts (DDRs) as a representation of Bank of Canada deposits, which were issued in the system by the Bank of Canada and backed one-for-one by cash pledged to the Bank by participants (Chapman, J., 2017).

Another challenge was settling payments efficiently with minimum DDRs or liquidity. The project explored real-time gross settlement (RTGS) systems, which process payments individually and immediately with finality but require significant liquidity demands. To address this, operators have implemented LSMs that periodically match offsetting payments submitted to a central payments queue and settle only the net obligations. However, offsetting algorithms can cause delays in settlement, which may not be suitable for some types of payment. The project explored the possibility of giving banks the choice of entering payments for immediate settlement or into a queue for netting and deferred settlement, making it the first public instance of implementing an LSM algorithm on a distributed ledger platform (Chapman, J., 2017). Ultimately, the project improved awareness of potential risks associated with DLT-based systems and how they can be mitigated. Although Project Jasper encountered challenges, its successful PoW can pave the way for future projects that use similar frameworks, such as blockchain technology in trade finance.

Based on the evidence presented, it is evident that Project Jasper represents a pivotal step toward transforming interbank payment settlements and cross-border transactions. The reduction in settlement times, increased transparency, and reduced dependency on intermediaries signify a promising evolution in trade finance practices. However, it’s essential to acknowledge that while Project Jasper has demonstrated considerable potential, challenges such as regulatory considerations and integration complexities remain important factors to address.

In light of the analysis, several strategic recommendations can be put forth. Firstly, stakeholders should continue to collaborate and share insights to fine-tune the implementation of Project Jasper. Secondly, efforts to ensure compatibility with existing financial infrastructure and regulatory frameworks should be pursued diligently. Lastly, exploring possibilities for cross-industry partnerships and international cooperation could facilitate the adoption of similar initiatives globally. Project Jasper offers a compelling glimpse into the future of trade finance. By recognizing the accomplishments achieved thus far and remaining vigilant in addressing challenges, financial institutions and policymakers can work collectively to harness the full potential of blockchain technology and reshape the landscape of global commerce.

TradeLens

TradeLens represented a transformative global trade digitization platform designed to streamline and enhance international trade processes. Its primary objective was to address the shipping industry’s inefficiencies, including outdated paper-based procedures, transaction opacity, and inadequate stakeholder trust. By introducing digital practices into supply chain operations, the initiative aimed to harness the potential of blockchain technology in minimizing paperwork, fostering collaborative data sharing and elevating cargo tracking and tracing capabilities. TradeLens significantly improved the exchange of information and cooperation across supply chains, promoting innovation and fostering a more seamless global trade environment.

A joint venture between IBM and GTD Solutions Inc., a subsidiary of Maersk, the world’s largest shipping company, TradeLens was launched in 2018. Despite its initial achievements, the platform encountered challenges due to its complexity in navigating the diverse facets of the industry. Nonetheless, critics of TradeLens attribute its setbacks not to blockchain technology itself but to the struggles in implementing and achieving widespread adoption. The potential of TradeLens’ technology remains promising for the future, and its ability to revolutionize the global trade landscape is still viable. However, this hinges on the collaboration required to surmount the barriers to effective blockchain technology implementation.

Challenges within the Supply Chain Industry

Inefficient and error-prone manual processes have resulted in significant resource wastage. The container industry revolutionized transportation around half a century ago, yet the methods and documentation of transporting goods have seen minimal evolution. A prime example of this inefficiency is a single shipment of avocados from Kenya to the Netherlands. Completing this transaction required the involvement of over 30 individuals and organizations, generating around 200 physical documents. Although these traditional practices were maintained to prevent potential technological fraud, sources indicate that fraud costs the shipping industry over $600 billion annually, with documentation accounting for nearly one-fifth of the overall cost of physical transportation.

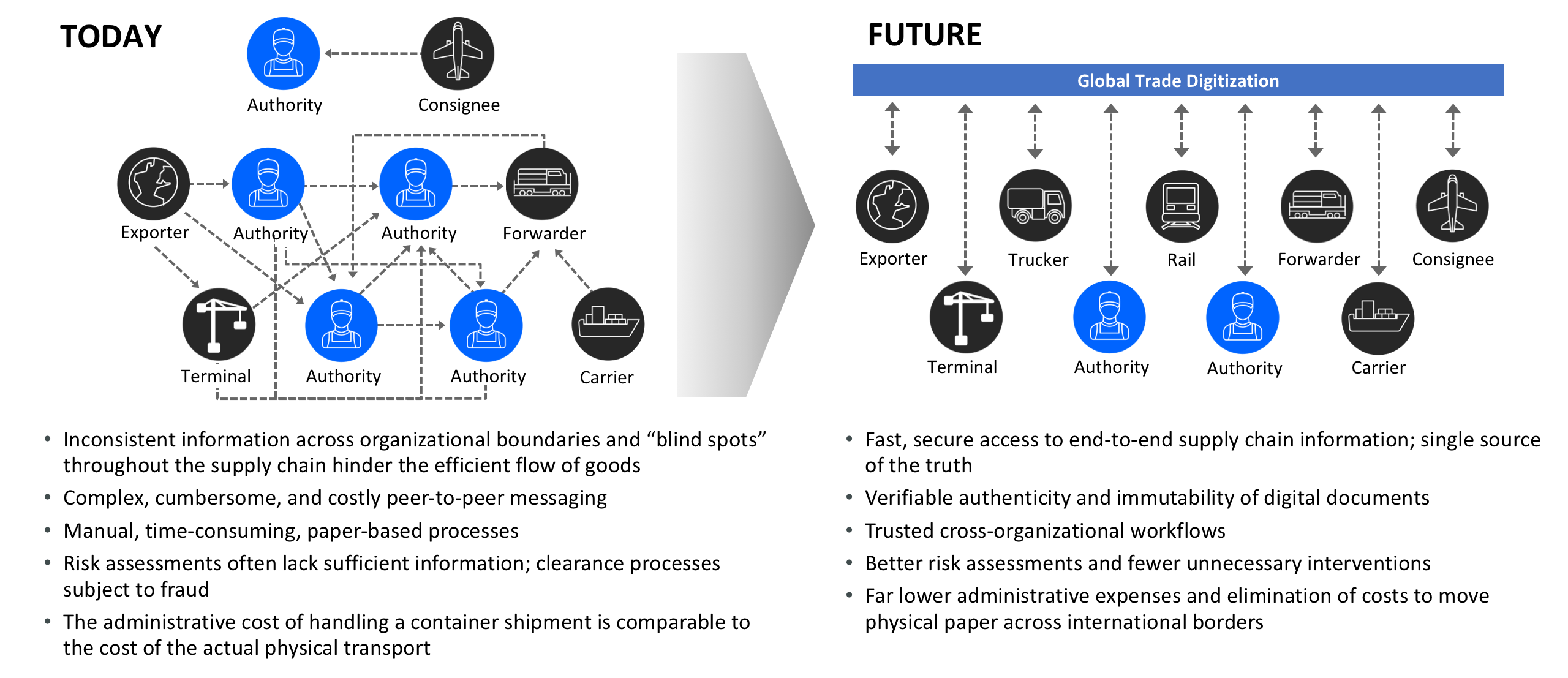

Another evident challenge lies in exchanging information within the shipment process, spanning multiple touchpoints. Observation of a shipment’s journey and its interactions at various stages, including goods transfer and documentation, revealed inconsistencies in information processing. The global supply chain encompasses three core activities: export, shipping, and import. These actions, while building the physical infrastructure of the supply chain and generating related documents, result in intricate information exchange networks (see Exhibit 1). Such disparities in information exchange often led to unnecessary and unforeseen delays due to misdirection of shipments. This environment lacks transparency and predictability, often stemming from processes reliant on personal connections, emails, and phone calls. Furthermore, IBM and Maersk’s assessments highlighted that certain shipments spend more time at ports than in transit. This obstructs the efficiency of global goods flow within supply chains, with only 64% of industry shipments being delivered on time.

Development of TradeLens

By 2017, the collaborative efforts of Maersk and IBM culminated in the announcement of their intention to establish a comprehensive global trade digitization platform. This platform aimed to provide freight forwarders, ports, shippers, and customs authorities with a digital avenue for exchanging essential documents, enhancing transparency and visibility throughout the trade process. The eventual blockchain-based platform was a product of the development of the Shipping Information Pipeline (SIP) and the Paperless Trade (PT) initiatives.

The Shipping Information Pipeline was designed to offer end-to-end visibility to all stakeholders, enabling secure real-time information exchange. It also addressed the existing deficiency in information exchange infrastructure by fostering connectivity through shared information. Companies would continually update relevant data on the pipeline throughout the journey of goods. Notably, this approach provided participating companies with a pre-existing dataset related to their shipments, obviating the need to construct individual systems for data collection. Notably, only the involved actors within the shipment process had access to the specific shipping events, ensuring the protection of competitive information (Chapman, J., 2017).

In tandem with the SIP initiative, IBM evaluated the feasibility of blockchain technology within the shipping industry. Collaborating with Maersk, the companies embarked on a journey to develop a prototype for trade finance, known as the PT initiative. After several rounds of iterations, the integration of smart contracts emerged as a significant breakthrough. These smart contracts, residing as lines of code on the blockchain, execute autonomously upon fulfilling predetermined conditions. This incorporation of smart contracts effectively demonstrated blockchain technology’s tangible and impactful potential, leading to its endorsement by Maersk’s CFO, Jacob Stausholm.

The final stage was the joint innovation initiative, which created the global trade digitization platform. This encompassed both the SIP and PT initiatives. While SIP focused on tracking and creating visibility for every event throughout the shipping process, PT concentrated on encrypting digital copies of crucial documents within global trade. The synergy between these two concepts was explored within the joint initiative. A pivotal milestone was reached with the successful pilot of the first trade lane, involving multiple companies as stakeholders for a shipment journey between Europe and the United States. The shipment embarked in January and reached its destination in February. This pilot proved successful, leading to the inception of a blockchain technology-based solution by IBM and Maersk. In 2017, Maersk’s CEO announced the network’s imminent expansion, opening the doors for all supply chain participants to utilize this transformative technology.

Architecture

Officially, in 2018, the initiative was announced and was commercially branded as TradeLens. IBM took on the role of hosting, operating, and supporting the platform. TradeLens’s primary objective is to establish connections across the entire supply chain ecosystem using the capabilities of blockchain technology. It facilitates permissioned sharing of documents and information through application program interfaces, regulated by access controls to ensure the integrity of transactions through encryption and verification. Additionally, TradeLens embraces smart contracts, adhering to predefined logical code and governance, which can be directly embedded within the shared ledger.

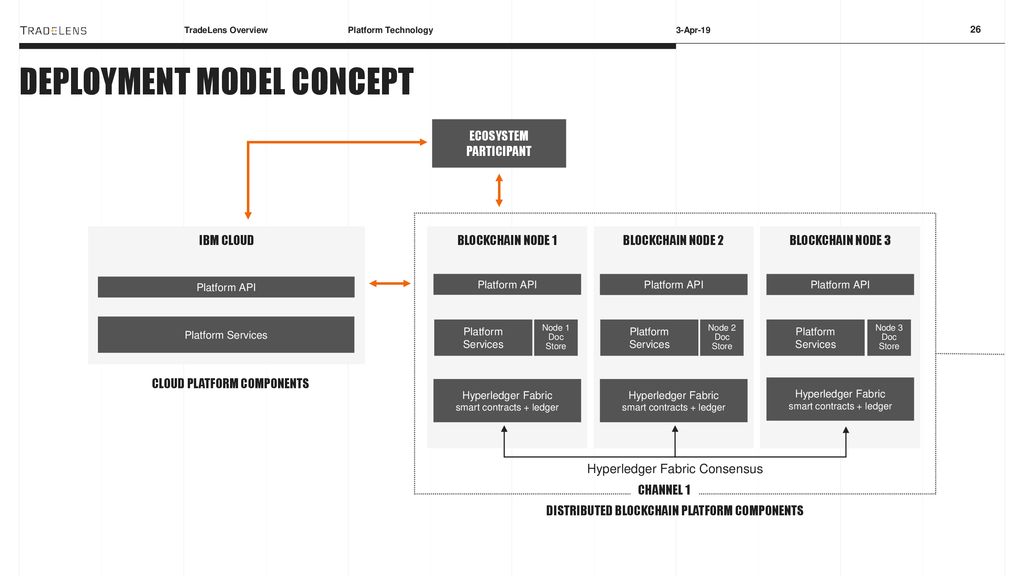

TradeLens consists of two foundational components. The first is the SIP platform, designed to give users comprehensive tracking and real-time updates on all pertinent event information across the supply chain. The second component is the PT blockchain network, which serves as the connective tissue among supply chain entities, housing and preserving essential documents. The architectural framework of TradeLens encompasses two distinct platform components: platform services and platform Application Programming Interfaces (APIs). These components operate within distributable blockchain nodes, leveraging Hyperledger Fabric to implement smart contracts and consensus platform elements to store documentation.

In more detail, the individual nodes of the distributed blockchain will be hosted by the varying actors and TradeLens. This process permits separation between competitors and participants. Each particular node will include a blockchain platform and a document storage component. An organization for each node will establish a communication channel, permitting all sensitive information to be distributed through the channels authorized by the actors. Documents are all stored in a single node, which can be accessed based on the organization’s permissions. TradeLens ensures interoperability by promoting industry UN/CEFACT standard, which includes access control and data model. This permits third-party platforms to expand new applications with APIs.

Benefits of TradeLens

TradeLens has the potential to completely transform the landscape of global trade and its operational procedures. As the World Economic Forum highlighted, adopting TradeLens could have a revolutionary impact on the trade ecosystem. By mitigating the prevailing trade barriers through TradeLens, the potential to lower international trade costs by as much as 20% exists. This cost reduction could simultaneously foster a significant 15% surge in trade volume. This transformative shift holds the power to reverberate through the global GDP, potentially contributing to a remarkable upswing of 5%. Additionally, this impact extends to crucial support for developing nations, with the possibility of an uplift of 15%.

A significant part of TradeLens is the digitization of documents, replacing the current paper-based and error-prone processes that the shipment industry continues to practice. Trade documents are now associated with specific containers and consignments, distributed on shared storage to eliminate unnecessary paper and endless information inspection.

TradeLens utilizes Hyperledger Fabric, ensuring all documentation is immutable and traceable. Furthermore, TradeLens’s adoption of Hyperledger Fabric aligns with the current trend of blockchain-based standards, enhancing interoperability with other blockchain technologies. Any amendments to documentation are instantly uploaded to the platform, eliminating unnecessary copies and inconsistencies between versions.

The introduction of blockchain brings connectivity to the supply chain ecosystem. The TradeLens blockchain boasts tamper-proof recording and non-repudiation for all data. This means that all data is securely recorded within the ledger of the Trust Anchors, a network based on cryptographic identities. Maintaining data privacy within the supply chain is paramount, and TradeLens ensures that data can only be accessed by registered entities with explicit permission bolstered by strong access controls. Moreover, TradeLens offers strong verifiability. All submissions on the blockchain can be verified against a hash of the original documentation submitted. This multi-layered approach to security, privacy, and traceability significantly fosters trust within the shipping industry.

Limitation of TradeLens

While TradeLens blockchain technology offers value to a wide range of industry participants, its key limitation lies in achieving widespread adoption. The global trade industry’s vast size and complexity and the many actors involved present a challenge: TradeLens may not deliver significant value without engaging all relevant parties. The platform’s effectiveness hinges on its ability to onboard diverse industry stakeholders. Some hesitated due to affiliations with Maersk, even though the platform is registered as a separate entity. Trust issues surrounding the platform’s culture, compounded by network effects, contributed to companies’ reluctance to embrace disruptive technology.

Experts suggest that the complexity of the TradeLens platform itself could be a barrier to adoption. This complexity pertains to both the blockchain application and the internal decision-making process required for adoption. The technological intricacy necessitates companies to invest in higher computing power, incurring potential additional expenses. IBM and Maersk’s stature as major multinational companies in their respective industries adds another layer of complexity. Transferring technical responsibilities to a neutral entity like the World Trade Organization is also challenging, potentially leading to further implementation delays due to limitations.

The platform operates in a diverse regulatory environment where different countries have varying governance restrictions. Adapting to these discrepancies can be time-consuming and costly. For instance, regulations like the European Union’s (EU) 1960/11 stipulate the mandatory use of physical documents, blocking the adoption of digitized alternatives. Political considerations come into play in certain countries, influencing decisions to avoid TradeLens. Establishing a broad acceptance base could pressure national authorities to revise regulations, creating a waiting scenario among industry actors due to network effects.

TradeLens’ primary limitation centers around its struggle to achieve widespread adoption. Despite its potential to digitize the supply chain, challenges stemming from factors such as Maersk’s involvement, intricate innovation, and governance hurdles contributed to the project’s discontinuation. Nevertheless, the obstacles TradeLens faces can be valuable lessons for future projects with a similar blockchain technology framework in trade finance.

We.Trade

We.Trade is a Europe-based blockchain platform introduced to address cross-border trade financing challenges SMEs face. Launched in 2018, the platform emerged from collaborating with several prominent European banks, including HSBC, KBC, and UniCredit. These institutions combined their expertise in trade finance and blockchain technology to develop a solution tailored to the needs of European SMEs. The consortium’s formation was prompted by the growing demand for blockchain-driven trade finance solutions and the recognition that blockchain could effectively tackle prevailing trade finance issues, including risk, errors, disputes, high costs, and lengthy processing times. The platform’s primary objective was to offer SMEs a secure and transparent avenue to access trade finance efficiently and affordably (We.Trade Case Study, n.d.).

We.Trade has since established itself as a leading blockchain-based trade finance solution in Europe. It successfully conducted pilot programs in European countries such as the Netherlands, Belgium, and Denmark. These pilots encompassed a range of services, including trade financing, risk management, invoice financing, and supply chain finance. The platform’s innovative approach to trade financing earned it accolades, including the Best Trade Finance Provider award at the 2020 Global Finance Awards (We.Trade Case Study, n.d.). By leveraging blockchain technology, We.Trade transformed the landscape of SMEs’ international trade transactions, rendering them simpler, quicker, and more secure.

The broader impact of We.Trade is evident in how it addresses trade finance challenges through blockchain technology. The platform showcases the potential to decrease costs, risks, and errors linked to cross-border transactions, empowering SMEs to expand their market reach and venture into new territories. Regulatory bodies, academics, and business leaders have taken a keen interest in We.Trade, fostering innovation and collaboration within the trade finance sector. As a significant advancement in international trade finance, We.Trade has the potential to reshape how SMEs access trade financing and navigate the complexities of global trade.

We.Trade Technology

Amongst the variety of blockchain platforms, We.Trade used a permissioned blockchain. This choice ensures that only authorized parties can access the blockchain, a strategic move to enhance security and align with data protection regulations. To this end, We.Trade leveraged the IBM blockchain, which facilitated the creation of a connected trade financing platform while maintaining stringent security measures (We.Trade Case Study, n.d.).

The foundation of the platform was established on the Hyperledger Fabric blockchain, a renowned open-source enterprise-oriented blockchain framework developed by the Linux Foundation’s Hyperledger project. This choice catered to the core requirements of European banks involved in We.Trade’s development, including security, privacy, and scalability. Moreover, the Hyperledger Fabric platform accommodated the integration of smart contracts, a pivotal innovation streamlining transactions and minimizing the likelihood of errors and disputes among involved parties (We.Trade Case Study, n.d.).

A suite of pivotal features is inherent in We.Trade’s technology. Notably, the digital representation of documents stands out. Trade-related documents, including invoices and purchase orders, find their place on the blockchain, ensuring transparency and tamper-proofing. The digitization of trade finance documents carries many benefits for the trade finance domain (We.Trade Case Study, n.d.).

Another noteworthy facet of utilizing IBM blockchain technology is the integration of APIs. These APIs bridge the platform and key stakeholders, such as banks and other financial institutions. The real-time data exchange these APIs facilitate is critical in cross-border trade financing (We.Trade Case Study, n.d.). We.Trade harnessed the capabilities of the permissioned IBM blockchain to forge a platform marked by security, efficiency, and transparency in cross-border trade finance. This specific flavor of blockchain technology empowered We.Trade to furnish SMEs with solutions that effectively curbed costs and mitigated risks associated with international trade activities.

Benefits of We.Trade

At its core, We.Trade pursued a primary objective: simplifying and diminishing the risks inherent in cross-border trade finance. One of the most pressing issues in this arena was the loss of trust between buyers and sellers, often culminating in payment delays and disputes. This difficulty was adeptly tackled by We.Trade through integrating two key solutions: the implementation of smart contracts and the removal of intermediaries. Smart contracts, characterized by their self-executing nature with agreement terms encoded directly, ushered in a more secure and transparent transactional paradigm within cross-border trade finance. These contracts are recorded immutably on the blockchain, rendering any alterations impossible. This heightened transparency not only combats fraudulent activities but ensures compliance with regulations. The displacement of intermediaries through smart contracts further alleviates the propensity for conflicts and payment delays. The collective outcome is enhanced security, transparency, precision, and transaction processing speed (IBM MediaCenter, 2019).

As explained in the discourse on We.Trade’s technological foundation, the IBM blockchain technology, facilitates the adoption of digital documents (IBM MediaCenter, 2019). Transitioning from physical documents to digital formats yields many benefits, including cost reduction, the promotion of sustainable business practices, ease of document accessibility, and a decrease in human errors. The migration to digital documents streamlines the entire trade finance process, empowering businesses to engage in transactions while expediting completion times.

In addition, real-time transactions present a notable advantage. Real-time transactions eradicate the protracted periods often associated with clearance and settlement, elevating efficiency and augmenting security via advanced encryption and authentication protocols. Enhanced encryption concurrently diminishes the risk of fraud. Real-time transactions also offer a strategic advantage in cash flow management, simplifying financial decision-making for businesses (IBM MediaCenter, 2019).

We.Trade extends a multitude of benefits to the trade finance landscape. The diverse technological features synergistically foster security, efficiency, transparency, precision, accelerated processing times, and sustainability. Taken together, these attributes wield the potential to wholly reshape trade finance, ushering in novel opportunities for SMEs to thrive in the industry and propelling the progression of the trade finance domain.

UBS’ Participation

Given the existence of competing trade finance solutions within the market, We.Trade faced challenges in securing traction and widespread adoption. The competitive landscape rendered it arduous for We.Trade to set itself apart and draw new banks into its fold. However, the entrance of UBS, a renowned and influential entity within the banking sphere, into the platform’s ranks in October 2019 stood as a meaningful testament to its credibility and value. UBS’ decision to align with We.Trade carried profound significance; it resonated as a vote of confidence in the platform’s potential. This strategic alignment with UBS resonated well beyond mere partnership—as a resounding endorsement of We.Trade’s credibility and efficacy. This noteworthy development amplified We.Trade’s visibility, attracting a surge of interest from other financial institutions. The participation of Erste Group from Austria and Spain’s CaixaBank, who commenced conducting live transactions through We.Trade, shortly thereafter, reinforced this momentum.

UBS’ integration into the We.Trade ecosystem bore remarkable implications, elevating We.Trade’s standing and instilling it with a unique distinction compared to its market rivals. The entry of UBS highlighted We.Trade’s importance as a dependable and indispensable solution in trade finance, augmenting its appeal to potential participant banks. By actively participating in the We.Trade platform, UBS furnished a tangible example of how a banking giant can wield considerable influence in swaying corporate decisions. The reinforcement of We.Trade’s reputation through UBS’ support precipitated a ripple effect, amplifying the platform’s allure and resonating as an exemplar of industry collaboration and validation (Allison, I., 2021).

We.Trade Cash Burn

We.Trade faced significant financial challenges that eventually led to its closure. Following the pandemic, the company encountered financial difficulties, which forced the firm to cut its workforce in half. Despite its attempts to raise capital through a funding round in 2021, which led to the firm securing €5.5mn from six member banks and a credit bureau provider, the investment was not enough to sustain the company’s operations, and it was forced to shut down in May 2022 (Wragg, E., 2022).

We.Trade’s downfall had a significant impact and shed light on the blockchain platform’s difficulties. It highlighted the challenges SME fintech companies face when competing with larger, more established players in the market. Although We.Trade provided a unique and innovative solution for trade finance, it was unable to obtain adequate funding to maintain its operations. In addition, the demise of We.Trade demonstrated the importance of securing sufficient funding for start-ups and early-stage companies. Without that capital, even the most promising and innovative solutions may struggle to survive in such a highly competitive market (Wragg, E., 2022).

We.Trade’s downfall also meant implications for its member banks and their customers. With We.Trade no longer operational, member banks were forced to engage directly with their customers to manage any existing trade activities. This likely created additional administrative and operational burdens for these banks and may have impacted their ability to provide seamless and efficient trade financing to their customers.

The Limitations of We.Trade

We.Trade was an innovative trade finance platform that streamlined international trade using blockchain technology. However, the platform faced some downsides that minimized its reach, effectiveness, and competition in the market.

One of the most significant limitations of We.Trade was its reduced reach since it was only available to member banks. Therefore, the platform already had a much narrower scope than other trade finance platforms. On top of that, We.Trade faced challenges with those member banks adopting the idea and technology as it was labeled “complex.” It was not open due to stiff competition from other established trade finance solutions. Furthermore, the platform’s dependence on its member banks for funding and operations made it vulnerable to changes in the banking industry and the financial health of its member banks, which ultimately was the cause of We.Trade’s demise (IBM MediaCenter, 2019).

Understanding the limitations of We.Trade is crucial for developing effective and competitive trade finance solutions that can meet the needs of businesses, reduce transaction costs, and promote international trade. By addressing the challenges faced by We.Trade, new industries can work towards developing more accessible, affordable, and user-friendly trade finance solutions that can drive economic growth and prosperity.

Challenges With Blockchain

Securing Blockchain

Trade finance is a complex process involving many aspects, including banks, exporters and importers. The traditional way of conducting trade financing transactions is inefficient, costly and risky. Though blockchain can revolutionize trade finance, the cases above outline some current risks associated with blockchain. For blockchain to reach its full potential, it must overcome interoperability, regulations, scalability, and standardization.

Interoperability

Interoperability is a potential issue found with blockchain technology in trade finance. It refers to the method by which different blockchain networks communicate. This is a focal part of trade finance since it enables the various stakeholders within the supply chain, such as banks, sellers, and buyers, to share and exchange secure and transparent information properly. Different blockchain platforms have unique languages, mechanisms and data structures, making communicating with one another challenging. In addition, most financial institutions use various systems predating blockchain technology. These existing systems are not designed to interact with blockchain-based systems, making the integration with existing systems very challenging. There are fundamental differences between the existing systems used by banks and blockchain systems. Traditional systems often rely on centralized databases managed and accessed by a single entity. Legacy systems have been developed for years, each designed to meet specific requirements. Blockchain systems use decentralized ledgers that allow for maintenance by a network of participants. Integrating the two systems would require new tools to translate data between the blockchain and legacy systems. If each party utilizes different blockchain platforms in trade finance, it will be increasingly difficult to interact, resulting in inefficient and slower processes.

Regulations

The regulatory environment is still evolving in trade finance. The lack of clear blockchain technology regulations creates barriers for banks and other important parties. Since blockchain disrupts the current traditional frameworks, there are challenges in regulating the new technology. Blockchain technology can operate across borders, which creates an ambiguous legal status. In addition, the novelty of the technology leads to inconsistencies in how it is regulated. An example of this can be perceived within the TradeLens platform, where the EU has a regulation 1960/11, which permits the use of physical documents, which directly opposes the practices of the platform and its paperless trade initiatives. Continually, the Anti-Money Laundering (AML) and Know-Your-Customers (KYC) Regulation in place requires financial institutions to verify who their customers are and monitor their transactions for potential dangers. In contrast, blockchain technology is designed to be anonymous, going against these regulations.

Scalability

Traditional blockchain can struggle with maintaining the complexity and high volume of trade transactions. The network begins to slow down with more participants and transactions on the blockchain. This inefficiency can weaken the usefulness of blockchain in trade finance. Since blockchain also relies on multiple nodes approving a transaction, with more nodes, the network becomes more vulnerable to bottlenecks. Storage can also begin to become an issue. As more documents are added, it can become difficult to access these documents.

Standardization

The absence of standardized formats makes it difficult for different parties to exchange data with one another and can frequently lead to the need for increased costs. Standardization of blockchain is a crucial aspect of implementing blockchain technology in trade finance. Standardization can not only increase trust in blockchain-based transactions but also reduce costs and promote interoperability. Achieving standardization is a complex challenge due to the requirement of cooperation from various stakeholders such as banks, technology providers, and government.

Blockchain Adoption

Despite blockchain’s many benefits to traditional trade finance, widespread adoption is lacking. The challenges outlined above cause hesitation from many organizations to invest in the technology. This problem must be solved for blockchain to have a significant role in the future of trade finance. A combination of strategies is needed to increase blockchain adoption, including education, collaborative partnership, user experience, and scalability.

Education is crucial for increasing awareness and understanding of the benefits of blockchain technology. Disruptive technologies often have decreased adoption due to a lack of understanding. People are hesitant about new ways and have a fear of change. Many businesses and individuals still lack knowledge about blockchain and its potential applications. Providing education and training can help the adoption of blockchain and showcase how it can be used to solve problems and create value. Providing more education can also help reduce the stigma associated with new technology.

Blockchain in trade finance also lacks popularity and mainstream acceptance since not many influential banks promote it. Industry giants’ backing can encourage other companies to follow and adopt the innovation when introducing a new platform or technology, as observed with We.Trade. Without the influence of other major league players in trade finance, a lack of understanding and awareness among businesses and individuals and concerns around security, privacy, and regulatory compliance can easily arise. Additionally, the technical complexity of blockchain solutions and the difficulty of integrating them with existing systems can also be a barrier to adoption.

The Future of Blockchain in Trade Finance

Breaking Down Barriers

To fully realize the potential of blockchain in trade finance, it is crucial to overcome the associated challenges. Blockchain can make trade finance more efficient, less prone to human errors, less costly, and more sustainable while decreasing the length of transaction time and improving security. There are a variety of solutions that can be developed to begin bringing blockchain to global commerce. Platforms such as Hyperledger, APIs, incentives, regulatory sandboxes, and sharding are some improvements that could be implemented to create a better blockchain-based trade finance environment.

Solution to Interoperability

One potential solution to interoperability with existing systems is the use of APIs. If financial institutions worked on building APIs and other integration tools, it would allow for easy blockchain integration with traditional systems. APIs provide a way for different systems to communicate. Integrating blockchain technology with existing systems is essential for creating global use of blockchain in trade finance. Though it would be a complex and time-consuming process, the potential benefits of blockchain in trade finance can completely revolutionize the industry (IBM MediaCenter, 2019).

As seen in the TradeLens case, using Hyperledger Fabric can solve the interoperability challenges in blockchain. This permissioned framework provides the modular architecture that permits decentralized application development. To begin, smart contracts utilize chain-code, which defines the logistics and rules of a transaction. Smart contracts can be derived from varying programming languages, allowing interaction from many blockchain networks thereby allowing communication amongst parties more efficiently. As mentioned, the modular design provides a level of flexibility and customization. This is because the modules can be modified based on the needs of different systems within parts of the network, all without creating a new network. Conclusively, Hyperledger Fabric is built on open standards and protocols, which facilitates communication between different systems much easier and, when combined, helps address the challenges of transparency, trust, and security, which are significant in trade finance (IBM MediaCenter, 2019).

Solution to Regulations

Regulatory sandboxes are one solution to the challenge of regulations. As touched on in Project Jasper, a sandbox environment is essential to allow businesses to test out blockchain technology without the fear of regulatory repercussions. With regulatory sandboxes, companies can work closely with and under regulatory authorities to meet all legal measures. This allows organizations to ensure the technology is compliant with relevant laws. Regulatory sandboxes can also help with the current struggle for trust from organizations and businesses, as seen in both cases, We.Trade and TradeLens. When regulatory authorities monitor the testing stages, this ensures compliance with AML and KYC regulations (IBM MediaCenter, 2019).

Solution to Scalability

Sharding is a potential solution to the scalability challenge with blockchain in trade finance. This is breaking up the ledger into smaller pieces or “shards.” Sharding creates a more manageable platform. Each shard is required only to validate relevant transactions to that specific channel. Sharding can be as easy as allocating nodes by random or more complex and ensuring shards are distributed evenly across networks. Sharding is a promising solution to the scalability challenge with blockchain in trade finance (IBM MediaCenter, 2019).

Solution to Standardization

Standardization is another challenge with blockchain in trade finance. A few changes need to be made to achieve standardization of blockchain technology. Firstly, regulatory authorities would need to come together and create a supportive legal framework for blockchain technology to begin promoting standardization. The many benefits outlined and the solutions that can combat challenges in finance are just some facts that could help organizations become less hesitant about investing in blockchain technology. These incentives, such as lower costs, access to new funding, better security and efficiency, should encourage more organizations to implement blockchain (IBM MediaCenter, 2019). Other incentives such as tokens or CBDC given to anyone that makes a transaction using blockchain have also been discussed to be used to begin creating blockchain-based global commerce.

Unlocking the Full Potential of Blockchain in Trade Finance

In a world where technology is advancing at an unprecedented rate, blockchain has emerged as a game-changing tool that has the potential to revolutionize the trade finance ecosystem. Its unique features, including transparency, security, and decentralization, make it a powerful instrument that can improve the efficiency and stability of the financial system. However, the challenges that must be addressed before blockchain can be applied to its full potential are significant. As policymakers and regulators consider the adoption of CBDCs, it is crucial that they carefully weigh the potential benefits and challenges to ensure that the implementation is both safe and beneficial for competition and innovation in the financial sector. To the same extent, there is a need for a shift in how we perceive blockchain technology, encouraging a change in corporate culture and fostering a resounding trust in its capabilities. The stakes are high, but with proper planning and execution, blockchain has the potential to usher in a new era of trade finance, creating a safer and more efficient financial system that will benefit individuals and businesses alike. The future of finance is blockchain, and it is up to us to seize the opportunity and embrace its potential.

Appendix

Exhibit 1: Basic Architecture of the TradeLens Platform

Note. Retrieved from Jensen, T., Hedman, J., & Henningsson, S. (2019). How TradeLens delivers business value with blockchain technology. MIS Quarterly Executive, 18(4).

Exhibit 2: A more detailed look into blockchain components with their distributed nodes on the TradeLens platform

Note. Retrieved from Jensen, T., Hedman, J., & Henningsson, S. (2019). How TradeLens delivers business value with blockchain technology. MIS Quarterly Executive, 18(4).

Exhibit 3: A demonstration of the complex organizational workflow and the knotwork created, and the future organizational workflow with future

Note. Retrieved from Bujak, A. (2018). The development of telematics in the context of the concepts of “Industry 4.0” and “Logistics 4.0”. In Management Perspective for Transport Telematics: 18th International Conference on Transport System Telematics, TST 2018, Krakow, Poland, March 20-23, 2018, Selected Papers 18 (pp. 509-524). Springer International Publishing.

References

Allison, I. (2021). Banking giant UBS goes live on We.Trade blockchain for trade finance. CoinDesk. Retrieved from https://www.coindesk.com/markets/2019/10/09/banking-giant-ubs-goes-live-on-wetrade-blockchain-for-trade-finance/

Bank for International Settlements. (2021). Innovation and technology in payments: An overview. Retrieved from https://www.bis.org/publ/arpdf/ar2021e3.htm

Bitcoin.com.au. (n.d.). The Bitcoin whitepaper. Retrieved from https://bitcoin.com.au/education/the-bitcoin-whitepaper/

Bujak, A. (2018). The development of telematics in the context of the concepts of “Industry 4.0” and “Logistics 4.0”. In Management perspective for transport telematics: 18th International Conference on Transport System Telematics, TST 2018, Krakow, Poland, March 20-23, 2018, Selected Papers 18 (pp. 509-524). Springer International Publishing.

Chapman, J. (2017). Fintech innovation: Blockchain in financial services. Bank of Canada Financial System Review, June 2017. Retrieved from https://www.bankofcanada.ca/wp-content/uploads/2017/05/fsr-june-2017-chapman.pdf

Cleo. (n.d.). What is API integration? Cleo. Retrieved from https://www.cleo.com/blog/what-is-api-integration

Government of Canada. (2019). What is a regulatory sandbox? Retrieved from https://www.canada.ca/en/government/system/laws/developing-improving-federal-regulations/modernizing-regulations/what-is-a-regulatory-sandbox.html

Golden, M. (n.d.). We.Trade – Wiki. Golden. Retrieved from https://golden.com/wiki/We.Trade-DB8MAJB

Horne, M. (2021). Why interoperability is the key to blockchain technology’s mass adoption. Cointelegraph. Retrieved from https://cointelegraph.com/news/why-interoperability-is-the-key-to-blockchain-technology-s-mass-adoption

IBM MediaCenter. (2019). We.Trade. IBM MediaCenter. Retrieved from https://mediacenter.ibm.com/media/We.Trade/0_jii81ab3

Jensen, T., Hedman, J., & Henningsson, S. (2019). How TradeLens delivers business value with blockchain technology. MIS Quarterly Executive, 18(4).

Monetary Authority of Singapore. (n.d.). Cross-border interbank payments and settlements: Emerging opportunities for digital transformation. Retrieved from https://www.mas.gov.sg/-/media/MAS/ProjectUbin/Cross-Border-Interbank-Payments-and-Settlements.pdf

Monetary Authority of Singapore. (2019). Project Jasper-Ubin design paper. Retrieved from https://www.mas.gov.sg/-/media/Jasper-Ubin-Design-Paper.pdf

Trade Finance Global. (2023, January 27). Risks and challenges of trade finance: 2023 trade finance guide. Retrieved from https://www.tradefinanceglobal.com/trade-finance/risks-challenges/

Wragg, E. (2022, June). We.Trade calls it quits after running out of cash. Global Trade Review. Retrieved from https://www.gtreview.com/news/fintech/we-trade-calls-it-quits-after-running-out-of-cash/