Supplementary Information: The 20-year Rule

A perpetuity is an annuity whose periodic payments (PMT) continue forever, based on an original endowment (PV) and a constant compound interest rate.

Solving Perpetuities with Formulas

The present value of a simple ordinary perpetuity is

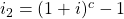

Calculating the present value of a general perpetuity requires two additional formulas:

, where C/Y = # compoundings per year, P/Y= # of payments per year

, where C/Y = # compoundings per year, P/Y= # of payments per year

A perpetuity due requires a fourth formula.

- Can it be done using the financial calculator?

- How do you enter an infinite number of payments?

N must be large enough to reflect a perpetuity, but not too large for the calculator to handle (in some cases)!

We use the following rule:

The present value of any perpetuity is identical to

the present value of an equivalent annuity, whose

term is 20 years divided by the perpetuity’s nominal interest rate (as a decimal fraction)

the present value of an equivalent annuity, whose

term is 20 years divided by the perpetuity’s nominal interest rate (as a decimal fraction)

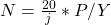

i.e.

- Number of years=

NOTE:

- N Should be rounded up if not an integer

- This is the minimum number of payments required to represent a perpetuity

- Larger values are fine, but sometimes only up to a certain point

See the attached Excel Template on using the 20 year rule: Perpetuities using 20 year rule