Effective Rates

The annual effective interest rate, ![]() , is defined as the annually compounded rate that produces the same future value after one year as the given nominal rate.

, is defined as the annually compounded rate that produces the same future value after one year as the given nominal rate.

We can use the following formula that can convert a nominal rate to its equivalent effective rate:

![]()

Where

: periodic rate

: periodic rate : number of compounding periods per year

: number of compounding periods per year : effective rate (annually compounded rate that produces the same future value after one year as the given nominal rate)

: effective rate (annually compounded rate that produces the same future value after one year as the given nominal rate)

Note: the periodic rate

![]()

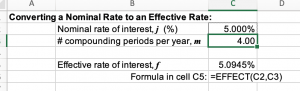

We can also use the EFFECT function in Excel to calculate the effective rate.

where:

- Nominal_rate is the nominal interest rate. (

)

) - Npery is the number of compounding periods per year. (

)

)

Example:

CIBC offers you a $1000 loan at a rate of 5% interest compounded quarterly. What is the effective rate of the loan?

We are given:

- Nominal rate (

): 5%

): 5% - Compounding frequency (

): 4

): 4

Using Excel, we find out that the effective rate is 5.0945%

Note: In your spreadsheet, make sure the cells that have rates are changed to percentage with at least 4 decimals.

For more details on using the EFFECT function, see the Microsoft Support site

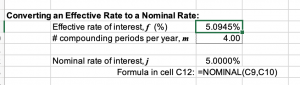

Finding the NOMINAL rate when you are given the EFFECTIVE rate

Sometimes you are given the Effective rate and need to find the nominal interest rate (![]() ) compounded m times per year.

) compounded m times per year.

We can use the Excel function: NOMINAL to find this rate.

where:

- Effect_rate is effective interest rate.

- Npery is the number of compounding periods per year (

).

).

Using the example above. If the bank is offering 5.0945% annually, what is the nominal rate if interest is compounded quarterly?

We can use the NOMINAL function as illustrated below:

Note: In your spreadsheet, make sure the cells that have rates are changed to percentage with at least 4 decimals.

For more details on using the NOMINAL function, see the Microsoft Support site

You can use the following template for these questions: Effective and Nominal Rate Conversions – Template